501(c)(14) organizations play a crucial role in the landscape of U.S. tax-exempt entities, specifically focusing on credit unions and mutual insurance companies. These organizations are established to promote thrift and provide financial services for their members, often serving local communities and specialized groups. In this guide, let’s explore the legal definitions, different types, and key components that distinguish 501(c)(14) organizations from other tax-exempt categories.

This content is provided for general informational purposes to help entrepreneurs and researchers understand the basics of 501(c)(14) organizations. We specialize in company formation, not in providing legal advisory services specific to U.S. nonprofit compliance. This information should not be considered professional tax advice. For specific guidance, please consult a nonprofit compliance expert or a legal professional with experience in credit unions and tax-exempt financial organizations.

What is 501(c)(14) organizations?

501(c)(14) organizations are tax-exempt entities under the Internal Revenue Code that primarily include state-chartered credit unions and mutual reserve funds. These organizations are typically state-chartered credit unions that are composed of members sharing a common bond, such as community or employment, and they operate on a not-for-profit basis for the mutual benefit of their members.

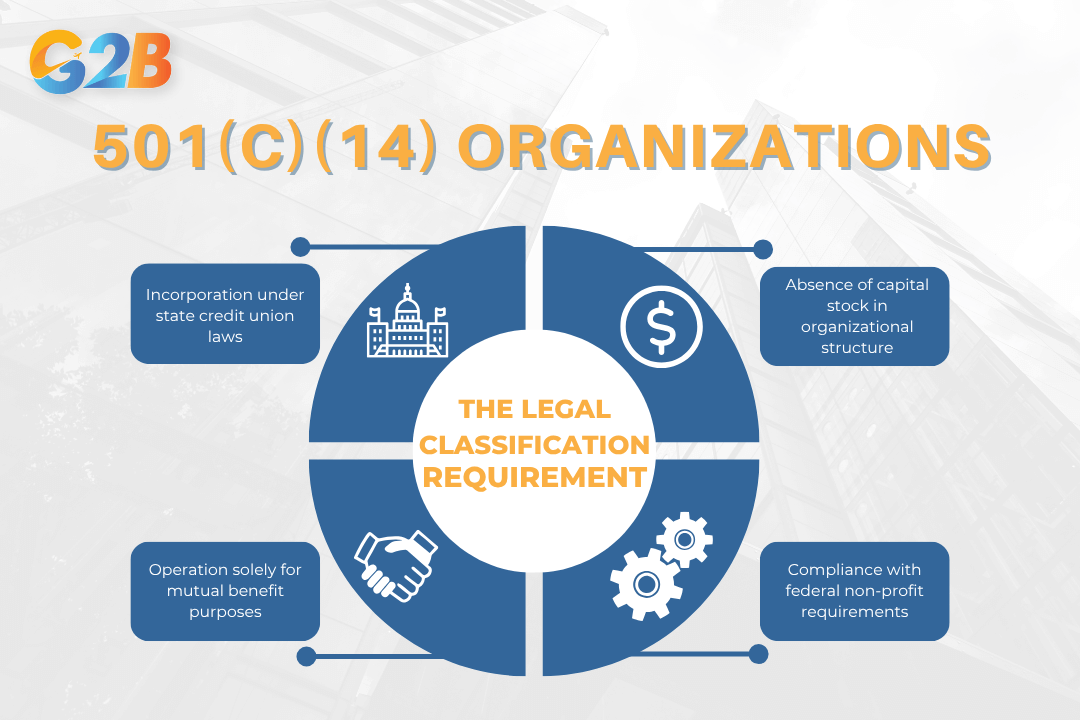

The legal classification requires:

- Incorporation under state credit union laws

- Absence of capital stock in organizational structure

- Operation solely for mutual benefit purposes

- Compliance with federal non-profit requirements

501(c)(14) organizations’ legal classification requires 4 features

Types of 501(c)(14) organizations

The 501(c)(14) designation applies to specific types of financial organizations that meet stringent criteria under the Internal Revenue Code. Not all non-profit financial institutions qualify for this tax-exempt status.

State-chartered credit unions without capital stock

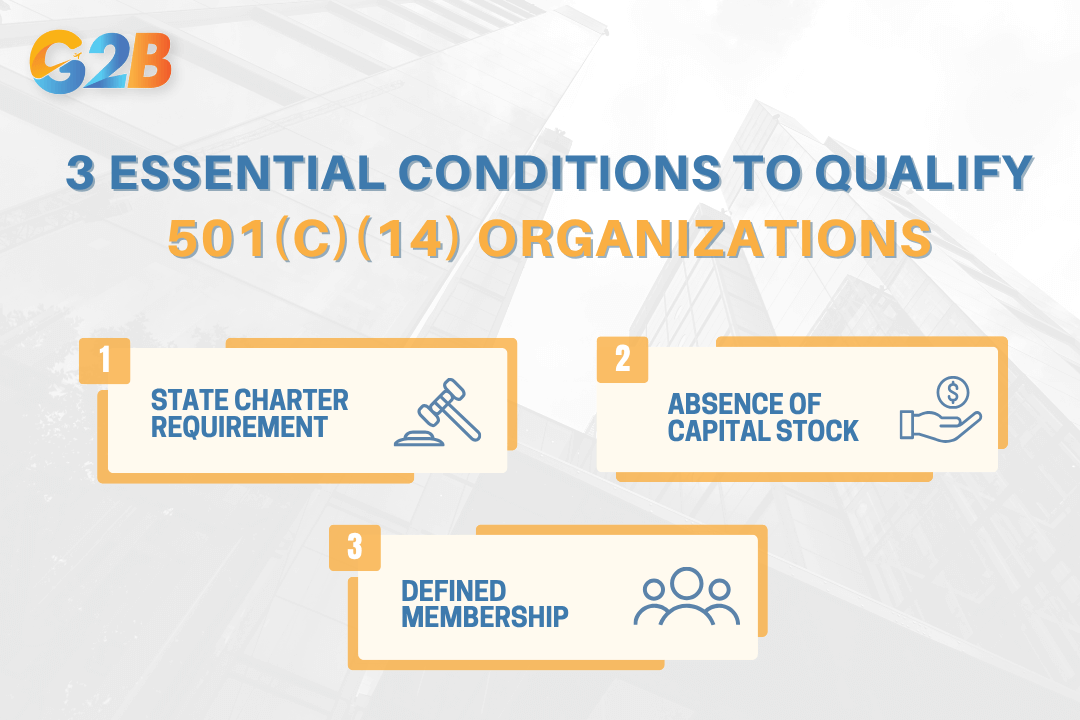

State-chartered credit unions form the core category of 501(c)(14) organizations. These institutions must operate under three essential conditions to qualify:

- State charter requirement: The credit union must be formally organized and chartered under state credit union laws, not federal regulations.

- Absence of capital stock: Unlike commercial banks, qualifying credit unions cannot issue capital stock or shares that represent ownership interests to outside investors.

- Defined membership: Each credit union must serve members united by a common bond, such as:

- Occupation (e.g., teachers, police officers)

- Association membership

- Geographic location (residing in specific communities)

501(c)(14) organizations must operate under three essential conditions to qualify

This common bond requirement reinforces the mutual and cooperative nature of these institutions. The absence of capital stock ensures the organization operates solely for members' benefit rather than generating profits for shareholders. State regulatory oversight provides additional assurance that these organizations adhere to non-profit principles.

Other mutual financial organizations

Beyond traditional credit unions, certain other mutual financial institutions may qualify for 501(c)(14) status, though these entities are considerably less common:

- Mutual reserve funds: Organizations created for insurance or similar protection for members

- Cooperative banking institutions: Member-owned financial cooperatives with specific mutual structures

These organizations face rigorous qualification standards, including:

- True non-profit operation with no pecuniary gain motive

- Mutual ownership structure where members control the institution

- Organizational documents and operational practices that consistently demonstrate mutual purposes

The rarity of these non-credit union 501(c)(14) organizations stems from the extremely narrow interpretation of qualifying criteria by the IRS. Most financial institutions seeking tax exemption find the state-chartered credit union model more accessible and clearly defined under tax law. Organizations considering 501(c)(14) status should thoroughly review both federal tax requirements and state-specific charter regulations to determine eligibility before proceeding with formation or application for tax exemption.

Key components and qualification criteria

501(c)(14) organizations’ eligibility centers on 4 critical components: Non-profit status, absence of capital stock, organization for members' mutual benefit, and proper state chartering with clearly defined membership parameters.

Organizational structure and member common bond

The common bond requirement stands as a cornerstone of 501(c)(14) organization qualification. Members must share a demonstrable connection through one of three established categories: occupation (such as employees of a specific company), association membership (belonging to the same professional or social organization), or geographic area (living or working within defined boundaries).

These bonds must be explicitly documented in the organization's charter and bylaws, creating clear membership criteria. Credit unions accept members' savings as deposits or through share purchases, with governance documents specifying these arrangements. This common bond principle preserves the mutual nature of the organization by ensuring the institution serves a cohesive community with aligned financial needs rather than disparate interests.

Operations without profit or capital stock

501(c)(14) credit unions must operate exclusively for members' benefit without issuing capital stock or distributing profits to outside interests. These organizations cannot:

- Issue stock certificates

- Operate with profit-seeking motives

- Distribute earnings to non-members

- Engage in activities designed for pecuniary gain

Organizational documents must specify the maximum number of shares any individual member may hold and establish clear conditions for share payment and transfer. All financial surpluses must be either:

- Returned to members through improved services and reasonable dividends

- Held in reserves to strengthen the institution

- Used to develop member-focused programs and services

This non-profit structure ensures resources remain dedicated to serving membership needs rather than enriching outside investors or shareholders.

State charter requirements

Every 501(c)(14) organization must secure and maintain a charter under applicable state credit union statutes. This requirement involves:

- Filing comprehensive applications with state regulatory authorities

- Providing detailed descriptions of proposed activities

- Submitting projected statements of revenue and expenses

- Including organizing documents with clear statements of purpose

- Demonstrating compliance with state-specific regulatory requirements

State charters establish the legal framework within which these credit unions operate and subject them to regular examination and oversight. Organizations seeking 501(c)(14) status must submit their state charter documentation when applying for federal tax exemption, as this serves as primary evidence of their qualifying structure and purpose. Ongoing compliance with state regulatory requirements remains essential for maintaining both charter and tax-exempt status.

Legal obligations, compliance, and oversight

State-chartered credit unions operating under 501(c)(14) status face rigorous compliance requirements to maintain their tax exemption. These organizations must navigate a complex regulatory environment while adhering to strict operational guidelines.

Maintaining non-profit and mutual operations

Credit unions must operate exclusively for mutual purposes without profit motives to maintain their 501(c)(14) status. This fundamental requirement means all operations must demonstrably serve member interests rather than outside investors or commercial objectives. Member benefits must drive every organizational decision. Surplus funds generated through operations must be either returned to members through improved services and competitive rates or retained within the credit union to strengthen its financial position.

The governance structure further reinforces this non-profit focus through:

- Volunteer or modestly compensated boards of directors

- Democratic member voting (one member, one vote)

- Transparent decision-making processes

- Regular member meetings and reporting

Charter and regulatory oversight

State regulatory authorities provide primary oversight for 501(c)(14) credit unions, monitoring their compliance with state banking laws and cooperative principles. These regulators conduct regular examinations to ensure safety, soundness, and adherence to state charter requirements. The National Credit Union Administration (NCUA) often provides secondary supervision, particularly for federally insured state-chartered credit unions. This dual oversight creates multiple compliance obligations:

| Regulatory body | Primary focus areas | Typical review cycles |

|---|---|---|

| State regulators | Charter compliance, state banking laws, and consumer protection | 12-18 months |

| NCUA | Deposit insurance requirements, safety and soundness | 12-18 months |

| IRS | Tax exemption compliance, proper financial reporting | As needed |

Regular examinations evaluate capital adequacy, asset quality, management capability, earnings, liquidity, and sensitivity to market risk-together forming the CAMELS rating system widely used by financial regulators.

Tax filings and ongoing compliance

Despite federal income tax exemption, 501(c)(14) credit unions must file annual informational tax returns, typically Form 990. These filings provide transparency into operations, executive compensation, and financial management practices. State-chartered credit unions remain subject to unrelated business income tax (UBIT) on income from activities unrelated to their core mission. This creates ongoing compliance requirements:

- Proper accounting segregation between exempt and non-exempt activities

- Annual UBIT assessment and potential Form 990-T filing

- Quarterly estimated tax payments if UBIT liability exists

- Documentation supporting mission-related nature of all income sources

Limitations on services and activities

Credit unions operating under 501(c)(14) face restrictions on permissible activities to preserve their tax exemption. While they may offer standard financial services, expanding into commercial activities risks their exempt status. Permissible activities typically include:

- Accepting member deposits and providing savings accounts

- Issuing personal, auto, and mortgage loans to members

- Offering checking accounts and payment services

- Providing financial education and counselling

- Issuing credit cards to members

However, activities presenting compliance risks include:

- Offering services primarily to non-members

- Engaging in speculative investments

- Expanding into unrelated business activities

- Operating with profit-focused rather than member-focused objectives

- Compensating executives at levels comparable to for-profit institutions

How to form a 501(c)(14) credit union

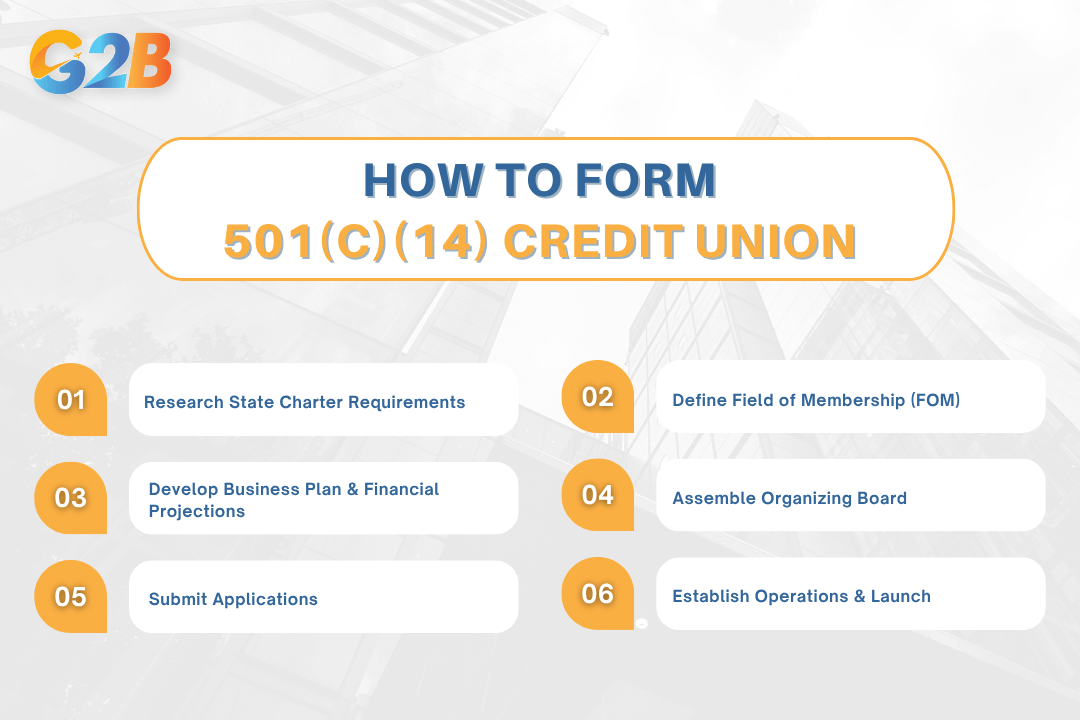

Establishing a 501(c)(14) organization requires methodical planning and adherence to regulatory requirements. The formation process blends strategic business development with legal compliance to create a financial institution serving member interests.

There are 6 main steps to form a 501(c)(14) credit union

Researching state charter requirements

State chartering laws vary significantly across jurisdictions, making early regulatory research essential for 501(c)(14) credit union organizers. Each state maintains unique qualification standards, capital requirements, and procedural steps for credit union formation. Founders should obtain the complete credit union statutes and administrative regulations from their state's regulatory authority, typically the Department of Financial Institutions or Banking Commission. This research phase often requires consultation with legal counsel experienced in financial institution formation.

Defining your field of membership

Every 501(c)(14) credit union must establish a clearly defined field of membership (FOM) that complies with regulatory standards. This legal definition determines eligible membership and forms the foundation of the credit union's common bond requirement. Legitimate membership fields fall into three primary categories:

- Occupational bonds: Based on employment relationships within companies, industries, or professions

- Associational bonds: Derived from membership in established organizations with substantive purposes

- Community bonds: Defined by geographic boundaries such as counties, cities, or well-defined neighborhoods

Regulatory authorities scrutinize FOM definitions closely during the application process. Successful definitions demonstrate meaningful connections between potential members while avoiding overly restrictive or impermissibly broad parameters.

Simplify your business launch with our Delaware incorporation service - Start your application today!

Developing a business plan and financial projections

A comprehensive business plan serves as the roadmap for a 501(c)(14) credit union's formation and demonstrates viability to regulatory authorities. Effective plans include:

- Market analysis: Detailed assessment of the proposed membership field

- Product/service offerings: Initial financial services and growth projections

- Governance structure: Board composition and management approach

- Operational framework: Staffing, technology, and facility requirements

Financial projections must demonstrate:

- Initial capitalization sources

- Three-year forward-looking statements (balance sheet and income)

- Realistic membership growth assumptions

- Path to sustainable operations

Regulators evaluate these projections for feasibility within the defined membership field. Overly optimistic or unsupported assumptions frequently trigger application rejections.

Assembling your organizing board

The organizing board forms the governance backbone of a new 501(c)(14) credit union. Effective boards balance diverse skills with representative membership composition. An ideal board composition includes:

- Financial sector experience

- Compliance/regulatory knowledge

- Community leadership

- Demographic diversity reflecting potential membership

- Professional expertise (legal, accounting, marketing)

Board members accept fiduciary responsibilities for the organization from inception. They must demonstrate commitment to the credit union philosophy of member service and cooperative ownership. Unlike commercial banks, these volunteer directors receive no compensation for governance activities, emphasizing the non-profit nature of the organization.

State charter and federal applications

The formal application process involves multiple regulatory submissions and examinations:

- State charter application: Filed with the state regulatory agency

- NCUA insurance application: Required for deposit insurance coverage

- IRS Form 1024: Required for 501(c)(14) tax exemption recognition

Each application requires extensive documentation, including:

- Articles of incorporation/organization

- Bylaws and governance policies

- Business plan with financial projections

- Field of membership documentation

- Evidence of initial capitalization

Applicants should anticipate multiple rounds of regulatory questions and requests for supplemental information during this phase.

Establishing operations and launch

Pre-launch operational development involves implementing governance structures, securing physical or digital infrastructure, and establishing financial systems. Critical pre-launch tasks include:

- Documenting board-approved policies and procedures

- Implementing technology systems (core processing, digital services)

- Securing facilities (branch locations or virtual alternatives)

- Hiring and training key personnel

- Developing initial product offerings

The formal launch occurs after regulatory approval, typically with a membership drive targeting the defined field. Initial membership typically requires a nominal deposit representing one ownership share in the credit union. This structure reinforces the cooperative ownership model central to 501(c)(14) organizations. Post-launch operations maintain a strict focus on member benefit rather than profit maximization. Earnings return to members through favorable interest rates, reduced fees, and enhanced services - reinforcing the mutual benefit structure essential to maintaining 501(c)(14) status.

Comparing 501(c)(14) credit unions with other financial institutions

Financial institution leaders must understand critical distinctions between 501(c)(14) credit unions and alternative organizational structures. These differences affect everything from governance and tax treatment to operational capabilities and member services.

501(c)(14) vs. Commercial banks

Credit unions under 501(c)(14) status operate with fundamentally different ownership structures than commercial banks. While banks exist to generate profits for external shareholders, credit unions function as member-owned cooperatives where each member holds equal voting rights regardless of deposit size. This democratic ownership model ensures decisions prioritize member interests rather than shareholder returns.

The profit motive represents another stark contrast. Banks operate specifically to maximize shareholder value, with profits distributed to investors. Credit unions, however, must reinvest surpluses into improving services, building reserves, or returning benefits to members through higher savings rates and lower loan rates. This non-profit nature directly supports the tax exemption granted under IRC 501(c)(14). Service delivery also differs substantially between these institutions:

- Credit unions:

- Restricted field of membership based on common bonds

- Often provide more personalized service

- Generally offer lower fees and more favorable rates

- Limited in certain commercial lending activities

- Commercial banks:

- Serve the general public without membership requirements

- Typically offer broader product ranges

- May have more extensive branch networks

- Face no restrictions on commercial activities

501(c)(14) vs. 501(c)(3) non-profits

The Internal Revenue Code creates distinct categories for different types of non-profit organizations, with 501(c)(14) and 501(c)(3) serving entirely different purposes. Organizations seeking exempt status must carefully determine which classification matches their activities and mission.

501(c)(3) status applies exclusively to entities operating for charitable, religious, educational, scientific, or literary purposes. These organizations typically rely on donations and grants to fund their mission-focused work. In contrast, 501(c)(14) designation exists specifically for state-chartered credit unions and certain mutual financial organizations operating without capital stock and on a non-profit basis.

Key operational distinctions include:

| Feature | 501(c)(14) credit unions | 501(c)(3) organizations |

|---|---|---|

| Primary activities | Financial services (loans, deposits, etc.) | Charitable programs and services |

| Revenue sources | Member deposits, interest income | Donations, grants, program fees |

| Beneficiaries | Defined membership field | General public or specific beneficiary groups |

| Deductibility of contributions | Not tax-deductible | Tax-deductible for donors |

| Public support requirements | None | Must demonstrate broad public support |

Organizations cannot simultaneously qualify for both 501(c)(14) and 501(c)(3) status, as these categories serve fundamentally different purposes within the non-profit sector and federal tax framework.

FAQs about 501(c)(14) organizations

- Do 501(c)(14) organizations have capital stock?

No, 501(c)(14) organizations must be corporations without capital stock to qualify under this IRS designation. - Are 501(c)(14) organizations allowed to serve low-to-moderate income members?

Yes, they often provide credit and financial services to low-to-moderate income members sharing a common bond, such as community or employer affiliation. - Can a 501(c)(14) organization be a credit union?

Yes, state-chartered credit unions operated under the Federal Credit Union Act qualify as 501(c)(14) organizations. - Are 501(c)(14) organizations allowed to distribute profits to members?

No, these organizations operate on a nonprofit basis, and net earnings do not benefit private shareholders or individuals. - Do 501(c)(14) organizations require IRS tax-exempt status?

Yes, they must be recognized by the IRS as tax-exempt under section 501(c)(14) to receive benefits associated with this status. - Is a mutual reserve fund included in the 501(c)(14) category?

Yes, mutual reserve funds are included under the 501(c)(14) classification along with credit unions and similar cooperative financial organizations.

A 501(c)(14) organization provides invaluable tax benefits and structural advantages to credit unions committed to community welfare and mutual benefit. By understanding the nuances of these financial cooperative frameworks, entrepreneurs can navigate tax exemptions confidently and align with socially responsible objectives. Comprehending the difference between 501(c)(14) classifications and others empowers executives and founders to enhance both compliance and ethical impact, ultimately fostering societies built on cooperation and financial integrity.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom