A 501(c)(22) organization is a specific type of tax-exempt entity created to hold assets of government-established pension plans. Though not widely known, it plays an important role in managing funds for deferred compensation arrangements set up by public agencies. Let’s take a closer look at its definition and investigate some of the most frequently asked questions about a 501(c)(22) organization in this article.

This article is provided for general informational purposes to help professionals understand the basics of 501(c)(22) organizations. We specialize in company formation services and do not provide legal or tax advice concerning U.S. nonprofit regulations. For detailed compliance guidance, please consult a legal expert familiar with government-established pension plans and deferred compensation arrangements.

What is a 501(c)(22) organization?

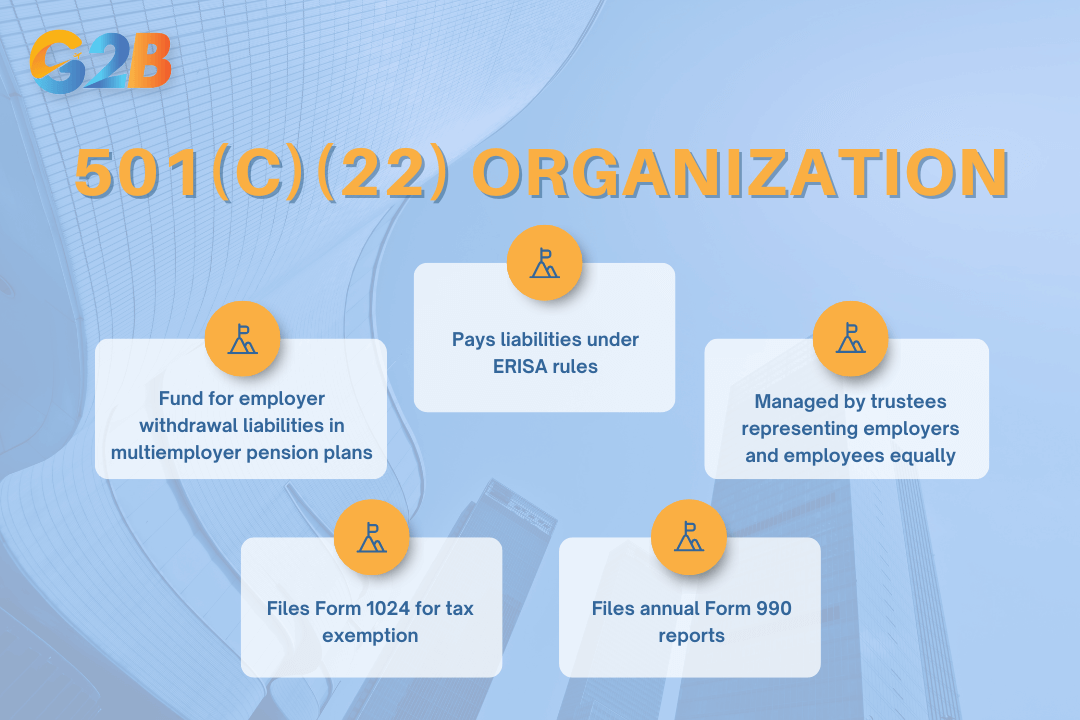

A 501(c)(22) organization is a withdrawal liability payment fund, a trust established and maintained by sponsors of multiemployer pension plans to provide funds meeting employers’ withdrawal liabilities when they exit those plans. These funds are administered by a board of trustees with equal employer and employee representation, and they pay both attributable and unattributable withdrawal liabilities under ERISA guidelines. To obtain tax-exempt status, such trusts file Form 1024 with the IRS and must annually report via the appropriate Form 990 series returns.

Take the first step toward business success - Explore our Delaware incorporation service today!

A 501(c)(22) organization is a withdrawal liability payment fund to provide funds meeting employers’ withdrawal liabilities when they exit those plans

Frequently asked questions (FAQ)

Understanding 501(c)(22) organizations can be complex due to their specialized nature and specific regulatory requirements. To help clarify common concerns, here are the answers to frequently asked questions.

1. Are 501(c)(22) organizations tax-exempt?

Yes, 501(c)(22) organizations are tax-exempt under section 501(c) of the Internal Revenue Code, similar to other nonprofit organizations in this category.

2. Do 501(c)(22) organizations serve individual employees?

No, 501(c)(22) organizations primarily serve employers by helping them meet pension fund withdrawal liabilities rather than providing direct services to individual employees.

3. Are 501(c)(22) organizations related to retirement benefits?

Yes, 501(c)(22) organizations are specifically designed to handle pension-related financial obligations when employers withdraw from multiemployer pension plans.

4. Do 501(c)(22) organizations require IRS approval?

Yes, like other 501(c) organizations, they must apply for and receive IRS recognition of their tax-exempt status through proper application procedures.

5. Are 501(c)(22) organizations common?

No, 501(c)(22) organizations are relatively specialized and less common than other nonprofit types, serving a specific niche in pension fund management.

6. Do 501(c)(22) organizations have boards of directors?

Yes, most 501(c)(22) organizations typically have governing boards to oversee operations and ensure compliance with fiduciary responsibilities and regulatory requirements.

7. Are 501(c)(22) organizations subject to annual reporting requirements?

Yes, 501(c)(22) organizations must typically file annual information returns with the IRS, similar to other tax-exempt organizations under section 501(c).

501(c)(22) organizations represent a specialized mechanism for managing assets tied to government-established pension plans. Though limited in scope, their tax-exempt status offers distinct advantages when properly structured and maintained. For professionals advising public entities or overseeing benefit-related funds, a clear understanding of these organizations is essential to ensure regulatory compliance and financial integrity. Strategic formation and sound governance are key to maximizing their intended purpose while avoiding unnecessary legal or tax complications.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom