Tailored for labor unions and agricultural groups, 501(c)(5) organization fosters mission-driven initiatives, encouraging sustainable impact without profit as the primary motive. Understanding eligibility nuances among tax-exempt types becomes simpler with a clear grasp of legal requirements and compliance. Let’s investigate how this status enhances influence, ensuring strategic growth in your mission-oriented endeavors.

This content is provided for general informational purposes to help entrepreneurs understand the basics of 501(c)(5) organizations. We specialize in company formation, not in providing legal or tax advisory services specific to US nonprofit compliance. This information should not be considered professional legal or tax advice. For guidance specific to your situation, please consult a nonprofit compliance expert or legal professional specializing in labor organizations and agricultural associations.

What is a 501(c)(5) organization?

A 501(c)(5) organization specifically serve labor unions, agricultural associations, and horticultural groups whose primary mission focuses on improving conditions, enhancing product quality, or increasing occupational efficiency for their members.

Formal definition and IRS basis

A 501(c)(5) organization is a tax-exempt nonprofit entity recognized under Section 501(c)(5) of the Internal Revenue Code. These organizations primarily serve labor unions, agricultural associations, and horticultural groups, with a mission focused on improving working conditions, enhancing product quality, and increasing occupational efficiency for their members.

Unlike charitable organizations (such as 501(c)(3) entities), 501(c)(5) organizations emphasize collective action, member advocacy, and industry-specific improvements rather than general charitable purposes. They often engage in activities like lobbying and collective bargaining to advance the interests of their members within their respective sectors. The IRS grants this status to organizations that meet specific criteria:

- The organization must operate primarily to improve conditions of work and advance members' interests

- Net earnings cannot benefit any private shareholder or individual

- The organization must serve a collective purpose rather than individual interests

Ready to establish company in the Delaware? Get started with a free consultation from our expert incorporation service!

Simple explanation for entrepreneurs

For business leaders and entrepreneurs, a 501(c)(5) status essentially creates a tax-free operating environment for unions, farm cooperatives, and similar organizations focused on member advocacy. These organizations typically engage in:

- Collective bargaining with employers or purchasers

- Lobbying for favorable industry regulations

- Providing education and resources to members

- Improving workplace conditions or agricultural practices

Unlike donations to charitable organizations, contributions to 501(c)(5) organizations generally aren't tax-deductible for donors. However, certain membership dues may qualify as business expenses in specific circumstances, offering potential tax benefits for members. This structure creates a sustainable framework for organizations focused on industry advocacy rather than public charity.

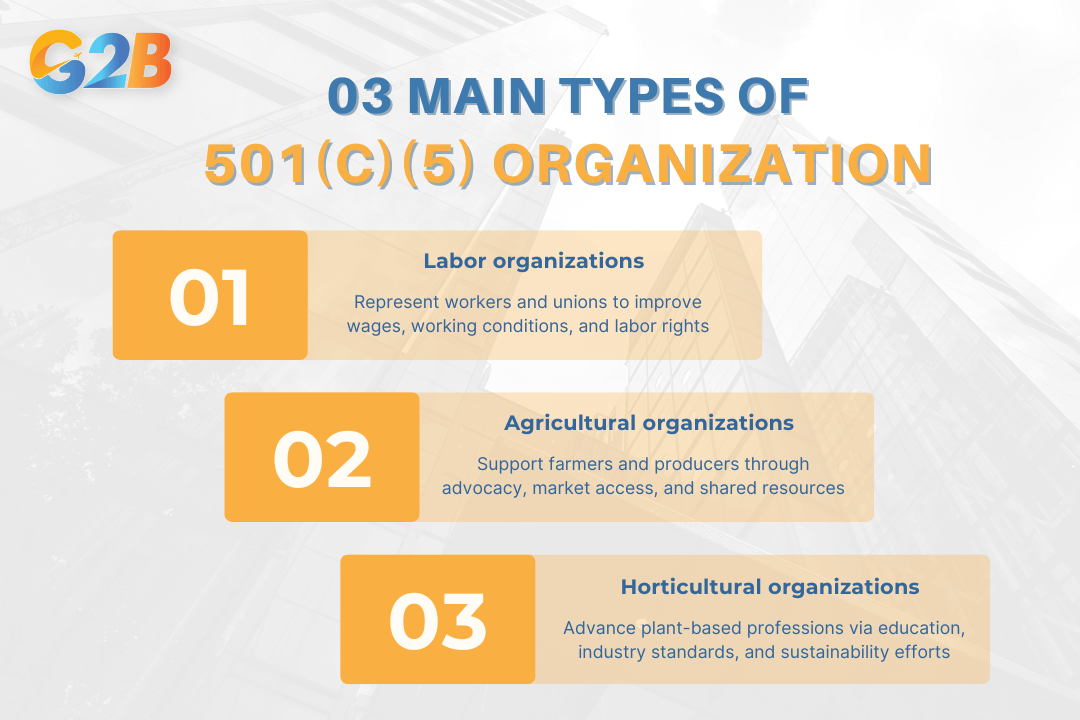

Types and roles of 501(c)(5) organizations

The Internal Revenue Service recognizes three distinct categories of 501(c)(5) organizations, each with specific functions yet sharing common objectives of advocacy and member support.

There are three distinct categories of 501(c)(5) organizations

1. Labor organizations

Labor organizations constitute the most recognizable segment of 501(c)(5) entities, primarily comprising unions that represent workers across various industries. These organizations qualify for tax-exempt status when they focus on bettering working conditions, securing fair wages, and enhancing employment terms through collective bargaining.

Typical activities include negotiating contracts with employers, advocating for workplace safety improvements, and managing grievance procedures when workers' rights are violated. Major examples include the United Auto Workers (UAW), American Federation of Teachers (AFT),... which collectively represent millions of American workers. These organizations often maintain strike funds, legal defense resources, and educational programs to support their membership effectively.

2. Agricultural organizations

Agricultural 501(c)(5) organizations serve farmers, ranchers, and others involved in food production by promoting sustainable practices, improving market access, and advocating for favorable agricultural policies. These organizations focus on bettering conditions for producers while enhancing product quality and distribution efficiency. Farm bureaus, dairy associations, and livestock producer groups exemplify this category, providing members with critical resources such as:

- Market intelligence and commodity pricing information

- Bulk purchasing programs for seeds, fertilizers, and equipment

- Technical assistance for implementing new farming technologies

- Representation in legislative matters affecting agricultural interests

3. Horticultural organizations

Horticultural organizations focus specifically on plant cultivation, landscaping, and related professions. These specialized 501(c)(5)s support nursery operators, florists, and gardening professionals through education and industry standards development.

Activities typically include:

- Organizing flower shows, county fairs, and exhibitions

- Developing certification programs for horticultural professionals

- Conducting research on plant varieties and cultivation techniques

- Promoting sustainable landscaping and conservation practices

Organizations like state horticultural societies and professional associations for landscape architects exemplify this category, working to advance both the science and business of plant cultivation.

Key roles and activities

All 501(c)(5) organizations, regardless of category, share fundamental functions that define their operational focus and tax-exempt purpose. These core activities establish their legitimacy as member-serving entities under IRS guidelines.

| Core function | Description | Examples |

|---|---|---|

| Collective representation | Advocating for members in negotiations | Contract bargaining, regulatory hearings |

| Industry advocacy | Influencing legislation and policy | Lobbying for farm bills, labor laws |

| Educational resources | Improving member knowledge and skills | Training programs, conferences and publications |

| Standards development | Enhancing quality and practices | Best practice guidelines, certification programs |

| Member services | Providing direct support and benefits | Legal assistance, insurance programs and networking |

These organizations must primarily serve collective interests rather than individual benefits to maintain their tax-exempt status, balancing advocacy work with tangible member services.

Eligibility and legal requirements for 501(c)(5) status

Obtaining and maintaining 501(c)(5) organization status requires meeting specific IRS criteria and following various compliance protocols. Understanding these requirements helps organizations secure their tax-exempt status and fulfill their mission effectively.

IRS eligibility criteria

To qualify for 501(c)(5) status, organizations must exclusively operate as labor, agricultural, or horticultural entities. The IRS requires these organizations to serve collective member interests rather than individual benefits. Net earnings cannot inure to the benefit of any individual member-a fundamental principle of nonprofit operation.

Organizations must demonstrate that their primary purpose is improving conditions for those engaged in their respective fields. Labor unions must focus on negotiating better working conditions and wages. Agricultural and horticultural organizations must concentrate on improving product quality and developing higher occupational efficiency in their sectors. The organization must maintain clear records showing how activities support these exempt purposes.

Permitted and prohibited activities

501(c)(5) organizations operate within defined boundaries regarding allowable activities. Permitted activities include representing employees in wage and hour negotiations, advocating for improved working conditions, and lobbying for legislation relevant to labor or agricultural programs. Unlike many other nonprofit types, 501(c)(5) organizations can engage in substantial lobbying activities without jeopardizing their tax-exempt status.

Prohibited activities create significant compliance risks. Organizations cannot:

- Operate primarily for private benefit

- Manage investment funds as their principal activity

- Engage in political campaign activities as their primary function

- Operate social clubs for recreation or pleasure

- Conduct business with the general public similar to for-profit entities

- Advertise the products or services of individual members as a primary activity

Violating these prohibitions may result in loss of tax-exempt status and potential penalties.

Compliance and reporting

501(c)(5) organizations face ongoing compliance obligations. Organizations must initially apply for tax-exempt status through the IRS. After recognition, annual reporting requirements include:

- Filing the appropriate Form 990 series return annually

- Maintaining detailed records demonstrating exempt-purpose activities

- Adhering to disclosure requirements about lobbying activities

- Tracking any unrelated business income

Organizations that engage in lobbying must either notify members about the percentage of dues used for these activities or pay a proxy tax. Political expenditures may trigger tax liability under section 527(f) of the Internal Revenue Code. Careful record-keeping and transparent operations minimize compliance risks.

State-level nuances and additional legal considerations

While federal requirements establish baseline compliance, state-level regulations add complexity for 501(c)(5) organizations. Formation occurs at the state level, with each state imposing specific incorporation requirements:

| State Requirements | Description |

|---|---|

| Formation documents | Articles of incorporation/organization specific to nonprofits |

| Governance structure | Bylaws and board of directors establishment |

| Registration | State-specific nonprofit registration protocols |

| Annual filings | State-level annual reports and renewals |

Noncompliance with state regulations can trigger penalties independent of federal requirements. Some states impose additional governance requirements, charitable solicitation registrations, or employment-related obligations. Organizations operating across multiple states must navigate varying requirements in each jurisdiction. Professional legal guidance helps organizations navigate these complex state-level nuances.

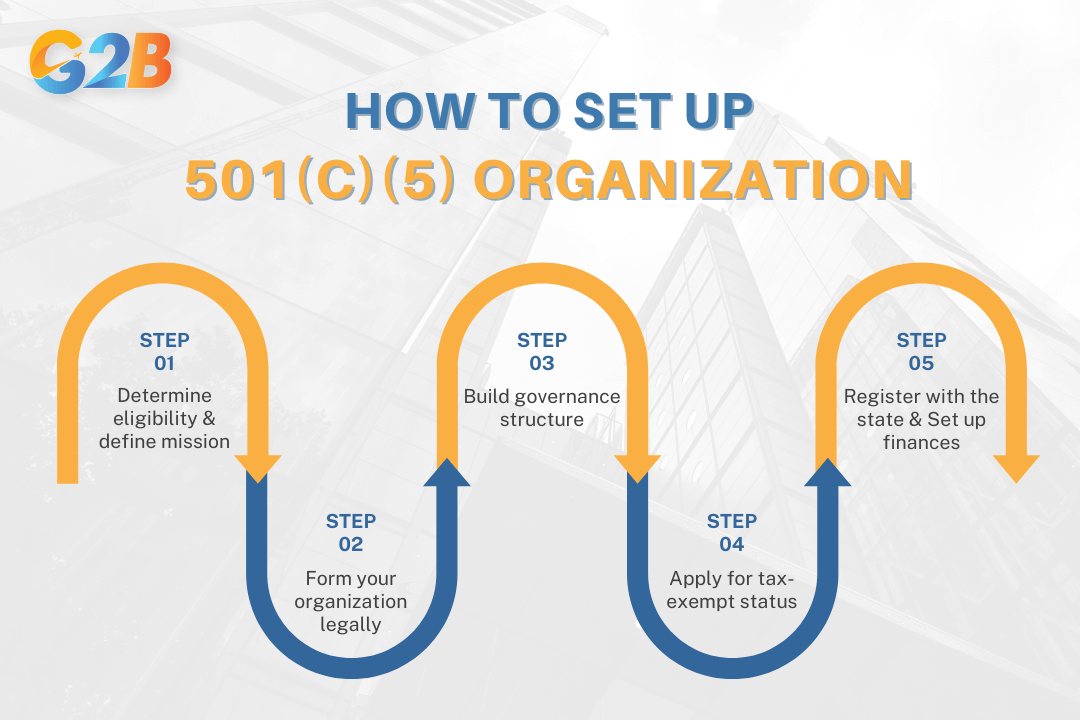

Step-by-step guide: How to start a 501(c)(5) organization

Establishing a 501(c)(5) organization requires methodical planning and careful adherence to legal requirements. Organizations seeking this tax-exempt status must focus on serving members in labor, agricultural, or horticultural sectors through a structured formation process that satisfies both federal and state regulations.

Establishing a 501(c)(5) organization has several steps to follow

Pre-formation planning

Assessing eligibility forms the critical first step in establishing a 501(c)(5) organization. The founding team must verify their proposed organization falls within one of the qualifying categories: Labor unions, agricultural associations, or horticultural societies. This determination affects every subsequent formation step.

The mission statement requires precise crafting to demonstrate how the organization will improve conditions, products, or occupational efficiency for members. Effective statements clearly articulate member benefits without suggesting private gain. Before proceeding, organizers should gather a core group of founding members who understand the organization's purpose and commitment to collective improvement within their industry. Key planning considerations include:

- Confirming alignment with IRS requirements for 501(c)(5) status

- Identifying specific member needs the organization will address

- Developing preliminary budget projections

- Researching similar successful organizations in the sector

Legal formation and governance

Incorporation begins with filing articles with the appropriate state agency. This document establishes the organization's legal existence and must include specific nonprofit language that aligns with 501(c)(5) requirements. State approval of these articles becomes a prerequisite for the IRS application.

Bylaws represent the organization's operating manual and require careful drafting. These documents should detail:

- Membership qualifications and admission procedures

- Board composition and election methods

- Meeting requirements and voting protocols

- Leadership roles and responsibilities

- Financial oversight mechanisms

The governance structure must reflect member interests while maintaining operational efficiency. Many successful 501(c)(5) organizations implement democratic leadership with clear checks and balances to prevent concentrated power while preserving effective decision-making capacity.

IRS application process

Form 1024 serves as the primary application for 501(c)(5) tax-exempt status. This comprehensive document requires detailed information about organizational structure, activities, and finances. The narrative description of activities must clearly demonstrate how the organization furthers the interests of those in labor, agricultural, or horticultural fields. Supporting documentation strengthens the application and should include:

- State-approved articles of incorporation

- Complete set of bylaws

- Financial statements or projected budgets

- Organizational chart

- List of governing body members

Current IRS processing times range from 8-12 months, requiring applicants to plan accordingly. Organizations may operate while awaiting determination, though they should understand potential tax implications if status is ultimately denied.

State registration and compliance

Beyond federal requirements, state-level registration demands attention. Requirements vary significantly, with some states requiring:

- Charitable solicitation registration

- State tax exemption applications

- Special permits for specific activities

- Annual financial reporting

State registration often requires separate applications and fees beyond the initial incorporation process. Organizations operating across multiple states may need to register in each jurisdiction where substantial activities occur.

Essential steps and documents

1. Formation documentation:

- Articles of incorporation with nonprofit provisions

- Comprehensive bylaws

- EIN confirmation from the IRS

- Form 1024 application package

- State registration confirmations

2. Governance requirements:

- Board member roster with contact information

- Initial board meeting minutes

- Adopted policies (conflict of interest, compensation, etc.)

- Membership criteria and application process

3. Financial setup:

- Accounting system implementation

- Bank account establishment

- Budget development

- Financial controls documentation

4. Compliance calendar:

- Form 990 filing deadline

- State annual report due dates

- Board meeting schedule

- Membership renewal periods

Get expert guidance with G2B’s Delaware incorporation service - Schedule your free consultation today!

Benefits and advantages of 501(c)(5) status

501(c)(5) organizations have significant advantages that enhance their ability to fulfill their mission of improving conditions for members in labor, agricultural, and horticultural sectors. The following advantages make this designation particularly valuable for qualifying organizations seeking to maximize their effectiveness.

Federal tax exemption

Federal tax exemption represents the cornerstone benefit of 501(c)(5) status. Organizations operating under this designation avoid federal income taxation on revenue directly related to their exempt purposes. This critical advantage allows labor unions and agricultural associations to direct more resources toward member services rather than tax obligations.

Income streams typically exempted include membership dues, convention receipts, and interest earned on investments. For example, a agricultural cooperative with annual dues of $500,000 can utilize those funds entirely for member programs rather than surrendering a portion to federal taxes. This tax advantage creates significant financial leverage compared to for-profit entities serving similar constituencies.

The exemption does have boundaries, however. Unrelated business income-revenue generated from activities not substantially related to the organization's exempt purpose-remains subject to taxation through the Unrelated Business Income Tax (UBIT). Additionally, certain political expenditures may trigger proxy taxes depending on the nature and extent of such activities.

Operational and strategic advantages

501(c)(5) organizations benefit from enhanced credibility and legitimacy within their industries and communities. This official IRS recognition often translates into greater influence when advocating for members' interests before governmental bodies and regulatory agencies. These organizations frequently qualify for:

- Reduced postal rates through USPS nonprofit mailing privileges

- Property tax exemptions in many localities

- Preferential treatment in certain grant programs

- Access to specialized nonprofit services and vendors

Limited liability protection represents another significant benefit. This protection shields officers, directors, and members from personal financial responsibility for organizational debts and legal obligations, encouraging qualified individuals to serve in leadership positions without risking personal assets.

Unlike charitable 501(c)(3) organizations, 501(c)(5) entities can engage in substantial lobbying activities directly related to their exempt purposes. This freedom allows unions and agricultural associations to effectively advocate for policy changes benefiting their members without endangering their tax-exempt status.

Member and community impact

The collective power of 501(c)(5) organizations creates substantial benefits for members and broader industry ecosystems. By pooling resources, these organizations achieve economies of scale that individual members could never attain independently. Typical member benefits include:

| Benefit category | Examples |

|---|---|

| Advocacy | Lobbying for favorable legislation, regulatory representation |

| Education | Industry training, professional development, certification programs |

| Research | Market analysis, best practices development and innovation testing |

| Community | Networking events, mentorship opportunities, information sharing |

This collaborative approach enables 501(c)(5) organizations to address systemic industry challenges. Agricultural associations, for instance, can fund research into sustainable farming practices that benefit all members while remaining beyond the financial reach of individual farmers. Similarly, labor unions can negotiate collective bargaining agreements that establish industry standards protecting thousands of workers simultaneously.

Disadvantages, limitations, and legal risks

501(c)(5) organizations offer notable benefits for labor, agricultural, and horticultural groups, but come with significant drawbacks and compliance challenges. Organizations should consider these disadvantages against the benefits before pursuing this classification.

Disadvantages compared to other nonprofits

501(c)(5) organizations operate under several key limitations not present with other nonprofit designations. Unlike donations to 501(c)(3) organizations, contributions to 501(c)(5) entities are generally not tax-deductible for donors. This creates a significant fundraising disadvantage when soliciting public support.

Members may only deduct dues or contributions as "ordinary and necessary" business expenses in limited circumstances. For instance, labor union dues might qualify, but general donations typically do not. The organization must also maintain a narrow focus on improving conditions specifically within labor, agricultural, or horticultural sectors, limiting operational flexibility.

- Not eligible for many foundation grants

- Limited to serving member interests rather than broader charitable purposes

- Restricted ability to attract tax-incentivized donations

- Narrower scope of acceptable activities than 501(c)(3) organizations

Compliance and reporting burdens

501(c)(5) organizations face stringent ongoing compliance requirements that create administrative and financial burdens. The IRS demands detailed annual reporting through Form 990, which requires comprehensive financial disclosure and organizational information. State-level reporting adds another layer of complexity, with requirements varying by jurisdiction.

Application fees and ongoing maintenance costs can be substantial. Initial federal filing fees range from $200-$850, with additional state incorporation fees. Organizations must track and potentially pay taxes on unrelated business income-revenue generated from activities not aligned with exempt purposes. The application process itself often stretches for months, requiring extensive documentation and legal review.

| Compliance requirement | Details | Potential consequences |

|---|---|---|

| Annual Form 990 filing | Comprehensive financial disclosure | Penalties, potential loss of status |

| State reporting | Varies by location | Fines, loss of good standing |

| Unrelated business income | Tax on non-exempt revenue | Tax liability, potential audit |

| Political activity tracking | Must report and pay tax on certain activities | Tax penalties, status challenges |

Legal risks and loss of status

501(c)(5) organizations operate under constant risk of status revocation if they fail to maintain compliance. The IRS closely monitors these organizations for prohibited activities, including excessive private benefit to individuals or significant engagement in unrelated business. Financial transparency requirements expose the organization to public scrutiny, including disclosure of executive compensation and major expenditures. Board members carry fiduciary responsibilities and can be held personally liable for mismanagement or failure to act in the organization's best interests.

Upon dissolution, assets cannot be distributed to members but must transfer to another nonprofit entity, limiting founders' control. Organizations violating regulations face:

- IRS audits and investigations

- Financial penalties and back taxes

- Permanent loss of tax-exempt status

- Potential personal liability for directors

- Damage to organizational reputation

Maintaining proper governance documentation, adhering strictly to exempt purposes, and implementing robust compliance systems represent essential protective measures against these significant legal risks.

Comparation of 501(c)(5) vs. Other 501(c) organization types

There are crucial distinctions between 501(c)(5) organizations and other tax-exempt entities. These differences impact eligibility, operational capabilities, and tax treatment that entrepreneurs should consider.

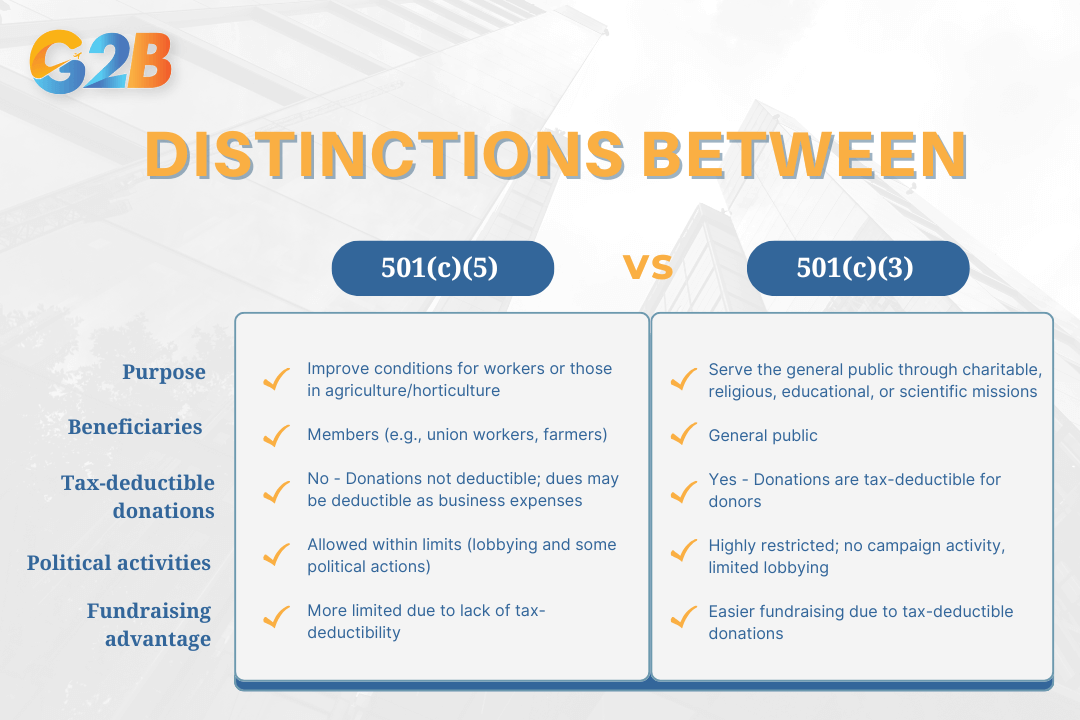

501(c)(5) vs. 501(c)(3)

501(c)(5) and 501(c)(3) organizations differ fundamentally in purpose and tax benefits. 501(c)(3) entities focus on charitable, religious, educational, scientific, and literary missions serving the general public. In contrast, 501(c)(5) organizations exist specifically to improve conditions for workers or those in agricultural and horticultural sectors.

The tax treatment creates the most significant practical distinction. Donations to 501(c)(3) organizations qualify as tax-deductible charitable contributions, making fundraising easier. 501(c)(5) organizations cannot offer this benefit to donors, though members may deduct union dues or similar payments as business expenses in certain situations.

Political activity restrictions also vary considerably. 501(c)(5) organizations can engage in lobbying and limited political activities as long as these don't constitute their primary purpose. 501(c)(3) organizations face much stricter limitations, prohibiting political campaign involvement and restricting lobbying activities to an insubstantial portion of their operations.

501(c)(5) and 501(c)(3) organizations differ fundamentally in purpose and tax benefits

501(c)(5) vs. 501(c)(6) and others

Business leagues, chambers of commerce, and professional associations typically organize under 501(c)(6) status, while 501(c)(5) status serves labor unions and agricultural organizations. This distinction reflects their different constituencies and purposes in the marketplace.

The 501(c)(6) designation allows trade associations to promote common business interests of their members, while 501(c)(5) organizations focus on improving working conditions, wages, or agricultural practices. Both can engage in lobbying efforts, but the nature of advocacy differs based on their constituent focus.

Social welfare organizations under 501(c)(4) status represent another alternative, serving community welfare rather than specific industries. These groups, including community associations and civic leagues, can engage in unlimited lobbying for legislative change-a more permissive environment than what 501(c)(3) organizations experience but similar to 501(c)(5) allowances.

Comparison table: Key features

| Feature | 501(c)(3) | 501(c)(5) | 501(c)(6) | 501(c)(4) |

|---|---|---|---|---|

| Primary purpose | Charitable, educational and religious | Labor, agricultural, horticultural | Business leagues, trade associations | Social welfare |

| Tax-deductible donations | Yes | No (dues may be business expenses) | No | No |

| Lobbying activities | Limited | Permitted | Permitted | Permitted |

| Political campaigns | Prohibited | Limited (not primary) | Limited (not primary) | Limited (not primary) |

| Primary beneficiaries | General public | Members in specific industries | Business members | Community |

| Public disclosure | Form 990 required | Form 990 required | Form 990 required | Form 990 required |

| Risk of status loss | High (political activity) | Medium | Medium | Medium |

This comparison highlights why organizational founders must carefully consider their mission, activities, and funding needs before selecting a tax-exempt classification. The 501(c)(5) designation creates specific advantages for labor and agricultural organizations while imposing certain limitations not present in other nonprofit models.

A 501(c)(5) organization is a suitable choice for those committed to advancing labor and agriculture, offering unmatched leverage through collective bargaining and advocacy. Navigating the terrain of compliance and understanding the distinct advantages compared to a 501(c)(3) unlocks vast potential in maximizing impact and ensuring sustainability.

As founders and legal advisers pioneer these paths, they forge not just compliant entities but enduring legacies that embody community strength and shared purpose.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom