Growth industry is a sector of an economy that experiences a higher-than-average growth rate compared to other sectors, the broader market, or the national Gross Domestic Product (GDP). For the modern investor, identifying these sectors is the difference between simply preserving wealth and actively multiplying it.

This article explains the key concepts of a growth industry. We specialize in company formation and not in industry forecasting or market analysis. For in-depth guidance on evaluating or investing in a specific growth industry, please consult a qualified market research or economic expert.

What is a growth industry?

A growth industry is not merely a sector generating profits but one that is expanding its market size, revenue, and earnings at a pace that significantly outpaces the broader economy. The primary benchmark for a growth industry is often compared to the national GDP growth rate as a reference point, although sometimes industry or global market averages are also used. Additionally, growth industries are typically characterized by strong innovation, changing consumer trends, and investments that sustain expansion.

For example, if the US or Vietnam economic growth rates are 2.5% or 6% respectively, a "Growth Industry" within those economies typically demonstrates year-over-year revenue expansion of 15% to 30% or more. This disparity creates an environment where market share is grabbed aggressively, leading to significant competitive displacement of slower-growing firms.

Key attributes of a growth industry

An investor or analyst cannot rely on "hype" but must look at the balance sheet and income statement. A true growth industry displays a specific set of financial fingerprints.

There are 04 key attributes of a growth industry

1. Rapid revenue expansion

The most obvious metric is the Compound Annual Growth Rate (CAGR) of revenue. In a growth industry, you will consistently see consistent double-digit top-line growth over multiple periods. This indicates that the demand for the product or service is exploding. Companies in these sectors are less concerned with cutting costs (efficiency) and more concerned with fulfilling demand. This drive for volume often allows them to achieve economies of scale, reducing per-unit costs over time as they grow larger.

2. Aggressive reinvestment

In a growth industry, paying a dividend is often seen as a failure of imagination. Management believes that $1 retained within the company will generate a higher excess return than if it were paid out to shareholders. Cash is aggressively funneled back into:

- Research & Development (R&D): To stay ahead of competitors.

- Capital expenditure (CapEx): To build factories, data centers, or infrastructure.

- Marketing & User acquisition: To capture market share before the industry matures.

To sustain this aggressive spending, these companies often utilize a specific capital structure that prioritizes reinvestment over immediate profit taking, often relying on rounds of equity financing to fuel their burn rate until they dominate the market.

3. High valuation ratios

Stocks in growth industries typically trade at high Price-to-earnings (P/E) ratios. This is not necessarily a sign of overvaluation; rather, it is a "premium" investors are willing to pay today for the expectation of significantly higher earnings per share (EPS) in the future.

- Analyst note: When analyzing these sectors, the PEG Ratio (Price/Earnings-to-growth) is often a better metric than standard P/E, as it accounts for the expected growth velocity. (with PEG <1 often indicating attractive growth value).

4. Volatility and beta

Growth industries are sensitive. They often have a high Beta (a measure of volatility relative to the overall market). Because their valuation is based on future cash flows discounted back to the present (DCF), they are highly sensitive to interest rate changes. When rates rise, the "present value" of those future earnings drops, causing volatility. However, for the long-term investor, this volatility is the price of admission for superior returns.

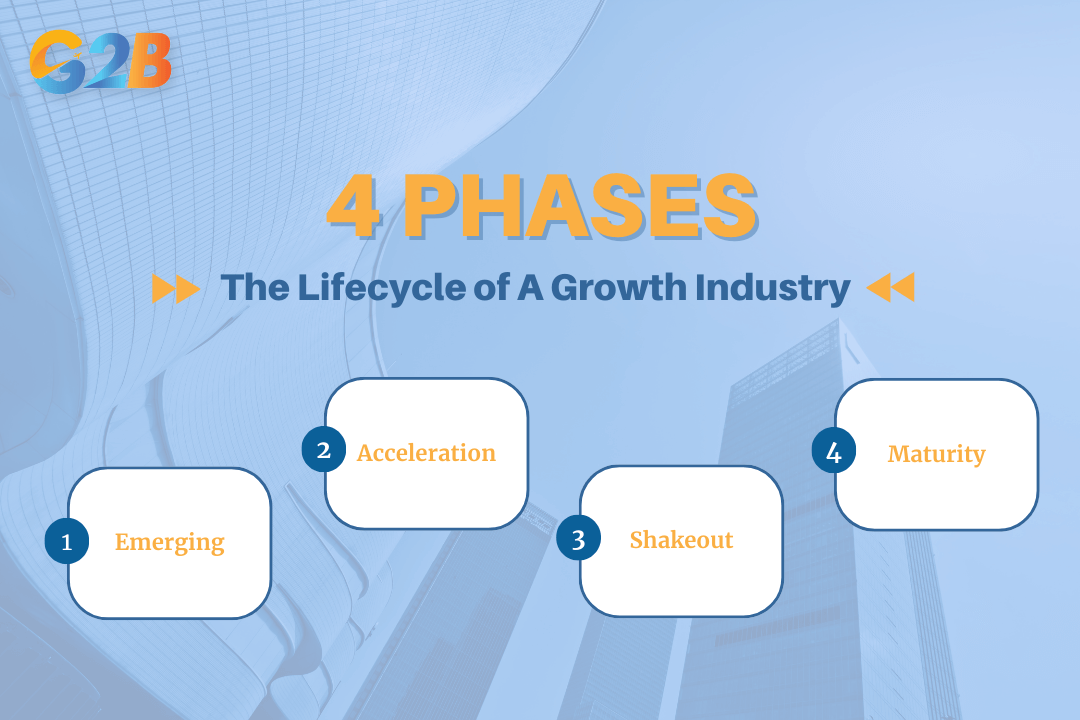

The lifecycle of a growth industry (the S-curve)

No industry grows forever. Understanding where a sector sits on the S-Curve is critical for timing your entry and exit. The S-Curve depicts the lifecycle of an industry from its inception to its eventual maturity or decline.

Phase 1: Emerging

- Characteristics: Unproven technology, high regulatory uncertainty, negative cash flows.

- Example: Quantum Computing or Space Tourism.

- Investor profile: Angel Investors vs Venture Capital.

- Risk/Reward: Extremely High. Most companies here will fail, but the winners will generate 100x returns.

Phase 2: Acceleration

- Characteristics: The product has achieved "Product-market fit." Adoption rates skyrocket. Competitors rush in. This is the steepest part of the curve where the term "Growth Industry" is most accurate. Companies at this stage often enjoy a first-mover advantage, allowing them to set pricing standards and build brand loyalty before the market becomes crowded.

- Example: Cloud Computing (a few years ago) or Generative AI (currently).

- Financials: Revenue grows exponentially. Margins may still be slim due to reinvestment, but the path to profitability is clear.

- Strategy: This is the ideal entry point for growth investors.

Phase 3: Shakeout

- Characteristics: Growth slows from exponential to linear. The market becomes saturated. Weaker players go bankrupt or are acquired by larger players through mergers and acquisitions.

- Example: Smartphones. The innovation has slowed, and the market is dominated by a few giants (Apple, Samsung).

- Financials: Focus shifts from "growth at all costs" to "profitability and efficiency."

Phase 4: Maturity

- Characteristics: The industry is now established. Growth aligns with GDP.

- Example: Consumer staples (Coca-Cola, P&G).

- Transition: The sector moves from a Growth Industry to a Mature/Value Industry. Companies begin paying dividends and buying back shares.

Understanding where a sector sits on the S-Curve is critical

Growth vs. mature and cyclical industries

To build a balanced portfolio, one must distinguish between growth, mature, and cyclical assets. This distinction often lies in the source of returns and sensitivity to the economic cycle.

Growth vs. mature industries

- Source of return: In growth industries, the return comes primarily from Capital Appreciation (stock price going up). In mature industries, the return comes largely from Income (Dividends).

- Risk profile: Growth industries carry "execution risk" (can they scale?), while mature industries carry "disruption risk" (will they be replaced?).

Growth vs. cyclical industries

This is a vital distinction.

- Cyclical industries: Sectors like Automotive, Construction, or Luxury goods. Their performance is tied directly to the economy. If the economy booms, they boom. If the economy recedes (see: global recession), they crash.

- Growth industries (Secular trends): True growth industries often ride Secular trends - long-term shifts that happen regardless of the immediate economic cycle. For example, the shift to Digital payments continued even during economic downturns because it was a structural change in how society functions.

Comparative investment table

| Feature | Growth industry | Mature industry | Cyclical industry |

|---|---|---|---|

| Primary goal | Capital appreciation | Income preservation | Market timing |

| Revenue growth | >15% (Double Digit) | 2% - 5% (GDP Pace) | Fluctuates with the economy |

| Dividends | Rare / None | High / Consistent | Variable |

| Volatility (Beta) | High | Low | High |

| Cash usage | Reinvestment (R&D, CapEx) | Share Buybacks / Dividends | Inventory / Solvency |

| Key metric | PEG Ratio, Sales Growth | Dividend Yield, FCF | Inventory Turnover, PMI |

Top 5 leading growth industries in Vietnam (2024-2025)

Vietnam is currently one of the most exciting emerging market economies globally. With a GDP growth target of 6.0% - 6.5%, the country is a hotbed for growth industries. The government’s strategic pivots, combined with foreign direct investment (FDI), have created specific pockets of high-velocity expansion.

1. The digital economy & fintech

Vietnam has one of the highest internet penetration rates in Southeast Asia and a young, tech-savvy population.

- The data: The digital economy is projected to reach $39 billion by 2025.

- The opportunity: While E-commerce is the visible giant, Fintech (Digital Payments, Peer-to-peer lending, and Wealth management apps) is the engine. The shift from cash to cashless is a classic "Secular trend" providing a massive runway for growth.

2. Renewable energy (PDP8 & Net Zero)

Following the approval of the Power Development Plan 8 (PDP8), Vietnam is undergoing a massive energy transition.

- The driver: The government has committed to Net Zero by 2050. This requires billions in CapEx for infrastructure.

- The sectors: Solar energy, offshore wind, and biomass are moving from the "Emerging" phase to the "Acceleration" phase. Companies involved in green tech and energy transmission are prime growth candidates. Furthermore, new projects often benefit from specific green field investment policies in Vietnam, which offer incentives to attract developers.

3. Industrial real estate (the "China +1" beneficiary)

As global supply chain management strategies diversify away from reliance on a single country, Vietnam has become the primary beneficiary of the "China +1" strategy.

- The trend: Major manufacturers (Apple suppliers, Lego, etc.) are moving production to Vietnam.

- The growth: This drives demand for Industrial Parks, Warehousing, and Logistics. Unlike residential real estate which can be cyclical, industrial real estate in Vietnam is currently a structural growth sector fueled by long-term FDI inflows.

4. Healthcare & pharmaceuticals

Vietnam’s demographic structure is changing. While the workforce is young, the population is aging rapidly, and the middle class is demanding better care.

- The projection: The healthcare market is forecast to reach ~$19 billion total healthcare market by 2025.

- The niches: Beyond general hospitals, high-growth niches include Telemedicine, Medical Device Manufacturing, and Nutraceuticals. The demand for quality healthcare is inelastic, providing a buffer against economic volatility.

5. Semiconductors & technology manufacturing

This is the newest and most potent growth entrant. Vietnam is positioning itself as a key node in the global semiconductor supply chain.

- The catalyst: Strategic partnerships with the US and South Korea have opened doors for packaging and testing facilities.

- The ambition: Vietnam aims to train 50,000 semiconductor engineers by 2030. This government backing lowers the risk for investors and signals a long-term commitment to high-tech manufacturing.

Investing in a growth industry requires a shift in mindset. It demands that you look beyond current profits and visualize future scale. It requires the stomach to endure volatility in exchange for the potential of exponential returns. Whether it is the global march toward Artificial Intelligence or the specific industrial transformation of Vietnam, the opportunities are abundant for those who know where to look.

However, identifying a growth industry is only step one. Executing an investment strategy - especially in a foreign market like Vietnam - requires precision. Conducting a thorough feasibility study is often necessary to validate market assumptions before deploying capital. Vietnam is open for business. The sectors mentioned above - Digital Economy, Renewables, Industrial Real Estate, Healthcare, and Semiconductors - are not just growing; they are reshaping the nation's economic identity. If you are looking to capture these opportunities at the right moment, now is the ideal time to register a company in Vietnam and position your business at the heart of Asia’s most dynamic growth industries.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom