Greenfield investment is a powerful strategy for companies looking to expand their global footprint with maximum control. As a form of foreign direct investment (FDI), it involves a parent company creating a new subsidiary in a foreign country and building its operations from the ground up - new facilities, new staff, and a new market presence. This approach stands in stark contrast to other entry strategies like acquiring an existing company.

What is a greenfield investment?

A greenfield investment is a form of foreign direct investment (FDI) where a parent company starts a new venture in a foreign country by constructing new facilities from the ground up. The name itself paints a clear picture: picture a company choosing an undeveloped plot of land - a "green field" - and building a factory, office, or retail complex on it. This method is distinct from other FDI types, such as mergers and acquisitions (M&A), where a company buys an existing business, or a joint venture, where it partners with a local entity.

Instead, the investing company establishes a new business unit that it owns or controls directly, which may be a wholly-owned subsidiary or a majority-controlled subsidiary. This strategy is common across many industries, such as automotive manufacturing, consumer electronics, and pharmaceuticals, where tailored facilities and processes are created to meet local market needs and specific technical standards.

Understanding greenfield investment

At its core, a greenfield investment is about creation rather than acquisition. A company decides to enter a foreign market and, instead of buying a local company or its assets, it builds everything from scratch. This process begins with extensive due diligence. Before breaking ground, investors must conduct a comprehensive feasibility study to analyze market viability, regulatory requirements, and financial projections.

This long-term commitment requires a significant investment of capital and time before any revenue is generated. The primary motivation behind this intensive approach is control. This approach gives the investing company full control over the venture, including its operations, branding, and corporate culture. By designing a new facility, the company can implement the latest technologies, optimize layouts for maximum efficiency, and ensure that the entire operation aligns perfectly with its global standards and strategic goals.

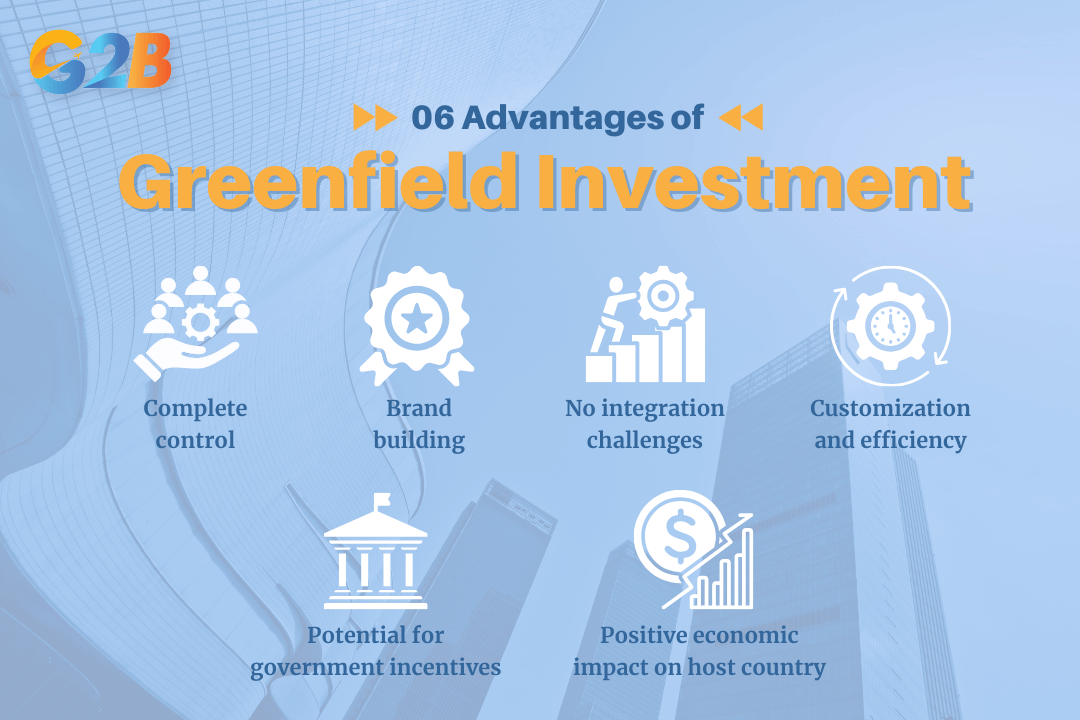

Benefits of greenfield investments

Opting to build from the ground up offers a unique set of strategic advantages that are often unattainable through other market entry methods.

Opting to build from the ground up offers a unique set of strategic advantages

- Complete control: The most significant benefit is the high degree of control the parent company retains. From management decisions and operational processes to quality control and brand messaging, the investor dictates every aspect of the business, ensuring it aligns perfectly with its global vision.

- Customization and efficiency: Greenfield projects allow a company to build state-of-the-art facilities tailored to its specific needs. This means incorporating the latest technology, optimizing workflows for efficiency, and meeting precise production standards without the constraints of an existing building's layout or outdated fixed capital.

- No integration challenges: Acquiring another company often leads to difficult and costly integration processes, including merging different corporate cultures, IT systems, and management styles. Greenfield investments bypass these issues entirely, allowing the company to establish its desired culture and systems from day one.

- Potential for government incentives: Host country governments often favor greenfield investments because they create new jobs and introduce new technology and capital into the economy. To attract such investments, governments may offer significant incentives, such as startup grants and incentives, tax breaks, and subsidies.

- Positive economic impact on host country: By building new facilities, these projects directly contribute to the host country's economic development. They create direct employment opportunities and can also stimulate indirect job growth within the local supply chain, boosting the overall economy. This often leads to better supply chain management integration as the new entity can select suppliers that meet its exact standards.

- Brand building: Establishing a new presence from scratch allows a company to shape its brand image in a new market without any preconceived notions or the baggage of an acquired company's reputation. It’s an opportunity to build a strong brand presence based on trust, quality, and the parent company's values.

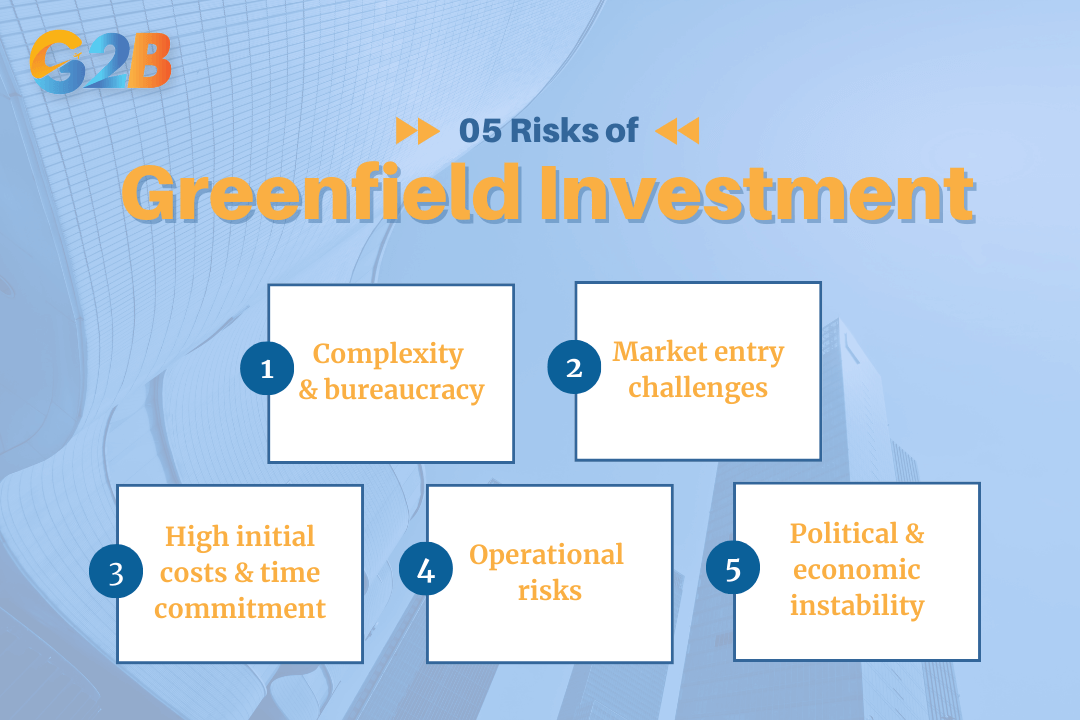

Risks of greenfield investments

While the benefits are compelling, greenfield investments are inherently complex and come with substantial risks that demand careful consideration and planning.

Greenfield investments also come with some risks

- High initial costs and time commitment: Building from the ground up is a capital-intensive endeavor. The costs associated with land acquisition, construction, equipment, and hiring can be enormous. Furthermore, these projects have long timelines, often taking years to become operational and start generating returns, which can be a major financial drain.

- Complexity and bureaucracy: Every greenfield project involves navigating the host country's complex regulatory landscape. This includes securing permits for construction, environmental clearances, and operational licenses, all of which can lead to unforeseen delays and bureaucratic hurdles.

- Market entry challenges: Unlike an acquisition where the company gains an existing customer base, a greenfield venture starts with zero market share. The company must build its brand, distribution channels, and customer relationships from scratch, which can be a slow and challenging process in a competitive market.

- Operational risks: Once the facility is built, the company faces the challenge of managing a new workforce, establishing a local supply chain, and adapting to local business practices. These operational hurdles can be significant, especially in emerging markets where infrastructure may be less developed.

- Political and economic instability: Foreign investments are always susceptible to the political and economic climate of the host country. Changes in government policy, regulatory shifts, or economic downturns - such as a global recession - can negatively impact the investment. The high fixed costs of a greenfield project make it difficult to exit the market quickly if conditions worsen.

Greenfield vs. Brownfield investment

To fully understand greenfield investing, it's essential to compare it with its main alternative: brownfield investment. A brownfield investment involves a company purchasing or leasing an existing facility to begin its operations in a foreign country. The term alludes to developing on land that has been previously used, which may require upgrades or even environmental remediation.

The choice between a greenfield and a brownfield strategy depends on a company's specific goals, risk tolerance, and timeline. A business looking for speed-to-market and lower initial costs might favor a brownfield project. In contrast, a company that prioritizes long-term control, efficiency, and brand image, and has the capital to support it, will likely find the greenfield approach more advantageous.

| Feature | Greenfield Investment | Brownfield Investment |

|---|---|---|

| Definition | Building new facilities from the ground up in a foreign country. | Purchasing or leasing an existing facility in a foreign country. |

| Control | High degree of control over operations and design. | Less control due to existing infrastructure and processes. |

| Cost | Higher initial investment costs. | Generally lower upfront costs. |

| Time to Market | Longer time to become operational. | Faster market entry. |

| Integration | No need to integrate existing systems or cultures. | Potential challenges with integrating different corporate cultures and systems. |

| Risks | Higher upfront risks associated with construction and market entry. | Risks associated with inheriting existing problems, such as environmental contamination or outdated technology. |

| Flexibility | Greater flexibility to innovate and customize. | Limited by the existing infrastructure. |

Real-world examples of successful greenfield investments

Many of the world's leading multinational corporations have used greenfield investments to establish a dominant global presence, often leveraging massive production volumes to achieve economies of scale.

- Tesla's gigafactories: Tesla's global expansion is a textbook example of a successful greenfield strategy. By building massive Gigafactories in locations like China, Germany, and Mexico, Tesla has been able to implement cutting-edge manufacturing processes from scratch, cater to local market demands, and avoid import tariffs. The Shanghai Gigafactory, for instance, was built in record time and has become a crucial hub in Tesla's global production network.

- Toyota in the United States and Mexico: In 1988, Toyota established its first wholly-owned U.S. manufacturing plant in Kentucky, a greenfield project that has created thousands of jobs and solidified its position in the American auto market. More recently, its billion-dollar investment in a new plant in Mexico was designed to enhance its competitiveness across North America by leveraging lower labor costs and proximity to the U.S. market.

- Hyundai in the Czech Republic: In 2006, Hyundai Motor Company made a major greenfield investment of over €1 billion to build a new manufacturing plant in Nosovice, Czech Republic. Supported by government tax relief and subsidies, the plant was projected to produce 300,000 cars a year and create thousands of direct and indirect jobs, significantly boosting the regional economy. The facility is now Hyundai's only EV production plant in Europe.

- Coca-Cola's bottling plants: The beverage giant has a long history of using greenfield investments to establish local bottling plants around the world, from Burkina Faso to Vietnam. This strategy allows Coca-Cola to reduce transportation costs, adapt its products to local tastes, and create a strong local economic footprint, often with a focus on sustainability and water stewardship.

- Unilever in Vietnam: Unilever entered Vietnam in the 1990s with a greenfield investment that helped it establish a powerful presence in the rapidly growing Southeast Asian market. By building its operations from the ground up, Unilever was able to deeply understand local consumer behaviors and develop products specifically tailored to the Vietnamese population, a key factor in its enduring success.

Future of greenfield investment in Vietnam

Vietnam has rapidly emerged as one of the most attractive destinations for foreign direct investment in Southeast Asia. As a prominent emerging market economy, it offers a stable political climate and a proactive government creating a favorable environment for growth and establishing companies in Vietnam.

Government policies and incentives

The Vietnamese government actively encourages FDI through a variety of supportive policies. Investors should specifically research the current green field investment policies in Vietnam, which outline specific benefits for new projects. The Law on Investment provides a clear legal framework, while numerous incentives are offered to attract capital into priority sectors. These include corporate income tax (CIT) reductions, import duty exemptions on raw materials and equipment, and favorable land lease rates. Furthermore, Vietnam's participation in major free trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA) provides foreign investors with preferential access to key global markets.

Key regulatory updates from 2024-2025 include streamlined approval processes for greenfield projects in industrial parks, high-tech zones, and special economic zones, reducing project commencement timelines by 250 to 300 days. Provincial People's Committees have expanded authority to approve certain industrial and port projects without requiring central government approval, accelerating investment licensing. Corporate income tax incentives for FDI are capped at 15% under global minimum tax rules effective from 2024, but the government has established an investment support fund to maintain attractiveness for strategic investors.

Promising growth sectors

Several sectors in Vietnam are ripe with opportunity for greenfield investment:

- Manufacturing: As global supply chains shift, Vietnam has become a manufacturing powerhouse, particularly in electronics, textiles, and furniture. This contributes significantly to overall Vietnam economic growth.

- Technology: Vietnam's digital economy is booming, creating opportunities in IT services, software development, and high-tech industries like semiconductors and AI.

- Healthcare: A growing middle class and an aging population are driving demand for higher-quality healthcare services and pharmaceuticals, opening the door for investment in hospitals and medical device manufacturing.

- Retail: Rising disposable incomes and increasing urbanization are fueling a retail revolution, with significant potential in supermarkets, convenience stores, and e-commerce.

- Renewable energy: With a national commitment to achieving net-zero emissions by 2050, Vietnam is heavily promoting investment in solar, wind, and biomass energy projects. This sector is a prime example of green tech adoption in the region.

- High-tech agriculture: The government is encouraging a shift toward sustainable and high-value agriculture, creating opportunities in food processing and agricultural technology.

Challenges and opportunities

Despite the immense opportunities, investing in Vietnam is not without its challenges. Investors may face regulatory complexity, underdeveloped infrastructure in some regions, and bureaucratic delays. Corruption remains a concern, although the government is taking steps to improve transparency. However, these challenges are balanced by the opportunities presented by a dynamic market with a young, vibrant workforce and a growing consumer base eager for new products and services.

Greenfield investment represents a bold, strategic move for companies aiming for long-term growth and maximum control in foreign markets. It is a demanding path, requiring significant capital, patience, and a deep understanding of the local environment. However, the rewards - a perfectly customized operation, a strong brand identity, and the potential for market leadership - are often well worth the effort. As global economic trends continue to evolve, greenfield investments will remain a critical tool for ambitious companies looking to build a lasting legacy on the world stage.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom