As a special tax-exempt cooperative structure, a 501(c)(16) organization enables farmers and agricultural leaders to reduce financial risks while accessing strategic financing options. This organization champions tax incentives and legal compliance, ensuring that collective efforts yield benefits for the community. Let’s dive into how embracing this cooperative structure significantly impacts the financial health and strengthens ties within the farming community.

This article is provided for general informational purposes to help entrepreneurs understand the basics of 501(c)(16) organizations, particularly those related to Nonprofit Mutual or Cooperative Associations. We specialize in company formation services and do not provide legal or tax advice concerning U.S. nonprofit regulations. For detailed compliance guidance, please consult a qualified nonprofit specialist or legal professional.

What is 501(c)(16) organizations?

501(c)(16) organization is officially classified as a "Cooperative Organization to Finance Crop Operations" under section 521 of the Internal Revenue Code. These farmer-owned cooperatives must meet strict IRS requirements to maintain their tax-exempt status, including operating primarily for member benefit. Organizations seeking this designation must file Form 1028 or electronic Form 1024, along with Form 8718, to apply for recognition of exemption.

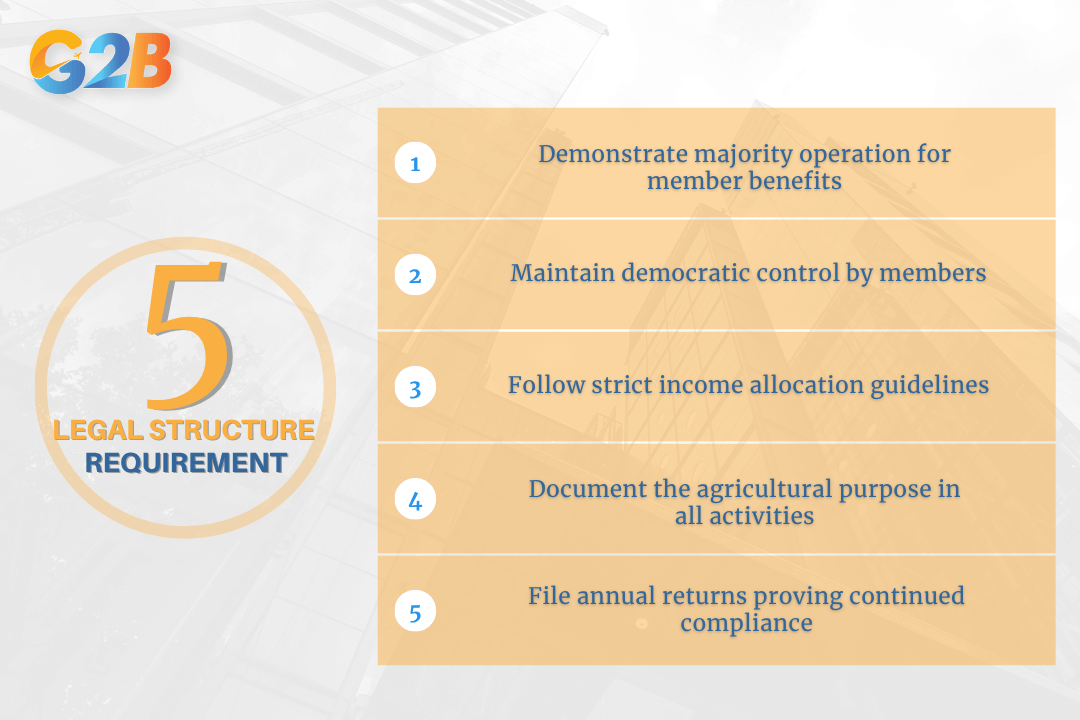

The legal structure requires these cooperatives to:

- Demonstrate majority operation for member benefits

- Maintain democratic control by members

- Follow strict income allocation guidelines

- Document the agricultural purpose in all activities

- File annual returns proving continued compliance

Legal structure requires cooperatives to operate for member benefits

Unlike standard Subchapter T cooperatives, 501(c)(16) organizations can potentially reduce their taxable income to zero through specific deductions from gross income, creating substantial tax advantages for the collective operation.

Find a reliable Delaware incorporation service? Contact us for a free consultation!

Types and roles of agricultural cooperatives under 501(c)(16)

Agricultural cooperatives qualifying for 501(c)(16) organization status serve crucial functions in supporting farm operations across America. These specialized entities help agricultural producers combine resources, minimize individual financial risks, and maximize collective benefits.

Marketing cooperatives

Marketing cooperatives enable farmers to sell their products collectively, creating significant advantages in competitive agricultural markets. These organizations consolidate harvests from multiple producers, then negotiate with buyers from a position of enhanced market power and volume efficiency.

Members benefit from professional marketing expertise that individual farmers typically cannot afford independently. By pooling products, these cooperatives achieve economies of scale in storage, transportation, and processing, translating directly into higher returns for participating farmers. Many marketing cooperatives also develop value-added processing capabilities, transforming raw commodities into higher-margin products.

These 501(c)(16) entities often establish recognizable brands and quality standards that command premium prices. Notable examples include dairy cooperatives that negotiate with major retailers, grain marketing organizations that export to international markets, and specialty crop cooperatives that supply consistent quality to food processors.

Purchasing and service cooperatives

Purchasing cooperatives dramatically reduce input costs through collective buying power. By consolidating orders for seeds, fertilizers, chemicals, and equipment, these 501(c)(16) organizations secure wholesale pricing that individual farmers cannot access independently. These cooperatives operate with several key advantages:

- Bulk purchasing discounts of 10-30% below retail prices

- Reduced transportation costs through coordinated delivery

- Enhanced bargaining power with suppliers

- Access to premium products without minimum order requirements

Beyond procurement, many service cooperatives provide specialized operational support like equipment sharing, crop storage facilities, and technical consulting. These shared resources eliminate the need for farmers to individually invest in expensive equipment or facilities used only seasonally, optimizing capital allocation across member operations.

Credit cooperatives

Agricultural credit cooperatives address the unique financing challenges farmers face due to seasonal cash flow patterns and weather-dependent production risks. These 501(c)(16) organizations create lending pools specifically designed around agricultural production cycles. Farm-focused credit cooperatives offer several distinct advantages:

- Loans structured around harvest timelines rather than arbitrary monthly schedules

- Financing terms that accommodate weather delays and market fluctuations

- Equipment loans with flexible repayment options tied to operational usage

- Operating capital that recognizes agricultural balance sheets and asset structures

Unlike traditional banks, these cooperatives involve farmer-members in lending decisions, ensuring that deep agricultural knowledge influences approval processes. This insider understanding of farming operations leads to more appropriate risk assessment and loan structuring than typically available through conventional financial institutions.

Key benefits of 501(c)(16) organizations for farmers

501(c)(16) organizations provide agricultural producers with substantial financial advantages that strengthen both individual operations and farming communities. The tax-exempt status serves as the foundation for numerous benefits that enhance profitability and operational stability for members.

Tax exemption on cooperative income

501(c)(16) cooperatives operate free from federal income tax obligations on qualifying income. This exemption represents a significant financial advantage that immediately increases the capital available within the cooperative structure. The tax savings generate additional funds that can be reinvested into agricultural operations, distributed to farmer-members as patronage dividends, or held as reserves to weather market fluctuations. This preserved capital strengthens the cooperative's financial position and directly enhances members' farming operations.

Shared risk and improved purchasing power

Agricultural cooperatives operating under 501(c)(16) status distribute financial risks across the membership, protecting individual farmers from bearing the full weight of market volatility or crop failures.

- Equipment purchasing: Members pool resources to acquire expensive machinery that would be cost-prohibitive individually

- Crop insurance: Group rates often reduce premium costs by 10-15% compared to individual policies

- Storage facilities: Shared ownership of grain elevators or cold storage reduces individual capital requirements

- Transportation costs: Collective shipping arrangements lower logistics expenses

This risk-sharing extends beyond tangible assets to market access and price negotiation. When purchasing supplies, the cooperative's volume buying power often secures discounts of 15-25% on seeds, fertilizers, and other essential inputs compared to individual purchasing.

Access to specialized financial services

501(c)(16) cooperatives develop and deliver financial products specifically tailored to the unique timing and cash flow patterns of agricultural production cycles. These specialized services include crop-specific loans that align repayment schedules with harvest timing rather than arbitrary monthly payments. The cooperative structure recognizes that farming operations face irregular income streams dictated by growing seasons and market conditions.

Member farmers gain access to:

- Flexible financing with terms matched to planting-to-harvest timelines

- Operating loans with competitive interest rates (often 2-3% lower than commercial lenders)

- Equipment leasing programs are structured around seasonal usage patterns

- Crop advance payments to manage cash flow between harvests

These agriculture-specific financial tools acknowledge the realities of modern farming operations while providing stability through collective financial strength.

Potential disadvantages and drawbacks

While 501(c)(16) organizations offer significant advantages for agricultural producers, they come with substantial challenges that warrant careful consideration. Farm cooperative leaders should realistically assess whether these potential hurdles outweigh their benefits.

Complex compliance and legal requirements

Maintaining 501(c)(16) status demands rigorous recordkeeping and regular filings with federal and state authorities. Every transaction must be documented to demonstrate the cooperative's focus on agricultural financing and member benefits. The IRS requires annual Form 990 submissions with detailed reporting on income sources, member transactions, and organizational activities.

Most agricultural cooperatives need professional assistance to navigate these requirements. Legal counsel experienced in cooperative law typically charges between $5,000-$15,000 for initial setup and ongoing consultation. Accounting professionals with specialized knowledge of exempt organization taxation add another layer of operational expense, often requiring $3,000-$7,000 annually for compliance supervision and accurate filing preparation.

Activity and capital restrictions

501(c)(16) organizations face strict limitations on permissible activities and capital structure. The IRS requires these cooperatives to operate primarily for member benefit in agricultural financing - venturing into unrelated commercial activities risks tax exemption. Even seemingly related diversification efforts can trigger scrutiny if they extend beyond the core agricultural financing mission.

Capital formation presents another significant constraint. These cooperatives cannot:

- Issue traditional equity investments to non-members

- Distribute profits based on investment rather than patronage

- Engage in certain types of debt financing without careful structuring

- Sell substantial assets without demonstrating alignment with exempt purposes

These restrictions often limit growth opportunities and competitive positioning against less-regulated agricultural businesses, creating a trade-off between tax benefits and operational flexibility.

Governance and decision-making challenges

Democratic control, while fundamentally aligned with cooperative principles, introduces operational complexity. When multiple members hold equal voting rights, decisions that would be straightforward in other business structures can become protracted negotiations. Board meetings frequently extend longer than anticipated as diverse perspectives must be considered and reconciled.

Key governance challenges include:

- Balancing the needs of small and large producers

- Managing expectations during market downturns

- Establishing clear decision-making protocols

- Preventing dominant personalities from undermining democratic processes

- Maintaining efficient operations despite potentially slower decisions

Successful cooperatives address these issues through strong bylaws, professional management, and communication systems designed to process member input efficiently while maintaining operational momentum.

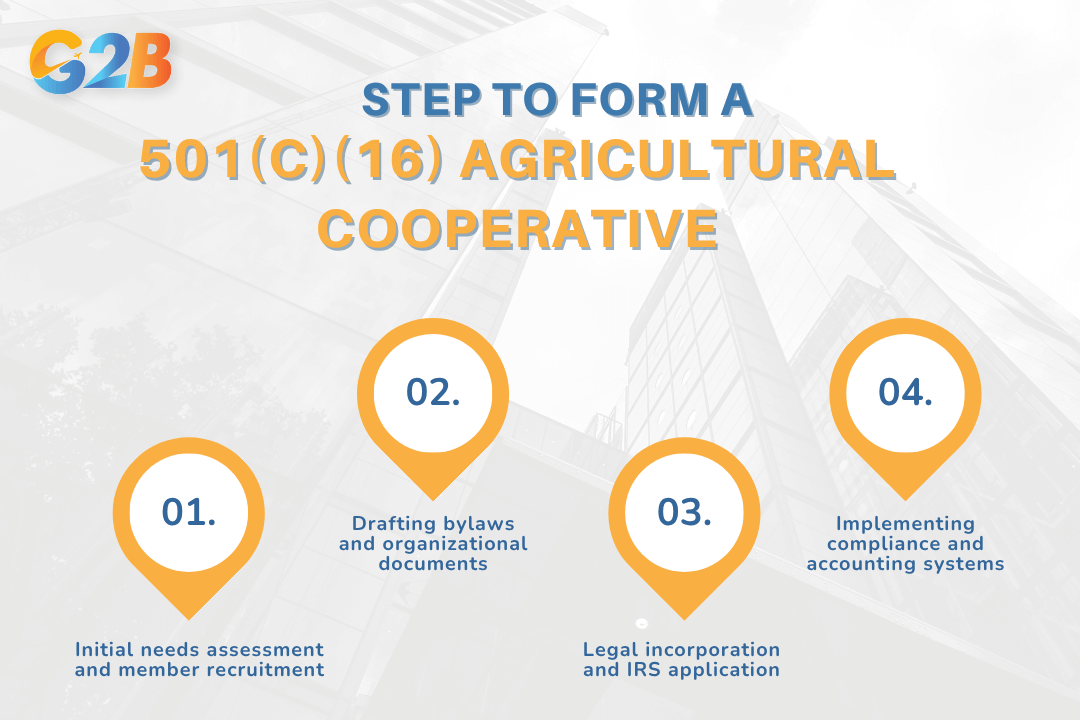

Step to form a 501(c)(16) agricultural cooperative

Establishing a 501(c)(16) organization requires methodical planning and execution to ensure compliance with both state laws and federal tax regulations. This systematic approach helps cooperatives secure proper recognition while building a foundation for sustainable member benefits.

Step to form a 501(c)(16) agricultural cooperative

Initial needs assessment and member recruitment

Agricultural producers must first identify common economic challenges that a 501(c)(16) cooperative structure can address. Successful cooperatives begin by bringing together farmers within a reasonable geographic radius - typically 75 miles - who share specific marketing, purchasing, or financing goals. These founding members should document their shared needs through formal meetings and assessments.

The recruitment phase requires creating venues for potential members to collaborate and discuss mutual interests. Focus group discussions help identify whether members' primary concerns involve accessing better markets, reducing input costs, or securing specialized financing. Documentation of these discussions provides critical evidence of agricultural purpose when applying for tax-exempt status.

Drafting bylaws and organizational documents

Cooperative bylaws serve as the governance foundation and must clearly outline democratic management principles and member benefits. These documents should specifically reference compliance with IRS requirements for agricultural cooperatives, including provisions for patronage dividends and democratic control by producer-members.

When crafting purpose statements, cooperatives should focus on agricultural production support rather than retail operations. A well-crafted purpose statement might read: "To educate the population within a 75-mile radius on the benefits of freshly grown agricultural products and to facilitate the marketing of members' agricultural outputs." In states with tiered incorporation options, selecting Type B corporation status may provide the most appropriate legal foundation.

Required bylaw elements:

- Membership eligibility criteria

- Democratic voting procedures

- Distribution of earnings

- Board composition and election processes

Legal incorporation and IRS application

The formal incorporation process begins by filing articles of incorporation with the appropriate state agency. These documents must include:

- The cooperative's official name

- Names and addresses of initial directors (minimum three)

- Legal address for the organization

- Clear statement of the agricultural cooperative's purpose

After state incorporation, the cooperative must submit Form 1028 to apply for 501(c)(16) tax exemption with the IRS. This application requires substantial documentation demonstrating that the cooperative exclusively serves agricultural producers. Supporting materials should include bylaws, meeting minutes, member agreements, and business plans that establish legitimate agricultural purposes.

Implementing compliance and accounting systems

Operational success for a 501(c)(16) organization depends on robust record-keeping and compliance systems established from day one. Member records must track patronage, voting rights, and benefit distributions. Cost-tracking systems should separate member-related activities from any non-member business.

Creating standardized membership agreements establishes clear expectations for both the cooperative and its members. These agreements should address:

- Member rights and responsibilities

- Service delivery standards

- Payment terms and schedules

- Dispute resolution procedures

Comprehensive documentation of all cooperative activities and distributions supports ongoing compliance with federal standards. Annual review procedures should verify continued alignment with the cooperative's tax-exempt purpose while addressing evolving member needs.

Legal implications and compliance considerations

501(c)(16) organizations must navigate complex regulatory frameworks to maintain their tax-exempt status. Farmers and cooperative leaders must understand that regulatory missteps can result in the revocation of tax exemption, financial penalties, or even forced dissolution of the organization.

Annual IRS filings and reporting

Agricultural cooperatives holding 501(c)(16) status must adhere to strict annual reporting requirements. These organizations must file timely returns with the IRS that comprehensively document all income sources, expenditures, and member benefits distributed throughout the fiscal year.

The IRS requires detailed financial statements, including balance sheets and income statements that demonstrate a continued commitment to agricultural purposes. For established cooperatives, this means providing complete financial records for the most recently completed tax year. New organizations must submit proposed budgets covering two full accounting periods, along with current assets and liabilities statements.

Key filing requirements include:

- Form 990 or an appropriate variant based on organizational size

- Detailed description of agricultural activities

- Documentation of member participation and benefits

- Proof that operations remain within permitted agricultural bounds

- Evidence of a democratic governance structure

Staying within permitted activities

501(c)(16) cooperatives must carefully restrict their operations to activities directly supporting member farms and agricultural production. The IRS defines "agricultural" activities as those involving land cultivation, crop harvesting, aquatic resource management, or livestock raising. Expanding beyond these prescribed boundaries creates serious compliance risks. Agricultural cooperatives that venture into non-permitted commercial activities face potential tax assessments, penalties, and loss of exempt status. To maintain compliance:

- Focus exclusively on member-oriented agricultural services

- Maintain proper documentation of all activities and their agricultural purpose

- Ensure members properly report their pro rata shares of taxable income

- Establish internal review processes for any new initiatives

- Seek legal counsel before pursuing ventures outside traditional cooperative functions

Governance and member control requirements

Democratic member control stands as a cornerstone requirement for 501(c)(16) organizations. Decision-making must remain firmly in members' hands, with each cooperative maintaining robust governance documentation to prove compliance with both cooperative principles and IRS expectations.

Agricultural cooperatives must implement:

- Clear bylaws detailing democratic voting procedures

- Documented member meetings with formal minutes

- Transparent decision-making processes

- Procedures ensuring equal member participation

- Systems for maintaining comprehensive organizational records

The cooperative must maintain detailed records of all governance activities, including meeting minutes, voting results, and policy changes. Any significant organizational modifications must be properly documented and, in many cases, reported to state and federal authorities to maintain compliance.

Ready to establish a company in Delaware? Get started with a free consultation from our expert incorporation service!

501(c)(16) vs. Other farm business structures - Key comparisons

Farmers seeking to organize collective operations must carefully weigh the benefits and limitations of different business structures. Understanding the differences helps agricultural leaders make informed decisions that align with their specific operational needs, tax objectives, and governance preferences.

Comparison with LLCs, S Corps, and standard cooperatives

501(c)(16) organizations offer tax exemption specifically designed for farmer-owned cooperatives focused on financing crop operations. This specialized tax treatment represents a significant advantage over standard business structures like LLCs and S Corporations, which remain subject to either entity-level or pass-through taxation. While these conventional business forms provide greater operational flexibility and fewer activity restrictions, they lack the targeted tax benefits the IRS extends to qualifying agricultural cooperatives.

Standard agricultural cooperatives without 501(c)(16) status may qualify for certain tax advantages under Subchapter T of the Internal Revenue Code, but these benefits typically fall short of full exemption. These cooperatives can deduct patronage dividends paid to members, but generally still face taxation on retained earnings and non-member business income.

LLCs and S Corporations excel in areas where 501(c)(16) organizations face limitations, particularly regarding activities outside direct member service, capital raising flexibility, and governance arrangements. Farm businesses requiring a broader operational scope or significant outside investment may find these conventional structures more accommodating despite their different tax treatment.

Pros and cons table

| Structure | Tax Treatment | Liability Protection | Governance Requirements | Capital Access | Operational Flexibility |

|---|---|---|---|---|---|

| 501(c)(16) Cooperative | Federal tax exemption on qualified activities | Limited liability for members | Democratic, one-member-one-vote | Primarily member-financed, limited outside investment | Restricted to agricultural financing activities |

| LLC | Pass-through taxation (default) | Limited liability for all owners | Highly flexible, can be member or manager-managed | Unrestricted access to outside investment | Few restrictions on business activities |

| S Corporation | Pass-through taxation | Limited liability for shareholders | Formal board structure, shareholder voting | Limited to 100 shareholders, one class of stock | Few activity restrictions but more formalities |

| Partnership | Pass-through taxation | Personal liability (general partnership) | Partner-controlled, typically by consensus | Partner contributions and external debt | Few formal requirements but higher personal risk |

| Standard Cooperative | Potential deductions for patronage dividends | Limited liability for members | Democratic member control | Member investment, limited outside capital | Must primarily serve members but broader than 501(c)(16) |

Agricultural operations should consider several key factors when selecting between these structures:

- Primary purpose - 501(c)(16) suits operations specifically focused on crop financing, while broader agricultural ventures may need different structures

- Tax priorities - Complete exemption versus pass-through treatment

- Governance preferences - Democratic control versus management flexibility

- Capital requirements - Member-based versus the ability to attract outside investors

- Growth plans - Activity restrictions versus operational freedom

Each structure presents distinct tradeoffs between tax benefits, operational constraints, capital access, and administrative requirements that agricultural leaders must evaluate based on their specific circumstances and long-term objectives.

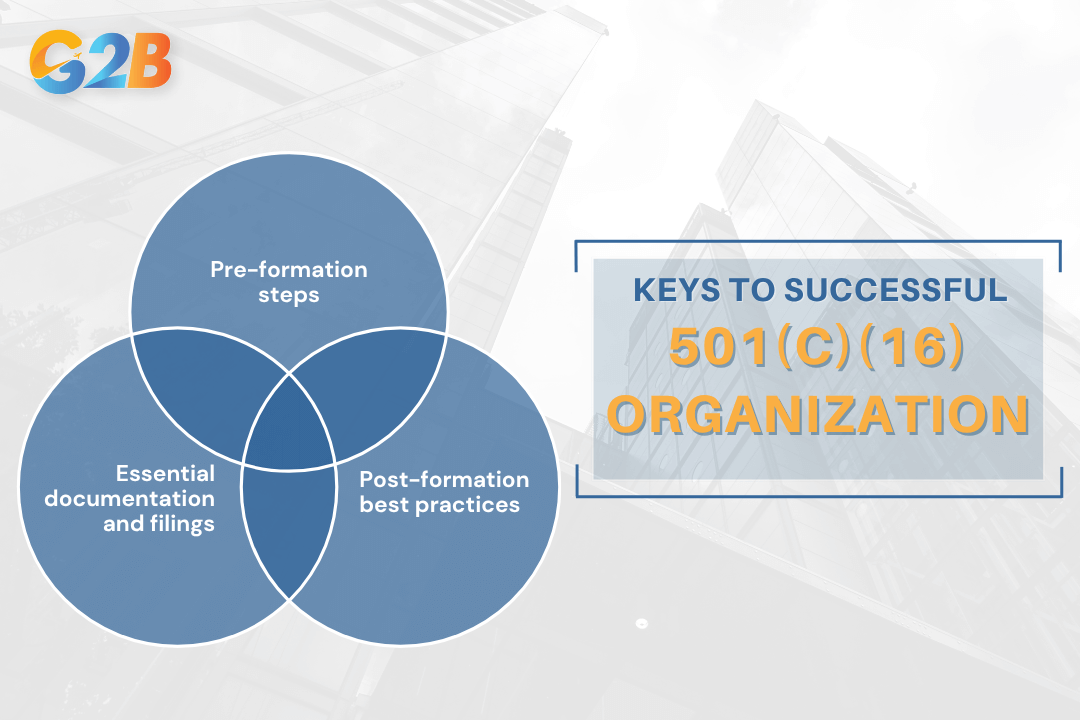

Keys to successful 501(c)(16) cooperative formation

Establishing a compliant 501(c)(16) organization requires methodical planning and execution. This comprehensive checklist serves as a roadmap for agricultural producers seeking to leverage collective financing power while maintaining full legal compliance.

Keys to successful 501(c)(16) cooperative formation

Pre-formation steps

Assessment and recruitment form the foundation of any successful 501(c)(16) cooperative. Begin with a thorough evaluation of local agricultural needs, identifying specific financing challenges that current systems fail to address. Document these gaps to demonstrate the legitimate purpose required for IRS approval.

Founding members should represent diverse agricultural interests within the community while sharing core values about cooperative principles. Hold preliminary meetings to establish commitment levels and potential financial contributions before any legal documentation begins. These early conversations create the collaborative culture essential for long-term cooperative success.

Essential documentation and filings

Proper legal documentation protects both the cooperative and its members from future complications. Draft comprehensive bylaws that clearly outline governance structure, membership qualifications, voting rights, and procedures for distributing benefits according to participation levels. These bylaws must explicitly state the organization's purpose of financing crop operations to satisfy 501(c)(16) requirements.

Articles of incorporation must be filed with the appropriate state agency, specifically designating the organization as an agricultural cooperative. Following state approval, prepare Form 1024 for IRS submission, including:

- Detailed description of all financing activities

- Explanation of member qualification requirements

- Proof of democratic control by producer members

- Financial projections demonstrating an exclusive agricultural focus

Membership agreements should clearly outline the rights, responsibilities, and financial obligations of participants, creating legally binding relationships between individual producers and the cooperative entity.

Post-formation best practices

Maintaining 501(c)(16) status requires ongoing vigilance. Schedule quarterly board meetings with formal agendas, complete minutes, and financial reviews to ensure continuous compliance with stated cooperative purposes. These regular governance sessions help prevent mission drift that could jeopardize tax exemption.

Annual compliance reviews should examine:

- IRS filing requirements (Form 990)

- State reporting obligations

- Member participation levels

- Financial activity alignment with exempt purposes

Professional guidance becomes particularly crucial during periods of operational change. Engage agricultural cooperative specialists when:

- Expanding services or membership criteria

- Restructuring financing mechanisms

- Responding to IRS inquiries

- Updating bylaws or governance practices

Implementing these best practices creates a sustainable 501(c)(16) cooperative that delivers lasting financial benefits to members while maintaining its valuable tax-exempt status.

FAQs about 501(c)(16) organizations

- Is a 501(c)(16) organization a cooperative association?

Yes, 501(c)(16) organizations are cooperative associations formed to finance or support members’ crop operations and related agricultural activities. - Do 501(c)(16) organizations primarily serve farmers?

Yes, they typically support farmers or agricultural producers by providing services like crop cultivation, equipment, warehouse, shipping, and marketing. - Can a 501(c)(16) organization be tax-exempt?

Yes, these organizations qualify for federal tax-exempt status under IRS Section 501(c)(16). - Are 501(c)(16) organizations allowed to distribute profits to members?

No, as tax-exempt cooperatives, their earnings must be used to support members’ operations, not distributed as profits. - Is a 501(c)(16) organization the same as a 501(c)(3) charity?

No, 501(c)(16) organizations focus on cooperative agricultural operations, unlike 501(c)(3) organizations which serve charitable, educational, or religious purposes. - Do 501(c)(16) organizations provide financial services?

Yes, they may provide financial support or credit services related to crop production and farming operations. - Are 501(c)(16) organizations limited to crop-related activities?

Yes, their primary purpose is to support crop operations and related agricultural activities for members. - Can a 501(c)(16) organization operate nationwide?

Yes, but they usually serve members within a defined agricultural community or region to support cooperative farming efforts. - Do 501(c)(16) organizations have to file IRS Form 990?

Yes, like most tax-exempt organizations, they must file annual information returns unless exempt due to low revenue. - Are 501(c)(16) organizations subject to unrelated business income tax?

Yes, income from unrelated business activities may be taxable even if the organization is 501(c)(16) tax-exempt.

A 501(c)(16) organization opens doors to a new era of cooperative farming, allowing agricultural communities to share resources and reduce risks collectively. By embracing this structure, farmers can tap into tax benefits and navigate financial complexities with greater confidence, ensuring legal compliance while maximizing economic opportunities. Embracing these collaborative endeavors cultivates a resilient future where traditional values are honored and shared success becomes a cornerstone of rural life

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom