A 501(c)(1) organization is one of 29 types of tax-exempt entities recognized under Section 501(c) of the Internal Revenue Code. Typically including federal credit unions and government-chartered nonprofits, these organizations operate under distinct legal frameworks - quite different from the more widely known 501(c)(3). For entrepreneurs, understanding these nuances is essential to ensure compliance, reduce risk, and strengthen strategic positioning. Let's explore the pathways to clarity and operational efficiency inherent in 501(c)(1) dynamics.

This article is provided for general informational purposes to help entrepreneurs better understand the fundamentals of 501(c)(1) organizations. We are specialists in company formation, not providers of legal or tax advisory services specific to U.S. nonprofit compliance. This information should not be considered professional legal or tax advice. Please consult a qualified attorney or nonprofit compliance expert for guidance tailored to your specific situation.

What is a 501(c)(1) organization?

A 501(c)(1) organization represents a distinct category of tax-exempt entities established directly through an Act of Congress. Unlike most nonprofit classifications, these organizations receive automatic federal tax exemption without requiring an IRS application process.

Formal definition and legal meaning

501(c)(1) organizations are expressly defined under Internal Revenue Code Section 501(c)(1) as corporations organized under an Act of Congress. Their tax-exempt status stems directly from federal legislation rather than through administrative IRS procedures. These entities function as instrumentalities of the United States government, operating with a statutorily defined purpose and structure.

The legal framework establishes 501(c)(1) status through two primary qualifications:

- Creation through specific Congressional action

- Automatic exemption from federal income taxation by statute

This classification differs fundamentally from other nonprofit designations, as the exemption exists by operation of law rather than administrative determination. The statutory basis provides these organizations with clear legal standing and exemption certainty not available to other nonprofit forms.

Get expert guidance with G2B’s Delaware incorporation service - Schedule your free consultation today!

Simple explanation for entrepreneurs and advisors

501(c)(1) organizations represent specialized nonprofit entities directly created through Congressional legislation. Federal credit unions constitute the most common example of this classification, operating under federal charters that establish their structure, governance, and purpose.

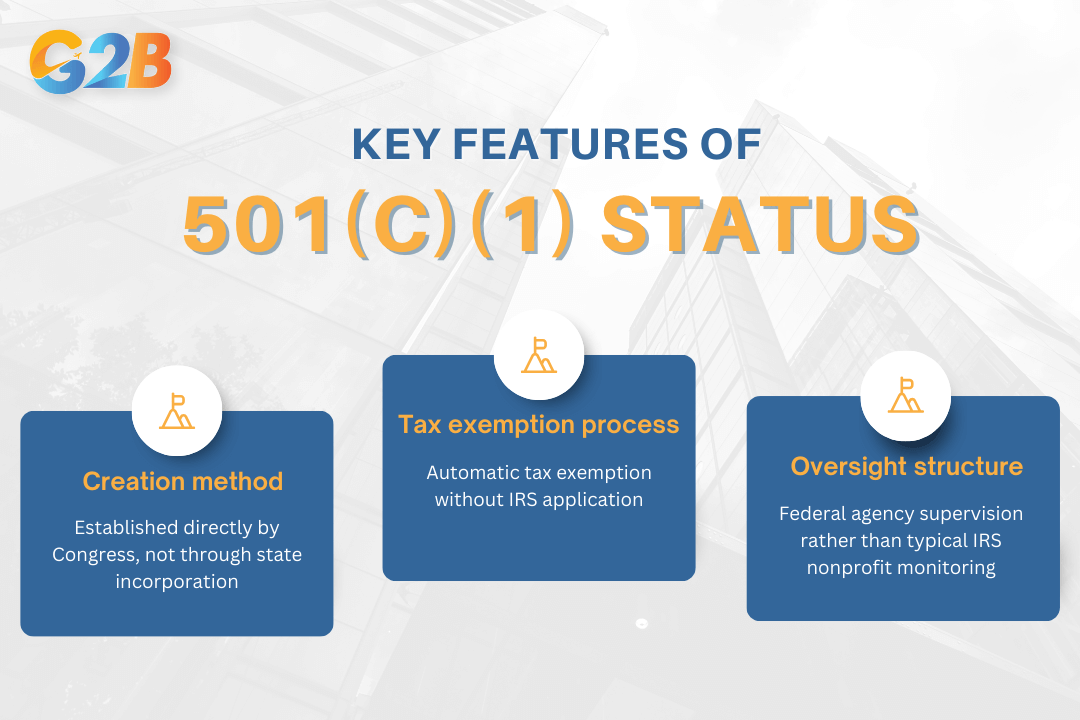

The key distinctions of 501(c)(1) status include:

- Creation method: Established directly by Congress, not through state incorporation

- Tax exemption process: Automatic tax exemption without IRS application

- Oversight structure: Federal agency supervision rather than typical IRS nonprofit monitoring

For advisors guiding organizations on nonprofit structures, understanding that 501(c)(1) status remains unavailable through standard formation procedures is essential. Unlike 501(c)(3) or 501(c)(4) organizations, entrepreneurs cannot independently create or apply for 501(c)(1) status - it exists exclusively for federally-chartered entities established through legislative action.

This classification offers significant administrative advantages through streamlined compliance requirements. Without Form 1023 applications or annual Form 990 filing requirements, 501(c)(1) entities operate with reduced paperwork burdens while maintaining complete tax exemption status.

The key distinctions of 501(c)(1) status include three main characteristics

Why 501(c)(1) status matters

The 501(c)(1) classification provides significant strategic advantages for eligible organizations, including automatic tax exemption without application processes. This streamlined pathway to exempt status eliminates the extensive documentation and waiting periods typical of other nonprofit classifications. However, this benefit comes with strict limitations - only congressionally chartered organizations qualify, making it inaccessible to standard nonprofits seeking tax exemption.

Understanding 501(c)(1) status enables proper risk management through:

- Correctly identifying exemptions from typical IRS filing requirements

- Recognizing the different oversight mechanisms (federal agency supervision rather than IRS oversight)

- Avoiding operational missteps that could jeopardize congressionally granted privileges

The classification also carries important mission alignment implications. Organizations with 501(c)(1) status operate under direct congressional mandate to fulfill specific public purposes. This federally established mission framework creates both opportunities and constraints:

- Greater institutional stability through formal governmental recognition

- Enhanced public trust due to the federal validation of the purpose

- Reduced flexibility in mission adaptation compared to other nonprofit types

- Heightened scrutiny regarding adherence to congressionally defined objectives

For eligible entities, maintaining alignment with these requirements ensures continued operation within their intended public service role while preserving their specialized tax benefits.

Key features and legal requirements of 501(c)(1) status

501(c)(1) organizations operate under a distinct framework that separates them from other nonprofit classifications. This section examines the unique characteristics, compliance requirements, and eligibility criteria that define 501(c)(1) organizations and their operational parameters.

Automatic tax exemption and no IRS application

Unlike other nonprofit organizations, 501(c)(1) entities receive tax-exempt status automatically through their federal charter. This creates a significant procedural advantage for qualifying organizations. The exemption process differs markedly from other nonprofit types:

- No Form 1023 application submission required

- No application fee payment necessary

- No waiting period for IRS determination letter

- No annual Form 990 information return filing obligation

This streamlined status reflects Congress's intent to facilitate the operations of these federally chartered organizations without administrative burdens that might impede their public missions. The tax exemption flows directly from the organization's enabling legislation rather than through discretionary IRS approval.

Federal oversight and compliance

501(c)(1) organizations operate under specialized regulatory frameworks determined by their enabling legislation rather than standard IRS oversight. This creates a unique compliance environment tailored to their specific functions. The regulatory structure typically includes:

- Direct oversight by designated federal agencies

- Compliance with the specific federal statute that created the organization

- Specialized reporting requirements to the relevant federal agency

- Exemption from standard IRS filing requirements (Form 990 series)

Federal agencies exercise varying degrees of control depending on the organization's mission and enabling legislation. For example, Federal Credit Unions fall under National Credit Union Administration (NCUA) regulation, while Federal Reserve Banks adhere to Federal Reserve Board requirements. This agency-specific oversight replaces the uniform compliance standards applicable to other 501(c) organizations.

Eligibility criteria: Who can qualify?

The eligibility parameters for 501(c)(1) status remain exceptionally narrow, making this classification inaccessible to most organizations seeking nonprofit status. Qualification requirements include:

| Requirement | Explanation |

|---|---|

| Congressional creation | Must be established through a specific Act of Congress |

| Federal instrumentality | Must function as an instrumentality of the United States |

| Public purpose | Must serve defined governmental purposes |

| Enabling legislation | Must operate according to federal charter parameters |

This restrictive eligibility means entrepreneurs, community groups, and even state-chartered organizations cannot apply for or convert to 501(c)(1) status regardless of their activities or missions. The classification exists exclusively for federally created entities designated to fulfill specific governmental functions deemed essential by Congress.

501(c)(1) vs. Other nonprofit types: A comparative analysis

Understanding the distinctions between a 501(c)(1) organization and other nonprofit classifications helps founders and compliance officers make informed decisions about organizational structure.

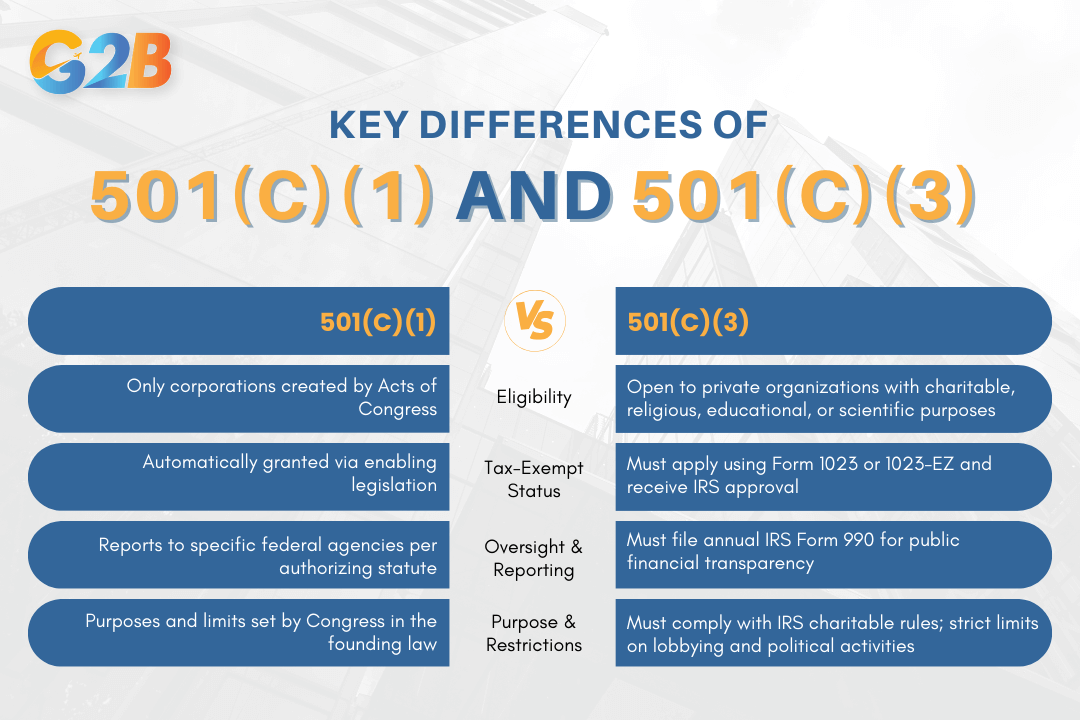

501(c)(1) vs. 501(c)(3): Key differences

501(c)(1) and 501(c)(3) organizations differ fundamentally in eligibility requirements and operational structure. 501(c)(1) status applies exclusively to corporations organized under Acts of Congress, such as federal credit unions and Federal Reserve Banks. In contrast, 501(c)(3) status remains accessible to a wide range of charitable, religious, educational, and scientific organizations formed by private citizens.

The application process creates another stark contrast. 501(c)(1) organizations receive automatic tax exemption through their founding statutes - no IRS application required. Meanwhile, 501(c)(3) entities must complete and submit Form 1023 or 1023-EZ, undergo IRS review, and receive formal determination letters before claiming exempt status.

Reporting obligations also diverge significantly. Most 501(c)(3) organizations must file annual Form 990 returns with the IRS, maintaining transparency about finances and activities. 501(c)(1) entities typically face different oversight mechanisms defined by their enabling legislation rather than standard IRS requirements, often reporting directly to specific federal agencies instead.

Operational restrictions create further distinction. Congress defines the specific purposes and limitations for 501(c)(1) organizations in their enabling legislation. Meanwhile, 501(c)(3) groups must adhere to broader charitable purpose requirements, including restrictions on political campaigning and limitations on lobbying activities.

Key main differences between 501(c)(1) and 501(c)(3)

Comparison table: 501(c)(1) vs. 501(c)(3) vs. Other 501(c) types

The following table provides a comprehensive comparison across common nonprofit classifications:

| Feature | 501(c)(1) | 501(c)(3) | 501(c)(4) | 501(c)(6) | 501(c)(7) |

|---|---|---|---|---|---|

| Primary purpose | Federal instrumentalities | Religious, charitable, educational | Social welfare | Business leagues | Social clubs |

| Creation method | Act of Congress | Private formation | Private formation | Private formation | Private formation |

| IRS application | None required | Form 1023/1023-EZ | Form 1024-A | Form 1024 | Form 1024 |

| Donor tax deductions | Generally no | Yes | No | Limited | No |

| Lobbying activities | As authorized by statute | Limited | Unlimited | Unlimited | Limited |

| Political campaigns | As authorized by statute | Prohibited | Permitted (not primary) | Permitted | Limited |

| Annual filing | Varied by statute | Form 990 series | Form 990 series | Form 990 series | Form 990 series |

| Examples | Federal Credit Unions, Federal Reserve Banks | Red Cross, universities, churches | AARP, civic leagues | Chambers of Commerce, trade associations | Country clubs, fraternal organizations |

This comparative analysis highlights several critical distinctions:

- Formation source: 501(c)(1) entities emerge from congressional action, while other types form through private initiative

- Application process: 501(c)(1) status comes automatically with congressional charter

- Operational freedom: Each category faces distinct restrictions on political and lobbying activities

- Donor benefits: Only contributions to 501(c)(3) organizations generally qualify for charitable tax deductions

- Oversight mechanisms: 501(c)(1) organizations face statutory supervision rather than standard IRS oversight

Benefits and strategic advantages of 501(c)(1) status

501(c)(1) organizations have unique benefits that set them apart from other nonprofit classifications in the U.S. tax system. This special status delivers operational advantages, enhanced legal certainty, and elevated public trust that directly supports their government-sanctioned missions.

Operational efficiency and legal certainty

501(c)(1) organizations operate with remarkable administrative efficiency due to their streamlined compliance requirements. Unlike 501(c)(3) organizations, these entities do not need to:

- File Form 1023 or 1024 for tax-exempt recognition

- Submit annual Form 990 returns to the IRS

- Worry about maintaining eligibility through ongoing compliance filings

This exemption from standard IRS documentation requirements significantly reduces administrative burden and compliance costs. Federal credit unions and other 501(c)(1) entities can dedicate more resources to their core missions rather than regulatory paperwork. The federal charter itself provides exceptional legal certainty. These organizations operate with clear statutory authority that establishes precise parameters for their activities and governance. This clarity eliminates many of the legal gray areas that other nonprofits must navigate, reducing legal expenses and compliance risks.

| Operational benefit | Impact on 501(c)(1) organizations |

|---|---|

| Automatic exemption | No application or renewal process |

| Reduced IRS filings | Lower administrative costs |

| Federal charter | Clear operational boundaries |

| Statutory protection | Reduced legal ambiguity |

Public trust and mission alignment

The Congressional imprimatur carried by 501(c)(1) organizations creates an immediate credibility advantage. These entities operate with formal federal recognition that signals trustworthiness to:

- Potential partners and collaborators

- The communities they serve

- Other government agencies

- Financial institutions and service providers

This inherent credibility stems from their explicit creation to fulfill specific public purposes. Federal credit unions, for example, carry public confidence based on their Congressional charter and mission to serve member-owners rather than maximize profits for external shareholders.

The alignment between 501(c)(1) organizations and government objectives creates natural synergies for public service delivery. These entities become effective vehicles for implementing specific federal policies without creating direct government agencies. This hybrid status - federally chartered but operationally independent - allows them to:

- Execute mandates with greater flexibility than government departments

- Maintain closer alignment with federal goals than private organizations

- Leverage their unique status to build strategic partnerships

- Access both public and private resources effectively

This mission alignment extends beyond operational advantages into tangible reputational benefits that enhance their ability to fulfill their chartered purposes.

Disadvantages, limitations, and common misconceptions

Despite their automatic tax exemption, these entities face significant restrictions and operational limitations that make them inaccessible to most nonprofit founders. Understanding these constraints prevents misguided attempts.

Strict eligibility and limited flexibility

The fundamental limitation of 501(c)(1) organizations lies in their creation method - They must be established through an Act of Congress. This requirement effectively eliminates the possibility for entrepreneurs, community leaders, and nonprofit founders to form or convert existing organizations into 501(c)(1) entities through normal incorporation processes. Federal credit unions and Federal Reserve Banks exemplify this exclusive category.

Organizations operating under 501(c)(1) status face substantial operational constraints imposed by their federal charters. These constraints often include:

- Restricted geographic service areas

- Defined membership criteria

- Limited scope of permissible activities

- Mandatory federal agency oversight

- Specific governance structures required by law

Unlike 501(c)(3) organizations that maintain significant autonomy in program development and implementation, 501(c)(1) entities must strictly adhere to their congressionally defined purpose. This rigidity often prevents adaptation to emerging community needs or innovative service approaches without legislative intervention.

Ready to establish company in the US? Get started with a free consultation from our expert incorporation service!

Common misconceptions about 501(c)(1)

The most prevalent misconception about 501(c)(1) organizations is that they represent an alternative classification option available to any nonprofit seeking tax exemption. This misunderstanding leads many founders to incorrectly believe they can choose between filing for 501(c)(1) or 501(c)(3) status based on their preference.

Other common myths include:

| Misconception | Reality |

|---|---|

| Any nonprofit can apply for 501(c)(1) status | Only congressionally chartered entities qualify |

| 501(c)(1) offers more favorable tax benefits than other statuses | Benefits are comparable but come with greater operational restrictions |

| The "1" designation indicates primacy or superiority over other 501(c) types | The numbering system is not hierarchical in importance |

| 501(c)(1) status eliminates all reporting requirements | Federal oversight may impose rigorous alternative reporting |

| Donations to 501(c)(1) organizations are automatically tax-deductible | Deductibility depends on the specific organization and purpose |

Another frequent confusion stems from the misinterpretation of automatic tax exemption. While 501(c)(1) organizations don't need to apply for exempt status using Form 1023, this advantage comes at the cost of requiring congressional action for formation - a far more complex and politically challenging process than standard IRS approval procedures.

501(c)(1) organizations have advantages and disadvantages that set them apart

Frequently asked questions (FAQs) about 501(c)(1) organizations

Organizations classified under section 501(c)(1) often generate many questions from compliance professionals, executives, and advisors seeking clarity on their unique status. Below are answers to the most common inquiries about 501(c)(1) organizations.

How do you form a 501(c)(1) entity?

Formation of a 501(c)(1) organization occurs exclusively through an Act of Congress. No standard application process exists for individuals, groups, or organizations seeking this designation. The congressional action requirement creates a significant barrier to entry. Private founders cannot independently establish such entities regardless of their mission or resources. This stands in stark contrast to other tax-exempt classifications that allow formation through standard nonprofit incorporation procedures followed by an IRS application.

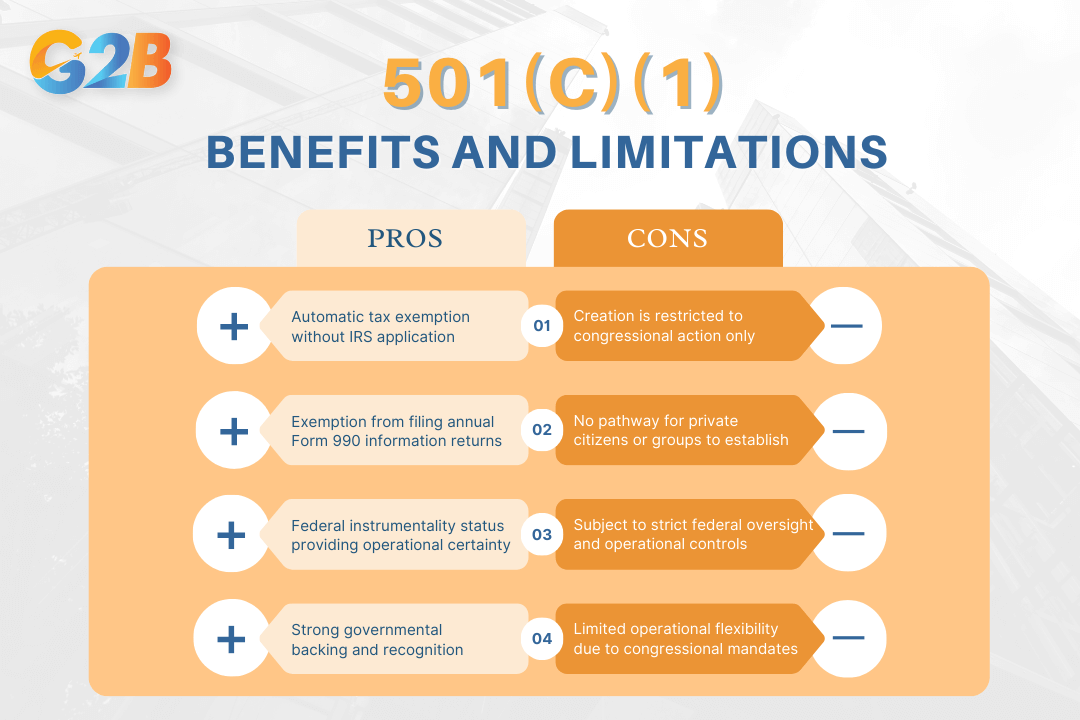

What are the benefits and limitations of 501(c)(1)?

Benefits:

- Automatic tax exemption without IRS application

- Exemption from filing annual Form 990 information returns

- Federal instrumentality status providing operational certainty

- Strong governmental backing and recognition

Limitations:

- Creation is restricted to congressional action only

- No pathway for private citizens or groups to establish

- Subject to strict federal oversight and operational controls

- Limited operational flexibility due to congressional mandates

- Restricted to specific congressionally defined purposes

Are federal credit unions 501(c)(1) organizations?

Yes, federal credit unions represent the most common and recognizable example of 501(c)(1) organizations. Created under the Federal Credit Union Act, these financial cooperatives operate as instrumentalities of the United States government. Federal credit unions satisfy all core requirements for 501(c)(1) status: They are organized under specific congressional legislation, function as federal instrumentalities, and receive automatic tax exemption without requiring separate IRS recognition. Their widespread presence makes them the reference point most practitioners use when explaining 501(c)(1) status.

The fundamental distinction lies in accessibility: while anyone meeting specific criteria can establish a 501(c)(3), only Congress can create a 501(c)(1) organization, making the latter extremely rare in comparison. 501(c)(1) organization status serves as a crucial foundation for entities seeking federal exemption with the backing of public trust. Navigating this structure empowers organizations to focus on their core missions without the burden of tax distractions, ushering efficiency by aligning with compliance standards.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom