Understanding a 501(c)(18) organization can unlock unique benefits for those crafting retirement solutions for unionized workforce sectors. These trusts, deeply rooted in labor law, offer tax advantages while fostering compliance and long-term security for employee contributions. Exploring the legal and tax dimensions of 501(c)(18) organizations empowers professionals to design robust, compliant financial strategies. In this article, let’s break down the definition and explore the key benefits of 501(c)(18) organizations.

This article is provided for general informational purposes to help entrepreneurs understand the basics of 501(c)(18) organizations, especially those related to pension trusts established before June 1959. We specialize in company formation, not in providing legal or tax advice for U.S. nonprofit compliance. For specific guidance on compliance, please consult a qualified nonprofit or legal expert.

What is a 501(c)(18) organization?

A 501(c)(18) organization is an employee-funded pension trust created before June 25, 1959. It is a specialized retirement plan primarily used in certain unionized trades and niche fields, predating modern retirement plans like 401(k)s.

Key characteristics of a 501(c)(18) organization

- Type: Employee-funded pension trust.

- Creation date: Must have been established before June 25, 1959.

- Funding: Funded solely by contributions from employees who are members of the plan.

- Tax status: Tax-exempt under IRS code 501(c)(18).

- Contributions: Made on an after-tax basis, meaning employees do not get an immediate tax deduction.

- Tax treatment: The money in the plan grows tax-deferred, but distributions in retirement are taxed as ordinary income.

- Usage: Rarely a primary retirement savings vehicle; often found in union contracts with specific terms such as employer matching, mandatory contributions, and vesting schedules.

- Legal requirements: A valid trust must be established under local law, as evidenced by an executed written document.

How 501(c)(18) organization differs from other retirement plans

- Contributions to a 501(c)(18) plan do not affect contribution limits on other retirement accounts like 401(k)s or IRAs, allowing employees to diversify their retirement savings tax treatment

- Because contributions are after-tax, there is no upfront tax deduction, unlike traditional retirement accounts

- The plan is a tax-exempt trust, meaning the growth of funds is tax-deferred until distribution

Need a reliable Delaware incorporation service? Contact G2B for a free consultation today!

Structural components and compliance essentials

Understanding the structural requirements of a 501(c)(18) organization helps trustees and administrators ensure continuous compliance and protect the retirement benefits of union members.

Written trust document and plan structure

Every 501(c)(18) organization must operate under a comprehensive written trust document created before June 25, 1959. This document serves as the legal foundation that defines the entire pension trust's operation, governance, and participant rights. The trust document must:

- Clearly outline beneficiary rights and responsibilities

- Establish specific contribution rules and limitations

- Detail trust operation procedures and fiduciary obligations

- Comply with IRS requirements for tax exemption

- Exist as valid under applicable local trust laws

These trusts may be structured as either a corporation or a trust entity, but regardless of form, they must incorporate a formal plan for paying benefits under the pension arrangement. The formality of this document cannot be overstated - it represents the contractual backbone of the entire 501(c)(18) organization.

Limits and rules of employee contributions

Unlike many retirement vehicles, 501(c)(18) pension trusts operate under unique contribution restrictions. Only union employees who are members of the plan may contribute funds, with employer contributions strictly prohibited. Key contribution rules include:

- Contributions must be made with after-tax dollars

- Trust funds must derive solely from employee contributions

- "Contributions" legally include earnings and gains derived from employee-contributed assets

- All contributions must follow the specific rules outlined in the trust document

- Contributions support supplemental unemployment compensation benefits

These distinctive funding mechanisms separate 501(c)(18) organizations from more common retirement plans like 401(k)s, which typically allow employer matching and pre-tax contributions. Participants must understand these limitations when planning their retirement strategy.

IRS and local law compliance

Maintaining a 501(c)(18) organization's tax-exempt status demands rigorous ongoing compliance efforts. Trustees must navigate dual compliance frameworks at both the federal and local levels. Essential compliance requirements include:

- Filing Form 1024 for the initial tax exemption application

- Submitting annual Form 990 or 990-EZ returns

- Meeting all requirements in section 501(c)(18) (A), (B), and (C)

- Maintaining status as a valid trust under local jurisdiction

- Following appropriate recordkeeping protocols

- Adhering to ERISA deadlines and disclosure requirements

Unlike 501(c)(3) organizations, these pension trusts generally don't need to report donor information. However, regular operational compliance checks remain crucial to prevent penalties or potential loss of tax-exempt status. Regular legal reviews and fiduciary oversight help ensure these grandfathered plans continue serving their intended purpose.

Roles and responsibilities in 501(c)(18) organizations

The successful operation of a 501(c)(18) organization requires clear delineation of duties among key stakeholders. Each participant plays a distinct role in maintaining the tax-exempt status and operational integrity of these legacy retirement vehicles.

Each participant plays a distinct role in a 501(c)(18) organization

Trust fiduciaries - Duties and liabilities

Trust fiduciaries in 501(c)(18) organizations bear significant legal responsibilities that directly impact plan viability. These individuals, typically trustees or union officers, must act exclusively in the best interests of plan participants while fulfilling numerous regulatory obligations. Fiduciaries must ensure the trust operates under a valid, executed written document that complies with local trust law. They bear personal liability for maintaining operational compliance with IRS requirements, including the timely filing of all required documentation.

Trustees must avoid prohibited transactions such as self-dealing as defined in Section 4941(d), which could jeopardize the trust's tax-exempt status. Key fiduciary responsibilities include:

- Prudent investment of trust assets

- Regular monitoring of trust operations

- Accurate and timely distribution of benefits

- Proper supervision of administrative staff

- Maintenance of comprehensive documentation

Participants - Rights and responsibilities

Plan participants in 501(c)(18) organizations, predominantly union members, maintain both specific entitlements and obligations within the trust framework. Their contributions form the exclusive funding source for these retirement vehicles, distinguishing them from employer-sponsored alternatives. Participants possess the right to receive accurate, timely information about their accrued benefits, plan operations, and financial standing. They can request determination letters to verify the organization's qualified status.

However, participants must also adhere to established contribution protocols, including limitations on contribution amounts and timing. Participant entitlements include:

- Complete disclosure of plan provisions

- Regular statements of account status

- Fair and consistent application of benefit formulas

- Confidential handling of personal financial information

- Access to grievance procedures for disputes

Advisors - Legal and compliance

Specialized legal and compliance experts serve essential functions in 501(c)(18) organizations by guiding trustees through complex regulatory landscapes. These advisors help establish and maintain compliance with both IRS requirements and ERISA provisions applicable to grandfathered plans. Compliance advisors perform critical functions including document verification, regulatory monitoring, and operational audits. They help trustees avoid prohibited activities that could trigger tax penalties or endanger the trust's exempt status.

Legal experts ensure the trust avoids retaining excess business holdings, making improper investments, or engaging in taxable expenditures as defined in relevant tax code sections. Value provided by specialized advisors:

| Advisory function | Benefit to organization |

|---|---|

| Document creation/revision | Ensures legally sound trust instruments |

| Compliance monitoring | Prevents regulatory violations |

| Operational audits | Identifies potential issues before the IRS review |

| Regulatory updates | Keeps trustees informed of changing requirements |

| Dispute resolution | Minimizes litigation exposure |

Comparative analysis: 501(c)(18) vs. 401(k) vs. 501(c)(5)

The 501(c)(18) organization represents a specialized pension trust option with distinct characteristics compared to the more common 401(k) plans and 501(c)(5) labor organizations.

Eligibility and formation rules

The 501(c)(18) trusts remain exclusively available to unions with pension plans established before June 25, 1959. These plans require a formal written trust document and can only accept employee contributions - no employer funding is permitted. 401(k) plans, in contrast, enjoy widespread availability across industries and organization types. These employer-sponsored retirement vehicles have no historical cutoff date and allow contributions from both employees and employers. Most private-sector businesses can establish these plans regardless of union status.

501(c)(5) organizations serve an entirely different purpose - they function as operational entities for labor, agricultural, or horticultural organizations rather than retirement vehicles. Their formation focuses on supporting union activities, advocacy, and member services, not specifically pension management or retirement savings.

Tax treatment - Contributions and distributions

The tax implications across these plans create significant operational differences. 401(k) contributions typically occur pre-tax, reducing an employee's taxable income in the contribution year. This pre-tax advantage, combined with potential employer matching, makes 401(k)s tax-efficient during the accumulation phase. 501(c)(18) plans operate differently, accepting only after-tax employee contributions. While the trust itself maintains tax-exempt status and investments grow tax-deferred, the initial contribution doesn't provide immediate tax benefits.

Both 501(c)(18) and 401(k) distributions are taxed as ordinary income during retirement. 501(c)(5) organizations don't function as retirement vehicles at all. Their tax status relates to organizational operations rather than individual retirement savings. These entities receive tax exemption for conducting labor organization activities, not for providing retirement benefits to members.

Operational flexibility and limitations

401(k) plans offer superior flexibility in almost every operational aspect. They permit adjustable contribution levels, diverse investment options, employer matching capabilities, and portability through rollovers. Plan administrators can customize these plans to match organizational goals and employee needs.

501(c)(18) trusts operate under rigid constraints:

- No new plans can be created after June 25, 1959

- Only employee contributions permitted

- Limited flexibility in plan design

- No employer matching or contributions

- Fixed eligibility requirements tied to union membership

These structural limitations explain why 501(c)(18) trusts have declined as retirement vehicles while 401(k) plans have flourished. The 501(c)(5) designation serves entirely different operational purposes as an organizational tax status rather than a retirement vehicle, focusing on supporting union activities, not managing retirement assets.

Get expert guidance with G2B’s Delaware incorporation service today!

Key benefits and disadvantages of 501(c)(18) pension trusts

501(c)(18) organizations represent a specialized category of pension trusts with distinct advantages and limitations. Understanding both sides provides crucial context for union administrators, compliance officers, and pension fund managers.

Benefits - Tax, security, and bargaining strength

501(c)(18) pension trusts operate as tax-exempt entities, providing significant financial advantages for participating union members. Contributions flow into these trusts after taxation, but the assets grow tax-deferred until distribution during retirement, maximizing long-term accumulation potential. This tax structure creates efficient retirement pools that shield investment growth from immediate taxation.

The trust model reinforces collective bargaining power by centralizing retirement management under union administration. This arrangement creates greater negotiation leverage and establishes a unified financial voice for members. Many electricians, teamsters, and trade worker unions have leveraged these structures to secure retirement benefits through collective strength rather than individual arrangements.

Key protective features include:

- Equal access guarantees prevent discrimination against any member class

- Fiduciary requirements that mandate prudent fund management

- Strict anti-favouritism provisions preventing preferential treatment of highly compensated employees

- Oversight mechanisms ensuring transparent administration

501(c)(18) pension trusts provide significant advantages for participating union members

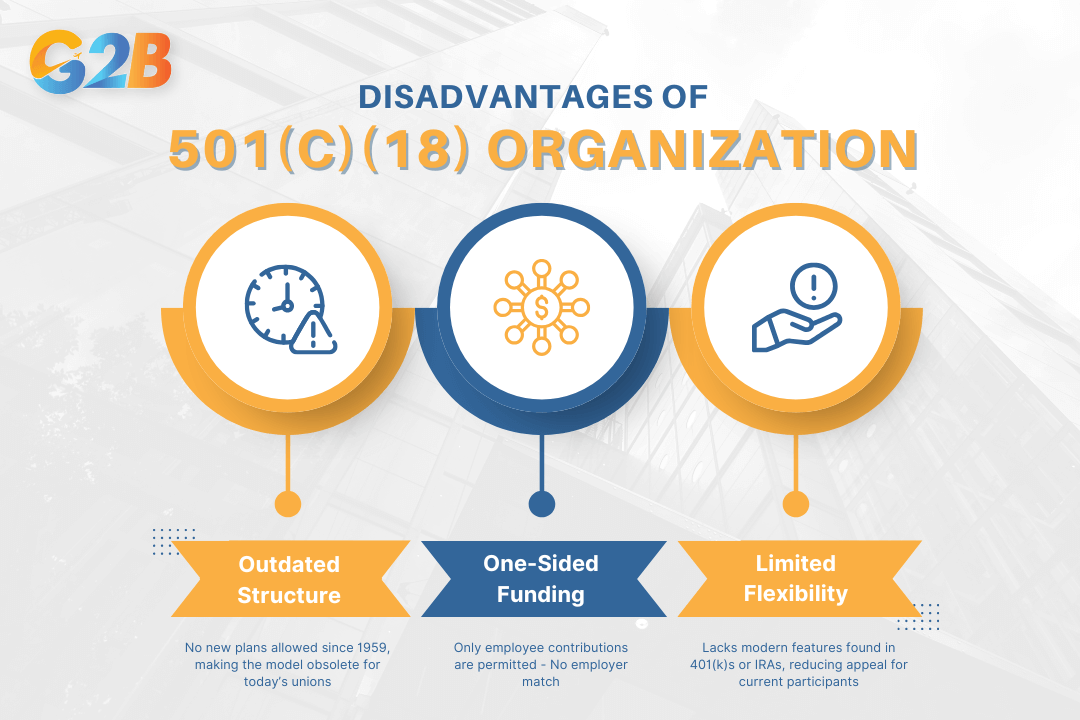

Disadvantages - Obsolescence and inflexibility

The primary limitation of 501(c)(18) pension trusts stems from their creation cutoff date. No new trusts can be established under this section after June 25, 1959, severely restricting their availability to modern unions. This regulatory constraint has effectively rendered the model obsolete for organizations seeking new retirement solutions.

These plans suffer from structural rigidity that modern retirement vehicles have overcome. They permit only employee contributions - employers cannot match or supplement funding - creating a one-sided financing model. This lack of employer participation places the entire financial burden on workers, contrasting sharply with contemporary 401(k) plans that often feature matching contributions and shared responsibility.

Additional disadvantages include:

| Limitation | Impact on participants |

|---|---|

| No employer contributions | Reduced total retirement accumulation |

| Limited investment options | Potentially lower returns and less diversification |

| Absence of loan provisions | No access to funds before retirement |

| Rigid withdrawal rules | Less flexibility for changing financial needs |

| Complex compliance requirements | Higher administrative costs and legal risks |

The combination of these restrictions makes 501(c)(18) trusts significantly less attractive than contemporary alternatives like 401(k)s, 403(b)s, or even IRA-based solutions that offer greater flexibility, potential employer participation, and modernized features that participants increasingly expect.

There are 3 main disadvantages of 501(c)(18) pension trusts

Common misconceptions and mistakes about 501(c)(18) organizations

Many union leaders, compliance officers, and financial professionals harbor misconceptions about these specialized pension trusts, leading to compliance violations and misguided planning.

501(c)(18) trusts can still be created today

The most pervasive misconception involves the belief that organizations can still establish new 501(c)(18) trusts. Federal regulations explicitly prohibit the formation of new 501(c)(18) pension trusts after June 25, 1959. This cutoff date represents a firm regulatory boundary that cannot be circumvented. Only pension trusts established before this date continue to operate legitimately under this tax code section. Organizations seeking to create employee retirement vehicles must explore alternative structures like 401(k)s, 403(b)s, or other modern pension options.

501(c)(18) plans mirror 401(k)s or IRAs

Many erroneously assume 501(c)(18) plans function similarly to more familiar retirement vehicles like 401(k)s or IRAs. The structural differences are substantial and consequential:

Key differences:

- Funding source: 501(c)(18) plans permit only employee contributions, while 401(k)s allow both employer and employee funding

- Investment flexibility: These trusts offer limited investment options compared to the diverse choices in modern retirement vehicles

- Contribution structure: Contributions are made after-tax, unlike the pre-tax options in many contemporary plans

- Purpose limitations: Funds can only be used for retirement benefits and minimal administrative expenses

Additionally, 501(c)(18) plans lack common features like employer matching contributions, hardship withdrawals, and the portability between employers that modern plans typically provide. These fundamental differences affect taxation, accessibility, and long-term growth potential.

Common operational mistakes

Organizations maintaining existing 501(c)(18) trusts frequently commit operational errors that threaten their tax-exempt status:

- Fund misappropriation

- Using trust assets for purposes beyond paying retirement benefits

- Charging non-administrative expenses against the trust

- Failing to maintain a clear separation between trust and general union funds

- Compliance failures

- Missing mandatory IRS filings and reporting deadlines

- Failing to issue required participant disclosures

- Neglecting to maintain current trust documentation

- Fiduciary breaches

- Ignoring participant rights to equal treatment and information

- Making investment decisions that fail to prioritize beneficiary interests

- Operating without regular legal reviews and compliance audits

These operational errors can trigger severe consequences, including retroactive taxation, penalties, and potential withdrawal of tax-exempt status. The strict regulatory framework governing 501(c)(18) organizations demands meticulous attention to compliance details and fiduciary responsibilities.

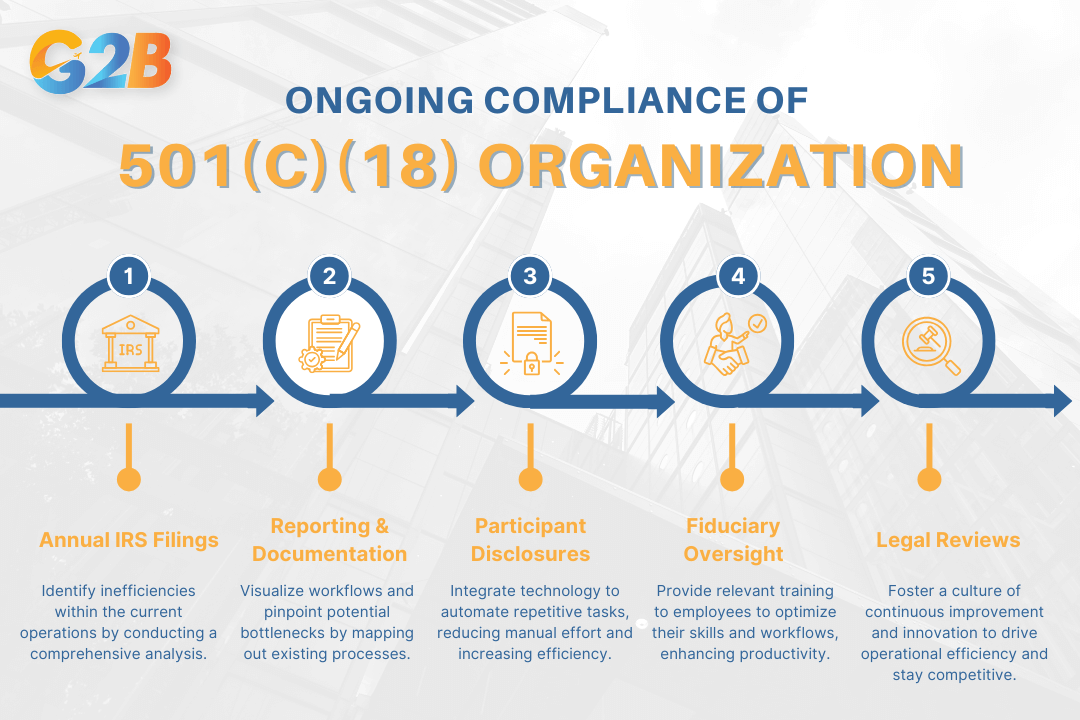

Ongoing compliance and best practices for 501(c)(18) trusts

Maintaining a 501(c)(18) organization requires vigilant adherence to regulatory requirements and fiduciary standards. The following comprehensive checklist provides union administrators and fiduciaries with essential guidance for preserving compliance.

Annual IRS filings (including 1099-R and plan reports)

Timely and accurate tax reporting forms the cornerstone of 501(c)(18) trust compliance. Administrators must issue Form 1099-R to all participants who received distributions during the previous year by January 31. This deadline is non-negotiable and failure to meet it may trigger penalties from the IRS. These same distribution forms must be filed with the IRS by February 28 for paper submissions or March 31 for electronic filings. Additionally, trust administrators should maintain a comprehensive filing calendar that includes:

- Annual information returns

- Required plan reports

- Supporting documentation for all transactions

- Updated trust instruments and amendments

Establishing a formal review process ensures all documentation remains current and complies with changing regulations. Many administrators implement quarterly internal audits to verify reporting accuracy before submission deadlines.

Participant communication and disclosure

Transparent communication with participants represents both a legal obligation and best practice for 501(c)(18) organizations. Quarterly statements must reach all participants within regulatory timeframes, typically within 45 days after each quarter's end. These statements should include:

| Required disclosure elements | Recommended additional information |

|---|---|

| Current account balance | Historical performance metrics |

| Recent contributions | Administrative fee breakdown |

| Distribution information | Upcoming regulatory changes |

| Vesting status | Contact information for questions |

Annual disclosure packages require more comprehensive information, including plan expenses, investment performance, and explicit statements regarding participant rights. Providing clear, jargon-free explanations helps ensure participants understand their benefits and responsibilities under the trust.

Fiduciary monitoring and legal reviews

Regular fiduciary oversight protects both participants and the tax-exempt status of 501(c)(18) trusts. Administrators should schedule bi-annual comprehensive trust audits conducted by independent examiners familiar with these specialized pension vehicles.

Meeting minutes represent critical documentation and should capture:

- All fiduciary decisions and their rationales

- Risk assessments and mitigation measures

- Attendance and voting records

- External consultant recommendations

Legal consultations warrant scheduling at least annually, with additional reviews whenever significant regulatory changes occur. These reviews should specifically address ERISA compliance requirements that affect grandfathered 501(c)(18) plans. Monitoring IRS bulletins, Department of Labor guidance, and relevant court decisions helps administrators anticipate compliance challenges before they threaten the plan's status.

Maintaining a 501(c)(18) organization requires vigilant adherence to regulatory requirements

Frequently asked questions about 501(c)(18) organizations

- Is a 501(c)(18) organization a type of pension trust?

Yes, it is an employee-funded pension trust created before June 25, 1959, providing pension benefits to employees. - Can a new organization qualify as a 501(c)(18) today?

No, only pension trusts established before June 25, 1959, can qualify for 501(c)(18) status. - Are contributions to a 501(c)(18) plan made by employers?

No, contributions to a 501(c)(18) plan are made solely by employees, not employers. - Is a 501(c)(18) organization tax-exempt?

Yes, it is recognized as tax-exempt under IRS code 501(c)(18). - Do 501(c)(18) contributions reduce taxable income immediately?

No, contributions are made on an after-tax basis and do not provide an immediate tax deduction. - Is the growth of funds in a 501(c)(18) plan tax-deferred?

Yes, the funds grow tax-deferred until distribution. - Does a 501(c)(18) organization operate like a typical nonprofit?

No, it is a pension trust, not a charitable or social nonprofit organization. - Are 501(c)(18) organizations common today?

No, they are rare and mostly found in certain unionized trades with historic pension plans. - Must a 501(c)(18) organization be a legally valid trust?

Yes, it must be a valid trust under local law with a written trust document. - Can 501(c)(18) contributions affect limits on other retirement accounts?

No, contributions to a 501(c)(18) plan do not count against limits on other retirement plans like 401(k)s.

A 501(c)(18) organization offers a unique, tax-advantaged path, empowering unionized workforces with retirement solutions that align with both compliance and long-term security. As an alternative to the traditional 401(k) or the broader 501(c)(5), it creates a niche yet vital option for those in labor organizations seeking structured, financially sound benefits for their members. Embrace the potential of this nuanced entity, where opportunity and regulation meet, guiding a secure future.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom