A 501(c)(2) organization plays a crucial role in managing real estate for nonprofits, protecting valuable assets while reducing liability exposure. As these title-holding corporations work seamlessly within nonprofit structures, understanding their legal framework becomes essential. Let’s delve into the definition, key benefits, and foundational steps to establish a 501(c)(2) organization with confidence and clarity.

This article is provided for general informational purposes to help entrepreneurs understand the basics of 501(c)(2) organizations. We are specialists in company formation, not providers of legal or tax advisory services specific to the US nonprofit compliance. This information should not be considered professional legal or tax advice. For guidance specific to your situation, please consult a nonprofit compliance expert.

What is a 501(c)(2) organization?

A 501(c)(2) organization is a special type of tax-exempt entity under the U.S. Internal Revenue Code, known as a title holding corporation for single parent corporations. Its exclusive purpose is to hold title to property, collect income from that property, and then turn over all net income (after expenses) to another tax-exempt organization.

Formal IRS definition and legal meaning

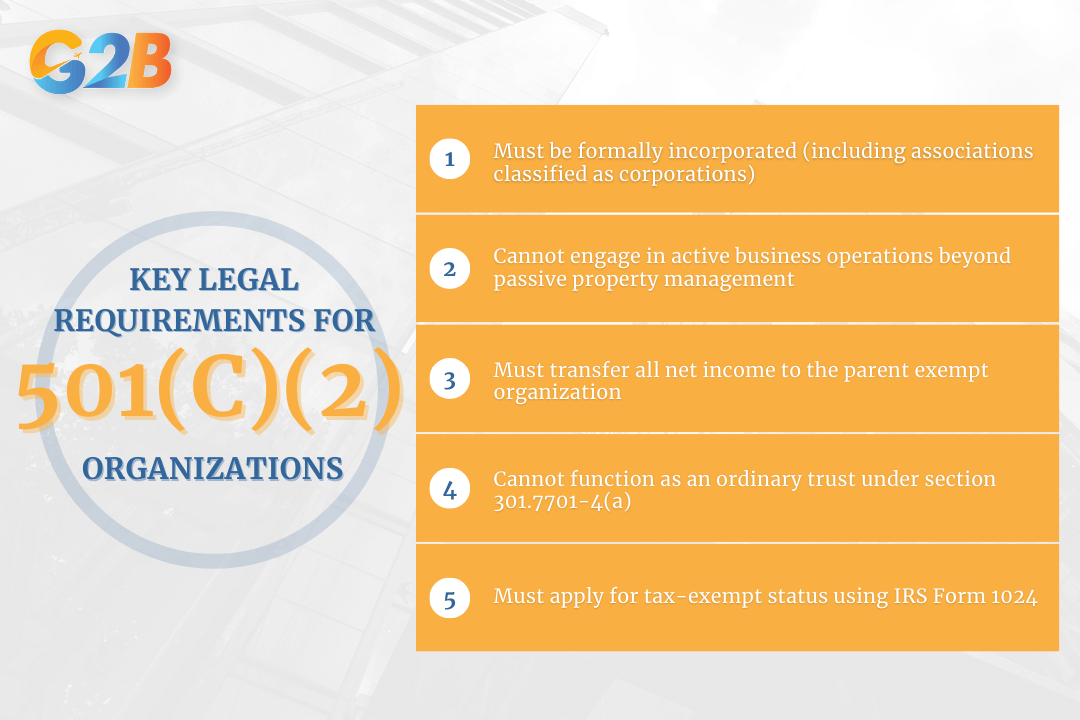

501(c)(2) organizations must adhere to strict legal criteria established by the Internal Revenue Code. The Internal Revenue Service (IRS) defines these entities as corporations organized exclusively for holding title to property, collecting income, and remitting that income (minus expenses) to an organization that qualifies for exemption under Section 501(a). Key legal requirements include:

- Must be formally incorporated (including associations classified as corporations)

- Cannot engage in active business operations beyond passive property management

- Must transfer all net income to the parent exempt organization

- Cannot function as an ordinary trust under section 301.7701-4(a)

- Must apply for tax-exempt status using IRS Form 1024

Five key legal requirements of 501(c)(2) organizations

The narrow scope of permissible activities distinguishes 501(c)(2) organizations from other nonprofit entities. They function strictly as passive holding companies with no authority to conduct charitable programs, fundraising activities, or unrelated business ventures.

Start your US business right - Contact G2B for a free consultation on Delaware incorporation service today!

Simple explanation for nonprofit leaders and entrepreneurs

Think of a 501(c)(2) organization as a specialized holding company designed specifically for nonprofits. It serves as a protective container for valuable assets such as:

- Real estate properties (buildings, land, facilities)

- Intellectual property (trademarks, patents, copyrights)

- Investment portfolios

- Equipment and vehicles

For nonprofit leaders, the 501(c)(2) model offers a straightforward solution to complex risk management challenges. Consider this structure as creating a separate "legal box" that:

- Shields valuable assets from operational liabilities

- Protects the parent organization from property-related lawsuits

- Simplifies property management accounting

- Preserves tax-exempt status for income derived from those assets

This arrangement proves especially valuable for organizations with significant property holdings or those operating in fields with higher liability exposure. The parent organization maintains full control over the 501(c)(2) while benefiting from the added layer of legal protection and streamlined asset management.

How 501(c)(2) organizations work: Structure and roles

The structural framework demands strict adherence to specific parameters - the organization must be incorporated, remain wholly controlled by its tax-exempt parent (typically a 501(c)(3)), limit activities to passive asset management, and transfer all net income to the parent organization after covering necessary expenses.

Key components and legal requirements

The foundation of every 501(c)(2) organization rests on four essential compliance pillars. First, the entity must be formally incorporated, establishing its separate legal existence. Second, its charter must contain narrowly defined language that explicitly limits its purpose to holding title to property and collecting income - broad or ambiguous language can trigger IRS scrutiny.

The organization must maintain complete control by a parent exempt organization, demonstrated through governance documents and operational practices. This control relationship represents a critical element the IRS examines during the application process. Finally, to secure tax-exempt status, the organization must file IRS Form 1024, providing comprehensive documentation of its structure, purpose, and relationship with its parent organization.

Types of title-holding corporations

Most 501(c)(2) organizations operate as single-entity title-holding corporations, serving one parent organization exclusively. This straightforward arrangement works effectively for most nonprofits seeking asset protection and simplified management. The parent organization maintains control through board appointments and oversight mechanisms.

For more complex situations involving multiple nonprofits with shared property interests, multi-parent structures may be established. These arrangements allow several tax-exempt organizations to benefit from a centralized property-holding entity. Such structures require careful legal planning to maintain proper governance and ensure compliant income distribution to multiple parent organizations.

Roles and responsibilities

The relationship between a 501(c)(2) and its parent organization follows clear lines of authority and responsibility. The parent nonprofit maintains control over the 501(c)(2) through board appointments and governance oversight. This control ensures alignment with the parent organization's mission while preserving the necessary legal separation.

The 501(c)(2) fulfills four primary responsibilities:

- Holding legal title to property assets

- Managing those properties effectively

- Collecting income generated from the assets

- Passing all net proceeds to the parent organization after expenses

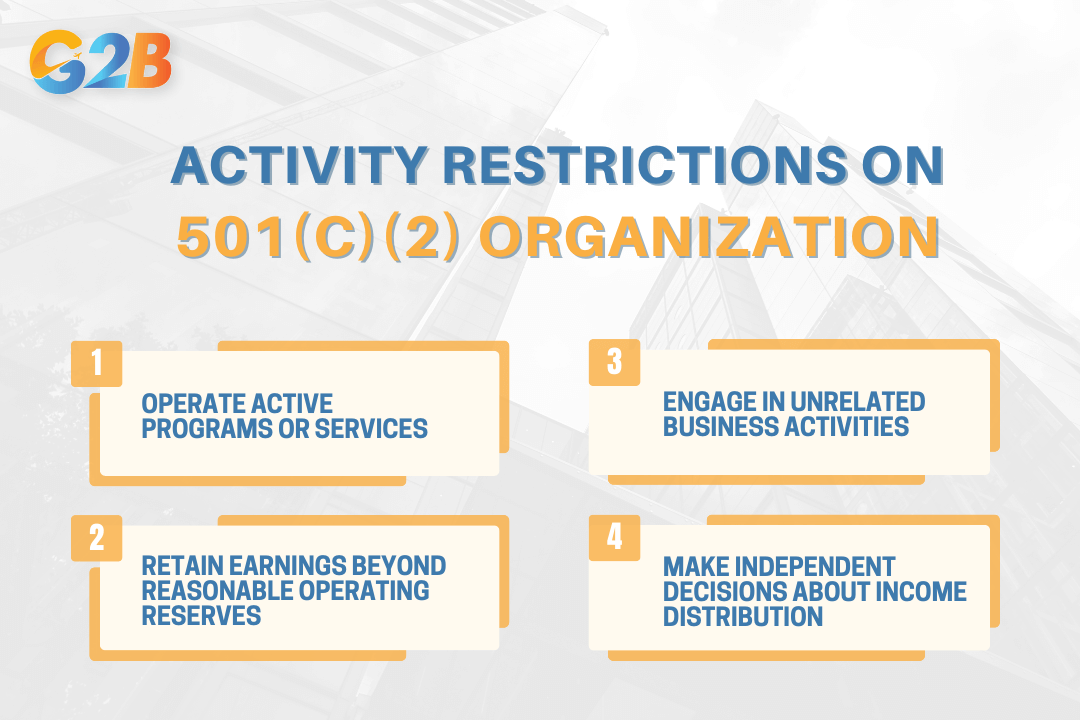

Significantly, a 501(c)(2) organization faces strict activity limitations. It cannot:

- Operate active programs or services

- Engage in unrelated business activities

- Retain earnings beyond reasonable operating reserves

- Make independent decisions about income distribution

These limitations reinforce the focused purpose of 501(c)(2) organizations within the nonprofit ecosystem - providing asset protection while maintaining a clear channel for income to flow to the parent organization's exempt activities.

A 501(c)(2) organization faces strict activity limitations

Benefits of using a 501(c)(2) organization

A 501(c)(2) organization offers strategic advantages for nonprofits seeking to protect their valuable assets while maintaining operational efficiency. These title-holding corporations serve as specialized vehicles that separate asset ownership from program activities, creating a powerful risk management framework.

Asset protection and risk mitigation

501(c)(2) organizations establish a critical liability barrier between valuable assets and the parent nonprofit's day-to-day operations. This separation shields the parent organization from property-related lawsuits, accidents, or financial claims that could otherwise threaten its mission and financial stability.

The protective structure works by legally isolating assets within the title-holding entity, making them significantly more difficult to attach in legal judgments against the parent. For youth programs, daycares, schools, and churches - organizations that face elevated liability risks - this additional protection layer can prove essential. The parent organization maintains control while reducing exposure to potentially catastrophic claims related to property ownership.

Tax and compliance advantages

Income generated from property held by a properly structured 501(c)(2) organization remains exempt from federal income tax. This creates significant financial benefits for nonprofits with income-producing assets, provided all regulatory requirements are satisfied. The tax advantages come with specific compliance parameters:

- All net income must transfer to the parent organization

- The entity must organize exclusively for holding title and collecting income

- The application requires Form 1024 submission to the IRS

Additionally, 501(c)(2) organizations may qualify for exemption from state sales and property taxes, though this varies by jurisdiction. For private foundations, these structures can assist in managing the 5% minimum distribution requirement, creating further compliance efficiencies.

Operational efficiency and flexibility

The centralization of asset management within a 501(c)(2) streamlines nonprofit operations in several ways:

- Financial clarity: Separates property-related finances from program operations

- Accounting simplification: Creates cleaner financial reporting and oversight

- Property management: Centralizes real estate and asset administration

- Investment flexibility: Allows holding various assets including stocks and bonds

This structure accommodates diverse property types beyond real estate, extending to intellectual property, equipment, and investment assets. For organizations with multiple properties or complex holdings, the operational advantages compound through simplified administration and focused management.

The 501(c)(2) also facilitates financing arrangements or operational support for other exempt organizations, creating additional flexibility for nonprofit leaders seeking to maximize their resource efficiency while maintaining strict compliance.

Discover how our Delaware incorporation service can support your goals - Begin with a free consultation!

Disadvantages and limitations of 501(c)(2) organizations

While 501(c)(2) organizations offer valuable asset protection benefits, they come with restrictions and compliance that should be considered. These title-holding corporations operate under strict IRS limitations that constrain their activities and require rigorous administrative oversight.

Legal and operational restrictions

501(c)(2) organizations face severe constraints on permissible activities, limiting their functionality compared to other nonprofit entities. These corporations must operate exclusively as passive asset managers, holding property and collecting income solely for their parent organizations. The IRS prohibits 501(c)(2) entities from:

- Conducting active charitable programs or direct mission work

- Engaging in unrelated business activities or general real estate ventures

- Developing property beyond basic maintenance functions

- Trading in mortgages or real estate interests

- Exercising broad powers outside their narrow title-holding purpose

These restrictions create a purely instrumental entity with no independent programmatic capacity. Parent organizations seeking both asset protection and operational flexibility must maintain separate structures for each function, potentially complicating governance and increasing administrative overhead.

Compliance and reporting obligations

501(c)(2) organizations bear substantial administrative burdens that require dedicated resources and expertise. The compliance requirements begin at formation and continue throughout the entity's existence, creating ongoing costs and potential liability. Essential compliance obligations include:

- Separate corporate formation with associated legal and filing fees

- Precise charter language strictly conforming to 501(c)(2) purposes

- Application for tax-exempt status via IRS Form 1024

- Annual Form 990 tax filings with the IRS

- Meticulous accounting to demonstrate all net income returns to the parent

- Detailed record-keeping systems documenting compliance

| Compliance requirement | Consequences of non-compliance |

|---|---|

| Strict charter language | Denial of the exemption application |

| Limited activities | Revocation of exempt status |

| Complete income transfer | Tax liability on retained funds |

| Annual IRS filings | Penalties and potential revocation |

Failure to maintain compliance can jeopardize tax-exempt status for both the 501(c)(2) and its parent organization, potentially creating significant tax liabilities and reputational harm. This risk requires vigilant oversight by boards and management to ensure continuous adherence to IRS regulations.

501(c)(2) vs 501(c)(3) and other 501(c) types: Key differences

501(c)(2) organizations operate within a distinct niche compared to other tax-exempt entities. These specialized corporations hold and manage assets exclusively for parent tax-exempt organizations, creating a clear separation between property ownership and operational activities.

Comparison table: 501(c)(2) vs 501(c)(3)

| Feature | 501(c)(2) | 501(c)(3) |

|---|---|---|

| Primary purpose | Hold/manage assets for exempt organizations | Operate charitable, educational and religious programs |

| Activities permitted | Title holding, passive asset management | Direct program delivery, fundraising |

| IRS application | Form 1024 | Form 1023 |

| Tax-deductible donations | No | Yes |

| Typical use cases | Real estate holding, asset protection | Charities, schools, churches, foundations |

| Public support test | No | Yes (for public charities) |

| Lobbying/political activities | Not applicable | Limited lobbying, no political campaigns |

This fundamental distinction in purpose drives significant differences in governance, compliance requirements, and operational scope. The 501(c)(2) structure offers specialized asset protection but lacks the broad operational mandate and donation benefits of a 501(c)(3).

When to use a 501(c)(2) vs other structures

Nonprofit boards face critical decisions when selecting the appropriate tax-exempt structure. The 501(c)(2) designation serves a narrow but powerful purpose: asset protection and risk management. Organizations should consider this structure when:

- Significant real estate holdings need protection from operational liabilities

- Intellectual property assets require segregation from program activities

- The organization needs to shield valuable assets from potential claims

- A parent nonprofit needs centralized asset management

In contrast, 501(c)(3) status remains appropriate for organizations primarily conducting charitable, educational, or religious programs. This classification offers the crucial benefit of tax-deductible donations and broader operational scope but comes with stricter public benefit requirements and limitations on political activities.

Other 501(c) designations address specialized needs across the nonprofit sector:

- 501(c)(4) organizations focus on social welfare activities

- 501(c)(5) entities represent labor, agricultural, and horticultural interests

- 501(c)(6) organizations serve business leagues and chambers of commerce

- 501(c)(7) groups operate social and recreational clubs

The selection between these structures depends on organizational mission, funding sources, governance preferences, and risk management priorities. Nonprofits should consult with legal and tax advisors before establishing any tax-exempt entity to ensure proper alignment with long-term objectives.

Step-by-step guide: How to set up a 501(c)(2) organization

Setting up a 501(c)(2) organization demands careful preparation and accurate implementation to meet IRS compliance requirements. Entrepreneurs should follow a structured approach to formation and maintain rigorous compliance protocols throughout the organization's lifecycle.

Formation and compliance steps

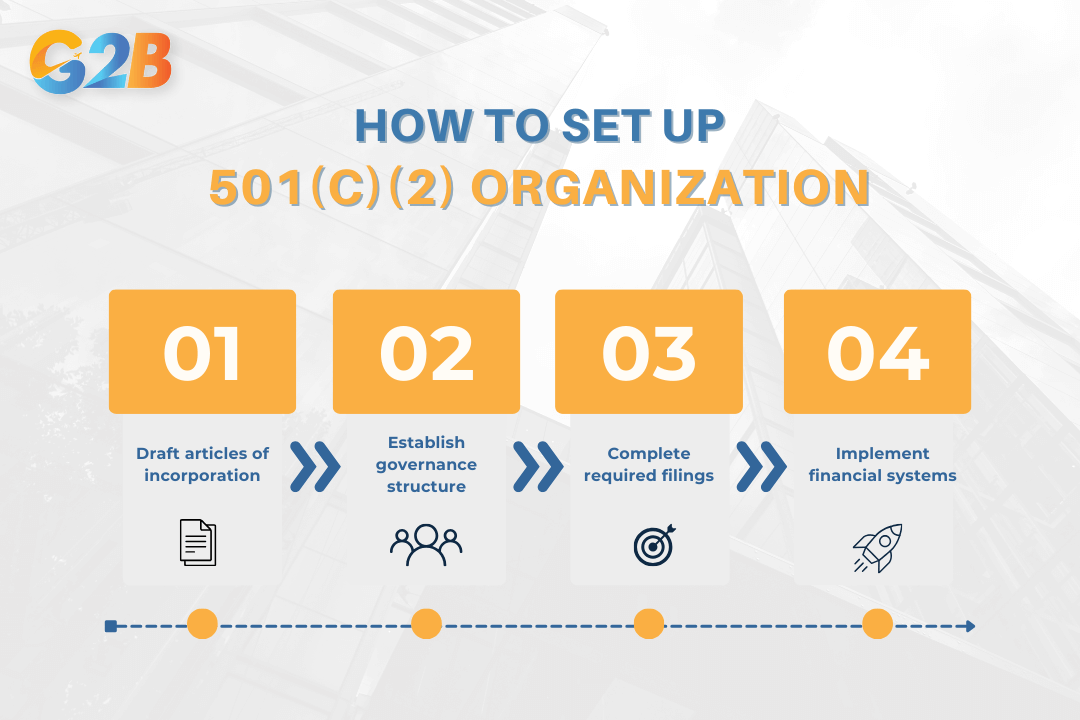

The formation of a 501(c)(2) organization follows a sequential process that begins with proper incorporation and continues through IRS recognition:

- Draft articles of incorporation

- Specify the exclusive purpose of holding title to property

- Include explicit language about collecting income for the parent organization

- Ensure compliance with state corporation laws

- Establish governance structure

- Create bylaws demonstrating parent organization control

- Form a board of directors (often overlapping with parent organization)

- Document the relationship between the 501(c)(2) and parent entity

- Complete required filings

- Apply for an Employer Identification Number (EIN)

- Submit IRS Form 1024 for tax-exempt recognition

- Include supporting documentation showing the exclusive purpose

- Register with the appropriate state agencies as required

- Implement financial systems

- Establish dedicated accounting procedures

- Create mechanisms to track income and expenses

- Develop protocols for transferring net income to the parent organization

- Set up separate bank accounts and financial controls

Maintaining compliance requires ongoing vigilance. Annual filing of Form 990 with the IRS, regular board meetings, and comprehensive documentation of all property transactions protect the organization's exempt status.

Steps to set up a 501(c)(2) organization to meet IRS compliance requirements

Common mistakes and how to avoid them

Many 501(c)(2) organizations jeopardize their tax-exempt status through preventable errors in structure or operation:

Charter language pitfalls

- Using overly broad language that suggests active business operations

- Failing to specify the exclusive purpose of holding title to property

- Solution: Employ an attorney with nonprofit expertise to draft precise formation documents

Operational boundary crossings

- Engaging in active business beyond passive property management

- Developing income sources unrelated to property holding

- Solution: Create clear operational guidelines limiting activities to the statutory purpose

Financial mismanagement

- Retaining income rather than transferring to the parent organization

- Using assets for purposes beyond the scope of the organization

- Solution: Implement regular financial reviews and compliance audits

Governance failures

- Inadequate parent control over the title-holding entity

- Insufficient documentation of board decisions

- Solution: Maintain meticulous records of all board meetings and decisions

Organizations should conduct annual compliance reviews with qualified legal counsel familiar with 501(c)(2) requirements. This proactive approach identifies potential issues before they trigger IRS scrutiny or compromise tax-exempt status.

Incorporating in Vietnam? - Talk to G2B’s expert team today!

Navigating legal challenges

Boards overseeing 501(c)(2) organizations should implement quarterly compliance reviews to identify potential issues before they attract IRS scrutiny. These reviews should examine:

- Organizational documents to ensure they explicitly limit activities to holding title to property

- Financial records confirming timely remittance of all net income to the parent organization

- Property management practices that remain within passive asset administration boundaries

The most effective protective measure involves creating clear operational boundaries. A 501(c)(2) must restrict its activities exclusively to:

- Holding title to property

- Collecting income from that property

- Paying necessary expenses

- Remitting the remaining net income to its parent organization

When complex situations arise, such as questions about permissible renovation activities or potential lease arrangements, consulting skilled nonprofit legal counsel becomes essential. Organizations should establish formal documentation protocols for all income distributions to the parent entity. This paper trail proves compliance during IRS examinations and serves as protection against allegations of improper asset retention.

Maintaining strong governance structures provides additional protection. Creating a board calendar with dedicated compliance checkpoints, annual legal reviews, and regular training for directors helps prevent inadvertent violations that could jeopardize tax-exempt status for both the 501(c)(2) and its parent organization.

A 501(c)(2) organization elegantly shields assets while providing a robust framework for legal compliance and stability. As a cornerstone of nonprofit structures, it empowers founders, executive directors, and real estate managers to mitigate risks and safeguard properties, ensuring longevity and peace of mind. Navigating the complexities of IRS rules, this entity offers tax benefits and a strategic advantage in maintaining impeccable asset care.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom