GDP, or Gross Domestic Product, is the single most important indicator of a nation's economic health. It offers a snapshot of the economic activity within a country and is a crucial metric for businesses, policymakers, and investors. Let’s explore the basic definition, types of GDP, real-world impact on business strategy, investment decisions, and national policy in this article.

This article explains the key concepts of GDP, helping readers understand how a country’s economic output is measured and why it remains a central indicator of economic performance. We specialize in company formation and not in macroeconomic analysis. For technical guidance on GDP, please consult a qualified economist.

What is gross domestic product?

Gross Domestic Product (GDP) represents the total monetary or market value of all the final goods and services produced within a country's borders in a specific time period. Typically measured on a quarterly or annual basis, GDP serves as a comprehensive scorecard of a given country’s economic health and size.

To create this value, an economy utilizes various factors of production - land, labor, capital, and entrepreneurship - to generate output. To provide an accurate measure of production, GDP focuses on the value of "final goods and services" - those that are purchased by the end-user. This approach avoids the issue of double-counting by excluding intermediate goods, which are products used in the production of other goods. For example, the flour used to make bread is an intermediate good, while the bread sold to a consumer is a final good. GDP only includes goods and services produced domestically and excludes imports.

03 Primary approaches to calculate GDP

There are three primary approaches to calculating GDP:

- The production (or output) approach: This method sums the "value-added" at each stage of production. Value-added is the total sales of a business minus the value of intermediate inputs.

- The income approach: This approach totals all the income generated by production, including the compensation employees receive and the operating surplus of companies.

- The expenditure approach: This is the most commonly used method and it calculates GDP by adding up all the spending on final goods and services in an economy.

Vietnam’s GDP growth performance in quarter III 2025

According to the Ministry of Finance, Vietnam economic growth remains impressive. Vietnam’s GDP grew by 8.23% year-on-year (YoY) in Q3 2025, bringing nine-month growth to 7.85% YoY, closely tracking the government’s full-year target of around 8%. This robust growth was driven by positive performance across all three main sectors of the economy. Notably, industrial output, with manufacturing and processing at its core, continued to be the primary engine of this expansion. It grew by 9.46% in the third quarter and nearly 8.6% over the nine-month period, aligning with established growth targets.

Here is a breakdown of the sectoral growth for clarity:

| Sector | Growth in Q3 2025 (%) | Growth in first 9 months 2025 (%) |

|---|---|---|

| Agriculture, forestry, and fisheries | 3.7 | 3.8 |

| Industry and construction | 9.46 | 8.6 |

| Services | 8.5 | 8.4 |

| Overall | 8.23 | 7.85 |

Types of gross domestic product

GDP is presented in several different ways, each offering a unique lens through which to view a country's economic standing. Understanding these variations is essential for accurate analysis.

- Nominal GDP: This is the raw measure of a country's economic output calculated using current market prices. It reflects the changes in both the quantity of goods and services produced and their prices. While useful for comparing economic output in the short-term, it can be misleading when comparing different time periods because of the effects of inflation. Nominal GDP does not adjust for inflation, so rising prices can increase nominal GDP without an actual increase in production.

- Real GDP: To get a more accurate picture of a country's economic growth, economists use real GDP. This is an inflation-adjusted measure that values the output of goods and services at constant prices from a specific base year. By removing the effects of price changes, real GDP allows for a more accurate comparison of economic output over time, making it the best metric for assessing true economic growth.

- GDP per capita: This metric is calculated by dividing a country's total GDP by its population. It represents the average economic output per person and is often used as a proxy for the standard of living in a country. A higher GDP per capita generally indicates a higher level of economic well-being for the average citizen. However, it is an average measure and does not account for income inequality within the population.

- GDP growth rate: This is the percentage increase or decrease in GDP from one period to another, usually expressed on a quarterly or annual basis. A positive growth rate signifies that the economy is experiencing expansion, while a negative rate indicates that it is contracting. This is the most frequently cited figure in economic news and reports as it provides a clear and immediate sense of an economy's momentum.

- Purchasing power parity (PPP) GDP: This variation adjusts GDP to account for differences in the cost of living and inflation rates between countries, allowing for more accurate international comparisons of economic output and living standards. It converts economic output into a common currency that reflects purchasing power rather than market exchange rates. This metric is particularly useful when analyzing an emerging market economy like Vietnam, where the cost of living is significantly lower than in developed nations.

Components of GDP

The expenditure approach is the most widely used method for calculating a nation's GDP. It is based on the principle that the total value of all produced goods and services must be equal to the total amount of money spent to purchase them.

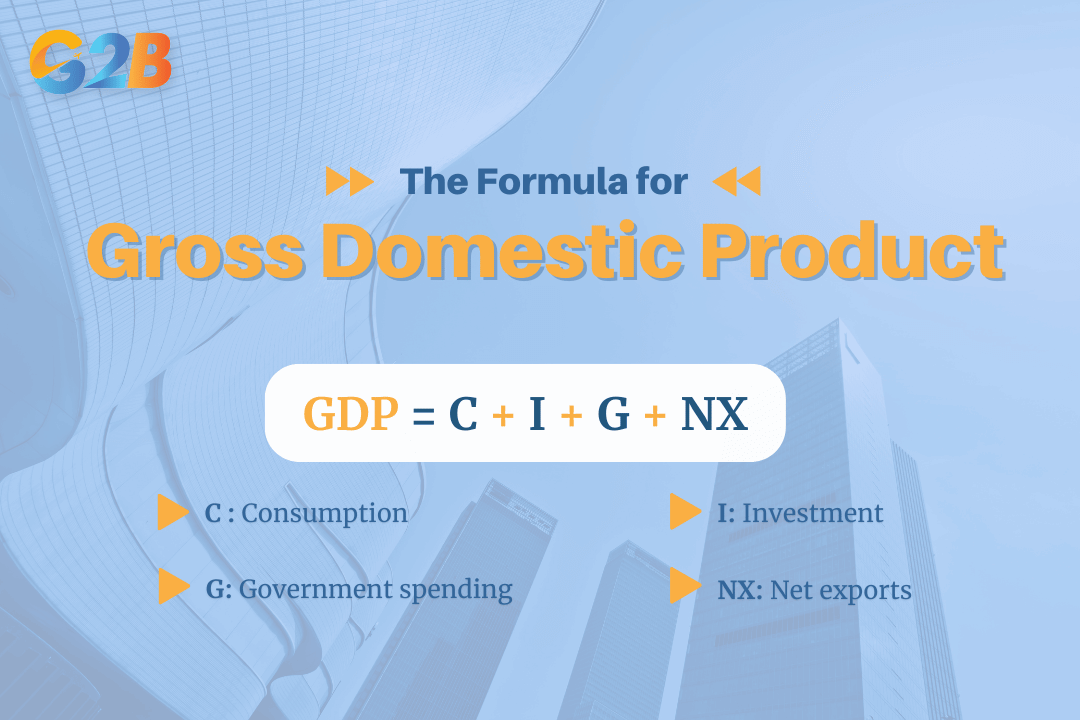

Gross Domestic Product’s calculated formula

The formula is straightforward and powerful:

GDP = C + I + G + NX

Let's break down each of these essential components:

- C (Consumption): This represents the total spending by households on goods and services and is typically the largest component of GDP. It includes expenditures on durable goods, such as cars, furniture, and appliances, non-durable goods, like food, clothing, and fuel, and services, such as haircuts, healthcare, and entertainment.

- I (Investment): This component, often referred to as gross private domestic investment, includes spending by businesses on fixed capital (such as machinery and factories), changes in business inventories, and spending by households on new housing. Examples of investment spending include the purchase of new technology or the construction of a new facility to increase production capacity.

- G (Government spending): This accounts for all government purchase expenditures on final goods and services. This includes salaries for public employees, the construction of infrastructure like roads and schools, and military spending. It's important to note that this does not include transfer payments, such as social security or unemployment benefits, as these do not represent the production of a good or service.

- NX (Net exports): This component represents a country's total exports minus its total imports (Exports - Imports). Exports are goods and services produced domestically and sold to foreigners, so they are added to GDP. Imports are goods and services produced abroad and purchased by domestic consumers, so they must be subtracted to ensure that only domestic production is counted.

Why is GDP important for business and finance?

GDP is a critical indicator for a wide range of stakeholders, providing essential insights that inform strategic decisions in both the public and private sectors. It serves as a fundamental measure of business activities and health, widely utilized across policymaking, business planning, and investment analysis.

- For policymakers: Governments and central banks closely monitor GDP to guide economic policy. For example, a slowing GDP growth rate might prompt a central bank to lower interest rates or adjust fiscal policy to stimulate economic activity and encourage borrowing and spending. Conversely, a rapidly growing GDP might lead to concerns about inflation, prompting policymakers to consider measures to cool down the economy.

- For businesses: Companies rely on GDP trends to inform their strategic planning. A strong and growing economy, as indicated by a rising GDP, often signals higher consumer confidence and spending, which can translate into increased demand for a company's products and services. This can influence decisions about expansion, hiring, and investment in new technologies.

- For investors: The health of the economy is a primary driver of corporate earnings and stock market performance. Investors use GDP data to assess the overall economic climate and make informed decisions about their portfolios. GDP growth rates help investors gauge economic cycles and assess risks and opportunities in their investment strategies. A period of robust GDP growth is generally associated with a bullish market, while a contracting economy, or global recession, often corresponds with a bearish market.

GDP’s importance for business and finance

With Vietnam consistently ranking among the fastest-growing economies in the region, its strong and resilient GDP performance continues to attract global entrepreneurs looking for new opportunities. A rising GDP not only reflects expanding consumer demand but also signals a dynamic, business-friendly environment supported by ongoing reforms and integration into international markets. If you are seeking a strategic location in Asia to scale your business, now is the ideal time to register a company in Vietnam and position yourself at the heart of one of the world’s most promising growth stories.

How to use GDP data?

GDP data is a versatile tool that can be applied in several ways to gain a deeper understanding of an economy.

- Gauging economic health: The most fundamental use of GDP is to measure the overall health and performance of an economy. A consistent pattern of positive GDP growth indicates a healthy, expanding economy. On the other hand, two consecutive quarters of negative GDP growth typically define a recession, signaling a period of economic downturn.

- Making international comparisons: GDP and GDP per capita are widely used to compare the economic size and performance of different countries. This allows for an understanding of the relative economic power and standard of living across the globe. For businesses looking to expand internationally, these comparisons are crucial for identifying promising markets. Investors and strategists also use these comparisons to allocate resources and plan market entry.

- Informing policy and strategy: For governments, GDP data is the foundation for fiscal and monetary policy decisions, helping to shape budgets and set economic goals. A thorough analysis of GDP trends is essential for effective business forecasting, helping firms predict sales trends and manage financial risk.

Is a high GDP good?

While a high GDP is often seen as a sign of national success, it is essential to have a nuanced understanding of what this metric represents and its inherent limitations.

The positives: Generally, a high or rising GDP is associated with positive economic outcomes. It often correlates with lower unemployment rates, higher wages, and increased corporate profits. For governments, a growing economy means higher tax revenues, which can be used to fund essential public services like healthcare, education, and infrastructure.

The limitations: Despite its utility, GDP is not a comprehensive measure of a country's well-being or quality of life. Its main criticisms include:

- It ignores inequality: A country can have a high and rising GDP while a significant portion of its population lives in poverty. GDP measures the total size of the economic pie but says nothing about how it is distributed among the population.

- It excludes non-market activities: GDP does not account for valuable unpaid work that contributes significantly to societal well-being. This includes activities such as caregiving for family members, volunteer work, and household production.

- It overlooks environmental costs: A major flaw of GDP is that it can increase through activities that are detrimental to the environment. It does not account for the depletion of natural resources or the long-term costs of pollution, which can negatively impact the quality of life and future economic potential.

- It doesn't measure well-being: GDP is not a direct measure of happiness, health, or overall life satisfaction. Factors that are crucial to a high quality of life, such as a clean environment, strong social connections, and a healthy work-life balance, are not captured in this economic indicator.

While GDP is an indispensable tool for understanding the economic activity and health of a nation, it should not be viewed as the sole indicator of a country's success or the well-being of its citizens. A sophisticated understanding of GDP, recognizing both its strengths and its significant limitations, is crucial for making well-rounded and sustainable business decisions in an increasingly complex global economy. By looking beyond this single metric and considering a broader range of indicators, we can gain a more complete and accurate picture of true prosperity.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom