501(c)(13) organization status provides a vital lifeline for sustaining cemeteries that serve the communities. As nonprofit entities, these groups not only ensure perpetual care but also benefit from significant tax exemptions. Navigating through cemetery perpetual care funding and state-specific cemetery regulations can be complex, especially for those committed to preserving heritage and fostering long-term legacies. Let’s investigate what defines a 501(c)(13) organization, the types that exist, and the unique benefits they offer.

This article is provided for general informational purposes to help entrepreneurs understand the basics of 501(c)(13) organizations, especially Nonprofit Cemetery Companies. We specialize in company formation, not in providing legal or tax advice for U.S. nonprofit compliance. For specific guidance on compliance, please consult a qualified nonprofit or legal expert.

What is a 501(c)(13) nonprofit cemetery organization?

A 501(c)(13) organization represents a specialized nonprofit entity recognized by the Internal Revenue Service specifically for cemetery companies dedicated to the burial and cremation of human remains.

501(c)(13) organizations operate exclusively for the disposal of human bodies and the perpetual care of cemetery grounds while maintaining a not-for-profit structure. The designation provides important protections for cemetery lands and ensures their continued maintenance beyond individual lifetimes.

Under Internal Revenue Code Section 501(c)(13), qualifying cemetery companies must be operated exclusively for human body disposal and not for profit. The cemetery must provide burial spaces for public use, even if described as a 'private' family cemetery. The organization must be chartered solely for burial purposes with its operations dedicated to public benefit.

This classification applies to several organizational structures:

- Mutual cemetery companies

- Nonprofit corporations chartered specifically for burial purposes

- Cemetery companies owned and operated exclusively for the benefit of their members

Key qualification requirements include:

- No part of net earnings may inure to the benefit of any private shareholder or individual

- The organization must apply excess profits toward cemetery maintenance or improvement

- Members (plot owners) must fully intend to use their plots for burial purposes, not resale

- The organization cannot engage in business activities not directly related to burial purposes

Get expert guidance with G2B’s Delaware incorporation service - Schedule your free consultation today!

Differences between 501(c)(13) and other nonprofit designations

While 501(c)(3) organizations can pursue a wide range of charitable, educational, religious, or scientific purposes, 501(c)(13) entities are restricted specifically to cemetery operations. This fundamental difference shapes every aspect of their structure and governance. Application procedures differ significantly:

| Nonprofit type | Application form | Primary focus | Donation deductibility |

|---|---|---|---|

| 501(c)(13) | Form 1024 | Cemetery operations | Perpetual care only |

| 501(c)(3) | Form 1023 | Charitable purposes | Generally deductible |

501(c)(13) organizations face stricter limitations on activities outside their core purpose. While 501(c)(3) organizations can engage in diverse educational or community service activities, cemetery nonprofits cannot undertake initiatives unless they directly relate to cemetery operations. This limitation affects fundraising strategies, community engagement, and operational planning. Contributions to 501(c)(13) organizations are only tax-deductible when designated for perpetual care funds, whereas donations to 501(c)(3) organizations are generally deductible.

Types of cemeteries that qualify

Several cemetery types can qualify for 501(c)(13) status, each with unique characteristics but sharing the fundamental requirement of operating exclusively for burial purposes without profit motive. Qualifying cemetery types include:

- Family cemeteries seeking long-term preservation

- Community burial grounds operated by local boards

- Historic cemeteries requiring ongoing maintenance

- Religious cemeteries (though many operate under 501(c)(3) religious organization exemptions)

- Green burial or conservation cemeteries

Family cemeteries often transition to 501(c)(13) status when ageing family members can no longer manage maintenance responsibilities. Community cemeteries typically form 501(c)(13) organizations to create formal governance structures and ensure perpetual care. Historic cemeteries benefit from nonprofit status through enhanced preservation funding opportunities and tax benefits. The key qualification factor is not the cemetery's size or affiliation but rather its operational structure and dedication to public benefit through perpetual care commitments.

Benefits of 501(c)(13) status for cemetery organizations

501(c)(13) organizations brings numerous advantages designed specifically for cemetery operations. This specialized nonprofit status creates a framework ensuring cemetery maintenance continues indefinitely while providing significant financial benefits.

Benefits of 501(c)(13) status for cemetery organizations

Tax exemption advantages

501(c)(13) organizations receive federal income tax exemption on revenue directly related to cemetery operations. This exemption covers income from plot sales, burial services, and earnings generated by perpetual care funds. The tax savings enable cemeteries to direct more resources toward essential maintenance and preservation efforts rather than paying federal taxes. Many states extend additional tax benefits to qualified cemetery organizations.

Property tax exemptions for nonprofit cemetery lands represent a significant advantage, though specific requirements vary by jurisdiction. Some states also offer sales tax exemptions on purchases directly connected to cemetery operations, further reducing overhead costs. These tax advantages come with important limitations. Income from unrelated business activities remains taxable, requiring meticulous financial management and accounting practices. Organizations must carefully track revenue sources and maintain clear documentation separating exempt cemetery functions from any taxable activities.

Perpetual care funding structures

The 501(c)(13) designation enables cemeteries to establish legally protected perpetual care trust funds. These specialized financial structures ensure ongoing maintenance regardless of future management changes, creating true perpetual care. The nonprofit framework provides transparency and accountability in the management of these essential resources. Contributions specifically designated for perpetual care funds receive tax-deductible status for donors.

This incentivizes financial support for long-term preservation, creating a sustainable funding stream. Successful cemetery organizations implement funding models that separate operational expenses from permanent maintenance funds. This separation protects long-term sustainability by preventing the depletion of perpetual care resources to cover short-term operational needs. Common funding structures include:

- Irrevocable trust accounts with professional management

- Investment policies balancing growth and capital preservation

- Restricted withdrawal policies protecting principal amounts

- Reserve funds beyond minimum requirements for future challenges

Preservation and community benefits

The nonprofit structure helps preserve historically significant burial grounds through sustainable governance and dedicated funding mechanisms. 501(c)(13) organizations often serve as cultural repositories preserving local history and genealogical information for future generations. Community-focused governance models encourage broader stakeholder involvement in cemetery preservation efforts. The nonprofit framework promotes:

- Collaboration with historical societies and preservation organizations

- Educational programming highlighting cultural significance

- Volunteer opportunities strengthening community connections

- Transparent operations building public trust

Cemetery nonprofits frequently develop partnerships with genealogical groups, educational institutions, and historical organizations to enhance preservation efforts. These collaborations create opportunities for documentation projects, historical research, and cultural programming that extend the cemetery's significance beyond burial functions.

Step-by-step process for establishing a 501(c)(13) organization

Establishing a 501(c)(13) organization requires a carefully structured approach that addresses both federal tax requirements and state-specific cemetery regulations. The process unfolds through four distinct phases.

4 steps for establishing a 501(c)(13) organization

Initial planning and assessment

Cemetery nonprofit formation begins with a thorough assessment of the current property status and maintenance needs. This foundational step determines whether creating a new cemetery or converting an existing one better serves the organization's objectives. Successful planning requires identifying and engaging key stakeholders - Family members, community leaders, and potential board members who share the vision for perpetual care and maintenance.

Develop a focused mission statement that explicitly addresses burial purposes and perpetual care commitments. This mission statement will guide all subsequent organizational decisions and appears in legal formation documents. Research state-specific cemetery regulations thoroughly during this phase, as these vary significantly and fundamentally impact operational requirements. Create a comprehensive preliminary budget covering:

- Formation expenses (legal fees, filing costs, professional services)

- Operational costs (maintenance, insurance, administrative expenses)

- Initial perpetual care funding requirements

Legal formation and state incorporation

Draft Articles of Incorporation that explicitly state the cemetery's nonprofit purpose and dedication to public use. This language must appear even for family cemeteries sometimes described as "private." The articles should specifically mention perpetual care as a primary organizational focus, establishing this commitment in the founding documents. Create detailed bylaws outlining:

- Governance structure and board composition

- Decision-making processes and meeting requirements

- Operational procedures and officer responsibilities

- Conflict of interest policies

File incorporation documents with your state's Secretary of State or designated regulatory agency. Apply for an Employer Identification Number (EIN) from the IRS using Form SS-4, which serves as the organization's tax identification number. Many states require registration with additional cemetery-specific regulatory bodies beyond standard nonprofit incorporation procedures.

IRS application process

Complete and submit IRS Form 1024, Application for Recognition of Exemption Under Section 501(a), to obtain federal tax-exempt status. This detailed application requires:

- Comprehensive descriptions of cemetery activities and governance structure

- Financial arrangements and funding mechanisms

- Current and planned operations supporting exempt burial purposes

- Copies of formation documents, bylaws, and financial statements

The IRS typically reviews applications over 3-6 months, often requesting supplemental information to clarify operations or ensure compliance with 501(c)(13) requirements. Maintain regular communication with the IRS examiner throughout this review period.

Establishing governance and operational policies

Develop a diverse board comprising individuals with expertise in relevant areas such as cemetery operations, law, finance, and community relations. This balanced composition ensures comprehensive oversight of all organizational aspects. Create explicit conflict of interest policies that establish ethical boundaries and guide decision-making processes. Establish financial management procedures that strictly segregate operational funds from perpetual care trusts. This separation remains legally and ethically essential for cemetery nonprofits.

Develop comprehensive record-keeping systems documenting plot ownership, burials, and maintenance activities that comply with state regulatory requirements. Create transparent pricing policies that balance service accessibility with financial sustainability. These policies should account for both immediate operational needs and long-term perpetual care obligations. The governance structure must honor the cemetery's community service mission while ensuring regulatory compliance and sound financial management.

Get started with a free consultation from our expert to establish company in Delaware!

State-specific requirements and regulations

501(c)(13) organizations face a complex patchwork of state-level regulations. These regulations often fall under different state agencies, creating additional compliance challenges for cemetery organizations operating across multiple jurisdictions.

Key regulatory differences between states

State cemetery regulations differ dramatically in several critical areas affecting 501(c)(13) operations. Licensing requirements show similar variation:

- Some states require no specific cemetery board licensing

- Others mandate extensive examinations, continuing education, and regular renewals

- Consumer protection regulations range from basic to comprehensive price disclosure mandates

- Green burial and conservation cemetery permissions vary widely by jurisdiction

- Record-keeping requirements differ in required detail and retention periods

Land use permissions present particular challenges for cemetery development, with some states imposing strict buffer zones from water sources, highways, and residential areas. Organizations must thoroughly research their specific state's requirements before establishing or expanding cemetery operations.

Navigating multiple regulatory authorities

Cemetery nonprofits typically interact with multiple state agencies, each with distinct compliance requirements:

| Regulatory authority | Primary oversight areas |

|---|---|

| Secretary of State | Nonprofit incorporation, annual filings |

| Cemetery board | Operational licensing, perpetual care oversight |

| Funeral board | Funeral service regulations, consumer protection |

| Environmental agencies | Land use restrictions, burial practices |

| Consumer protection | Pricing transparency, marketing regulations |

| State tax authorities | Property tax exemptions, sales tax compliance |

Successful 501(c)(13) organizations develop comprehensive compliance calendars tracking reporting deadlines across agencies. Building relationships with regulatory officials provides valuable guidance on compliance matters. Many cemetery nonprofits engage attorneys specializing in both nonprofit law and cemetery regulations to navigate these complex requirements effectively.

Perpetual care requirements across jurisdictions

Perpetual care regulations represent one of the most significant variables in state cemetery law. These differences directly impact the financial structure and sustainability of 501(c)(13) organizations:

- Funding percentage requirements range from 0% to 25% of plot sales

- Investment restrictions often limit equity percentages or require government-backed securities

- Annual reporting requirements vary in detail and frequency

- Withdrawal limitations typically restrict spending to interest earnings

- Trust structure requirements differ regarding trustee qualifications and governance

Some states mandate irrevocable trust structures while others allow more flexible fund management approaches. Investment options often face restrictions designed to preserve capital, sometimes limiting growth potential. Understanding these specific requirements is essential for creating compliant financial models that ensure ongoing cemetery maintenance while meeting state trust regulations.

Operational challenges and solutions

Cemetery nonprofits face unique operational challenges stemming from their perpetual nature, physical land management responsibilities, and specialized recordkeeping requirements.

Sustainable maintenance planning

Effective maintenance planning starts with tiered prioritization systems that address critical preservation needs while establishing ideal standards for periods when resources are more abundant. This approach allows 501(c)(13) cemetery organizations to allocate limited maintenance resources strategically rather than spreading efforts too thinly across entire properties.

Implementing sustainable landscaping significantly reduces long-term maintenance burdens. Native plantings, natural meadows, and water-efficient designs require less frequent attention while often enhancing the cemetery's aesthetic value. These environmentally-conscious approaches also reduce water consumption, chemical inputs, and labor costs while creating habitat value within the cemetery grounds.

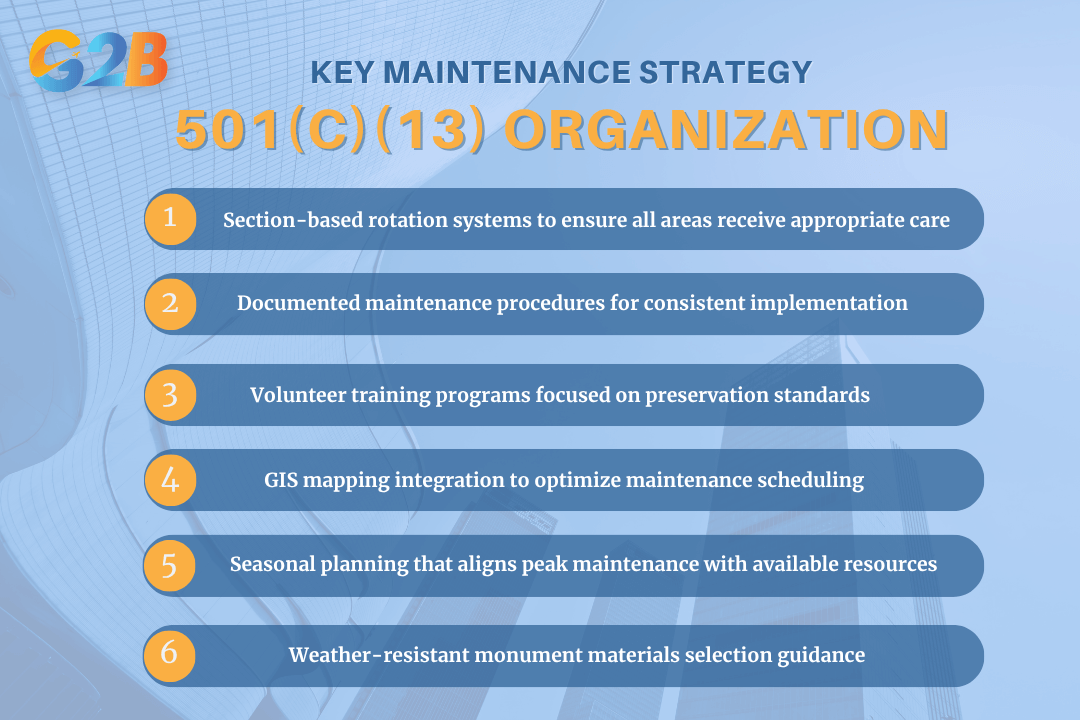

Key maintenance strategies:

- Section-based rotation systems to ensure all areas receive appropriate care

- Documented maintenance procedures for consistent implementation

- Volunteer training programs focused on preservation standards

- GIS mapping integration to optimize maintenance scheduling

- Seasonal planning that aligns peak maintenance with available resources

- Weather-resistant monument materials selection guidance

6 Key maintenance strategies of 501(c)(13) organizations

Records management and digital preservation

Comprehensive digital record systems form the backbone of effective cemetery management. These systems preserve burial locations, monument information, historical data, and institutional knowledge across generations of leadership. Modern cemetery records management requires redundancy through multiple backup systems, including cloud storage solutions and physical copies stored in geographically separate locations.

Standardized documentation protocols ensure consistency in recording new burials, monument installations, and maintenance activities. These processes should balance thoroughness with practicality, collecting essential information without creating unmanageable administrative burdens for limited staff or volunteers.

Digital preservation best practices:

- Regular data verification and integrity checks

- Integration of mapping systems with burial records

- Photographic documentation of monuments with condition assessments

- Partnerships with genealogical organizations for specialized preservation

- Standardized procedures for handling historical record requests

Working with volunteers and limited staff

Structured volunteer programs enable 501(c)(13) cemeteries to accomplish significant maintenance and preservation work despite limited financial resources. Effective programs include clear role descriptions, comprehensive training procedures, and appropriate supervision guidelines that balance volunteer autonomy with quality standards.

Creating a spectrum of volunteer opportunities accommodates different skills, interests, and availability. One-time service days appeal to individuals with limited time commitments, while ongoing specialized roles engage those with particular expertise or deeper connection to the cemetery. Recognition programs acknowledge contributions while building community bonds that sustain volunteer involvement.

Volunteer management framework:

- Cross-training protocols for essential functions

- Documentation systems that maintain continuity through transitions

- Strategic scheduling around seasonal needs and volunteer availability

- Identification of tasks requiring professional expertise versus volunteer support

- Partnership development with community organizations for special projects

- Regular assessment of volunteer program effectiveness and satisfaction

Frequently asked questions about 501(c)(13) organizations

501(c)(13) nonprofit cemetery organizations generate numerous questions from operators, board members, and families seeking clarity on specific aspects of formation, management, and compliance.

Is a 501(c)(13) cemetery organization exempt from federal income tax?

Yes. These organizations are exempt from federal income tax as long as they operate exclusively for the care and maintenance of cemetery grounds and are nonprofit mutual cemetery companies or nonprofit cemetery companies and crematoria.

Are donations to a 501(c)(13) cemetery tax-deductible for federal income tax purposes?

Yes, but only if the donations are made for the care of the cemetery as a whole and not for the care of individual burial plots or crypts. Donations specifically for individual lots or payments for burial plots are not deductible.

Can a family-owned cemetery qualify for 501(c)(13) status?

Yes, but only if it is organized as a nonprofit entity and its funds are irrevocably dedicated to the perpetual care of the cemetery as a whole. Such applications are closely scrutinized by the IRS.

A 501(c)(13) organization stands as a testament to legacy preservation, offering vital tax-exempt status that ensures cemetery maintenance free from financial burdens. It provides a structured framework for perpetual care, crucial for those safeguarding community heritage. Navigating the intricate nonprofit cemetery regulations allows leaders and family planners to forge enduring governance structures.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom