Navigating the intricate world of nonprofit entities, the 501(c)(20) organization plays a pivotal role in the realm of employee and medical benefit plans. Often linked to legacy benefit structures, understanding these organizations is crucial for those managing compliance and reporting. Let’s investigate what defines a 501(c)(20) organisation, how it operates, and why it still matters today.

This article is provided for general informational purposes to help professionals understand the basics of 501(c)(20) organizations. We specialize in company formation services and do not provide legal or tax advice concerning U.S. nonprofit regulations. For detailed compliance guidance, please consult a qualified nonprofit specialist or legal professional.

What is a 501(c)(20) organization?

A 501(c)(20) organization was a type of tax-exempt entity under the Internal Revenue Code that applied to "qualified group legal services plans". These organizations provided individual legal services benefits to their members. However, this tax-exempt status was eliminated after June 30, 1992, meaning no new organizations can qualify under 501(c)(20) today.

Who typically managed or used 501(c)(20) trusts?

Large employers with substantial workforces, industry associations representing multiple businesses, and established nonprofit institutions commonly utilized 501(c)(20) trusts for health benefit funding. These organizations typically maintained sufficient scale to justify the administrative complexity and compliance requirements associated with these specialized trusts.

The administration of 501(c)(20) trusts generally involved multiple stakeholders:

- Designated trustees with fiduciary responsibility

- Legal counsel specializing in tax-exempt entities

- Financial advisors managing trust investments

- Compliance officers ensuring adherence to IRS regulations

- Human resource departments coordinating with benefits administration

Management focused primarily on two critical areas: ensuring proper asset protection through strict compliance with tax regulations and maintaining appropriate funding levels to meet projected healthcare obligations for covered employees.

Ready to establish a company in Delaware? Get started with a free consultation from our expert incorporation service!

Historic and legal background

The 501(c)(20) designation emerged as part of legislative efforts to formalize and regulate employer-funded health benefit systems. These trusts offered a structured approach to asset protection for funds designated specifically for employee medical coverage, addressing concerns about proper segregation of health benefit assets.

However, the tax code provision authorizing 501(c)(20) status was phased out after June 30, 1992, due to several factors:

- Administrative complexity created compliance challenges

- Regulatory redundancy with other available structures

- Limited flexibility compared to alternatives

- Emergence of more versatile options like 501(c)(9) VEBA trusts

The IRS and Congress determined that the single-purpose nature of these trusts created unnecessary complexity in the tax code. Organizations seeking similar benefits could utilize Voluntary Employee Beneficiary Associations (VEBAs) under section 501(c)(9), which provided comparable tax advantages with greater flexibility and simplified compliance frameworks.

Key features and requirements of 501(c)(20)

501(c)(20) organizations operated under a strict regulatory framework designed specifically for group legal service plans. The following components defined these specialized tax-exempt entities during their active period.

Formal definition and legal criteria

To qualify as a 501(c)(20) organization, trusts had to meet several stringent IRS requirements. The trust structure needed to be irrevocable, permanently removing assets from the employer's control once contributed. These trusts existed solely to fund employee medical benefits under a qualifying employer plan, prohibiting any deviation from this specific purpose.

IRS reporting standards imposed rigorous compliance obligations, including detailed annual filings that documented all financial transactions, beneficiary payments, and fund management. The trust could only provide benefits related to medical expenses, creating a narrow operational scope compared to other tax-exempt entities. This single-purpose limitation ultimately contributed to the decline in popularity of 501(c)(20) organizations.

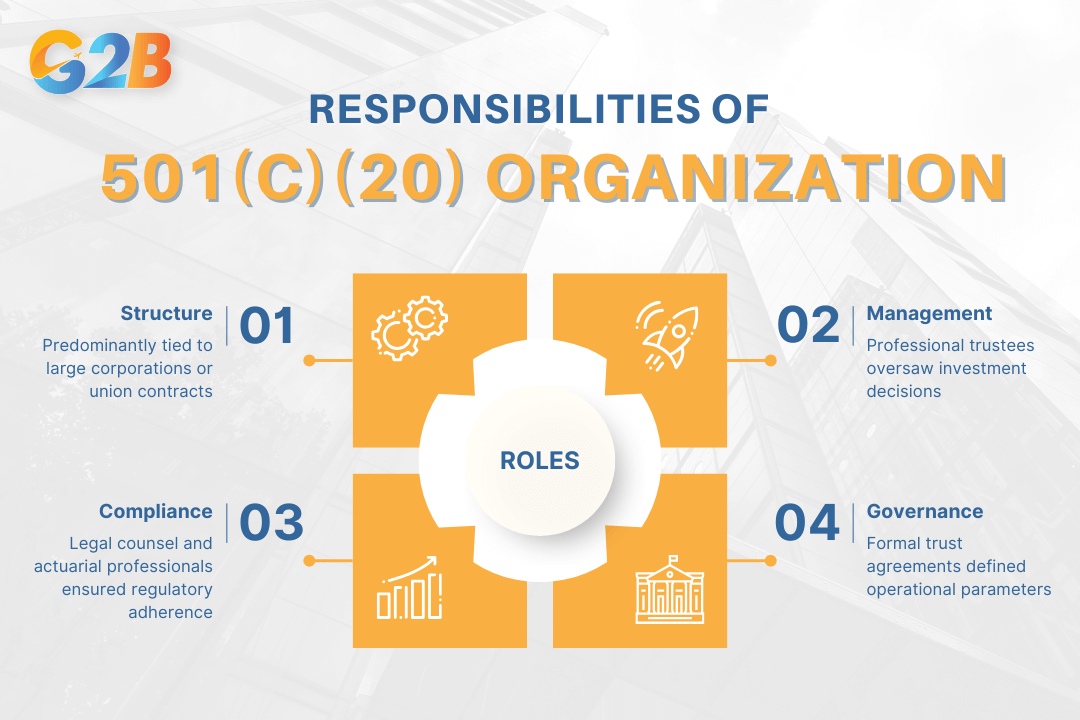

Typical structure - Types and roles

501(c)(20) trusts operated as single-purpose vehicles with clearly defined management roles and responsibilities:

- Structure: Predominantly tied to large corporations or union contracts

- Management: Professional trustees oversaw investment decisions

- Compliance: Legal counsel and actuarial professionals ensured regulatory adherence

- Governance: Formal trust agreements defined operational parameters

Trustees bore significant fiduciary responsibility, managing investments to maximize returns while maintaining liquidity for anticipated medical claims. Behind the scenes, a complex support network of legal and actuarial advisors ensured compliance with tax regulations and funding requirements, contributing to the relatively high operational costs of these entities.

501(c)(20) trusts operated as single-purpose vehicles with clearly defined management roles

Asset restrictions and tax benefits

The assets within 501(c)(20) trusts are operated under tight constraints with specific financial advantages:

| Restriction/Benefit | Description |

|---|---|

| Permitted uses | Limited exclusively to qualified health claim reimbursements |

| Tax advantages | Complete exemption from taxes on investment growth |

| Employer benefits | Reduced liability exposure and controlled benefit costs |

| Prohibited activities | No asset diversion to unrelated business purposes |

These trusts enjoyed full exemption from taxation under subsection (a) of the Internal Revenue Code, allowing investment growth to accumulate tax-free. This structure created significant financial efficiency for funding medical benefits while simultaneously reducing employer liability through the irrevocable trust arrangement. However, strict limitations prevented using these assets for any purposes beyond qualified health claims.

Why 501(c)(20) was phased out

The elimination of 501(c)(20) organization status represents a significant regulatory shift in nonprofit tax law. These once-valuable structures for group medical benefit trusts faced mounting criticism for their operational complexity and limited flexibility. By the early 1990s, regulators determined that more adaptable tax-exempt frameworks could better serve employer benefit plans while reducing administrative burden.

Regulatory timeline and phase-out

Congressional action formally ended the formation of new 501(c)(20) trusts through legislation that took effect for any taxable year beginning after June 30, 1992. This decisive regulatory shift came after years of scrutiny regarding the effectiveness and administrative efficiency of these specialized tax-exempt entities. Existing 501(c)(20) organizations received grandfather provisions allowing their continued operation, but with strict parameters. These legacy trusts faced three primary options:

- Continue operations under heightened compliance requirements

- Convert to alternative tax-exempt structures

- Dissolve and distribute assets according to IRS regulations

The IRS established transition guidelines that required comprehensive documentation for any status changes, ensuring proper asset protection during the phase-out period.

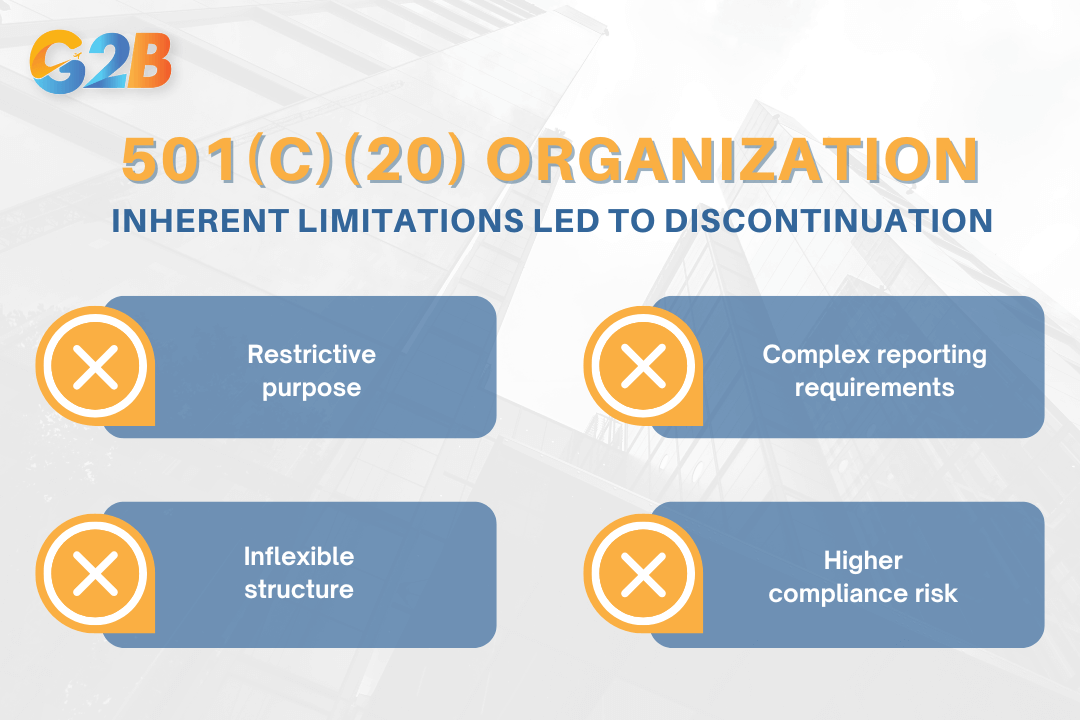

Problems and limitations with 501(c)(20) entities

501(c)(20) trusts struggled with several inherent limitations that ultimately led to their discontinuation:

- Restrictive purpose: Trusts could only fund qualified group health plans, preventing diversification of benefit offerings

- Complex reporting requirements: Organizations faced burdensome documentation standards and specialized actuarial certifications

- Inflexible structure: The single-purpose design couldn't adapt to evolving healthcare financing models

- Higher compliance risk: Specialized rules increased the likelihood of inadvertent violations compared to newer alternatives

Additionally, these trusts operated under operational models designed for an earlier era of employee benefits administration. As healthcare funding evolved throughout the 1980s, the rigid framework became increasingly problematic for both employers and regulators.

501(c)(20) trusts struggled with several inherent limitations that ultimately led to their discontinuation

Transition to 501(c)(9) and other structures

The Voluntary Employee Beneficiary Association (VEBA) structure under 501(c)(9) emerged as the natural successor to 501(c)(20) organizations. VEBAs offered several distinct advantages:

- Broader benefit administration capabilities

- More flexible funding mechanisms

- Streamlined compliance frameworks

- Continued tax advantages for qualified plans

Most legacy 501(c)(20) trusts successfully converted to the VEBA model, allowing them to maintain tax advantages while expanding their operational capacity. This transition typically required:

- Board approval for conversion

- Professional consultation with tax specialists

- Asset transfer documentation

- IRS notification and approval

The 501(c)(9) framework continues to serve as the primary tax-exempt vehicle for employee benefit plans, demonstrating greater resilience and adaptability in the changing regulatory landscape.

501(c)(20) vs 501(c)(9) and other tax-exempt benefit entities

Understanding the distinctions between various tax-exempt benefit structures remains crucial for nonprofit managers and advisors. This comparative analysis helps compliance officers and board members navigate the complex terrain of employee benefit structures.

Definition table: 501(c) organization types (20 vs 9)

| Feature | 501(c)(20) | 501(c)(9) |

|---|---|---|

| Status | Obsolete (post-1992) | Active |

| Function | Group Legal Services Plan Organizations | Voluntary Employees' Beneficiary Associations |

| Eligible Employers | No longer applicable | Employees with common employer or same union |

| Compliance Complexity | High | Moderate |

| Formation Allowed | No | Yes |

| Typical Use Case | No longer applicable | Payment to members for sickness, accident, or other benefits |

| Application Form | n/a | Form 1024 |

| Annual Filing | n/a | Form 990 or 990EZ |

Addressing common misconceptions

Many compliance officers encounter misconceptions regarding the availability of 501(c)(20) status. The most critical fact: No new 501(c)(20) organizations can be formed since 1992. This status represents a closed chapter in nonprofit tax law history, not an active option for modern benefit trusts.

Another prevalent misunderstanding involves the scope of permissible activities. The 501(c)(20) designation specifically covered group legal service plans with narrow application parameters. In contrast, 501(c)(9) organizations embrace a much broader mandate, handling payments for life, sickness, accident, and various other member benefits. Organizations seeking tax-exempt status for employee benefits must pursue currently recognized classifications rather than attempting to revive obsolete designations.

Alternative entities for employee benefits

Contemporary organizations have numerous IRS-approved tax-exempt structures available for employee benefit programs. The 501(c)(9) Voluntary Employees' Beneficiary Association (VEBA) stands as the most direct replacement for legacy 501(c)(20) plans, offering flexible benefit administration with streamlined compliance requirements. Additional alternatives include:

- 501(c)(10) Domestic Fraternal Societies and Associations

- 501(c)(11) Teachers' Retirement Fund Associations

- 501(c)(22) Withdrawal Liability Payment Fund

- 501(c)(8) Fraternal Beneficiary Societies providing member benefits

For retirement planning specifically, both nonprofit and for-profit entities typically utilize 401(k) and 403(b) arrangements. These qualified plans deliver tax advantages while meeting modern regulatory standards. The selection of an appropriate benefit structure depends on organizational type, employee demographics, and specific benefit offerings. Benefit plan administrators must consult with specialized legal counsel to determine which structure best accommodates their organizational needs while ensuring full regulatory compliance and maximizing available tax benefits.

Get expert guidance with G2B’s Delaware incorporation service - Schedule your free consultation today!

Compliance, reporting, and risks for legacy 501(c)(20) plans

Although no new 501(c)(20) trusts can be formed after 1992, existing organizations must adhere to strict recordkeeping practices and reporting requirements or consider dissolution options to protect beneficiaries and trustees.

Audit, reporting, and recordkeeping obligations

Legacy 501(c)(20) entities must maintain comprehensive audit trails documenting all financial activities. These records should include detailed information about fund sources, investment activities, and benefit disbursements to qualified recipients. Trust managers must verify and document that no trust assets are being used for unrelated business purposes, as this could jeopardize tax-exempt status.

Reporting requirements remain stringent for grandfathered 501(c)(20) organizations. Annual information returns must be filed through Form 990, 990-EZ, or 990-N depending on the organization's gross receipts and total assets. Organizations with annual gross receipts of $200,000 or more, or total assets of $500,000 or greater, must file the complete Form 990. Failure to file required returns for three consecutive years results in automatic revocation of tax-exempt status - a potentially devastating outcome for beneficiaries.

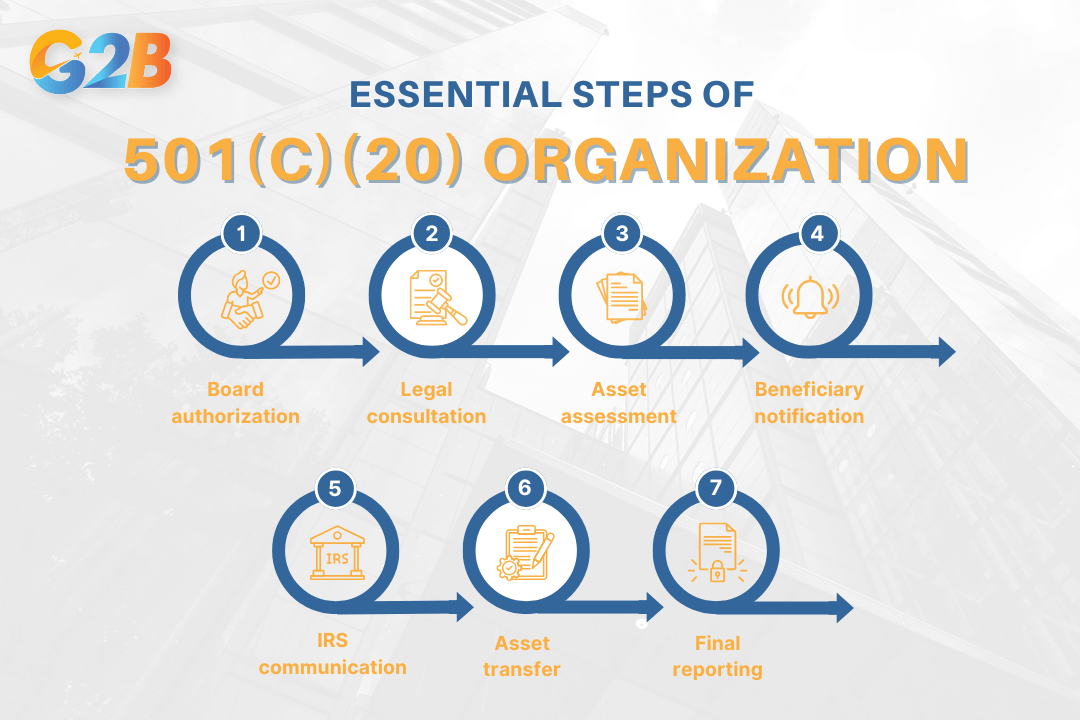

Conversion or dissolution - Stepwise process

Dissolving a 501(c)(20) trust requires careful planning and execution through these essential steps:

- Board authorization: Secure formal approval from trustees and document the decision in meeting minutes

- Legal consultation: Engage specialized nonprofit tax counsel to navigate regulatory requirements

- Asset assessment: Inventory all trust assets and determine fair distribution methods

- Beneficiary notification: Inform all stakeholders of the pending dissolution or conversion

- IRS communication: Submit required notifications about status changes

- Asset transfer: Reallocate funds to compliant structures (typically 501(c)(9) VEBA plans)

- Final reporting: Complete terminal tax filings and documentation

The dissolution process demands meticulous attention to detail. Organizations that fail to wind down operations properly face significant penalties, including excise taxes, retroactive taxation of benefits, and potential personal liability for trustees. Most 501(c)(20) trusts transition to 501(c)(9) structures, which offer broader benefit options with continued tax advantages.

Dissolving a 501(c)(20) trust requires careful planning through 7 essential steps

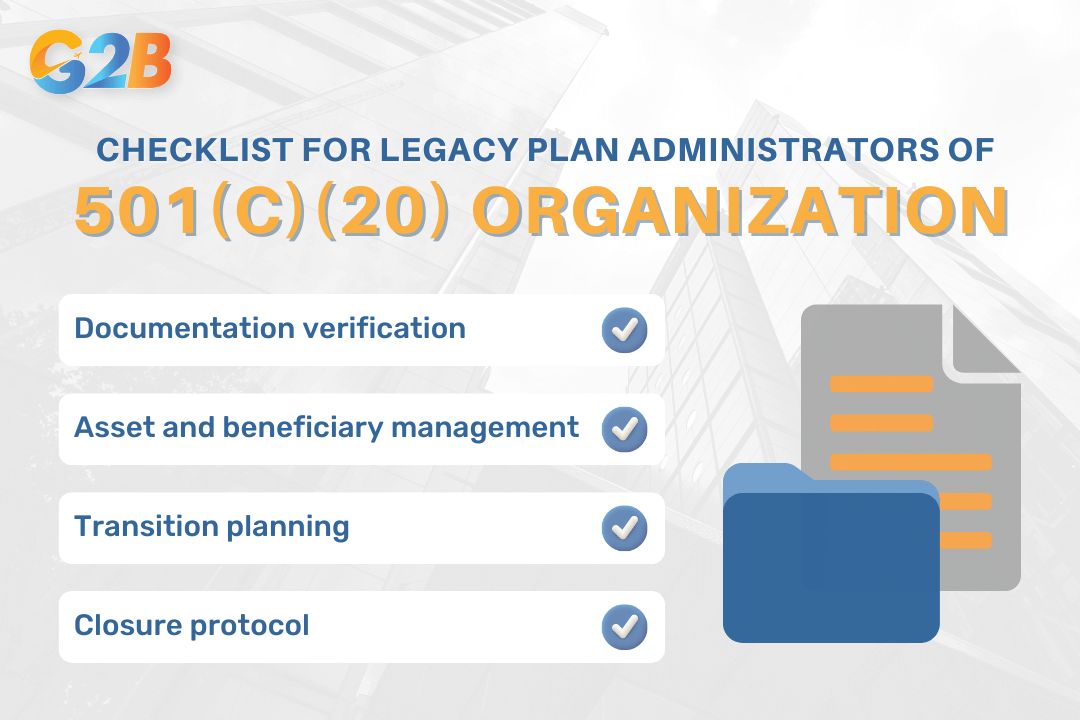

Checklist for legacy plan administrators

Administrators of 501(c)(20) trusts should systematically verify operational compliance through this comprehensive checklist:

- Documentation verification

- Locate original IRS determination letter

- Review historical tax filings for gaps

- Examine trust documents for required provisions

- Verify accuracy of employer identification information

- Asset and beneficiary management

- Conduct complete inventory of all trust assets

- Update beneficiary records and eligibility status

- Document benefit distribution history

- Verify investment compliance with trust provisions

- Transition planning

- Consult specialized legal and tax advisors

- Develop formal conversion or dissolution strategy

- Create beneficiary communication plan

- Establish timeline for regulatory notifications

- Closure protocol

- Submit final tax filings (Form 990 series)

- Notify IRS of status changes via Form 8976

- Transfer assets to successor benefit plans

- Archive all records securely (minimum 7-year retention)

Maintaining accurate records throughout this process provides protection against future audits and ensures compliance with federal and state nonprofit regulations.

Administrators of 501(c)(20) trusts should systematically verify operational compliance through 4-step checklist

Frequently asked questions (FAQ) about 501(c)(20) organizations

- Is a 501(c)(20) organization a type of tax-exempt legal services plan?

Yes, it was a tax-exempt group legal services plan providing prepaid legal benefits to employees or members. - Can new organizations still qualify as 501(c)(20) entities today?

No, the 501(c)(20) tax-exempt status was eliminated after June 30, 1992, so no new organizations qualify. - Did 501(c)(20) plans provide legal services only to employees?

Yes, they were designed to provide personal legal services exclusively to employees, their spouses, or dependents. - Was employer contribution a requirement for 501(c)(20) plans?

Yes, employers typically contributed to these plans to provide prepaid legal services to employees. - Did 501(c)(20) organizations have to file IRS Form 1024 for exemption?

Yes, they had to apply for recognition of exemption using Form 1024 and meet specific IRS requirements. - Are 501(c)(20) organizations still recognized as tax-exempt by the IRS?

No, the IRS no longer recognizes 501(c)(20) organizations as tax-exempt after 1992. - Could 501(c)(20) plans discriminate in favor of highly compensated employees?

No, these plans were required not to discriminate in favor of highly compensated employees. - Did 501(c)(20) plans cover legal services obtained outside the plan?

No, benefits were limited to legal services provided through the plan, not reimbursement for outside services. - Were 501(c)(20) organizations considered nonprofits?

Yes, they were nonprofit entities organized to provide prepaid legal services to members. - Did the repeal of 501(c)(20) status affect existing plans immediately?

Existing plans lost tax-exempt status after June 30, 1992, and had to reorganize or change structure to maintain benefits.

Although no longer active for new registrations, 501(c)(20) organizations offer a unique glimpse into how the U.S. once supported employee access to legal services through tax-advantaged structures. Familiarity with this classification can still be relevant for those tasked with managing legacy plans or reviewing historical benefit arrangements. Whether entrepreneurs are navigating old filings or unwinding outdated trusts, having clarity on the role and limitations of 501(c)(20) status can help prevent compliance missteps and support informed decision-making.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom