A 501(c)(19) organization is a beacon for those committed to serving veterans. These nonprofit entities, tied closely with tax exemption and specific eligibility requirements, play a crucial role in supporting military communities. Let’s delve into the intricacies of establishing a veterans' nonprofit and unveil the practical steps with benefits inherent in gaining 501(c)(19) status.

This article is provided for general informational purposes to help individuals understand the basics of 501(c)(19) organizations, especially those established to support veterans and their families. We specialize in company formation, not in providing legal or tax advice for U.S. nonprofit compliance. For specific guidance on compliance, please consult a qualified nonprofit or legal expert.

What is a 501(c)(19) veterans organization?

A 501(c)(19) organization is a tax-exempt veterans' organization recognized by the IRS that primarily benefits past or present members of the United States Armed Forces, their auxiliaries, or related trusts and foundations.

Formal IRS definition

Section 501(c)(19) of the Internal Revenue Code grants tax exemption to organizations dedicated to veterans' welfare, provided they meet specific structural and operational requirements. To qualify, these entities must be organized within the United States or its possessions and maintain a primary mission of serving current or former military personnel. The tax code stipulates strict membership composition requirements, typically mandating that a significant percentage of members must be veterans or active military.

The IRS carefully regulates these organizations to ensure their legitimacy. Key compliance elements include:

- Organization in U.S. territory

- Dedicated focus on veterans' welfare

- Specific membership composition thresholds

- Prohibition against private benefit to shareholders or individuals

Key compliance elements of 501(c)(19) veterans organization include 4 features

Key features of a 501(c)(19) veterans organization

- Membership requirements: At least 75% of members must be past or present U.S. Armed Forces members. Additionally, at least 97.5% of members must be veterans, cadets (such as ROTC students), or close relatives (spouses, widows, widowers, ancestors, or lineal descendants) of such members.

- Purpose: Must operate exclusively for purposes such as promoting social welfare, assisting disabled or needy veterans and their families, providing care to hospitalized veterans, perpetuating the memory of deceased veterans, conducting charitable, educational, or patriotic programs, providing insurance benefits, or offering social and recreational activities for members.

- Organization types: Can be a veterans' post or organization, an auxiliary unit or society affiliated with such a post, or a trust/foundation supporting a veterans' post or organization.

- Tax benefits: These organizations are exempt from federal income tax, and contributions made to them are generally tax-deductible for donors.

- Legal requirements: Must be organized in the United States or its possessions and operate under rules that prevent any part of net earnings from benefiting private individuals.

Get expert guidance with G2B’s Delaware incorporation service - Schedule your free consultation today!

Who can qualify for 501(c)(19) status?

Qualifying for 501(c)(19) organization status requires strict adherence to specific IRS guidelines regarding membership composition and organizational structure. These veterans organizations must maintain a strong connection to the United States.

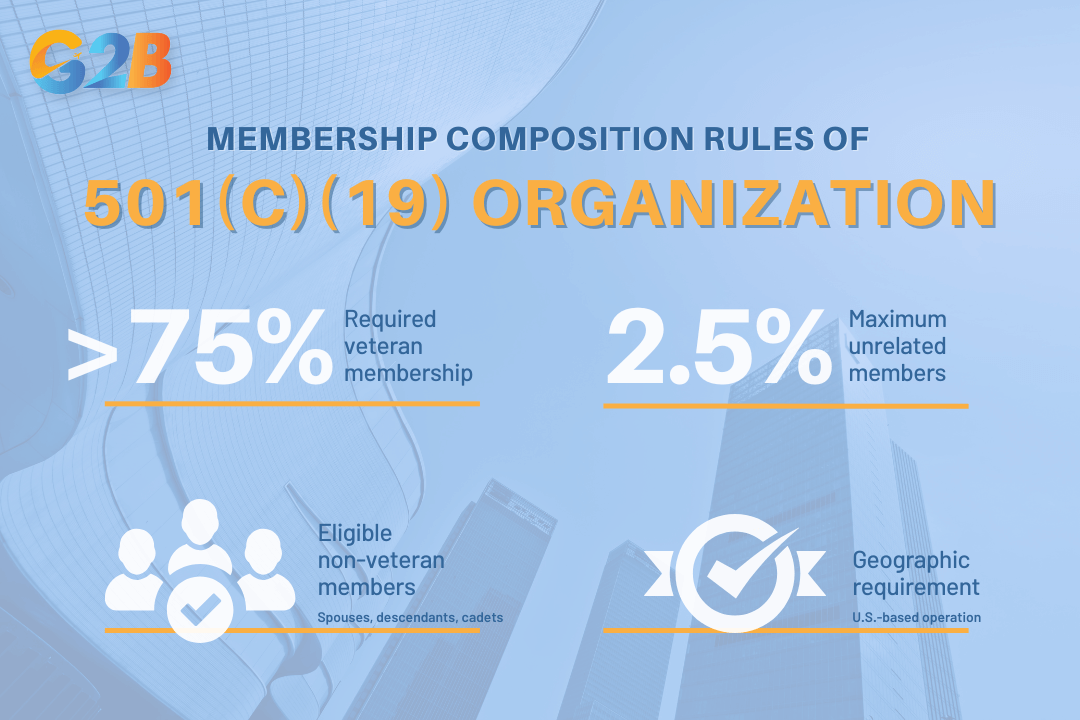

Membership composition rules

The 75% veteran membership rule stands as the cornerstone requirement for 501(c)(19) organizations. At least three-quarters of all members must be present or former members of the United States Armed Forces. This supermajority ensures these organizations truly represent and serve the veteran community they were designed to support. The remaining 25% of members must fall into specific categories: Cadets, spouses, widows, widowers, ancestors, or lineal descendants of qualifying veterans.

Additionally, organizations must enforce a strict cap, allowing no more than 2.5% of total membership to consist of individuals without direct military connections (such as social members). The organization itself must be physically based in the United States or its territories, and no portion of net earnings may benefit any private shareholder or individual.

- Required veteran membership: Minimum 75%

- Eligible non-veteran members: Spouses, descendants, cadets

- Maximum unrelated members: 2.5%

- Geographic requirement: U.S.-based operation

Membership composition rules of the 501(c)(19) organization

Role and structure of auxiliary units

Auxiliary units, such as spouses' or family members' organizations, can obtain their own 501(c)(19) status while supporting the main veterans organization. These affiliated groups must meet specific structural requirements to qualify for tax exemption under this designation. To qualify, auxiliary units must:

- Maintain formal affiliation with a qualifying primary 501(c)(19) organization

- Organize according to the bylaws and regulations of the main organization

- Operate within the United States or its territories

- Restrict membership to individuals related to the primary organization's members

The membership criteria for auxiliary units require members to be either part of the primary 501(c)(19) organization, spouses of those members, or related to members within two degrees of consanguinity (including grandparents, siblings, and grandchildren). Like the primary organizations, auxiliary units cannot allow net earnings to benefit private individuals.

Permitted activities and purpose

501(c)(19) veterans organizations enjoy considerable flexibility in their operational activities compared to other nonprofit designations. These organizations can conduct both charitable programs benefiting veterans and their families alongside member-focused social or recreational activities. Permissible activities include:

- Providing financial assistance to disabled or needy veterans

- Supporting educational opportunities for veterans or their dependents

- Organizing memorial events and ceremonies

- Offering social and recreational gatherings for members

- Advocating for veterans' rights and benefits

- Maintaining facilities for member use

All activities, whether charitable or social, must align with the overarching purpose of supporting veterans' welfare and promoting social welfare in the broader community. This dual-purpose capability distinguishes 501(c)(19) organizations from more restrictive nonprofit designations, providing greater operational flexibility while maintaining their tax-exempt status.

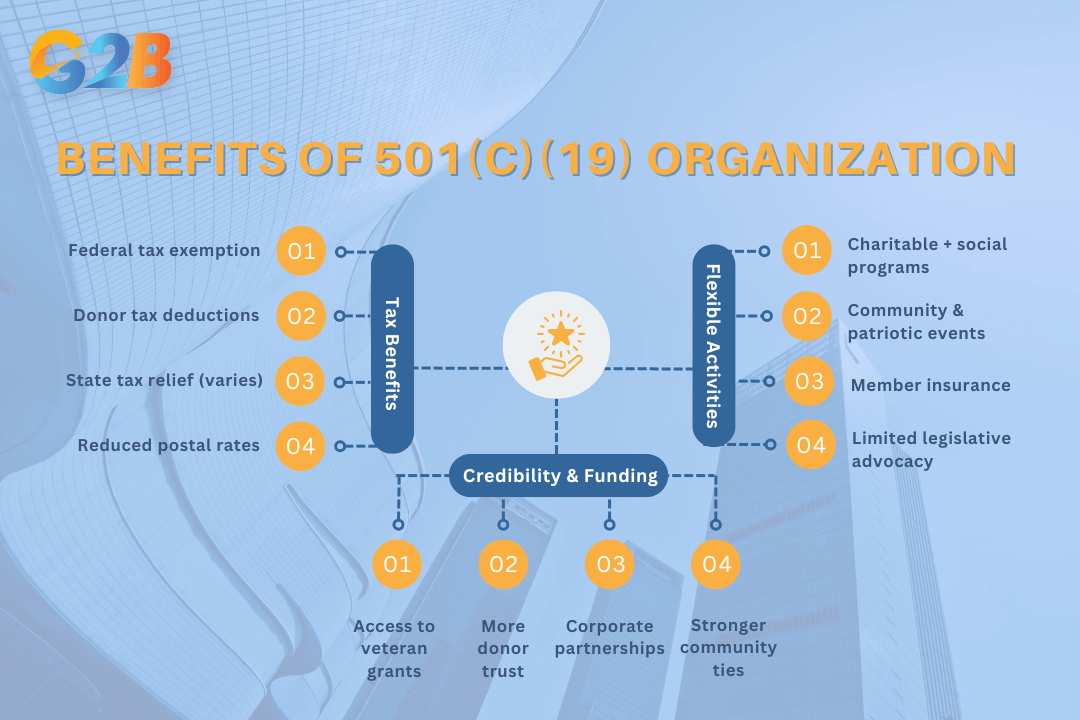

Advantages of 501(c)(19) organizations

The 501(c)(19) organization status offers substantial benefits that extend beyond basic tax exemption. These advantages enable veterans' organizations to more effectively serve their communities while maintaining financial stability.

The 501(c)(19) organization status offers substantial benefits

Federal and state tax advantages

501(c)(19) organizations receive complete exemption from federal income taxes, dramatically increasing their financial efficiency. This exemption applies to most income-generating activities, allowing more resources to flow directly toward veteran support programs rather than tax obligations. Donations to these organizations can be tax-deductible for contributors when specific requirements are met, particularly for war veterans' organizations. This deductibility serves as a powerful incentive for donors, potentially increasing both the frequency and size of contributions.

- Federal income tax exemption on organizational revenue

- Potential tax deductibility for donors' contributions

- Eligibility for reduced postal rates

- Possible exemption from certain state taxes (varies by location)

Flexibility of mission and activities

501(c)(19) organizations can simultaneously pursue charitable objectives like veteran assistance programs while also conducting social and recreational activities for members without jeopardizing their tax status. This dual-purpose capability allows organizations to address veterans' needs holistically. They can provide critical services such as disability support and educational resources while also fostering community through social events and recreational programs. The organization may also engage in limited legislative activities that affect veterans.

- Ability to conduct both charitable and social activities

- Freedom to sponsor patriotic and community events

- Permission to provide insurance benefits for members/dependents

- Authorization to engage in limited legislative advocacy related to veterans' issues

Enhanced credibility and access to funding

The official 501(c)(19) designation significantly enhances an organization's credibility with potential supporters, partners, and the veteran community. This formal recognition demonstrates both IRS compliance and commitment to serving veterans, establishing trust with stakeholders. This elevated status opens doors to funding sources specifically earmarked for veterans' causes. Many government grants, corporate giving programs, and foundation opportunities specifically target recognized veterans' organizations.

- Access to grants specifically designated for veterans' organizations

- Strengthened position for corporate partnership opportunities

- Increased donor confidence through official recognition

- Greater leverage when building community collaborations and support networks

A comparison between 501(c)(19) and other tax-exempt veterans organizations

Understanding the key differences between these tax-exempt statuses helps founders make informed decisions about which structure best aligns with their mission, membership composition, and planned activities.

501(c)(19) vs. 501(c)(3) key differences

| Feature | 501(c)(19) | 501(c)(3) |

|---|---|---|

| Primary beneficiaries | Veterans & families | General public |

| Membership rule | 75%+ veterans required | No specific requirement |

| Permitted activities | Charitable + social/recreational | Primarily charitable |

| Fundraising | Donations sometimes tax-deductible | Donations are nearly always deductible |

| Social activities | Permitted if secondary | Generally not allowed |

These fundamental differences highlight why military-focused organizations must carefully evaluate their structure and mission before applying for tax-exempt status. The membership requirements, permissible activities, and donation deductibility directly impact organizational operations and fundraising capabilities.

Which organizations should choose 501(c)(19)?

Veterans' groups should select the 501(c)(19) designation when their membership consists predominantly of former or current military personnel. This structure proves ideal for organizations that want to balance charitable support services with social and recreational activities for members. Organizations must maintain detailed membership records to demonstrate compliance with this requirement during IRS reviews. American Legion posts, Veterans of Foreign Wars chapters, and similar groups typically operate under this designation because it accommodates their mixed mission of veteran advocacy, community service, and member social activities.

Other alternative exemptions (armed forces nonprofits)

Military-focused nonprofits with broader public service missions often consider alternative tax-exempt designations. The 501(c)(3) classification works best for veterans' organizations primarily focused on charitable, educational, or scientific purposes without membership restrictions. Organizations failing to meet the strict 75% veteran membership requirement but still serving military communities might pursue 501(c)(4) status as social welfare organizations. Though this classification offers flexibility in advocacy activities, donations to 501(c)(4) groups aren't tax-deductible for donors, creating potential fundraising challenges.

Some military support organizations structure as 501(c)(7) social clubs when their primary purpose centers on recreation and social activities. However, this designation significantly limits fundraising options and tax benefits compared to 501(c)(19) or 501(c)(3) statuses. Each classification carries specific operational restrictions and reporting requirements that veteran-focused nonprofits must carefully evaluate before selecting their optimal legal structure.

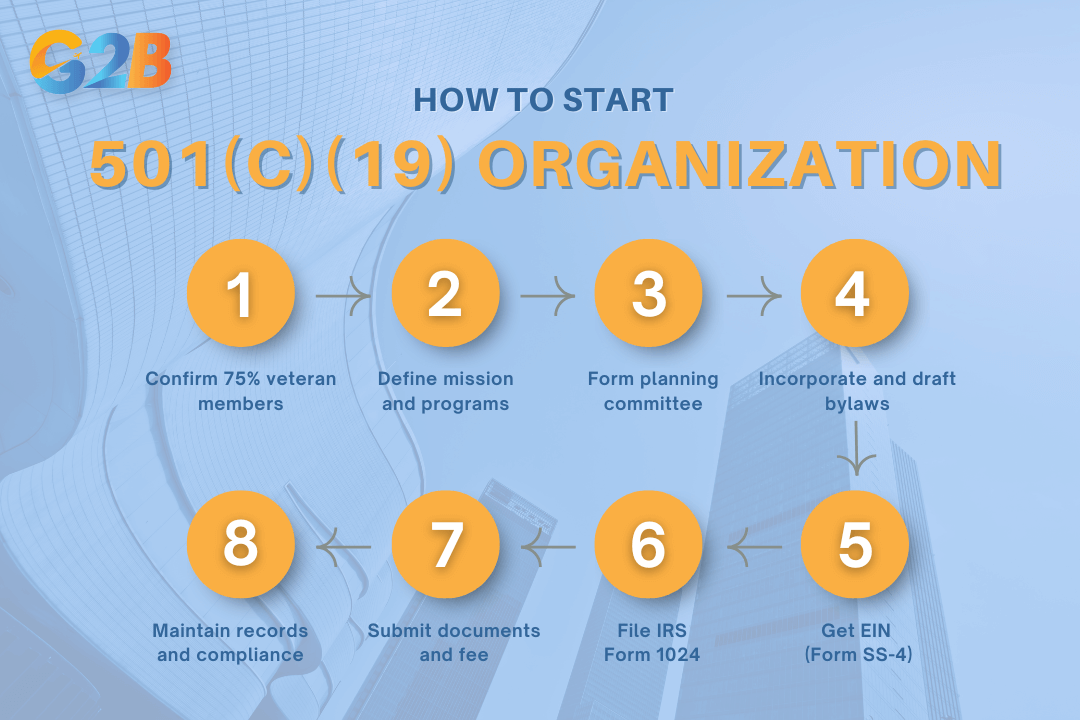

How to start a 501(c)(19) veterans nonprofit

Establishing a 501(c)(19) organization requires methodical planning, strict adherence to legal requirements, and comprehensive documentation. This systematic approach ensures your veterans' organization secures and maintains its tax-exempt status.

Establishing a 501(c)(19) organization requires several steps

Eligibility and planning

Before forming a 501(c)(19) veterans organization, verify that your proposed membership meets the IRS threshold of at least 75% current or former Armed Forces members. This membership composition forms the backbone of eligibility and must be documented from the organization's inception.

Creating a strategic roadmap helps clarify the organization's purpose and direction. Develop a mission statement that specifically addresses veterans' needs and outlines core programs such as assistance for disabled veterans, memorial activities, or social welfare initiatives. Define measurable objectives, identify target beneficiaries, and estimate resource requirements including volunteer needs, facilities, and initial funding sources.

Consider forming a planning committee composed of qualified veterans who understand military culture and can provide insight into the needs of your potential membership base. This committee should conduct a community needs assessment to identify service gaps your organization can address effectively.

Incorporation and bylaws

State incorporation establishes your 501(c)(19) organization as a legal entity capable of conducting business. Research your state's nonprofit laws through the Secretary of State's office and select an available name that clearly identifies your veterans' focus. Draft articles of incorporation that include:

- The organization's name and principal address

- Statement of purpose aligned with 501(c)(19) requirements

- Dissolution clause specifying asset distribution to similar organizations

- Names and addresses of initial directors/incorporators

Develop comprehensive bylaws that govern internal operations, meeting IRS requirements for veterans' organizations. These should include:

- Membership eligibility criteria with verification procedures

- Board composition and term limits

- Meeting frequency and quorum requirements

- Committee structures and responsibilities

- Conflict of interest policies

- Amendment procedures

For organizations planning auxiliary units, include specific provisions defining their relationship to the main organization and eligibility requirements for auxiliary membership.

Applying for federal tax-exempt status

The tax-exemption application process requires precise documentation and adherence to IRS procedures. First, obtain an Employer Identification Number by submitting Form SS-4 online, by mail, or by fax. Next, prepare IRS Form 1024, "Application for Recognition of Exemption Under Section 501(a)," which specifically addresses 501(c)(19) organizations. This application requires:

- Detailed description of all activities

- Sources of financial support

- Documentation of membership composition

- Copies of organizing documents

- Financial statements or proposed budgets

Prepare a membership roster demonstrating compliance with the 75% veterans requirement, including verification methods. Submit all materials with the appropriate user fee and be prepared to respond to IRS information requests during the review period, which typically takes 3-6 months.

Maintaining ongoing compliance

Maintaining 501(c)(19) status demands diligent record-keeping and regulatory compliance. Implement a systematic approach to membership documentation that tracks:

- Current membership percentages against IRS thresholds

- Verification of members' military service

- Annual certification of continued eligibility

File required annual returns on time:

- Form 990, 990-EZ, or 990-N based on gross receipts

- Form 990-T for any unrelated business income

- State-specific compliance filings

Conduct annual compliance reviews examining:

- Membership composition changes

- Program alignment with exempt purposes

- Financial controls and transparency

- Governance best practices

- Risk management procedures

Regular leadership training on compliance requirements helps prevent inadvertent violations that could jeopardize tax-exempt status. Consider engaging a nonprofit attorney or accountant familiar with veterans' organizations for periodic compliance assessments.

Get started with a free consultation from our expert to establish a company in Delaware!

Common challenges and how to avoid them

501(c)(19) organizations often encounter significant operational and compliance challenges that can threaten their tax-exempt status. These veterans' organizations must navigate complex regulatory requirements while fulfilling their missions to support military communities.

Key steps for compliance

Maintaining 501(c)(19) status requires vigilant attention to several critical requirements. Organizations must verify that at least 75% of their membership consists of past or present members of the Armed Forces. Operations must be based exclusively within the United States or its territories to qualify for exemption. The organization's bylaws should clearly establish veteran-focused purposes and membership criteria that align with IRS requirements.

Accurate record-keeping includes obtaining and maintaining an Employer Identification Number (EIN), filing timely annual returns, and documenting all organizational activities. Leadership education remains essential, as board members and officers need thorough training on permissible activities and funding sources to avoid jeopardizing the organization's exempt status.

Frequent mistakes and audit triggers

IRS scrutiny often results from preventable administrative oversights and operational missteps. Incomplete or inaccurate membership records represent the most common compliance failure, particularly when organizations cannot demonstrate they meet the 75% veteran membership requirement. Excessive non-veteran-focused activities can signal mission drift to regulators. Private benefit violations occur when organizational assets or income primarily benefit individual members rather than advancing the exempt purpose..

Other common audit triggers include:

- Inadequate documentation of members' military service status

- Poor tracking of income sources (member vs. non-member)

- Misclassification of workers

- Failure to connect expenditures to exempt purposes

Organizations should institute regular internal compliance reviews to identify and address these issues before they attract regulatory attention.

Converting an existing nonprofit to 501(c)(19)

Established nonprofits sometimes discover the 501(c)(19) designation better aligns with their mission and membership. This conversion requires careful planning and documentation to meet specialized requirements. The organization must first analyze its current membership composition against the 501(c)(19) standard requiring 75% veterans and 97.5% total qualifying members (including cadets and certain family members). Bylaws and articles of incorporation need amendment to reflect veteran-focused purposes and membership criteria.

Key conversion steps include:

- Amending organizational documents to demonstrate exclusive operation for permitted purposes

- Verifying U.S.-based operations

- Implementing safeguards against private inurement

- Filing Form 1024 with the IRS along with supporting documentation

The transition requires board approval, meticulous record-keeping, and potentially consulting with nonprofit legal specialists familiar with veterans' organization regulations.

Frequently asked questions about 501(c)(19) organizations

- Is a 501(c)(19) organization exclusively for U.S. military veterans?

Yes, at least 75% of members must be past or present U.S. Armed Forces members, and 97.5% must be veterans, cadets, or their close relatives. - Can spouses and descendants of veterans be members of a 501(c)(19) organization?

Yes, spouses, widows, widowers, ancestors, and lineal descendants of veterans or cadets can be members. - Is a 501(c)(19) organization tax-exempt under federal law?

Yes, these organizations are exempt from federal income tax under IRS code 501(c)(19). - Are contributions to 501(c)(19) organizations tax-deductible?

Yes, individual contributions to 501(c)(19) veterans organizations are generally tax-deductible. - Can a 501(c)(19) organization operate as an auxiliary or trust?

Yes, auxiliaries and trusts related to veterans posts can qualify if they meet IRS requirements. - Must a 501(c)(19) organization be organized in the United States?

Yes, the organization must be organized in the U.S. or its possessions to qualify. - Can a youth organization affiliated with a veterans post qualify as a 501(c)(19)?

Yes, if it meets auxiliary membership and organizational requirements, youth units can qualify. - Are 501(c)(19) organizations allowed to provide social and recreational activities?

Yes, providing social and recreational activities for members is one of the permitted purposes. - Is it possible for a 501(c)(19) organization to engage in charitable and educational programs?

Yes, conducting charitable, scientific, literary, or educational programs is allowed under IRS rules. - Do 501(c)(19) organizations have restrictions on net earnings benefiting private individuals?

Yes, no part of net earnings may inure to the benefit of any private shareholder or individual.

A 501(c)(19) organization does not just offer a financial benefit; it’s a pathway to sustaining invaluable services that honor military legacy. Understanding membership requirements is crucial, but more importantly, it's about shaping a community that thrives on patriotism. As you navigate this rewarding journey, envision the profound impact your efforts can have, fostering enduring connections and support for those who served.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom