Navigating the complexities of a 501(c)(27) organization requires expert insight into tax-exempt structures and state-sponsored insurance pools. These entities provide essential support for state-managed risk reinsurance, especially concerning workers’ compensation. They not only ensure compliance with intricate statutory requirements but also offer significant tax benefits. Let’s explore the structure, compliance, and tax treatment of 501(c)(27) organizations.

This article is provided for general informational purposes to help professionals understand the fundamentals of 501(c)(27) organizations. We specialize in company formation services and do not provide legal or tax advice concerning U.S. insurance-related nonprofit entities. For detailed compliance guidance, please consult a qualified tax advisor with experience in state-sponsored reinsurance organizations.

What is a 501(c)(27) Organization?

A 501(c)(27) organization is a state-established, nonprofit workers’ compensation reinsurance entity recognized under Internal Revenue Code Section 501(c)(27). These organizations are formed under state law to pool and reinsure workers’ compensation risks for self-insuring employers or insurers within a state. These organizations operate on a nonprofit basis, returning surplus income to members or policyholders and reducing initial premiums in anticipation of investment earnings; they may be classified as 501(c)(27)(A) if formed before June 1, 1997, or 501(c)(27)(B) if formed after December 1, 1997, with differing state support and asset-reversion requirements upon dissolution.

To obtain and maintain tax-exempt status, a 501(c)(27) entity must apply via IRS Form 1024 and comply with annual reporting requirements, including Form 990, while adhering to the exclusive-benefit and state sponsorship conditions outlined in IRS guidance. 501(c)(27) entities serve as nonprofit insurance funds established through state government action to address specific market gaps in workers' compensation coverage. These specialized organizations insure or reinsure employers against workers' compensation claims, stepping in where traditional private insurers cannot or will not provide adequate coverage.

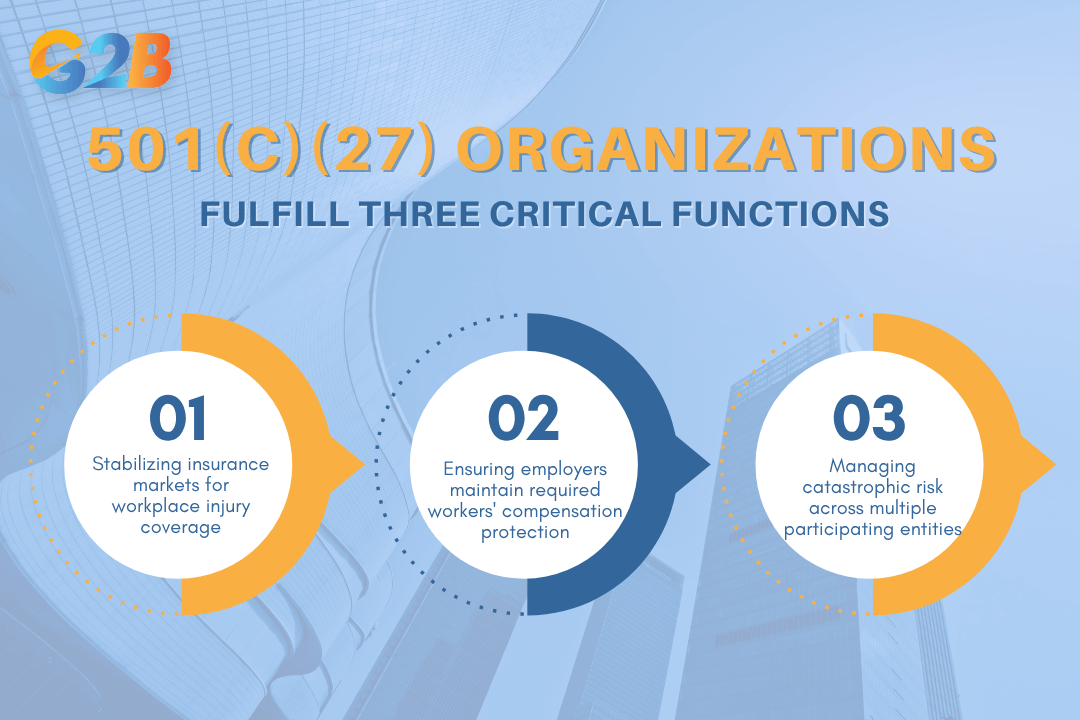

These organizations fulfill three critical functions:

- Stabilizing insurance markets for workplace injury coverage

- Ensuring employers maintain the required workers' compensation protection

- Managing catastrophic risk across multiple participating entities

501(c)(27) organizations fulfill three critical functions

State governments create these entities when private markets fail to provide affordable or accessible coverage, particularly during insurance market contractions. The structure allows for efficient risk-pooling across multiple employers or insurance providers, creating economies of scale that benefit the broader workers' compensation system.

Start your US business right - Contact G2B for a free consultation on Delaware incorporation service today!

Eligibility, types, and formal structure

The 501(c)(27) organization classification represents one of the most restricted tax-exempt categories in the Internal Revenue Code. These state-sponsored workers' compensation insurance entities operate under exceptionally narrow eligibility requirements and structural limitations.

Who qualifies for 501(c)(27) status?

Eligibility for 501(c)(27) status is highly exclusive. Only entities established or explicitly authorized by state legislative action qualify for this designation. These organizations must have been created by specific state statute prior to June 1, 1997 (for 501(c)(27)(A) status), or after December 1, 1997 (for 501(c)(27)(B) status), reflecting critical cutoff dates that govern formation eligibility.

Private insurance companies, entrepreneurs, conventional nonprofit organizations, and voluntary associations cannot create, convert to, or claim 501(c)(27) status under any circumstances. This designation is reserved exclusively for state insurance funds or state-backed reinsurance pools with explicit statutory authorization focused on workers' compensation risk management.

Qualifying organizations typically demonstrate eligibility through:

- Original enabling state legislation

- Proof of formation date consistent with IRS cutoff dates (pre-June 1, 1997 for 501(c)(27)(A), post-December 1, 1997 for 501(c)(27)(B))

- Documentation showing exclusive workers' compensation (re)insurance for the purpose

- Evidence of direct state sponsorship, authorization, or oversight

Organizational structure and governance

The formal structure of 501(c)(27) organizations follows strict governance frameworks dictated by their founding statutes. Most operate under the direct supervision of state insurance departments, labor agencies, or specially designated public authorities that maintain significant control over operations and policies. Board composition typically reflects mandatory stakeholder representation including:

- State government officials (often ex-officio members)

- Employer representatives

- Insurance industry experts

- Public interest appointees

The governance model prohibits private control or profit-oriented operation. Membership rights, voting privileges, and participation guidelines appear explicitly in organizational bylaws or statutory provisions, with minimal flexibility for structural modification without legislative action. This rigid governance framework ensures 501(c)(27) organizations maintain their public purpose while preventing mission drift or private benefit that would compromise their tax-exempt status. Key structural characteristics include:

- State-controlled board appointment processes

- Statutorily defined operational boundaries

- Restricted membership eligibility

- Transparent public reporting requirements

- Prohibition against expanding beyond workers' compensation functions

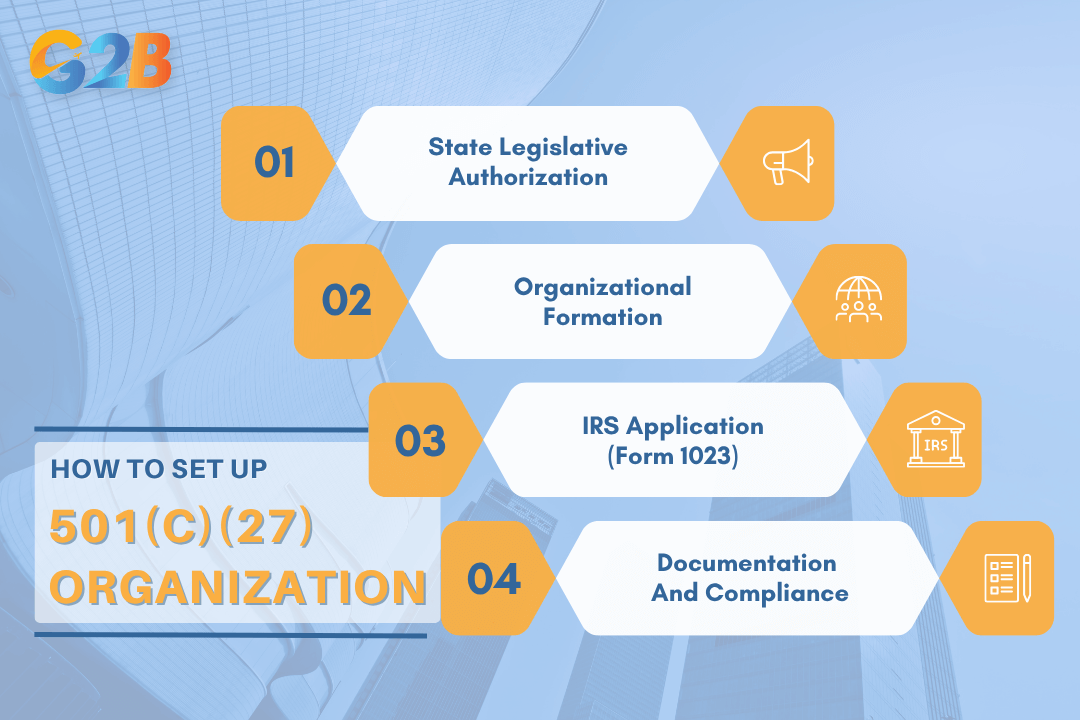

How to set up a 501(c)(27) organization

Establishing a 501(c)(27) organization involves a highly structured process governed by specific legal requirements. This comprehensive guide outlines the essential steps for proper establishment, compliance maintenance, and audit readiness for state-sponsored workers' compensation reinsurance funds.

Establishing a 501(c)(27) organization involves a highly structured process

Legal and legislative prerequisites

The foundation of any 501(c)(27) organization begins with explicit state action. State legislatures must enact enabling legislation that specifically authorizes the creation of a workers' compensation reinsurance entity. This legislation must clearly articulate the organization's purpose, structure, and operational parameters within the workers' compensation insurance framework.

The statutory language requires precise wording that designates the organization as a nonprofit insurance entity with public sponsorship. State officials must formally appoint initial leadership through proper channels, typically including a governing board with members representing key stakeholders. These appointments must follow state-mandated procedures and receive appropriate confirmations from relevant authorities.

Internal governance documentation must include founding resolutions that establish the organization's mission, operational scope, and nonprofit status. These resolutions serve as critical reference points during IRS review and future compliance audits, establishing the legitimate public purpose of the entity.

IRS registration and tax-exempt recognition

Securing IRS recognition requires submitting Form 1023, Application for Recognition of Exemption. The application package must include conformed copies of all state-approved organizing documents, including Articles of Incorporation with explicit statutory references to the enabling legislation.

The organization must provide comprehensive evidence demonstrating:

- State establishment through legislative action

- Governance structure aligning with nonprofit principles

- Financial controls preventing private inurement

- Program purpose restricted to workers' compensation insurance

- Compliance with the pre-June 1996 formation requirement

The IRS conducts particularly rigorous scrutiny of 501(c)(27) applications due to their specialized nature and statutory limitations. Organizations must prepare detailed supporting documentation of legislative histories and eligibility facts that demonstrate compliance with all technical requirements under Internal Revenue Code section 501(c)(27).

Key documents and compliance steps

Successful 501(c)(27) establishment requires maintaining these essential documents:

Foundational documents:

- Articles of Incorporation with statutory citations

- Current bylaws approved by authorized board

- Proof of public sponsorship (authorizing statute/resolution)

- Risk pooling plan detailing insurance operations

Operational documentation:

- Federal Employer Identification Number (FEIN) confirmation

- Initial board resolutions establishing the purpose

- Minutes documenting all official meetings and decisions

- Templates for required annual IRS filings

Technical compliance records:

- Documentation showing pre-1996 formation

- Records demonstrating state administrative oversight

- Evidence of continued adherence to the statutory purpose

- Financial separation from general state operations

Organizations must maintain these records in an easily accessible format for periodic state audits, IRS inquiries, and internal compliance reviews. Proper documentation serves as the primary defense during regulatory examinations and ensures operational continuity through leadership transitions.

Operational and ongoing compliance requirements

501(c)(27) organizations face stringent ongoing compliance requirements to maintain their tax-exempt status. Failure to meet these requirements threatens not only their exempt status but also compromises organizational operations and sustainability.

Annual filings and IRS reporting obligations

Form 990 submissions represent the cornerstone of federal compliance for 501(c)(27) organizations. These annual returns must comprehensively document all financial activities, including detailed breakdowns of reinsurance income, investment returns, and member claim payouts. The IRS requires complete transparency regarding program operations, executive compensation, and governance practices.

Documentation requirements extend beyond basic tax filings. Organizations must maintain:

- Auditable financial records for all transactions

- Minutes from board meetings documenting key decisions

- Proof of continuing state authorization

- Evidence of ongoing adherence to statutory purpose requirements

- Records demonstrating exclusive focus on workers' compensation reinsurance activities

Many 501(c)(27) entities implement specialized accounting systems specifically designed to track and report reinsurance activities according to IRS specifications. This specialized record-keeping serves dual purposes: Demonstrating compliance during potential audits while providing required transparency to member organizations participating in the risk pool.

State-level oversight and risk management

State regulatory bodies typically conduct regular audits of 501(c)(27) organizations to ensure compliance with state insurance laws and risk management standards. These examinations evaluate:

- Actuarial soundness of the risk pool

- Appropriate claim processing procedures

- Adequacy of reserves for future obligations

- Implementation of risk controls and loss prevention measures

- Adherence to statutory objectives and limitations

Responding to audit findings requires prompt action. State authorities may mandate operational adjustments, governance changes, or reporting modifications based on examination results. Additionally, legislative changes affecting workers' compensation insurance often necessitate corresponding adjustments to 501(c)(27) policies and procedures. Risk management protocols represent another critical compliance component. Organizations must develop and maintain:

| Risk management element | Compliance requirement |

|---|---|

| Claims processing | Standardized procedures for evaluation, payment timing, and dispute resolution |

| Reserve calculations | Actuarially sound methodologies for determining adequate financial reserves |

| Member assessments | Equitable formulas for distributing costs among participating organizations |

| Investment policies | Conservative parameters for managing pooled funds with appropriate safeguards |

| Catastrophic planning | Strategies for addressing unusual claim volumes or severe financial disruptions |

Many 501(c)(27) organizations establish separate compliance committees to oversee these interrelated federal and state requirements, ensuring coordinated responses to regulatory changes affecting this specialized insurance category.

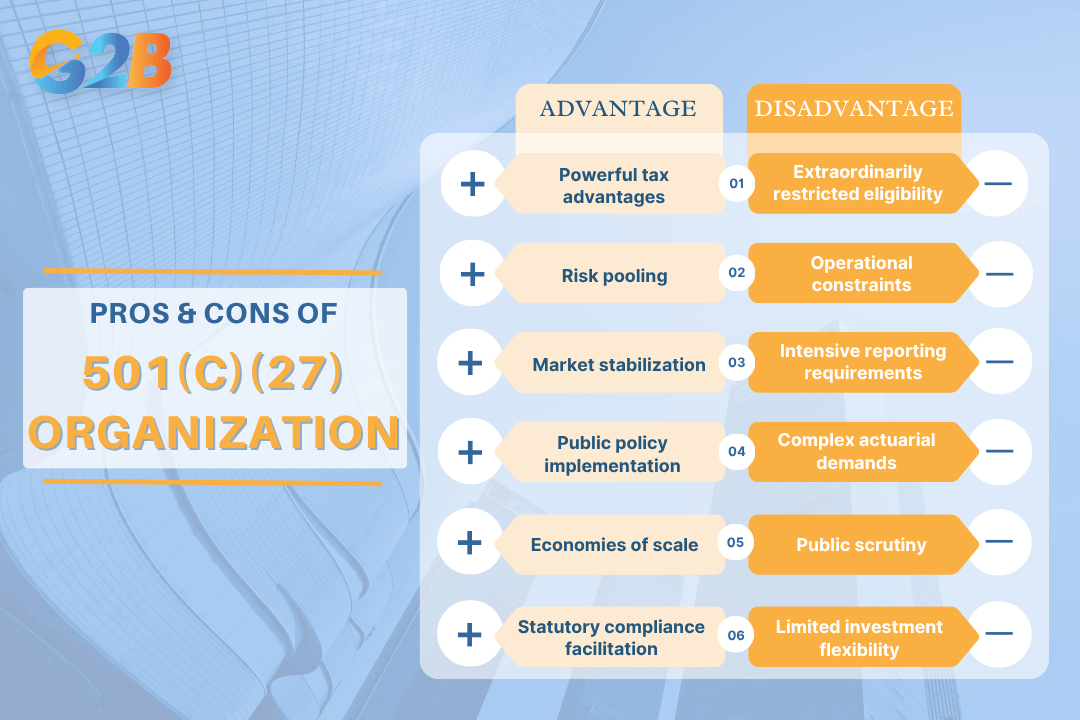

Pros and cons of 501(c)(27) status

501(c)(27) organizations present a specialized framework for state-sponsored workers' compensation insurance pools with distinct advantages and limitations. These tax-exempt entities provide critical infrastructure for managing catastrophic workplace injury claims.

Benefits of 501(c)(27) status

The primary appeal of 501(c)(27) status centers on its powerful tax advantages. Organizations qualifying for this designation receive complete federal income tax exemption on premium collections, investment earnings, and reserve accumulations - allowing states to maximize financial resources for workers' compensation coverage rather than taxation.

Risk pooling represents another significant benefit. These organizations enable employers and insurance carriers to distribute catastrophic claim exposure across a broader base, protecting individual businesses from devastating financial impacts when severe workplace injuries occur. This collective approach stabilizes premiums and enhances market predictability.

Additional advantages include:

- Market stabilization: Provides continuity during private market disruptions or withdrawals

- Public policy implementation: Allows states to address coverage gaps through direct intervention

- Economies of scale: Creates cost efficiencies through centralized administration

- Statutory compliance facilitation: Helps employers meet mandatory coverage requirements

For member employers, participation often results in more predictable insurance costs, reduced administrative burdens, and access to specialized risk management resources that might otherwise be unavailable or prohibitively expensive.

501(c)(27) organizations present a specialized framework with distinct advantages and limitations

Disadvantages and risks of 501(c)(27) status

The most significant limitation of 501(c)(27) status lies in its extraordinarily restricted eligibility. Only state-sponsored entities established before June 1, 1996, qualify - effectively closing this option to any organization formed after this statutory deadline. This creates an insurmountable barrier for newer state initiatives seeking similar tax advantages.

Operational constraints represent another major drawback. These organizations must maintain a singular focus on workers' compensation reinsurance activities without diversification into other insurance lines or nonprofit endeavors. This narrow scope limits adaptability in changing markets or policy environments.

Other key disadvantages include:

| Limitation | Impact |

|---|---|

| Intensive reporting requirements | Substantial administrative costs and compliance risks |

| Complex actuarial demands | Requires specialized expertise and regular recertification |

| Public scrutiny | Subject to government transparency requirements and oversight |

| Limited investment flexibility | Restricted options for reserve management and returns |

Technical noncompliance presents a persistent existential threat. Minor procedural deviations or governance missteps can trigger IRS penalties or, in extreme cases, loss of tax-exempt status - potentially destabilizing the entire workers' compensation ecosystem that depends on these entities.

Common misconceptions and mistakes

Misconceptions about 501(c)(27) organizations abound in professional circles, largely due to their technical nature and exclusive eligibility requirements. These misconceptions often lead to compliance failures and wasted resources for those attempting to establish or maintain these specialized organizations.

What 501(c)(27) organizations are not

501(c)(27) organizations operate exclusively as state-established workers' compensation reinsurance funds. They are not:

- General-purpose nonprofits available to private companies or individuals

- Convertible from existing private insurance pools

- Equivalent to other tax-exempt entities like 501(c)(3) charitable organizations

- Available for formation by private businesses seeking tax advantages

Many organizations mistakenly attempt to adapt operational templates from other nonprofit types - particularly 501(c)(3) or 501(c)(4) - to these specialized entities. This approach invariably fails because 501(c)(27) status has fundamentally different requirements, governance structures, and operational constraints. The IRS scrutinizes these entities under completely separate criteria, focusing on state sponsorship and workers' compensation reinsurance as core qualifying elements.

Insurance industry professionals often incorrectly assume these organizations function similarly to private reinsurance pools or risk retention groups. However, 501(c)(27) entities must adhere to state-mandated governance and cannot operate with the flexibility of private insurance mechanisms.

Common mistakes in setup or administration

Several critical errors frequently undermine 501(c)(27) compliance:

| Common mistake | Potential consequence |

|---|---|

| Incomplete legislative documentation | IRS rejection of tax-exempt status |

| Improper member reimbursements | Loss of exemption; tax penalties |

| Failed segregation of reinsurance activities | Compliance violations; legal exposure |

| Inadequate board governance documentation | Regulatory scrutiny; operational limitations |

Organizations frequently fail to maintain comprehensive legislative histories that validate their state-sponsored origin. The IRS requires clear evidence of statutory establishment specifically for workers' compensation reinsurance purposes - not general-purpose risk pooling. Administrative errors routinely occur in member reimbursement practices. The Internal Revenue Code strictly regulates how 501(c)(27) organizations may distribute funds to members. Payments outside statutory guidelines for workers' compensation losses can trigger immediate compliance issues and potentially revoke tax-exempt status.

Another common operational mistake involves inadequate separation between reinsurance activities and other state functions. Many state agencies fail to maintain proper financial and operational boundaries, creating compliance vulnerabilities during IRS examinations. This segregation must be evident in accounting practices, governance documentation, and day-to-day operations.

Ready to establish a company in Delaware? Get started with a free consultation from our expert incorporation service!

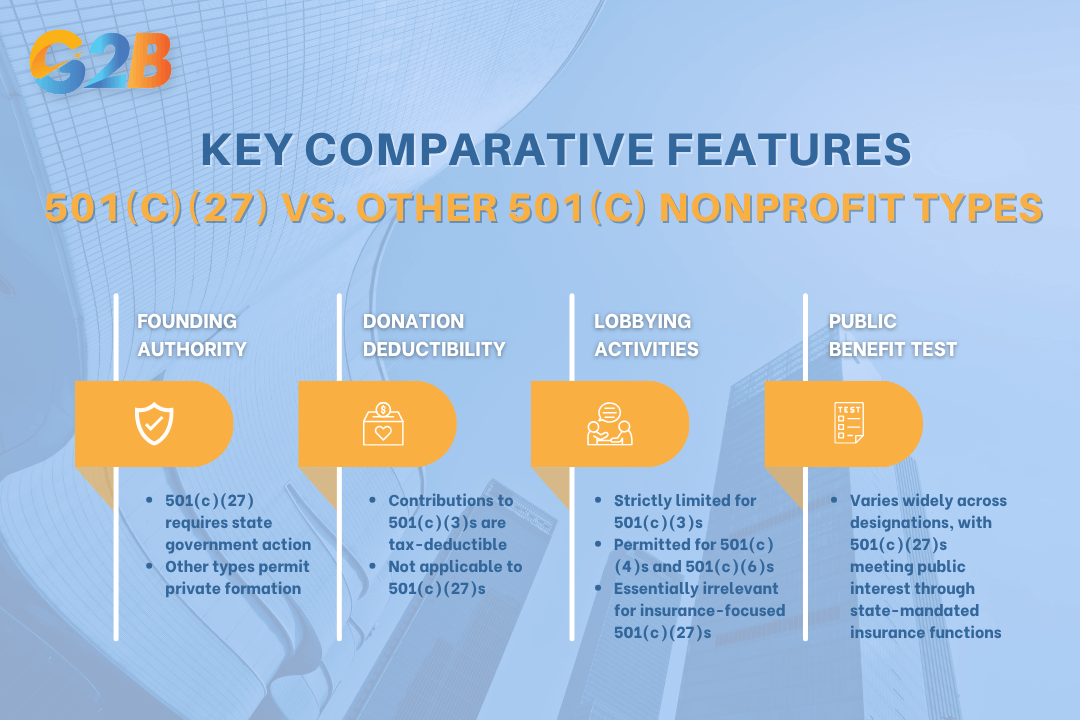

Comparison of 501(c)(27) vs. other 501(c) nonprofit types

While all 501(c) organizations share tax-exempt status, 501(c)(27) organizations stand apart as one of the most specialized and restricted nonprofit designations in the Internal Revenue Code. Understanding these distinctions proves essential for state agencies and legal advisors navigating the complex landscape of tax-exempt organizations.

501(c)(27) vs. 501(c)(3), 501(c)(4), and 501(c)(6)

The 501(c)(27) classification differs fundamentally from other common nonprofit designations across multiple dimensions. Unlike 501(c)(3) charitable organizations that serve broad religious, educational, or scientific purposes, a 501(c)(27) entity focuses exclusively on workers' compensation reinsurance. This singular purpose contrasts sharply with the community-oriented 501(c)(4) social welfare organizations or the industry-supporting 501(c)(6) business leagues.

Formation requirements highlight the most striking difference. While individuals or groups can establish 501(c)(3), 501(c)(4), or 501(c)(6) organizations at any time, 501(c)(27) status remains forever limited to state-sponsored entities formed before June 1, 1996. This historical restriction effectively prevents new entities from gaining this designation, regardless of their purpose or structure.

Key comparative features:

- Founding authority: 501(c)(27) requires state government action; other types permit private formation

- Donation deductibility: Contributions to 501(c)(3)s are tax-deductible; not applicable to 501(c)(27)s

- Lobbying activities: Strictly limited for 501(c)(3)s; permitted for 501(c)(4)s and 501(c)(6)s; essentially irrelevant for insurance-focused 501(c)(27)s

- Public benefit test: Varies widely across designations, with 501(c)(27)s meeting public interest through state-mandated insurance functions

Key comparative features between 501(c)(27) and other 501(c) nonprofit types

Unique features of the 501(c)(27) designation

The 501(c)(27) classification stands as the most narrowly defined category in the entire nonprofit tax code. Its distinguishing characteristics include not only the pre-1996 formation requirement but also mandatory state sponsorship and an exclusive focus on workers' compensation reinsurance activities. No other 501(c) designation combines such temporal, governmental, and functional restrictions.

The IRS imposes stringent governance requirements on 501(c)(27) organizations, demanding clear statutory authority, proper risk pooling protocols, and transparent member reimbursement structures. These entities must maintain strict separation between their reinsurance activities and any other state functions, creating compliance challenges foreign to most other nonprofit types.

Distinctive 501(c)(27) attributes:

- Limited to organizations established by direct state action

- Must exclusively serve workers' compensation reinsurance functions

- Cannot operate for private profit or benefit

- Required to maintain comprehensive records of all reinsurance activities

- Subject to both federal IRS oversight and state regulatory authority

- Prohibited from expanding the mission beyond statutory insurance purposes

This specialized classification serves a crucial economic role in states where private insurance markets failed to provide adequate workers' compensation coverage, but its highly specialized nature makes it unsuitable for most nonprofit purposes.

Frequently asked questions (FAQ)

Below are some frequently asked questions to help clarify the structure, purpose, and compliance requirements of 501(c)(27) organizations. These answers aim to support professionals and organizations seeking a better understanding of this specialized tax-exempt entity:

1. Are donations to 501(c)(27) organizations tax-deductible?

No, donations to 501(c)(27) organizations are not tax-deductible for donors. Unlike 501(c)(3) charitable organizations, contributions to 501(c)(27) state-sponsored workers' compensation reinsurance organizations do not qualify for charitable deduction benefits under federal tax law.

2. Must 501(c)(27) organizations be established by state governments?

Yes, 501(c)(27) organizations must be state-sponsored organizations established exclusively for providing workers' compensation reinsurance. They cannot be created by private entities and must operate under specific state authorization for workers' compensation insurance purposes.

3. Are 501(c)(27) organizations required to file Form 990?

Yes, 501(c)(27) organizations must file Form 990 annual returns with the IRS by the 15th day of the 5th month after their fiscal year ends. Failure to file for three consecutive years results in automatic revocation of tax-exempt status.

4. Can 501(c)(27) organizations operate for profit?

No, 501(c)(27) organizations must "operate as nonprofit organization by returning surplus income to members or workers' compensation policyholders on a periodic basis and by reducing initial premiums in anticipation of investment income". They cannot accumulate profits for private benefit.

5. Do 501(c)(27) organizations need to apply for tax exemption?

Yes, 501(c)(27) organizations must apply for tax-exempt status using Form 1024, which must be filed electronically through Pay.gov. The application requires detailed documentation of state sponsorship and workers' compensation reinsurance purposes.

6. Are there different types of 501(c)(27) organizations?

Yes, there are two classifications: 501(c)(27)(A) entities established before June 1, 1997, and 501(c)(27)(B) entities established after December 1, 1997. Each has different requirements regarding state financial support and asset reversion upon dissolution.

7. Must 501(c)(27) organizations make their tax returns publicly available?

Yes, 501(c)(27) organizations must make their Form 990 returns and exemption applications available for public inspection upon request. They must provide copies of the three most recent annual returns without charge, except reasonable copying costs.

8. Can 501(c)(27) organizations engage in unrelated business activities?

Limited, like other tax-exempt organizations, 501(c)(27) entities may engage in some unrelated business activities but must pay unrelated business income tax (UBIT) on such income. Substantial unrelated business activity could jeopardize their tax-exempt status.

9. Are all workers' compensation organizations in a state required to be members?

Yes, for 501(c)(27)(A) organizations, "every organization in the state that self-insures or provides workers' compensation insurance must be a member". This mandatory membership structure ensures comprehensive coverage of the state's workers' compensation reinsurance needs.

10. Must 501(c)(27)(B) organizations revert assets to the state upon dissolution?

Yes, 501(c)(27)(B) organizations must have "all assets of the organization revert to the state upon dissolution or the state must prohibit the organization from dissolving". This requirement ensures state control over these financially supported entities.

A 501(c)(27) organization stands as a pivotal structure for those seeking tax-exempt avenues in managing state-sponsored risk reinsurance pools. Tailored specifically for addressing challenges in workers’ compensation, this designation offers not only statutory compliance but also operational viability. Recognizing the intrinsic value of risk management and tax benefits amplifies the organization's strategic role within state agencies.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom