The U.S. Internal Revenue Code recognizes 29+ types of 501(c) organizations, each tailored to a specific nonprofit purpose and eligible for federal tax exemption. These organizations form the backbone of America’s nonprofit sector, advancing causes that range from charitable and educational work to social welfare and professional associations. Let’s explore their key tax-deductible donations features and uncover what distinguishes each category.

This article is provided for general informational purposes to support a better understanding of 501(c) organizations and their classifications. We specialize in company formation services and do not offer legal or tax advice specific to nonprofit entities under U.S. law. For detailed compliance guidance, please consult a qualified legal or tax professional with expertise in nonprofit organizations.

What is 501(c) Organization?

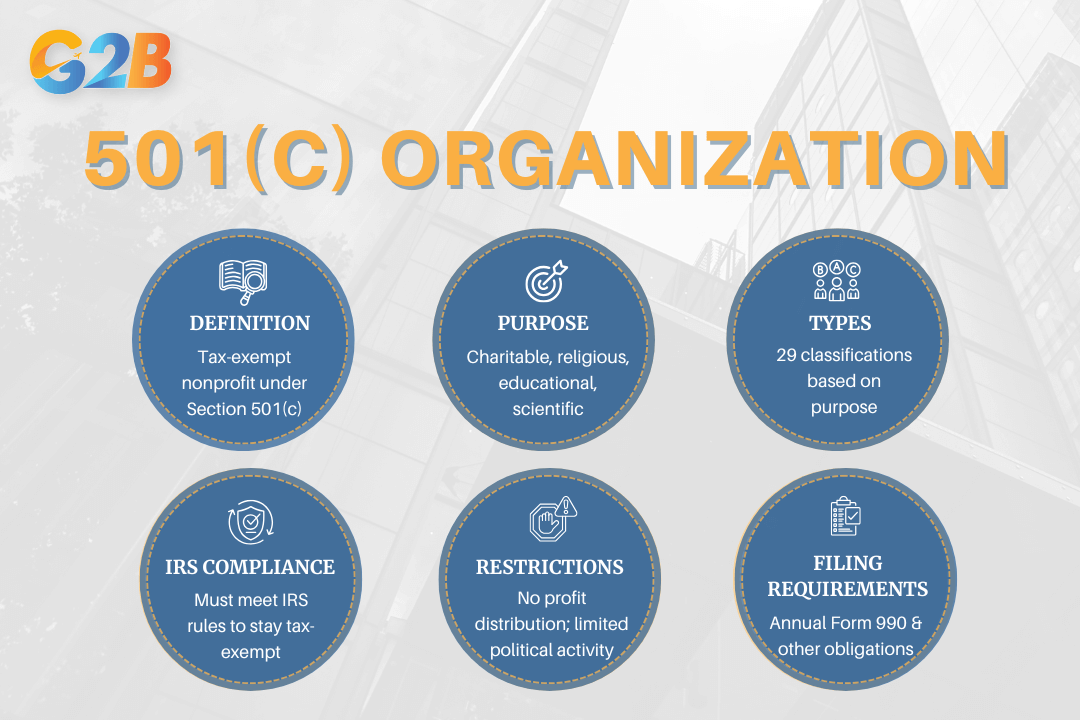

A 501(c) organization is a nonprofit organization recognized under Section 501(c) of the United States Internal Revenue Code that is exempt from federal income tax. These organizations operate for various exempt purposes such as charitable, religious, educational, scientific, literary, social welfare, labor, business leagues, veterans' groups, and more, depending on their specific classification within the 501(c) subsections. There are 29 types of 501(c) organizations, each defined by its purpose and activities.

To maintain tax-exempt status, these organizations must meet IRS requirements, such as operating primarily for exempt purposes, not distributing earnings to private individuals or shareholders, and complying with limitations on political and lobbying activities (especially for 501(c)(3) organizations). They are also subject to filing annual information returns (such as Form 990) and other compliance obligations.

A 501(c) organization is a nonprofit organization recognized of the United States Internal Revenue Code

Get expert guidance with Delaware incorporation service - Schedule your free consultation today!

29 types of 501(c) Organization?

- 501(c)(1) Organization: 501(c)(1) organizations are corporations that are organized under an act of Congress and are exempt from federal income tax by that congressional charter. A prime example of such organizations includes corporations created by Congress for governmental purposes.

- 501(c)(2) Organization: 501(c)(2) organizations are tax-exempt entities established exclusively to hold title to property, collect income from that property, and then turn over the entire amount of income (minus expenses) to one or more organizations that are themselves exempt under Section 501(c), typically 501(c)(3) charitable organizations or 501(c)(19) veterans' organizations.

- 501(c)(3) Organization: A 501(c)(3) organization is a United States nonprofit entity - such as a corporation, trust, unincorporated association, or similar organization - that is exempt from federal income tax under section 501(c)(3) of the Internal Revenue Code. It is organized and operated exclusively for one or more exempt purposes, including religious, charitable, scientific, literary, educational purposes, testing for public safety, fostering amateur sports competition, or preventing cruelty to children or animals.

- 501(c)(4) Organization: A 501(c)(4) organization is a nonprofit entity that is not organized for profit and is operated primarily to promote social welfare. It primarily furthers the common good and general welfare of the community, such as by bringing about civic betterment and social improvements, rather than benefiting private individuals or select groups.

- 501(c)(5) Organization: A 501(c)(5) organization is a labor, agricultural, or horticultural organization that is exempt from federal income tax. Its purpose is to better the conditions of those engaged in labor, agriculture, or horticulture, improve the quality of their products, and develop greater efficiency in their occupations. The organization's net earnings may not benefit any individual member, and it primarily serves the interests of its members in these fields.

- 501(c)(6) Organization: A 501(c)(6) organization is a nonprofit membership entity such as a business league, chamber of commerce, real estate board, board of trade, or professional football league that is not organized for profit. Its primary purpose is to promote the common business interests of its members and improve business conditions in one or more lines of business, rather than engaging in a regular business for profit. No part of its net earnings may benefit any private shareholder or individual.

- 501(c)(7) Organization: A 501(c)(7) organization is a nonprofit social or recreational club that is organized for pleasure, recreation, and other nonprofitable purposes. It exists primarily to provide opportunities for personal contact and social interaction among its members, and its facilities and services are generally limited to members and their guests.

- 501(c)(8) Organization: A 501(c)(8) organization is a fraternal beneficiary society, order, or association that operates under a lodge system and is organized to provide life, sick, accident, or other benefits to its members or their dependents. Membership is based on a common bond such as a vocation, profession, religion, ethnicity, gender, or shared values, and the organization maintains a substantial program of fraternal activities for the benefit of its members.

- 501(c)(9) Organization: A 501(c)(9) organization is a voluntary employees' beneficiary association organized to provide life, sick, accident, or similar benefits to its members or their dependents or designated beneficiaries. Membership must consist of employees sharing an employment-related common bond, such as a common employer, collective bargaining agreement, or labor union membership. No part of the organization's net earnings may inure to the benefit of any private individual or shareholder except through the payment of such benefits.

- 501(c)(10) Organization: A 501(c)(10) organization is a domestic fraternal society, order, or association that operates under the lodge system, does not provide life, sick, accident, or other benefits to its members, and devotes its net earnings exclusively to religious, charitable, scientific, literary, educational, and fraternal purposes.

- 501(c)(11) Organization: A 501(c)(11) organization is a teachers' retirement fund association that is locally organized and funded through taxes, member contributions, and investment revenue. Most of its members must be teachers, though it may also include non-instructional school employees. These organizations are typically established and regulated at the state or local level to provide retirement benefits to teachers.

- 501(c)(12) Organization: A 501(c)(12) organization is a tax-exempt cooperative or mutual association such as benevolent life insurance associations of a purely local character, mutual ditch or irrigation companies, mutual or cooperative telephone companies, electric cooperatives, or similar organizations. To qualify, these organizations must be organized and operated as cooperatives, derive at least 85 percent of their income from their members (usually amounts collected to cover losses and expenses), and operate primarily for the benefit of their members by providing services at or near cost.

- 501(c)(13) Organization: A 501(c)(13) organization is a nonprofit mutual cemetery company that is owned and operated exclusively for the benefit of its members or is not operated for profit. It is chartered specifically to dispose of human bodies by burial or cremation, and its net earnings do not inure to the benefit of any private shareholder or individual. The members of such organizations are typically the plot owners who intend to use their plots for bona fide burial purposes rather than resale.

- 501(c)(14) Organization: A 501(c)(14) organization is a tax-exempt entity under the Internal Revenue Code that primarily includes state-chartered credit unions and mutual reserve funds. These organizations are composed of members sharing a common bond, such as community or employment, and operate on a not-for-profit basis for the mutual benefit of their members. They must be organized under state credit union laws, have no capital stock, and function solely for mutual purposes without profit. 501(c)(14) also includes mutual reserve funds and cooperative organizations.

- 501(c)(15) Organization: A 501(c)(15) organization is a small insurance company or association that is generally organized on a mutual basis, often restricted to individuals of a particular county. These organizations primarily provide property damage coverage and may also include certain burial and funeral benefit associations and marine insurance organizations. To qualify, small stock-owned insurance companies must have at least 50% of their annual revenue from member premiums and total annual revenue not exceeding $600,000, while mutual insurance companies must have at least 35% of revenue from member premiums and total annual revenue not exceeding $150,000.

- 501(c)(16) Organization: A 501(c)(16) organization is a cooperative corporation organized by a farmers' cooperative marketing or purchasing association or its members to finance the members' or other producers' crop operations. These organizations are tax-exempt under the Internal Revenue Code and operate primarily to provide financing for agricultural producers' crop-related activities. They must meet specific IRS requirements to maintain their exemption, including operating primarily for the benefit of their members and complying with cooperative principles.

- 501(c)(17) Organization: A 501(c)(17) organization is a tax-exempt supplemental unemployment benefits (SUB) trust established under Internal Revenue Code Section 501(c)(17). These trusts provide payments to employees who are involuntarily separated from employment, such as through layoffs or plant closures. The trust is created and maintained by an employer or a group of employees solely to provide supplemental unemployment compensation benefits. Benefits must be paid according to objective standards and cannot discriminate in favor of highly compensated employees or officers. The funds in the trust may only be used to pay such benefits and, secondarily, for accident or illness benefits subordinate to the unemployment benefits.

- 501(c)(18) Organization: A 501(c)(18) organization is a special class of employee pension trust created before June 25, 1959, that is authorized to provide pension and retirement benefits. These trusts and their assets must be funded solely by member contributions and may only use funds to pay benefits. They must operate without discrimination in benefit determination and follow an objective benefits schedule.

- 501(c)(19) Organization: A 501(c)(19) organization is a tax-exempt veterans organization that consists of past or present members of the United States Armed Forces, or an auxiliary unit or society affiliated with such an organization, or a trust or foundation for such an organization. To qualify, at least 75% of its members must be current or former armed forces members, and at least 97.5% must be members, cadets, or family members of such individuals. These organizations operate to promote social welfare, assist disabled and needy veterans and their dependents, provide care and entertainment to hospitalized veterans, perpetuate the memory of deceased veterans, conduct charitable and educational programs, sponsor patriotic activities, provide insurance benefits, and offer social and recreational activities for members.

- 501(c)(20) Organization: A 501(c)(20) organization is a "qualified group legal services plan" that provided individual legal services benefits to members. This tax-exempt status was eliminated after June 30, 1992, so such organizations no longer qualify under this section.

- 501(c)(21) Organization: A 501(c)(21) organization is a black lung benefit trust established by coal mine operators to pay claims under the Federal Black Lung Benefit Act of 1969. These trusts are tax-exempt entities organized specifically for this purpose.

- 501(c)(22) Organization: A 501(c)(22) organization is a withdrawal liability payment fund established to provide funds to meet the liability of employers withdrawing from a multi-employer pension fund.

- 501(c)(23) Organization: A 501(c)(23) organization is a veterans' association that was established before 1880. To qualify, more than 75% of its members must be past or present members of the United States Armed Forces, and its principal purpose is to provide insurance and other benefits to veterans or their dependents. At least 90% of the membership must consist of war veterans, defined as those who served during a war period. These organizations are tax-exempt under section 501(a) of the Internal Revenue Code.

- 501(c)(24) Organization: A 501(c)(24) organization was a single-employer benefit trust described in Section 4049 of the Employee Retirement Income Security Act (ERISA) of 1974. This tax-exempt status applied to these trusts but was repealed by the Pension Protection Act of 2006.

- 501(c)(25) Organization: A 501(c)(25) organization is a tax-exempt title-holding corporation or trust that holds title to real property, such as land or buildings, on behalf of multiple parent tax-exempt organizations. These entities are designed to limit ownership liability, improve borrowing capabilities, and reduce accounting complexities for the parent organizations. They can have up to 35 shareholders, and all income, except expenses, must be distributed to the tax-exempt parent organizations.

- 501(c)(26) Organization: A 501(c)(26) organization is a state-sponsored high-risk health coverage organization that provides health insurance to individuals who have pre-existing conditions or otherwise have difficulty obtaining coverage through standard insurance providers. These organizations offer a health coverage alternative for high-risk individuals who might otherwise be unable to secure affordable insurance.

- 501(c)(27) Organization: A 501(c)(27) organization is a state-sponsored workers' compensation reinsurance organization. These organizations are classified into two types: 501(c)(27)(A) entities, established before June 1, 1997, which reimburse members for costs associated with providing workers' compensation insurance and operate as nonprofits by returning surplus income to members or policyholders; and 501(c)(27)(B) entities, established after December 1, 1997, created by state law to provide workers' compensation insurance and financially supported by the state, with assets reverting to the state upon dissolution or dissolution prohibited by the state.

- 501(c)(28) Organization: A 501(c)(28) organization is the National Railroad Retirement Investment Trust established under 45 U.S.C. 231n(j). It is a tax-exempt trust created to manage and invest the assets of the Railroad Retirement system.

- 501(c)(29) Organization: A 501(c)(29) organization is a qualified nonprofit health insurance issuer (QNHII) that has received a loan or grant under the Centers for Medicare and Medicaid Services (CMS) Consumer Operated and Oriented Plan (CO-OP) program. These organizations operate with a strong consumer focus and offer qualified health insurance plans, using their profits to lower premiums, improve benefits, or enhance the quality of health care delivered to their members. They must comply with all CO-OP program requirements and loan agreements with CMS to maintain their tax-exempt status.

Start your business with our Delaware incorporation service - Begin your application today!

Tax-deductible donations to 501(c) Organizations

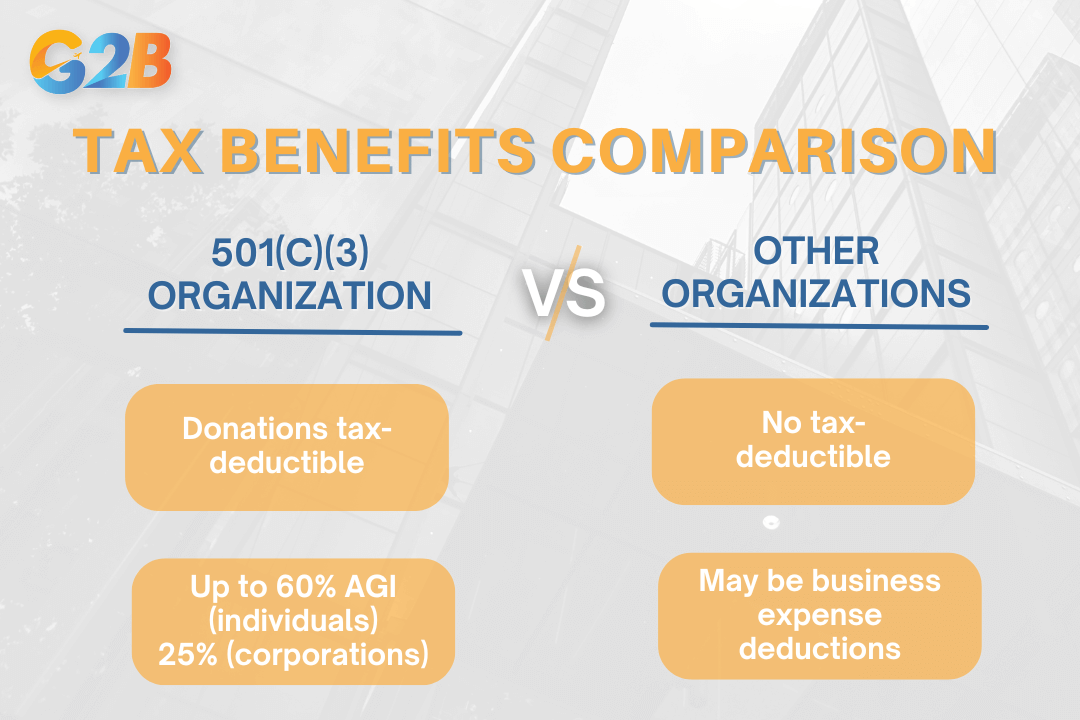

Only certain 501(c) organizations qualify for tax-deductible donations, with the most notable being 501(c)(3) public charities and private foundations.

- 501(c)(3) Organizations: Donations to these organizations are generally tax-deductible for donors. Individuals can deduct contributions up to 60% of their adjusted gross income (AGI), and in certain years, such as 2020 and 2021, this limit was temporarily increased to 100% for cash donations to public charities. Corporations have different limits, often up to 25% of taxable income. To claim a deduction, donors must itemize deductions on their tax returns. Donations over $250 require a written acknowledgment from the charity. If goods or services are received in exchange for a donation over $75, the donor must reduce the deductible amount by the value of those benefits and receive a disclosure statement.

- Other 501(c) Organizations: Donations to organizations classified under other 501(c) sections, such as 501(c)(4) social welfare organizations or 501(c)(6) business leagues, generally are not deductible as charitable contributions. However, such donations may be deductible as ordinary and necessary business expenses if related to the donor’s trade or business.

- Special cases: Contributions to certain volunteer fire companies and war veterans organizations may be deductible if those organizations are recognized as 501(c)(3) entities or operate exclusively for public purposes.

- Documentation: Donors must keep proper records such as receipts, bank statements, or credit card statements. For non-cash donations over $5,000, a qualified appraisal is required. Substantiation rules are strict to ensure the donation qualifies for a deduction.

Only certain 501(c) organizations qualify for tax-deductible donations

In conclusion, 501(c) organizations are a broad category of nonprofit entities recognized under Section 501(c) of the Internal Revenue Code, granting them exemption from federal income tax based on their specific purposes and activities. 29 distinct types of 501(c) organizations serve different functions-from charitable, religious, and educational groups (501(c)(3)) to veterans' associations, social clubs, and specialized insurance or pension trusts.

Among these, 501(c)(3) organisations are the most prominent, as they qualify for tax-deductible donations and operate exclusively for charitable, religious, scientific, or educational purposes. While all 501(c) organizations enjoy tax-exempt status, only certain types, primarily 501(c)(3)s, allow donors to claim tax deductions for contributions. Compliance with IRS regulations, including proper record-keeping and filing of annual returns, is essential for maintaining tax-exempt status. Overall, 501(c) organizations play a vital role in supporting a wide array of public and member-focused activities across the United States.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom