While not as widely known as their 501(c)(3) counterparts, 501(c)(4) organizations serve an important purpose in supporting community well-being, civic engagement, and public education. Whether operating at the local or national level, these organizations are structured to give individuals and groups a way to contribute to the public good through organized efforts. This article will bring a closer look at what 501(c)(4) organizations are, how they function, and why they matter in today’s nonprofit landscape.

This content is provided for general informational purposes to help entrepreneurs understand the basics of 501(c)(4) organizations. We are specialists in company formation, not providers of legal or tax advisory services specific to the US nonprofit compliance. This information should not be considered professional legal or tax advice. For guidance specific to your situation, please consult a nonprofit compliance expert.

What is a 501(c)(4) organization?

A 501(c)(4) organization is a tax-exempt nonprofit entity recognized under Section 501(c)(4) of the Internal Revenue Code, primarily designed to promote social welfare and advance the common good of communities. They can engage in lobbying and some political activity while promoting community and civic well-being.

Formal definition and legal meaning

Under IRS regulations, a 501(c)(4) organization must operate primarily to further the common good and general welfare of the community. The legal framework requires these organizations to use their net earnings exclusively for charitable, educational, or recreational purposes - never for private benefit to individuals or shareholders. Their defining legal characteristics include:

- Tax exemption on income related to their exempt purpose

- Ability to engage in unlimited lobbying activities

- Permission to participate in some political activity, provided it remains secondary to their social welfare mission

- No requirement to disclose donor information publicly (unlike many other nonprofits)

The "primarily" test represents a critical legal threshold, as the organization must devote more than 50% of its activities to promoting social welfare rather than political campaigning. Failing this test can jeopardize the organization's tax-exempt status and trigger potential penalties.

Simple explanation for entrepreneurs

A 501(c)(4) organization serves as a nonprofit vehicle that can advocate for causes, lobby for legislative changes, and participate in political activities - all while maintaining tax-exempt status. For founders and advocacy leaders, this structure offers a powerful platform to:

- Influence public policy through direct lobbying efforts without limits

- Educate communities about social issues and drive civic engagement

- Create meaningful social impact through community improvement initiatives

- Support or oppose legislation aligned with the organization's social welfare mission

However, while the organization itself remains tax-exempt, donations to 501(c)(4) organizations are not tax-deductible for donors, potentially affecting fundraising strategies. The primary requirement remains that the organization must clearly demonstrate its commitment to community benefit, regardless of its advocacy work.

Let’s discover how our Delaware incorporation service can support your goals - Begin with a free consultation!

Types and roles of 501(c)(4) organizations

501(c)(4) organizations fall into several distinct categories recognized by the Internal Revenue Service (IRS), each serving different community needs while sharing core operational freedoms that distinguish them from other nonprofit designations.

Main types of 501(c)(4)s

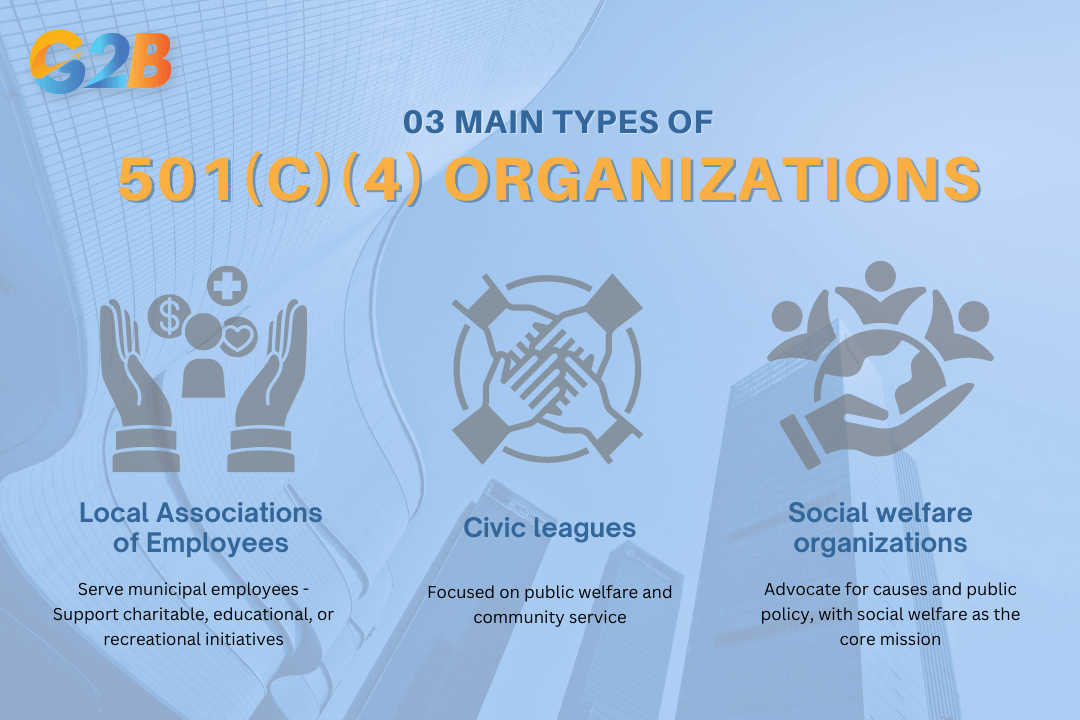

The IRS recognizes three primary categories of 501(c)(4) organizations, each with specific characteristics and purposes:

- Civic leagues: Community-focused organizations dedicated to improving public welfare through local initiatives. Examples include Kiwanis Clubs, Rotary Clubs, and Lions Clubs that organize community service projects and public improvement campaigns.

- Social welfare organizations: Groups formed to advocate for particular causes, influence public policy, or address specific social needs. These organizations engage in substantial lobbying and advocacy work while maintaining social welfare as their primary mission.

- Local associations of employees: Organizations with membership limited to employees within a specific municipality. These associations devote their earnings to charitable, educational, or recreational purposes that benefit their members and communities.

These classifications provide different structural frameworks while maintaining the core 501(c)(4) benefits of tax exemption and advocacy flexibility.

The IRS recognizes three primary categories of 501(c)(4) organizations

Key roles and activities

501(c)(4) organizations perform several vital functions that distinguish them from other nonprofits:

- Social welfare promotion: Implementing programs that improve community conditions, public health, or address systemic issues.

- Policy advocacy: Engaging in unlimited lobbying activities to influence legislation and administrative rules at local, state, and federal levels.

- Public education: Conducting research, publishing reports, and disseminating information to raise awareness about critical social issues.

- Community organizing: Mobilizing citizens around specific causes, building grassroots movements, and facilitating civic engagement.

- Limited political activity: Supporting or opposing candidates for public office, provided this doesn't become the organization's primary purpose.

Unlike 501(c)(3) charities, these organizations face fewer restrictions on advocacy activities, making them powerful vehicles for driving policy change.

501(c)(4) vs 501(c)(3): Key differences and when to choose each

Organizations seeking nonprofit status must understand the fundamental differences between 501(c)(4) and 501(c)(3) designations. While both offer tax-exempt status, 501(c)(4) organizations have distinct advantages for advocacy-focused groups.

Comparison table: 501(c)(4) vs 501(c)(3)

| Feature | 501(c)(3) | 501(c)(4) |

|---|---|---|

| Primary purpose | Religious, charitable, educational, scientific | Social welfare, community benefit |

| Tax benefits | Tax-exempt; donations tax-deductible for donors | Tax-exempt; donations NOT tax-deductible |

| Lobbying activities | Limited (generally under 20% of expenditures) | Unlimited; can be primary activity |

| Political campaign activities | Strictly prohibited | Permitted but cannot be primary purpose |

| Donor disclosure | Public disclosure required for major donors | Greater donor privacy protection |

| Formation process | Form 1023 application | Form 1024-A application |

| Public trust | Higher perceived legitimacy with donors | May face greater scrutiny |

| Funding flexibility | More restricted use of funds | Greater operational flexibility |

The structure selected significantly impacts an organization's ability to drive social change through different mechanisms. 501(c)(3)s operate with greater restrictions but attract a broader donor base seeking tax benefits, while 501(c)(4)s trade tax deductibility for expanded advocacy capabilities.

Which status is right for your organization?

Organizations primarily focused on direct community service and education typically benefit from 501(c)(3) status. This structure works best when:

- Broad-based fundraising from individual donors is essential

- The mission focuses on charitable services rather than systems change

- Political neutrality aligns with organizational values

- Grant funding from foundations forms a significant revenue stream

- Tax deductibility of donations is crucial for fundraising success

Conversely, 501(c)(4) status proves advantageous when advocacy and policy influence drive the mission. This structure excels when:

- Lobbying represents a core organizational activity

- The organization plans to endorse political candidates or engage in elections

- A small number of committed funders support the work regardless of tax benefits

- Privacy protection for donors is important due to controversial advocacy positions

- The mission primarily involves influencing legislation or public opinion

Many successful organizations operate tandem structures - a 501(c)(3) for educational work and a 501(c)(4) for advocacy campaigns. This hybrid approach allows strategic allocation of resources while maximizing both tax benefits and advocacy impact. However, maintaining proper separation between these affiliated entities requires rigorous compliance systems and governance practices. Founders must realistically assess their funding prospects, policy goals, and operational needs before selecting a structure.

Guide to start a 501(c)(4) organization

The formation process of a 501(c)(4) organization involves several phases from state registration to federal recognition, each requiring careful attention to detail and compliance with specific timelines.

Formation and registration steps

The establishment of a 501(c)(4) organization begins with fundamental organizational decisions and documentation. First, create a clear written statement of purpose that emphasizes social welfare objectives. Select a distinctive name that reflects the organization's mission and resonates with potential supporters.

Form a leadership structure by establishing a board of directors with standard officer positions including President, Treasurer, Secretary, and Vice President. Draft comprehensive bylaws that outline governance procedures, voting rights, and operational guidelines. These foundational documents must align with both federal requirements and state-specific regulations.

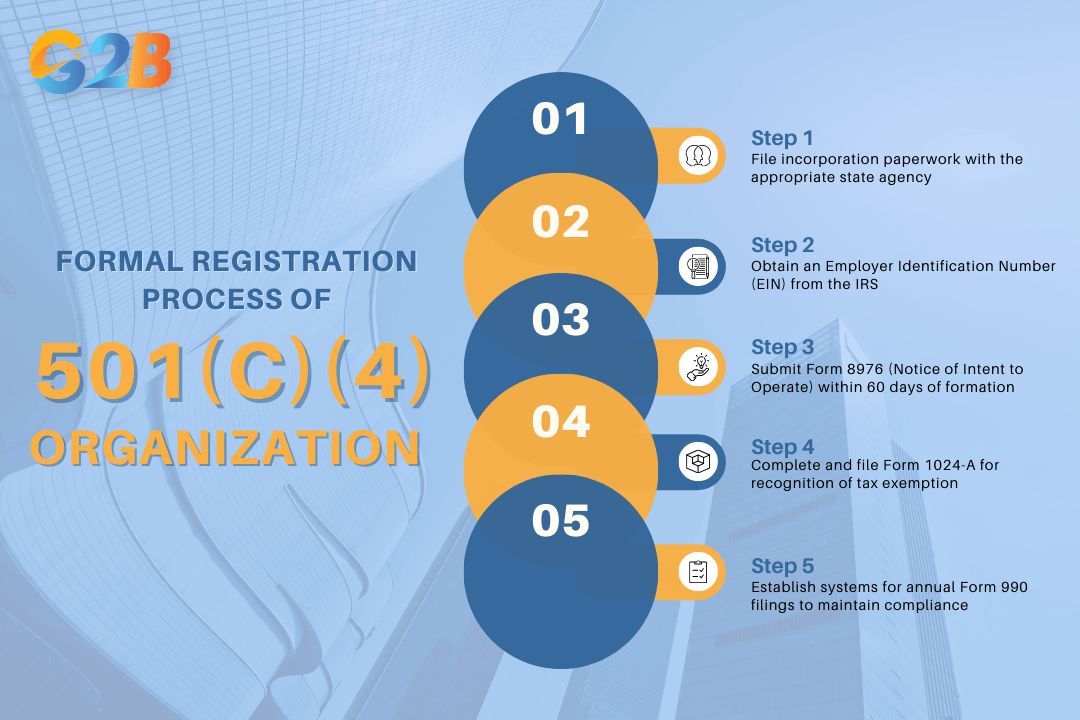

The formal registration process proceeds as follows:

- File incorporation paperwork with the appropriate state agency

- Obtain an Employer Identification Number (EIN) from the IRS

- Submit Form 8976 (Notice of Intent to Operate) within 60 days of formation

- Complete and file Form 1024-A for recognition of tax exemption

- Establish systems for annual Form 990 filings to maintain compliance

The formal registration process proceeds of 501(c)(4) organization

Common mistakes and how to avoid them

Procedural errors during formation can lead to costly delays or rejection of 501(c)(4) status. Organizations frequently miss the 60-day deadline for Form 8976 submission or fail to include required filing fees, resulting in automatic rejection without review. Substantive mistakes include drafting vague mission statements that inadequately demonstrate social welfare purposes. Organizational documents must strictly comply with state laws while incorporating specific provisions required by the IRS for exempt organizations.

Operational compliance issues frequently derail new 501(c)(4) organizations. These include:

- Neglecting annual Form 990 filing requirements

- Conducting activities primarily benefiting private interests rather than community welfare

- Exceeding political activity limitations by making it the organization's primary purpose

- Confusing 501(c)(4) compliance standards with 501(c)(3) requirements

Start your US business right - Contact G2B for a free consultation on Delaware incorporation service today!

Compliance and ongoing legal requirements for 501(c)(4)s

501(c)(4) organizations must adhere to both federal and state requirements to avoid potential penalties, public scrutiny, and loss of exempt status. Compliance serves as the foundation for organizational legitimacy and effectiveness.

IRS reporting and transparency

501(c)(4) organizations must file annual information returns with the IRS using Form 990, Form 990-EZ, or Form 990-N, depending on the organization's gross receipts and total assets. These filings require comprehensive financial reporting, governance details, and program activity information. The deadline typically falls on the 15th day of the fifth month after the organization's fiscal year ends.

Public disclosure requirements mandate that 501(c)(4) entities make their three most recent annual returns available for public inspection upon request. Many organizations enhance transparency by publishing these documents on their websites. Maintaining accurate and accessible records demonstrates accountability and builds stakeholder trust.

Best practices include:

- Creating standardized filing procedures with internal deadlines

- Implementing document retention policies for supporting materials

- Scheduling regular reviews of public-facing information

- Ensuring financial statements accurately reflect program activities

Lobbying and political activity rules

Unlike 501(c)(3) organizations, 501(c)(4) groups can engage in unlimited lobbying activities that advance their social welfare mission. This includes directly contacting legislators, mobilizing grassroots campaigns, and publicly advocating for specific legislation. However, strict boundaries exist regarding political campaign interventions.

While political activities supporting or opposing candidates for public office are permitted, these cannot constitute the organization's primary purpose. Most tax professionals recommend political expenditures remain below 40% of total spending to maintain a clear social welfare focus. Organizations must meticulously track and document:

- Lobbying expenditures and activities

- Political campaign interventions

- Issue advocacy communications

- Voter education initiatives

Federal Election Commission rules, state lobbying registration requirements, and campaign finance laws create additional compliance layers that vary by jurisdiction. Many 501(c)(4) organizations maintain separate segregated funds for political activities to ensure proper accounting and regulatory adherence.

Operational best practices

Effective governance structures form the backbone of 501(c)(4) compliance. Organizations should establish clear bylaws, regular board meetings with detailed minutes, and documented decision-making processes. Internal controls help prevent misuse of resources and maintain focus on the social welfare mission.

Record-keeping systems must capture:

- Board meeting minutes and resolutions

- Financial transactions and supporting documentation

- Program activities and their connection to social welfare

- Member communications and public statements

- Donation records and restricted fund allocations

Regular compliance reviews conducted by legal and accounting professionals help identify potential issues before they become problems. These assessments should evaluate state filing requirements, public disclosure obligations, and the balance of activities against the primary purpose test. Organizations operating alongside affiliated entities (such as 501(c)(3)s or PACs) must maintain clear operational separation through:

- Separate bank accounts and financial systems

- Distinct boards with documented independence

- Written agreements for resource sharing

- Allocation methods for shared expenses

- Time tracking for staff serving multiple entities

Benefits and strategic advantages of 501(c)(4) status

The tax-exempt status, combined with expanded lobbying rights, creates a powerful vehicle for groups seeking to drive social change through direct advocacy and community mobilization.

Advocacy and policy influence

501(c)(4) organizations can make lobbying and advocacy for legislative change their core function. Unlike 501(c)(3) organizations that face substantial restrictions, these entities can dedicate unlimited resources toward influencing legislation and public policy. These organizations effectively shape policy by engaging directly with legislators, mobilizing community support for issues, and running educational campaigns about legislative matters.

Organizations can also endorse political candidates whose platforms align with their social welfare mission, provided such political activity remains secondary to their primary purpose. This ability creates strategic opportunities for policy influence that other nonprofit structures cannot match.

Tax exemption and financial flexibility

Income generated through activities related to the social welfare mission remains tax-exempt, providing significant financial advantages. This exemption applies to membership dues, program revenue, and certain fundraising initiatives directly supporting the organization's mission. 501(c)(4) organizations benefit from broader flexibility in funding allocation compared to other nonprofits. Funds can support:

- Extensive advocacy campaigns

- Educational initiatives

- Community improvement programs

- Legislative lobbying efforts

- Issue-based advertising

Another notable advantage is the absence of a public support test. Unlike 501(c)(3) organizations, which must demonstrate broad public funding, a 501(c)(4) can receive substantial funding from a single source or limited donor base. This feature proves particularly valuable for causes supported by a small group of dedicated donors or those requiring rapid mobilization of financial resources.

Organizational freedom and flexibility

501(c)(4) status offers operational freedom that creates dynamic advocacy possibilities. These organizations can:

- Respond rapidly to emerging policy issues

- Adjust strategies based on shifting political landscapes

- Devote substantial resources to lobbying efforts

- Support ballot initiatives directly

- Engage in limited political campaign activities

This flexibility allows organizations to adopt multi-pronged approaches to advancing their missions. The ability to establish affiliated organizations, such as related 501(c)(3) foundations or political action committees, further enhances strategic options, allowing for sophisticated organizational structures that maximize impact while maintaining compliance.

Disadvantages, risks, and common misconceptions

Entrepreneurs should consider this nonprofit structure should understand the drawbacks of 501(c)(4) organizations to make informed decisions.

Disadvantages and operational risks

Non-tax-deductible donations represent one of the most significant drawbacks of 501(c)(4) status. Unlike contributions to 501(c)(3) organizations, donors cannot claim tax deductions for supporting 501(c)(4) entities, potentially limiting fundraising capabilities and donor incentives.

Organizations must maintain strict vigilance over their political activities. The IRS requires that political campaigning remain secondary to social welfare purposes - generally interpreted as less than 50% of overall activities and resources. Crossing this threshold risks severe consequences, including loss of tax-exempt status.

Ongoing compliance demands create substantial administrative burden. 501(c)(4) organizations must file annual Form 990s with the IRS, maintain detailed activity records, and implement governance systems to track political versus social welfare activities. These requirements demand significant time, expertise, and financial resources.

Potential financial penalties:

- Tax on political expenditures under IRC 527(f)

- Excise taxes for excessive lobbying

- Penalties for incomplete or late filings

Scrutiny risks:

- IRS audits and investigations

- Media and watchdog organization attention

- Donor community skepticism

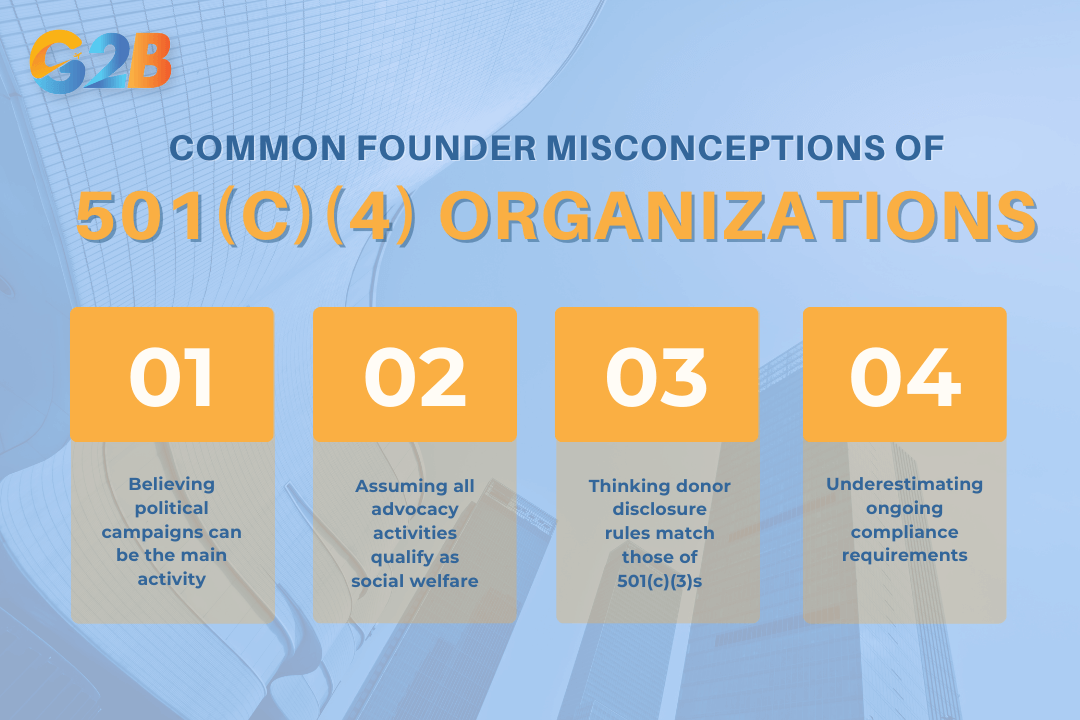

Common misconceptions and pitfalls

The most persistent misconception involves comparing 501(c)(4) organizations with 501(c)(3) charities. Many founders mistakenly believe these structures share the same benefits and limitations. In reality, they operate under fundamentally different legal frameworks with distinct advantages and constraints.

Another dangerous misunderstanding concerns political activity freedom. While 501(c)(4) organizations can engage in some political campaigning, many leaders incorrectly believe they can function primarily as political entities. This misconception has led numerous organizations into compliance problems and potential status revocation.

The primary purpose requirement creates particular confusion. The IRS has never precisely defined what constitutes a "primary" social welfare purpose versus political activity, creating a gray area that poses ongoing compliance challenges. Organizations must develop internal metrics and documentation systems to demonstrate their primary focus remains on social welfare activities.

Common founder misconceptions:

- Believing political campaigns can be the main activity

- Assuming all advocacy activities qualify as social welfare

- Thinking donor disclosure rules match those of 501(c)(3)s

- Underestimating ongoing compliance requirements

Top common misconceptions of 501(c)(4) organizations

Frequently asked questions (FAQs) about 501(c)(4) organizations

The following part answers the most common concerns and uncertainties that founders, nonprofit executives, and advocacy leaders encounter when exploring this organizational structure.

What is a 501(c)(4) organization?

A 501(c)(4) organization is a nonprofit entity focused primarily on promoting social welfare and the common good of communities. These organizations operate under Section 501(c)(4) of the Internal Revenue Code, which grants them tax-exempt status for activities related to their social welfare mission.

Unlike charitable organizations, 501(c)(4)s possess greater flexibility to engage in advocacy work while maintaining their nonprofit status. They typically serve as civic leagues, social welfare groups, or community improvement organizations that address systemic issues through educational initiatives, community programs, and policy advocacy.

Can a 501(c)(4) lobby or participate in politics?

Yes, 501(c)(4) organizations enjoy significant latitude regarding lobbying and political activities. Lobbying efforts - attempting to influence legislation through direct contact with lawmakers or mobilizing public support - face no legal limitations for these groups.

Political campaign activities, such as supporting or opposing specific candidates, are permitted but must remain secondary to the organization's social welfare mission. Most experts recommend keeping political expenditures below 50% of the organization's overall activities and resources to maintain compliance with IRS regulations. This distinction provides 501(c)(4)s with advocacy capabilities that 501(c)(3) charities cannot access.

Are donations to 501(c)(4)s tax-deductible?

No, contributions to 501(c)(4) organizations are not tax-deductible for donors. This represents one of the primary financial tradeoffs for the increased advocacy flexibility these organizations enjoy.

Donors should understand this limitation before contributing, as it differs significantly from gifts to 501(c)(3) charitable organizations. While the organization itself maintains tax-exempt status on income related to its exempt purpose, this benefit does not extend to its donors. Fundraising strategies must account for this distinction when cultivating donor relationships.

How do you form a 501(c)(4)?

Forming a 501(c)(4) organization involves several essential steps:

- Incorporation - File articles of incorporation as a nonprofit at the state level

- EIN Application - Obtain an Employer Identification Number from the IRS

- IRS Notification - Submit Form 8976 within 60 days of formation to notify the IRS of intent to operate as a 501(c)(4)

- Exemption Application - File Form 1024-A to apply for formal tax-exempt recognition

- Governance Structure - Develop bylaws, board policies, and compliance systems

The process typically takes 3-9 months from incorporation to formal recognition, with filing fees ranging from $50-300 depending on state requirements and IRS processing fees.

What activities can a 501(c)(4) engage in?

501(c)(4) organizations may participate in a diverse range of activities that advance social welfare:

- Advocacy campaigns focused on public policy issues

- Unlimited lobbying for legislation aligned with organizational mission

- Public education through workshops, publications, and media

- Community improvement projects addressing local needs

- Limited political campaign activities supporting or opposing candidates

All activities must ultimately connect to the organization's social welfare purpose, ensuring that direct community benefit remains the primary focus rather than private interests or predominantly political objectives.

A 501(c)(4) organization embodies the spirit of civic engagement, offering a robust framework for those driven to impact public policy and advocate for change. Its unique status, bridging advocacy and community involvement, allows for flexible lobbying efforts while navigating the nuances of tax-exempt compliance. For founders and social entrepreneurs who aim to merge purpose with policy, understanding this structure is crucial. Embracing its power brings both challenges and opportunities, leading to meaningful social transformation.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom