A 501(c)(10) organization can unlock significant benefits for fraternal societies without insurance provisions. These entities benefit from tax-exempt status from the IRS, similar to 501(c)(3) and 501(c)(8) organizations. Understanding the legal landscape and compliance requirements is vital for founders and leaders of such groups. Let’s explore how this formality bestows credibility, fostering growth and opening doors to grants and funding.

This content is provided for general informational purposes to help entrepreneurs and researchers understand the basics of 501(c)(10) organizations. We specialize in company formation, not in providing legal advisory services specific to U.S. nonprofit compliance. This information should not be considered professional tax advice. For specific guidance, please consult a nonprofit compliance expert or a legal professional with experience in domestic fraternal societies and tax-exempt organizations.

What is a 501(c)(10) organization?

501(c)(10) organizations are a tax-exempt entity that applies specifically to domestic fraternal societies, orders, or associations operating under the lodge system. They must devote their net earnings exclusively to religious, charitable, scientific, literary, educational, or fraternal purposes and do not provide life, sick, or other benefits to their members.

Simple explanation for entrepreneurs and leaders

501(c)(10) organizations function as mission-driven fraternal societies bound by common ties and shared values. These groups operate through a structured system where a parent organization oversees local chapters (lodges), each maintaining a degree of self-governance while adhering to the parent organization's rules and principles.

Consider organizations like certain Masonic lodges that focus on community service, educational programs, or historical preservation. These entities qualify for tax exemption when they maintain their fraternal character without offering insurance benefits to members. The tax-exempt status enables them to direct more resources toward their charitable and educational missions.

For entrepreneurs and nonprofit leaders exploring organizational structures, 501(c)(10) status offers a specialized option for groups with strong fraternal bonds and community-focused objectives. The structure preserves traditions while providing a formal legal framework that acknowledges their unique position in society.

Take the first step toward business success - Explore our Delaware incorporation service today!

Formal legal definition and IRS criteria

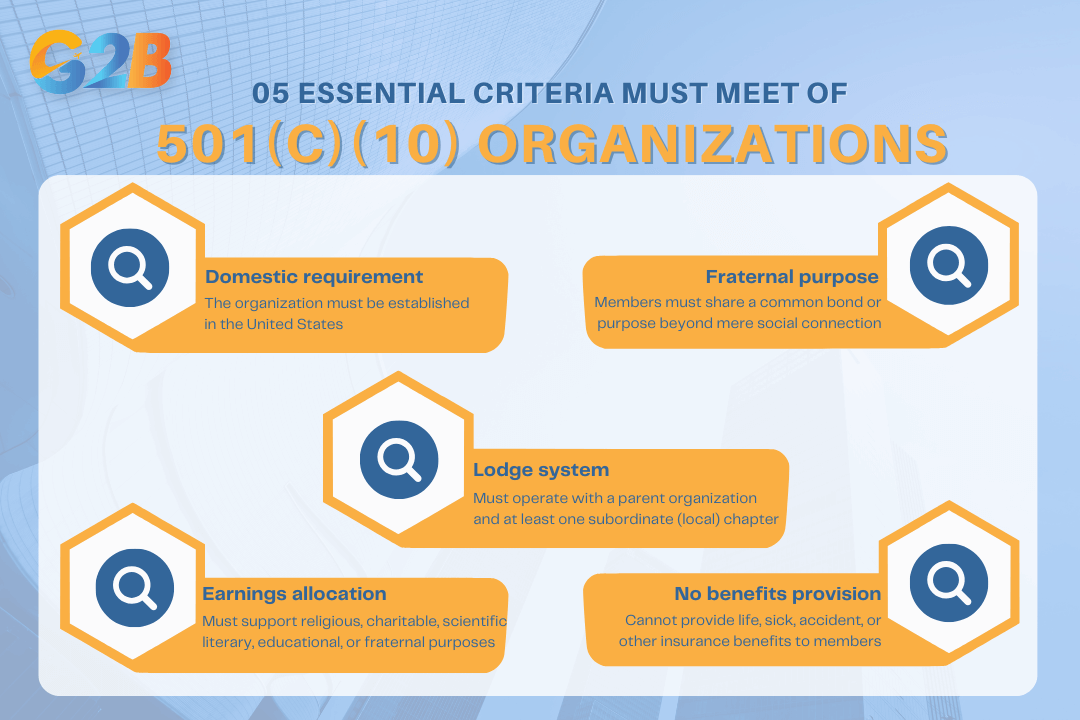

The Internal Revenue Service establishes five essential criteria that organizations must meet to qualify for 501(c)(10) status:

- Domestic requirement: The organization must be established in the United States

- Fraternal purpose: Members must share a common bond or purpose beyond mere social connection

- Lodge system: Must operate with a parent organization and at least one subordinate (local) chapter

- Earnings allocation: Net earnings must exclusively support religious, charitable, scientific, literary, educational, or fraternal purposes

- No benefits provision: Cannot provide life, sick, accident, or other insurance benefits to members

05 essential criteria that organizations must meet to qualify for 501(c)(10) status

501(c)(10) organizations must submit Form 1024 to apply for tax exemption, along with supporting documentation demonstrating compliance with these requirements. The approval process typically involves IRS review of the organization's governance documents, activities, and financial structure. The legal framework creates a clear distinction between 501(c)(10) organizations and other nonprofit categories, particularly 501(c)(8) fraternal beneficiary societies that can offer insurance benefits.

Types and roles within 501(c)(10) organizations

501(c)(10) organizations encompass a diverse range of fraternal societies dedicated to religious, charitable, educational, or community service missions. The organizational structure typically follows a hierarchical model where a parent body establishes guidelines and charters local lodges that implement programs at the community level.

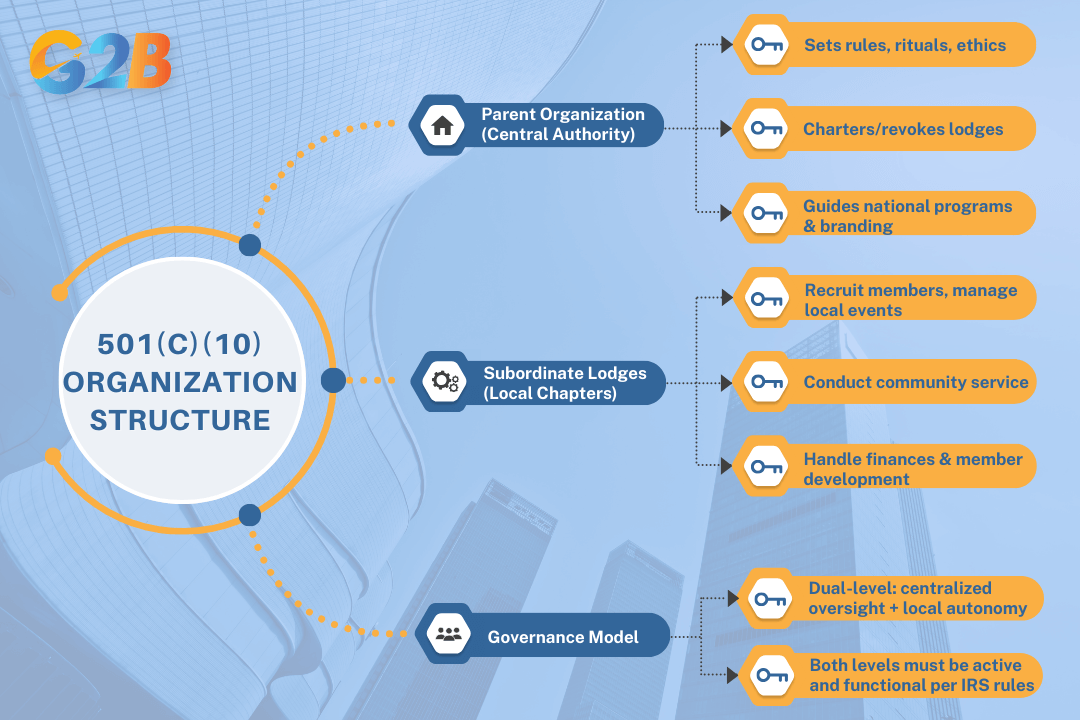

Role and responsibilities of the parent organization

The parent organization in a 501(c)(10) structure serves as the central governing body, providing comprehensive oversight and strategic direction for the entire fraternal society. These national or regional headquarters establish the organizational constitution, develop standardized rituals and ceremonies, and maintain the fraternal order's traditions. Parent organizations hold the authority to charter new subordinate lodges and revoke charters when necessary. They typically establish:

- Membership qualification standards

- Ritual procedures and ceremonial protocols

- Ethical codes of conduct

- Strategic initiatives and national programs

- Branding and identity guidelines

Functions and autonomy of subordinate lodges

Subordinate lodges function as the local implementation arms of the fraternal society, managing day-to-day operations and building direct relationships with members. These community-based chapters must maintain substantial self-governance while adhering to the parent organization's established framework. Subordinate lodges typically manage:

- Local membership recruitment and retention

- Community outreach and service projects

- Regular lodge meetings and fraternal activities

- Local financial management and fundraising

- Member education and development programs

The relationship between these entities creates a balanced governance model that preserves organizational consistency while allowing for local adaptation. This dual-level structure enables 501(c)(10) organizations to maintain national cohesion through the parent organization while remaining responsive to community needs through autonomous subordinate lodges. The IRS requires both levels to be active, not merely mentioned in bylaws, with the parent organization maintaining genuine authority and subordinate lodges exercising meaningful self-governance.

Structures of 501(c)(10) organizations includes many features

Key requirements and legal compliance for 501(c)(10) organizations

The primary requirements of 501(c)(10) organizations include operating under a lodge system, dedicating net earnings to approved purposes, abstaining from providing insurance benefits, and fulfilling annual reporting obligations. Noncompliance with these regulations can result in the revocation of an organization's tax-exempt status.

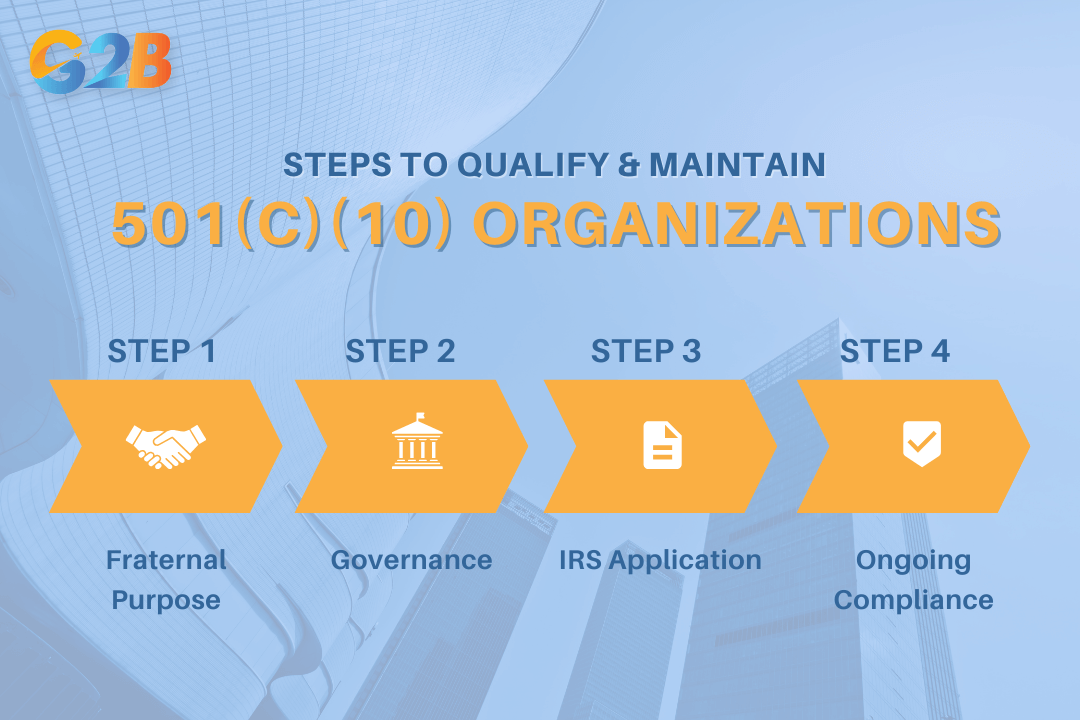

Steps to qualify and maintain 501(c)(10) status

Establishing and maintaining a compliant 501(c)(10) organization requires methodical attention to several critical elements. Organizations must first ensure they have a genuine fraternal purpose with a common bond among members. This foundational element distinguishes fraternal societies from other nonprofit types. Documenting a legitimate lodge system represents another crucial step. This system must include a parent organization with chartered subordinate lodges that maintain substantial self-governance while adhering to the parent organization's principles and guidelines.

Comprehensive bylaws and governance policies must clearly outline the organization's structure, purpose, and operational procedures. These documents serve as the constitutional framework for the organization and provide guidance for decision-making processes. The application process requires submitting Form 1024 to obtain IRS recognition. This application must thoroughly document the organization's purpose, structure, and activities to demonstrate compliance with 501(c)(10) requirements.

- Maintain detailed financial and activity records

- File annual IRS returns (Form 990 series)

- Conduct regular internal compliance reviews

- Document member meetings and lodge activities

- Review bylaws periodically for compliance updates

- Ensure all charitable activities align with stated purposes

04 Steps to qualify and maintain 501(c)(10) status

Common compliance pitfalls and how to avoid them

501(c)(10) organizations frequently encounter specific compliance challenges that can threaten their tax-exempt status. The most significant risk involves inadvertently offering insurance or direct financial benefits to members. Unlike 501(c)(8) organizations, 501(c)(10) entities cannot provide life, sick, accident, or other similar benefits to members without jeopardizing their exempt status.

Some organizations struggle to maintain a true lodge system over time. As membership changes or chapters evolve, the structured parent-subsidiary relationship may deteriorate, potentially invalidating the organization's exempt status. Regular organizational assessments and clear documentation of lodge relationships help preserve this critical structure.

Misallocation of funds presents another common problem. Net earnings must be exclusively devoted to approved purposes - religious, charitable, scientific, literary, educational, or fraternal activities. Organizations should:

- Implement clear financial controls and approval processes

- Conduct annual financial audits or reviews

- Provide regular treasurer training for local lodges

- Use designated accounts for different organizational purposes

- Document the charitable purpose of all significant expenditures

Professional guidance proves invaluable in preventing compliance issues. Engaging legal counsel with nonprofit expertise and financial advisors familiar with 501(c)(10) requirements provides essential protection against inadvertent violations that could threaten an organization's tax-exempt status.

Need a reliable Delaware incorporation service? Contact G2B for a free consultation today!

501(c)(10) vs. Other nonprofit types: Key differences and comparisons

501(c)(10) organizations occupy a distinct position within the nonprofit landscape. These fraternal societies operate without providing insurance benefits, making them fundamentally different from similar nonprofit classifications. Understanding these differences proves essential for organization founders and nonprofit advisors.

Comparison table: 501(c)(10) vs. 501(c)(8) vs. 501(c)(3) vs. 501(c)(7)

| Feature | 501(c)(10) Fraternal societies | 501(c)(8) Fraternal beneficiary societies | 501(c)(3) Charitable organizations | 501(c)(7) Social clubs |

|---|---|---|---|---|

| Primary purpose | Fraternal, charitable, religious, and educational purposes | Fraternal with insurance/benefits provision | Charitable, religious, educational, and scientific purposes | Social and recreational activities |

| Membership requirement | Common bond; lodge system | Common bond; lodge system | No specific membership requirements | Common recreational interest |

| Insurance benefits | Prohibited | Required | Not applicable | Not applicable |

| Tax-exempt status | Yes | Yes | Yes | Yes |

| Tax-deductible donations | Generally not | Limited circumstances | Yes | No |

| Operational structure | Parent organization with subordinate lodges | Parent organization with subordinate lodges | Board governance structure | Club governance structure |

| Primary beneficiaries | Members and community | Members (via benefits) and community | General public | Members only |

| Political activities | Limited | Limited | Highly restricted | Permitted with limitations |

The structural requirements for 501(c)(10) organizations mirror those of 501(c)(8) entities through the lodge system requirement, but diverge sharply regarding member benefits. Similarly, while 501(c)(10) groups may pursue charitable aims like 501(c)(3) organizations, they maintain distinctly different membership structures and donation tax benefits.

Common misconceptions clarified

Many fraternal organizations mistakenly believe all such entities qualify for the same tax classification. In reality, the provision of insurance creates a fundamental dividing line - only 501(c)(8) organizations can legally provide insurance benefits to members, while 501(c)(10) organizations explicitly cannot.

Another widespread misconception concerns donation deductibility. Unlike contributions to 501(c)(3) organizations, donations to 501(c)(10) entities generally do not qualify as tax-deductible charitable contributions for donors. This creates significant fundraising differences between these organization types.

The distinction between 501(c)(10) fraternal societies and 501(c)(7) social clubs often causes confusion. While both serve defined membership groups, 501(c)(10) organizations must maintain a fraternal purpose and operate under a formal lodge system. Social clubs under 501(c)(7) exist primarily for pleasure and recreation without these structural requirements.

Operational boundaries frequently blur in practice. For example, some organizations mistakenly attempt to combine fraternal benefits (like insurance) with 501(c)(10) status. This violates IRS requirements and risks tax-exempt status revocation. Similarly, fraternal organizations sometimes incorrectly position themselves as charitable organizations without meeting the stringent public benefit requirements of 501(c)(3) classification.

The membership requirements also differ significantly. While 501(c)(3) organizations generally maintain open membership policies serving the general public, 501(c)(10) organizations require members sharing common ties or objectives - an essential element of their fraternal nature.

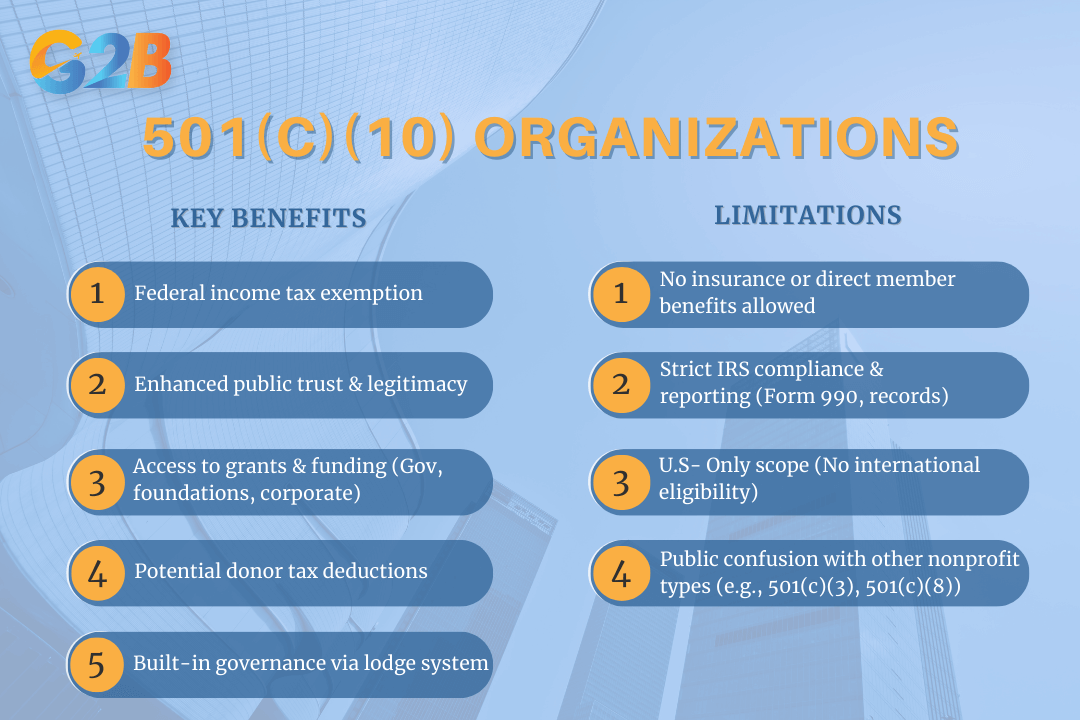

Benefits and disadvantages of 501(c)(10) status

501(c)(10) organizations benefit from significant tax advantages and operational credibility, but must navigate several regulatory challenges. Understanding these practical implications helps founders and board members make informed decisions about whether this classification aligns with their organizational mission and capabilities.

Benefits and disadvantages of 501(c)(10) status

Key benefits for organizations and communities

501(c)(10) status provides federal income tax exemption, eliminating tax liability on organizational income and allowing more resources to flow toward the fraternal mission. This exemption represents a substantial financial advantage that helps these organizations maintain financial sustainability while pursuing their charitable or educational goals.

The formal IRS recognition enhances organizational legitimacy and public trust. Communities, potential donors, and partnering institutions view 501(c)(10) organizations as credible entities with government validation. This increased credibility often translates to greater community support and engagement.

Certain donations to 501(c)(10) organizations may qualify for tax deductions, though the rules differ from those governing 501(c)(3) charities. This potential tax benefit incentivizes charitable giving and can boost fundraising efforts for qualifying fraternal activities and programs. Access to grants and public funding sources represents another significant advantage. Many foundations and government programs limit their funding to tax-exempt organizations, opening doors to financial resources unavailable to for-profit entities or informal groups.

• Government grants

• Foundation support

• Corporate giving programs

• Community foundation funding

The lodge system provides built-in governance structure, preserving traditions while ensuring operational continuity across generations of leadership. This established framework simplifies organizational management and helps maintain consistency in fraternal activities.

Disadvantages and limitations

501(c)(10) organizations cannot provide insurance or direct member benefits, a crucial limitation distinguishing them from 501(c)(8) fraternal beneficiary societies. Organizations planning to offer death, medical, or accident benefits must pursue alternate tax classifications or fundamentally restructure their operations. Compliance with IRS regulations requires meticulous record-keeping, regular filings, and operational transparency. Annual reporting obligations include:

- Filing Form 990 tax returns

- Maintaining detailed financial records

- Documenting fraternal activities

- Adhering to governance requirements

The geographic restriction to U.S.-based organizations prevents international fraternal societies from qualifying under this specific tax classification. Foreign entities must establish domestic operations or seek alternative frameworks for their activities in the United States.

Public confusion between 501(c)(10) and other nonprofit classifications creates communication challenges. Organizations must frequently explain their status to donors, partners, and community members who may mistakenly assume they operate under 501(c)(3) or 501(c)(8) rules. This confusion sometimes complicates fundraising efforts when donors expect tax deductions that may not apply.

Frequently asked questions (FAQ) about 501(c)(10) organizations

- Does a 501(c)(10) organization get federal income tax exemption?

Yes. It is exempt from federal income tax if it uses its net earnings exclusively for exempt purposes and does not provide benefits like insurance to members. - Can a 501(c)(10) organization provide insurance benefits to members?

No. Unlike 501(c)(8) fraternal benefit societies, 501(c)(10) organizations do not offer life, sick, accident, or other benefits to members. - Must a 501(c)(10) organization file an annual IRS Form 990?

Yes. Most 501(c)(10) organizations must file Form 990 or similar returns to maintain their tax-exempt status and report financial activities. - Can a 501(c)(10) organization engage in political campaigning?

No. These organizations are prohibited from participating in political campaigns or endorsing candidates to keep their tax-exempt status. - Are donations to 501(c)(10) organizations tax-deductible?

No. Contributions to 501(c)(10) groups generally are not tax-deductible as charitable donations, unlike donations to 501(c)(3) organizations. - Does a 501(c)(10) organization have individual members?

Yes. Membership is typically composed of individuals who share a common bond, such as religion, ethnicity, or occupation, within a lodge structure. - Can a 501(c)(10) organization operate internationally?

They primarily operate domestically in the U.S., but limited international activities are allowed if consistent with exempt purposes and IRS rules. - Is a 501(c)(10) organization allowed to generate unrelated business income?

Yes, but unrelated business income may be subject to tax and should be insubstantial to maintain exemption. - Can a 501(c)(10) organization convert to a 501(c)(3) status?

Yes. Conversion is possible but requires meeting different IRS criteria, including restrictions on political activity and benefit distribution.

A 501(c)(10) organization is suitable for those seeking to sculpt lasting legacies within community pillars like fraternal societies. Such entities offer not just the advantage of tax-exempt status, but a framework to foster genuine camaraderie and shared purpose. This path, distinct from 501(c)(3) or 501(c)(8) variants, amplifies your mission's legitimacy while maintaining compliance. Embrace the potential to unite tradition and innovation, forging connections that transcend generations.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom