Among the various classifications of tax-exempt entities recognized by the Internal Revenue Code, 501(c)(8) organizations occupy a distinct and often overlooked position. These entities, known as fraternal benefit societies, combine elements of social purpose, mutual aid, and financial protection, operating under a structure that is both historically significant and functionally unique. This article explores the defining characteristics, regulatory framework, and operational requirements of 501(c)(8) organizations

This content is provided for general informational purposes to help entrepreneurs and researchers understand the basics of 501(c)(8) organizations. We specialize in company formation, not in providing legal or tax advisory services specific to U.S. nonprofit compliance. This information should not be considered professional legal or tax advice. For guidance specific to individual circumstances, please consult a nonprofit compliance expert or a legal professional with experience in fraternal benefit societies and exempt organizations.

What is a 501(c)(8) organization?

A 501(c)(8) organization is a fraternal beneficiary society, order, or association that operates under a lodge system and is recognized by the IRS as tax-exempt under Internal Revenue Code section 501(c)(8). These organizations consist of members who share a common bond such as a vocation, profession, religion, ethnicity, gender, or shared values, and they unite to promote the common good and support each other.

Formal definition and legal criteria

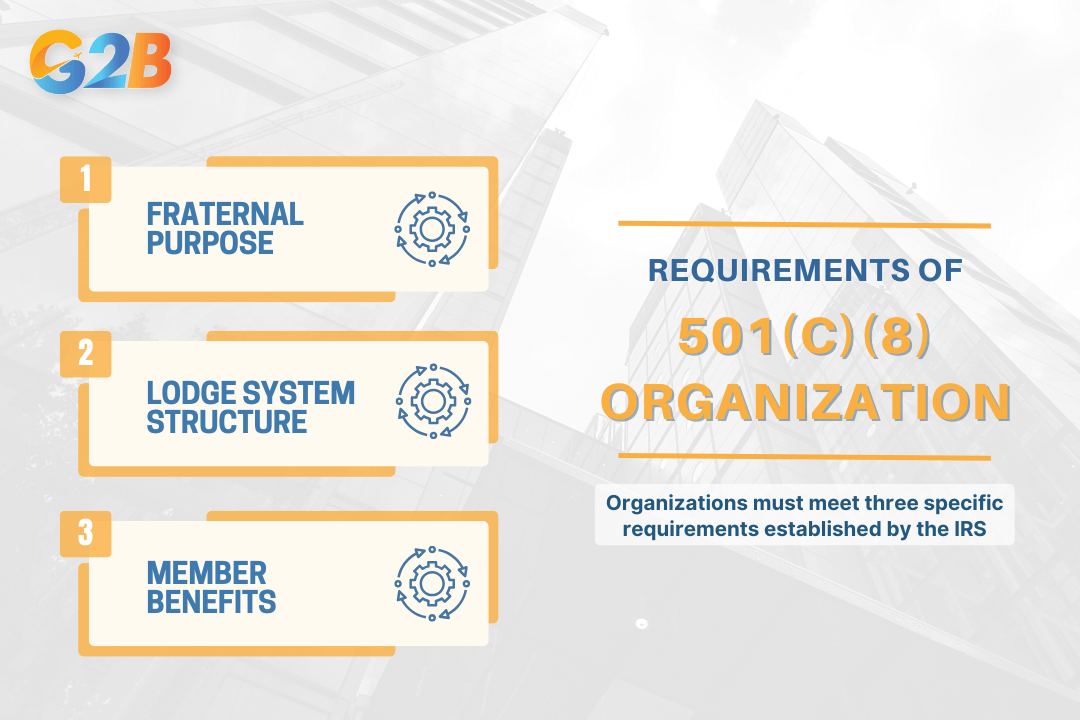

A 501(c)(8) organization operates as a fraternal beneficiary society that provides life, health, or similar benefits to its members while maintaining tax-exempt status. These organizations unite individuals with a common bond, operate under a lodge system with a parent organization and subordinate lodges, and serve both social and financial purposes for their membership base. To qualify for 501(c)(8) status, organizations must meet three specific requirements established by the IRS:

- Fraternal purpose: The organization must exist for fraternal purposes, meaning membership is based on a common bond or shared pursuit. This requires maintaining a substantial program of fraternal activities that foster community among members.

- Lodge system structure: The organization must operate under a lodge system consisting of at least two active entities:

- A parent (or central) organization that provides oversight

- One or more subordinate organizations (local lodges or branches) that are chartered by the parent and maintain significant self-governance

- Member benefits: The organization must provide payment of life, sick, accident, or other specified benefits to its members or their dependents.

Failure to maintain any of these three criteria can jeopardize an organization's tax-exempt status under section 501(c)(8) of the Internal Revenue Code.

501(c)(8) organizations must meet three specific requirements established by the IRS

Simple explanation for entrepreneurs

501(c)(8) organizations function as specialized nonprofits that bring together individuals with shared interests or vocations while providing tangible financial benefits. These entities:

- Establish a membership community based on common bonds (profession, faith, ethnicity, etc.)

- Provide financial security through insurance products, investment opportunities, and benefit plans

- Maintain a two-tier structure with a central authority and local chapters

- Engage in social activities that strengthen member relationships

- Often participate in charitable initiatives that benefit both members and the broader community

The tax-exempt status of these organizations allows them to dedicate more resources toward member benefits and community service rather than tax obligations. This creates a unique vehicle for entrepreneurs seeking to establish organizations that balance mutual aid with social purpose. Unlike public charities (501(c)(3) organizations), 501(c)(8) entities primarily serve their members rather than the general public, focusing on both community building and financial protection for a defined membership group.

Get expert guidance with G2B’s Delaware incorporation service - Schedule your free consultation today!

Impact on modern nonprofits and insurance

Fraternal benefit societies pioneered innovative social welfare and insurance models that continue to influence contemporary organizations. Their member-owned, democratic governance structures established precedents for:

- Mutual insurance companies

- Community-based welfare systems

- Modern nonprofit insurance organizations

These societies created a distinctive organizational model characterized by:

- Not-for-profit structure

- Member ownership and participation

- Community service mission

- Financial benefit provision

Today, over 80 fraternal benefit societies operate throughout the United States and Canada, serving more than 9 million members with approximately $380 billion of insurance in force. Their continued relevance demonstrates the enduring value of their approach to combining financial protection with community engagement. The fraternal model's influence extends beyond direct descendants, having shaped fundamental concepts in social insurance, community banking, and mutual aid organizations. Their lasting legacy lies in demonstrating how organizations can successfully balance financial sustainability with social purpose and member governance.

Core structure and governance of 501(c)(8) organizations

The structural foundation of a 501(c)(8) organization follows a distinct hierarchical model that ensures proper governance and member representation. These fraternal beneficiary societies must operate under a lodge system with parent and local organizations working in tandem to fulfill their mission.

The lodge system explained

The lodge system forms the backbone of every 501(c)(8) organization, consisting of a parent body and at least one subordinate lodge. The parent organization serves as the central authority, issuing charters that formally recognize local lodges as official branches of the fraternal society. These local lodges function with significant autonomy while remaining accountable to the parent organization's overarching guidelines.

This hierarchical arrangement requires active participation at both levels - mere provisions in bylaws aren't sufficient for IRS compliance. Local lodges typically conduct regular meetings at designated locations, where members engage in rituals and fraternal activities that strengthen their common bond. The system allows for organic growth, as existing lodges can band together to form a parent organization, or local chapters can establish new subordinate lodges with proper authorization.

Roles and responsibilities

The parent organization and local lodges maintain distinct yet complementary responsibilities within the 501(c)(8) structure:

Parent organization duties:

- Establishing rules and regulations for the entire fraternal network

- Issuing official charters to qualifying subordinate lodges

- Providing strategic direction and oversight to constituent groups

- Maintaining standards for benefit programs and fraternal activities

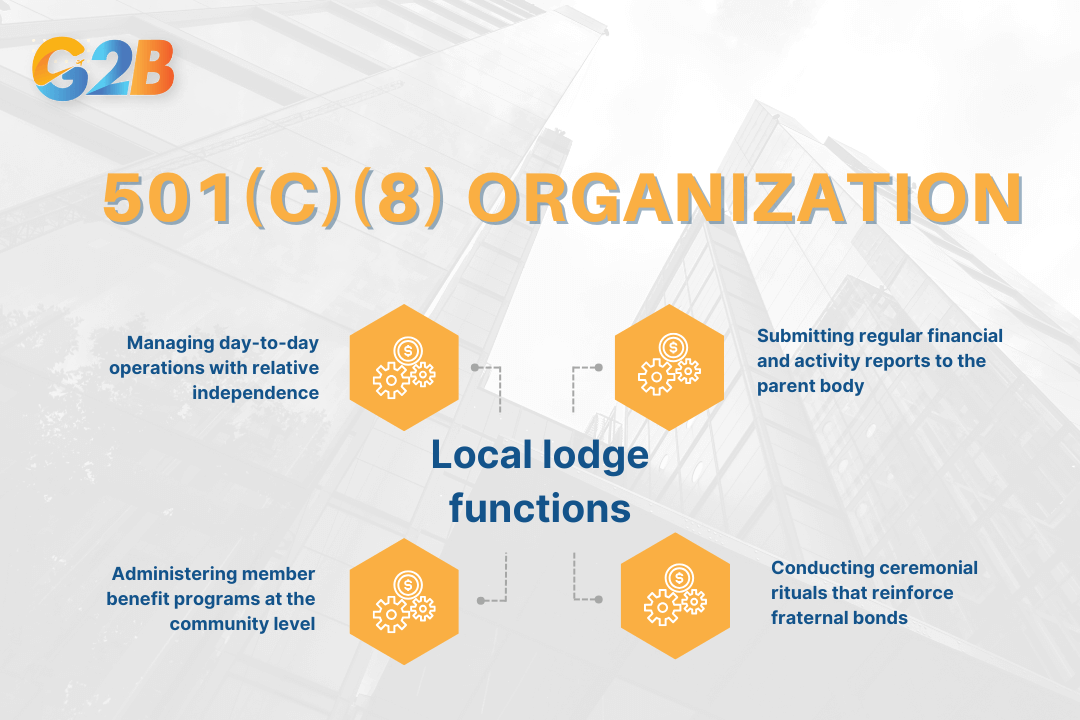

Local lodge functions:

- Managing day-to-day operations with relative independence

- Submitting regular financial and activity reports to the parent body

- Administering member benefit programs at the community level

- Conducting ceremonial rituals that reinforce fraternal bonds

Local lodges maintain complementary responsibilities within the 501(c)(8) structure

Members play a crucial role in governance through a representative system, electing officers and participating in decision-making processes. This democratic structure ensures that the organization remains responsive to member needs while delivering promised benefits such as life, sick, or accident insurance.

Bylaws, boards, and compliance

Strong organizational documents and governance practices are essential for 501(c)(8) organizations to maintain their tax-exempt status. Every fraternal beneficiary society must establish:

- Comprehensive constitution and bylaws defining the governance framework

- Clear processes for officer selection and board composition

- Documented ceremonial practices or rituals

- Regular meeting schedules and financial contribution requirements

Compliance challenges for these organizations include:

- Maintaining active relationships between parent and subordinate lodges

- Developing substantial fraternal activities beyond benefit programs

- Ensuring all activities support the organization's fraternal purpose

- Adhering to IRS reporting requirements and governance standards

The board of directors bears significant responsibility for organizational transparency and accountability. Through active oversight, boards ensure that both the parent organization and local lodges operate according to established bylaws while fulfilling their obligations to members and regulatory authorities.

Types of 501(c)(8) organizations and common bonds

501(c)(8) organizations unite members through a clearly defined common bond that shapes their mission and activities. These fraternal beneficiary societies create communities based on shared characteristics like faith, profession, ethnicity, or common interests.

Traditional, professional, and faith-based societies

Faith-based fraternal organizations represent one of the most established categories of 501(c)(8) entities. Significant categories include:

- Professional societies: Uniting members of specific trades or vocations

- Ethnic organizations: Preserving cultural heritage and supporting immigrant communities

- Special interest groups: Forming around shared interests or activities

The diversity among these organization types highlights the flexibility of the 501(c)(8) classification, accommodating various community needs while maintaining the core lodge structure and benefit requirements.

The role of rituals and social activities

Regular meetings and ritual ceremonies form the backbone of 501(c)(8) organizations, reinforcing organizational values and strengthening member connections. These rituals often include:

- Formalized opening and closing ceremonies

- Member recognition and advancement procedures

- Symbolic gestures and shared customs

- Heritage celebrations and commemorations

Social gatherings complement these formal activities, providing opportunities for member interaction outside structured ceremonies. From community service projects to recreational events, these activities maintain engagement and strengthen organizational bonds. Regular meetings demonstrate active member participation - a crucial element for maintaining tax-exempt status. These gatherings also facilitate democratic governance, allowing members to participate in organizational decisions and leadership selection processes.

Benefits and importance of 501(c)(8) organizations

501(c)(8) organizations deliver substantial value to both their members and the broader society. These fraternal beneficiary societies combine tax advantages with comprehensive member benefits while making significant contributions to their communities.

Tax-exempt status and financial advantages

501(c)(8) organizations enjoy federal income tax exemption, freeing up crucial resources that can be redirected toward member benefits and community initiatives. This tax advantage significantly enhances their financial sustainability, allowing fraternal societies to maintain robust benefit programs without the burden of corporate taxation.

The tax benefits extend beyond the organizational level. Member dues allocated to the organization's social and fraternal activities typically qualify as tax-deductible charitable contributions. Additionally, the organization can accumulate reserves for benefit payments without incurring tax liabilities, creating long-term stability for their insurance and aid programs.

Insurance and member benefits

Members of 501(c)(8) organizations gain access to valuable insurance protections that might otherwise be unavailable or unaffordable. These benefits generally include:

- Life insurance coverage

- Health insurance options

- Accident and disability protection

- Educational assistance programs

- Emergency financial aid

Most fraternal benefit societies maintain separate funds specifically for these benefits, funded through member contributions. This collective approach spreads risk across the membership while ensuring targeted support during critical life events. The benefit structure must comply with state insurance regulations while fulfilling the organization's core mission of mutual support.

Community service and social impact

Fraternal beneficiary societies contribute millions of volunteer hours and dollars annually to charitable initiatives, amplifying their impact far beyond their membership. Their community service often includes:

- Supporting local educational institutions

- Providing disaster relief assistance

- Funding medical research

- Building and maintaining community facilities

- Offering programs for youth development

| Impact area | Typical activities | Societal benefit |

|---|---|---|

| Education | Scholarships, mentoring programs | Increased access to education |

| Health | Medical equipment donations, research funding | Improved community health outcomes |

| Economic | Financial literacy programs, small business support | Enhanced local economic development |

| Social welfare | Food drives, housing assistance | Reduction of poverty impacts |

These service activities align with the fraternal mission while addressing critical community needs. Many 501(c)(8) organizations have established foundations or charitable arms that extend their impact through strategic philanthropic initiatives, effectively complementing government and private sector social services.

Disadvantages, risks, and compliance challenges

Operating a 501(c)(8) organization comes with significant regulatory burdens and operational constraints that founders must navigate carefully. Non-compliance with these requirements can result in severe consequences, including the revocation of tax-exempt status and potential legal liabilities for officers and directors.

IRS and state regulatory requirements

501(c)(8) organizations must maintain rigorous compliance with IRS regulations starting from formation. The application process begins with filing Form 1024 to seek recognition of tax-exempt status, which requires detailed documentation of the organization's structure, activities, and financial information. This includes:

- Complete descriptions of past, present, and planned activities

- Financial statements showing revenue and expenses

- Current balance sheet information

- Evidence of operating under a lodge system

- Documentation of member benefits

Once established, these organizations face ongoing reporting obligations, including annual Form 990 filings that disclose detailed financial and operational information. These filings are subject to public inspection and IRS scrutiny. State-level compliance adds another layer of complexity, particularly for organizations offering insurance benefits. Most states require:

- Registration with the state insurance department

- Compliance with state-specific reserve requirements

- Regular financial reporting to state authorities

- Adherence to state insurance regulations

Operational limitations and member focus

501(c)(8) organizations operate under significant constraints that restrict their activities and scope:

- Member-centric operations: These organizations must primarily serve their members rather than the general public. Activities primarily benefiting non-members could jeopardize tax-exempt status.

- Lodge system requirement: Maintaining a functional parent-subordinate lodge system is mandatory, not optional, creating administrative overhead.

- Benefit provision mandate: The organization must provide qualifying life, sick, accident, or similar benefits to members or their dependents.

- Fraternal purpose: Activities must advance a genuine fraternal purpose promoting the social, moral, and intellectual welfare of members.

These limitations restrict growth strategies and revenue generation. Unlike 501(c)(3) charities that can broadly serve the public, fraternal beneficiary societies must carefully balance member services against external activities. Revenue from non-member services must remain insubstantial, limiting potential funding sources.

Ready to establish a company in Delaware? Get started with a free consultation from our expert incorporation service!

Common pitfalls and legal risks

Fraternal beneficiary societies face numerous compliance pitfalls that can threaten their tax-exempt status:

- Lodge system degradation: Failing to maintain a genuine, functioning lodge system with a proper hierarchical structure and regular meetings

- Documentation deficiencies: Inadequate recordkeeping of financial transactions, meeting minutes, and membership criteria

- Mission drift: Straying from the original fraternal purpose toward commercial or public service activities

- Benefit structure problems: Not ensuring that most members qualify for and receive mandated benefits

- Common bond erosion: Inability to demonstrate a continuing common bond (religious, occupational, ethnic, or shared values) among members

Additionally, governance failures present significant legal risks. Board members may face personal liability for mismanagement of funds, excessive compensation arrangements, or failure to exercise proper oversight of the organization's activities. The complex regulatory framework requires constant vigilance and often specialized legal counsel to navigate successfully, creating ongoing administrative and financial burdens for these organizations.

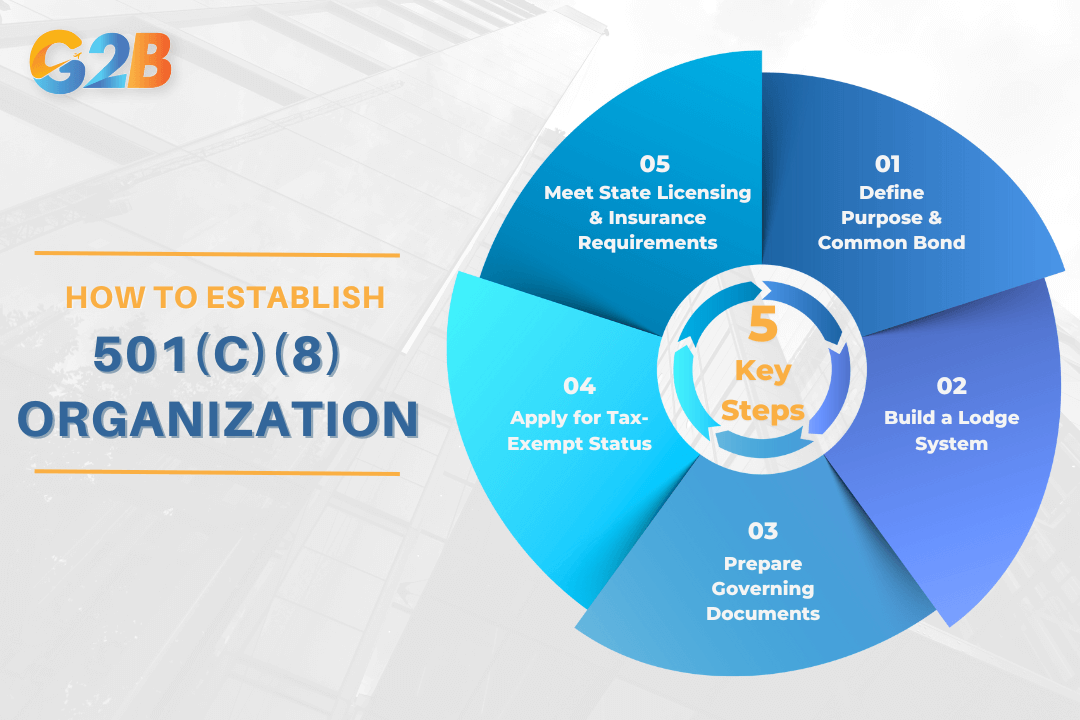

Step-by-step guide: how to start a 501(c)(8) organization

The following roadmap breaks down the complex process into manageable steps for founders seeking to create sustainable fraternal organizations.

The following roadmap breaks down the complex process into 5 steps

Planning and structuring your organization

Successful 501(c)(8) organizations begin with clear definition of the fraternal purpose and identification of a concrete common bond among potential members. This common bond - whether based on profession, faith, ethnicity, or shared interests - forms the foundation of the organization's identity and mission. Founders must document this common bond explicitly in organizational documents to satisfy IRS requirements.

The governance structure requires establishing both a parent organization and at least one subordinate lodge. This lodge system remains a non-negotiable requirement for 501(c)(8) status, with local branches operating semi-autonomously while adhering to parent organization guidelines. Comprehensive bylaws must address membership criteria, benefit eligibility, officer roles, election procedures, and meeting requirements to create a legally sound foundation.

Key planning documents include:

- Articles of incorporation

- Detailed bylaws

- Membership criteria documentation

- Benefit description and eligibility requirements

- Lodge system structure diagrams

Filing for IRS tax-exempt status (Form 1024)

The IRS application process represents a critical milestone for achieving tax-exempt status. Organizations must first obtain an Employer Identification Number (EIN) before completing Form 1024. This detailed application requires comprehensive documentation demonstrating how the organization meets specific fraternal benefit society requirements.

Form 1024 submissions must include:

- Complete organizational documents (articles, bylaws)

- Financial data (revenue/expense statements, balance sheets)

- Detailed descriptions of past, present, and planned activities

- Evidence of the functioning lodge system structure

- Documentation of planned member benefits

The application review process typically takes 3-12 months, with the IRS often requesting additional information to verify compliance with Section 501(c)(8) requirements. Successful applications result in a determination letter confirming tax-exempt status, which serves as the organization's proof of exemption.

State licensing and insurance compliance

Beyond federal recognition, 501(c)(8) organizations face significant state-level regulatory requirements, particularly regarding insurance products and financial benefits. State insurance departments typically require separate licensing procedures before organizations can legally provide benefits to members.

Compliance requirements vary by state but generally include:

- Registration with the Secretary of State

- Insurance department licensing and oversight

- Financial reserve requirements

- Regular audit and reporting procedures

- Actuarial reviews of benefit programs

Organizations offering insurance products must maintain sufficient reserves to guarantee payment of future claims, with many states requiring specific funding levels based on membership size and benefit offerings. Partnering with experienced insurance professionals familiar with fraternal benefit regulations can help navigate these complex requirements.

Comparing 501(c)(8) with other nonprofit types

Nonprofit founders must navigate various tax-exempt classifications when establishing their organizations. The 501(c)(8) organization represents one specific category with distinct characteristics compared to other common nonprofit structures.

501(c)(8) vs. 501(c)(3) vs. 501(c)(4) vs. 501(c)(10)

The primary distinctions between these nonprofit classifications relate to purpose, membership structure, and tax benefits. 501(c)(8) fraternal beneficiary societies operate fundamentally differently from traditional charities and social welfare organizations.

| Feature/Type | 501(c)(3) charitable org. | 501(c)(4) social welfare org. | 501(c)(8) fraternal benefit society | 501(c)(10) domestic fraternal society |

|---|---|---|---|---|

| Primary purpose | Charitable, religious, educational, scientific, literary, etc. | Social welfare, civic betterment | Fraternal, provides member benefits (insurance, etc.) | Fraternal, supports external causes (no member benefits) |

| Eligibility | Open to public, broad mission | Open to public, broad mission | Members with common bond, lodge system | Members with common bond, lodge system |

| Permitted activities | Charitable programs, grants, education, etc. | Advocacy, lobbying, community programs | Member benefits (insurance, scholarships), fraternal activities | Fraternal activities, charitable programs (no insurance/benefits to members) |

| Tax deductibility of donations | Yes, for donors | No | Only if used for charitable/religious/scientific/literary purposes | Only if used for charitable/religious/scientific/literary purposes |

| Tax-exempt status | Yes | Yes | Yes | Yes |

| Lobbying/Political activity | Limited | Permitted (as long as not the primary activity) | Limited, must relate to fraternal purpose | Limited, must relate to fraternal purpose |

| Required structure | Board of directors | Board of directors | Lodge system with parent and subordinate bodies | Lodge system with parent and subordinate bodies |

The compliance requirements differ significantly between these classifications. While 501(c)(3) organizations must file Form 1023 for tax exemption, the other types typically file Form 1024. All nonprofit categories must submit annual Form 990 reports, though specific requirements vary by organizational size and revenue.

Choosing the right structure for your mission

Several practical considerations should drive the decision between nonprofit structures. Organization founders must weigh both immediate needs and long-term vision when selecting the appropriate classification. Mission alignment represents the fundamental consideration. Organizations primarily focused on providing member benefits through a fraternal structure should pursue 501(c)(8) status. Those seeking broader public impact through charitable activities typically benefit more from 501(c)(3) designation.

Funding strategy plays a crucial role in structure selection:

- 501(c)(3) organizations offer donors tax deductions, making fundraising easier

- 501(c)(8) entities generate revenue primarily through membership dues and benefit programs

- 501(c)(4) groups allow more advocacy work but without tax-deductible donation incentives

Operational complexity also differs between structures. The lodge system requirement of 501(c)(8) organizations demands specific governance mechanisms not needed in 501(c)(3) or 501(c)(4) entities. Additionally, organizations offering insurance benefits face more regulatory scrutiny than those focused solely on charitable activities.

Organizations should assess these decision factors:

- Intended beneficiaries (members vs. general public)

- Revenue sources and financial model

- Governance preferences and structural requirements

- Regulatory compliance capacity and resources

- Long-term sustainability plan

Frequently asked questions (FAQs)

Organizations considering 501(c)(8) status often have specific questions about operations, benefits, and compliance. This section addresses the most common inquiries from founders, advisors, and community leaders about fraternal beneficiary societies and their requirements under the Internal Revenue Code.

What is a fraternal beneficiary society?

A fraternal beneficiary society is a not-for-profit membership organization that unites individuals with a common bond or interest. These societies operate as tax-exempt entities under section 501(c)(8) of the Internal Revenue Code, providing both financial and social benefits to their members.

Fraternal beneficiary societies differ from other nonprofits because they maintain a dual purpose: fostering social connections among members while delivering tangible financial benefits. They typically organize around shared values, faiths, professions, or cultural backgrounds, creating lasting communities built on mutual support and shared responsibility.

Can a 501(c)(8) organization have employees?

Yes, 501(c)(8) organizations can hire employees to manage operations and deliver member services. Employment within these organizations must directly support the fraternal purpose and help fulfill compliance obligations rather than serving purely commercial aims.

Key considerations for employment include:

- Ensuring compensation remains reasonable and justifiable

- Documenting how staff positions advance the organization's exempt purpose

- Maintaining appropriate employment tax compliance

- Establishing clear policies to prevent conflicts of interest between employees and the organization's fraternal mission

What benefits can a 501(c)(8) provide?

501(c)(8) organizations offer a distinctive range of member benefits that combine financial security with community support:

Insurance benefits:

- Life insurance policies

- Health insurance coverage

- Accident and disability insurance

- Long-term care protection

Additional member assistance:

- Educational scholarships and grants

- Emergency financial assistance

- Disaster relief funds

- Funeral benefits

- Member discount programs

These benefits serve as the practical manifestation of the fraternal bond, providing tangible value while strengthening community connections.

How do 501(c)(8) organizations maintain tax-exempt status?

Maintaining tax-exempt status requires vigilant compliance with several key requirements:

- Operational structure:

- Maintain an active lodge system with functioning parent and local organizations

- Document regular meetings and fraternal activities

- Demonstrate democratic governance and member participation

- Benefit programs:

- Provide qualifying insurance or other financial benefits to members

- Keep accurate records of benefit distributions

- Reporting and transparency:

- File annual Form 990 with the IRS (Form 990-EZ or 990-N for smaller organizations)

- Meet state regulatory requirements for fraternal benefit societies

- Maintain proper books and records for inspection

What is the lodge system?

The lodge system forms the organizational backbone of all 501(c)(8) organizations. This hierarchical structure consists of a parent organization (sometimes called a supreme lodge) that charters and oversees local lodges or chapters.

Core components:

- Parent organization: Provides overall governance, establishes bylaws, and maintains standards

- Local lodges: Conduct regular meetings, deliver member services, and maintain local governance

- Representative democracy: Members elect officers at both local and parent levels

- Ritualistic elements: Often include ceremonial practices that reinforce shared values

The lodge system ensures member engagement through direct participation, democratic processes, and community-based activities. This structure distinguishes fraternal benefit societies from other nonprofits and insurance companies, creating a unique blend of social connection and mutual aid. A 501(c)(8) organization offer a foundation grounded in mutual aid and long-term stability. Crafting a successful 501(c)(8) requires a deep understanding of fraternal societies and insurance provisions, fostering a legacy of shared values, transparency, and sustainable impact.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom