501(c)(28) organizations represent a specialized category within the Internal Revenue Code, established exclusively as non-profit trusts dedicated to managing and investing assets of the National Railroad Retirement Investment Trust. These entities operate under strict legal parameters that differentiate them from standard nonprofits, serving as the financial stewards for retirement funds benefiting railroad workers throughout the United States. Let's investigate the 501(c)(28) organization’s purpose, structure, and advantages.

This article is provided for general informational purposes to help professionals understand the fundamentals of 501(c)(28) organizations. We specialize in company formation services and do not offer legal or tax advice related to U.S. nonprofit trust regulations. For specific compliance guidance, please consult a qualified attorney or nonprofit trust expert.

What is a 501(c)(28) organization

A 501(c)(28) organization is the National Railroad Retirement Investment Trust, established under the Railroad Retirement and Survivors’ Improvement Act of 2001 to manage and invest assets of the Railroad Retirement Account for the benefit of rail workers and retirees. It operates as a tax-exempt trust under IRC Section 501(c)(28), pooling and investing funds to secure retirement benefits while remaining neither an agency nor instrumentality of the federal government.

The Trust is exempt from filing Form 1024 due to its statutory status and may have specific reporting requirements distinct from typical 501(c) organizations. It is exempt from federal, state, and local income taxes on its investment activities. Key operational aspects include:

- Professional investment management using diversified strategies

- Independent board governance with fiduciary responsibility

- Strict prohibition against using assets for non-retirement purposes

- Regular reporting to Congress and the IRS

- Public disclosure requirements for financial operations

The trust structure balances professional investment expertise with rigorous oversight, creating accountability while allowing sufficient independence to manage assets effectively for long-term stability of the railroad retirement system.

Finding a trustworthy Delaware incorporation service? Let G2B simplify the process - Book your free consultation now!

Organizational structure and roles

The National Railroad Retirement Investment Trust (NRRIT), as the sole 501(c)(28) organization, must adhere to comprehensive rules that eliminate operational latitude while ensuring professional asset management exclusively for the national railroad retirement system.

How trustees are appointed and their duties

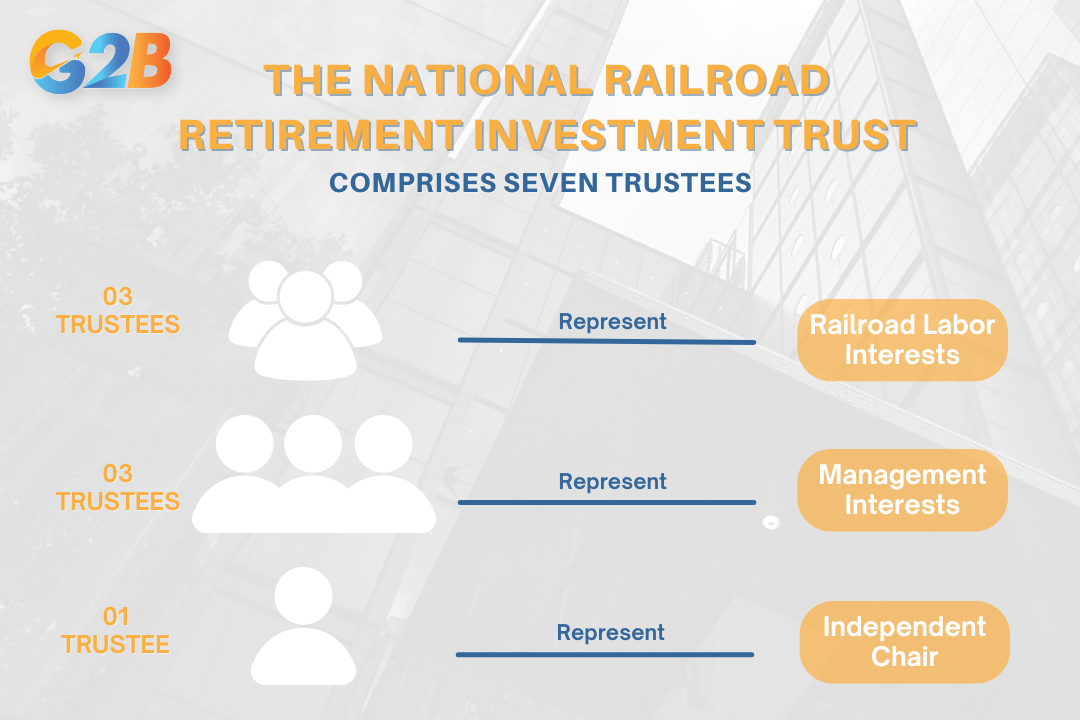

The NRRIT board comprises seven trustees, each selected for their expertise in pension management and investment strategy. Three trustees represent railroad labor interests, three represent management interests, and one independent trustee serves as chair. This balanced composition ensures fair representation across the railroad industry's stakeholder spectrum. Trustees shoulder substantial fiduciary responsibilities that exceed typical board obligations. They must:

- Maintain professional qualifications in pension or investment management

- Act exclusively to benefit railroad retirement system participants

- Make investment decisions based on rigorous market analysis

- Submit to comprehensive oversight mechanisms

- Document all decision-making processes

- Avoid conflicts of interest that could compromise trust assets

The selection process includes formal nomination procedures that verify expertise, confirm absence of conflicts, and ensure candidates understand the strict statutory limitations on their authority. Once appointed, trustees cannot deviate from their mandate to safeguard and grow retirement assets.

The National Railroad Retirement Investment Trust comprises seven trustees

Asset management practices and separation of powers

The trust functions with intentional independence from daily government operations, creating a crucial separation of powers. While supporting a federal benefit program, NRRIT operates with significant autonomy in its investment strategies and portfolio management. This independence manifests in several key operational practices:

- External management engagement - The trust selects and oversees private investment managers with specialized expertise

- Portfolio diversification - Assets span multiple investment vehicles to balance risk and return objectives

- Performance accountability - Regular, detailed reporting tracks investment outcomes against benchmarks

- Legal firewalls - Strict structural barriers prevent outside organizational influence

The asset management framework emphasizes:

| Principle | Implementation |

|---|---|

| Independence | Autonomous decision-making is separate from political influence |

| Transparency | Regular public disclosure of investment strategies and results |

| Expertise | Utilizing professional investment managers for specialized portfolio segments |

| Exclusivity | Assets managed solely for railroad retirement benefit purposes |

This separation ensures trust investments remain protected from both political pressures and potential conflicts with private interests, while maintaining clear accountability to the program's beneficiaries.

Eligibility, formation, and compliance process

The 501(c)(28) organization designation stands apart from other tax-exempt categories due to its extraordinarily narrow eligibility criteria and unique formation process. Strict compliance requirements ensure proper management of railroad retirement assets through rigorous documentation and transparent public disclosure.

Eligibility criteria - Who can qualify?

Qualification for 501(c)(28) status operates under the strictest statutory limitation in tax-exempt law. Only the National Railroad Retirement Investment Trust (NRRIT), specifically established through federal legislative action, can hold this designation. No other entity - regardless of purpose or structure - meets eligibility requirements.

The exclusivity extends universally. Individual investors, private businesses, pension administrators, and conventional nonprofits cannot qualify, regardless of their connection to railroad operations or retirement fund management. This deliberate limitation ensures railroad retirement assets remain under congressionally sanctioned oversight, protecting the integrity of these specialized funds from potential misuse or diversion.

How the trust is (and is not) formed

The formation process for a 501(c)(28) entity fundamentally differs from standard nonprofit establishment procedures. No IRS applications, Form 1023 filings, or typical registration processes apply. Instead:

- Congress creates the trust through explicit statutory authority

- Lawmakers establish the trust's governance structure and operational parameters

- Trustees receive appointments according to the legislatively mandated process

- The trust automatically receives exempt status by virtue of its statutory origin

This formation mechanism stands in stark contrast to traditional nonprofit creation, where founders file articles of incorporation, develop bylaws, and submit formal IRS exemption applications. The NRRIT's creation path reflects its unique national importance and specialized function in managing railroad retirement assets.

Ongoing IRS and federal compliance checklist

Maintaining 501(c)(28) status demands meticulous adherence to federal regulations. Essential compliance requirements include:

- Financial reporting requirements

- Filing annual IRS reports (specialized Form 990 or similar documents)

- Submitting comprehensive audited financial statements

- Providing detailed investment performance metrics

- Transparency obligations

- Publishing financial records for public review

- Documenting investment strategies and outcomes

- Maintaining accessible records of trustee decisions

- Operational mandates

- Conducting regular investment activity audits

- Following strict Railroad Retirement Act provisions

- Adhering meticulously to trust bylaws

- Implementing robust controls to prevent private benefit

Failure to meet these compliance standards risks regulatory scrutiny, potential penalties, and questions about the trust's proper functioning. The trust must demonstrate continuous commitment to its exclusive purpose - managing railroad retirement assets for the benefit of eligible railroad workers and retirees.

Essential compliance requirements of 501(c)(28) organizations include 3 main factors

Key benefits of 501(c)(28) designation

The 501(c)(28) organization designation delivers exceptional advantages for the National Railroad Retirement Investment Trust (NRRIT), creating a robust framework for managing retirement assets.

Tax exemption and public benefit priorities

Tax exemption forms the cornerstone benefit of 501(c)(28) status, creating significant financial advantages for railroad retirement funds. All investment income, capital gains, and asset appreciation remain completely tax-sheltered, provided funds maintain their exclusive dedication to the national railroad retirement system. This tax protection directly translates to stronger retirement security for beneficiaries.

The structure ensures mission purity by legally binding assets to serve their intended purpose. Every dollar saved through tax exemption flows directly toward strengthening railroad workers' retirement benefits rather than being diminished through taxation. This preservation of capital creates a compound benefit over decades of investment activity. Notable benefits include:

- Protection from federal income taxation on all investment returns

- Preservation of principal through tax-sheltered growth

- Elimination of tax filing complexities that would otherwise reduce fund efficiency

- Legal guardrails preventing mission drift or resource diversion

Strengthened oversight and credibility

The dual oversight mechanism embedded in 501(c)(28) status creates extraordinary credibility advantages. Both IRS regulation and dedicated federal statutory provisions monitor the trust's activities, creating multiple layers of accountability that signal trustworthiness to stakeholders, lawmakers, and the public. This governance structure enhances pension security through mandated transparency and compliance requirements. Railroad employees and retirees benefit from knowing their retirement assets operate under strict fiduciary standards with dedicated federal attention. The trust must maintain exemplary investment practices, rigorous recordkeeping, and consistent public disclosure.

The 501(c)(28) model demonstrates several best practices for large investment trusts:

| Oversight element | Benefit to stakeholders |

|---|---|

| IRS regulatory framework | Guarantees adherence to tax-exempt purpose |

| Federal statutory controls | Ensures consistent mission alignment |

| Public reporting requirements | Provides transparency for participants |

| Independence with accountability | Balances operational efficiency with proper controls |

Disadvantages and legal risks

The 501(c)(28) organization operates within one of the most stringent regulatory frameworks in tax-exempt law. Trustees and legal advisors face significant challenges navigating the narrow operational scope, extensive compliance requirements, and severe penalties for violations.

Narrow applicability and use restrictions

The 501(c)(28) designation serves exclusively one statutorily defined purpose: Managing railroad retirement investments. This extreme specialization creates inflexible operational boundaries that trustees must vigilantly maintain. The trust cannot engage in any private, for-profit, or non-railroad activities whatsoever. Even minor deviations from the prescribed railroad retirement function risk immediate regulatory scrutiny. When trustees attempt to repurpose assets or blend functions with other organizational activities, they face irrevocable tax-exempt status loss and potential federal lawsuits that can permanently disrupt operations.

Railroad retirement trustees must implement robust safeguards to prevent mission drift, including:

- Regular purpose verification audits

- Clear documentation of every investment decision

- Strict prohibition of mixed-use arrangements

- Ongoing legal review of all operational activities

Heavy compliance and reporting obligations

The 501(c)(28) entity bears extensive operational reporting burdens that generate continuous compliance costs and exposure. The documentation requirements exceed those of most other tax-exempt organizations. Annual filing obligations include:

- Detailed financial reports documenting every transaction

- Comprehensive investment portfolio disclosures

- Trustee appointment and qualification certifications

- Asset allocation justifications

- Benefits distribution documentation

Missed deadlines, incomplete disclosures, or documentation gaps trigger immediate regulatory attention. Even administrative oversights can escalate to full IRS audits, financial penalties, or potential revocation of exempt status. The compliance infrastructure requires significant investment in specialized legal counsel, accounting staff, and document management systems to mitigate these risks.

Legal and operational sanctions for non-compliance

Regulatory violations for 501(c)(28) organizations carry particularly severe consequences that extend beyond the organization to impact beneficiaries directly. When trustees fail to invest prudently or distribute funds according to statutory requirements, the response from authorities progresses through escalating interventions:

| Violation type | Potential sanctions | Impact on stakeholders |

|---|---|---|

| Imprudent investments | Statutory penalties, trustee removal | Reduced fund performance |

| Improper distributions | Financial penalties, audit expansion | Benefit delays for retirees |

| Asset misallocation | Loss of exemption, tax liability | Diminished retirement security |

| Reporting failures | Court-mandated restructuring | Administrative disruption |

| Repeated violations | Trust dissolution | Complete system failure |

These sanctions create direct repercussions for railroad retirement stakeholders and fund beneficiaries, potentially disrupting retirement income streams for thousands of former railroad employees nationwide.

Find a reliable Delaware incorporation service? Contact us for a free consultation!

Comparing 501(c)(28) with other tax-exempt entities

The 501(c)(28) organization classification stands distinct among nonprofit designations in the Internal Revenue Code. Understanding these distinctions proves critical for legal advisors, pension trustees, and financial consultants operating in the railroad retirement sector.

Key differences of 501(c)(28) vs 501(c)(3) and 501(c)(6)

The National Railroad Retirement Investment Trust (NRRIT) operates under rigid parameters unlike any other tax-exempt entity. Its singular mission focuses on managing railroad retirement assets, while other nonprofit classifications serve broader purposes.

| Feature | 501(c)(28) | 501(c)(3) | 501(c)(6) |

|---|---|---|---|

| Purpose | Railroad retirement asset management | Charitable, educational, religious, scientific | Industry advancement, business leagues |

| Eligibility | Only NRRIT | Public charities, private foundations | Trade associations, chambers of commerce |

| Reporting | Stringent, public, trust-based | Annual IRS Form 990 | Annual IRS Form 990 |

| Flexibility | None | Moderate | High |

| Public donations | Not applicable | Tax-deductible | Non-deductible |

| Political activity | Severely restricted | Limited | Permitted with restrictions |

The operational constraints on 501(c)(28) entities reflect their specialized focus. While 501(c)(3) organizations maintain reasonable flexibility within charitable activities, and 501(c)(6) groups enjoy considerable latitude in serving industry interests, the NRRIT must adhere strictly to its congressional mandate without deviation. The governance structures also differ markedly. NRRIT requires specialized trustees with investment expertise, while 501(c)(3) boards typically represent diverse stakeholders, and 501(c)(6) boards often include industry leaders focusing on member benefits rather than public welfare.

Why general nonprofits cannot be 501(c)(28)

General nonprofits face absolute barriers to 501(c)(28) classification due to its exclusive statutory designation. Congress created this status solely for the National Railroad Retirement Investment Trust, making it impossible for other organizations to qualify. The legal architecture surrounding 501(c)(28) status derives from specific federal legislation - the Railroad Retirement and Survivors' Improvement Act of 2001 - rather than general nonprofit principles. This legislation established a single entity with a unique purpose: Managing railroad retirement funds. No application process exists because no other entity can legally qualify.

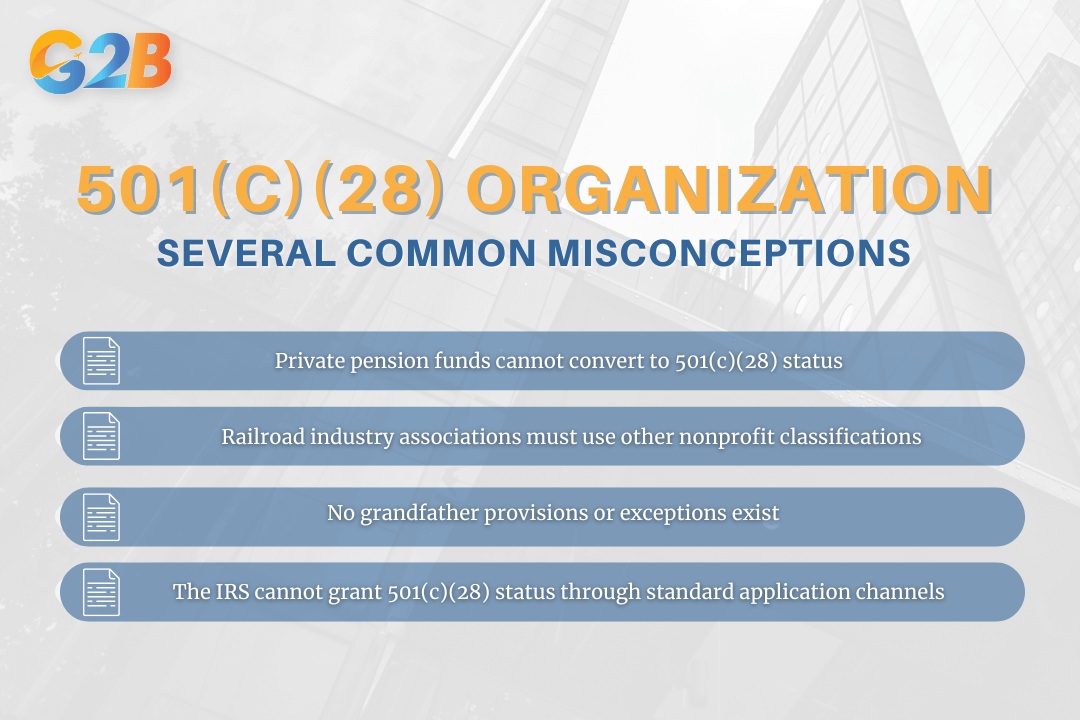

Several common misconceptions persist about potential eligibility:

- Private pension funds cannot convert to 501(c)(28) status

- Railroad industry associations must use other nonprofit classifications

- No grandfather provisions or exceptions exist

- The IRS cannot grant 501(c)(28) status through standard application channels

Several common misconceptions persist about potential eligibility

Even organizations with similar functions - such as other public pension trusts or retirement investment vehicles - must operate under different tax classifications. The legal firewall around 501(c)(28) remains impenetrable by design, preserving the integrity of the national railroad retirement system and its dedicated management structure.

501(c)(28) compliance and governance essentials

Maintaining a 501(c)(28) organization requires meticulous attention to regulatory compliance and governance practices. The National Railroad Retirement Investment Trust faces unique oversight requirements that demand structured management approaches.

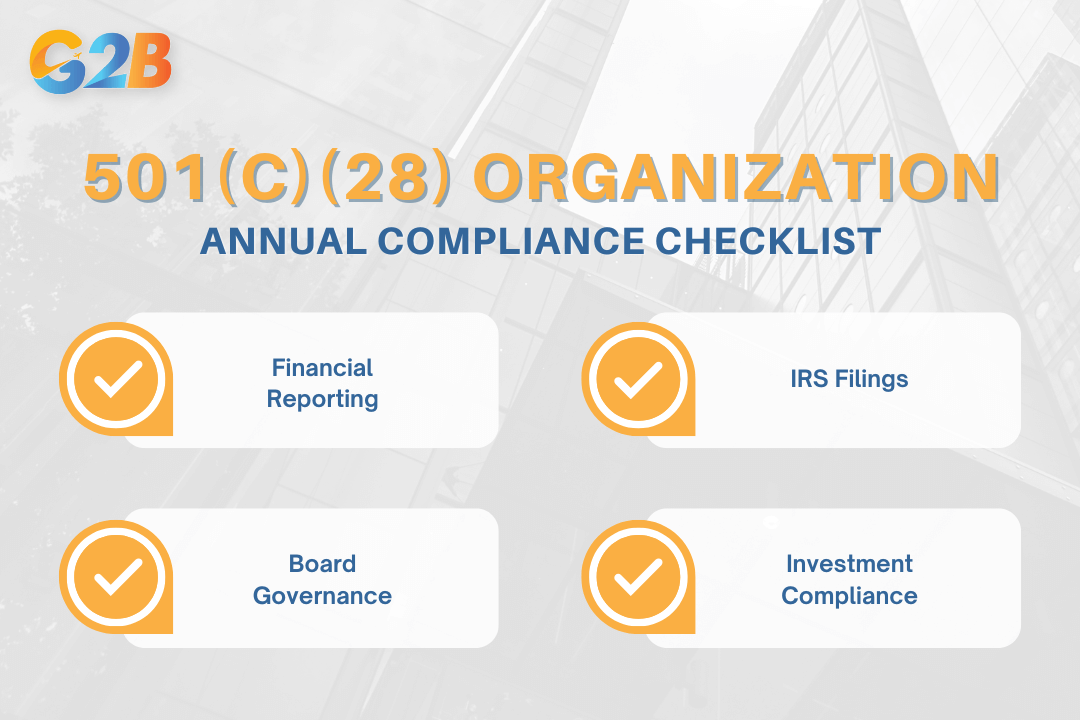

Annual compliance checklist

Financial transparency forms the foundation of 501(c)(28) compliance. Trustees must prepare and review annual financial statements that accurately reflect the trust's investment activities and performance metrics. These statements require independent verification through professional audits before submission to regulatory authorities.

Required IRS filings present critical deadlines that demand calendar-based tracking systems. The trust must submit complete and accurate information returns on schedule, including specialized disclosures unique to railroad retirement assets. Board governance requires regular, documented meetings with formal minutes that capture all material decisions, dissenting opinions, and voting records.

Investment compliance involves:

- Quarterly portfolio reviews against trust mandates

- Documentation of investment committee deliberations

- Third-party validation of asset allocation strategies

- Verification that all investments serve exclusive railroad retirement purposes

- Certification that no conflicts of interest influenced investment decisions

Maintaining a 501(c)(28) organization requires attention to regulatory compliance

Risk red flags and common pitfalls

Documentation failures represent the most frequent compliance breakdown for 501(c)(28) organizations. Every significant decision requires comprehensive records detailing the rationale, alternatives considered, and expected outcomes. Missing or incomplete documentation creates regulatory vulnerability that can trigger intensive audits or investigations.

Asset misuse constitutes a severe threat to exempt status. The use of any trust resources outside the railroad retirement system's direct benefit violates the core purpose of the 501(c)(28) designation. Warning signs include:

| Risk signal | Potential consequences |

|---|---|

| Incomplete IRS filings | Penalties, expanded audits, loss of exempt status |

| Undocumented investment decisions | Fiduciary breach allegations, legal liability for trustees |

| Non-transparent practices | Public confidence erosion, congressional scrutiny |

| Asset diversion | Tax exemption revocation, potential criminal charges |

Investment practice transparency requires particular attention as railroad retirement assets must demonstrate consistent alignment with statutory objectives. Documentation should clearly establish how each investment strategy serves the long-term interests of railroad retirees rather than other stakeholders or priorities.

Frequently asked questions (FAQ)

Below are some frequently asked questions to help clarify the structure, purpose, and regulatory framework of 501(c)(28) organizations. These answers are intended to provide a clearer understanding of how these specialized nonprofit trusts operate within the U.S. tax system:

1. Are donations to 501(c)(28) organizations tax-deductible?

No, donations to 501(c)(28) organizations are not tax-deductible for donors. Unlike 501(c)(3) charitable organizations, contributions to 501(c)(28) National Railroad Retirement Investment Trusts do not qualify for charitable deduction benefits under federal tax law.

2. Must 501(c)(28) organizations be related to railroad retirement?

Yes, 501(c)(28) organizations must be National Railroad Retirement Investment Trusts organized exclusively for managing and investing Railroad Retirement Account assets. They were established by the Railroad Retirement and Survivors' Improvement Act of 2001 and are neither agencies nor instrumentalities of the Federal Government.

3. Are 501(c)(28) organizations required to file Form 990?

501(c)(28) organizations like NRRIT are generally exempt from filing Form 990. Instead, they comply with specific federal reporting requirements established by law.

4. Do 501(c)(28) organizations need to apply for tax exemption?

501(c)(28) organizations do not need to apply for tax-exempt status via Form 1024 because their exemption is automatic by being established through federal statute.

5. Can 501(c)(28) organizations benefit private shareholders?

No, 501(c)(28) organizations cannot benefit any private shareholders or individuals. As tax-exempt organizations, none of their net earnings may inure to the benefit of private parties, and they must operate exclusively for their exempt purpose.

6. Are 501(c)(28) organizations exempt from federal income tax?

Yes, 501(c)(28) organizations are exempt from federal income taxes under Section 501(c)(28) of the Internal Revenue Code. They are also exempt from state and local taxes in most jurisdictions.

7. Can 501(c)(28) organizations engage in unrelated business activities?

Limited, like other tax-exempt organizations, 501(c)(28) entities may engage in some unrelated business activities but must pay unrelated business income tax (UBIT) on such income. Substantial unrelated business activity could jeopardize their tax-exempt status.

8. Must 501(c)(28) organizations make their tax returns publicly available?

While 501(c)(28) organizations do not file Form 990, they are subject to federal reporting and transparency requirements as mandated by the Railroad Retirement Act and related laws.

9. Is there only one 501(c)(28) organization in existence?

Yes, there is only one 501(c)(28) organization - the National Railroad Retirement Investment Trust (NRRIT). It was created specifically to manage railroad retirement assets and became effective on February 1, 2002.

10. Are 501(c)(28) organizations governed by a board of trustees?

Yes, 501(c)(28) organizations are governed by a board of trustees who have fiduciary responsibilities. The National Railroad Retirement Investment Trust is required to act solely in the interest of the Railroad Retirement Board and the participants and beneficiaries of programs funded under the Railroad Retirement Act.

A 501(c)(28) organization plays an important role for those managing pension trusts within the railroad industry, offering significant tax advantages and aiding in strategic financial planning. These entities embody reliability in an often uncertain financial landscape, ensuring that regulatory compliance is maintained seamlessly. By prioritizing legal certainty and operational efficacy, they anchor themselves as a pillar for those seeking stability and sound investment management, leaving decision-makers confident in their path forward, inspired by clear guidelines and proven frameworks.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom