501(c)(15) tax-exempt insurance organizations are specialized entities that provide insurance services while benefiting from federal tax exemptions. The benefits include exemption from federal income tax, which helps reduce operational costs and enhance member value. Let’s investigate the key requirements, advantages, and steps to successfully establish a 501(c)(15) tax-exempt insurance organization.

This content is provided for general informational purposes to help entrepreneurs and researchers understand the basics of 501(c)(15) tax-exempt insurance organizations. We specialize in company formation, not in providing legal advisory services specific to U.S. nonprofit or insurance regulatory compliance. For specific guidance, please consult a tax advisor or legal professional with experience in insurance entities and U.S. tax-exempt organization law.

What is a 501(c)(15) organization?

501(c)(15) organization is a type of nonprofit recognized under the U.S. Internal Revenue Code that applies specifically to small insurance companies or associations. These organizations are exempt from federal income tax under section 501(c)(15) of the Internal Revenue Code.

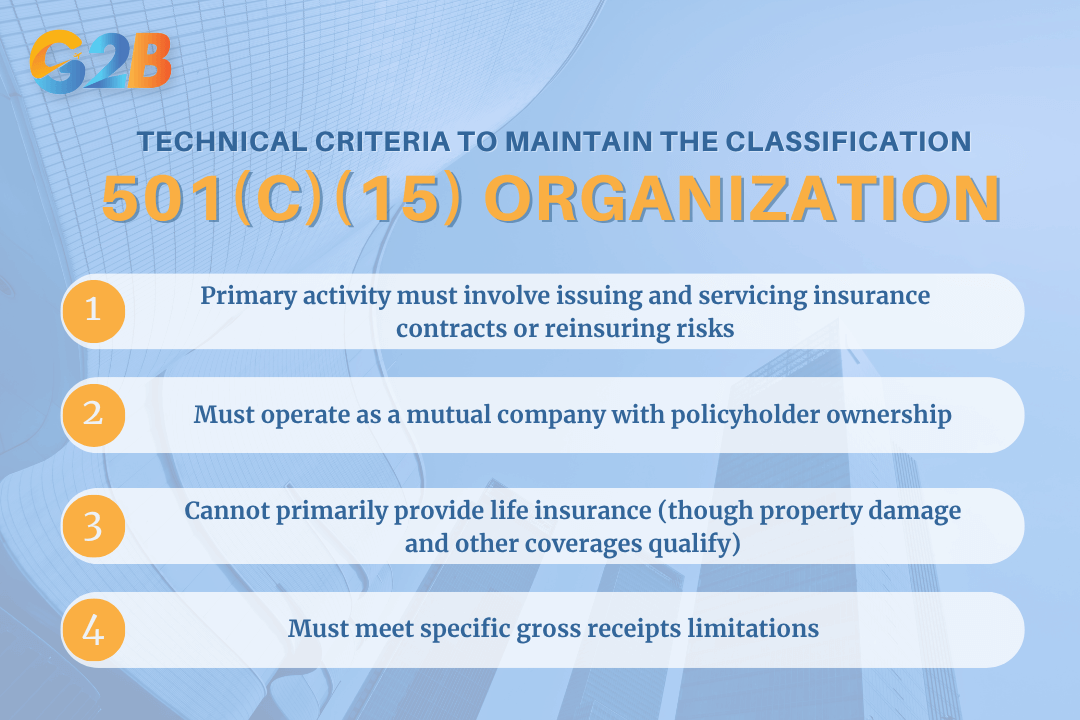

More specifically, 501(c)(15) organizations are mutual insurance companies or associations that meet certain criteria set by the IRS, typically involving small insurance entities that provide insurance to their members or policyholders. Organizations must satisfy several technical criteria to maintain this classification:

- Primary activity must involve issuing and servicing insurance contracts or reinsuring risks

- Must operate as a mutual company with policyholder ownership

- Cannot primarily provide life insurance (though property damage and other coverages qualify)

- Must meet specific gross receipts limitations

501(c)(15) organizations must satisfy several technical criteria to maintain classification

The IRS evaluates these organizations based on their operational structure, ensuring they function as genuine member-oriented insurance providers rather than commercial-type insurance operations. This classification contains precise technical boundaries that distinguish these tax-exempt entities from other insurance company structures in the tax code.

Get expert guidance with G2B’s Delaware incorporation service - Schedule your free consultation today!

Qualification requirements for 501(c)(15) status

Obtaining 501(c)(15) tax-exempt status requires insurance companies to meet stringent IRS criteria spanning financial thresholds, organizational structure, and operational parameters.

Revenue and premium income limitations

The IRS imposes strict financial thresholds on 501(c)(15) organizations to restrict exemption eligibility to genuinely small insurance providers. To qualify, an insurance company's gross receipts must not exceed $600,000 for the taxable year, with more than 35% of those receipts consisting of premiums. These dual requirements create a clear boundary between small mutual insurers and larger commercial enterprises.

Organizations approaching these thresholds must implement robust financial monitoring systems to track their position relative to these limits throughout the year. The IRS applies specific calculation guidelines when evaluating these figures during annual reporting reviews.

| Qualification criteria | Requirement |

|---|---|

| Maximum annual gross receipts | $600,000 |

| Minimum premium percentage | >35% of gross receipts |

| Calculation basis | Taxable year |

Mutual structure and member control requirements

The IRS mandates specific organizational characteristics for 501(c)(15) entities centered on policyholder control and mutual ownership principles. Membership must be restricted to policyholders, with all policyholders automatically becoming members who possess the right to select organizational management. This structure ensures those receiving coverage maintain direct control over operations. Additional mutual structure requirements include:

- Provision of insurance at substantially the cost

- Systems for returning excess premiums through dividends or reduced renewal rates

- Common equitable ownership of assets among all members

- Member's right to receive the organization's net assets upon dissolution

Types of insurance permitted under 501(c)(15)

501(c)(15) status permits organizations to offer specific insurance products while prohibiting others based on classification and purpose. Qualifying organizations typically provide:

- Property insurance coverage

- Casualty insurance policies

- Marine insurance (following legislative amendments)

However, the IRS explicitly prohibits organizations primarily offering life insurance from qualifying under 501(c)(15). Insurance companies focusing predominantly on life insurance products must seek qualification under different code sections, such as 501(c)(12), which addresses benevolent life insurance associations.

The IRS carefully evaluates each organization's insurance product portfolio to verify alignment with exemption requirements. Products must serve the member community rather than function as general commercial offerings for the broader public. This distinction maintains the community-focused intent behind the 501(c)(15) exemption.

Benefits of establishing a 501(c)(15) organization

The 501(c)(15) organization structure offers substantial advantages for qualifying small insurance companies. Organizations meeting the strict qualification criteria gain several competitive advantages that enhance their operational efficiency.

Federal and state tax advantages

The primary benefit of 501(c)(15) status lies in the complete exemption from federal income taxation on insurance operations. This tax advantage allows qualifying organizations to operate with greater financial efficiency by eliminating federal tax obligations on their core business activities. The tax savings directly improve the organization's bottom line and financial sustainability.

Beyond federal benefits, many states offer parallel tax exemptions or favorable treatment for organizations with federal 501(c)(15) status. These state-level advantages vary significantly by jurisdiction, potentially including exemptions from state income taxes, premium taxes, or other industry-specific assessments. Organizations should conduct jurisdiction-specific research as state tax benefits can substantially multiply the financial advantage of the federal exemption.

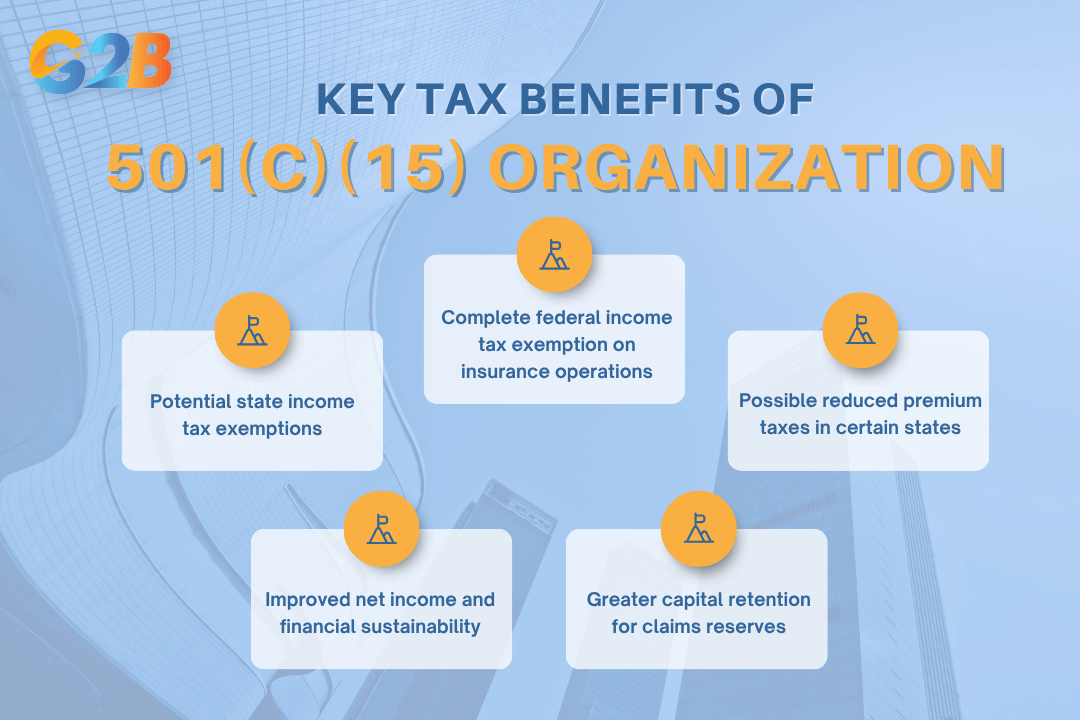

Key tax benefits:

- Complete federal income tax exemption on insurance operations

- Potential state income tax exemptions

- Possible reduced premium taxes in certain states

- Improved net income and financial sustainability

- Greater capital retention for claims reserves

Investigate 5 key tax benefits of 501(c)(15) organizations

Member-controlled governance and community focus

The mutual structure typically required for 501(c)(15) organizations creates perfect alignment between the insurance provider and its members. This policyholder-owned model fundamentally shifts operational priorities from profit maximization toward member benefit maximization. Without external shareholders demanding returns, these organizations can focus exclusively on providing optimal coverage at minimum cost.

This alignment often results in insurance products precisely tailored to the specialized needs of the member community. Whether serving specific professional groups, geographic regions, or specialized industries, 501(c)(15) organizations can develop highly customized coverage options addressing unique risk profiles. This community-focused approach proves particularly valuable in underserved markets where commercial insurance options may be inadequate or prohibitively expensive.

Cost-effective insurance delivery

The combination of tax exemption and mutual ownership allows 501(c)(15) organizations to deliver insurance coverage at substantially lower costs than commercial alternatives. The tax savings flow directly to members through reduced premiums rather than enriching external shareholders. Additionally, the requirement to return excess premiums ensures policyholders receive the financial benefit of efficient operations.

This cost advantage becomes especially significant in niche insurance markets where commercial options may be unavailable or excessively priced. For businesses with specialized insurance needs, this cost-effective delivery mechanism provides substantial financial benefits while ensuring appropriate coverage.

Comparative cost advantages:

| Factor | 501(c)(15) Organization | Commercial Insurer |

|---|---|---|

| Federal income tax | Exempt | 21% Corporate Rate |

| Profit requirement | None (operates at cost) | Typically 10-20% |

| Premium returns | Required for excess | None (profits to shareholders) |

| Community focus | High (member-controlled) | Limited (shareholder-focused) |

| Administrative costs | Often lower (smaller scale) | Higher (corporate structure) |

Step-by-step guide to forming a 501(c)(15) organization

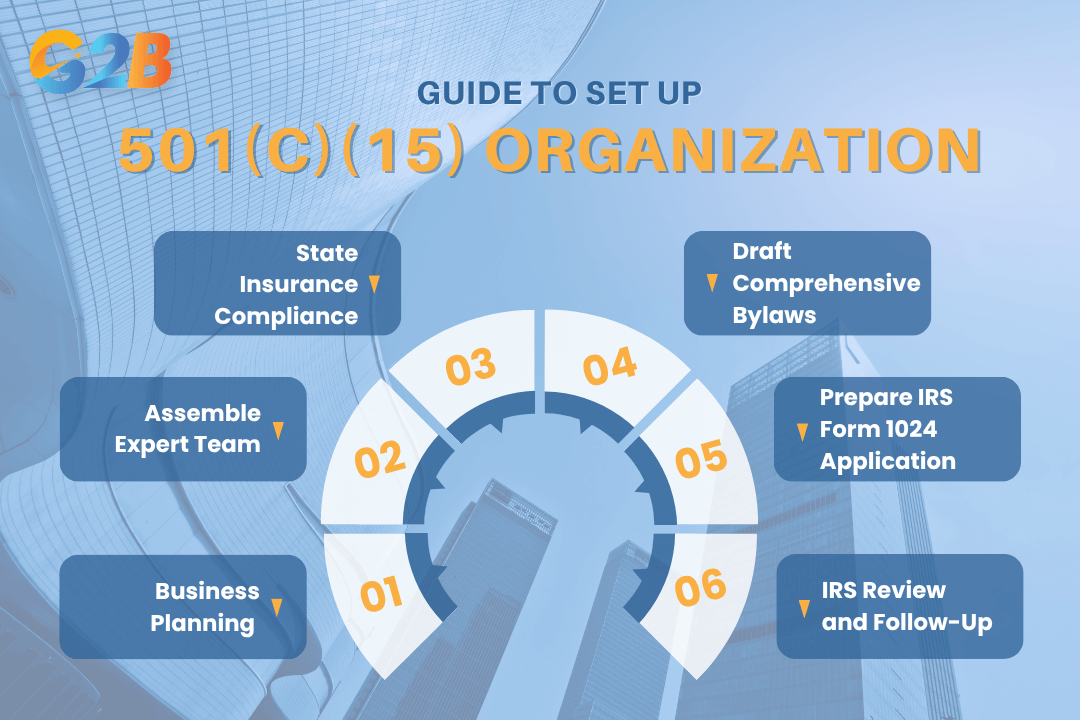

Establishing a 501(c)(15) organization demands meticulous planning and execution through distinct phases. The following roadmap guides potential founders through this complex process with specific action items at each stage.

There are six steps to form a 501(c)(15) organization

Business planning and feasibility assessment

Before diving into formation, conduct a comprehensive feasibility assessment to determine if a 501(c)(15) organization aligns with your objectives. This assessment begins with market analysis to identify insurance gaps within your target community and evaluate whether member needs can be met within the strict revenue limitations imposed on 501(c)(15) entities.

Financial modeling forms the cornerstone of this planning phase. Develop detailed projections that account for premium income, investment returns, operating expenses, and claims forecasts - ensuring operations remain below the $600,000 gross receipts threshold. These models should demonstrate sustainable operations while maintaining the required premium income percentage above 35% of gross receipts.

During this stage, assemble a team of subject matter experts including:

- Insurance actuaries to analyze risk and premium structures

- Tax professionals with exempt organization experience

- Legal counsel specializing in insurance regulation

- Industry experts familiar with the specific insurance niche

Get started with a free consultation from our expert to establish company in Delaware!

Legal entity formation and state insurance requirements

Formation of a 501(c)(15) organization typically begins with creating a mutual insurance company under state law. This process varies significantly across jurisdictions but generally requires filing articles of incorporation that specifically establish the entity as a mutual insurer with member ownership and control rights clearly defined.

State insurance departments impose stringent requirements before granting operating authority:

- Minimum capital and surplus requirements (often $250,000-$500,000)

- Detailed business plans with 3-5 year projections

- Background checks on officers and directors

- Actuarial certifications of proposed rates and coverages

- Evidence of reinsurance arrangements

The organization must also develop comprehensive bylaws addressing:

- Membership qualification criteria

- Governance structure and voting rights

- Premium setting mechanisms

- Procedures for returning excess premiums

- Dissolution provisions specifying asset distribution to members

IRS application process using Form 1024

Securing formal recognition of 501(c)(15) status requires submitting Form 1024 (Application for Recognition of Exemption Under Section 501(a)) to the IRS with comprehensive supporting documentation. The application package must demonstrate that the organization satisfies all statutory requirements.

Essential components of a complete application include:

- Signed Form 1024 with all required schedules

- User fee payment (currently $600)

- Articles of incorporation and bylaws

- Sample insurance policies or certificates

- Financial statements and projections

- Detailed narrative description of operations

- Evidence of state insurance licensure

The narrative portion requires particular attention, explaining clearly how the organization meets each qualification requirement, especially the revenue limitations and mutual structure provisions. After submission, the IRS typically takes 3-6 months to review applications, often requesting supplemental information to clarify specific aspects of operations. Organizations should prepare for this follow-up by maintaining comprehensive documentation of all aspects described in the application.

Operational compliance and ongoing IRS requirements

Maintaining tax-exempt status for a 501(c)(15) organization requires vigilant operational compliance and adherence to IRS reporting obligations. Organizations must implement systematic monitoring processes to preserve their valuable tax exemption while fulfilling their mission of providing cost-effective insurance to members.

Annual tax filing requirements

501(c)(15) organizations must file annual returns with the IRS using the appropriate Form 990-series document. The specific form required depends on the organization's size and gross receipts:

- Form 990-N (e-Postcard) for organizations with gross receipts ≤$50,000

- Form 990-EZ for organizations with gross receipts <$200,000 and total assets <$500,000

- Form 990 for larger organizations

These returns must be submitted by the 15th day of the fifth month following the close of the organization's fiscal year. For calendar-year organizations, this deadline falls on May 15th. The filing provides transparency regarding operations, finances, and continued qualification for exempt status.

Organizations should establish reliable filing systems with appropriate reminders, as failure to file required returns for three consecutive years results in automatic revocation of tax-exempt status. This automatic revocation creates significant complications, requiring a complete reapplication process through Form 1024 to restore exempt status.

Maintaining qualification through revenue management

501(c)(15) organizations must implement robust financial monitoring systems to ensure ongoing compliance with qualification requirements. Two critical thresholds require continuous attention:

- Gross receipts must remain at or below $600,000 annually

- Premium income must constitute more than 35% of gross receipts

Organizations should conduct quarterly financial reviews, with more frequent monitoring as year-end approaches. This proactive approach helps identify potential compliance issues before they jeopardize tax-exempt status. Some organizations implement strategic operational adjustments when approaching revenue thresholds, including:

- Deferring certain income to subsequent tax years

- Modifying premium structures

- Timing certain financial transactions to maintain compliance

These strategies must be implemented with appropriate legal and accounting guidance to ensure they comply with both tax law and accounting principles. Improper management of these thresholds can result in unexpected loss of exempt status and substantial tax liabilities.

Member relations and governance best practices

Member control and appropriate governance practices form essential elements of 501(c)(15) compliance. Organizations must maintain proper member relations through:

- Regular policyholder voting procedures

- Democratic processes for management selection

- Transparent communication regarding organizational decisions

The mutual structure requires systems to track and calculate excess premiums for return to policyholders through:

- Policyholder dividends

- Reduced renewal premiums

- Other equitable distribution mechanisms

Board meetings should thoroughly document decisions regarding reserves and premium adjustments, demonstrating that the organization provides insurance at cost rather than accumulating excessive profits. Minutes should reflect discussions about member needs, claim patterns, and premium adequacy.

Governance documents require periodic review to ensure they reflect current operations and comply with both state law and IRS requirements for mutual organizations. This includes bylaws, policies and procedures, and organizational structure documentation. Well-maintained governance documentation provides critical evidence of compliance during IRS examinations.

Comparing 501(c)(15) with alternative insurance structures

Business owners seeking optimal insurance structures must understand how 501(c)(15) organizations compare to alternative options. Different insurance structures provide varying tax treatments, operational flexibility, and regulatory requirements.

501(c)(15) vs. Commercial insurance companies

Commercial insurance companies and 501(c)(15) organizations operate under fundamentally different models and incentive structures. While commercial insurers pursue profit for shareholders, 501(c)(15) organizations provide insurance substantially at cost for members who collectively own the organization.

Commercial insurers face full corporate taxation but enjoy unlimited operational scope. They can offer any insurance product, serve any market segment, and grow without size restrictions. Their profit-driven model allows them to raise capital through various mechanisms, including equity offerings, debt financing, and retained earnings. In contrast, 501(c)(15) organizations receive complete tax exemption but must operate within strict size limitations and maintain mutual ownership structures.

Key differences include:

- Tax Treatment: Complete exemption for 501(c)(15) vs. full corporate taxation for commercial insurers

- Size Limitations: Strict caps for 501(c)(15) vs. unlimited growth potential for commercial insurers

- Governance: Member control for 501(c)(15) vs. shareholder control for commercial entities

- Purpose: Service at cost for 501(c)(15) vs. profit maximization for commercial companies

501(c)(15) vs. 831(b) small insurance companies

Both 501(c)(15) and 831(b) companies offer tax advantages for small insurance operations, but with significant differences in structure and limitations. This comparison helps organizations determine which option better suits their specific needs and growth projections.

The 501(c)(15) structure provides complete tax exemption on all income, while 831(b) companies (often called micro-captives) pay no tax on underwriting income but remain taxable on investment earnings. The premium threshold represents another key difference: 831(b) companies can accept up to $2.45 million in annual premiums (indexed for inflation), substantially higher than the $600,000 gross receipts limit for 501(c)(15) organizations.

Organizations considering these alternatives should evaluate:

| Feature | 501(c)(15) | 831(b) small insurer |

|---|---|---|

| Premium capacity | $600,000 gross receipts | $2.45 million (indexed) |

| Tax on operating income | Exempt | Exempt |

| Tax on investment income | Exempt | Taxable |

| Ownership requirements | Mutual structure is typically required | More flexible ownership options |

| Growth potential | Severely limited by the receipts cap | Moderate growth capacity |

Organizations anticipating significant growth or substantial investment income might prefer the 831(b) election despite its partial taxation, as the higher premium capacity provides greater operational flexibility.

501(c)(15) vs. Risk retention groups and other alternatives

Risk Retention Groups (RRGs) provide a mechanism for businesses in similar industries to jointly insure against liability risks across state lines. While RRGs benefit from streamlined regulatory requirements under the federal Liability Risk Retention Act, they lack the tax exemption available to 501(c)(15) organizations. Self-insurance arrangements maximize control over claims management and risk financing but typically lack tax advantages and require substantial capital reserves.

Other alternatives include:

- Insurance purchasing groups: Aggregate buying power for better commercial rates without forming an actual insurer

- 501(c)(12) cooperative insurance: Alternative tax-exempt option for certain insurance types, particularly in rural areas

- Captive insurance companies: Parent-owned insurers that offer various tax and risk management benefits with more flexible structures

Each structure presents different trade-offs regarding:

- Tax treatment and potential advantages

- Regulatory compliance obligations

- Capitalization requirements

- Operational flexibility and limitations

- Governance structures and control

The optimal choice depends on the organizing group's specific insurance needs, financial resources, growth plans, and risk appetite. Organizations should conduct a thorough analysis with qualified insurance and tax professionals before selecting their insurance structure.

FAQs about 501(c)(15) organizations

- Is a 501(c)(15) organization a type of tax-exempt small insurance company?

Yes, 501(c)(15) status applies to small insurance companies or associations that are tax-exempt under IRS rules. - Do 501(c)(15) organizations operate on a mutual basis?

Yes, many 501(c)(15) organizations are mutual insurance companies where members share ownership and risks. - Are 501(c)(15) organizations limited in annual revenue to qualify?

Yes, mutual insurance companies must have annual revenue under $150,000, and stock-owned companies under $600,000 to qualify. - Can stock-owned insurance companies qualify for 501(c)(15) status?

Yes, small stock-owned insurance companies can qualify if they meet the revenue and premium requirements. - Is participation in 501(c)(15) organizations often restricted geographically?

Yes, many 501(c)(15) associations restrict membership to individuals within a particular county or region. - Do 501(c)(15) organizations mainly provide property damage coverage?

Yes, the majority offer property damage insurance, though some also provide burial, funeral, or marine insurance benefits. - Are 501(c)(15) organizations subject to federal income tax?

No, qualifying 501(c)(15) organizations are exempt from federal income tax under IRS regulations. - Do 501(c)(15) organizations have to be incorporated?

Yes, these organizations are typically incorporated entities organized to provide insurance services. - Can 501(c)(15) organizations distribute profits to members?

No, as tax-exempt entities, their earnings generally must be used to benefit the members and not distributed as profits. - Is the 501(c)(15) status limited to insurance companies only?

Yes, this IRS classification specifically covers small insurance companies or associations, not other nonprofit types.

For those navigating the intricate tapestry of tax benefits and eligibility requirements, this designation serves as a great opportunity. By understanding mutual insurance company formation, professionals can craft bespoke, compliant structures that align with their strategic goals. Embrace the potential within 501(c)(15), where innovation meets financial prudence, unlocking new horizons for small insurance ventures.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom