A 501(c)(29) organization represents a specialized IRS tax designation for qualified nonprofit health insurance issuers. These entities occupy a distinct niche in the American nonprofit and healthcare landscape, operating at the intersection of public service and health insurance delivery. The designation emerged from the Affordable Care Act (ACA) reforms, creating a framework for consumer-oriented health insurance providers that operate without profit motives. Let's explore the key functions, eligibility criteria, and compliance requirements of 501(c)(29) organizations.

This article is provided for general informational purposes to help professionals understand the fundamentals of 501(c)(29) organizations. We specialize in company formation services and do not offer legal or tax advice regarding U.S. nonprofit healthcare regulations. For specific compliance guidance, please consult a qualified healthcare nonprofit specialist or legal advisor.

What is a 501(c)(29) organization?

A 501(c)(29) organization is a qualified nonprofit health insurance issuer established under Section 501(c)(29) of the Internal Revenue Code by the Affordable Care Act to operate as member-governed, consumer-focused nonprofit insurers issuing qualified health plans in the individual and small-group markets.

These issuers must have received loans or repayable grants under the CMS CO-OP program and comply with all program requirements and any loan agreements to qualify for tax exemption.

They must apply for recognition of exemption using IRS Form 1024, ensure that no net earnings benefit private individuals, and use any profits to reduce premiums, improve benefits, or enhance healthcare quality while filing annual Form 990 series returns. These organizations differ significantly from other healthcare nonprofits. While hospitals, clinics, and health foundations may qualify for other tax exemptions, 501(c)(29) status applies exclusively to entities offering health insurance as their primary activity. The designation carries specific governance requirements, including member control through a board primarily elected by policyholders.

Take the first step toward business success - Explore our Delaware incorporation service today!

Key features and types of 501(c)(29) organizations

501(c)(29) organizations represent a specialized category within the nonprofit sector, created specifically under the Affordable Care Act (ACA) for consumer operated and oriented health insurance plans. These entities must operate exclusively to provide qualified nonprofit health insurance while adhering to strict ACA requirements.

Distinctive features vs. other 501(c) entities

501(c)(29) organizations differ significantly from their nonprofit cousins in both purpose and structure. Unlike 501(c)(3) charitable organizations that can engage in a broad spectrum of humanitarian activities, 501(c)(29) entities must focus solely on providing health insurance under ACA guidelines through the CO-OP model. While 501(c)(4) social welfare organizations can advocate for community improvement, 501(c)(29) organizations must directly deliver health insurance products.

The reinvestment requirement creates another stark contrast. Traditional nonprofits may allocate resources across various mission-aligned programs, but 501(c)(29) organizations must channel all surplus exclusively into policyholder benefits or operational improvements. This restriction ensures that these health insurance issuers maintain their consumer-focused mission rather than benefiting private interests.

Who can form a 501(c)(29)?

Eligibility for 501(c)(29) status remains tightly restricted to nonprofit health insurance issuers whose primary purpose centers on providing qualified health insurance under the ACA. These entities must establish a governance structure where the majority of board members are elected by policyholders, creating direct accountability to the consumers they serve.

To qualify, organizations must meet specific CO-OP program eligibility requirements established jointly by the Department of Health and Human Services and the Internal Revenue Service. This includes demonstrating both nonprofit status and the capability to deliver ACA-compliant health insurance products to individuals and small groups in the marketplace. The narrow eligibility criteria distinguish 501(c)(29) organizations from general health nonprofits, which might provide services or advocacy but do not directly issue insurance policies under ACA provisions.

Mandatory roles and governance requirements

501(c)(29) organizations must maintain specific leadership structures to satisfy regulatory requirements. The governing body must feature a majority of members elected directly by policyholders, creating consumer representation in strategic decision-making. This democratic structure differs from traditional corporate insurance models. Executive management positions such as CEO, CFO, and operations leadership must be established with clear reporting structures and accountability mechanisms. Additionally, organizations must designate compliance and legal officers responsible for:

- Overseeing annual IRS filings and tax compliance

- Managing insurance regulatory obligations at state and federal levels

- Ensuring all organizational activities remain within 501(c)(29) parameters

- Coordinating governance elections and board operations

Benefits and tax advantages of 501(c)(29) status

501(c)(29) organizations enjoy significant financial and operational advantages that distinguish them from traditional insurers and other nonprofit entities. These advantages create both immediate financial benefits and long-term strategic advantages for organizations committed to the nonprofit health insurance model.

Federal income tax exemption and cost savings

The cornerstone benefit of 501(c)(29) status is complete exemption from federal income tax. This exemption creates substantial operational savings by allowing organizations to retain earnings that would otherwise go to tax payments. For nonprofit health insurers, this translates to millions of dollars annually redirected toward mission-driven activities.

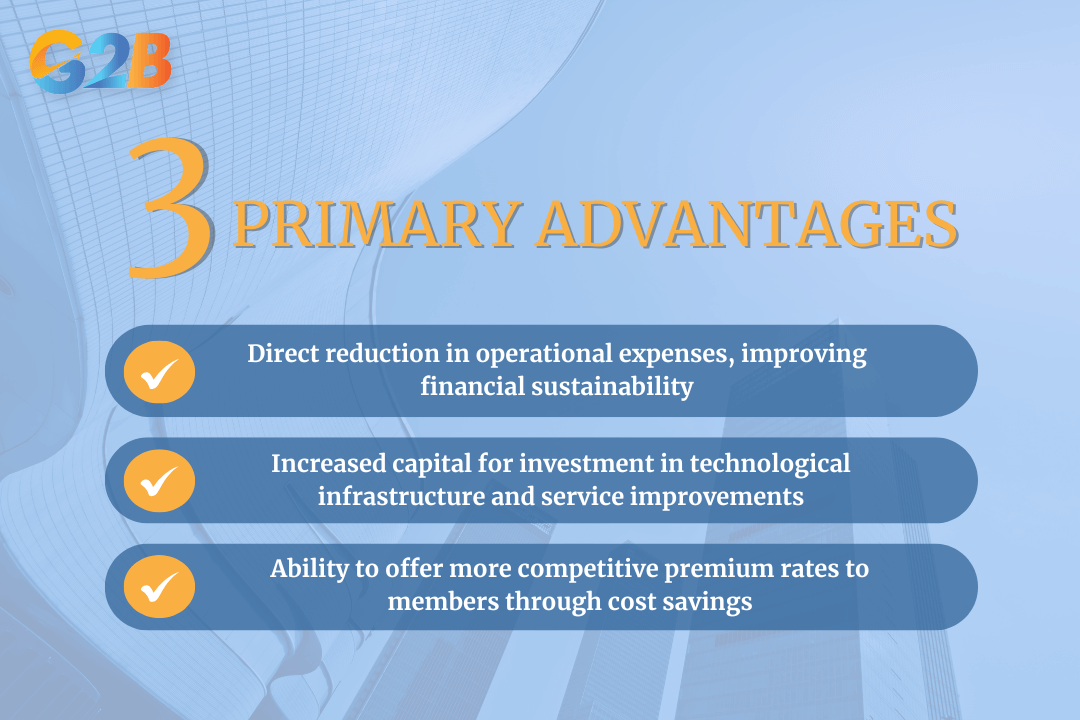

The tax savings generate three primary advantages:

- Direct reduction in operational expenses, improving financial sustainability

- Increased capital for investment in technological infrastructure and service improvements

- Ability to offer more competitive premium rates to members through cost savings

The tax savings of 501(c)(29) organizations generate three primary advantages

Unlike for-profit insurers that distribute profits to shareholders, 501(c)(29) organizations must reinvest surplus funds into operations or premium reductions. This reinvestment requirement ensures that financial benefits flow directly to policyholders rather than outside investors, creating a virtuous cycle of organizational and member benefits.

Eligibility for ACA grants and loans

501(c)(29) status opened doors to exclusive federal funding opportunities unavailable to other entities. The ACA's Consumer Operated and Oriented Plan (CO-OP) program provided:

| Funding type | Purpose | Typical amount |

|---|---|---|

| Start-up loans | Initial operational costs | $10-30 million |

| Solvency loans | Meeting state insurance reserve requirements | $50-100+ million |

These financial resources addressed critical barriers to market entry for nonprofit insurers, particularly steep capital requirements that typically prevent new entrants in the insurance sector. By providing access to this specialized funding, 501(c)(29) status enabled nonprofit organizations to overcome traditional financing obstacles and establish themselves as legitimate market competitors. The financial backing also helped organizations develop competitive pricing models during the crucial early operational phase, when building membership bases and establishing market presence.

Brand and impact differentiation

501(c)(29) organizations leverage their nonprofit status as a powerful branding and differentiation tool. The mission-driven structure creates distinctive market positioning through:

- Governance transparency and consumer control through policyholder-elected boards

- Elimination of the profit imperative that drives many unpopular insurance industry practices

- Commitment to community health improvement rather than shareholder returns

Research indicates consumers increasingly value mission-aligned organizations, creating a natural competitive advantage. The community-focused governance structure required for 501(c)(29) status resonates with healthcare consumers seeking alternatives to traditional insurance models. The ability to promote organizational decisions based on member benefit rather than profit maximization builds trust and loyalty - particularly valuable in health insurance markets where consumer dissatisfaction with traditional carriers remains high.

Disadvantages, limitations, and compliance challenges

501(c)(29) organizations face significant operational, regulatory, and market hurdles that prospective founders must carefully evaluate. The combination of regulatory intensity, limited program support, and ongoing financial constraints has contributed to the high failure rate among these specialized entities.

Complex compliance and regulatory burden

Organizations with 501(c)(29) status must maintain extraordinarily detailed documentation systems that satisfy multiple regulatory bodies. The application process begins with filing IRS Form 1024, which requires extensive documentation of governance structure, operational parameters, and financial projections. This initial hurdle represents just the beginning of ongoing compliance demands.

Annual reporting requirements create substantial administrative overhead, with organizations needing dedicated staff or consultants to manage IRS filings, ACA compliance documentation, and HHS regulatory submissions. These reports must demonstrate continued adherence to specific operational standards, including board composition, market focus, and appropriate fund utilization.

Regulatory audits pose persistent operational risks, as multiple agencies maintain oversight authority. Organizations must prepare for and successfully navigate periodic reviews from the IRS, state insurance commissioners, and HHS representatives. These audits examine financial transactions, governance procedures, and marketplace activities to verify continued eligibility for tax-exempt status.

Eligibility constraints and scarcity of active CO-OPs

The CO-OP program's strict eligibility requirements severely limit which organizations can obtain and maintain 501(c)(29) status. The "substantially all" test mandates that these organizations focus predominantly on providing health insurance in the individual and small group markets, restricting their ability to diversify revenue streams or market segments.

Historical data reveals the challenging reality: Of the original 23 CO-OPs that received federal funding, only three remain operational in 2025. This dramatic contraction reflects the program's practical limitations and competitive disadvantages in the health insurance marketplace. Most early entrants faced insurmountable challenges including:

- Inadequate pricing models resulting in unsustainable premium levels

- Higher-than-projected claims costs from members with significant medical needs

- Limited marketing capabilities due to federal funding restrictions

- Insufficient capital reserves compared to established market competitors

- Unexpected reductions in federal risk-sharing programs

The CO-OP landscape demonstrates that regulatory status alone cannot overcome structural market disadvantages, particularly in capital-intensive industries like health insurance.

Potential for exemption revocation

501(c)(29) organizations face continuous risk of losing their tax-exempt status through operational drift or compliance failures. The IRS maintains vigilant oversight and can revoke exemption for violations including:

- Private inurement violations where insiders receive inappropriate benefits

- Failure to maintain the required policyholder-elected board structure

- Deviation from the core ACA-compliant health insurance purpose

- Missed filing deadlines for annual IRS Form 990 submissions

- Insufficient documentation of ongoing eligibility under program requirements

The consequences of revocation extend beyond taxation issues. Organizations face potential retroactive tax obligations, penalties for late filing, and permanent damage to market reputation. Recovery from revocation is nearly impossible given the narrow eligibility window and limited federal support for the program.

| Challenge category | Key limitations and risks |

|---|---|

| Regulatory burden | Complex multi-agency oversight, extensive documentation requirements, and continuous audit risk |

| Market constraints | Limited to individual/small group markets, restricted from certain marketing activities |

| Financial hurdles | Capital acquisition restrictions, competitive disadvantage against established insurers |

| Governance requirements | Mandatory policyholder-elected board with strict independence rules |

| Exemption vulnerability | Continuous risk of status revocation from operational or reporting failures |

How to form a 501(c)(29) organization

Establishing a 501(c)(29) organization requires navigating specific regulatory requirements designed for nonprofit health insurance issuers. The formation process involves several critical phases that ensure compliance with both the Internal Revenue Service (IRS) and Centers for Medicare & Medicaid Services (CMS) requirements.

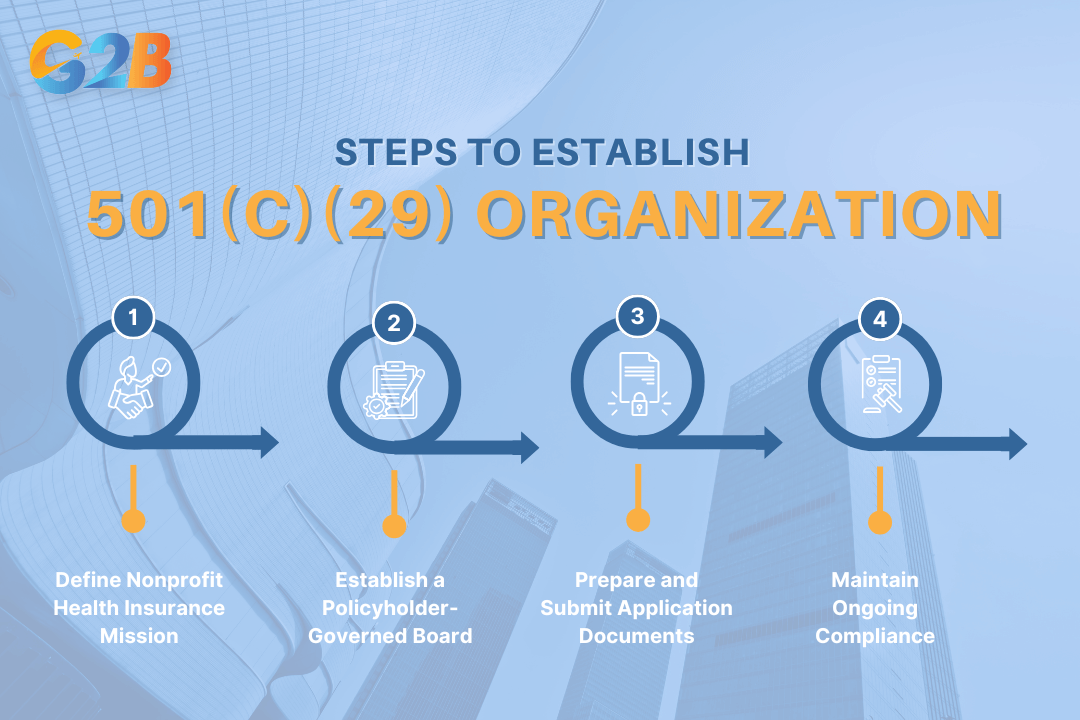

Establishing a 501(c)(29) organization requires four steps

Certification of nonprofit health insurance mission

Creating a solid foundation for a 501(c)(29) organization begins with clearly articulating the nonprofit health insurance mission. Organizations must develop comprehensive bylaws that explicitly state the nonprofit purpose and commitment to providing ACA-compliant health insurance. These governing documents should address membership eligibility, premium structures, and benefit design.

The business plan requires specific elements unique to nonprofit health insurers, including financial projections demonstrating sustainability without prioritizing profit. This plan must outline strategies for maintaining competitive premiums while ensuring solvency reserves meet state insurance regulations. Successful applicants typically include market analysis showing how the organization will address healthcare access gaps in their service area.

Building a policyholder-governed board

The governance structure of a 501(c)(29) organization fundamentally differs from other nonprofits. Federal regulations require a majority of board directors to be elected by policyholders, creating a consumer-controlled model that prioritizes member interests over commercial concerns. Board composition documentation must include:

- Clear election procedures for policyholder representatives

- Term limits and qualification requirements

- Conflict of interest policies preventing private inurement

- Governance structures ensuring member-focused decision-making

Organizations should establish nomination committees and transparent election processes before launching insurance products. The bylaws must explicitly prohibit actions benefiting private stakeholders beyond standard insurance operations. Successful 501(c)(29) organizations implement governance training programs specifically addressing the unique fiduciary responsibilities of policyholder-elected board members.

Application and compliance documentation process

The application process requires meticulous documentation preparation following a specific sequence:

- File articles of incorporation with appropriate state agencies

- Obtain federal Employer Identification Number (EIN)

- Complete the IRS Form 1024 application for tax exemption

- Submit evidence of CO-OP program qualification

- Provide detailed business operations documentation

The compliance documentation must demonstrate adherence to both:

- State insurance filing requirements (including capital reserve requirements)

- Federal ACA provisions (particularly regarding medical loss ratios)

Successful applicants maintain comprehensive compliance calendars tracking recurring filing deadlines for the IRS, state insurance departments, and CMS. Organizations should implement documentation systems capturing board governance records, financial transactions, and member communications to withstand regulatory reviews. Most 501(c)(29) entities engage specialized legal counsel familiar with both nonprofit and insurance regulatory frameworks to navigate this complex application process.

Need a reliable Delaware incorporation service? Contact G2B for a free consultation today!

501(c)(29) compliance checklist and ongoing obligations

Maintaining a 501(c)(29) organization requires vigilant adherence to both IRS and ACA requirements. These nonprofit health insurance issuers face unique compliance demands that exceed those of standard nonprofits.

Essential IRS and IRS form 1024 filings

The IRS imposes specific filing requirements that every 501(c)(29) organization must meet to maintain tax-exempt status. Form 1024 serves as the foundation document for initial recognition, requiring detailed organizational, financial, and operational information about the nonprofit health insurer. This comprehensive application establishes the baseline for ongoing compliance.

Beyond initial application, annual reporting through Form 990 remains mandatory, with submissions due by the 15th day of the fifth month following the close of the fiscal year. Organizations must maintain meticulous documentation of all income sources, expenditures, and program activities to substantiate tax filings. Prudent compliance practices include:

- Creating a calendar-based tracking system for all filing deadlines

- Establishing a dedicated document repository for IRS correspondence

- Implementing executive compensation review procedures

- Conducting quarterly internal audits of financial documentation

- Developing a rapid-response protocol for handling IRS inquiries

Regular board review of IRS compliance status reduces the risk of unexpected issues during regulatory examinations. Organizations should allocate resources specifically for managing compliance documentation and designate a responsible officer with direct board reporting authority.

ACA - Mandated reporting and governance

The Affordable Care Act imposes additional compliance obligations beyond standard IRS requirements for 501(c)(29) entities. ACA compliance centers on two critical elements: operational reporting and governance structure verification. Annual ACA reports must detail qualified health plan activities, enrollment statistics, premium ratios, and other metrics specific to health insurance operations. These reports require accurate documentation of all insurance activities, benefit designs, and consumer-facing operations.

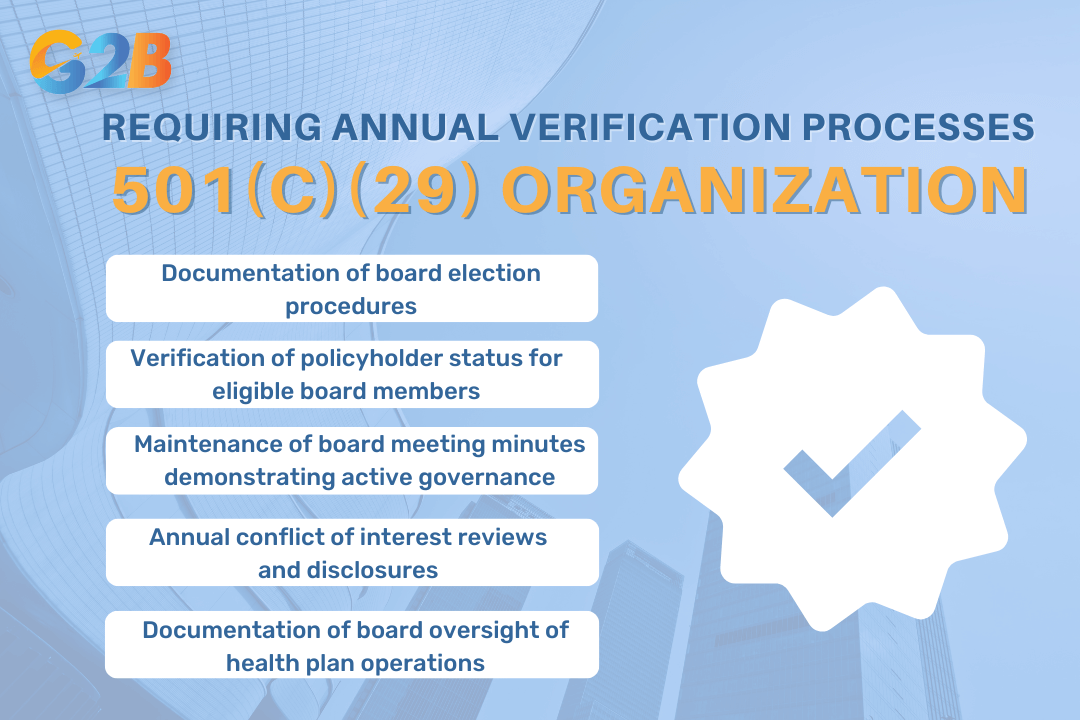

The governance structure represents a particularly critical compliance area unique to 501(c)(29) organizations. Boards must maintain a majority of policyholder-elected members, requiring annual verification processes including:

- Documentation of board election procedures

- Verification of policyholder status for eligible board members

- Maintenance of board meeting minutes demonstrating active governance

- Annual conflict of interest reviews and disclosures

- Documentation of board oversight of health plan operations

There are five requiring annual verification processes

| Compliance element | Documentation requirement | Review frequency |

|---|---|---|

| Policyholder board majority | Election records, verification of status | Annually |

| Financial operations | Detailed income/expense reports | Quarterly |

| ACA reporting | Qualified health plan statistics, premium data | Annually |

| Mission alignment | Program activity summaries | Semi-annually |

| Risk assessment | Internal compliance audit reports | Quarterly |

Implementing a comprehensive board self-audit process significantly reduces the risk of noncompliance. Organizations should establish clear documentation standards and maintain centralized records accessible to authorized compliance personnel and board members.

501(c)(29) vs. other 501(c) organizations

Nonprofit founders face critical decisions when selecting the appropriate tax-exempt designation. Understanding these distinctions helps entrepreneurs make informed decisions about their nonprofit structure before committing to the application process.

Comparison table: 501(c)(29) vs. 501(c)(3) and (4)

When evaluating nonprofit tax designations, a side-by-side comparison reveals important distinctions in structure, permissible activities, and compliance requirements:

| Feature | 501(c)(29) | 501(c)(3) | 501(c)(4) |

|---|---|---|---|

| Primary purpose | Health insurance provision via the CO-OP program | Charitable, educational, religious, and scientific activities | Social welfare and community benefits |

| Tax deductibility of donations | No | Yes (tax-deductible for donors) | Generally no |

| Lobbying permitted | Limited by ACA regulations | Limited (substantial part test or 501(h) election) | Unlimited |

| Political activities | Restricted | Prohibited | Limited (not primary purpose) |

| Public disclosure | Form 990 plus ACA reporting | Form 990 | Form 990 |

| Eligibility criteria | Qualified nonprofit health insurance issuers only | Charitable organizations | Social welfare organizations |

| Formation complexity | High (requires ACA CO-OP approval) | Moderate | Moderate |

| Governance requirements | The majority policyholder-elected board | Independent board | Board with a community focus |

This comparison highlights the specialized nature of 501(c)(29) organizations compared to the more common nonprofit structures organizations typically consider.

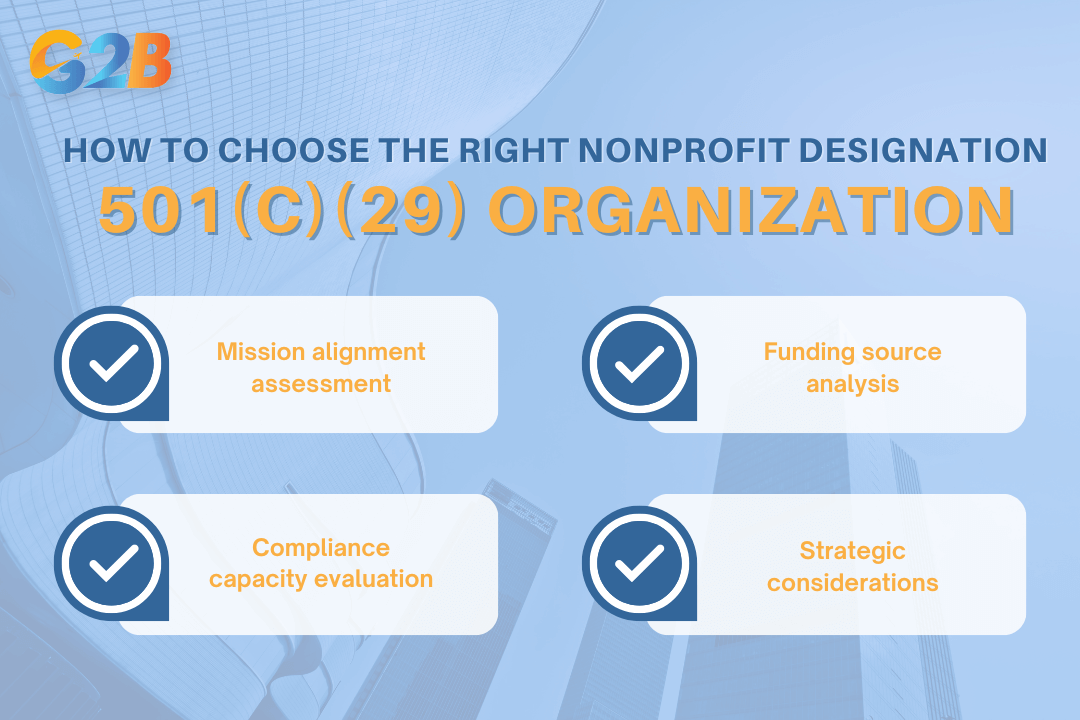

How to choose the right nonprofit designation

Selecting the optimal nonprofit designation requires careful analysis of organizational mission, operational models, and long-term strategic goals.

Mission alignment assessment:

- Choose 501(c)(29) only if establishing a nonprofit health insurance issuer under ACA's CO-OP program

- Select 501(c)(3) for traditional charitable, educational, or religious purposes

- Consider 501(c)(4) for community improvement and social welfare activities

Funding source analysis:

- Organizations relying on tax-deductible donations should prioritize 501(c)(3) status

- Entities funded through government loans/grants related to healthcare CO-OPs align with 501(c)(29)

- Organizations dependent on membership dues may find 501(c)(4), 501(c)(6), or 501(c)(7) more suitable

Compliance capacity evaluation:

- Assess internal expertise and resources for ongoing regulatory requirements

- Calculate the budget for annual legal/accounting support

- Determine capacity for specialized ACA reporting (particularly important for 501(c)(29))

- Review board recruitment capabilities to meet governance requirements

Strategic considerations:

- Growth trajectory and scaling plans

- Need for lobbying or advocacy activities

- Primary beneficiary groups (public vs. members)

- Anticipated revenue sources and sustainability model

Organizations must balance immediate designation benefits against long-term operational implications, particularly when considering the specialized 501(c)(29) structure with its rigid requirements and compliance obligations in both tax and healthcare regulatory spheres.

Four steps to choose the right nonprofit designation

Frequently asked questions

Below are some of the most frequently asked questions about 501(c)(29) organizations. These answers aim to clarify key aspects of their structure, eligibility, and regulatory obligations under the Affordable Care Act:

1. Are donations to 501(c)(29) organizations tax-deductible?

No, donations to 501(c)(29) organizations are not tax-deductible for donors. Unlike 501(c)(3) charitable organizations, contributions to 501(c)(29) qualified nonprofit health insurance issuers do not qualify for charitable deduction benefits under federal tax law.

2. Must 501(c)(29) organizations be Consumer Operated and Oriented Plans (CO-OPs)?

Yes, 501(c)(29) organizations must be qualified nonprofit health insurance issuers that have received loans or repayable grants under the Centers for Medicare and Medicaid Services CO-OP program. They cannot be created independently without CMS program participation and approval.

3. Are 501(c)(29) organizations required to file Form 990?

Yes, 501(c)(29) organizations must file Form 990 annual returns with the IRS. However, they are recognized as section 501(c)(29) nonprofit health insurance issuers and have specific filing requirements that differ from other exempt organizations.

4. Can 501(c)(29) organizations benefit private shareholders?

No, 501(c)(29) organizations cannot benefit any private shareholders or individuals. However, they are required by the Affordable Care Act to use profits to lower premiums, improve benefits, or improve healthcare quality for members.

5. Do 501(c)(29) organizations need to apply for tax exemption?

Yes, 501(c)(29) organizations must apply for recognition of tax-exempt status with the IRS. The effective date of exemption is the later of the application date or March 23, 2010, when the Affordable Care Act was enacted.

6. Are 501(c)(29) organizations exempt from federal income tax?

Yes, 501(c)(29) organizations are exempt from federal income taxes under Section 501(c)(29) of the Internal Revenue Code. This exemption applies only for periods when they remain in compliance with CO-OP program requirements and loan agreements.

7. Can 501(c)(29) organizations engage in political campaign activities?

No, 501(c)(29) organizations cannot participate or intervene in campaigns for public office. They also cannot engage in substantial legislative activities or attempts to influence legislation, similar to restrictions on 501(c)(3) organizations.

8. Must 501(c)(29) organizations comply with CMS loan agreements?

Yes, 501(c)(29) organizations must remain in compliance with all CO-OP program requirements and any loan agreement with CMS. If CMS determines non-compliance, the organization will lose its tax-exempt status under section 501(c)(29).

9. Are 501(c)(29) organizations subject to unrelated business income tax?

Yes, like other tax-exempt organizations, 501(c)(29) entities may be subject to unrelated business income tax (UBIT) on income from activities not substantially related to their exempt purpose. They must file Form 990-T if they have unrelated business income exceeding $1,000.

10. Do 501(c)(29) organizations have governance requirements?

Yes, 501(c)(29) organizations must meet specific governance requirements as qualified nonprofit health insurance issuers. They must be organized as nonprofit, member corporations under state law and meet additional requirements set forth in the Affordable Care Act.

A 501(c)(29) organization embodies the spirit of innovation and compassion in healthcare, offering a unique platform for nonprofit health insurance issuers to emerge as harbingers of affordable and sustainable care. This IRS designation not only helps them navigate the complex compliance landscape but also unlocks opportunities for tax benefits and fiscal support. With strategic vision, these entities can bridge the gap in healthcare delivery, empowering communities and nurturing a healthier, more just society.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom