In the complex landscape of U.S. tax-exempt entities, certain organizational structures are designed to meet very specific operational and financial goals. Among these, 501(c)(25) organizations serve a targeted role that is particularly relevant for entities managing real estate assets within a tax-advantaged framework. Though not widely known, they offer strategic benefits for qualified parent organizations seeking greater control and efficiency. Let’s explore the definition, compliance requirements and benefits of 501(c)(25) organizations.

This article is provided for general informational purposes to help professionals understand the basics of 501(c)(25) organizations. We specialize in company formation services and do not provide legal or tax advice concerning U.S. nonprofit regulations. For detailed compliance guidance, please consult a legal expert familiar with real estate holding entities and tax-exempt organizational structures.

What is a 501(c)(25) organization?

A 501(c)(25) organization is a title-holding corporation or trust with no more than 35 shareholders or beneficiaries, organized exclusively to acquire, hold title to, and collect income from real property, then remit all net income to its qualified shareholders or beneficiaries. These entities may only hold real property directly, with limited incidental personal property, and must distribute their entire income (less expenses) annually to pension plans, governmental plans, 501(c)(3) charities, or similar exempt organizations.

Take the first step toward business success - Explore our Delaware incorporation service today!

Who can form and control a 501(c)(25)?

These title-holding corporations or trusts operate under precise ownership restrictions that directly impact their tax-exempt status. Qualifying parent entities must fall within specific categories defined by the Internal Revenue Code, with no exceptions permitted for individual or non-exempt corporate ownership.

Eligible shareholders and parent organizations

Only certain tax-exempt organizations may legally own or control a 501(c)(25) entity. The IRS specifically limits ownership to:

- Tax-exempt organizations described in section 501(c)

- Governmental units at federal, state, or local levels

- Qualified pension, profit-sharing, or stock bonus plans that meet stringent IRS standards

- Designated employee benefit funds

Ownership structure faces additional constraints beyond entity type. The 501(c)(25) organization cannot exceed 35 shareholders or beneficiaries and must maintain only one class of stock or beneficial interest. Any transfer of shares to non-qualifying entities immediately jeopardizes tax-exempt status. Recent IRS regulatory focus has intensified on preventing indirect control by non-qualified organizations. Examiners now scrutinize governance documents and decision-making processes to ensure exempt-status integrity remains intact throughout the organizational lifecycle.

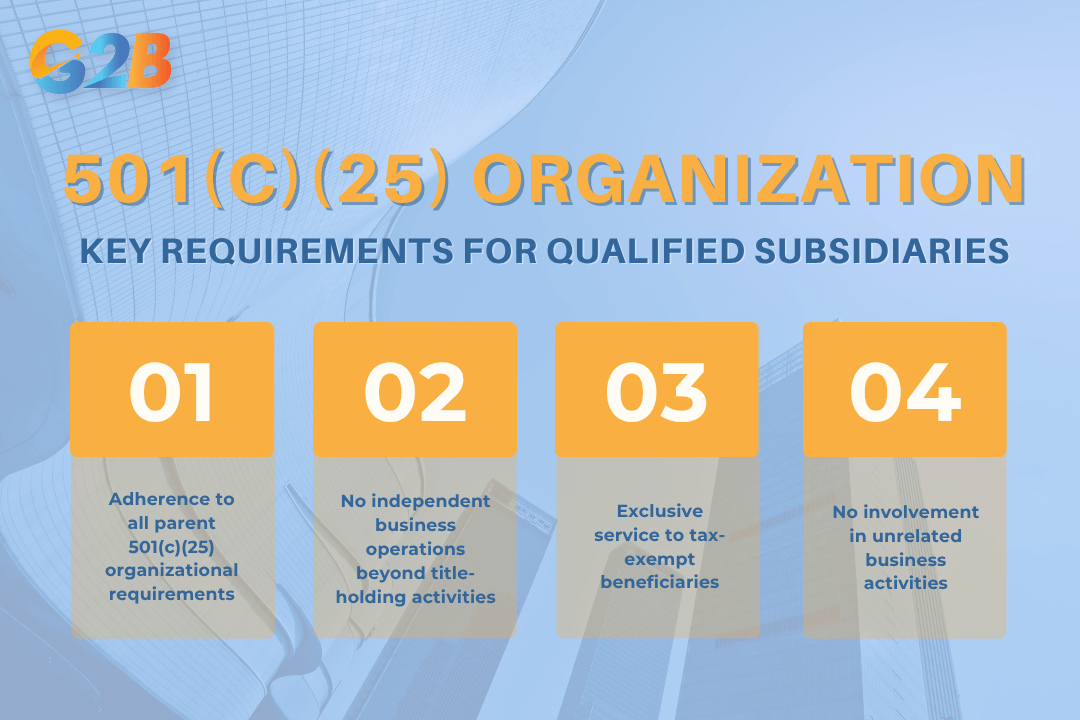

Qualified subsidiaries - Structure and requirements

A 501(c)(25) organization may establish what the IRS terms "qualified subsidiaries" as part of its property-holding structure. These subsidiaries must be 100% owned by the parent 501(c)(25) entity and created exclusively to hold additional real property titles. Key requirements for qualified subsidiaries include:

- Adherence to all parent 501(c)(25) organizational requirements

- No independent business operations beyond title-holding activities

- Exclusive service to tax-exempt beneficiaries

- No involvement in unrelated business activities

Key requirements for qualified subsidiaries include four main criteria

While no statutory limit exists on subsidiary quantity, each subsidiary's activities and income combine with the parent's for compliance evaluation. This consolidated approach prevents organizations from circumventing operational restrictions through subsidiary structures. The IRS considers qualified subsidiary compliance inseparable from parent compliance - if any subsidiary fails to meet requirements or transfers interest to ineligible parties, the entire organizational structure faces potential exemption revocation.

How do 501(c)(25) organizations work?

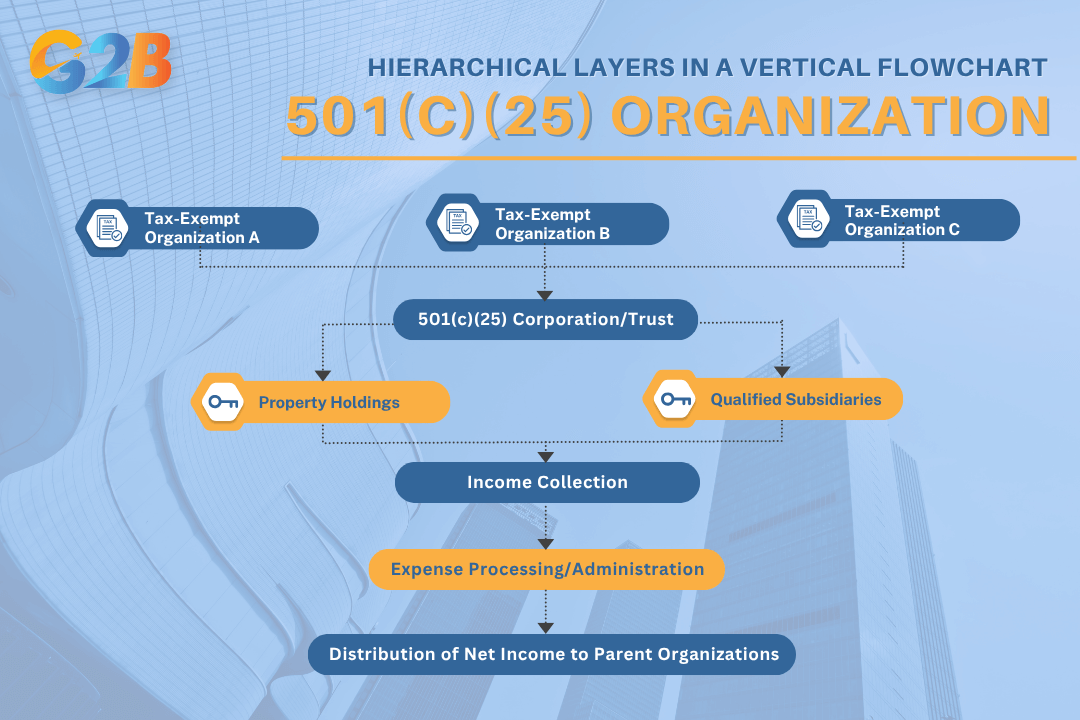

501(c)(25) organizations operate through a layered organizational structure designed specifically for real estate holdings. These title-holding entities enable multiple nonprofit organizations to collectively own and manage property while maintaining tax-exempt status.

Operational flow and governance

The operational workflow of a 501(c)(25) organization follows a strict, linear path. The title-holding company collects rental income and other permissible revenue from its real estate holdings, pays necessary expenses related to property maintenance and administration, then distributes the remaining income entirely to its exempt parent organizations. This pass-through mechanism preserves the tax advantages while ensuring all financial benefits flow to the qualifying shareholders.

Income distribution must adhere to precise IRS guidelines. The 501(c)(25) entity cannot retain earnings beyond reasonable operating reserves or engage in any activities beyond passive real estate management. Regular compliance audits form a critical component of governance, typically examining:

- Documentation of all property-related transactions

- Verification that no unrelated business activities occur

- Confirmation that income distribution follows proper channels

- Validation that all shareholders remain qualifying exempt organizations

Board governance operates under the direction of representatives from the parent organizations, with decision-making authority strictly limited to property acquisition, management, and income distribution matters.

Example organizational charts

A typical 501(c)(25) organizational structure resembles a vertical flowchart with distinct hierarchical layers:

501(c)(25) organizational structure resembles a vertical flowchart with distinct hierarchical layers

The firewall between operational and holding activities represents a critical design element. Parent organizations conduct their charitable, educational, or other exempt activities entirely separate from the property holding functions of the 501(c)(25) entity. In more complex structures, qualified subsidiaries may each hold different properties within specialized regional or functional categories. This multi-tiered approach maintains clean organizational boundaries while optimizing property management efficiency and ensuring precise regulatory compliance throughout the entire structure:

- Region-based subsidiaries (East Coast Properties LLC, West Coast Properties LLC)

- Use-based subsidiaries (Medical Facilities Holding Co., Education Campus Holdings)

- Asset-class subsidiaries (Multi-Family Holdings, Commercial Office Holdings)

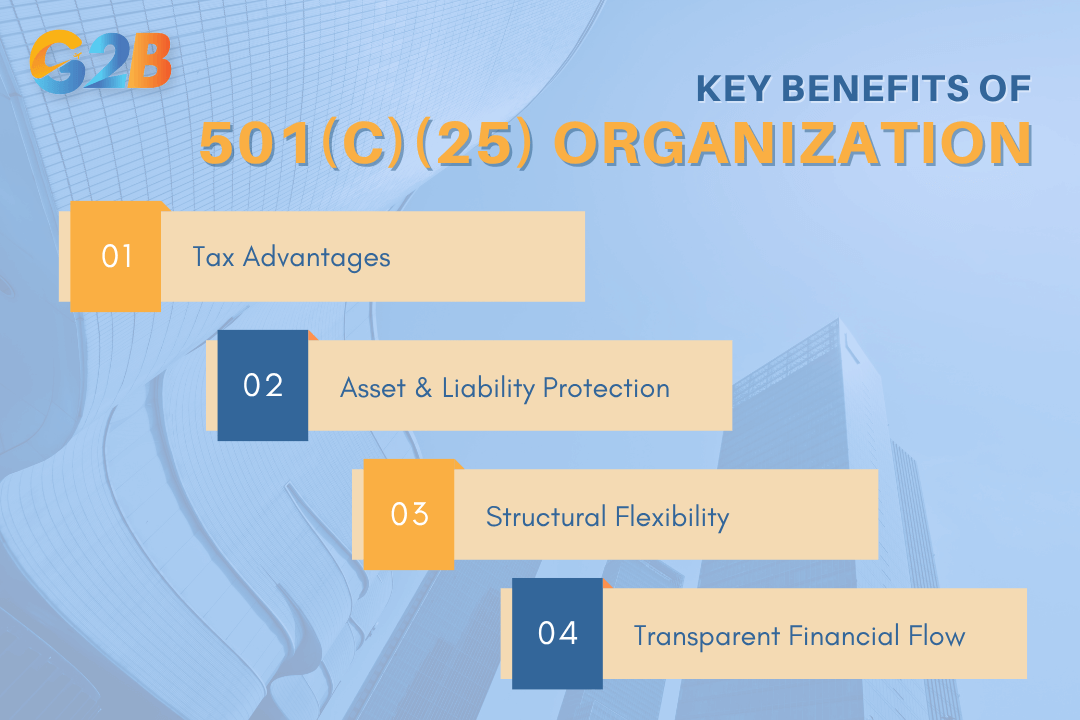

Benefits of using a 501(c)(25) title-holding corporation

A 501(c)(25) organization provides substantial advantages for qualifying tax-exempt entities seeking to hold real estate assets. This specialized title-holding structure delivers a powerful combination of tax benefits, liability protection, and administrative flexibility.

A 501(c)(25) organization provides substantial advantages

Tax advantages and asset protection

The primary financial benefit of 501(c)(25) status is federal income tax exemption on qualifying rental income and capital gains from property holdings. When structured properly, this exemption applies to both regular income streams and appreciation realized upon sale of real estate assets. For nonprofit consortiums managing substantial property portfolios, these tax savings can significantly enhance returns and increase capital available for mission-focused activities.

Beyond tax advantages, 501(c)(25) entities create a robust liability firewall between valuable real estate assets and the operational activities of member organizations. By housing property in a separate legal entity, the title-holding corporation prevents potential claims against operating nonprofits from reaching these assets. Similarly, liabilities arising from property ownership remain contained within the 501(c)(25) structure, protecting the exempt parent organizations from direct exposure to real estate-related risks including:

- Environmental claims

- Premises liability issues

- Property-specific contractual disputes

- Construction defect litigation

Flexibility for complex real estate holding structures

The 501(c)(25) framework excels at accommodating multi-entity ownership arrangements that would otherwise create compliance challenges. Up to 35 qualifying tax-exempt organizations can participate as shareholders while maintaining a clear channel for fiscal responsibility and governance. This structure proves particularly valuable in scenarios such as:

- Hospital systems jointly acquiring medical office buildings

- University consortiums sharing research facilities

- Nonprofit associations pooling resources for shared headquarters

- Pension funds collaborating on institutional-grade investments

Each participating entity retains proportional rights to income streams while benefiting from consolidated management and administrative efficiency. The structure also facilitates orderly entry and exit of participating organizations without disrupting overall property ownership or management. Unlike alternatives such as LLCs or direct co-ownership, the 501(c)(25) model preserves tax exemption while establishing clear governance protocols that prevent operational deadlocks. The corporation must distribute all net income to its qualifying shareholders, ensuring transparent financial flows and maintaining the connection between property performance and organizational benefit.

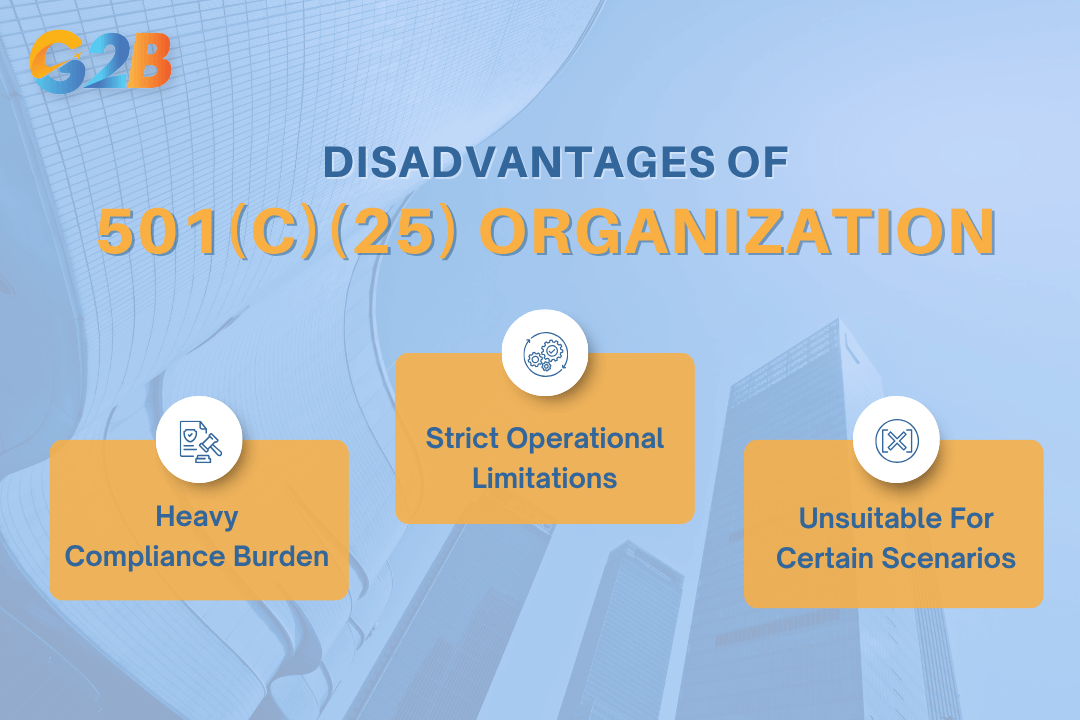

Limitations and disadvantages of 501(c)(25)

501(c)(25) organizations face significant constraints that potential founders must understand before committing to this structure. These limitations create an environment where compliance missteps can jeopardize the organization's tax-exempt status.

501(c)(25) organizations may face significant constraints

Regulatory burden and compliance risks

The ongoing compliance requirements for 501(c)(25) organizations create a substantial administrative burden. These entities must:

- File annual Form 990 returns with complete and accurate disclosure

- Maintain meticulous documentation of all board decisions and meetings

- Continuously verify and document the qualifying status of all parent organizations

- Preserve evidence of compliance with ownership and control requirements

Any errors in this extensive documentation process can trigger severe consequences. The IRS reviews 501(c)(25) applications with exceptional scrutiny, referring all applications to the National Office for approval rather than handling them at the regional levels. This heightened examination continues throughout the organization's lifecycle. Organizations that fail to maintain proper records or submit required filings face penalties ranging from monetary fines to complete revocation of tax-exempt status. This revocation risk creates an ongoing compliance pressure that many organizations find difficult to sustain, especially as leadership changes over time or as the organization grows in complexity.

Strict purpose and use limitations

501(c)(25) organizations must adhere to an extremely narrow operational scope. The entity can only engage in passive title holding of real property and related income collection - nothing more. This restriction means:

- No operational trade or business activities whatsoever

- No holding of assets other than real property

- No participating in partnerships or trusts for indirect property ownership

- No flexible adaptation to changing business needs or opportunities

These purpose limitations create significant operational inflexibility. For example, if a qualifying organization wishes to expand activities beyond simple property holding to include property development or management services, the 501(c)(25) structure becomes immediately unsuitable. Adding non-qualifying owners or expanding into even minimally active business operations automatically voids the tax-exempt status. The organization must maintain a firewall between ownership and operations, preventing the natural evolution many organizations would otherwise pursue. This makes the 501(c)(25) unsuitable for:

- Organizations needing operational flexibility

- Groups anticipating mixed ownership in the future

- Entities hoping to expand into related business activities

- Situations requiring complex property development activities

These strict limitations create a compliance environment where many organizations find the costs of maintaining the structure outweigh the benefits of its tax advantages.

501(c)(25) vs. 501(c)(2) and other holding structures

Organizational leaders face critical decisions when selecting property holding structures. The 501(c)(25) organization represents one option among several, each with distinct advantages for specific scenarios.

Comparative table: 501(c)(25) vs 501(c)(2) vs LLC

| Feature | 501(c)(25) | 501(c)(2) | LLC (non-exempt) |

|---|---|---|---|

| Owners | Multiple tax-exempt entities | Single tax-exempt entity | Any eligible members |

| IRS oversight | Very strict | Strict | Standard |

| Tax-exemption scope | Real property only | Real property only | Not automatic |

| Subsidiaries allowed | Qualified only, 100% owned | No | Yes |

| Active operation allowed | No | No | Yes |

The structural differences highlighted above create distinct compliance landscapes. 501(c)(25) organizations operate under heightened scrutiny compared to standard LLCs, requiring meticulous record-keeping and governance. While both 501(c) options restrict operations to passive real estate activities, LLCs offer operational flexibility but sacrifice automatic tax exemption. Tax treatment varies significantly between these structures. Both 501(c) variants offer federal income tax exemption on qualifying property income, but LLCs typically operate as pass-through entities with taxation flowing to members unless special elections are made.

Which holding structure is right?

Several key factors should drive structure selection. Geographic distribution of properties, ownership composition, and operational intentions represent critical decision points. For consortiums of unrelated nonprofits seeking joint ownership of property, the 501(c)(25) provides the ideal vehicle. Hospital networks, educational institutions, and religious organizations frequently leverage this structure to maximize tax benefits while maintaining shared governance. The explicit legal framework accommodates multiple stakeholders while preserving tax advantages.

Single nonprofits owning real estate should typically consider the 501(c)(2) structure instead. The compliance burden remains lighter than with a 501(c)(25), and the administrative complexity decreases substantially. Universities, foundations, and charities commonly employ this approach when consolidating property holdings under a single institutional umbrella. Meanwhile, organizations requiring operational flexibility benefit most from LLC structures. This approach accommodates:

- Mixed ownership between exempt and non-exempt entities

- Active business operations beyond passive real estate holding

- Simplified formation and maintenance requirements

- Customizable governance structures

Compliance requirements and the IRS application process

Establishing and maintaining a 501(c)(25) organization demands meticulous attention to regulatory requirements. The IRS subjects these title-holding entities to rigorous scrutiny during the application process and throughout their operational lifecycle.

Setting up and running a 501(c)(25)

The formation of a 501(c)(25) organization follows a systematic procedure that begins well before IRS application submission. Organizations must first verify that all prospective shareholders qualify as eligible tax-exempt organizations under IRS guidelines. This verification process requires obtaining and documenting proof of each entity's tax-exempt status.

Organizational documents require careful drafting with specific language that explicitly limits activities to title holding. Articles of incorporation or trust documents must contain purpose clauses that restrict operations to acquiring, holding title to, and collecting income from real property. These documents should also include dissolution provisions ensuring that assets are transferred only to qualifying tax-exempt entities.

The application process continues with entity formation under state law followed by submission of IRS Form 1024 with substantial supporting documentation:

- Complete organizational documents (articles, bylaws/trust agreement)

- List of all shareholders with proof of their tax-exempt status

- Detailed property holding plans and intended distribution methods

- Financial projections demonstrating passive-only income sources

- Governance structure documentation ensuring compliant operations

National Office review typically takes 3-9 months, during which IRS examiners may request additional information or clarification. Organizations must respond promptly and thoroughly to prevent application delays or rejection.

Need a reliable Delaware incorporation service? Contact G2B for a free consultation today!

Ongoing reporting and annual IRS filings

Securing 501(c)(25) status represents only the beginning of compliance obligations. These organizations must file annual returns using the appropriate Form 990-series documents based on organizational size and income. These filings must accurately report all property holdings, income sources, and distributions to shareholders. Documentation requirements extend beyond IRS filings to include comprehensive records of:

- All shareholder changes, including verification of new members' exempt status

- Property acquisition, management, and disposition activities

- Board meeting minutes demonstrating governance oversight

- Income distribution calculations and transactions

- Evidence that all net income (after expenses) flows to qualifying owners

Regular internal compliance audits help identify potential issues before they trigger IRS scrutiny. Many organizations implement scheduled reviews to verify:

| Compliance area | Key requirements | Verification method |

|---|---|---|

| Shareholder status | All owners maintain a qualifying tax-exempt status | Annual certification requests |

| Property use | Properties used exclusively for permitted purposes | Regular property inspection reports |

| Income sources | Only passive real estate income generated | Quarterly financial review |

| Distribution compliance | All net income is properly distributed to owners | Annual reconciliation process |

| Governance | Board decisions comply with organizational limitations | Meeting minutes review |

Failure to maintain these compliance measures can result in penalties, back taxes, or complete revocation of exempt status. The IRS may conduct periodic examinations, making ongoing documentation essential for defending organizational practices during audits.

Common misconceptions and mistakes

Many organizations misunderstand the specialized nature of 501(c)(25) organizations, leading to costly compliance failures and tax exemption revocations. Misconceptions about eligibility, operational scope, and compliance requirements create significant pitfalls for organizations attempting to utilize this tax-advantaged structure.

Separating 501(c)(25) fact from fiction

FICTION: Any nonprofit can establish a 501(c)(25) organization.

FACT: Only specific qualified tax-exempt organizations may serve as shareholders, and multiple eligible owners are required.

FICTION: A 501(c)(25) works like a standard 501(c)(3) property holding company.

FACT: 501(c)(25) entities have distinct ownership requirements and operational limitations focused solely on passive real estate activities.

FICTION: Single organizations can use 501(c)(25) status for their real estate.

FACT: The structure specifically requires multiple qualifying shareholders, making it unsuitable for single-entity holdings.

501(c)(25) organizations frequently face confusion with 501(c)(2) title-holding corporations, which serve different purposes with different ownership structures. While both provide tax advantages for property ownership, 501(c)(25) entities require multiple participating organizations and face stricter operational limitations. Income streams unrelated to passive real property holdings will immediately jeopardize exemption status. Organizations must maintain clear separation between property holding activities and any operational functions to preserve compliance.

Costly errors - Real audit red flags

The IRS actively scrutinizes 501(c)(25) organizations, and certain compliance failures consistently trigger audits and penalties:

- Ineligible shareholder introduction: Adding even one unqualified shareholder invalidates the exemption status immediately. Common violations include:

- Adding for-profit corporate owners

- Including individual investors

- Failing to verify ongoing exempt status of existing shareholders

- Income commingling: Organizations lose their exemption when they fail to separate:

- Property rental income (permitted)

- Operating income from services (prohibited)

- Unrelated business income (prohibited)

- Active business revenue streams (prohibited)

- Functional expansion: Attempting to conduct incidental businesses beyond passive title holding frequently triggers IRS enforcement actions. Examples include:

- Providing property management services beyond basic maintenance

- Developing real estate beyond simple improvements

- Operating businesses within owned properties

- Failing to distribute all income (minus expenses) to shareholders

Documentation deficiencies represent another major compliance risk. Organizations must maintain meticulous records demonstrating qualified ownership, proper income distribution, and adherence to passive holding requirements. Failure to produce these records during IRS review often results in immediate revocation of exempt status.

Frequently asked questions about 501(c)(25) organizations

While 501(c)(25) organizations serve a specific and often overlooked role, questions frequently arise about how they operate and who can benefit from them. Below are answers to some of the most common questions surrounding their structure, compliance, and eligibility:

1. Are donations to 501(c)(25) organizations tax-deductible?

No, donations to 501(c)(25) organizations are not tax-deductible for donors. Unlike 501(c)(3) charitable organizations, contributions to 501(c)(25) title-holding corporations do not qualify for charitable deduction benefits under federal tax law.

2. Can a 501(c)(25) organization have more than 35 shareholders?

No, a 501(c)(25) organization is strictly limited to a maximum of 35 shareholders or beneficiaries. This limitation was specifically designed by Congress to ensure that ownership remains within a sufficiently small group of qualified entities.

3. Must 501(c)(25) organizations only hold real property?

Yes, 501(c)(25) organizations must hold only real property, with limited exceptions for personal property connected to real estate leasing. They cannot hold interests in partnerships, real estate investment trusts, or make mortgage loans.

4. Can 501(c)(25) organizations operate businesses?

No, 501(c)(25) organizations cannot operate unrelated businesses. They must be organized exclusively for acquiring, holding title to, and collecting income from real property, then remitting net income to qualified shareholders.

5. Are 501(c)(25) organizations required to file Form 990?

Yes, 501(c)(25) organizations must file Form 990 annual returns with the IRS. However, any qualified subsidiaries they own do not file separate returns, as their activities are consolidated with the parent organization.

6. Can individuals be shareholders of 501(c)(25) organizations?

No, individuals cannot be shareholders of 501(c)(25) organizations. Only qualified pension plans, governmental plans, the United States government or its subdivisions, and 501(c)(3) organizations can be shareholders or beneficiaries.

7. Do 501(c)(25) organizations need to apply for tax exemption?

Yes, 501(c)(25) organizations must apply for tax exemption using Form 1024. The application must demonstrate that each shareholder meets the requirements of section 501(c)(25)(C) and include supporting documentation.

8. Can 501(c)(25) organizations have qualified subsidiaries?

Yes, 501(c)(25) organizations can own 100% of qualified subsidiary corporations. These subsidiaries are not treated as separate entities for tax purposes and must comply with all 501(c)(25) rules.

9. Must 501(c)(25) organizations distribute all income to shareholders?

Yes, 501(c)(25) organizations must remit their entire income, less expenses, to shareholders or beneficiaries at least once annually. They cannot accumulate income and retain tax exemption.

10. Is there a limit on unrelated business income for 501(c)(25) organizations?

Yes, 501(c)(25) organizations can have limited unrelated business income up to 10% of combined gross income. Income exceeding this threshold or from non-incidental business activities would jeopardize their tax-exempt status.

A 501(c)(25) organization presents a formidable avenue for real estate investors and nonprofit executives aiming for tax efficiency and asset protection. By navigating the nuanced IRS regulations, these entities can secure tax exemptions while ensuring legal transparency. The intersection of strategic planning and compliance, the lifeblood of asset management and risk reduction, fosters a secure foundation for property holdings. Embracing this sophisticated structure, stakeholders resonate with a profound sense of achievement and enduring stability.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom