A 501(c)(24) organization provides a critical framework for those managing ERISA trusts designed for pension plan terminations. With strategic foresight, such entities offer tax-exempt advantages while ensuring compliance with both IRS and federal regulations. For corporate legal counsel, tax professionals, and HR managers aiming to reduce liability, understanding these structures can be transformative. Let’s delve into the definition, benefits and process of 501(c)(24) organization.

This article is provided for general informational purposes to help entrepreneurs understand the basics of 501(c)(24) organizations. We specialize in company formation services and do not provide legal or tax advice concerning U.S. nonprofit regulations. For detailed compliance guidance, please consult a legal expert familiar with government-sponsored retiree health benefit plans and Section 401(h) medical reimbursement arrangements.

What is a 501(c)(24) ERISA Trust?

A 501(c)(24) organization is a Section 4049 ERISA Trust, a type of tax-exempt trust established under the Employee Retirement Income Security Act to hold and invest assets of terminated single-employer defined benefit pension plans for which the Pension Benefit Guaranty Corporation (PBGC) has become statutory trustee. These trusts are used exclusively for the benefit of participants and beneficiaries of the terminated plans.

To qualify for exemption, the trust must meet ERISA’s exclusive-benefit, separate-account, and domestic-trust requirements and file under Section 501(c)(24) of the Internal Revenue Code. The 501(c)(24) category is now obsolete for new trusts due to legislative changes. Section 4049 of ERISA deals with single-employer plan termination and the associated financial obligations, not multiemployer plans.

Need a reliable Delaware incorporation service? Contact G2B for a free consultation today!

Formation and operational requirements

Establishing a 501(c)(24) organization demands strict adherence to regulatory frameworks. Unlike typical nonprofits, their formation follows specific protocols designed to protect beneficiary interests and ensure proper asset management.

Who can form a 501(c)(24) organization?

The formation of 501(c)(24) trusts is narrowly restricted to authorized entities involved in pension plan terminations. Primarily, the Pension Benefit Guaranty Corporation (PBGC) holds the authority to establish these trusts when assuming responsibility for terminated pension plans. In certain circumstances, designated plan administrators may also establish a 501(c)(24) trust under PBGC supervision.

Standard businesses, nonprofits, and individuals cannot independently create these specialized trusts. The eligibility requirements directly connect to ERISA provisions governing involuntary plan terminations, making these organizations fundamentally different from conventional tax-exempt entities. Plan sponsors must understand this limitation before attempting to pursue this classification for general benefit management purposes.

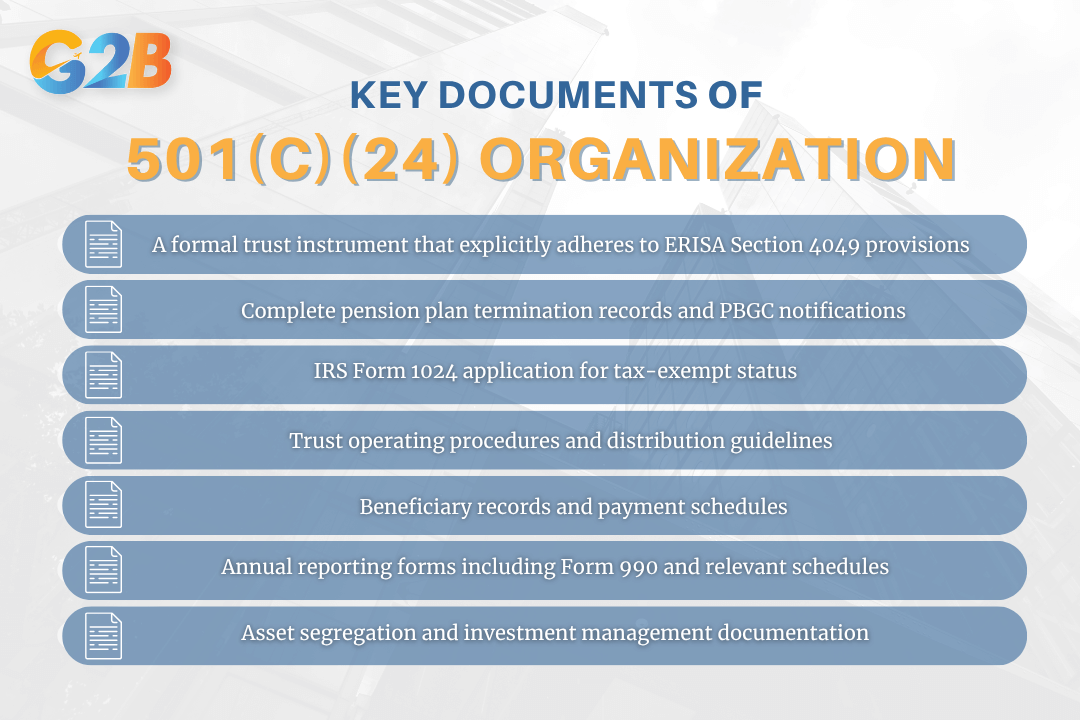

Key documents and legal instruments required

501(c)(24) trusts require comprehensive documentation to establish and maintain compliance. The cornerstone document is a formal trust instrument that explicitly adheres to ERISA Section 4049 provisions. This legal instrument must clearly define the trust's limited purpose, governance structure, and asset management protocols. Additional essential documentation includes:

- Complete pension plan termination records and PBGC notifications

- IRS Form 1024 application for tax-exempt status

- Trust operating procedures and distribution guidelines

- Beneficiary records and payment schedules

- Annual reporting forms including Form 990 and relevant schedules

- Asset segregation and investment management documentation

501(c)(24) trusts require comprehensive documentation to establish and maintain compliance

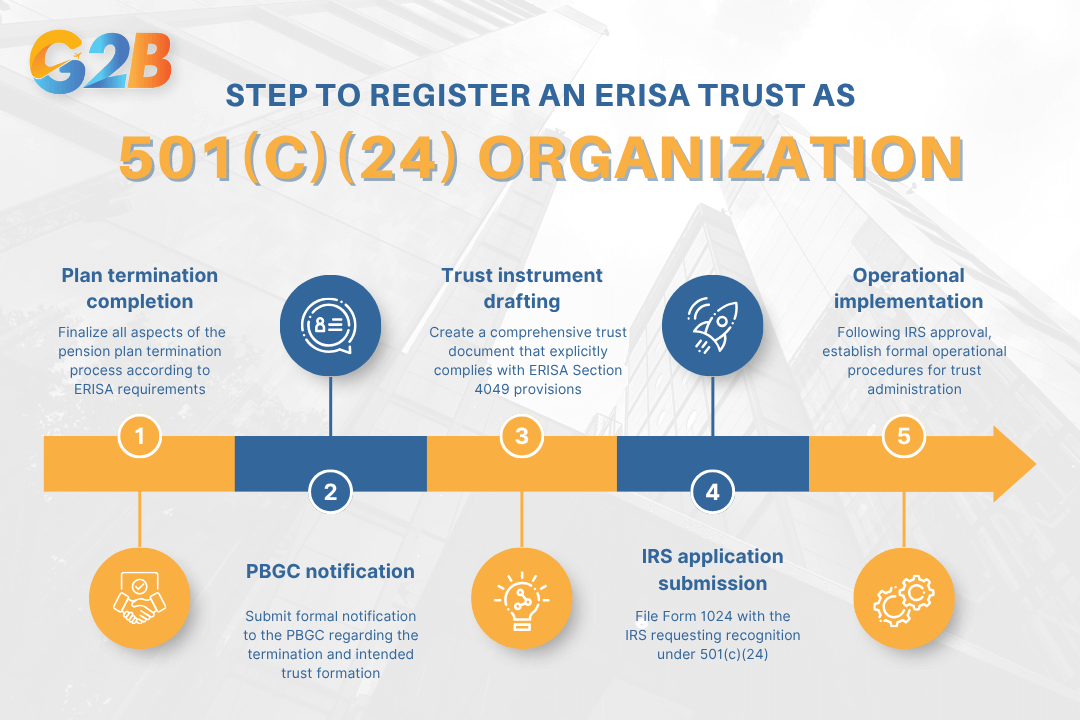

Step-by-step to registering an ERISA trust as 501(c)(24)

The registration process for a 501(c)(24) organization follows a sequential pathway:

- Plan termination completion: Finalize all aspects of the pension plan termination process according to ERISA requirements.

- PBGC notification: Submit formal notification to the PBGC regarding the termination and intended trust formation.

- Trust instrument drafting: Create a comprehensive trust document that explicitly complies with ERISA Section 4049 provisions.

- IRS application submission: File Form 1024 with the IRS requesting recognition under 501(c)(24), including:

- Detailed explanation of trust purpose

- PBGC documentation

- Trust governance structure

- Asset management protocols

- Operational implementation: Following IRS approval, establish formal operational procedures for trust administration.

5 Steps to registering an ERISA trust as 501(c)(24) organization

Ongoing operational and reporting requirements

Maintaining a 501(c)(24) organization requires vigilant adherence to compliance obligations. Annual filing of IRS Form 990 represents the cornerstone of ongoing reporting duties. These filings must accurately detail trust activities, asset allocation, and distributions to beneficiaries. Operational requirements include:

- Strict segregation of trust assets from other organizational funds

- Regular financial audits and reconciliations

- Maintenance of beneficiary records and distribution tracking

- Documentation of all trust board or administrator decisions

- Prompt implementation of any regulatory changes affecting ERISA trusts

Trust administrators must also ensure all plan documents and amendments receive proper execution and preservation. Any material deviation from ERISA guidelines or trust purposes may jeopardize the organization's tax-exempt status, potentially triggering significant tax liabilities and compliance penalties.

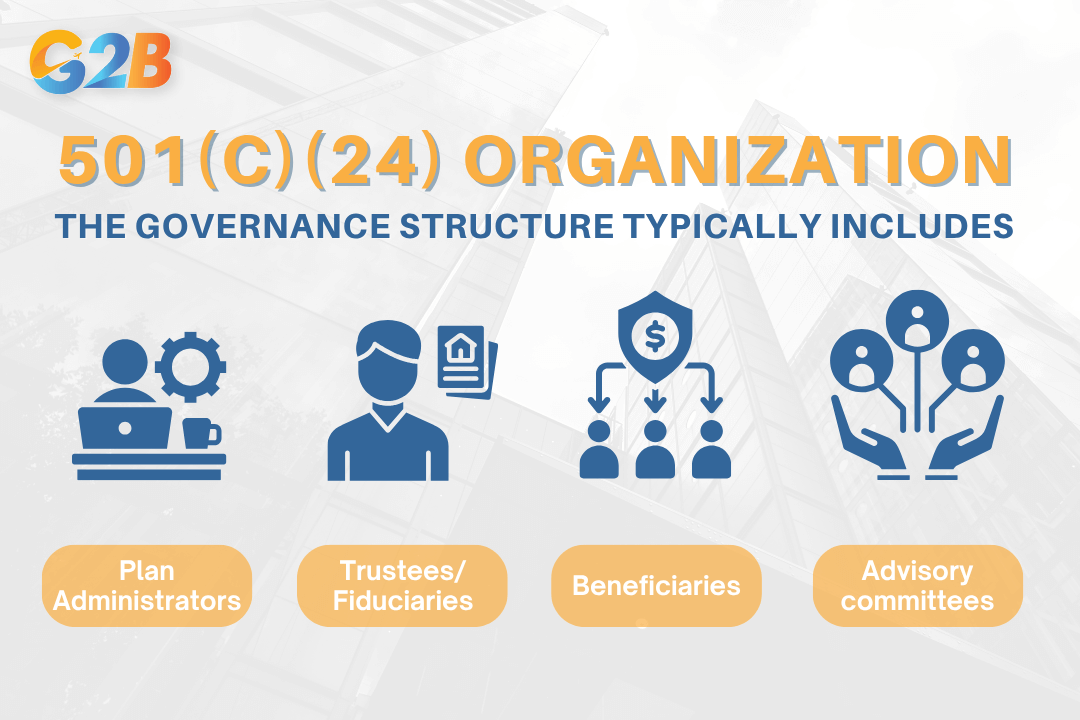

Roles, governance, and fiduciary responsibilities

The operational success of a 501(c)(24) organization depends on the proper assignment of roles and a clear understanding of fiduciary obligations under both ERISA and IRS regulations.

Who directs and oversees the trust?

Plan administrators form the primary operational leadership of a 501(c)(24) trust. These administrators - typically officials from the Pension Benefit Guaranty Corporation (PBGC) or specifically named individuals in plan documents - bear responsibility for overall compliance with ERISA requirements. They coordinate with designated fiduciaries who hold discretionary authority over plan assets and administration.

The governance structure typically includes:

- Plan administrators - Oversee regulatory compliance and operations

- Trustees/fiduciaries - Manage assets and make distribution decisions

- Beneficiaries - Plan participants and their designated recipients

- Advisory committees - May provide specialized guidance on investments or distributions

The governance structure typically includes 4 roles

Fiduciaries must adhere to the "prudent expert" standard, requiring them to act solely in beneficiaries' interests with the skill and diligence a prudent person would exercise in similar circumstances. This includes avoiding conflicts of interest, maintaining proper documentation, and ensuring all decisions reflect the exclusive purpose of providing benefits and covering reasonable administrative expenses.

Fiduciary and legal risks

Fiduciary status attaches to individuals based on function rather than title. Anyone exercising discretionary authority or control over plan assets automatically assumes fiduciary responsibility - regardless of formal designation. This functional definition creates significant exposure for professionals involved in 501(c)(24) trusts. Non-compliance consequences include:

- Personal liability for losses resulting from fiduciary breaches

- Potential revocation of the trust's tax-exempt status

- Regulatory enforcement actions and penalties

- Potential criminal prosecution in cases of willful violations

The Department of Labor actively pursues fiduciaries who breach their duties. Courts have consistently upheld that fiduciaries must restore losses caused by their actions or omissions, often imposing personal financial responsibility that extends beyond corporate protections. Risk mitigation strategies include:

- Maintaining clear documentation of decision processes

- Establishing governance committees with defined responsibilities

- Conducting regular compliance reviews with ERISA counsel

- Securing appropriate fiduciary liability insurance coverage

- Implementing internal controls for distributions and investments

Fiduciaries should document all major decisions with supporting rationales that demonstrate prudence and exclusive focus on beneficiaries' interests. This documentation provides critical protection if decisions are later questioned by regulators or beneficiaries.

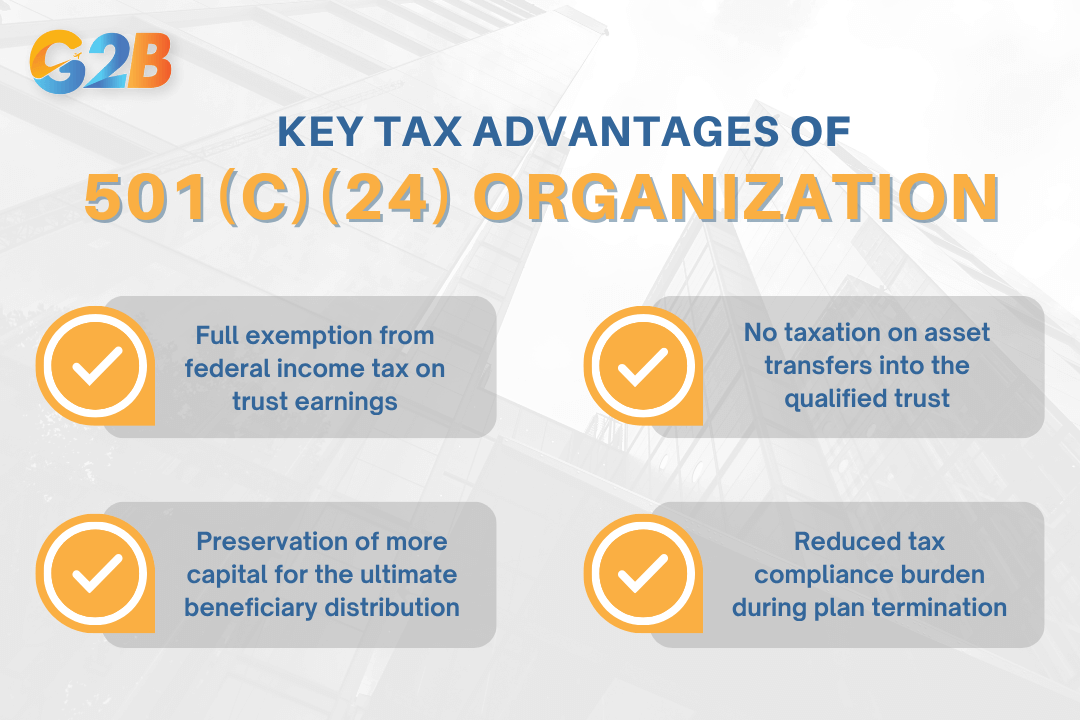

Benefits, tax advantages, and strategic value

501(c)(24) organizations provide essential financial benefits and regulatory certainty during the tumultuous process of pension plan termination. For organizations facing the complex challenges of plan termination, these trusts deliver strategic value through reduced tax liability and enhanced compliance with federal regulations.

Major tax benefits

Income generated through a 501(c)(24) trust remains completely exempt from federal income taxation. This powerful advantage preserves a greater portion of the plan's assets for eventual distribution to beneficiaries, maximizing the value delivered to pension participants during plan wind-down. For example, investment earnings, interest, and dividends that accumulate during the trust administration period flow directly to beneficiaries rather than being reduced by tax obligations.

The tax exemption applies exclusively to trusts operating strictly within the parameters established by the Internal Revenue Code and ERISA guidelines. Plan sponsors benefit through reduced overall financial liability, as the exemption eliminates potential tax burdens that might otherwise deplete plan resources. Key tax advantages include:

- Full exemption from federal income tax on trust earnings

- No taxation on asset transfers into the qualified trust

- Preservation of more capital for the ultimate beneficiary distribution

- Reduced tax compliance burden during plan termination

The 501(c)(24) organizations provide 4 essential key tax advantages

Asset protection and legal certainty

The 501(c)(24) trust structure creates a robust protective barrier around pension assets during the vulnerable termination phase. ERISA and the PBGC mandate such trusts to prevent improper diversion of funds, ensuring that assets remain exclusively dedicated to beneficiaries as legally required. The trust instrument establishes ironclad provisions prohibiting any use of funds outside the strict parameters of beneficiary payments and necessary administrative expenses. This protection serves multiple critical purposes:

- Shields assets from corporate creditors during bankruptcy proceedings

- Prevents employer attempts to recapture pension assets

- Ensures regulatory compliance with ERISA fiduciary standards

- Creates clear legal boundaries around permissible fund usage

For fiduciaries, the structure provides a clear framework for proper asset management during termination, reducing personal liability risk. Beneficiaries gain peace of mind through the federal oversight mechanisms built into the 501(c)(24) designation, with assets protected by comprehensive regulatory controls. The trust arrangement establishes transparent governance and documentation requirements that demonstrate compliance with regulators while clarifying roles and responsibilities for all parties involved in the termination process.

Disadvantages, misconceptions, and limitations

501(c)(24) organizations offer significant protection for terminated pension plan assets, but operate within strict parameters with substantial compliance requirements.

Narrow use cases and eligibility

501(c)(24) trusts serve an extremely limited purpose in the tax-exempt landscape. These entities exclusively manage assets from involuntarily terminated pension plans, typically occurring during major corporate bankruptcies or large-scale multiemployer plan dissolutions. The Pension Benefit Guaranty Corporation (PBGC) generally initiates or oversees these trusts following plan failure.

Organizations cannot qualify for 501(c)(24) status if they manage ongoing employee benefits or serve routine pension administration functions. The IRS strictly enforces these boundaries, rejecting applications that fall outside the narrow statutory definition. Plan administrators seeking tax exemption for conventional benefit arrangements must explore alternative classifications like 501(c)(9) or other appropriate structures.

Common misconceptions

The most prevalent misconception involves confusing 501(c)(24) trusts with other employee benefit organizations. Unlike 501(c)(9) voluntary employee beneficiary associations (VEBAs), a 501(c)(24) trust cannot manage active employee benefits or serve ongoing organizational purposes. These trusts operate exclusively under ERISA Section 4049 framework.

Another common error involves assuming 501(c)(24) qualification applies when the PBGC isn't involved. These trusts typically require PBGC oversight or similar federal regulatory participation. Standard pension terminations or routine benefit administration fall outside this classification's scope. Organizations erroneously seeking this status for conventional nonprofit activities face certain rejection and potential compliance penalties.

| 501(c)(24) Trusts | 501(c)(9) VEBAs |

|---|---|

| For terminated plans only | For active employee benefits |

| PBGC oversight required | No PBGC requirement |

| Single-purpose entity | Multi-purpose benefit entity |

| Limited duration | Can operate indefinitely |

Compliance and operational risks

Noncompliance with 501(c)(24) requirements carries severe consequences. Organizations that improperly document transactions, commingle assets, or deviate from strict statutory purposes risk immediate tax exemption revocation. The IRS closely scrutinizes these specialized trusts due to their connection to significant pension assets. Fiduciaries face personal liability for improper trust management, with potential penalties including:

- Monetary damages for breaches of fiduciary duty

- Tax assessment on improperly managed trust assets

- Legal costs from regulatory enforcement actions

- Potential removal from trustee positions

Additional operational risks include:

- Failure to maintain proper documentation of pension plan termination

- Inadequate record-keeping of beneficiary distributions

- Missing required annual filings with regulatory agencies

- Improper investment management of remaining plan assets

Protecting against these risks requires specialized legal counsel familiar with both ERISA requirements and IRS regulations governing 501(c)(24) organizations.

Take the first step toward business success - Explore our Delaware incorporation service today!

Comparison between 501(c)(24) vs. other ERISA-related trusts

Understanding the critical differences between various ERISA-related trusts helps avoid costly classification errors when dealing with a 501(c)(24) organization. The key distinctions center around whether the trust serves active or terminated plans and the specific regulatory regimes that apply.

501(c)(24) vs. 501(c)(9)

501(c)(9) trusts, commonly known as Voluntary Employee Beneficiary Associations (VEBAs), differ fundamentally from 501(c)(24) trusts in their operational scope and timing. VEBAs manage ongoing employee benefits for active workforce members, covering health, welfare, and similar benefits during regular business operations. In contrast, 501(c)(24) trusts exclusively handle assets from pension plans after termination under ERISA Title IV provisions. These trusts only come into existence following a plan's discontinuation, typically under Pension Benefit Guaranty Corporation (PBGC) oversight.

The regulatory frameworks also diverge significantly:

- 501(c)(9) VEBAs operate under standard ERISA provisions for active benefits

- 501(c)(24) trusts function under specialized ERISA Section 4049 requirements exclusively for terminated plans

Why not use 501(c)(3) or a general nonprofit exemption?

The specialized nature of terminated pension plan assets makes 501(c)(3) or general nonprofit classifications inappropriate and legally insufficient. Plan asset trusts following termination require compliance with both ERISA and IRS regulations specific to pension assets. Traditional nonprofit exemptions fail to satisfy these requirements for several reasons:

- 501(c)(3) organizations serve charitable, educational, or religious purposes

- Terminated plan assets require specialized handling beyond general nonprofit provisions

- ERISA compliance mandates specific fiduciary standards not covered by 501(c)(3) rules

Additionally, the tax treatment differs significantly. While both classifications offer tax exemption, 501(c)(24) trusts follow specialized reporting requirements designed specifically for terminated pension assets, ensuring proper distribution to beneficiaries under PBGC guidelines.

Comparative framework for trust selection:

| Feature | 501(c)(24) | 501(c)(9) | 501(c)(3) |

|---|---|---|---|

| Plan Status | Terminated only | Active plans | Not pension-related |

| Regulatory Authority | PBGC & ERISA Title IV | Standard ERISA | General IRS nonprofit |

| Distribution Focus | Former plan participants | Current employees | Public charitable purposes |

| Formation Trigger | Plan termination event | Voluntary establishment | Charitable mission |

| Asset Restrictions | Strict pension asset rules | Flexible benefit design | Broad charitable use |

Setting up and maintaining 501(c)(24) compliance

Establishing and maintaining a 501(c)(24) organization requires meticulous attention to regulatory requirements and procedural steps. The following comprehensive checklists provide actionable guidance to ensure compliance throughout the trust's lifecycle.

Formation checklist

Properly establishing a 501(c)(24) trust requires careful execution of several critical steps in the correct sequence. This prevents costly compliance issues and potential tax complications. The formation process begins with completing the plan termination process in accordance with ERISA requirements. This includes filing all necessary PBGC notifications and receiving confirmation of the involuntary termination status. Organizations must then draft a trust instrument that explicitly complies with ERISA Section 4049 provisions, ensuring all mandatory language regarding asset management and distribution protocols is included.

Next, administrators must file IRS Form 1023 (Application for Recognition of Exemption) or the appropriate designated form for trusts seeking 501(c)(24) status. This application must thoroughly document how the trust meets all statutory requirements. Finally, before transferring any pension assets into the trust, organizations must obtain explicit written confirmation of tax-exempt status from the IRS to avoid potential tax liabilities.

| Formation step | Key requirements |

|---|---|

| Plan termination | Complete all termination procedures; obtain PBGC acknowledgement |

| Trust documentation | Draft instrument with explicit ERISA 4049 compliance language |

| IRS application | Submit Form 1023 with all supporting documentation |

| Exemption confirmation | Secure written IRS approval before asset transfer |

Ongoing compliance checklist

The cornerstone of ongoing compliance is filing the annual IRS Form 990, complete with all schedules specific to 501(c)(24) organizations. This mandatory filing provides transparency regarding trust assets, distributions, and administrative expenses. Organizations must also regularly update plan documents to reflect legal changes, including modifications resulting from the SECURE Act and other pension-related legislation. Regular trust audits form another critical component of compliance maintenance. These reviews should examine financial records, distribution practices, and administrative procedures. Trustees should:

- Reconcile all distributions against beneficiary records

- Verify compliance with ERISA distribution requirements

- Document investment decisions and their alignment with trust purposes

- Maintain minutes of trustee meetings discussing compliance matters

- Conduct periodic reviews of service provider performance

Common mistakes and how to avoid them

Proactive identification of recurring errors in 501(c)(24) organizations prevents costly compliance issues during plan terminations. Understanding common pitfalls is essential for maintaining tax-exempt status and fulfilling fiduciary obligations.

Mistaking trust type or purpose

Misclassification represents one of the most fundamental errors in 501(c)(24) compliance. Organizations frequently apply for this specialized exemption when another trust classification would be more appropriate for their circumstances. This misalignment triggers immediate IRS scrutiny and can result in rejected applications, wasted resources, and significant legal exposure.

The purpose limitation of 501(c)(24) trusts cannot be overstated. These entities exist exclusively for managing assets of involuntarily terminated pension plans - not for routine benefit administration. Attempting to use this classification for general employee benefit management violates the statutory requirements and creates substantial legal and tax consequences, including potential fiduciary liability and loss of tax-exempt status.

Documentation and filing errors

Inadequate trust documentation represents a critical failure point for 501(c)(24) organizations. Trust instruments lacking precise ERISA section 4049 references, incomplete termination documentation, or improperly executed beneficiary provisions all undermine the trust's validity and threaten its tax exemption. The IRS regularly revokes exemptions based on documentation deficiencies alone.

Common documentation errors include:

- Missing ERISA-required provisions

- Inadequate explanation of benefit calculation methods

- Incomplete beneficiary identification systems

- Improper delegation of fiduciary responsibilities

Filing compliance presents another substantial risk area. Late or missed Form 990 submissions, incomplete schedules, or inaccurate information reporting frequently trigger compliance investigations. Maintaining a rigorous filing calendar with adequate preparation time helps prevent these administrative errors that disproportionately impact 501(c)(24) organizations due to their specialized nature.

Failing to monitor legal updates

Regulatory evolution represents an ongoing compliance challenge for 501(c)(24) trusts. ERISA amendments, IRS procedural modifications, and PBGC requirement changes directly impact operational compliance. Organizations that fail to implement updated requirements rapidly find themselves operating under outdated protocols.

Recent significant changes affecting 501(c)(24) compliance include:

- SECURE Act provisions modifying distribution requirements

- Updated PBGC participant notification requirements

- Revised IRS electronic filing mandates for trust returns

- Enhanced fiduciary documentation requirements

Professional trustees must establish systematic regulatory monitoring systems to track relevant changes. This typically involves subscriptions to specialized legal updates, regular consultation with ERISA counsel, and participation in professional associations focused on pension trust administration. Without these proactive measures, regulatory drift inevitably occurs, placing the trust's compliant operation at risk.

Frequently asked questions (FAQ)

Understanding 501(c)(24) organizations can be complex due to their unique role in supporting government pension systems. This FAQ section aims to clarify common questions about their purpose, eligibility, tax treatment, and compliance requirements:

- Are 501(c)(24) organizations tax-exempt?

Yes, 501(c)(24) organizations are tax-exempt under section 501(c) of the Internal Revenue Code, similar to other nonprofit organizations in this category.

- Do 501(c)(24) organizations handle pension plans?

Yes, 501(c)(24) organizations specifically operate under Section 4049 of ERISA and deal with multiemployer pension plan terminations and related financial obligations.

- Are 501(c)(24) organizations common?

No, 501(c)(24) organizations are highly specialized and relatively rare, serving a specific niche in employee retirement benefit plan administration under ERISA.

- Do 501(c)(24) organizations require IRS approval?

Yes, like other 501(c) organizations, they must apply for and receive IRS recognition of their tax-exempt status through proper application procedures.

- Can individuals donate to 501(c)(24) organizations?

This depends on their specific structure, but they typically receive funding related to pension plan obligations rather than general public donations.

- Are 501(c)(24) organizations subject to annual reporting requirements?

Yes, 501(c)(24) organizations must file required annual returns with the IRS, similar to other tax-exempt organizations under section 501(c).

- Do 501(c)(24) organizations serve individual employees directly?

No, 501(c)(24) organizations primarily handle institutional pension plan obligations rather than providing direct services to individual employees or beneficiaries.

- Do 501(c)(24) organizations have liability for guaranteed benefits?

Yes, Section 4062(c) imposes liability on section 4049 trusts for benefit commitments, typically 75% of outstanding benefits or 15% of actuarial present value.

The 501(c)(24) organization stands as a vital instrument for fulfilling compliance with ERISA requirements while securing significant tax benefits, especially as it pertains to managing employee benefit plan terminations. This unique entity allows professionals like corporate legal counsel and tax specialists to strategically navigate complex regulatory landscapes. Through careful establishment and maintenance of these structures, businesses achieve not only assured compliance but also strengthen their financial stewardship, ensuring confidence in their long-term strategic planning.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom