In the landscape of employee benefits and tax planning, 501(c)(9) organizations - formally known as Voluntary Employees’ Beneficiary Associations (VEBAs) - provide a critical structure for employee welfare benefits. For HR professionals and financial officers, understanding the nuances, including IRS regulations and tax advantages, is crucial. This article will investigate how 501(c)(9) organisations work, what sets them apart, and why they matter in today’s benefits landscape.

This content is provided for general informational purposes to help HR professionals, nonprofit stakeholders, and employers understand the basics of 501(c)(9) organizations. We specialize in company formation, not in providing legal or tax advisory services related to U.S. nonprofit compliance. This information should not be considered professional legal or tax advice. For guidance tailored to specific circumstances, please consult a qualified attorney or tax advisor with experience in employee benefit associations and exempt organizations.

What is a 501(c)(9) organization?

A 501(c)(9) organization is a Voluntary Employees' Beneficiary Association (VEBA) recognized by the IRS as a tax-exempt entity under Internal Revenue Code section 501(c)(9). These organizations are formed to provide life, sick, accident, or similar benefits to their members, their dependents, or designated beneficiaries.

Formal definition and legal meaning

A 501(c)(9) organization, commonly known as a Voluntary Employees' Beneficiary Association (VEBA), serves as a tax-exempt entity recognized by the Internal Revenue Service (IRS). These organizations exist specifically to provide life, health, accident, or similar benefits to members and their dependents. The critical distinction of a 501(c)(9) lies in its operational structure - no part of its net earnings may benefit any private individual except through the legitimate payment of approved benefits.

Specifically, 501(c)(9) organizations must satisfy several stringent IRS requirements to maintain their tax-exempt status. First, they must function as voluntary associations of employees who share a common employment bond, typically through the same employer, union, or collective bargaining group. This employment connection forms the legal foundation of the organization.

The operations must focus almost exclusively on providing permissible benefits to members. The IRS closely scrutinizes these organizations to ensure they maintain this focused purpose. Any deviation could jeopardize their tax-exempt status. Key legal requirements include:

- Voluntary membership structure

- Clear employment-based common bond among members

- Dedicated focus on providing permissible benefits

- Prohibition of earnings inuring to individuals except as benefit payments

The legal framework prevents these organizations from functioning as vehicles for tax avoidance while ensuring they serve their intended purpose of providing employee benefits in a tax-advantaged manner.

Simple explanation for entrepreneurs

For business owners and HR professionals, a 501(c)(9) organization represents a specialized trust that offers significant advantages when providing employee benefits. The structure allows employers or employee groups to establish a tax-exempt fund dedicated to providing essential benefits like health insurance, life insurance, or disability coverage.

VEBAs operate under a straightforward principle: They create a separate, tax-advantaged entity to hold and distribute funds for employee benefits. This separation offers protection and compliance benefits that direct employer benefit programs might not provide. Benefits of VEBAs for entrepreneurs include:

- Tax advantages for contributions

- Dedicated structure for managing benefit funds

- Potential cost savings through pooled resources

- IRS-compliant framework for benefit distribution

- Flexibility in benefit design within regulatory parameters

These organizations particularly appeal to businesses seeking structured, tax-efficient methods to enhance their employee benefits packages while maintaining compliance with complex IRS regulations. Many companies implement VEBAs as part of their comprehensive employee retention strategy, recognizing that formal benefit structures often outperform ad-hoc programs in both effectiveness and compliance.

Simplify your business launch with our Delaware incorporation service? Start your application today!

How does a 501(c)(9) work?

A 501(c)(9) organization must adhere to strict Internal Revenue Service regulations to maintain its tax-exempt status while delivering valuable benefits to qualifying members. This part will cover its structure and the key roles responsible for its operation.

Key components and structure

The foundation of any VEBA begins with a comprehensive written plan document that outlines covered benefits, eligibility requirements, and administrative procedures. This document must be submitted to the IRS as part of the tax-exemption application process using Form 1024. Without IRS approval and a determination letter, the organization cannot operate as a tax-exempt entity.

VEBAs require a formal governance structure, typically including:

- A board of trustees or administrators (often employee representatives)

- Clear membership eligibility standards based on employment relationships

- Documented benefit provisions

- Financial controls and accounting systems

The membership structure must maintain an employment-related common bond, with at least 90% of members being employees (measured quarterly). Additionally, VEBAs cannot discriminate in favor of highly compensated employees, requiring fair benefit distribution across all eligible participants.

Roles and responsibilities

There are several key stakeholders with critical roles in VEBA operations as below:

- Trustees/administrators: These individuals, often elected employee representatives or union officials, manage the trust's assets, determine benefit eligibility, process claims, and ensure regulatory compliance. They hold fiduciary responsibility to act in the best interest of plan participants.

- Employer sponsors: Organizations that establish or contribute to VEBAs provide funding through tax-deductible contributions. They may participate in plan design but typically delegate day-to-day administration to the trustees.

- Employee members: As beneficiaries of the VEBA, employees receive benefits according to plan provisions. Their eligibility stems from their employment relationship with the sponsoring organization or membership in a qualifying employee group.

There are 3 key stakeholders with critical roles in VEBA operations

Types of VEBAs

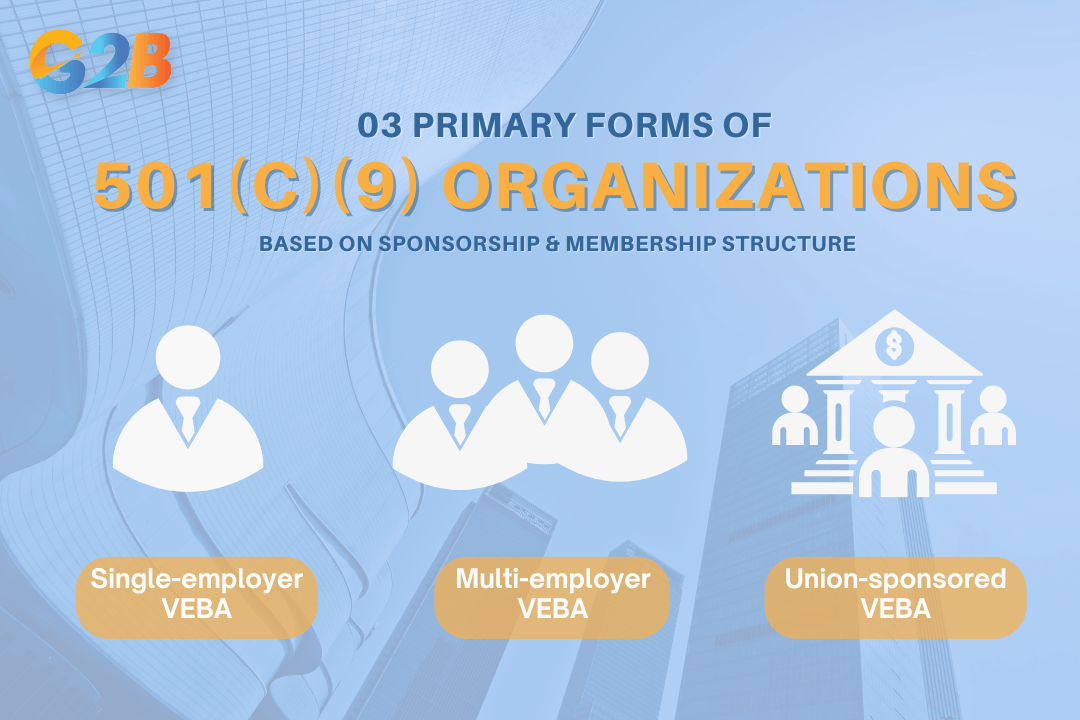

VEBAs come in three primary forms based on their sponsorship and membership structure:

- Single-employer VEBAS: Established by one organization exclusively for its employees, these VEBAs allow companies to fund employee benefits while gaining tax advantages. The employer maintains significant control over plan design and funding.

- Multi-employer VEBA: Created through collaboration between multiple employers, often in the same industry, these arrangements allow smaller organizations to achieve economies of scale in benefit provision. They frequently arise from collective bargaining agreements.

- Union-sponsored VEBA: Labor unions establish these trusts to provide benefits to their members across multiple workplaces. These VEBAs typically result from collective bargaining and may receive funding from multiple employers with unionized workforces.

Each VEBA type must maintain an employment-related common bond among participants while exclusively using trust earnings for benefit provision and necessary administrative expenses.

The VEBA comes in 3 forms based on sponsorship and membership structure

Eligibility and compliance requirements

The foundational requirement of VEBAs is that members share an employment-related common bond, ensuring these organizations serve their intended purpose of providing employee benefits in a tax-advantaged structure.

Who can join or sponsor a VEBA?

Membership in a 501(c)(9) organization is limited to individuals who share an "employment-related common bond." This common bond typically exists through:

- Employment by the same employer

- Employment by affiliated employers

- Being covered under a collective bargaining agreement

- Membership in the same labour union

- Working in the same line of business within the same geographic area

At least 90% of total VEBA membership must consist of employees, measured on one day of each quarter during the taxable year. While self-employed individuals aren't technically employees, they may receive coverage under the de minimis rule in certain circumstances. Sponsorship typically comes from:

- Employers seeking to provide benefits to their workforce

- Labour unions establish benefits for their members

- Employee associations are formed specifically to provide benefits

The participation must be voluntary rather than automatic based on employment status, and VEBAs must have more than one participant to qualify for tax-exempt status.

Permissible benefits and coverage

501(c)(9) organizations can only provide specific types of benefits to maintain compliance:

| Allowed Benefits | Description |

|---|---|

| Life benefits | Current protection only, with limited exceptions for permanent life insurance |

| Health benefits | Medical, dental, and vision coverage |

| Sick benefits | Payments during illness |

| Accident benefits | Coverage for injuries |

| Disability benefits | Short and long-term disability protection |

| Severance pay | Upon termination of employment |

| Supplemental unemployment | Additional support during periods of unemployment |

These benefits must be "definitely determinable," meaning they cannot be subject to the discretion of any person or committee. The benefit structure must be clearly outlined in the plan documents with specific, objective criteria for benefit eligibility and payment amounts.

IRS compliance and reporting

VEBAs face substantial ongoing compliance obligations to maintain tax-exempt status:

- Initial requirements:

- Obtain an IRS determination letter through Form 1024

- Create proper organizational documents (trust document or articles of incorporation)

- Establish a separate entity from the employer

- Annual reporting obligations:

- File Form 990 (Return of Organization Exempt from Income Tax)

- Submit Form 5500 (Annual Return/Report of Employee Benefit Plan)

- File Form 990-T for any unrelated business income

- Complete applicable state income tax returns

- Operational compliance:

- Follow nondiscrimination requirements under Section 505(b)

- Ensure benefits don't favor highly compensated individuals

- Conduct substantially all operations to provide permissible benefits

- Prevent net earnings from inuring to private shareholders or individuals

These compliance requirements demand rigorous documentation and regular review to avoid penalties or loss of tax-exempt status. Most 501(c)(9) organizations engage legal and accounting professionals to help navigate these complex regulatory obligations.

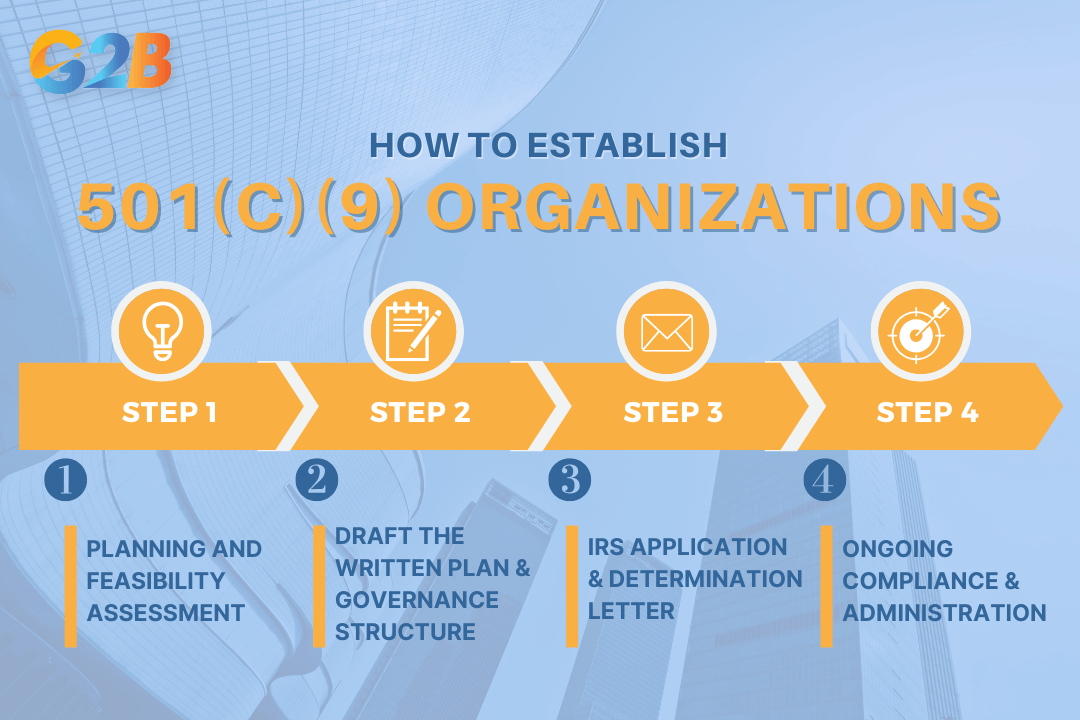

Step-by-step guide: How to start a 501(c)(9) organization

Establishing a 501(c)(9) organization requires careful planning, proper documentation, and strict adherence to IRS regulations. The process involves several critical stages from initial assessment to ongoing compliance maintenance.

The 501(c)(9) organizations’ setting up process involves 4 critical stages

Planning and feasibility assessment

Before launching a VEBA, organizations must conduct a thorough needs analysis to determine if this structure aligns with employee requirements. This assessment begins with identifying the specific benefits employees need most - whether health insurance, disability coverage, life insurance, or other permissible benefits under 501(c)(9) regulations.

The assessment phase should include financial modelling to project contribution requirements, potential tax advantages, and long-term sustainability. Organizations must verify that they meet the fundamental eligibility requirement of having members with an employment-related common bond, such as working for the same employer or belonging to the same union. Consulting with benefits attorneys, actuaries, and tax professionals during this phase proves essential for identifying potential compliance issues before they become problematic.

Drafting the written plan and governance structure

The written plan serves as the foundation for any 501(c)(9) organization. This crucial document must clearly define eligible benefits, membership criteria, funding mechanisms, and governance procedures. The plan should specify which benefits the VEBA will cover - typically health benefits, disability insurance, life insurance, or similar offerings permitted under IRS regulations.

Establishing appropriate governance involves selecting trustees or administrators who will oversee the VEBA's operations. These individuals bear fiduciary responsibility for managing funds and ensuring benefits are distributed according to plan provisions. The governance structure must demonstrate that the organization operates for the exclusive benefit of members rather than private interests.

Essential plan components:

- Comprehensive benefits list with coverage details

- Objective membership eligibility standards

- Non-discrimination provisions

- Contribution structures and funding mechanisms

- Claims procedures and appeal processes

IRS application and determination letter

Securing tax-exempt status for organizations described under section 501(c)(9) of the Internal Revenue Code does require filing Form 1024 with the IRS. Form 1024 is the application for recognition of exemption under section 501(a) for organizations other than those described in sections 501(c)(3) and 501(c)(4). This application must be submitted within 27 months of the organization's formation to ensure retroactive tax exemption from the establishment date.

The application package must include the organization's founding documents, written plan, and detailed descriptions of benefits and operations. IRS examiners scrutinize these materials to verify the organization meets all statutory requirements for VEBA status. Organizations should anticipate follow-up questions and be prepared to provide additional documentation as requested.

| Application components | Description |

|---|---|

| Form 1024 | Primary application for tax exemption |

| Articles of organization | Legal formation documents |

| Written benefits plan | Detailed description of covered benefits |

| Governance documents | Bylaws and trustee information |

| Financial projections | Anticipated revenues and expenses |

Ongoing compliance and administration

After receiving IRS approval, maintaining tax-exempt status requires rigorous administrative practices and regular compliance monitoring. Organizations must implement comprehensive recordkeeping systems to track membership eligibility, benefit payments, and financial transactions.

Annual filing requirements include Form 990, which reports the organization's financial activities and governance practices. This information becomes publicly available, creating transparency around the VEBA's operations. Regular compliance reviews help identify potential issues before they trigger IRS scrutiny or penalties.

Compliance checklist:

- File annual returns (Form 990) by required deadlines

- Maintain records proving the 90% employee membership requirement

- Ensure that benefits solely benefit members and their dependents

- Document that operations substantially further permissible benefits

- Conduct regular non-discrimination testing

- Review plan documents periodically for needed updates

Form your company the right way - Try G2B’s Delaware incorporation service with peace of mind!

Benefits and advantages of 501(c)(9) organizations

501(c)(9) organizations offer substantial advantages for employers, unions, and employee groups seeking tax-efficient benefit solutions. This part will highlight the main benefits associated with VEBAs.

Tax benefits for employers and employees

For employers, contributions to a properly established 501(c)(9) organization are tax-deductible as business expenses, subject to IRS limitations. This deductibility applies regardless of when employees access the benefits, creating immediate tax advantages for the sponsoring organization.

The VEBA trust itself enjoys tax-exempt status on investment earnings and interest income, allowing funds to grow more efficiently than in taxable accounts. This tax-exempt growth compounds over time, maximizing the available resources for employee benefits. For employees, qualified benefit distributions from VEBAs typically remain tax-free when used for eligible expenses, creating a complete tax-advantaged cycle from contribution to distribution.

- Employer contributions: Tax-deductible within IRS guidelines

- VEBA trust earnings: Generally exempt from federal income tax

- Benefit distributions: Tax-free for employees when used for qualified expenses

- Prefunding potential: Tax advantages for setting aside funds for future benefit obligations

Flexible benefit design

501(c)(9) organizations offer remarkable flexibility in benefit structure and design. Sponsors can customize benefit packages to address specific workforce needs, industry challenges, or competitive pressures within their sector. This adaptability allows organizations to create precisely tailored benefit solutions including:

| Benefit type | Examples |

|---|---|

| Health benefits | Medical, dental, and vision coverage |

| Life insurance | Term life, accidental death |

| Disability | Short-term, long-term disability |

| Other | Severance benefits, supplemental unemployment |

Organizations retain control over crucial plan design elements, including eligibility requirements, benefit levels, and distribution timing. This flexibility enables employers and unions to respond quickly to changing workforce demographics, emerging health challenges, or shifts in industry conditions.

Employee attraction and retention

In competitive labor markets, 501(c)(9) organizations provide a powerful talent management advantage. By offering comprehensive, tax-advantaged benefits through a VEBA, employers strengthen their value proposition to current and prospective employees.

The enhanced benefits structure serves as a powerful recruitment tool, particularly for organizations competing for specialized talent. Studies consistently show that robust benefit offerings significantly influence job selection decisions among qualified candidates, especially when those benefits include tax advantages unavailable through standard benefit arrangements.

For existing employees, VEBA participation fosters increased loyalty and reduced turnover intention. The long-term nature of many VEBA benefits creates "golden handcuffs", encouraging valued team members to remain with the organization. Additionally, VEBAs demonstrate organizational commitment to employee welfare beyond basic compensation, strengthening psychological contracts between employers and workers.

- Differentiates the organization in competitive hiring environments

- Reduces turnover-related costs (recruiting, training, productivity losses)

- Creates a positive perception of organizational values

- Builds long-term employee commitment through extended benefit structures

Disadvantages, risks, and common mistakes

While 501(c)(9) organizations offer significant benefits, they come with substantial legal, operational, and compliance challenges. Understanding these pitfalls helps organizations properly evaluate if establishing a VEBA aligns with their strategic goals.

Legal and compliance risks

Non-compliance with IRS regulations can result in severe consequences for 501(c)(9) organizations. The most significant risk is the potential 100% excise tax on any VEBA assets that revert to the employer - essentially confiscating the entire amount. Additionally, failing to disclose prohibited tax shelter transactions carries penalties of $105 per day, up to $54,000.

VEBAs must strictly adhere to anti-discrimination rules that prevent favoring highly compensated employees. Any preferential treatment in benefit distribution can trigger penalties or loss of tax-exempt status. Similarly, improper benefit payments that fall outside the permissible categories defined by the IRS place the organization at risk.

The Unrelated Business Income Tax (UBIT) presents another compliance challenge. Income generated from activities not substantially related to the VEBA's exempt purpose becomes taxable, requiring additional filings and potential tax liability that many organizations fail to properly anticipate or budget for.

Operational challenges and costs

The administrative burden of managing a VEBA often surprises organizations unprepared for the complexity involved. Setup costs include legal fees, actuarial services, and administrative infrastructure that can be substantial, particularly for smaller organizations. Ongoing reporting requirements demand significant resources, including:

- Annual Form 990 filings with the IRS

- Form 5500 submissions for employee benefit plans

- Potential Form 990-T for unrelated business income

- State-level income tax returns where applicable

Long-term financial viability poses a persistent challenge. Some high-profile VEBAs, including those established by Caterpillar and Detroit Diesel, eventually depleted their funds. Healthcare cost fluctuations make accurate long-range forecasting difficult, creating sustainability concerns, especially for union-run VEBAs managing finite resources for retiree benefits.

501(c)(9) vs. Other nonprofit structures

Understanding the distinctions between 501(c)(9) organizations (VEBAs) and other nonprofit structures helps organizations select the appropriate tax-exempt status for their objectives.

501(c)(9) vs. 501(c)(3): Key differences

501(c)(9) organizations and 501(c)(3) charities differ fundamentally in their purpose, eligibility requirements, and tax treatment. VEBAs exclusively provide employee benefits such as health insurance, life insurance, and similar coverages to a defined membership pool based on employment relationships. They cannot solicit general public donations and must maintain strict compliance with nondiscrimination rules.

In contrast, 501(c)(3) organizations serve charitable, religious, educational, or scientific purposes benefiting the general public. These charities can receive tax-deductible contributions from individuals and corporations, making them attractive for fundraising purposes. While VEBAs serve only their members, 501(c)(3) organizations must demonstrate a broad public benefit to maintain their tax-exempt status.

| Feature | 501(c)(9) VEBA | 501(c)(3) Charity |

|---|---|---|

| Primary purpose | Employee benefits | Public charitable service |

| Membership | Employment-based | Open to the general public |

| Funding sources | Employer/employee contributions | Donations, grants, program fees |

| Tax-deductible donations | Limited to employer contributions | Yes, fully deductible |

| Public support test | Not applicable | Required for public charities |

| Lobbying activities | Severely restricted | Limited but permitted |

Other IRS nonprofit types: Quick overview

The IRS recognizes numerous nonprofit classifications beyond 501(c)(9) and 501(c)(3) organizations, each serving distinct purposes with specific compliance requirements. 501(c)(4) social welfare organizations promote community welfare and can engage in substantial lobbying activities, unlike VEBAs. These organizations often advocate for particular social or political causes while maintaining tax-exempt status, though donations to them are not tax-deductible.

501(c)(5) labor unions represent employees in collective bargaining with employers and improve working conditions. While they share some similarities with VEBAs in serving employee interests, their focus remains on workplace representation rather than benefit administration. 501(c)(6) business leagues include chambers of commerce, real estate boards, and trade associations that promote common business interests. These organizations differ from VEBAs by serving industry advancement rather than individual employee benefits.

Other notable nonprofit classifications include:

- 501(c)(7) social clubs organized for pleasure and recreation

- 501(c)(8) fraternal benefit societies operating with lodge systems

- 501(c)(12) mutual benefit organizations like electric cooperatives

- 501(c)(21) black lung benefit trusts for coal miners

Selecting the appropriate nonprofit structure requires careful consideration of:

- Organizational purpose and primary activities

- Intended beneficiaries (members vs. general public)

- Funding mechanisms and sources

- Tax considerations for both the organization and contributors

- Governance and operational requirements

Each nonprofit classification carries distinct advantages and limitations that directly impact an organization's operational flexibility and tax treatment.

Frequently asked questions (FAQs) about 501(c)(9) organizations

This part will answer the most common inquiries about eligibility, benefits, tax status, disadvantages, and organizational fit of the Voluntary Employees’ Beneficiary Associations.

What benefits can a 501(c)(9) provide?

501(c)(9) organizations offer a specific range of permissible benefits focused on employee welfare. These include life insurance, health insurance, accident coverage, and disability benefits for members and their dependents. The IRS strictly regulates the scope of allowable benefits, which must fall within these categories:

- Life insurance and death benefits

- Health and medical coverage

- Disability income protection

- Accident insurance

- Sickness benefits

- Dental and vision care

- Severance benefits

Benefits must be provided uniformly to members within their classification groups. Recreational benefits, vacation facilities, child care, education assistance, or legal services fall outside the permissible scope of 501(c)(9) benefits unless ancillary to the primary welfare benefits.

Who can join a VEBA?

Membership eligibility for 501(c)(9) organizations centers around employment-related common bonds. Individuals must share connections through:

- Employment with the same company or affiliated organizations

- Membership in the same labor union

- Coverage under identical collective bargaining agreements

- Employment in the same geographic region for related industries

The IRS requires this "common bond" to prevent discriminatory practices. Membership must remain voluntary, though employers may automatically enrol eligible employees with opt-out provisions. Dependents of eligible members typically receive coverage through the member's participation rather than direct membership. Retirees from qualified employment groups often maintain eligibility, ensuring continuity of benefits beyond active employment.

Are VEBAs tax-exempt?

501(c)(9) organizations enjoy federal tax exemption when properly established and maintained. This tax-exempt status applies to:

- Income generated from investments

- Contributions received from employers

- Assets held in the trust

Employer contributions to VEBAs qualify as tax-deductible business expenses, creating significant advantages for sponsoring organizations. However, tax exemption hinges on strict compliance with IRS regulations regarding:

- Benefit distributions

- Non-discrimination requirements

- Proper documentation

- Annual reporting

The fund's investment growth remains tax-free, allowing for more efficient benefit funding compared to taxable alternatives. However, unrelated business income may trigger Unrelated Business Income Tax (UBIT), particularly for larger VEBAs exceeding certain thresholds under section 419A.

What are the disadvantages of a 501(c)(9)?

Despite their advantages, 501(c)(9) organizations present several significant challenges:

Compliance burden

- Complex IRS regulations require specialized legal counsel

- Extensive documentation and record-keeping requirements

- Mandatory annual filings (Form 990) with detailed financial disclosure

- Regular compliance reviews to maintain tax-exempt status

Operational limitations

- Restricted scope of permissible benefits

- Anti-discrimination rules limiting benefit design flexibility

- Potential for unrelated business income tax on investments

- Prohibition against inurement to private individuals

The administrative costs of maintaining compliance often make VEBAs impractical for smaller organizations. Additionally, mandatory participation requirements for eligible employee groups can create workforce communication challenges and resistance.

Is a VEBA right for my company?

The suitability of a 501(c)(9) organization depends on several organizational factors:

| Factor | Considerations |

|---|---|

| Size | More practical for mid-to-large employers (100+ employees) |

| Industry | Common in manufacturing, utilities, education and healthcare |

| Resources | Requires dedicated compliance and administrative support |

| Benefit goals | Appropriate for long-term benefit funding strategies |

| Legal support | Needs specialized ERISA and tax counsel |

Organizations must evaluate their capacity to establish and maintain a separate legal entity with proper governance structures. The commitment extends beyond setup to include ongoing oversight by employee representatives, regular IRS filings, and documented compliance procedures.

A 501(c)(9) organization provides a practical, tax-efficient solution for delivering employee benefits, particularly for employers and unions seeking compliant alternatives to traditional plans. By understanding its unique structure and regulatory requirements, especially in contrast to more familiar entities like 501(c)(3) nonprofits, HR professionals and business leaders can better navigate the complexities of employee welfare programs. When implemented effectively, a VEBA can support long-term retention, financial sustainability, and organizational compliance.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom