A 501(c)(7) organization offers a unique blend of camaraderie and tax advantages, allowing for vibrant member-driven environments. As founders, board members, and nonprofit consultants, understanding the nuances of tax-exempt status and compliance is necessary. Navigating IRS requirements and operational boundaries ensures sustainability while minimizing risks. Let’s take a closer look at what makes 501(c)(7) organizations distinct, covering from definition to their key advantages.

This content is provided for general informational purposes to help entrepreneurs understand the basics of 501(c)(7) social clubs. We specialize in company formation, not in providing legal or tax advisory services specific to U.S. nonprofit compliance. This information should not be considered professional legal or tax advice. For guidance specific to your situation, please consult a nonprofit compliance expert or legal professional with experience in social clubs and tax-exempt organizations.

What is a 501(c)(7) Social Club?

A 501(c)(7) Social Club operates as a tax-exempt social or recreational club specifically established for pleasure, recreation, and similar nonprofitable purposes. These member-driven organizations enjoy federal income tax exemption on dues and fees collected from members when they adhere to strict IRS guidelines.

Simple explanation for entrepreneurs

A 501(c)(7) is essentially a member-funded club organized around social or recreational activities. Common examples include country clubs, alumni associations, sports leagues, and hobby groups. The primary advantage for entrepreneurs establishing such organizations is the exemption from federal income tax on revenue derived from member dues and fees.

Key characteristics of 501(c)(7) organizations include:

- Focused on social or recreational activities

- Funded primarily through membership dues

- Tax exemption applies only to member-derived income

- Not classified as charitable organizations

- Unable to offer tax-deductible donation options to contributors

Entrepreneurs should recognize that while these organizations offer tax advantages, they operate under a distinct classification from charitable nonprofits. This difference significantly impacts fundraising approaches, operational structure, and tax benefits available to supporters of the organization.

Get expert guidance with G2B’s Delaware incorporation service - Schedule your free consultation today!

Formal legal definition

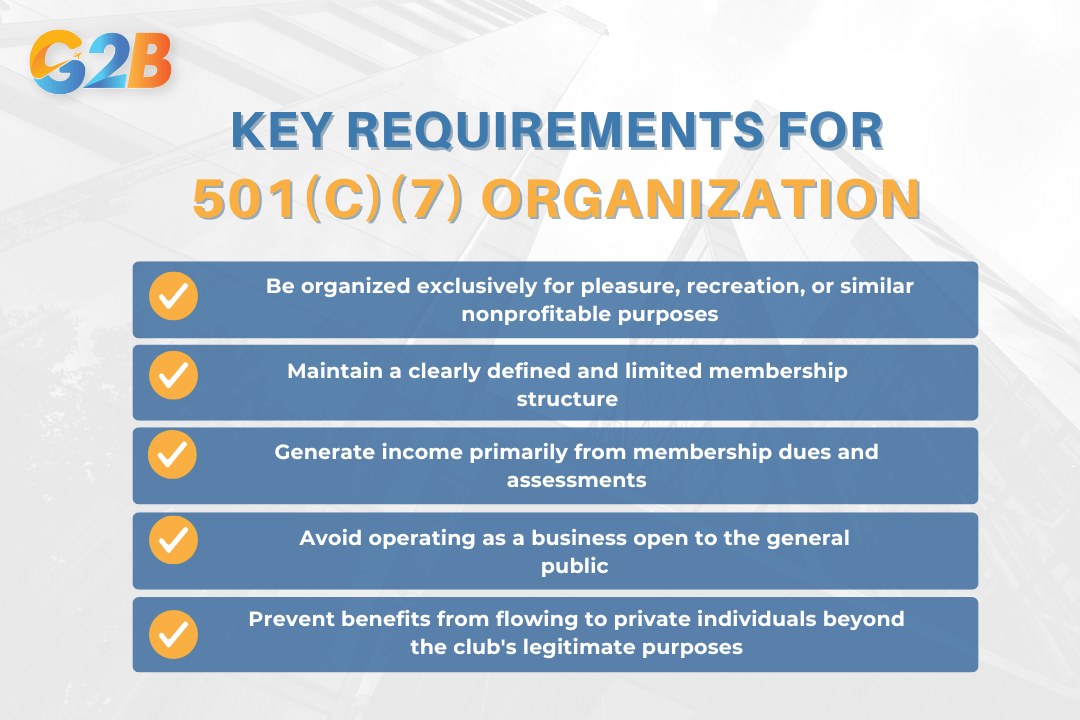

Legally, a 501(c)(7) organization must fulfill specific IRS criteria to maintain its tax-exempt status. The formal requirements establish clear boundaries around eligibility, operations, and governance. To qualify as a 501(c)(7) social club, an organization must:

- Be organized exclusively for pleasure, recreation, or similar nonprofitable purposes

- Maintain a clearly defined and limited membership structure

- Generate income primarily from membership dues and assessments

- Avoid operating as a business open to the general public

- Prevent benefits from flowing to private individuals beyond the club's legitimate purposes

The legal structure prohibits these organizations from conducting activities that would classify them as public businesses. Additionally, the IRS enforces strict limits on income from non-member sources, receiving up to 35% of its total gross receipts from nonmember sources, including investment income, with no more than 15% of total gross receipts derived from nonmember use of club facilities or services. Exceeding these thresholds may jeopardize the organization's tax-exempt status and trigger potential compliance issues with tax authorities.

An organization must meet key requirements to qualify as a 501(c)(7) social club

Types and real-world examples of 501(c)(7) social clubs

501(c)(7) organizations encompass a diverse range of member-driven clubs united by a common purpose: Providing social and recreational opportunities exclusively for their members.

Common types of 501(c)(7) organizations

Social clubs represent a primary category of 501(c)(7) organizations, covering establishments where members gather primarily for socializing. Country clubs stand as perhaps the most recognizable example, offering dining, golf, and other recreational amenities exclusively to members who pay substantial dues. Dinner clubs provide regular gathering spaces with dedicated meeting rooms and dining facilities. Book clubs and wine appreciation societies also qualify when organized formally with membership requirements and regular social activities.

Recreational clubs focus on specific sporting or leisure activities. These include:

- Amateur sports organizations (tennis, swimming, basketball leagues)

- Hunting and fishing clubs with private access to land or water

- Yacht clubs maintaining docks and hosting sailing events

- Garden clubs with shared cultivation spaces

- Gun and shooting clubs with private ranges

Fraternal organizations form the third major category, encompassing college fraternities and sororities, Elks lodges, Lions Club chapters, and Masonic lodges. These groups combine social interaction with traditions, rituals, and sometimes community service - though the service aspect remains secondary to member activities.

Practical examples and scenarios

A local tennis club demonstrates classic 501(c)(7) characteristics when it maintains courts exclusively for dues-paying members, hosts members-only tournaments, and restricts facility access to non-members. The club may occasionally invite guests or host limited public events, but must ensure that non-member revenue remains below 35% of total income to maintain tax-exempt status.

Alumni associations qualify when they focus primarily on organizing class reunions, maintaining common social spaces, and hosting exclusive gatherings. For example, a university graduating class might form a 501(c)(7) to manage reunion events, publish newsletters, and maintain connections among classmates, distinct from the university's 501(c)(3) alumni development foundation.

Car enthusiast groups illustrate another common scenario. When formally organized with bylaws, membership requirements, and regular activities like private rallies, car shows, and social gatherings, these clubs can qualify for 501(c)(7) status. Their activities must center on member enjoyment rather than public exhibitions or charitable purposes.

Homeowners associations sometimes qualify for 501(c)(7) status when they primarily maintain recreational facilities like swimming pools, tennis courts, and community centers exclusively for residents. However, if they focus mainly on property management and maintenance, they typically fall under different tax classifications.

Key benefits and disadvantages of 501(c)(7) status

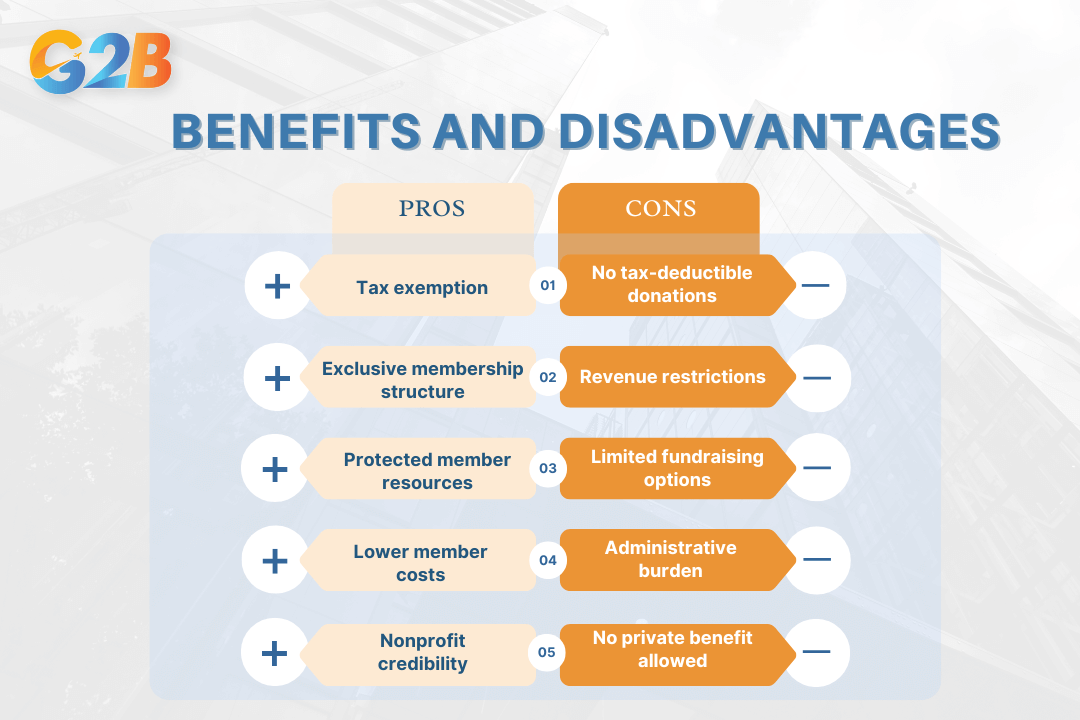

501(c)(7) organizations offer distinctive advantages for member-driven social clubs while imposing specific limitations that require careful management.

501(c)(7) organizations offer distinctive advantages and specific limitations

Benefits for founders and members

Tax exemption represents the primary financial advantage for 501(c)(7) organizations. The IRS excludes income derived from member dues, fees, and assessments from federal taxation, enabling clubs to dedicate more resources toward fulfilling their core recreational purposes. This exemption applies to membership fees, activity charges, and facility usage fees paid by members.

The organizational structure facilitates the creation of exclusive communities with clearly defined membership criteria. Country clubs, alumni associations, and special interest groups benefit from this framework by establishing governance systems that protect their selective nature while maintaining compliance with non-discrimination laws. Additionally, the formal nonprofit status enhances credibility when negotiating contracts, purchasing insurance, or conducting official business.

Member resources receive protection from taxation, creating a pool of funds dedicated exclusively to club activities and facilities. This arrangement allows for:

- Preservation of capital for facility improvements

- Funding of social events and recreational activities

- Accumulation of reserves for future club enhancements

- Reduced overall costs for members compared to commercial alternatives

Disadvantages and limitations

Unlike charitable organizations, 501(c)(7) clubs cannot offer tax-deductible donations. Contributions from members or outside parties do not qualify as charitable giving for tax purposes, limiting fundraising options and potential donor incentives. This restriction affects capital campaigns for facility improvements and other major funding initiatives.

Revenue restrictions impose strict operational boundaries. The IRS mandates that no more than 35% of gross receipts come from non-member sources, with a further restriction that no more than 15% of total revenue may derive from public use of facilities or services. These limitations significantly constrain:

- Investment income opportunities

- Facility rental to non-members

- Public events and tournaments

- Commercial activities

Ongoing compliance requirements create administrative burdens for club leaders. Annual IRS filings (Form 990), state nonprofit reporting, and detailed financial recordkeeping demand significant time and expertise. Many clubs must invest in professional accounting services to maintain proper documentation and avoid compliance issues that could threaten their tax-exempt status. The prohibition against private benefit and profit distribution presents another operational constraint. Clubs cannot distribute earnings to members, officers, or directors, and must reinvest all surplus funds into the organization's exempt recreational purpose.

501(c)(7) vs. other nonprofit types: Key differences

501(c)(7) organizations operate differently from other nonprofit categories in purpose, funding mechanisms, and tax benefits. While both 501(c)(7) social clubs and 501(c)(3) charitable organizations enjoy tax exemption, they serve fundamentally different purposes.

Comparison table: 501(c)(7) vs. 501(c)(3) vs. 501(c)(4)

| Feature | 501(c)(7) Social Clubs | 501(c)(3) Charities | 501(c)(4) Social Welfare |

|---|---|---|---|

| Primary purpose | Member recreation and social activities | Charitable, educational, religious, scientific purposes | Community improvement and social welfare |

| Beneficiaries | Members only | General public | Community or public |

| Tax-deductible donations | No | Yes | Generally no |

| Public access | Limited; primarily for members | Open to public | Usually open to public |

| Income sources | Primarily member dues and fees | Donations, grants, program fees | Membership dues, donations, program revenue |

| Non-member income limits | Strict (generally 35% maximum) | No specific limits | No specific limits |

| Lobbying activities | Limited | Restricted | Permitted |

| Political campaign activity | Limited | Prohibited | Permitted (not primary purpose) |

| IRS application | Form 1024 | Form 1023/1023-EZ | Form 1024-A |

This comparison highlights the operational boundaries and compliance requirements each organization type must observe. The 501(c)(7) clubs face particularly strict limitations regarding non-member income and activities, reflecting their exclusive nature compared to public-serving nonprofits.

Common misconceptions and mistakes

Organizations frequently misunderstand the limitations of 501(c)(7) status, leading to compliance issues and potential loss of tax exemption. The most prevalent misconception involves tax deductibility. Payments to 501(c)(7) clubs - whether membership dues, fees, or donations - do not qualify as charitable contributions and offer no tax deduction benefits to payers. This stands in stark contrast to 501(c)(3) organizations, where donations typically qualify for tax deductions.

Another common error involves public access and revenue sources. The IRS strictly limits income from non-members, generally to 35% of total gross receipts. Clubs that routinely exceed this threshold risk losing their tax-exempt status. For example, a golf club that frequently opens facilities to non-members could inadvertently shift into commercial operation territory.

Profit distribution represents another critical misunderstanding. While 501(c)(7) organizations may generate surplus revenue, they cannot distribute these funds to members as dividends or benefits. All income must further the club's social or recreational purposes. Similarly, the assets of a dissolving 501(c)(7) organization cannot be distributed to members but must transfer to another nonprofit entity.

Many clubs erroneously attempt to operate as pseudo-charities, holding public fundraisers or soliciting general donations. Such activities contradict the member-focused nature of 501(c)(7) status and can trigger IRS scrutiny. Understanding these boundaries helps organizations maintain compliance while fulfilling their intended purpose of providing exclusive social and recreational opportunities for members.

Ready to establish company in the Delaware? Get started with a free consultation from our expert incorporation service!

Legal structure, roles, and governance of a 501(c)(7) club

A 501(c)(7) organization requires clear organizational structures, well-defined leadership roles, and sound governance practices to maintain compliance with IRS regulations and state laws.

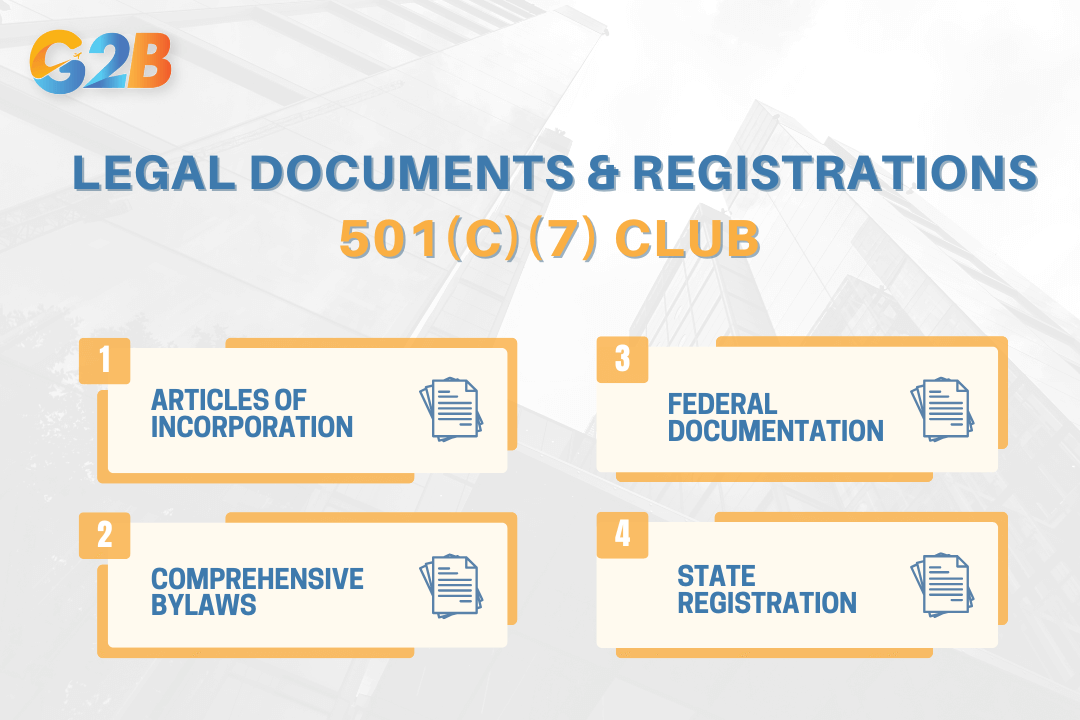

Essential legal documents and registration

Establishing a compliant 501(c)(7) club requires several critical legal documents and registrations:

- Articles of incorporation: This foundational document establishes the club as a legal entity within your state, outlining essential information such as the organization's name, registered address, initial board members, and specific purpose.

- Comprehensive bylaws: These internal rules must address:

- Membership criteria and processes

- Governance structure and procedures

- Meeting requirements and voting protocols

- Financial management guidelines

- Dissolution procedures

- Federal documentation:

- Employee Identification Number (EIN): Obtained by filing IRS Form SS-4

- IRS Form 1024: The application for tax-exempt status

- Annual Form 990: Required for ongoing compliance

- State registration: Requirements vary by location but typically include:

- Initial filing with the Secretary of State

- Annual reports

- State-specific tax exemption applications

Proper documentation serves both as proof of compliance and as operational guidelines that protect the organization's tax-exempt status.

Establishing a 501(c)(7) club requires critical legal documents and registrations

Key roles and responsibilities

The governance structure of a 501(c)(7) organization typically includes several distinct roles with specific responsibilities:

- Board of directors/trustees:

- Holds ultimate legal responsibility for club governance

- Sets organizational policy and strategic direction

- Ensures financial oversight and legal compliance

- Cannot fully delegate fiduciary responsibilities

- Club officers:

- President: Leads the organization, chairs meetings, represents the club externally

- Treasurer: Manages financial records, prepares budgets, ensures tax compliance

- Secretary: Maintains official records, documents meetings, manages communications

- Founders/organizers:

- Establish initial vision and organizational structure

- Recruit initial board members and leadership

- Often transition to board or officer roles

- Members:

- Form the core constituency of the organization

- Must have opportunities for meaningful personal contact

- Share common objectives related to pleasure, recreation, or other nonprofitable purposes

- May serve on committees or in volunteer capacities

A clearly defined leadership structure with documented roles helps maintain organizational continuity, ensures proper oversight, and promotes transparent decision-making that serves the club's mission while maintaining compliance with legal requirements.

IRS requirements and compliance checklist for 501(c)(7) clubs

501(c)(7) organizations face specific compliance requirements to maintain their tax-exempt status. These social and recreational clubs must adhere to strict IRS guidelines regarding organization purpose, membership structure, income sources, and financial reporting.

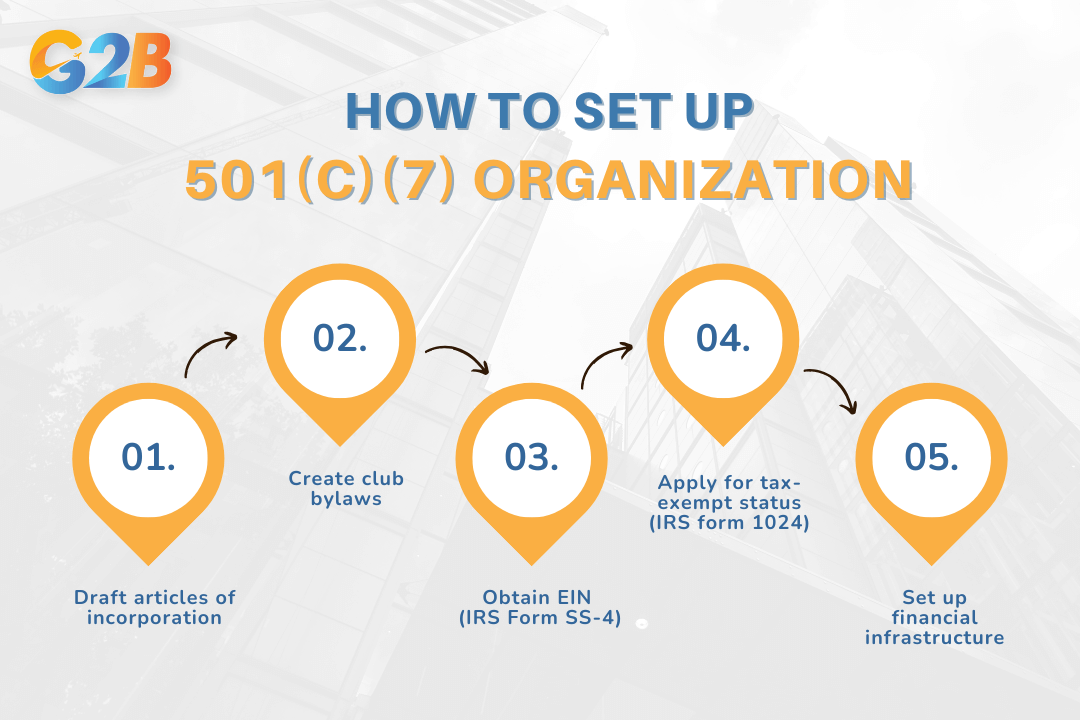

Step-by-step startup process

Establishing a compliant 501(c)(7) organization requires methodical preparation and documentation. Club founders must begin by drafting comprehensive articles of incorporation that clearly state the organization's pleasure or recreational purpose. These articles should explicitly prohibit private inurement and establish the club's nonprofit character.

Next, develop detailed bylaws outlining membership eligibility, selection processes, and governance procedures. These bylaws form the operational foundation for the club and must align with IRS requirements. After finalizing organizational documents, apply for an Employer Identification Number (EIN) through IRS Form SS-4, which serves as the club's federal tax ID.

The critical step involves submitting IRS Form 1024 to apply for tax-exempt status. This application requires:

- Detailed description of club activities

- Financial statements or proposed budgets

- Copies of organizational documents

- Information about facilities and membership

After securing tax exemption, establish proper financial infrastructure by opening a dedicated bank account, implementing accounting systems, and creating membership dues collection procedures.

Setting up a compliant 501(c)(7) organization requires five steps

Ongoing compliance and reporting

Annual IRS filings represent the cornerstone of 501(c)(7) compliance. Clubs must file the appropriate version of Form 990 based on their financial activity. Failure to file required returns for three consecutive years results in automatic revocation of tax-exempt status. Reinstating exemption requires reapplication and payment of fees.

Beyond annual filings, clubs must maintain detailed financial records documenting all income sources. The IRS strictly enforces the requirement that non-member income cannot exceed 35% of gross receipts. Clubs exceeding this threshold risk losing their exemption. Regular monitoring of income percentages through quarterly financial reviews helps avoid compliance issues.

Maintaining 501(c)(7) status

A comprehensive compliance checklist serves as an essential tool for club officers and advisors. Begin with membership requirements verification:

- Maintain limited, selective membership with formal approval processes

- Facilitate regular fellowship and personal contact among members

- Document how club activities fulfill recreational or social purposes

- Ensure membership practices avoid prohibited discrimination

Financial compliance tracking must include:

- Monitor income sources quarterly, maintaining member income at 65%+ of total

- Limit non-member income to under 35% of gross receipts

- Document all expenditures with a clear connection to club's purpose

- Track and properly report unrelated business income

- Prevent private inurement or excessive compensation to insiders

Organizational maintenance requires:

- Conduct annual bylaw review with legal counsel

- Hold regular board meetings with proper documentation

- Maintain current membership records

- File timely reports with both federal and state authorities

- Review insurance coverage annually

Performing regular compliance audits using this checklist helps 501(c)(7) organizations identify potential issues before they threaten tax-exempt status.

Legal risks and operational boundaries

501(c)(7) social clubs face significant legal and operational challenges that can threaten their tax-exempt status. The IRS maintains strict surveillance over these organizations, particularly concerning income sources, operational methods, and compliance with filing requirements.

Legal risks and IRS enforcement

The consequences of non-compliance for 501(c)(7) organizations can be severe and immediate. Clubs risk automatic revocation of tax-exempt status after three consecutive years of missed filings, regardless of their operational excellence in other areas. Daily penalties accrue quickly - smaller organizations face fines of $20 per day (up to $10,500) for late returns, while larger clubs may incur $105 daily fees potentially reaching $54,000.

Income threshold violations represent another critical risk area. When non-member revenue exceeds 35% of gross receipts (with only 15% permitted from facility usage by non-members), clubs face taxation on this unrelated business income and potential loss of exemption status. The IRS evaluates whether the organization has effectively transformed into a commercial enterprise rather than a member-focused social club.

Discrimination presents both legal and operational hazards. Social clubs that discriminate based on race, color, or religion may lose their exemption status and face additional legal consequences under federal and state laws. Modern clubs must ensure their membership policies align with anti-discrimination requirements while still maintaining their selective membership character.

Avoiding common pitfalls

Common compliance failures often begin with seemingly innocent decisions that accumulate over time. Documentation errors frequently undermine otherwise compliant organizations. Practical prevention measures include:

- Implementing quarterly financial reviews specifically tracking member versus non-member income percentages

- Establishing a compliance calendar with automatic reminders for annual filings

- Creating a governance committee responsible for reviewing and updating bylaws annually

- Maintaining detailed minutes documenting how board decisions align with the club's exempt purpose

- Developing an onboarding program to educate new officers about compliance responsibilities

Sound record-keeping forms the foundation of risk management. Clubs should maintain:

- Detailed membership applications and records

- Complete financial records segregating income sources

- Documentation supporting the primary social/recreational purpose

- Evidence of member-to-member interaction ("commingling")

- Properly executed and current governance documents

The fundamental distinction lies in whom the organization serves: 501(c)(7) clubs exist for member benefit while 501(c)(3) organizations serve public charitable purposes. Understanding 501(c)(7) requirements and compliance is crucial in navigating legal structures to avoid IRS penalties, while reducing the tax burden for member-funded clubs empowers long-term sustainability. By steering these social clubs with precision, founders craft legacies that stand resiliently against time.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom