A 501(c)(11) organization plays a vital role in securing the future of educators and public employees through specialized retirement funds. These funds, blending legal requirements, tax-exempt benefits, and nonprofit compliance, serve as the backbone for those detail-oriented professionals driving public service and fiduciary excellence. Understanding the nuances between a 501(c)(11) and other nonprofit types helps optimize fund management and avoid regulatory pitfalls.

This content is provided for general informational purposes to help entrepreneurs understand the basics of 501(c)(11) organizations, especially Teachers’ Retirement Fund Associations. We specialize in company formation, not in providing legal or tax advice for U.S. nonprofit compliance. For specific guidance on compliance, please consult a qualified nonprofit or legal expert.

What is a 501(c)(11) organization?

A 501(c)(11) organization is a specialized tax-exempt entity formally recognized by the Internal Revenue Service (IRS) as a Teachers' Retirement Fund Association. These organizations exist specifically to manage and administer retirement funds for teachers at the state or local levels.

Formal definition and legal meaning

501(c)(11) organizations operate within a specific legal framework established by the Internal Revenue Code. Unlike broader nonprofit categories, 501(c)(11) associations serve a singular, focused purpose within the educational sector's financial infrastructure. They receive federal income tax exemption provided they function exclusively to manage teachers' retirement funds while adhering to strict IRS governance and reporting standards.

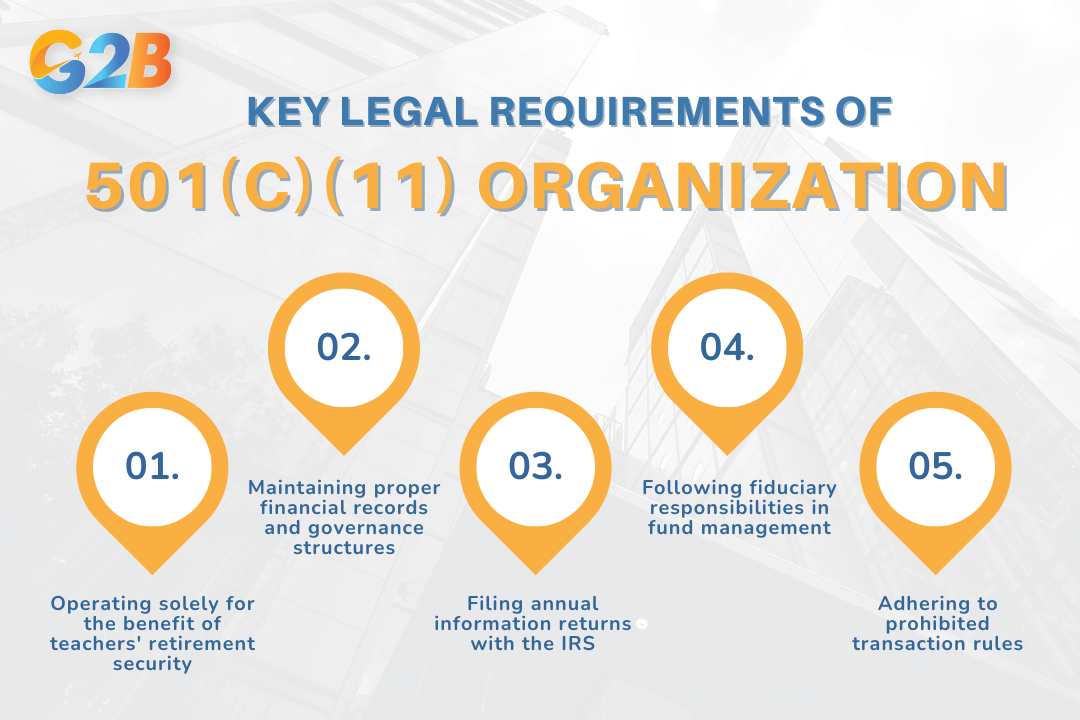

Key legal requirements include:

- Operating solely for the benefit of teachers' retirement security

- Maintaining proper financial records and governance structures

- Filing annual information returns with the IRS

- Following fiduciary responsibilities in fund management

- Adhering to prohibited transaction rules

Key legal requirements of 501(c)(11) organization

These organizations must demonstrate their exclusive dedication to teacher retirement fund management. The IRS closely monitors their activities to ensure compliance with the narrow statutory purpose that justifies their tax-exempt status.

Need a reliable Delaware incorporation service? Contact G2B for a free consultation!

Simple explanation for nonprofit leaders and entrepreneurs

A 501(c)(11) functions as a specialized nonprofit trust or association that collects contributions, invests retirement savings for teachers, and distributes benefits upon retirement. The organizational structure requires a board of trustees that oversee operations, investment committees that manage asset allocation, and administrative staff who handle day-to-day member services. Unlike general nonprofits, 501(c)(11) organizations focus exclusively on retirement fund management rather than charitable activities.

The organization serves as a financial steward for educators' future security. These entities typically:

- Collect regular contributions from active teachers

- Manage investment portfolios to grow retirement assets

- Process retirement benefit applications and payments

- Maintain records of member contributions and earnings

- Communicate regularly with members about fund performance

Types and structures of 501(c)(11) organizations

501(c)(11) organizations exhibit diverse structural models while maintaining their core purpose of serving teachers' retirement needs. It can significantly impact the effectiveness in managing retirement funds for educators across various jurisdictions.

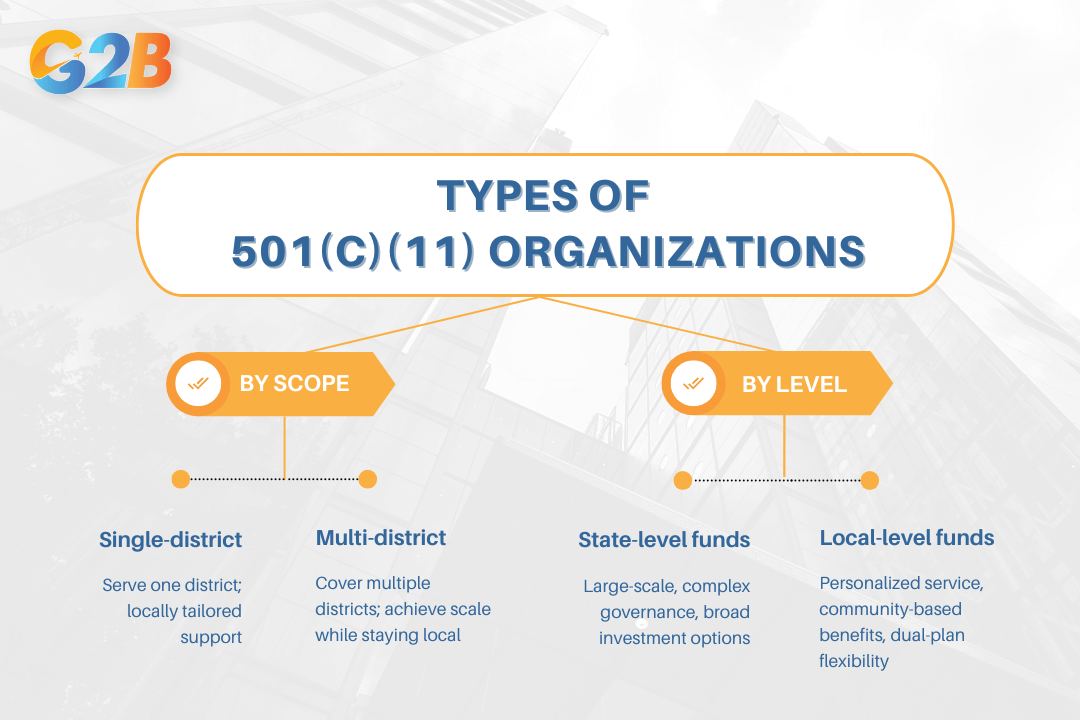

Single-district vs. Multi-district associations

Single-district 501(c)(11) organizations focus their services exclusively on teachers within one school district, creating a concentrated support system tailored to local needs. These associations maintain the "purely local character" requirement stipulated by IRS regulations while serving a clearly defined membership base. Their governance structures typically reflect local educational priorities and financial considerations. Multi-district associations, by contrast, expand their service area to encompass several adjacent districts, creating economies of scale while maintaining the "local character" requirement.

State-level vs. Local-level funds

State-level 501(c)(11) funds manage substantially larger asset pools and typically feature more complex governance structures than their local counterparts. Eight states - Florida, Indiana, Michigan, Ohio, Pennsylvania, South Carolina, Utah, and Washington - offer multiple retirement plan options for teachers, requiring educators to make significant financial choices about their futures. These larger entities benefit from expanded investment opportunities and administrative efficiencies.

Local-level funds often provide more personalized service and tailored benefits reflective of community needs and priorities. In states like Illinois, Minnesota, Missouri, and New York, both statewide teacher plans and separately managed municipal teacher plans coexist. A notable advantage of this dual system includes provisions allowing educators to combine service credit earned across different retirement systems, enhancing career flexibility while maintaining retirement security.

Types and structures of 501(c)(11) organizations

Key roles: Trustees, administrators, and members

Boards of trustees serve as the fiduciary backbone of 501(c)(11) organizations, bearing responsibility for investment decisions and organizational oversight. These boards typically comprise elected or appointed representatives who ensure the fund adheres to its legal obligations while maximizing returns for beneficiaries. Their decisions directly impact the long-term financial health of the retirement fund.

Administrators handle the day-to-day operational aspects of 501(c)(11) organizations, including:

- Processing retirement applications

- Managing contribution records

- Coordinating benefit distributions

- Ensuring regulatory compliance

Members primarily consist of teachers, though some school employees may receive incidental inclusion. The organization must maintain strict compliance with the prohibition against private inurement, ensuring no individual benefits from net earnings except through legitimate retirement distributions. Filing requirements vary based on organizational size:

- Form 990-N: For organizations with gross receipts ≤$50,000

- Form 990-EZ: For gross receipts <$200,000 and assets <$500,000

- Form 990: For gross receipts ≥$200,000 or assets ≥$500,000

Key benefits and importance of 501(c)(11) status

The 501(c)(11) organization designation offers substantial advantages for teachers' retirement fund associations. The benefits extend beyond mere tax advantages to include operational efficiencies that serve teachers and the educational community.

Tax exemption and financial advantages

501(c)(11) organizations benefit from complete exemption from federal income tax on their investment earnings. This tax-free status allows retirement funds to accumulate assets more efficiently, creating a compounding effect that significantly benefits members over time. The tax exemption applies specifically to income derived from three primary sources: Public taxation, contributions from teaching salaries, and investment returns. This financial advantage translates directly into stronger retirement security for teachers, as more capital remains working within the fund rather than being diverted to tax payments.

Operational and fiduciary benefits

The 501(c)(11) structure establishes a centralized management framework with clear fiduciary responsibilities. This creates a robust governance system where retirement assets receive professional oversight and protection from misuse or diversion. The strict operational parameters of these organizations serve as guardrails that ensure funds remain dedicated solely to providing retirement benefits. This focused mission prevents mission drift and keeps administrators accountable to members' long-term interests.

Key operational benefits include:

- Structured investment management protocols

- Clear fiduciary responsibility chains

- Protection from creditors of the sponsoring educational institutions

- Limited scope that prevents expansion into unrelated activities

- Local character that ensures administrators understand the specific needs of their teacher population

Key operational benefits of the 501(c)(11) status

Credibility and stakeholder trust

IRS recognition through 501(c)(11) status signals compliance with rigorous federal standards, instantly conveying legitimacy to all stakeholders. This official designation demonstrates the fund's commitment to proper governance and financial management. The credibility boost from proper classification affects multiple stakeholder relationships:

- Teachers gain confidence in the security of their retirement assets

- Educational employers benefit from enhanced recruitment and retention

- Regulatory bodies recognize the organization's commitment to compliance

- Financial partners view the fund as a stable, properly governed entity

The structure's clearly defined purpose - providing retirement benefits exclusively for teachers - further strengthens stakeholder trust by eliminating concerns about conflicting priorities or mission confusion. This singular focus on teacher retirement security creates a foundation of confidence that supports the entire educational ecosystem.

Disadvantages, limitations, and common misconceptions

While 501(c)(11) organizations offer significant tax advantages for teachers' retirement funds, they also face considerable restrictions and compliance burdens. Understanding these challenges is essential to manage a 501(c)(11) organization.

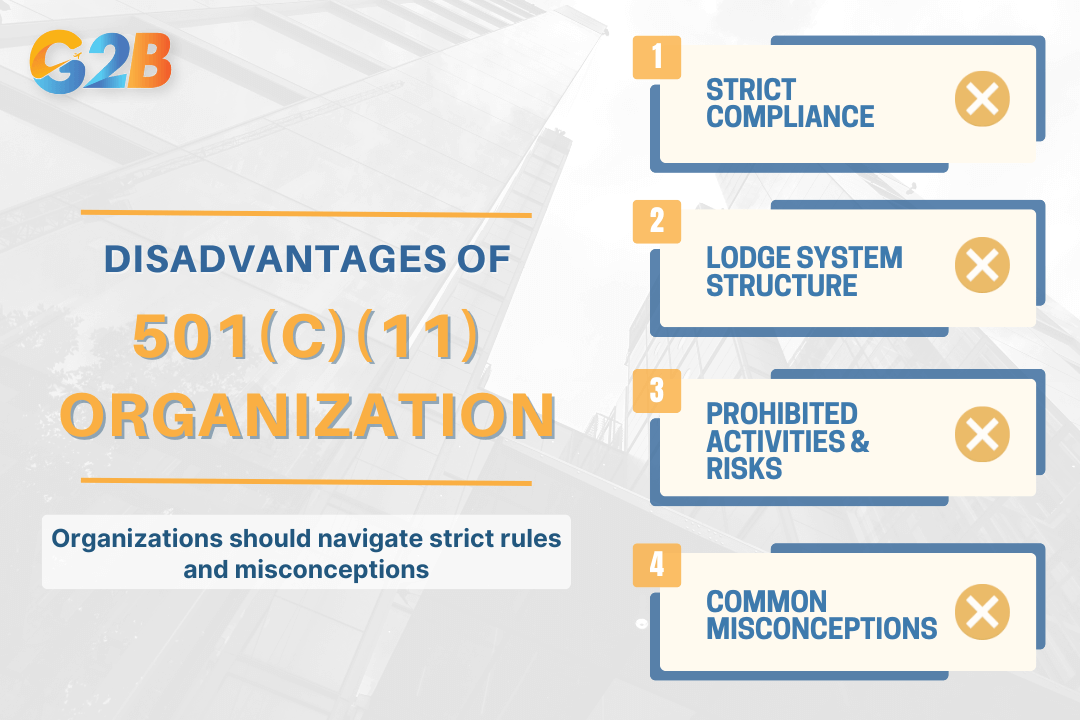

Key disadvantages of the 501(c)(11) organizations

Strict compliance and reporting requirements

501(c)(11) organizations bear substantial reporting obligations that demand meticulous record-keeping and timely submissions. These organizations must file annual reports with both state authorities and the IRS by specified deadlines to maintain their tax-exempt status. The requirements include:

- Statement of Information (Form SI-100) submissions every two years

- Annual Registration Renewal Fee Reports (RRF-1) filed within four months and 15 days after the fiscal year ends

- Filing fees ranging from $25 to $1,200 based on total organizational revenue

- Annual Treasurer's Reports (CT-TR-1) for organizations with gross receipts under $50,000

Failure to comply with these requirements carries serious consequences, including financial penalties and potential revocation of tax-exempt status. Many organizations find they need dedicated staff or professional assistance to manage these ongoing compliance obligations effectively.

Operational limitations and fiduciary risks

501(c)(11) retirement fund associations operate under significant restrictions that limit their flexibility. Unlike commercial enterprises, these organizations:

- Cannot distribute profits to members beyond reasonable compensation

- Face strict limitations on income sources and asset utilization

- Must prevent personal use of organizational assets

- Cannot allow departing individuals to claim organizational assets

The fiduciary responsibilities are particularly stringent. Board members and administrators must avoid conflicts of interest and prevent any form of private inurement - the improper use of organizational assets for personal gain. Organizations that engage in prohibited activities such as political campaigning or excessive lobbying risk losing their exempt status and facing substantial penalties.

| Prohibited activities | Potential consequences |

|---|---|

| Private inurement | Loss of tax-exempt status |

| Political campaigning | Penalties and taxes |

| Excessive lobbying | Revocation of 501(c)(11) status |

| Unrelated business activities | Unrelated business income tax |

Common misconceptions

Many misconceptions surround 501(c)(11) status, leading organizations to pursue this designation without fully understanding its implications. The most prevalent misunderstanding involves confusing 501(c)(11) with other exempt categories - particularly 501(c)(3) charitable organizations. Unlike 501(c)(3) entities, 501(c)(11) organizations serve the exclusive purpose of managing teachers' retirement funds and cannot engage in broader charitable activities. Other common misconceptions include:

- The belief that tax exemption eliminates all tax and reporting obligations

- Assuming founders maintain personal control over the organization

- Expecting pass-through tax treatment similar to S-Corporations

- Underestimating the significant time, effort, and expense required for formation

- Overlooking that organizational finances remain open to public scrutiny

Additionally, smaller organizations often fail to recognize that the advantages of 501(c)(11) status may not outweigh the administrative burden for modestly sized teachers' retirement funds.

How to start a 501(c)(11) teachers' retirement fund association

Establishing a 501(c)(11) organization requires meticulous planning and strict adherence to specific IRS requirements. The formation process involves several critical steps, from confirming eligibility to navigating federal and state regulations.

Eligibility and qualification criteria

Teachers' retirement fund associations must meet strict qualification standards to obtain 501(c)(11) status. The organization must exclusively serve teachers' retirement needs and maintain a local character in its operations. The IRS mandates that eligible organizations have a clearly defined membership limited primarily to teachers and educational staff.

Income sources face significant restrictions, with funding limited to three categories: Public taxation, salary-based member assessments, and investment earnings. The association cannot engage in substantial business activities beyond managing retirement investments. Additionally, net earnings must benefit only the retirement fund members rather than private individuals outside the intended beneficiary group.

Governing documents and organizational structure

Successful 501(c)(11) organizations require comprehensive governing documents that establish clear operational parameters. Founders must develop detailed bylaws defining membership criteria, board composition, and fiduciary responsibilities. The organizational structure must include designated trustees or officers with specific roles in fund oversight and management.

Trust agreements or articles of incorporation serve as essential organizing documents that must be properly executed and filed with the appropriate state officials. These documents should clearly articulate:

- The organization's exclusive purpose of providing teacher retirement benefits

- Governance structure and leadership roles

- Fiduciary standards and investment policies

- Membership eligibility requirements

- Fund distribution procedures

Supporting documentation should include meeting procedures, election protocols, and specific fiduciary guardrails to ensure prudent fund management.

IRS application process (Form 1024)

Securing 501(c)(11) tax-exempt status requires submitting Form 1024 to the Internal Revenue Service. This comprehensive application package must include:

- Completed Form 1024 with all required sections

- Organizing documents (articles, trust agreements)

- Bylaws and governance policies

- Detailed description of past, present, and planned activities

- Financial statements and projections

The IRS review process evaluates whether the organization meets all statutory requirements for 501(c)(11) classification. After approval, organizations face ongoing compliance obligations, including annual filing of the appropriate Form 990 series based on organizational size and financial activity.

State and local compliance considerations

Beyond federal requirements, 501(c)(11) organizations must navigate state and local regulations. State laws frequently impose additional compliance obligations, including:

- Registration with state nonprofit or financial regulatory agencies

- State-specific incorporation or trust documentation

- Annual financial reporting and disclosures

- Regular audits or regulatory examinations

- Fiduciary standards specific to retirement fund management

Local jurisdictions may require permits, licenses, or additional registrations before the fund can begin operations. Organizations should conduct thorough research on specific state requirements, as these vary significantly nationwide and may include specialized regulations for retirement fund associations operating within educational systems.

Compliance, reporting, and ongoing management

Maintaining tax-exempt status for a 501(c)(11) organization requires diligent adherence to regulatory requirements and implementation of strong governance practices. The following framework outlines essential reporting obligations and management practices.

Annual IRS reporting and audits

501(c)(11) organizations must file Form 990 annually with the IRS, typically due by the 15th day of the fifth month after the organization's fiscal year ends. This crucial filing provides transparency about the organization's operations, governance, and financial activities. The form requires detailed information about:

- Financial statements and fund performance

- Board composition and leadership structure

- Compensation of key employees and officers

- Investment policies and asset allocation

- Operational activities and program accomplishments

Many Teachers' Retirement Fund Associations also undergo independent financial audits, either voluntarily or as required by state regulations. These audits verify financial statement accuracy, assess internal controls, and identify potential compliance issues before they develop into serious problems. Establishing a compliance calendar with clearly defined deadlines helps organizations avoid penalties for late or incomplete filings.

Fiduciary duties and risk management

Board members of 501(c)(11) organizations hold significant legal and ethical responsibilities to their beneficiaries. These fiduciary duties include:

- Duty of care: Making informed, prudent decisions based on thorough research and consideration

- Duty of loyalty: Placing the organization's interests above personal gain and avoiding conflicts of interest

- Duty of obedience: Following governing documents, laws, and regulations applicable to retirement funds

Effective risk management requires implementing comprehensive investment policies that:

- Define acceptable risk tolerance levels

- Establish diversification requirements

- Set performance benchmarks and evaluation criteria

- Create procedures for selecting and monitoring investment managers

Documentation of decision-making processes provides critical protection during regulatory reviews. Many successful 501(c)(11) organizations implement enterprise risk management frameworks that systematically identify, assess, and mitigate threats to organizational stability and beneficiary assets.

Best practices for governance and oversight

Strong governance structures form the foundation of well-managed 501(c)(11) organizations. Implementing these best practices strengthens oversight and reduces compliance risks:

| Governance element | Key implementation strategies |

|---|---|

| Board composition | Recruit trustees with diverse expertise in finance, law, education, and retirement planning |

| Policy framework | Develop and regularly update conflict of interest, investment, and records retention policies |

| Performance evaluation | Conduct annual board self-assessments and independent governance reviews |

| Fiduciary education | Require ongoing training for board members on retirement fund management and compliance |

| Transparency | Communicate clearly with stakeholders about fund performance and governance practices |

Regular governance reviews help identify weaknesses before they become compliance issues. The most successful Teachers' Retirement Fund Associations establish ethics committees that oversee policy implementation and address potential conflicts of interest. These organizations also maintain detailed minutes of board meetings that document the rationale for key decisions, particularly those involving investment strategies or benefit administration.

Simplify your business launch with our Delaware incorporation service - Start your application today!

501(c)(11) vs. Other 501(c) nonprofit types

501(c)(11) organizations differ fundamentally from other tax-exempt entities. Understanding these distinctions helps organizations select the appropriate tax-exempt classification and maintain compliance with federal regulations.

501(c)(11) vs. 501(c)(3) (charitable organizations)

501(c)(11) organizations operate with a singular focus - managing retirement funds for teachers. Their mission centers exclusively on this specific financial function, creating a narrow but deep specialization in retirement asset management for educational professionals. 501(c)(3) organizations, by contrast, encompass a broad spectrum of charitable, religious, educational, and scientific purposes. These represent approximately two-thirds of all registered nonprofits in the United States and can receive tax-deductible contributions from donors, a significant advantage not available to 501(c)(11) entities.

While a 501(c)(11) organization must exclusively serve teachers' retirement needs, 501(c)(3) organizations may engage in diverse charitable activities ranging from hunger relief to environmental conservation. Key differences include:

- Donor benefits: Contributions to 501(c)(3)s are tax-deductible; contributions to 501(c)(11)s are not

- Mission scope: 501(c)(11)s have a single-purpose mission; 501(c)(3)s can have diverse charitable purposes

- Funding models: 501(c)(11)s primarily manage retirement assets; 501(c)(3)s often rely on donations and grants

501(c)(11) vs. 501(c)(5) and 501(c)(6) (labor and business leagues)

Labor organizations under 501(c)(5) status focus on improving working conditions and educational opportunities within specific industries. Meanwhile, 501(c)(6) organizations serve business interests through trade associations, chambers of commerce, and professional leagues. These entities work to improve business conditions for entire industries rather than individual companies. 501(c)(11) organizations differ from both classifications in several important ways:

| Classification | Primary purpose | Typical activities | Member focus |

|---|---|---|---|

| 501(c)(11) | Teachers' retirement fund management | Investment management, benefit administration | Teachers only |

| 501(c)(5) | Labor and industry improvement | Advocacy, education, and collective bargaining | Workers in specific industries |

| 501(c)(6) | Business condition improvement | Networking, advocacy, and professional development | Business entities or professionals |

While 501(c)(5) and 501(c)(6) organizations may engage in political activities and lobbying to advance their causes, 501(c)(11) associations must maintain a strict focus on fund management without political engagement.

Choosing the right IRS classification

Selecting the appropriate tax-exempt classification requires a thorough evaluation of an organization's primary purpose, operational structure, and long-term objectives. Misclassification can lead to significant compliance issues and potential loss of tax-exempt status. Organizations must consider these critical factors:

- Core mission alignment: Does the primary purpose match the classification requirements?

- Funding structure: How will the organization receive and manage funds?

- Governance requirements: Different classifications have varying governance standards

- Political activity restrictions: Some classifications permit limited lobbying; others prohibit it entirely

- Reporting obligations: Annual filing requirements vary by classification

For organizations exclusively focused on managing retirement funds for teachers, 501(c)(11) provides the appropriate classification. Organizations with broader missions should carefully review alternative classifications like 501(c)(3), 501(c)(4), or others that better align with their operational objectives and activities.

Frequently asked questions (FAQ) about 501(c)(11) organizations

- Are 501(c)(11) organizations funded by taxes?

Yes. These organizations are locally organized and receive funding through taxes, member contributions, and investment revenue to manage retirement benefits for teachers and school employees. - Do 501(c)(11) organizations provide retirement benefits?

Yes. Their primary purpose is to manage and provide retirement fund benefits for teachers and other school employees within a local jurisdiction. - Must 501(c)(11) organizations file annual IRS returns?

Yes. Like most tax-exempt organizations, they must file annual information returns such as Form 990 to maintain their tax-exempt status. - Can 501(c)(11) organizations operate outside the education sector?

No. They are specifically established to manage retirement funds for teachers and related school employees, not for other industries or purposes. - Are donations to 501(c)(11) organizations tax-deductible?

No. Contributions to 501(c)(11) organizations are not considered charitable donations and generally are not tax-deductible for donors. - Can 501(c)(11) organizations invest their funds?

Yes. They invest member contributions and tax revenues to generate income to support retirement benefits for their members. - Are 501(c)(11) organizations governed by federal law?

Yes. They are recognized under IRS code section 501(c)(11) and must comply with federal tax regulations for tax-exempt organizations. - Do 501(c)(11) organizations serve individual members directly?

Yes. They serve individual members-teachers and school employees-by managing their retirement funds and benefits. - Can 501(c)(11) organizations engage in political activities?

No. Like most tax-exempt organizations, they are prohibited from participating in political campaigns or endorsing candidates to maintain tax-exempt status.

501(c)(11) organizations operate as standalone entities with specific legal parameters designed for teacher retirement security. This entity, pivotal in fostering teachers' retirement funds, ensures compliance with legal frameworks while delivering vital tax benefits. The seamless management of such organizations exemplifies a commitment to responsible stewardship and financial prudence, nurturing hope and security for educators.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom