A 501(c)(23) organization plays a crucial role in supporting veterans by offering tax-exempt status to specific nonprofit entities. While closely associated with 501(c)(19) organizations, 501(c)(23) is distinct due to its specific focus on funding veterans' benefits programs, often through loans backed by the Veterans Administration. Let’s figure out how this unique designation operates, who qualifies, and why it still matters today.

This article is provided for general informational purposes to help professionals understand the basics of 501(c)(23) organizations. We specialize in company formation services and do not provide legal or tax advice concerning U.S. nonprofit regulations. For detailed compliance guidance, please consult a qualified nonprofit advisor or legal expert familiar with veterans-related benefit structures.

What is a 501(c)(23) organization?

A 501(c)(23) organization is a veterans’ association established before 1880 whose primary purpose is to provide insurance and related benefits to past or present members of the U.S. Armed Forces and their dependents. More than 75% of its membership must consist of current or former military personnel, and the group must operate exclusively to furnish such insurance coverage or benefits. Donations to these organizations are tax-deductible as charitable contributions, provided the entity meets all IRS requirements for veterans’ organizations under section 501(c)(23).

Historical origins and rationale

The 501(c)(23) organization classification emerged from America's early approach to veterans' welfare, long before comprehensive federal benefits existed. This specialized tax-exempt status was designed specifically to protect and sustain benefit societies formed before 1880, ensuring their pooled insurance funds could continue serving veteran members and their dependents without tax burden. These organizations played a crucial historical role in providing financial security when government programs were nonexistent or insufficient for military veterans.

Start your US business right - Contact G2B for a free consultation on Delaware incorporation service today!

The era before federal veterans' benefits

Before 1880, veterans' mutual aid societies functioned as essential safety nets in American society. Civil War veterans, in particular, formed fraternal organizations that collected dues to provide insurance policies, survivor benefits, and financial assistance to members and their families during hardship. These early 501(c)(23) organizations operated on principles of collective support and solidarity. Members contributed to common funds that provided:

- Death benefits for widows and orphans

- Disability payments for injured veterans

- Emergency financial assistance

- Medical care reimbursements

- Burial expenses

The financial protection these societies offered represented the primary safety net for many veterans in an era when federal support was minimal or nonexistent. Their structure, collecting premiums to pay benefits, resembled modern insurance companies but operated as nonprofit entities exclusively serving their veteran membership.

Why most 501(c)(23) organizations are rare today

The historical requirement that qualifying organizations must have been established before 1880 creates a natural limitation on the number of active 501(c)(23) entities. Most original organizations have:

- Dissolved due to declining membership

- Merged with larger veterans' organizations

- Converted to other nonprofit structures (often 501(c)(19))

- Ceased operations as federal programs expanded

Federal veterans' benefits expanded dramatically following World War I, World War II, and subsequent conflicts, diminishing the need for private benefit societies. The Veterans Administration (now Department of Veterans Affairs) assumed many functions these mutual aid societies once provided. Modern alternatives have also emerged to serve veterans:

| Alternative structure | Primary function | Tax status |

|---|---|---|

| 501(c)(19) | Modern veterans' groups | Tax-exempt |

| 501(c)(3) | Charitable veterans' causes | Tax-exempt with donation deductibility |

| Commercial insurance | Life/health coverage | For-profit |

The restrictive founding date requirement, coupled with the evolution of veterans' services, explains why 501(c)(23) organizations remain a rare historical artifact rather than a common nonprofit structure in today's landscape.

Eligibility, requirements, and types of 501(c)(23) organization

The 501(c)(23) organization category represents one of the most restrictive tax-exempt classifications in the Internal Revenue Code. Only veteran benefit societies established before 1880 that exclusively manage insurance or benefit funds for their members qualify for this rare designation.

Legal requirements for 501(c)(23) status

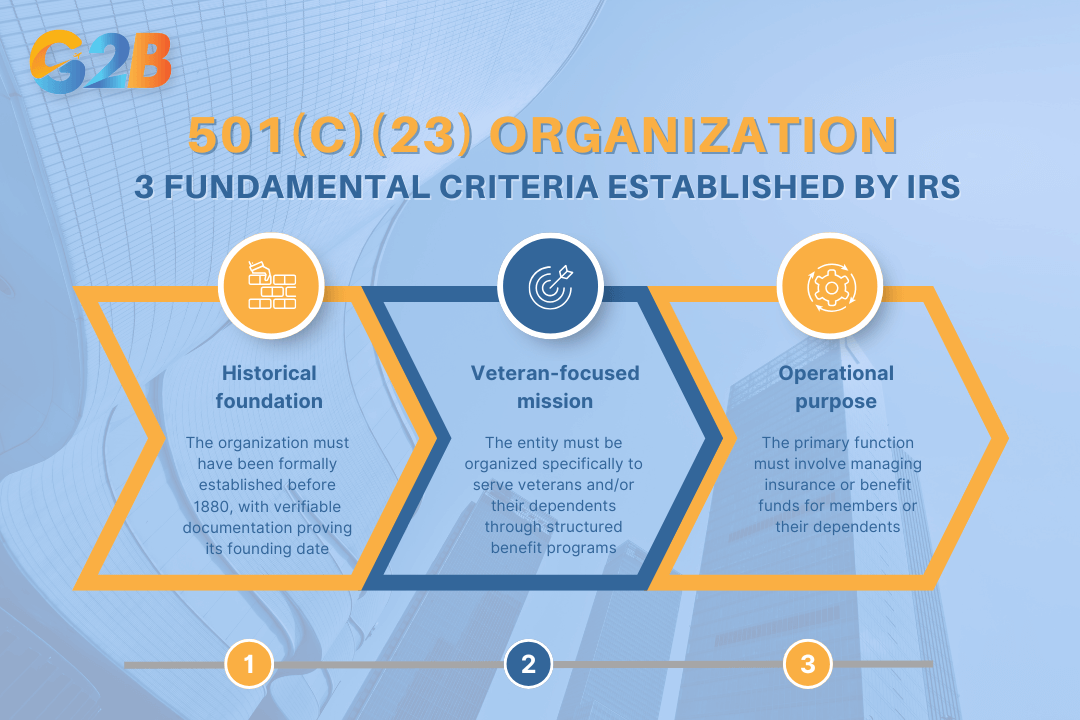

To qualify for 501(c)(23) status, organizations must satisfy three fundamental criteria established by the Internal Revenue Service:

- Historical foundation: The organization must have been formally established before 1880, with verifiable documentation proving its founding date.

- Veteran-focused mission: The entity must be organized specifically to serve veterans and/or their dependents through structured benefit programs.

- Operational purpose: The primary function must involve managing insurance or benefit funds for members or their dependents.

These requirements create an exceptionally narrow qualification window. Organizations must maintain detailed historical records dating back over 140 years to substantiate their eligibility claim. The IRS typically requires original articles of incorporation, founding bylaws, and continuous operational documentation when reviewing applications.

Organization must satisfy 3 fundamental criteria established by the IRS to qualify for 501(c)(23) status

Who should not apply

Modern veterans' organizations should avoid pursuing 501(c)(23) status due to the pre-1880 requirement. This includes:

- Post-World War era veterans' clubs and associations

- Newly formed veteran advocacy nonprofits

- Modern mutual aid societies for military personnel

- Veterans' educational or recreational organizations

These organizations should instead consider:

- 501(c)(19) status for traditional veterans' service organizations

- 501(c)(3) status for charitable veterans' causes

- 501(c)(4) status for social welfare organizations serving veterans

Pursuing 501(c)(23) status when ineligible wastes organizational resources and delays obtaining the appropriate tax exemption. The application process for inappropriate status may trigger IRS scrutiny across other compliance areas.

Types of 501(c)(23) organizations

The 501(c)(23) classification exclusively encompasses:

- Fraternal benefit societies for Civil War veterans

- Pre-1880 mutual insurance associations for military personnel

- Historic veterans' associations managing member benefits

- Longstanding trusts established for veteran insurance purposes

| Common examples | Non-qualifying organizations |

|---|---|

| Civil War era benevolent societies | Modern VFW or American Legion posts |

| Spanish-American War mutual aid funds | Veterans' advocacy nonprofits |

| 19th-century fraternal insurance trusts | Veterans' memorial foundations |

| Early veterans' cooperative benefit associations | Military support charities |

These organizations functioned as early forms of insurance providers before modern veterans' benefits existed. Their operational model focused on pooling resources to provide financial security for veterans and their families in an era preceding social safety nets and federal veterans' programs.

Key benefits and disadvantages of 501(c)(23) status

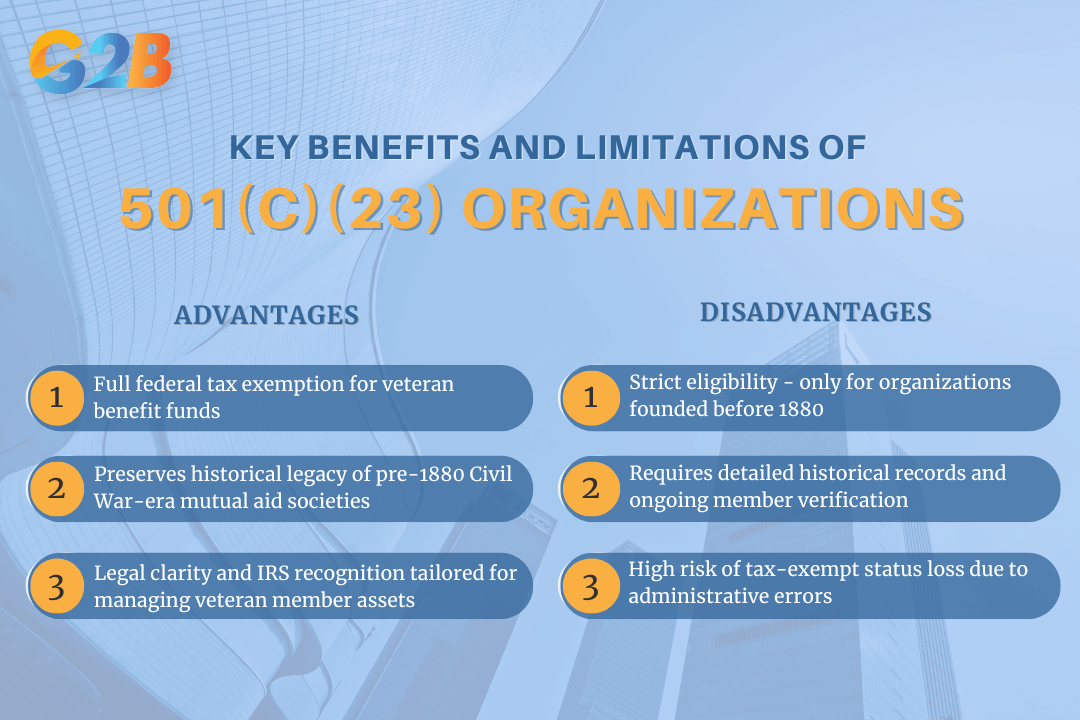

The 501(c)(23) organization status offers a specialized tax exemption framework with significant advantages for qualifying veteran benefit societies, but it also comes with substantial limitations that restrict its practical application.

The 501(c)(23) organization status offers special benefits and disadvantages

Benefits overview

501(c)(23) status provides complete federal income tax exemption for qualifying veteran benefit funds, preserving their financial resources entirely for member services rather than tax obligations. This exemption extends to all insurance-related activities and investment income generated from benefit fund management, creating a protective financial environment for these historic institutions.

The designation also helps preserve America's nonprofit heritage by recognizing the historical significance of pre-1880 veterans' mutual aid societies. These organizations played a crucial role in supporting Civil War veterans and their families before federal benefits existed, and their classification maintains this important legacy within the tax code.

Organizations holding 501(c)(23) status benefit from established IRS recognition that specifically acknowledges their unique mission. This recognition provides legal clarity and operational continuity for managing member assets, ensuring these benefit funds remain protected under dedicated regulatory guidelines designed for their specialized function.

Critical disadvantages

The most significant limitation of 501(c)(23) status stems from its rigid eligibility restriction to entities established before 1880. This historical requirement effectively eliminates virtually all modern veterans' organizations from consideration, making it irrelevant for contemporary nonprofit founders seeking tax exemption options. Compliance requirements create substantial operational challenges for the few qualifying organizations. The IRS applies heightened scrutiny to these rare entities, requiring meticulous documentation of:

- Historic founding dates

- Continuous operation evidence

- Member veteran status verification

- Benefit fund management records

Administrative errors in reporting or fund management can trigger serious consequences, including potential revocation of tax-exempt status. This risk represents a significant ongoing concern for organizations operating under this classification, requiring specialized legal counsel familiar with its uncommon requirements. For most veterans' groups seeking nonprofit status today, alternative classifications like 501(c)(19) or 501(c)(3) offer far greater flexibility, broader operational scope, and more accessible qualification requirements than the highly restricted 501(c)(23) designation.

501(c)(23) vs 501(c)(19) and 501(c)(3) - Veterans' organization choices compared

Selecting the appropriate tax-exempt status remains critical for veterans' organizations seeking compliance with IRS regulations. The 501(c)(23) organization classification serves a highly specialized purpose compared to more common alternatives.

Comparison between 501(c)(23) and 501(c)(19)

501(c)(23) status applies exclusively to pre-1880 insurance societies established to provide benefits for veterans and their dependents. These organizations represent historical benefit funds that predate modern veterans' support systems. 501(c)(19), conversely, addresses the needs of contemporary veterans' organizations formed after World War I. This classification encompasses posts, associations, chapters, and similar groups where at least 75% of members are past or present members of the U.S. Armed Forces. For organizations seeking tax-exempt status today, 501(c)(19) provides substantially greater accessibility and operational flexibility compared to the highly restrictive 501(c)(23) designation.

Difference between 501(c)(23) and 501(c)(3)

The 501(c)(3) classification represents the broadest category for nonprofit organizations and differs fundamentally from 501(c)(23) in purpose and function. While 501(c)(23) organizations exclusively manage insurance or benefit funds for pre-1880 veterans' societies, 501(c)(3) status applies to charitable, educational, religious, scientific, and literary organizations serving the public good. Veterans' organizations pursuing 501(c)(3) status focus on charitable mission work rather than mutual benefit activities. For newly established organizations supporting veterans through education, advocacy, or direct assistance programs, 501(c)(3) status typically provides the optimal structure for achieving mission objectives and financial sustainability.

Quick reference comparison table

This comparison highlights why modern veterans' organizations typically pursue either 501(c)(19) or 501(c)(3) status rather than the highly specialized and restrictive 501(c)(23) classification:

| Feature | 501(c)(23) | 501(c)(19) | 501(c)(3) |

|---|---|---|---|

| Eligibility | Pre-1880 vet societies | Modern vet orgs | Charities (inc. vets) |

| Insurance funds | Yes | Occasionally | No |

| New formations | No | Yes | Yes |

| Main use | Benefit societies | Posts/associations | Education/aid |

| Donation deductibility | Limited | Partial | Full |

| Membership requirements | Veteran-focused | 75% of veterans | None specific |

| Primary purpose | Member benefits | Veteran community | Charitable mission |

| Formation complexity | Extreme (historical) | Moderate | Moderate-high |

Steps to register and maintain a 501(c)(23) organization

Registering and maintaining a 501(c)(23) organization involves specialized procedures due to the historic nature of these rare tax-exempt entities. Legal advisors and consultants managing these legacy veterans' benefit societies must navigate rigorous verification processes, detailed IRS applications, and ongoing compliance requirements.

Initial verification and documentation

Historical documentation forms the foundation for 501(c)(23) eligibility confirmation. Organizations must locate and preserve original articles of incorporation or bylaws conclusively demonstrating establishment prior to 1880. These documents serve as primary evidence of the organization's historic origins and purpose.

Financial records demonstrating continuous operation of insurance or benefit funds for veterans must accompany organizational documents. This includes ledgers, benefit payment histories, and member enrollment records. Legal advisors should ensure these records clearly document the veteran-member purpose, beneficiary arrangements, and governance structure in legally binding formats that satisfy modern regulatory scrutiny.

IRS application and approval process

The formal 501(c)(23) application process requires submission of IRS Form 1024, specifically identifying Section 501(c)(23) as the requested exemption category. This application demands comprehensive historical documentation beyond standard nonprofit filings. Organizations must prepare an exhaustive package including:

- Certified copies of pre-1880 formation documents

- Chronological operational timeline spanning the organization's existence

- Evidence of continuous veteran benefit activities

- Current financial statements detailing insurance or benefit fund management

- Organizational structure documentation

Approval timelines often extend significantly beyond standard nonprofit applications due to the specialized review these rare applications undergo. The IRS typically assigns specialized agents who conduct thorough verification of historical claims, sometimes requesting supplemental documentation or clarification during the review process.

Discover how our Delaware incorporation service can support your goals - Begin with a free consultation!

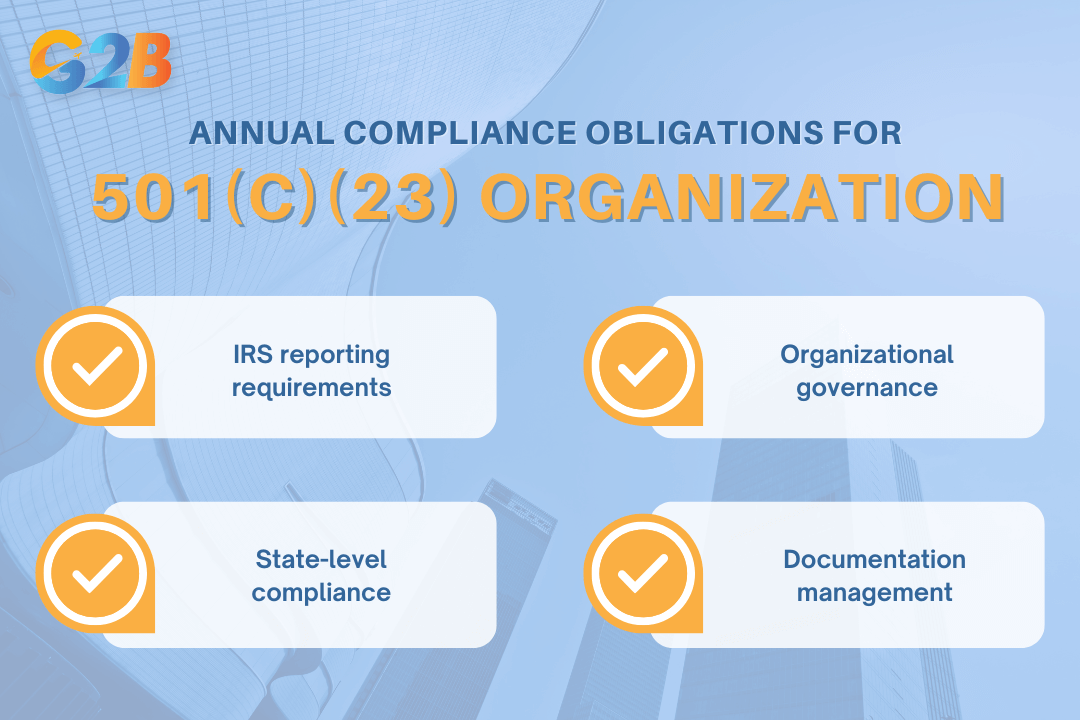

Ongoing compliance and reporting checklist

Annual compliance obligations for 501(c)(23) organizations include:

- IRS reporting requirements

- File Form 990 annually by the established deadline

- Submit all required schedules appropriate to the organization's activities

- Maintain detailed financial records segregating benefit fund activities

- Organizational governance

- Conduct and document regular board meetings

- Review benefit fund performance and distribution metrics

- Update organizational policies to align with current regulations

- State-level compliance

- Register with the appropriate state charity regulators

- File annual reports with Secretary of State's office

- Comply with state insurance regulations governing benefit funds

- Documentation management

- Update membership records promptly

- Document all operational or structural changes

- Maintain archived historical records proving continued eligibility

Organizations should implement a comprehensive compliance calendar with automated alerts to prevent missed deadlines that could jeopardize their rare and valuable tax-exempt status.

Annual compliance obligations for 501(c)(23) organizations include 4 steps

Common misconceptions, mistakes, and risks

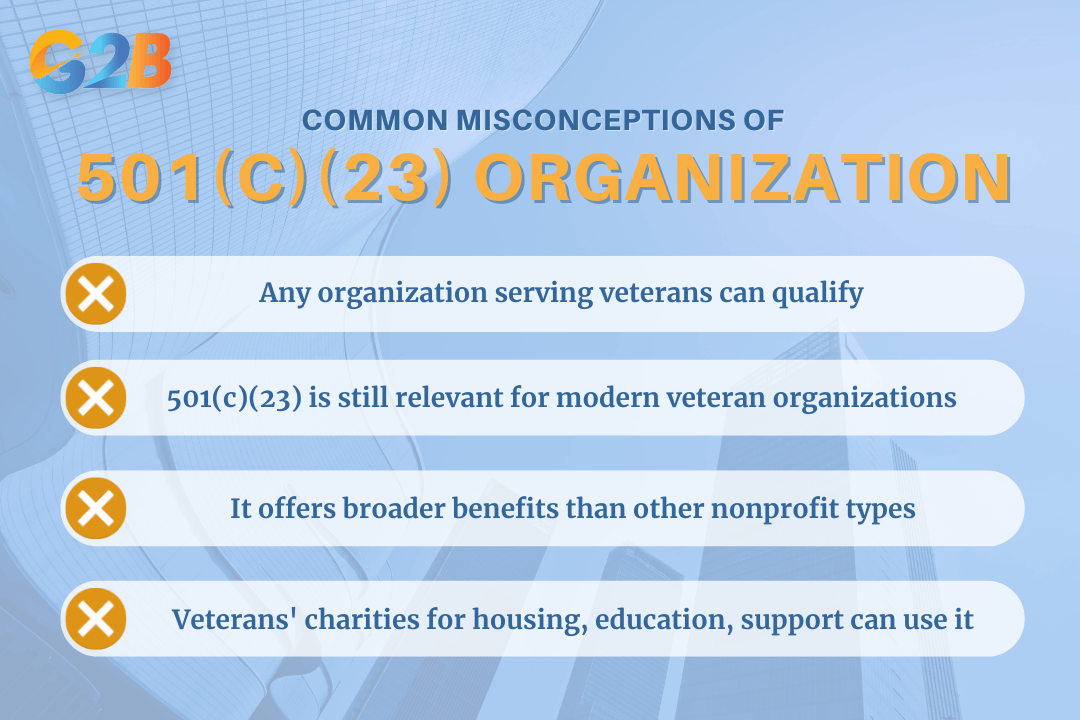

Many organizations mistakenly believe they can qualify for 501(c)(23) status simply by serving veterans. For compliance officers and legal advisors working with veterans' organizations, understanding these limitations prevents costly application errors and potential status revocation risks for 501(c)(23) organizations.

Top misconceptions debunked

501(c)(23) designation is not available to most veterans' organizations operating today. Only organizations established before 1880 specifically for veterans' insurance purposes qualify. This historical requirement eliminates virtually all modern veterans' groups from eligibility consideration.

Many incorrectly assume 501(c)(23) status offers broader benefits than it actually does. The classification exists solely to protect legacy mutual benefit funds serving veterans from specific historical periods. Organizations formed after World War I, Korea, Vietnam, or recent conflicts must pursue 501(c)(19) status instead. Similarly, veterans' charities focused on education, housing, or support services should apply for 501(c)(3) designation rather than pursuing the 501(c)(23) classification.

Frequent compliance errors

Annual reporting failures represent the most common compliance pitfall for the few remaining 501(c)(23) organizations. The IRS requires timely Form 990 submissions, and organizations with this rare status face particularly intense scrutiny regarding their filings. Other critical errors include:

- Failure to document and maintain current organizational records

- Improper commingling of benefit funds with operational accounts

- Not updating bylaws when membership or operational structures change

- Inadequate board oversight of insurance or benefit fund activities

- Missing state-level filing requirements in addition to federal obligations

Organizations holding this historic designation must maintain meticulous records proving continued compliance with all statutory requirements, as the standards for maintaining eligibility align precisely with those for initial qualification.

Legal and operational risks

Noncompliance carries severe consequences for 501(c)(23) organizations. The IRS can revoke tax-exempt status, forcing benefit funds to pay corporate taxes and potentially triggering retroactive penalties for previous tax periods. Financial penalties may include:

- Back taxes on previously exempt income

- Interest on unpaid tax liabilities

- Late filing penalties for missed reports

- Additional fines for substantiation failures

Beyond monetary consequences, these historic organizations face significant reputational damage if their tax status becomes compromised. Member trust deteriorates when organizations mismanage funds or lose exemption status, potentially leading to litigation from beneficiaries or dependents expecting promised benefits. Legacy organizations should implement regular compliance audits and retain specialized legal counsel familiar with the unique requirements of this tax classification.

Many organizations have common misconceptions about 501(c)(23) organizations

Frequently asked questions (FAQ)

Understanding 501(c)(23) organizations can be complex due to their specialized nature and specific regulatory requirements. To help clarify common concerns, here are the answers to frequently asked questions.

1. Are 501(c)(23) organizations tax-exempt?

Yes, 501(c)(23) organizations are tax-exempt under section 501(c) of the Internal Revenue Code, similar to other nonprofit organizations in this category.

2. Do 501(c)(23) organizations serve individual employees?

No, 501(c)(23) organizations primarily serve employers by helping them meet pension fund withdrawal liabilities rather than providing direct services to individual employees.

3. Are 501(c)(23) organizations related to retirement benefits?

Yes, 501(c)(23) organizations are specifically designed to handle pension-related financial obligations when employers withdraw from multiemployer pension plans.

4. Do 501(c)(23) organizations require IRS approval?

Yes, like other 501(c) organizations, they must apply for and receive IRS recognition of their tax-exempt status through proper application procedures.

5. Are 501(c)(23) organizations common?

No, 501(c)(23) organizations are relatively specialized and less common than other nonprofit types, serving a specific niche in pension fund management.

6. Do 501(c)(23) organizations have boards of directors?

Yes, most 501(c)(23) organizations typically have governing boards to oversee operations and ensure compliance with fiduciary responsibilities and regulatory requirements.

7. Are 501(c)(23) organizations subject to annual reporting requirements?

Yes, 501(c)(23) organizations must typically file annual information returns with the IRS, similar to other tax-exempt organizations under section 501(c).

A 501(c)(23) organization stands as a cornerstone for veteran support, embodying commitment to public stewardship and regulatory clarity. For legal and nonprofit professionals, understanding this unique tax-exempt status not only averts legal pitfalls but also empowers the secure management of veteran benefit funds. Recognizing its distinct position alongside entities like the 501(c)(19) amplifies confidence in nonprofit formation and legacy-driven growth, ensuring that mission-driven goals align seamlessly with compliance and impactful support for veteran communities.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom