Nonprofit organizations in the United States are classified into various types under section 501(c) of the Internal Revenue Code. Among them, 501(c)(12) organizations serve a unique role in providing essential services to their members through a cooperative structure. Understanding the structure and legal framework of 501(c)(12) entities is essential for ensuring compliance and maximizing benefits. Let’s investigate the definition, types, benefits, and steps to establish a 501(c)(12) organization.

This content is provided for general informational purposes to help entrepreneurs and researchers understand the basics of 501(c)(12) organizations. We specialize in company formation, not in providing legal advisory services specific to U.S. nonprofit compliance. This information should not be considered professional tax advice. For specific guidance, please consult a nonprofit compliance expert or a legal professional with experience in mutual or cooperative associations and tax-exempt organizations.

What is a 501(c)(12) organization?

A 501(c)(12) organization is a type of tax-exempt entity under the U.S. Internal Revenue Code that applies primarily to cooperatives and similar organizations. Specifically, it includes benevolent life insurance associations of a purely local character, mutual ditch or irrigation companies, mutual or cooperative telephone companies, electric companies, and other like organizations that operate on a cooperative basis.

Formal definition and legal meaning

A 501(c)(12) organization is a type of tax-exempt cooperative recognized by the Internal Revenue Code (IRC) that includes benevolent life insurance associations of a purely local character, mutual ditch or irrigation companies, mutual or cooperative telephone companies, electric companies, or similar organizations. These organizations are exempt from federal income tax under section 501(c)(12) of the IRC.

To qualify for 501(c)(12) status, organizations must fulfill specific IRS requirements. The organization must be structured and operated as a cooperative or mutual association, characterized by democratic member control and subordination of capital interests. Eligible entities include:

- Benevolent life insurance associations

- Mutual ditch or irrigation companies

- Mutual or cooperative telephone companies

- Electric cooperatives

- Similar organizations providing specific member services

Simple explanation for entrepreneurs and founders

501(c)(12) organizations represent member-owned cooperatives that operate fundamentally differently from traditional businesses. Members collectively own the organization and democratically control its operations through a one-member, one-vote system. Unlike conventional corporations seeking to maximize shareholder profits, these cooperatives function at cost to deliver essential services-like electricity, water, or telecommunications-particularly in rural or underserved areas.

For entrepreneurs considering this model, the key appeal lies in the tax exemption and community-focused structure. Any financial surplus generated must return to members as patronage dividends or reinvestment in service improvements. This structure creates a sustainable cycle where members benefit directly from efficient operations while maintaining local control of essential services.

Get expert guidance with G2B’s Delaware incorporation service - Schedule your free consultation today!

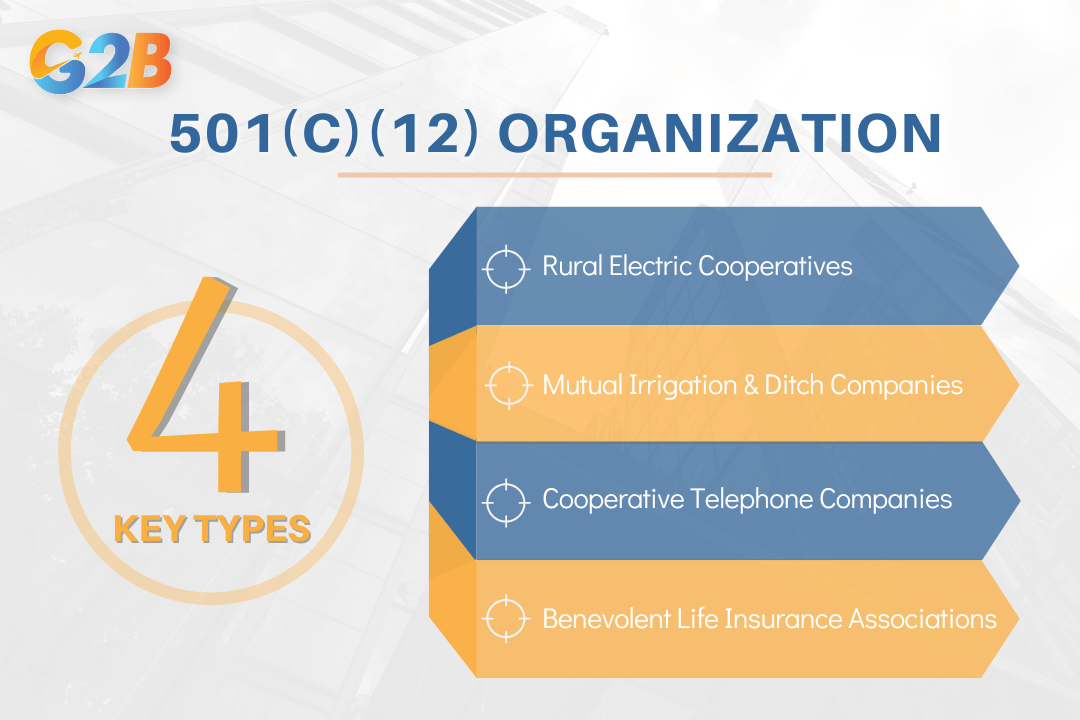

Types of 501(c)(12) organizations and their roles

501(c)(12) organizations operate across several essential service sectors, providing member-owned solutions where commercial entities often fail to serve effectively. Each type follows the core cooperative principles of member ownership.

There are 4 types of 501(c)(12) organizations

Rural electric cooperatives

Rural electric cooperatives represent one of the most widespread and impactful types of 501(c)(12) organizations. These member-owned utilities deliver electricity to areas traditional for-profit companies consider unprofitable or logistically challenging to serve. These cooperatives operate under a unique business model where customers are also owners with voting rights. Any surplus revenue generated is either:

- Reinvested into grid infrastructure improvements

- Applied toward reducing future rates

- Returned to members as capital credits

Many rural electric cooperatives have expanded their services to include renewable energy programs, energy efficiency initiatives, and smart grid technologies while maintaining their community-focused mission. Their democratic structure ensures decisions about rates, infrastructure investments, and service priorities reflect local needs rather than external shareholder demands.

Mutual irrigation and ditch companies

Mutual irrigation and ditch companies manage vital water resources for agricultural communities under the 501(c)(12) framework. These organizations distribute water equitably among member farmers according to established rights and shares. Members typically:

- Own shares representing water allocation rights

- Contribute to maintenance costs proportionally

- Participate in governance through voting

- Share responsibility for infrastructure upkeep

These cooperative water management systems maintain critical irrigation infrastructure such as canals, ditches, reservoirs, and distribution systems. By pooling resources and operating on a cost-sharing basis, these organizations make agricultural water access more affordable and reliable than individual systems could achieve. Many mutual ditch companies have centuries-old histories, demonstrating the sustainability of the cooperative model for natural resource management.

Cooperative telephone companies

Cooperative telephone companies bring essential communication services to communities underserved by commercial providers. These 501(c)(12) organizations have evolved beyond basic telephone service to deliver broadband internet and other modern telecommunications needs. These telecommunications cooperatives typically offer:

- Affordable local and long-distance telephone service

- High-speed internet access

- Technical support from local technicians

- Infrastructure tailored to rural connectivity challenges

Many telecom co-ops have become critical bridges across the "digital divide," connecting rural areas to economic opportunities, educational resources, and healthcare services that require reliable internet access. Their member-ownership structure allows them to prioritize universal service over cherry-picking profitable areas, ensuring comprehensive community coverage.

Benevolent life insurance associations

Benevolent life insurance associations provide financial protection to members through a mutual, nonprofit structure. These 501(c)(12) organizations pool risk among members and operate without the profit motivation that drives commercial insurance companies. These associations typically:

- Issue policies directly to members

- Maintain lower overhead costs than commercial insurers

- Return surplus premiums to policyholders

- Make decisions based on member needs rather than investor demands

By eliminating external shareholders from the equation, these mutual insurance organizations can offer more affordable coverage to their specific membership communities. This member-focused approach creates alignment between the interests of the organization and its policyholder-members, avoiding the conflicts of interest that can arise in for-profit insurance models.

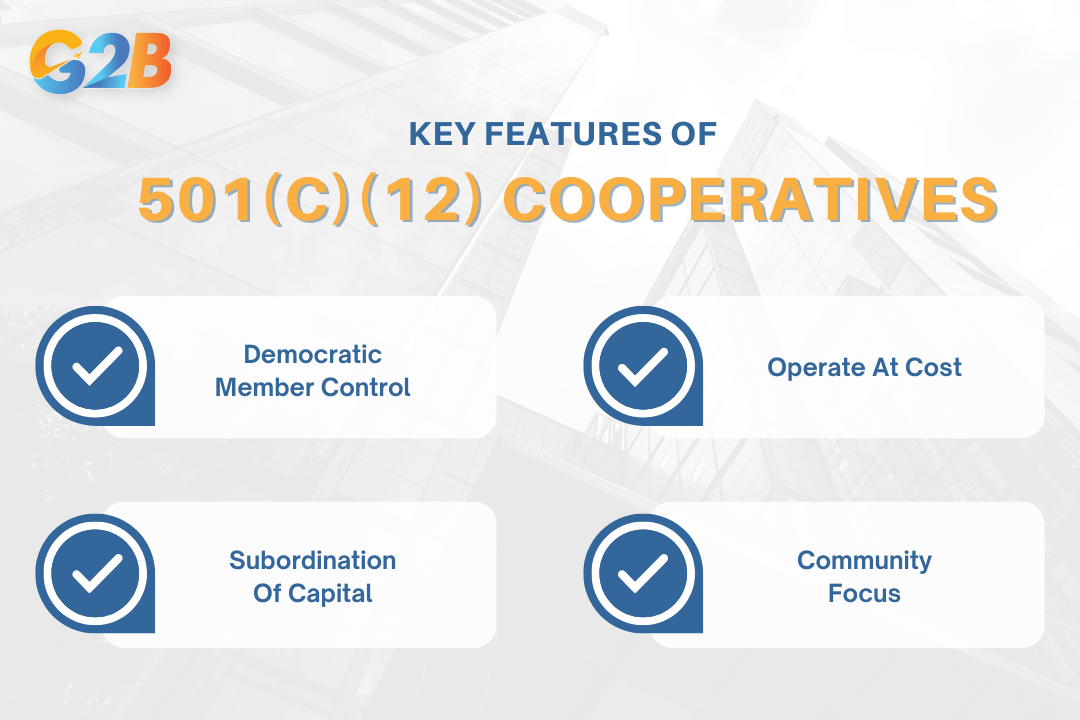

Key features and principles of 501(c)(12) cooperatives

501(c)(12) organizations operate under distinct cooperative principles that separate them from traditional businesses and other nonprofit entities. The cooperative structure ensures that essential services remain affordable and responsive to local needs.

There are 4 key features and principles of 501(c)(12) cooperatives

Democratic member control

Each member of a 501(c)(12) organization holds equal voting power regardless of their financial contribution. This "one member, one vote" principle ensures balanced representation across the membership base. Leadership positions are filled through democratic elections, with officers directly accountable to the members who elect them.

Rural electric cooperatives demonstrate this principle through annual member meetings where important decisions affecting service rates and infrastructure investments receive collective approval. Board members typically serve rotating terms, preventing power concentration and ensuring regular opportunities for member input. This democratic structure creates a responsive organization that aligns operations with community priorities rather than external interests.

Member participation rights include:

- Voting in leadership elections

- Participating in major policy decisions

- Attending open board meetings

- Reviewing financial reports and operational plans

Operating at cost and surplus allocation

501(c)(12) organizations function on a cost-basis rather than seeking profit maximization. Any surplus revenue generated beyond operational expenses must be returned to members as patronage dividends or reinvested to improve services and infrastructure. Member benefits appear through:

- Capital credits (returns based on usage)

- Rate stabilization during market fluctuations

- Service improvements funded by retained earnings

- Emergency funds for disaster recovery and system repairs

Cooperatives may maintain reasonable reserves for future capital improvements and unexpected expenses, but cannot hoard excessive funds. The financial structure requires transparency, with members regularly informed about their proportional share of organizational savings based on their patronage levels.

Subordination of capital and community focus

In 501(c)(12) organizations, capital investment takes a secondary role to member benefits. External investors cannot control operations or claim priority returns, ensuring that the cooperative remains focused on member and community needs rather than shareholder profits. This subordination of capital manifests in several ways:

- Limited returns on invested capital

- Member ownership of organizational assets

- Democratic control regardless of investment size

- Dissolution proceeds distributed to members based on patronage

The community-focused model provides significant social benefits by retaining economic resources locally. Member capital credits serve as the primary funding source for most cooperatives, typically retained for approximately 20 years to support infrastructure development and service expansion. This structure ensures long-term sustainability while maintaining affordable access to essential utilities and services for the entire membership.

Comparing 501(c)(12) with other 501(c) nonprofit types

The IRS classifies nonprofit organizations under various 501(c) subsections, each with distinct purposes, requirements, and benefits:

| Feature | 501(c)(12) | 501(c)(3) | 501(c)(5) |

|---|---|---|---|

| Primary purpose | Mutual/cooperative utilities serving members | Charitable, educational and religious activities | Labor, agricultural organizations |

| Member income requirement | 85% from members | No specific requirement | No specific requirement |

| Tax-deductible donations | No | Yes | No |

| Lobbying activities | Limited | Highly restricted | Permitted if related to member interests |

| Primary beneficiaries | Members only | General public | Organization members |

| Application form | Form 1024 | Form 1023/1023-EZ | Form 1024 |

501(c)(12) organizations must operate as cooperatives or mutuals in specific sectors like rural utilities or insurance. Unlike 501(c)(3) public charities that serve the general public, 501(c)(12) entities primarily benefit their members. This fundamental distinction affects everything from funding models to governance structures.

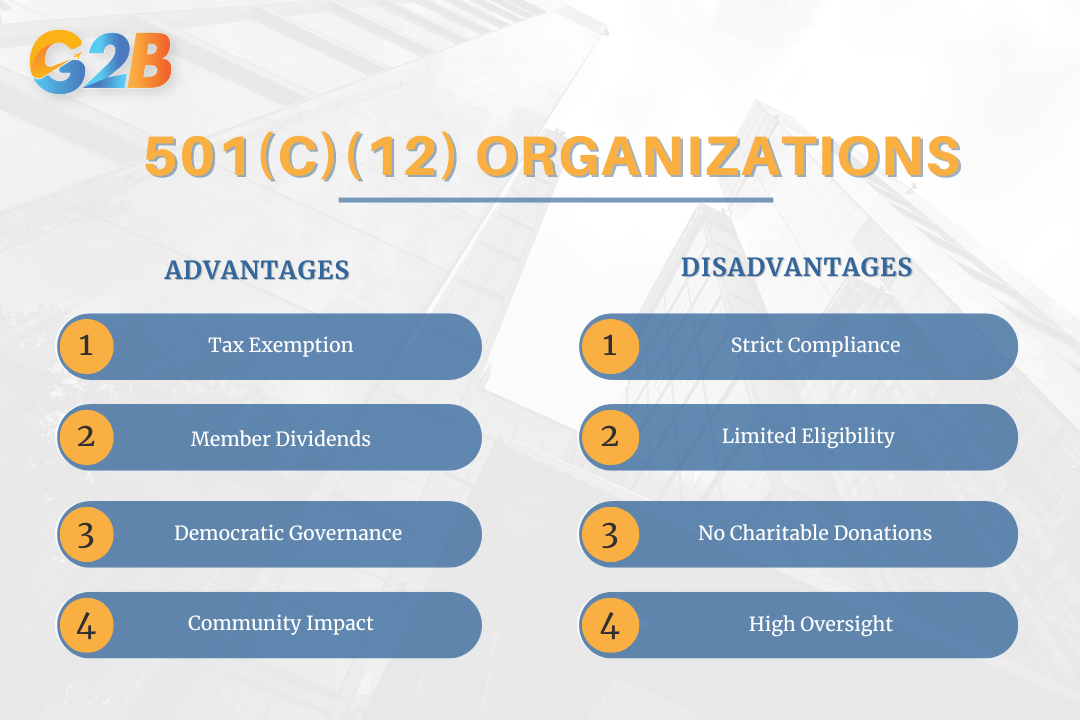

Benefits and importance of 501(c)(12) status

501(c)(12) organizations offer substantial advantages that extend beyond mere tax benefits. These cooperatives create a unique economic structure that prioritizes member needs over profit maximization.

501(c)(12) organizations bring both benefits and limitations

Tax exemption and financial advantages

Federal tax exemption forms the cornerstone benefit for 501(c)(12) organizations, significantly reducing operational expenses compared to traditional business models. This exemption allows cooperatives to maintain lower overhead costs, translating directly into more affordable services for members. Members experience two distinct financial advantages: reduced service rates due to operational savings and the return of excess revenues as patronage dividends based on service usage.

Organizations operating under this structure can focus resources on infrastructure development and service improvements rather than tax obligations. For rural electric cooperatives, this means more resources available for grid maintenance and expansion. The financial structure creates a virtuous cycle where tax savings enable service improvements, which in turn strengthen member loyalty and organizational stability.

Democratic governance and member empowerment

The one-member, one-vote principle distinguishes 501(c)(12) organizations from shareholder-controlled corporations. This democratic governance ensures all members have equal influence regardless of their financial contribution or service usage level. Board members and officers are elected directly by the membership, creating a clear line of accountability between leadership and those served.

Member participation extends beyond voting rights to include attendance at annual meetings, committee service, and policy development. This involvement fosters organizational transparency and responsiveness to changing community needs. Rural telephone cooperatives exemplify this advantage when they can quickly respond to member requests for service improvements or coverage expansions without navigating layers of corporate approval.

Community development and local impact

501(c)(12) organizations function as powerful economic anchors in their communities, particularly in rural and underserved areas. These cooperatives create local jobs with competitive wages and benefits, from lineworkers at electric cooperatives to customer service representatives at mutual insurance associations. The multiplier effect extends as these organizations often prioritize local vendors and contractors for their operational needs. Key community benefits include:

- Infrastructure investments that might otherwise be deemed unprofitable

- Workforce development through local hiring and training

- Emergency response capabilities during natural disasters

- Community education programs and scholarships

Disadvantages, risks, and common misconceptions

While 501(c)(12) organizations offer significant benefits for member-owned cooperatives, they come with substantial limitations and compliance challenges. Understanding these constraints proves essential before pursuing this specialized nonprofit classification.

Operational and compliance risks

The 85% member income test represents the most critical compliance requirement for 501(c)(12) organizations. Failure to derive at least 85% of income from members can trigger immediate loss of tax-exempt status and potential tax liability. This threshold creates ongoing monitoring challenges, especially for growing cooperatives.

Organizations must maintain meticulous financial records documenting member versus non-member income sources. The IRS scrutinizes these records during examinations, which can occur randomly or following suspected compliance issues. Penalties for non-compliance include retroactive taxation of previously exempt income and potential interest charges.

Annual filing requirements add another layer of complexity. Form 990 submissions demand detailed financial reporting and governance disclosures, with specific deadlines that cannot be missed without consequences. Multiple missed filings result in automatic revocation of tax-exempt status, requiring a complex and costly reinstatement process.

Sector and activity limitations

501(c)(12) status applies exclusively to specific categories of organizations:

- Rural electric cooperatives

- Mutual or cooperative telephone companies

- Benevolent life insurance associations

- Mutual ditch or irrigation companies

- Mutual or cooperative water companies

Organizations outside these specific sectors cannot qualify regardless of their cooperative structure or member service focus. This limitation makes 501(c)(12) status unavailable for many cooperative businesses, including food co-ops, housing cooperatives, and worker-owned enterprises. Additionally, qualified organizations must operate according to core cooperative principles, including:

- Democratic member control (one member, one vote)

- Operation at cost, not for profit

- Subordination of capital to member service

- Distribution of surplus revenues to members based on patronage

Common misconceptions and pitfalls

Many founders mistakenly believe any cooperative qualifies for 501(c)(12) status. In reality, only specific utility and service cooperatives meet eligibility requirements, leaving many community-based projects ineligible despite their cooperative structure. Another common misconception equates 501(c)(12) status with 501(c)(3) charitable status. Unlike charitable organizations, 501(c)(12) entities cannot offer tax deductions to donors. Contributions to these cooperatives do not qualify as charitable donations, potentially limiting fundraising opportunities.

Some founders pursue 501(c)(12) status expecting complete operational autonomy. However, these organizations face substantial IRS oversight, including:

- Public disclosure requirements for financial information

- Restrictions on accumulated reserves

- Limitations on non-exempt activities

- Mandatory member dividend distributions

Organizations seeking primarily commercial objectives or significant non-member business will find 501(c)(12) status incompatible with their goals, as the strict member-service focus and income restrictions prevent profit-maximization strategies.

Ready to establish a company in Delaware? Get started with a free consultation from our expert incorporation service!

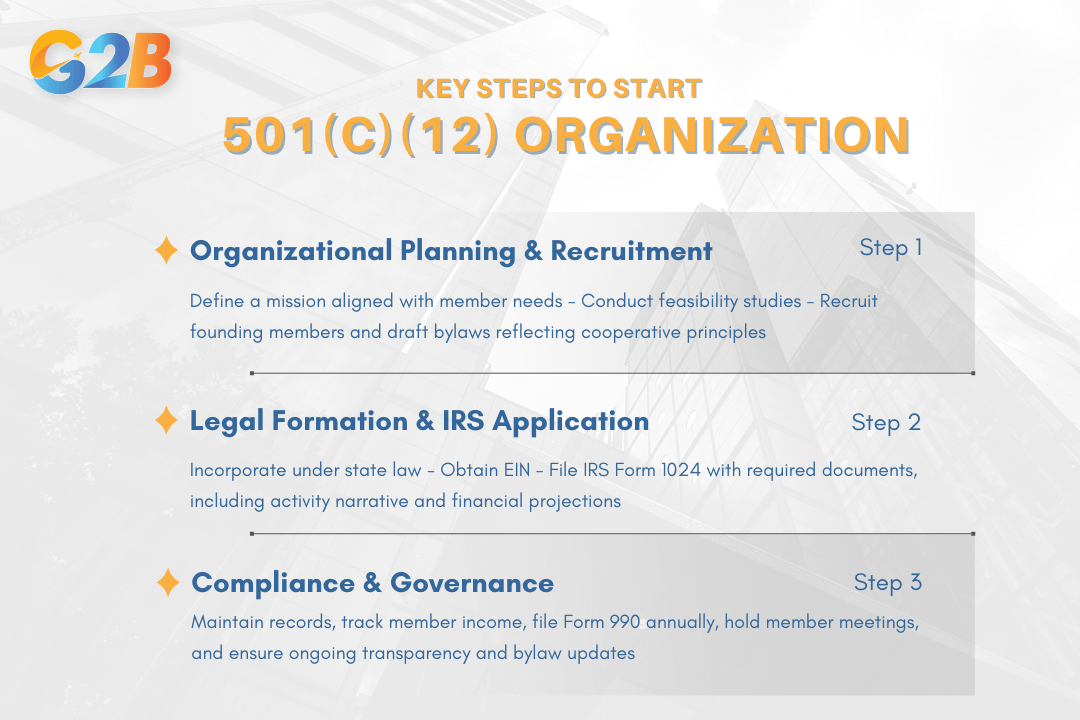

How to start a 501(c)(12) organization: Step-by-step guide

Establishing a 501(c)(12) organization requires careful planning and adherence to specific IRS requirements. The following roadmap outlines essential steps for founders and advisors navigating this specialized nonprofit structure.

Three main steps to start a 501(c)(12) organization

Organizational planning and member recruitment

Defining a clear mission aligned with 501(c)(12) requirements forms the foundation of a successful cooperative. Start by identifying the specific member need-electric service, water access, or telecommunications-that aligns with qualifying activities. Conduct feasibility studies to confirm sufficient member interest and economic viability in the service area.

Recruit founding members who share common interests and will actively participate in governance. Effective recruitment strategies include community meetings, door-to-door outreach, and partnerships with existing community organizations. Draft comprehensive bylaws that specifically incorporate democratic control (one member, one vote), operation at cost principles, and subordination of capital to member interests.

When structuring the organization, establish formal procedures for:

- Regular membership meetings

- Board elections and term limits

- Financial transparency mechanisms

- Patronage allocation formulas

- Membership application and termination processes

Legal formation and IRS application

Incorporating under state law establishes the legal foundation for a 501(c)(12) organization. Research specific state requirements for cooperative corporations, as these vary by jurisdiction. File articles of incorporation that explicitly state the cooperative purpose and include provisions for democratic member control and nonprofit operation. The IRS application process requires thorough documentation:

- Obtain an Employer Identification Number (EIN)

- Complete Form 1024 (Application for Recognition of Exemption)

- Prepare a detailed narrative describing proposed activities

- Develop financial projections for the first three years

- Submit signed organizing documents and bylaws

Compliance, reporting, and ongoing governance

Maintaining tax-exempt status requires diligent compliance and record-keeping practices. Establish accounting systems that clearly differentiate between member and non-member income sources. Track patronage allocations systematically to demonstrate that excess revenues return to members proportionate to their usage. Regular compliance activities include:

- Filing annual Form 990 or 990-EZ by the applicable deadline

- Conducting annual membership meetings with proper notice

- Maintaining minutes of all board and membership meetings

- Documenting member patronage and allocation formulas

- Periodically reviewing bylaws for continuous compliance

Frequently asked questions (FAQs) about 501(c)(12) organizations

Understanding 501(c)(12) organizations requires clarity on several key aspects of their operation, compliance requirements, and tax status. Below are answers to the most common questions about these specialized nonprofit entities.

Does a 501(c)(12) organization provide services to members at cost?

Yes. 501(c)(12) organizations are typically cooperatives or mutual companies that provide services like utilities to their members at cost, meaning they do not operate to make a profit.

Must a cooperative get at least 85% of its income from members to keep 501(c)(12) status?

Yes. To maintain tax-exempt status, at least 85% of the organization’s income must come from its members, ensuring it serves primarily its member base.

Are 501(c)(12) organizations required to operate at cost for members?

Yes. These organizations must operate on a mutual or cooperative basis, meaning revenues beyond costs are typically returned to members or used to reduce future costs.

Can a 501(c)(12) lose its tax-exempt status?

Yes. If the organization fails to meet the income test, operates for profit, or violates IRS rules, it can lose its tax-exempt status.

Are donations to a 501(c)(12) tax-deductible?

No. Donations to 501(c)(12) organizations are not tax-deductible for donors, as these entities are not classified as public charities.

501(c)(12) organizations play a vital role in delivering essential services through a member-owned, cooperative model. Their tax-exempt status offers significant financial advantages but also requires strict adherence to regulatory standards, particularly regarding income sources and membership structure. For entities that meet the qualifications, forming a 501(c)(12) can be a strategic choice that supports long-term sustainability and community service.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom