Among the many categories of U.S. tax-exempt organizations, 501(c)(26) entities serve a highly specific yet vital purpose: Providing state-sponsored health insurance to individuals who are considered high-risk and may be denied private coverage. While they may not be widely known, these organizations play a key role in supporting public health initiatives and expanding access to care for underserved populations. Let’s dive into the definition, compliance requirements, and formation process of 501(c)(26) organizations.

This article is provided for general informational purposes to help professionals understand the basics of 501(c)(26) organizations. We specialize in company formation service and do not provide legal or tax advice concerning U.S. nonprofit regulations. For detailed compliance guidance, please consult a legal expert familiar with state-sponsored health coverage programs and tax-exempt healthcare-related entities.

What is a 501(c)(26) organization?

A 501(c)(26) organization is a state-sponsored high-risk health coverage entity established under Section 501(c)(26) of the Internal Revenue Code to provide medical insurance to residents with pre-existing conditions who cannot obtain coverage through the private market. These entities are created exclusively by state legislatures and operate to pool risk for high-cost individuals, offering access to necessary health coverage that would otherwise be unavailable or unaffordable.

The 501(c) classification originated as a mechanism to distinguish various types of tax-exempt organizations based on their specific missions and activities. Congress initially established this framework to recognize that certain organizations operating for public benefit rather than private profit deserved special tax treatment. The system formally emerged in the Revenue Act of 1954, codifying existing practices and establishing clear categories for different nonprofit purposes.

Over time, the system has expanded significantly beyond the well-known charitable category. Today's 501(c) framework includes over 29 distinct classifications, reflecting evolving social needs and legislative priorities. Each addition to the code typically corresponds to emerging public policy objectives - from supporting veterans' organizations to addressing healthcare access concerns.

Discover how our Delaware incorporation service can support your goals - Begin with a free consultation!

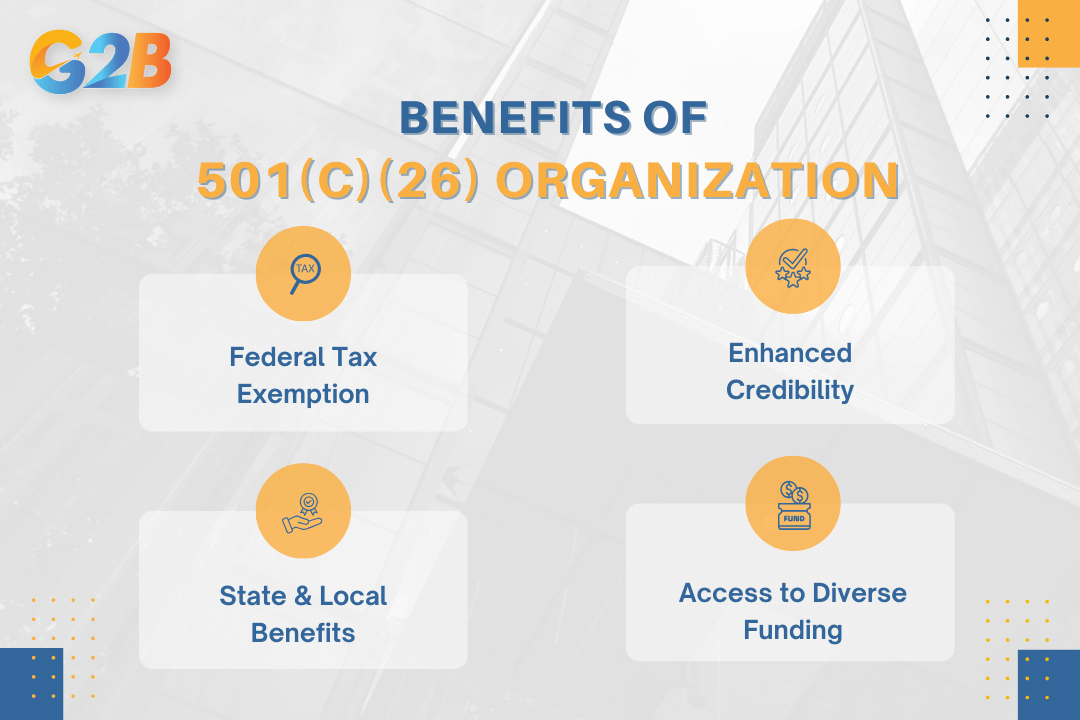

Key benefits and advantages of 501(c)(26) status

Organizations pursuing 501(c)(26) status gain significant advantages that support their specialized missions. Understanding these advantages helps founders and advisors make informed decisions about whether this specialized nonprofit classification aligns with their organizational goals.

501(c)(26) status organizations have significant advantages

Federal tax exemption

501(c)(26) organizations receive exemption from federal income tax on their qualifying revenue streams. This tax shield allows these specialized nonprofits to dedicate more resources directly to fulfilling their statutory purposes rather than paying federal taxes. The exemption applies specifically to income derived from approved activities that align with the organization's exempt purpose. For instance, membership fees, program service revenue, and investment income related to the organization's mission typically qualify for this protection. This tax advantage creates substantial financial efficiency, enabling 501(c)(26) entities to operate with higher net margins than taxable entities performing similar functions.

Enhanced legitimacy and trust

IRS recognition through 501(c)(26) status confers an official government endorsement that significantly bolsters organizational credibility. This formal validation signals to stakeholders that the organization meets rigorous federal standards for public service and financial accountability. The resulting legitimacy translates into tangible benefits:

- Increased confidence from potential donors and grantmakers

- Greater willingness from partners to engage in collaborative ventures

- Enhanced standing with regulatory agencies at all government levels

- Improved public perception as a trustworthy institution

Organizations frequently leverage this credibility advantage in marketing materials, grant applications, and stakeholder communications to strengthen their position in the nonprofit ecosystem.

Potential state and local benefits

Federal 501(c)(26) status often serves as a gateway to additional tax relief at the state and local levels. Many jurisdictions automatically extend exemptions to organizations recognized by the IRS, creating a compounding effect on financial benefits. These state and local advantages commonly include:

| Benefit type | Common examples |

|---|---|

| Tax relief | Sales tax exemption, property tax reduction |

| Fee waivers | Reduced filing fees, permit costs |

| Special access | Eligibility for state contracts, regulatory exemptions |

Organizations should conduct state-specific research, as benefits vary significantly across jurisdictions. Some states require separate application processes, while others grant automatic exemptions upon federal approval.

Access to diverse revenue streams

Tax-exempt status under 501(c)(26) unlocks funding opportunities unavailable to for-profit or non-exempt entities. This expanded financial ecosystem strengthens long-term sustainability and mission advancement. Organizations gain access to:

- Government grants specifically allocated for tax-exempt entities

- Foundation funding restricted to IRS-recognized organizations

- Corporate giving programs with tax-exempt requirements

- Program-related investments from foundations

- Direct public support through tax-advantaged donations

These diversified revenue channels create stability through multiple income streams while allowing the organization to align funding sources with its core mission activities. Financial diversification reduces dependency on any single revenue source, creating greater operational resilience during economic fluctuations.

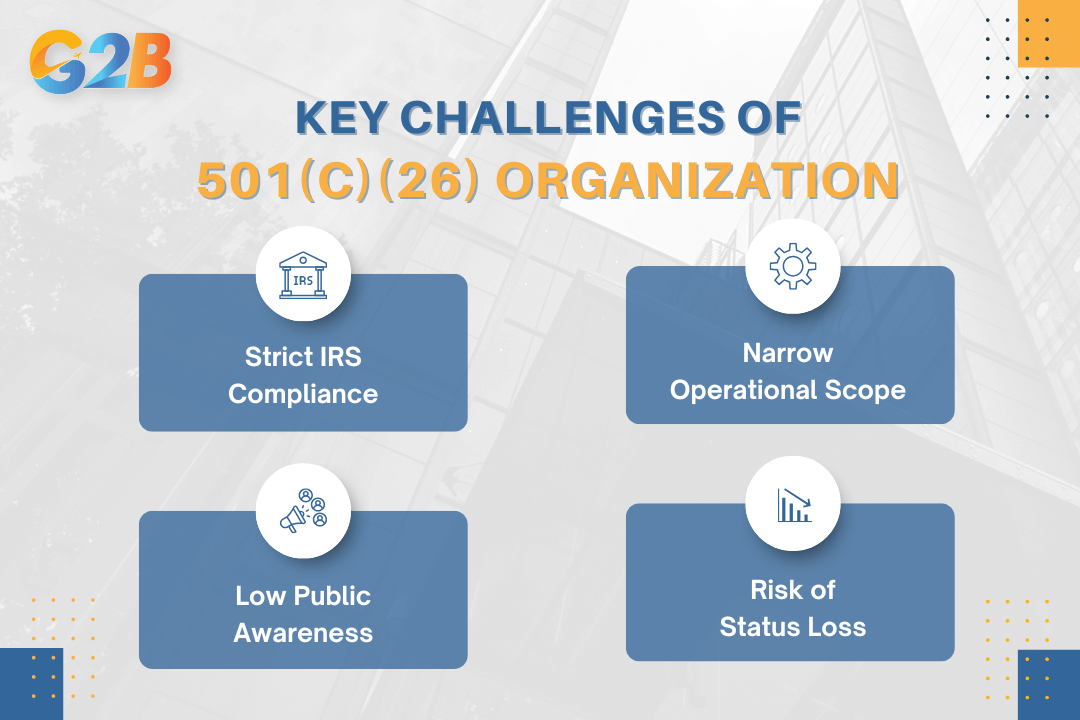

Critical disadvantages and legal risks

While tax exemption offers advantages, these specialized nonprofits encounter substantial regulatory hurdles, operational limitations, and potential legal vulnerabilities that can impact their sustainability and effectiveness.

A 501(c)(26) organization may have limitations that can impact its sustainability

Strict IRS compliance and monitoring

Organizations operating under 501(c)(26) status face heightened regulatory scrutiny that exceeds typical nonprofit oversight. The IRS implements rigorous monitoring protocols, requiring meticulous documentation of activities, financial transactions, and governance decisions. These entities must maintain comprehensive record-keeping systems that demonstrate continued adherence to their exempt purpose. Regular audits occur with higher frequency than for other nonprofit categories, with even minor compliance failures potentially triggering extensive investigations. Organizations typically require:

- Dedicated compliance officers or committees

- Regular internal audits and compliance reviews

- Specialized legal counsel familiar with 501(c)(26) requirements

- Advanced financial tracking systems

- Detailed documentation of all operational decisions

Narrow operational scope

501(c)(26) organizations must operate within extraordinarily restrictive parameters defined by federal statute. Unlike broader nonprofit categories, these entities cannot pivot to adjacent activities or expand their mission without risking their exempt status. The operational constraints create significant strategic limitations. Activities falling outside explicitly permitted functions - even those seemingly aligned with the organization's general purpose - can trigger disqualification. Many organizations find these limitations hamper their ability to:

- Adapt to changing market conditions

- Respond to emerging community needs

- Develop innovative service models

- Generate sustainable revenue

- Scale operations effectively

Lower public awareness

The specialized nature of 501(c)(26) status creates recognition challenges that impact organizational effectiveness. Unlike widely recognized 501(c)(3) charities, these entities operate without the benefit of broad public understanding or automatic credibility. This awareness deficit manifests in multiple operational challenges. Potential donors, partners, and stakeholders often require extensive education about the organization's legitimacy and purpose. Communications teams frequently struggle to:

- Develop concise, compelling explanations of their unique status

- Differentiate from better-known nonprofit categories

- Build fundraising messages that overcome awareness barriers

- Establish credibility with skeptical audiences

- Create brand recognition in competitive nonprofit environments

Potential for loss of status

The most severe risk facing 501(c)(26) organizations is the catastrophic consequence of status revocation. Non-compliance, whether deliberate or accidental, can trigger severe penalties that threaten organizational survival. Loss of exemption creates cascading financial and reputational damage. Organizations face retroactive taxation on previously exempt income, substantial penalties, and public trust erosion. Common triggers for status loss include:

| Compliance failure | Potential consequences |

|---|---|

| Mission drift | Immediate exemption revocation |

| Inadequate governance | Back taxes plus penalties |

| Failure to file required reports | Public disclosure of non-compliance |

| Private benefit violations | Personal liability for directors |

| Excess business activities | Difficulty regaining exempt status |

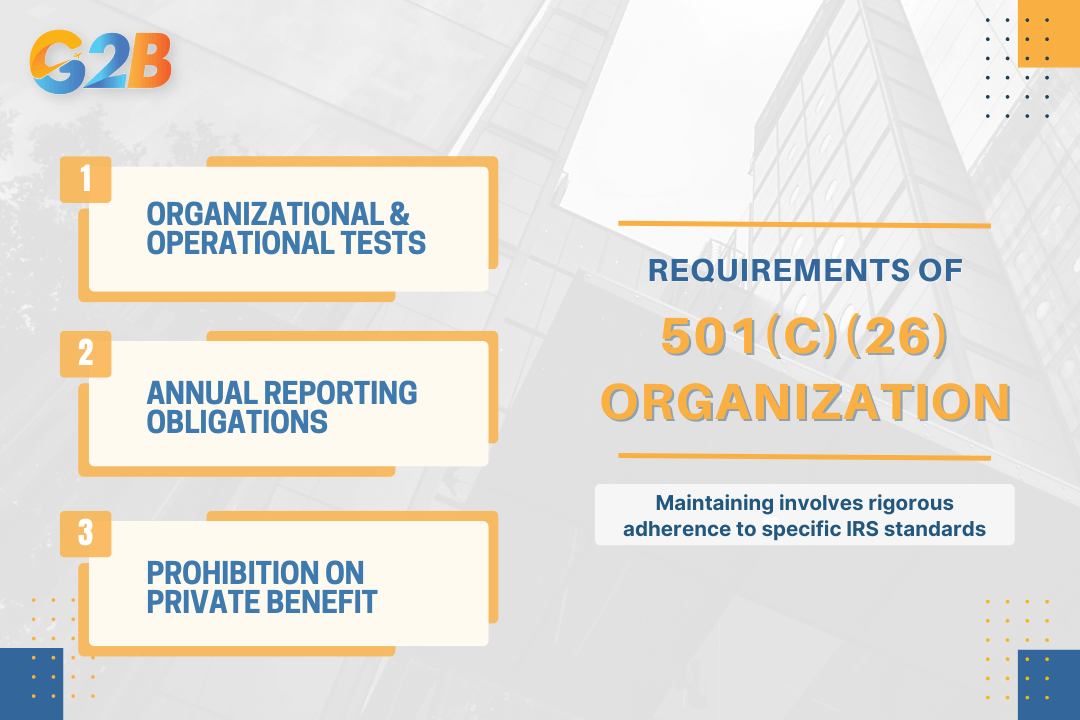

501(c)(26) compliance requirements and IRS expectations

Maintaining a 501(c)(26) organization involves rigorous adherence to specific IRS standards designed to ensure these specialized nonprofits fulfill their intended purpose. The IRS establishes clear guidelines for these membership organizations established by states to provide medical care coverage.

Maintaining a 501(c)(26) organization involves specific compliance requirements

Organizational and operational tests

501(c)(26) organizations must satisfy both organizational and operational tests to maintain their tax-exempt status. The organizational test examines whether the entity's formation documents - including articles of incorporation and bylaws - explicitly limit activities to providing medical care coverage for members as established by state law. These governing documents must include specific provisions such as:

- A purpose clause limiting activities to those permitted under 501(c)(26)

- A dissolution clause directing assets to similar exempt purposes

- Prohibition against private inurement

The operational test focuses on actual activities rather than documentation. Organizations must demonstrate that operations exclusively advance their exempt purpose of providing medical care or incidental services to members. Any significant activities falling outside this mission may jeopardize exempt status, regardless of how well-crafted the organizing documents appear.

Annual reporting and filing duties

501(c)(26) organizations face mandatory annual reporting requirements to maintain good standing with the IRS. Most file Form 990 series returns, with specific forms determined by organizational size and revenue. Key filing obligations include:

- Form 990 (or 990-EZ/990-N) is submitted annually by the deadline

- Schedule A and other required attachments

- State-level annual reports and renewals

- Local business licenses or permits

These filings serve multiple purposes - demonstrating continued eligibility for exemption, providing transparency into operations, and ensuring accountability. The IRS increasingly scrutinizes these filings for accuracy and completeness. Organizations should implement robust systems for tracking deadlines, gathering required information, and maintaining supporting documentation for all reported figures.

Restrictions on private benefit

The prohibition against private benefit represents a foundational requirement for 501(c)(26) organizations. The tax code explicitly states that no part of the organization's net earnings may inure to the benefit of private individuals, including founders, directors, officers, or key employees. Prohibited activities include:

- Excessive compensation arrangements

- Below-market loans to insiders

- Non-fair-market-value property transfers

- Business arrangements favoring board members or their businesses

Violations carry severe consequences, potentially including:

- Excise taxes on disqualified persons

- Personal liability for board members

- Revocation of exempt status

- Requirement to pay back taxes with penalties and interest

Organizations should implement conflict of interest policies, independent compensation reviews, and transaction approval procedures to prevent even the appearance of private benefit.

What can trigger loss of exemption?

Several common pitfalls can lead to revocation of 501(c)(26) status. Understanding these risks helps organizations implement preventative measures.

| Risk factor | Description | Prevention strategy |

|---|---|---|

| Mission drift | Expanding beyond medical care coverage | Regular mission alignment reviews |

| Inadequate documentation | Failure to maintain proper records | Comprehensive recordkeeping systems |

| Reporting failures | Missing annual filing deadlines | Compliance calendar with reminders |

| Private benefit issues | Self-dealing or insider advantage | Strong governance oversight |

| Substantial non-exempt activities | Focusing on unauthorized functions | Regular operational audits |

Regular self-audits provide essential protection against compliance failures. These assessments should evaluate organizational structure, governance practices, financial management, and program activities against current IRS requirements for 501(c)(26) organizations.

501(c)(26) vs. Other 501(c) nonprofit types: A comparative guide

Organizations seeking tax-exempt status must navigate numerous 501(c) classifications, each with distinct requirements and benefits. This comparative analysis helps founders and advisors determine which nonprofit structure aligns best with their organizational mission and statutory requirements.

501(c)(26) vs. 501(c)(3): Core differences

The 501(c)(26) designation serves a significantly narrower purpose than its more common 501(c)(3) counterpart. While 501(c)(3) organizations encompass broad charitable, religious, educational, and scientific pursuits, 501(c)(26) entities focus exclusively on state-sponsored high-risk health coverage pools established by statute. Besides that, 501(c)(3) status represents the default choice for most nonprofit founders, offering benefits like tax-deductible donations and widespread public recognition. In contrast, 501(c)(26) organizations operate within strict statutory parameters and typically require specific state legislation for their formation and operation.

| Feature | 501(c)(26) | 501(c)(3) |

|---|---|---|

| Primary purpose | High-risk health insurance pools | Broad charitable activities |

| Formation requirements | State legislation typically required | No statutory mandate needed |

| Donation deductibility | Generally not tax-deductible | Tax-deductible for donors |

| Public recognition | Limited, specialized | Widely recognized |

| Operational flexibility | Narrow, statutorily defined | Broad range of permissible activities |

501(c)(26) vs. other 501(c) categories

The Internal Revenue Code includes numerous 501(c) classifications beyond the commonly known 501(c)(3) and specialized 501(c)(26) designations. 501(c)(4) organizations focus on social welfare activities and advocacy, allowing significantly more lobbying than 501(c)(3) entities. Examples include civic leagues and community improvement organizations. Meanwhile, 501(c)(6) status suits business leagues, chambers of commerce, and professional associations that promote common business interests without operating for profit. These organizations can engage in substantial lobbying related to their exempt purposes.

Additional categories include:

- 501(c)(5): Labor and agricultural organizations

- 501(c)(7): Social and recreational clubs

- 501(c)(8): Fraternal beneficiary societies

- 501(c)(9): Voluntary employees' beneficiary associations

- 501(c)(12): Benevolent life insurance associations and utilities

How to choose the right status

Selecting the appropriate 501(c) designation requires a systematic analysis of organizational goals, activities, and legal requirements. First, assess statutory eligibility by examining whether the organization's activities align with the specific requirements of specialized designations like 501(c)(26). For state-mandated health risk pools, 501(c)(26) may be mandatory rather than optional.

Mission alignment represents the second critical factor. Organizations should select the classification that most closely matches their core activities and governance structure. While 501(c)(3) offers the broadest flexibility, specialized classifications provide targeted benefits for specific activities. Consider these practical factors when selecting a 501(c) designation:

- Revenue sources and funding strategies

- Political or lobbying activity requirements

- Governance structure and stakeholder relationships

- Public perception and recognition needs

- Long-term sustainability and growth plans

Expert consultation proves invaluable during this decision process. Tax attorneys, nonprofit specialists, and accountants familiar with exempt organizations can provide critical guidance before committing to a specific classification.

Start your US business right - Contact G2B for a free consultation on Delaware incorporation service today!

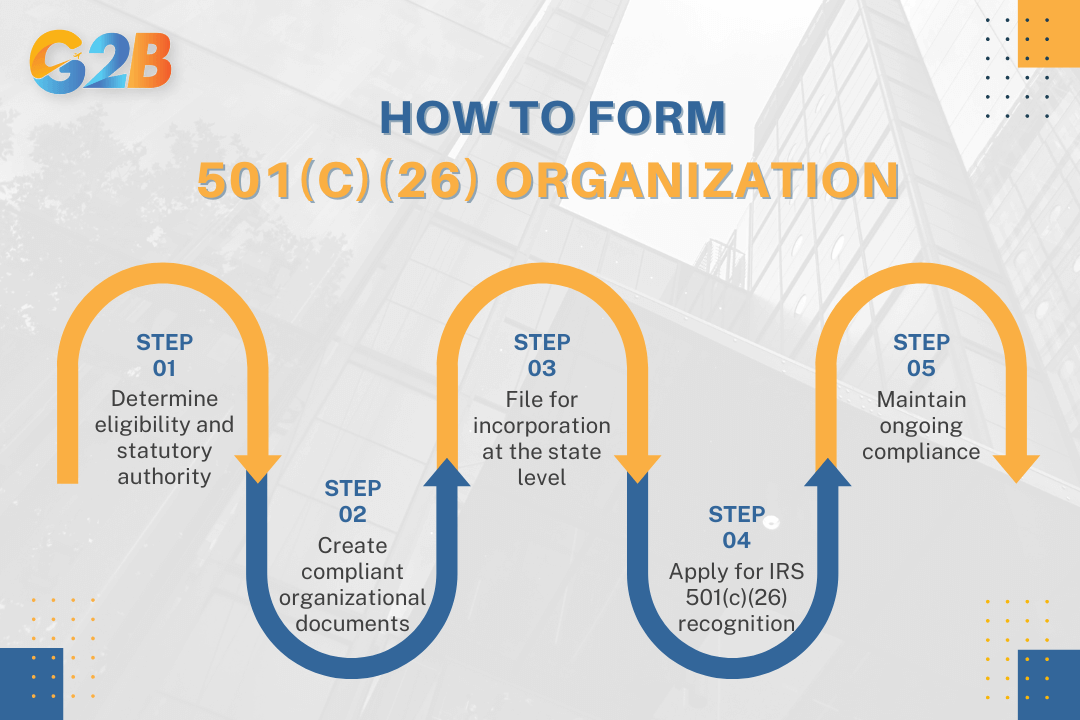

How to form a 501(c)(26) organization

Establishing a 501(c)(26) organization requires careful navigation through specific legal and regulatory requirements. The following checklist provides founders with a systematic approach to creating a compliant organization recognized by both state authorities and the IRS.

Establishing a 501(c)(26) organization requires five steps

1. Determine eligibility and statutory authority

Eligibility for 501(c)(26) status hinges on specific statutory requirements. Organizations must confirm their purpose aligns with IRS definitions for this category, which typically involves state-sponsored high-risk health insurance pools. Before proceeding, founders should:

- Review federal tax code provisions to ensure activities fall within permissible parameters for 501(c)(26) status. This specialized classification requires verification that the organization's purpose matches statutory language in section 501(c)(26) of the Internal Revenue Code.

- Secure state enabling legislation or government sponsorship documentation where required. Many 501(c)(26) organizations exist as state-mandated entities, requiring formal legislative authorization or executive branch sponsorship before formation can proceed.

2. Create compliant organizational documents

Organizational documents form the foundation for IRS recognition. These documents must contain specific provisions to meet federal requirements for 501(c)(26) status:

- Articles of incorporation should explicitly state the exempt purpose aligned with 501(c)(26) requirements, include language prohibiting private inurement, and contain appropriate dissolution clauses directing assets to similar exempt entities. These provisions aren't optional - they represent core IRS requirements for recognition.

- Bylaws must establish governance structures, operational procedures, and internal controls that support compliance with both state and federal regulations. Properly crafted bylaws should address board composition, meeting requirements, officer duties, and conflict of interest policies specific to 501(c)(26) operations.

3. File for incorporation at the state level

State-level registration establishes the legal entity before seeking federal tax exemption:

- Submit completed articles of incorporation to the appropriate state agency, typically the Secretary of State. Include all required supplemental materials and pay applicable filing fees to secure legal standing as a nonprofit corporation.

- Obtain an Employer Identification Number (EIN) from the IRS, even before applying for tax-exempt status. This unique identifier serves as the organization's federal tax ID and is necessary for banking, hiring, and subsequent tax filings.

- Research and secure any required state business licenses, permits, or additional registrations based on operational activities. Some states offer separate tax exemptions at the state level requiring additional applications.

4. Apply for IRS 501(c)(26) recognition

Federal recognition requires comprehensive documentation submitted to the IRS:

- Prepare Form 1024, "Application for Recognition of Exemption Under Section 501(a)" with complete supporting documentation. Unlike 501(c)(3) organizations that use Form 1023, most 501(c)(26) entities use the alternative Form 1024.

- Include all corporate documents: articles of incorporation, bylaws, and any amendments. Attach detailed descriptions of organizational activities, evidence of statutory authority, and financial projections demonstrating operational viability within exempt parameters.

- Be prepared to respond to IRS inquiries or requests for additional information during the review process. Applications frequently trigger follow-up questions requiring clarification or supplemental documentation.

5. Maintain ongoing compliance

Securing exempt status represents only the beginning of compliance obligations:

- Establish systems for annual IRS filings, typically Form 990-series returns due within 4.5 months after fiscal year-end. Calendar reminders and designated responsibility assignments help prevent missed deadlines that could jeopardize exempt status.

- Implement governance best practices including regular board meetings, detailed minutes, and periodic bylaw reviews. Maintaining active governance demonstrates organizational commitment to mission and compliance requirements.

- Create record-keeping protocols for financial transactions, program activities, and board decisions. Comprehensive documentation provides essential evidence during IRS examinations or routine compliance reviews.

Frequently asked questions (FAQ)

Understanding the unique role and regulatory requirements of 501(c)(26) organizations can raise many important questions, especially for those new to this tax-exempt category. Below are some of the most frequently asked questions to help clarify how these state-sponsored high-risk health coverage providers operate:

1. Are donations to 501(c)(26) organizations tax-deductible?

No, donations to 501(c)(26) organizations are not tax-deductible for donors. Unlike 501(c)(3) charitable organizations, contributions to 501(c)(26) state-sponsored high-risk health coverage organizations do not qualify for charitable deduction benefits under federal tax law.

2. Must 501(c)(26) organizations be established by state governments?

Yes, 501(c)(26) organizations must be state-sponsored membership organizations established exclusively by states for providing medical care coverage to high-risk individuals who are state residents. They cannot be created by private entities or individuals.

3. Can 501(c)(26) organizations serve individuals without pre-existing conditions?

No, 501(c)(26) organizations are specifically designed to serve high-risk individuals with pre-existing medical conditions who cannot obtain coverage through regular insurance or HMOs, or can only obtain coverage at significantly higher rates.

4. Do 501(c)(26) organizations need to apply for tax exemption?

Yes, 501(c)(26) organizations must apply for tax-exempt status using Form 1024 - Application for Recognition of Exemption. The application must demonstrate that the organization meets all requirements for state-sponsored high-risk health coverage organizations under IRC Section 501(c)(26).

5. Are 501(c)(26) organizations required to file annual tax returns?

Yes, 501(c)(26) organizations that obtain federal tax exemption are required to file Form 990 series returns annually with the IRS. The specific form depends on their annual gross receipts and total assets.

6. Can 501(c)(26) organizations have shareholders or private investors?

No, 501(c)(26) organizations cannot benefit any private shareholders or individuals. As tax-exempt organizations, none of their net earnings may inure to the benefit of private parties, and they must operate exclusively for their exempt purpose.

7. Must 501(c)(26) organizations provide coverage directly or can they contract with others?

Either, 501(c)(26) organizations can provide medical care coverage either by issuing insurance directly or by entering into arrangements with health maintenance organizations (HMOs). Both methods are acceptable under the tax code provisions.

8. Are 501(c)(26) organizations still relevant after the Affordable Care Act?

Limited relevance, since the ACA prohibits insurers from denying coverage based on pre-existing conditions and requires guaranteed issue. Many state high-risk pools were phased out or became less necessary after the ACA implementation in 2014.

9. Can 501(c)(26) organizations engage in unrelated business activities?

Limited, like other tax-exempt organizations, 501(c)(26) entities can engage in some unrelated business activities but must pay unrelated business income tax (UBIT) on such income. Substantial unrelated business activity could jeopardize their tax-exempt status.

10. Do 501(c)(26) organizations have membership restrictions?

Yes, membership is restricted to high-risk individuals who are residents of the sponsoring state and meet specific eligibility criteria related to their inability to obtain affordable health coverage due to pre-existing conditions. Coverage may extend to spouses and children of eligible individuals.

A 501(c)(26) organization embodies the harmonious blend of financial prudence and altruistic ambition, offering significant tax advantages while supporting uninsured public services. Entrepreneurs and advisors who embrace the complexities of IRS compliance discover a path to sustainable operations and enhanced credibility. By understanding the distinct characteristics of 501(c) organization types, think tank leaders confine financial worries, focusing energy on societal impacts.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom