Ground lease agreements are a cornerstone of commercial real estate, offering a unique structure that separates the ownership of land from the buildings constructed upon it. This specialized arrangement allows developers and businesses to erect properties on desirable land without the prohibitive cost of purchasing it outright. This article will explore the ins and outs of ground lease, a unique real estate agreement separating land and building ownership.

This article explains the key concepts of a ground lease. We specialize in company formation in Vietnam and not in real estate law or property consulting. For technical guidance on structuring or evaluating a ground lease, please consult a qualified real estate expert.

What is a ground lease?

A ground lease, also known as a land lease, is a long-term rental agreement where a tenant leases a parcel of land and has the right to develop and construct their own buildings and improvements on it, subject to the terms of the lease and applicable local laws. The core concept is the separation of ownership: The tenant rents the land but owns the buildings and any capital improvements they construct for the duration of the lease.

These are distinctly long-term leases, with a typical term length that commonly ranges from 50 to 99 years. This extended timeframe is necessary to allow the tenant to realize a return on their significant investment in construction. A critical component of every ground lease is the reversion clause, which specifies that at the end of the lease term, the land and all improvements made by the tenant revert to the landowner, usually without compensation to the tenant.

During the lease period, the tenant is responsible for nearly all expenses associated with the property. This includes costs such as property taxes, property and liability insurance, construction, and all ongoing maintenance. This structure provides the landlord with a passive income stream while placing the operational responsibilities squarely on the tenant.

Types of ground leases

Ground leases are primarily categorized into two main forms: Subordinated and Unsubordinated. The fundamental difference between them centers on the landlord's rights in relation to the tenant's financing for the property's development.

Ground leases are primarily categorized into two main forms

Subordinated ground lease

In a subordinated ground lease, the landlord agrees to a lower priority (or "subordinates") their interest in the property to the tenant's lender's claim on the leasehold interest and improvements, rather than on the land itself. This means that the property itself, including the landlord's land, acts as collateral for the tenant's construction loan.

The major implication is that if the tenant defaults on their loan, the lender can foreclose on the property, and the landlord could lose control over the leased land for the duration of the lease term to satisfy the debt. The primary benefit for the tenant is that this arrangement makes it significantly easier to secure financing because it offers greater security to the lender, often resulting in more favorable loan terms. In exchange for taking on this substantial risk, the landlord can typically negotiate higher rent payments and other more favorable lease terms.

Unsubordinated ground lease

With an unsubordinated ground lease, the landlord maintains the top priority of claims on the property. Their ownership interest remains superior to the lien of the tenant's lender. The key implication is that if the tenant defaults on their loan, the lender can go after the tenant's assets - the building and the leasehold interest - but cannot foreclose upon the land or the landlord's ownership rights.

This structure provides significant asset protection for the landowner, making it the safer and more common option for landlords. However, from the lender's perspective, this arrangement is riskier, which makes it more difficult for the tenant to obtain financing for their development project. As a trade-off for this safer position, landlords typically receive lower rental payments compared to what they could command with a subordinated lease.

Financial dynamics of a ground lease

The financial dynamics of a ground lease play a pivotal role in shaping the long-term viability and profitability of a real estate project. By understanding how rent structures, valuation methods, and capital allocation interact, stakeholders can better assess risks and optimize returns.

Structuring rent and escalation clauses

The financial structure of a ground lease is designed to be resilient over its multi-decade term. While a base rent is established at the beginning, often based on a percentage of the land's appraised value, it is not static. To account for inflation and changes in property value, ground leases almost always contain escalation clauses that allow rent to increase over the long term.

There are several common methods for these adjustments, such as:

- Fixed increases: Predetermined percentage or dollar amount increases at regular intervals, such as every 5 or 10 years.

- CPI adjustments: Rent increases are tied to the Consumer Price Index (CPI) or another inflation measure, ensuring the landlord's income retains its purchasing power.

- Fair market value reappraisals: The land is periodically reappraised (e.g., every 20 years), and the rent is reset based on its current fair market value.

The tenant's financial obligations: Taxes, insurance, and maintenance

A defining financial characteristic of a ground lease is that the tenant is almost always responsible for all operating expenses related to the property. This structure is very similar to a triple-net (NNN) lease, where the tenant bears the full financial burden of the property's operation.

These obligations typically include a wide range of costs, such as:

- Property taxes: The tenant is responsible for paying all real estate taxes assessed on both the land and the improvements.

- Insurance: The tenant must secure and maintain adequate property and liability insurance for the entire property.

- Maintenance: All costs for the maintenance and repair of the improvements they build, from the foundation to the roof, are the tenant's responsibility.

Financing strategies for ground lease developments

Financing a project on leased land is known as leasehold financing, and the tenant uses their leasehold interest in the property as collateral for a loan. The ability to secure this financing is heavily dependent on the type of ground lease.

As previously noted, financing is far easier to obtain with a subordinated ground lease. Lenders strongly prefer this structure because having the land as part of the collateral significantly reduces their risk. With an unsubordinated lease, lenders have recourse only to the building and the lease agreement itself, making them more hesitant to extend credit. In either case, lenders will meticulously scrutinize the ground lease agreement for clauses that protect their interest, such as rights to be notified of and to cure a tenant's default.

Accounting for ground leases (ASC 842)

The accounting treatment for leases, including ground leases, is governed by the ASC 842 standard. This standard has a significant impact on how a tenant reports the lease on its financial statements. Under ASC 842, tenants must recognize a "right-of-use" asset and a corresponding lease liability on their balance sheet for most leases.

For a long-term ground lease, this requirement dramatically increases the reported assets and liabilities on a tenant's balance sheet. This can affect key financial ratios, debt covenants, and the overall financial picture of the company. The lease is further classified as either an operating lease or a finance lease, which determines the specific pattern of expense recognition over the lease term.

Tax implications for both parties

Ground leases present distinct tax implications for both the landlord (lessor) and the tenant (lessee).

- For the landlord (lessor): The rent received from the tenant is taxable as ordinary income. A major advantage for the landlord is avoiding the large capital gains tax that would be triggered by an outright sale of the property. They generate a steady income while retaining ownership and deferring a significant tax event.

- For the tenant (lessee): Rent payments made to the landlord are typically tax-deductible as a business expense. Furthermore, because the tenant owns the buildings and other improvements, they can depreciate these capital improvements over their useful life, creating another valuable tax deduction that lowers their overall tax burden.

Advantages of a ground lease

The advantages of a ground lease offer compelling benefits for both landowners and tenants, creating a flexible structure that supports long-term development.

The advantages of a ground lease offer compelling benefits for both landowners and tenants

Benefits for the tenant and developer

For tenants and developers, the advantages are primarily financial and strategic.

- Lower upfront cost: The primary advantage for a developer is accessing a prime location without the high upfront cost of purchasing the land. This significantly reduces the initial capital required for a project.

- Frees up capital: By not buying the land, the tenant can allocate more financial resources toward constructing high-quality improvements and investing in their core business operations.

- Tax benefits: The ability to deduct rent payments and depreciate the value of the constructed improvements provides significant tax advantages.

For large-scale infrastructure projects, similar principles apply in Public-Private Partnerships, such as the Build-Operate-Transfer (BOT) contract, where a private entity finances and operates a project for a set period before transferring it back to the public entity.

Benefits for the landlord and property owner

For landowners, a ground lease offers a secure, long-term investment strategy with multiple benefits.

- Steady, long-term income: The landlord secures a reliable and passive stream of revenue for decades with minimal management responsibilities.

- Retain ownership: The landlord keeps the title to the land, allowing them to benefit from its long-term value appreciation. This is often a preferred strategy for a holding company that wishes to maintain a portfolio of real estate assets without engaging in active development.

- Reversion of improvements: At the end of the lease, the landlord acquires the developed property - including the buildings and infrastructure - at no cost, which can dramatically increase the property's overall value.

- Tax advantages: Landlords avoid the immediate and substantial capital gains tax they would face if they sold the property.

Disadvantages and risks to consider

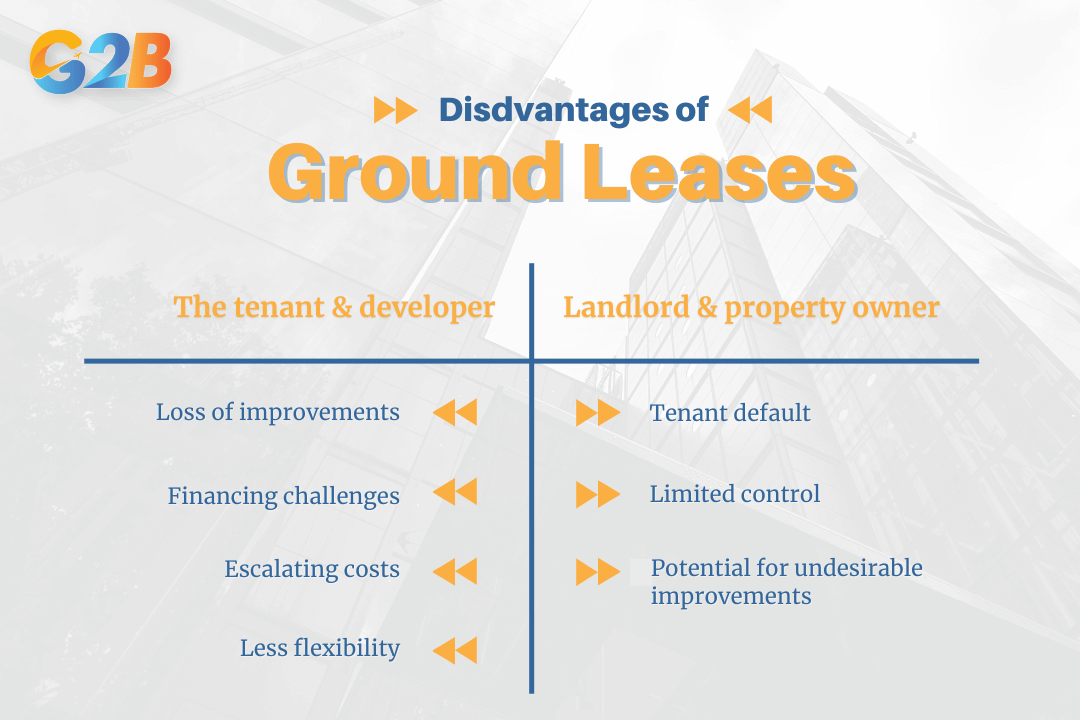

Despite its strategic benefits, a ground lease also carries notable disadvantages and risks that stakeholders must evaluate carefully.

A ground lease also carries notable disadvantages and risks

Potential drawbacks for the tenant and developer

Tenants also face significant risks and limitations that must be carefully considered.

- Loss of improvements: The most significant drawback is that the tenant loses ownership of all the assets they built when the lease expires and they revert to the landlord.

- Financing challenges: Securing a loan can be difficult and may come with less favorable terms, particularly with an unsubordinated lease where the land isn't collateral.

- Escalating costs: Over the long term, escalating rent, property taxes, and maintenance costs can become a significant financial burden.

- Less flexibility: The ground lease may require landlord approval for certain developments, changes in use, or alterations to the property, limiting the tenant's autonomy.

Potential risks for the landlord and property owner

Landlords are not without risks, especially concerning the tenant's performance and the structure of the lease.

- Tenant default: The primary risk, especially with a subordinated lease, is tenant default. If the tenant defaults on their loan, the landlord could lose their property to the lender through foreclosure.

- Limited control: For the duration of the lease, the landlord has very little control over the day-to-day use and management of the property.

- Potential for undesirable improvements: At the end of the term, the landlord could be left with a poorly maintained, obsolete, or poorly designed building that may require significant investment to become profitable again.

Ground lease in Vietnam

The concept of a ground lease in Vietnam operates within a unique legal framework where land is collectively owned by the people and administered by the State. Land use rights are granted or leased by the State as property rights under Vietnamese law, rather than private land ownership. Both foreign and domestic entities can acquire long-term "Land Use Rights" (LURs) from the government, which function similarly to a long-term land lease, but are a form of state-granted land use rights under Vietnamese law.

Foreign investors typically obtain LURs in one of two ways: By leasing land directly from the state or by entering into a joint venture where a Vietnamese partner contributes their existing LUR to the venture. This is particularly relevant for green field investment policies in Vietnam, where foreign entities lease undeveloped land to construct new factories or facilities from the ground up. The lease term for these rights is typically 50 years, though it can be extended up to 70 years for projects in difficult socioeconomic areas or those with large investment capital.

There are two primary rent payment structures for LURs:

- Annual rental payments: The investor pays rent to the state on an annual basis.

- One-off, lump-sum payment: The investor pays the entire rental amount for the full 50- or 70-year term upfront.

Choosing the one-off payment method grants the investor more extensive rights, similar to ownership in other markets. These expanded rights include the ability to transfer, sublease, or mortgage the Land Use Rights as collateral for a loan, although these rights remain subject to strict regulation under Vietnamese land laws.

In Vietnam, a ground lease-like arrangement provides developers with access to prime land use rights with lower upfront capital, while offering the State or Vietnamese partners long-term benefits and stable income. The choice between a subordinated and unsubordinated structure fundamentally alters the risk and financing dynamics for all parties involved.

For tenants, the trade-off involves weighing the benefit of reduced initial capital outlay against the eventual loss of their constructed improvements. For landlords, it is a balance between higher returns with higher risk (subordinated) and greater security with lower returns (unsubordinated). Ultimately, a meticulously negotiated ground lease can create a mutually beneficial arrangement, but understanding its intricate legal and financial obligations is crucial for a successful long-term real estate strategy.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom