Navigating the nuances of a 501(c)(21) organization unlocks unique advantages for those managing employee-funded pension trusts. These entities, designed specifically for the mining industry, aid in structuring compensation while ensuring regulatory compliance. Let’s investigate the definition, types, features and relationship with other entities of the 501(c)(21) organization.

This article is provided for general informational purposes to help individuals understand the basics of 501(c)(21) organizations, particularly those established to manage black lung benefit trusts for coal miners. We specialize in company formation, not in providing legal or tax advice regarding U.S. nonprofit compliance. For specific guidance on regulatory requirements, please consult a qualified nonprofit or legal expert.

What is 501(c)(21) organization

A 501(c)(21) organization is a tax-exempt entity under the Internal Revenue Code specifically designated as a Black Lung Benefit Trust. These trusts were established by coal mine operators to pay claims under the Federal Black Lung Benefits Act of 1969, providing benefits to coal miners suffering from black lung disease.

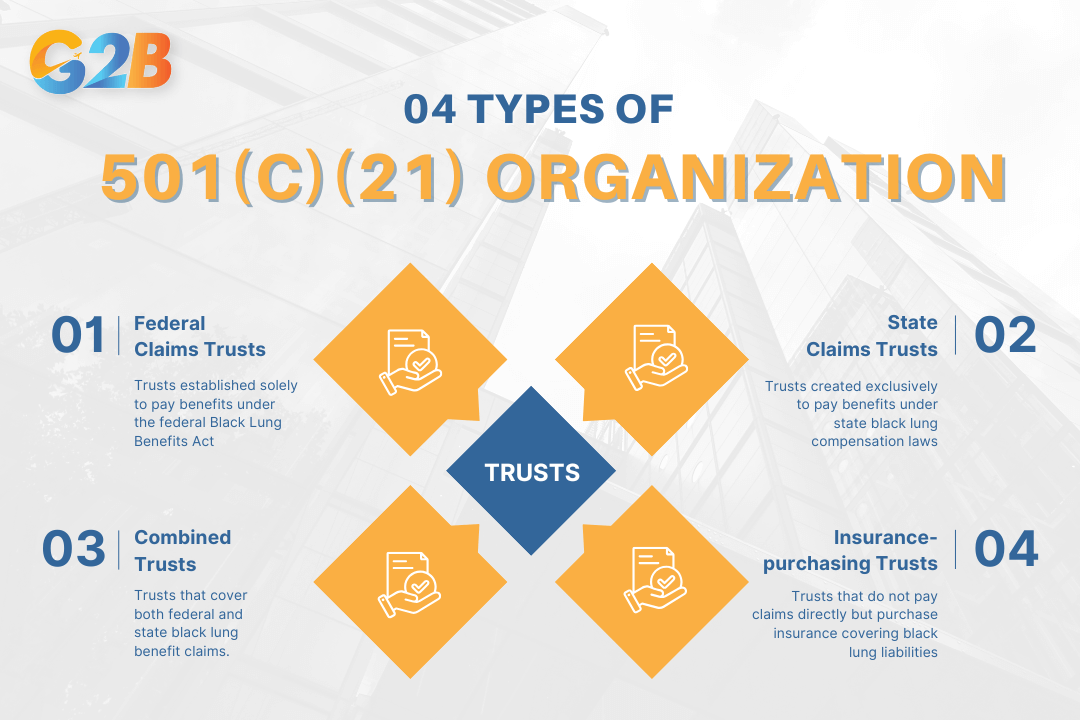

Types of 501(c)(21) organization

501(c)(21) organizations are categorized based on how they manage black lung benefit liabilities. These include trusts that directly pay claims under federal or state laws, combined trusts handling both, and those that purchase insurance rather than paying claims themselves. Each type plays a specific role in ensuring financial support for coal miners affected by black lung disease:

- Federal Claims Trusts: Trusts established solely to pay benefits under the federal Black Lung Benefits Act.

- State Claims Trusts: Trusts created exclusively to pay benefits under state black lung compensation laws.

- Combined Trusts: Trusts that cover both federal and state black lung benefit claims.

- Insurance-purchasing Trusts: Trusts that do not pay claims directly but purchase insurance covering black lung liabilities

Schedule your free consultation and get expert guidance with G2B’s Delaware incorporation service!

Each type of 501(c)(21) organizations plays a specific role in ensuring financial support for coal miners affected by black lung disease

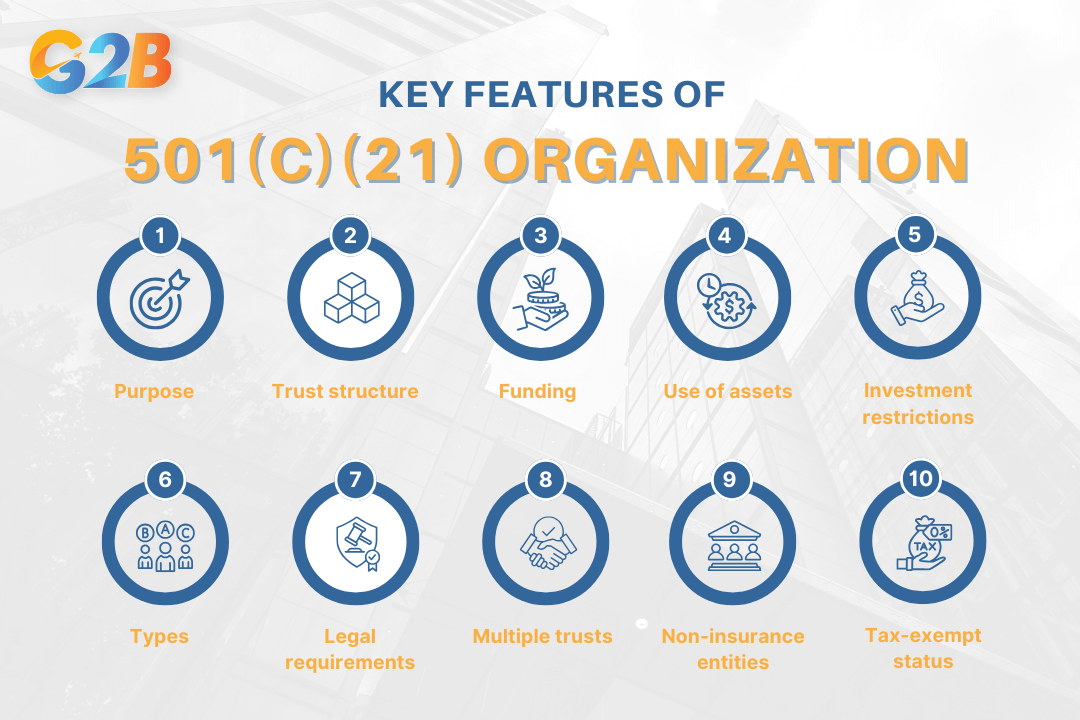

Key features of 501(c)(21) organization

Key features of 501(c)(21) organization, also known as black lung benefit trusts, include:

- Purpose: Established by coal mine operators to pay benefits to miners disabled by black lung disease or their survivors under the Black Lung Benefits Act of 1969.

- Trust structure: Must be irrevocable trusts created solely for paying black lung benefit claims.

- Funding: Supported by coal mine operators who pay premiums, insurance, and health benefits for miners and their dependents.

- Use of assets: Trust assets can only be used to pay benefits, administrative costs, and certain excise taxes.

- Investment restrictions: Allowed to invest in low-risk securities such as U.S. government obligations or insured deposits, limited to amounts exceeding current obligations.

- Types: Can cover federal claims, state claims, or both, and may also purchase insurance instead of paying claims directly.

- Legal requirements: Must comply with federal and IRS regulations regarding the use of funds and trust management.

- Multiple trusts: Operators may establish multiple trusts for different claims or jurisdictions.

- Non-insurance entities: Insurance companies cannot establish these trusts because their obligations are contract-based, not from mining operations.

- Tax-exempt status: Recognized as tax-exempt under IRS code 501(c)(21).

There are many key features of a 501(c)(21) organization

The realtionship between 501(c)(3) and 501(c)(21)

The relationship between 501(c)(3) and 501(c)(21) organization lies in their status as tax-exempt entities under different subsections of the Internal Revenue Code, but they serve fundamentally different purposes:

| Feature | 501(c)(3) Organization | 501(c)(21) Organization |

|---|---|---|

| Purpose | Charitable, religious, educational, scientific | Pay black lung benefits to miners and survivors |

| Beneficiaries | General public or specific charitable causes | Coal miners disabled by black lung disease |

| Tax benefits | Tax-exempt; donations are tax-deductible | Tax-exempt trusts focused on benefit payments |

| Structure | Nonprofit corporation or foundation | Irrevocable trust established by coal operators |

| Scope | Broad public benefit | Narrow, specific worker compensation |

| Regulatory oversight | IRS nonprofit regulations | IRS and federal black lung benefits law |

While both are tax-exempt under section 501(c), 501(c)(3) organizations serve broad public charitable purposes, whereas 501(c)(21) organization are specialized trusts focused on fulfilling statutory obligations to coal miners. They do not overlap in mission or operational structure but share the commonality of tax-exempt status granted by the IRS under different provisions.

Ready to establish a company in Delaware? Get started with a free consultation from our expert incorporation service!

FAQs about 501(c)(21) organization

Understanding the structure and compliance requirements of a 501(c)(21) organization can be complex, especially given its specialized role in administering black lung benefit trusts. To help clarify key points, here are answers to some of the most frequently asked questions about these unique tax-exempt entities:

- Is a 501(c)(21) organization a black lung benefit trust?

Yes, it is a tax-exempt trust established to pay benefits to coal miners disabled by black lung disease and their survivors. - Are 501(c)(21) organization created by coal mine operators?

Yes, coal mine operators establish these trusts to fulfill their obligations under the Black Lung Benefits Act. - Do 501(c)(21) organization provide benefits only to coal miners?

No, they also provide benefits to eligible surviving spouses of miners affected by black lung disease. - Are 501(c)(21) trusts allowed to invest in high-risk securities?

No, they are restricted to investing in low-risk securities like U.S. government obligations or insured deposits. - Can insurance companies establish 501(c)(21) trusts?

No, insurance companies cannot establish these trusts because their obligations arise from contracts, not mining operations. - Are 501(c)(21) organization tax-exempt under the IRS code?

Yes, they are recognized as tax-exempt under IRS section 501(c)(21). - Can a single coal operator establish multiple 501(c)(21) trusts?

Yes, operators may establish multiple trusts for different claims or jurisdictions. - Must 501(c)(21) trusts use their assets solely for paying black lung benefits?

Yes, trust assets can only be used to pay benefits, administrative costs, and certain excise taxes. - Are 501(c)(21) organization considered nonprofits?

Yes, they are nonprofit trusts with a specialized purpose related to worker compensation. - Are 501(c)(21) trusts subject to federal regulations?

Yes, they must comply with federal laws governing black lung benefits and IRS regulations.

501(c)(21) organizations play a crucial role in supporting coal miners affected by black lung disease by ensuring that financial resources are available to cover benefit claims. Whether through direct payments or insurance arrangements, these trusts operate under strict guidelines to maintain compliance with federal or state compensation programs. Understanding the structure and function of each type of 501(c)(21) trust is essential for organizations seeking this tax-exempt status.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom