A 501(c)(6) organization stands distinct, tailored for business leagues, chambers of commerce, and similar groups. Unlike a 501(c)(3), it offers unique benefits, especially in advocacy and networking without the charitable restrictions. Understanding legal compliance is essential to avoid IRS pitfalls and maximize potential. Let’s investigate how establishing one can reduce your tax burden and elevate your industry's influence, making it a strategic choice.

This content is provided for general informational purposes to help entrepreneurs understand the basics of 501(c)(6) organizations. We specialize in company formation, not in providing legal or tax advisory services specific to US nonprofit compliance. This information should not be considered professional legal or tax advice. For guidance specific to your situation, please consult a nonprofit compliance expert or legal professional specializing in trade associations and business leagues.

What is a 501(c)(6) organization?

A 501(c)(6) organization is a type of nonprofit entity recognized under Section 501(c)(6) of the Internal Revenue Code. It is typically a business league, chamber of commerce, real estate board, board of trade, professional association, or similar group that is not organized for profit and whose net earnings do not benefit any private shareholder or individual.

Formal definition and legal meaning

A 501(c)(6) organization represents a specialized nonprofit entity recognized by the Internal Revenue Service (IRS) that exists primarily to promote the common business interests of its members. Unlike charitable organizations, these entities focus on advancing industry or professional goals rather than providing public benefit. Chambers of commerce, trade associations, business leagues, and professional sports leagues like the NFL exemplify this classification, serving as collaborative platforms for businesses or professionals within specific industries.

To qualify as a 501(c)(6) organization under IRS regulations, an entity must meet several specific criteria. The organization must function as a membership-based association with participants sharing a common business interest. It cannot operate for profit, and no part of its earnings may benefit private individuals or shareholders. The organization's activities must demonstrably improve business conditions for an entire industry or line of business - not just serve individual members. This distinction proves critical: The entity must advance collective interests rather than providing particular services to specific businesses.

Additionally, the organization must:

- Maintain meaningful membership support

- Operate with financial transparency

- Not engage in regular business activities typically conducted for profit

- Adhere to specific governance requirements

These legal requirements create a framework ensuring 501(c)(6) organizations serve their intended purpose of collective industry advancement rather than private enrichment.

Start your US business right - Contact G2B for a free consultation on Delaware incorporation service today!

Simple explanation for entrepreneurs and executives

For busy professionals, a 501(c)(6) organization functions essentially as a nonprofit industry club that enables businesses or professionals to collaborate strategically. This structure creates a formal mechanism for:

- Collective advocacy on regulatory and legislative matters

- Industry standard development and implementation

- Professional networking and resource sharing

- Market expansion and opportunity identification

Think of these organizations as business collectives that pool resources to address shared challenges and pursue common goals. Unlike charitable nonprofits, which focus on public service, 501(c)(6) entities concentrate on advancing industry interests through collaborative action.

The structure offers significant flexibility for industry initiatives while providing tax benefits. Members typically can deduct dues as business expenses rather than charitable contributions, and the organization itself enjoys tax exemption on related business income. For executives seeking industry influence, a 501(c)(6) provides a powerful platform for collective advancement and advocacy.

Types and roles of 501(c)(6) organizations

501(c)(6) organizations encompass a diverse range of business-focused nonprofits that serve specific functions within their respective industries. These entities operate under federal tax exemption while promoting common business interests across various sectors.

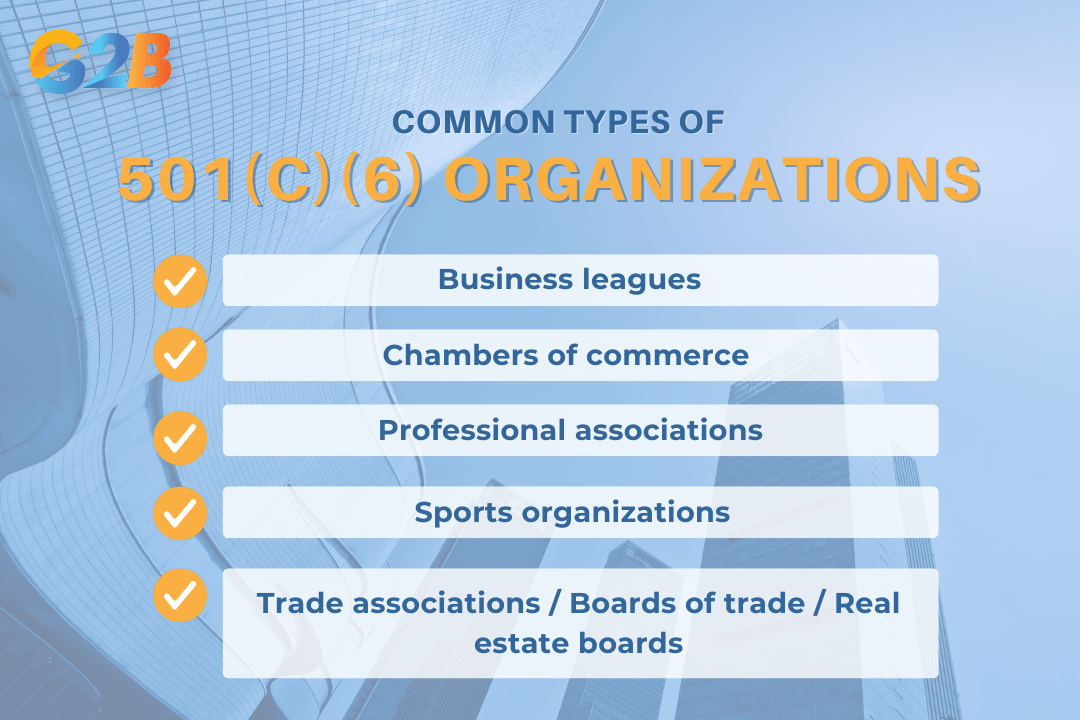

Common types: Business leagues, chambers, boards, and more

Business leagues represent the broadest category of 501(c)(6) organizations, serving as umbrella associations for companies in particular industries. The United States Chamber of Commerce stands as the most prominent example, advocating for businesses nationwide while providing resources to foster economic growth.

Chambers of commerce operate at local and regional levels, supporting business interests within specific geographic areas. Organizations like the Denver Metro Chamber of Commerce focus on cultivating favorable business conditions for their communities through policy advocacy and networking events.

Professional associations serve specific occupational groups, providing industry-specific benefits and credentials. The American Medical Association exemplifies this category, establishing standards for medical practitioners while representing their interests in healthcare policy discussions.

Sports organizations constitute another significant 501(c)(6) category, with prominent examples including:

- National Football League

- National Hockey League

- Professional Golfers' Association

- Professional Women's Hockey Players Association

Trade associations, boards of trade, and real estate boards round out the major types, with organizations like the Beer Institute and National Board for Health & Wellness Coaching representing their respective industries.

There are five most common types of 501(c)(6) organizations

Key roles and functions

Advocacy and lobbying represent primary functions of 501(c)(6) organizations. These entities leverage collective strength to influence legislation and regulatory decisions affecting their industries. Unlike 501(c)(3) organizations, business leagues face no restrictions on lobbying activities, making them powerful voices in policy development.

Standard-setting and ethical practice development create industry-wide benchmarks that promote professionalism and consistency. Through certification programs, codes of conduct, and best practice guidelines, 501(c)(6) organizations establish quality parameters that elevate entire sectors rather than individual businesses.

Networking and educational opportunities foster professional growth through:

- Conferences and conventions

- Webinars and workshops

- Mentorship programs

- Industry publications

- Research initiatives

Economic development initiatives support broader market growth, particularly through chambers of commerce that work to attract investment, improve infrastructure, and create favorable business environments. These activities benefit entire industries rather than specific businesses, fulfilling the IRS requirement that 501(c)(6) organizations improve business conditions for complete industry segments.

Marketing and promotion for the collective industry represents another vital function, with associations developing campaigns that raise awareness and enhance public perception of entire sectors rather than individual member businesses.

Benefits of 501(c)(6) status for industry leaders

501(c)(6) organizations offer strategic advantages to business leaders seeking to amplify their influence within an industry. These tax-exempt entities provide a legitimate structure for collective action, enabling professionals to pool resources while maintaining operational flexibility.

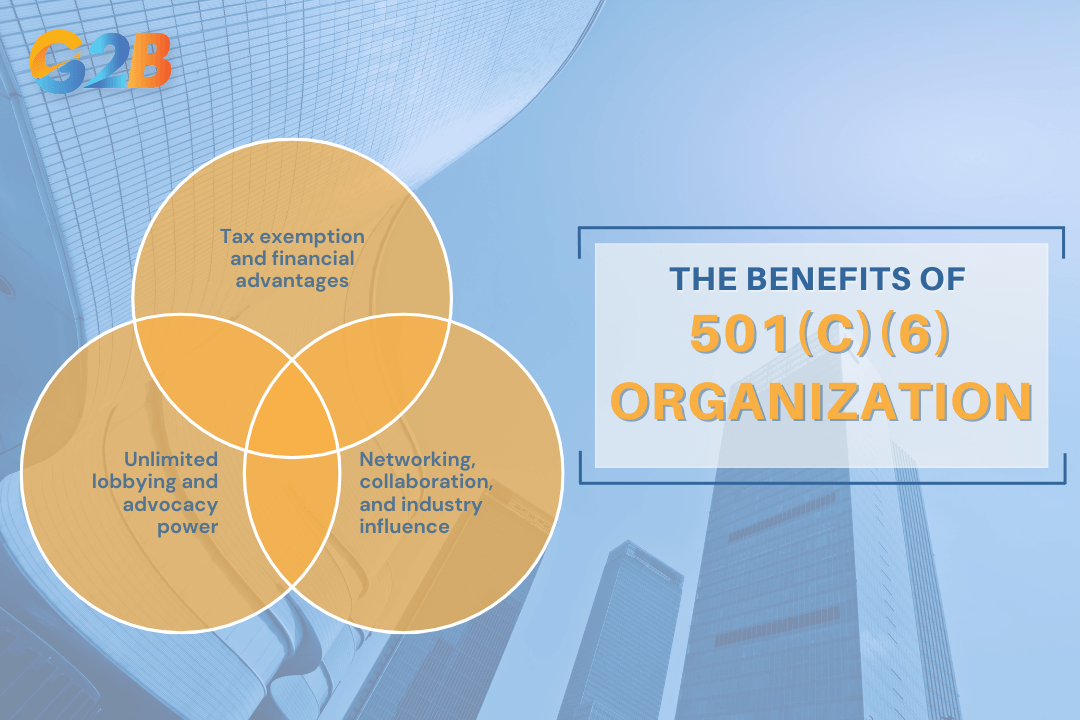

Tax exemption and financial advantages

501(c)(6) organizations enjoy federal income tax exemption on revenue related to their exempt purpose. This status allows business leagues to dedicate more resources toward member services rather than tax obligations. The financial structure creates immediate savings and long-term sustainability for the organization's mission.

Member dues typically qualify as ordinary and necessary business expenses, making them tax-deductible for participating companies. For example, a manufacturing company can deduct annual trade association membership fees as a legitimate business expense, reducing their overall tax burden while gaining valuable industry connections. This dual benefit creates a compelling value proposition for potential members.

Many 501(c)(6) organizations also generate non-dues revenue through conferences, certification programs, and publications - all while maintaining their tax-exempt status. This diversified revenue model strengthens financial stability and expands member services without triggering federal income tax liability.

Unlimited lobbying and advocacy power

Unlike 501(c)(3) charitable organizations, which face strict limitations on lobbying activities, 501(c)(6) entities can engage in unlimited advocacy efforts. This freedom enables business leagues to actively shape legislation and regulations affecting their industry. A restaurant association, for instance, might lobby extensively for favorable food safety regulations or against burdensome labor laws.

The advocacy advantage extends beyond traditional lobbying. Business leagues can conduct educational campaigns, publish position papers, and form coalitions to influence public opinion and policy decisions. These activities help create more favorable business conditions across an entire industry rather than benefiting individual companies.

Many successful 501(c)(6) organizations maintain dedicated government affairs teams and political action committees, maximizing their influence in legislative and regulatory processes. This structured approach to advocacy delivers tangible benefits to members through improved business conditions and reduced regulatory barriers.

Networking, collaboration, and industry influence

501(c)(6) organizations create powerful platforms for professional networking, facilitating connections that drive business development and career advancement. Members gain access to industry leaders, potential clients, and strategic partners through conferences, committees, and digital platforms.

These organizations enable resource sharing that benefits the entire membership:

- Technical standards development

- Industry research and benchmarking data

- Best practices documentation

- Professional development programs

- Mentoring opportunities

By establishing industry-wide standards and certifications, 501(c)(6) groups elevate professional practices and build consumer confidence. For example, a real estate board might develop ethical standards and professional certifications that increase client trust in certified agents. This collective authority helps maintain quality standards while differentiating members from non-members in the marketplace.

501(c)(6) organizations offer three strategic advantages to business leaders

Disadvantages and limitations of 501(c)(6) organizations

There are also important restrictions and compliance challenges that association executives and business owners should understand before establishing or maintaining a 501(c)(6) organization.

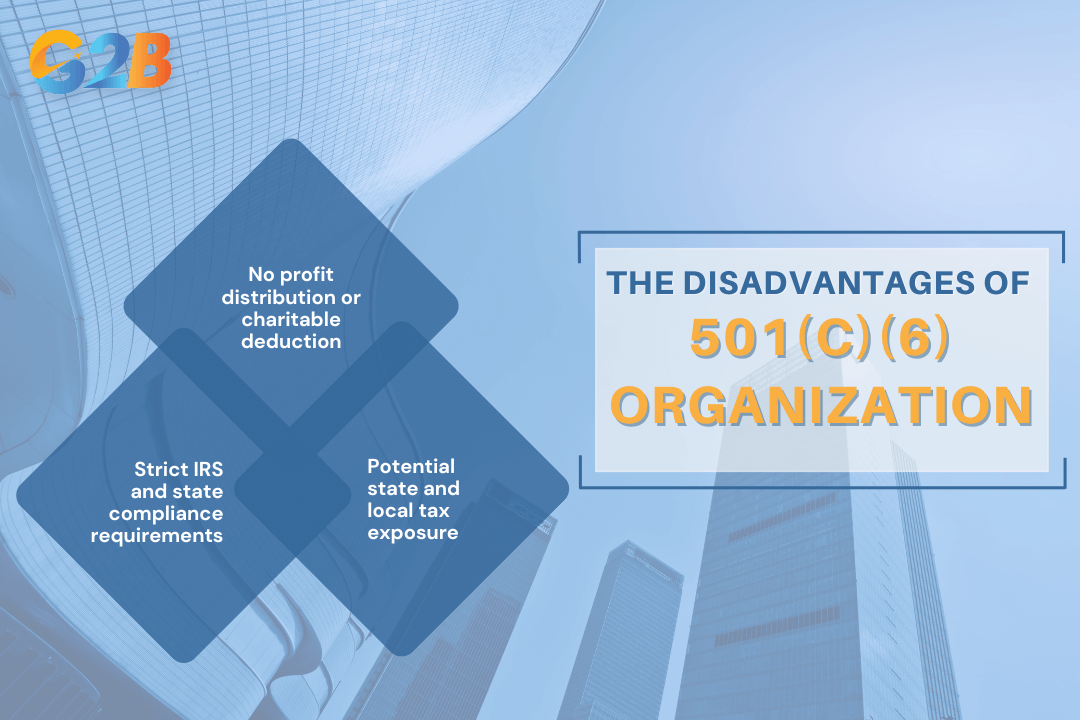

No profit distribution or charitable deduction

501(c)(6) organizations operate under strict profit distribution limitations that differentiate them from for-profit entities. Net earnings cannot benefit private shareholders or individual members, regardless of their contributions to the organization. This fundamental restriction means all revenue must be reinvested into the organization's exempt purposes.

Equally important, contributions to 501(c)(6) organizations do not qualify for charitable tax deductions. While membership dues and sponsorships may qualify as business expense deductions, donors cannot claim charitable contribution deductions as they would with 501(c)(3) organizations. This distinction often creates confusion among potential donors and can limit fundraising potential for business leagues and trade associations seeking additional financial support beyond membership fees.

Strict IRS and state compliance requirements

501(c)(6) organizations face rigorous compliance obligations at both federal and state levels. These requirements include:

- Filing Form 1024 to apply for tax-exempt status

- Submitting annual Form 990 information returns to the IRS

- Maintaining detailed records of activities and expenditures

- Ensuring activities remain aligned with exempt purposes

- Following strict political campaign activity restrictions

Failure to meet these obligations can trigger severe consequences, including penalties, back taxes, and potential revocation of tax-exempt status. Once revoked, reinstatement requires a complex application process and payment of substantial fees. Industry associations must implement robust compliance procedures, often requiring dedicated staff or professional assistance to navigate the regulatory landscape effectively.

Potential state and local tax exposure

Federal tax exemption for 501(c)(6) organizations does not automatically extend to state and local taxes. Depending on location, these organizations may face:

| Tax Type | Potential Exposure | Mitigation Strategy |

|---|---|---|

| State income tax | Varies by state | Research state-specific exemptions |

| Sales tax | Often applies to goods sold | Maintain proper documentation |

| Property tax | Typically applies to owned property | Seek specific exemptions where available |

| Local business taxes | Common in many jurisdictions | Budget for these ongoing expenses |

This tax exposure creates additional administrative burden and can significantly impact operating budgets. Organizations must conduct thorough research regarding tax obligations in each jurisdiction where they operate and budget accordingly for these expenses. Business leagues operating across multiple states face particularly complex compliance challenges requiring specialized tax expertise.

There are three important restrictions business owners should understand

501(c)(6) vs 501(c)(3) and other nonprofit types

The 501(c)(6) organization structure offers distinct advantages for business leagues and associations compared to other tax-exempt entities. Understanding these fundamental differences enables executives to align organizational structure with strategic goals.

Comparison table: 501(c)(6) vs 501(c)(3) vs 501(c)(4)

| Feature | 501(c)(3) | 501(c)(4) | 501(c)(6) |

|---|---|---|---|

| Primary purpose | Charitable, religious, educational | Social welfare, civic improvement | Business league, trade association |

| Tax exemption | Federal, state, and local | Federal; some state/local | Federal; some state/local |

| Donation tax deductibility | Yes - charitable deduction | No | No (dues may be business expenses) |

| Lobbying activities | Limited, restricted percentage | Unlimited (not the primary purpose) | Unlimited for industry-related issues |

| Political campaigning | Prohibited | Permitted (not primary activity) | Limited - no candidate endorsements |

| Typical funding sources | Grants, donations, program fees | Membership dues, donations | Member dues, event revenue and sponsorships |

| Primary beneficiaries | General public | Community or specific group | Members with common business interests |

| Public disclosure | Extensive | Moderate | Moderate |

| Formation complexity | High | Medium | Medium |

The structural differences impact fundraising capabilities, advocacy power, and operational flexibility. For chamber executives and trade association leaders, these distinctions directly affect organizational strategy and effectiveness.

Which type is right for your organization?

Organizations should select 501(c)(6) status when industry advancement represents the primary mission. This classification proves ideal when:

- The entity represents businesses with common interests rather than a public charity

- Lobbying and advocacy form core organizational activities

- Membership consists primarily of businesses or professional individuals

- Industry standards, business conditions, and collective advancement drive operations

Trade associations, chambers of commerce, and professional leagues typically thrive under this structure due to greater lobbying flexibility and industry-focused missions.

Conversely, 501(c)(3) status offers advantages when:

- Charitable, educational, or religious activities define the organization

- Tax-deductible donations represent a crucial funding mechanism

- The entity serves primarily public rather than member interests

- Grant funding from foundations forms a significant revenue stream

The 501(c)(4) classification works best for social welfare organizations with:

- Community improvement as the central purpose

- Significant advocacy needs beyond what 501(c)(3) permits

- Less reliance on tax-deductible contributions

- Membership structures serving broader community interests

For organizations straddling multiple categories, executives should evaluate primary funding sources, advocacy requirements, and membership structure. Some entities establish complementary organizations with different classifications to maximize benefits while maintaining clear operational separation. Industry leaders must consider long-term strategic objectives alongside immediate operational needs when selecting nonprofit classification. The right structure creates the foundation for sustainable impact and effective advocacy.

Discover how our Delaware incorporation service can support your goals - Begin with a free consultation!

Step-by-step guide: How to start a 501(c)(6) organization

Establishing a 501(c)(6) organization involves navigating specific legal requirements and administrative procedures. The formation process requires meticulous attention to governance, documentation, and adherence to both federal and state regulations.

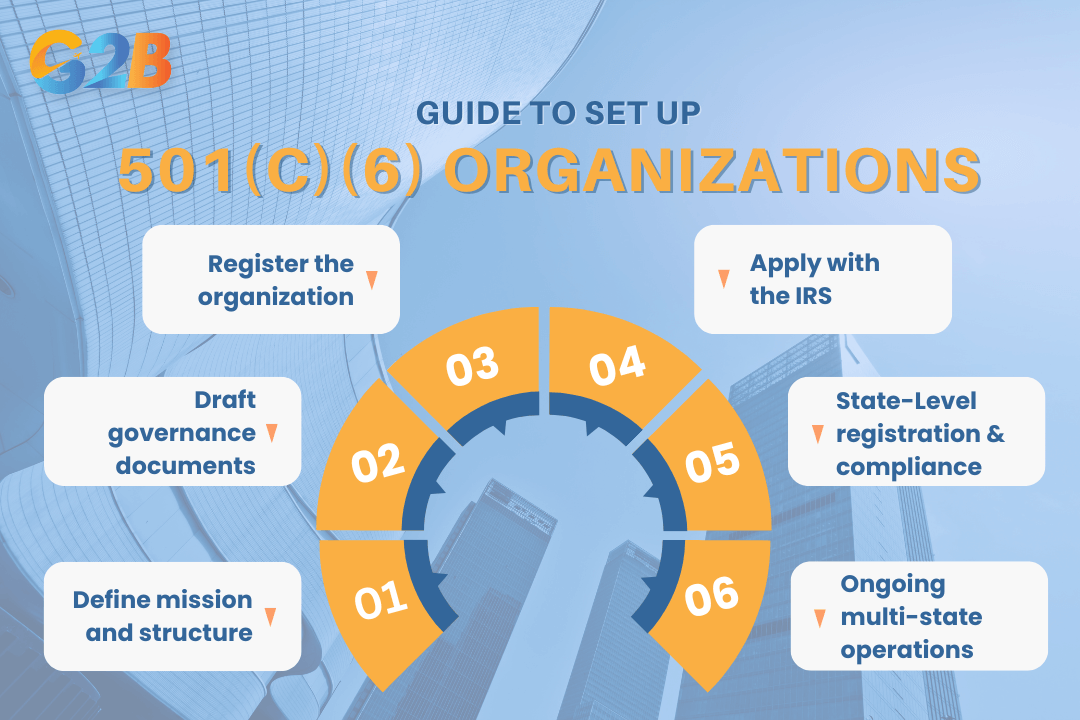

Formation and IRS application

There are essential foundational steps before approaching the IRS for formal recognition. First, define the organization's mission and purpose clearly, ensuring it aligns with IRS requirements for business leagues. This mission must focus on promoting common business interests rather than individual member benefits. Assemble a diverse board of directors - ideally with four or more members - who bring relevant industry expertise and leadership capabilities.

Draft comprehensive bylaws that detail the organization's structure, membership requirements, voting procedures, and operational guidelines. These bylaws serve as the constitutional framework for the organization's governance and must align with state corporate law requirements.

The formal registration process includes:

- Filing articles of incorporation with the state's Secretary of State

- Securing an Employer Identification Number (EIN) via IRS Form SS-4

- Conducting an initial organizational meeting to approve bylaws and elect officers

- Developing a conflict of interest policy to prevent private benefit issues

- Preparing and submitting IRS Form 1024 with required documentation

The IRS application package must include a detailed narrative describing the organization's activities, membership criteria, and how these advance common business interests within an industry or profession.

State-level registration and compliance

Beyond federal requirements, 501(c)(6) organizations must navigate state-specific regulations to operate legally and maintain their exempt status. Most states require separate applications for state tax exemption, which typically involve submitting:

- State-specific application forms (varying by jurisdiction)

- Copies of federal exemption determination letters

- Articles of incorporation and bylaws

- Financial statements or budgets

State compliance obligations continue after formation through:

- Annual or biennial report filings

- State unemployment and income tax registrations

- Business license renewals

- Charitable solicitation registrations (when applicable)

- Sales tax exemption for maintenance

Many states impose specific governance requirements on nonprofit corporations, including board composition, conflict of interest disclosures, and auditing thresholds based on revenue size. Maintaining proper documentation - including meeting minutes, financial records, and membership communications - provides critical protection during state-level reviews or audits.

Organizations operating across multiple states face additional complexities, potentially requiring foreign corporation registrations and adherence to varying compliance calendars. Implementing a comprehensive compliance tracking system helps association leaders manage these ongoing obligations effectively.

There are six steps to start a 501(c)(6) organization

Legal compliance and ongoing obligations

Maintaining compliance with federal and state regulations remains crucial for 501(c)(6) organizations to preserve their tax-exempt status. These business leagues, trade associations, and chambers of commerce must navigate complex reporting requirements and operational restrictions to avoid penalties or revocation.

IRS rules and reporting requirements

501(c)(6) organizations face specific federal filing obligations based on their size and activity level. Organizations with annual gross receipts of $50,000 or more must file Form 990 or Form 990-EZ by the 15th day of the fifth month following their fiscal year end. Smaller organizations may qualify to file an electronic notice (e-Postcard) instead of the full form.

Financial transparency and proper recordkeeping form the foundation of federal compliance. Organizations must maintain comprehensive financial records documenting all transactions and make annual returns available for public inspection upon request. The IRS prohibits private inurement, meaning net earnings cannot benefit any private shareholder or individual. While 501(c)(6) organizations may engage in lobbying activities related to their exempt purpose, they must properly document and disclose these activities to members, particularly regarding dues used for political activities.

- Required forms:

- Form 990/990-EZ (annual return)

- Form 8868 (extension request)

- e-Postcard (for smaller organizations)

State laws and regulatory pitfalls

State-level compliance requirements create additional obligations beyond federal regulations. Organizations must file Articles of Incorporation with appropriate state agencies and fulfill all applicable local laws governing nonprofit entities. Many professionals overlook that federal tax exemption does not automatically exempt organizations from state and local tax filings.

Common compliance pitfalls include failure to register with state charity regulators, missed annual report deadlines, and inadequate transparency regarding the tax treatment of member contributions. Organizations must communicate to donors and members that contributions are not tax-deductible as charitable donations. Failure to meet state reporting requirements can lead to suspension of corporate status, financial penalties, or loss of state tax exemptions.

| Common state requirements | Consequences of non-compliance |

|---|---|

| Annual corporate filings | Suspension of corporate status |

| Registered agent maintenance | Loss of good standing |

| State tax department registration | Financial penalties |

| Fundraising registration (if applicable) | Forced dissolution |

Risks of non-compliance and IRS revocation

The consequences of non-compliance can be severe, with IRS revocation representing the most significant threat to 501(c)(6) organizations. Revocation triggers immediate tax liability and can destroy organizational credibility. The IRS typically initiates revocation after persistent filing failures or discovery of activities inconsistent with exempt status.

Organizations must maintain their qualifying characteristics to retain exempt status, including:

- Serving a common business interest

- Maintaining meaningful membership support

- Operating as a non-profit entity

- Preventing private inurement

- Directing activities toward improving business conditions

Risk mitigation strategies include implementing compliance calendars, conducting regular self-audits, and establishing clear policies regarding conflicts of interest, lobbying activities, and member services. Organizations should also consider professional guidance from accountants and attorneys specializing in nonprofit compliance to navigate these complex requirements.

Frequently asked questions (FAQs) about 501(c)(6) organizations

These nonprofit entities play a vital role in industry advancement, but their specific regulations and benefits often create confusion. The following answers address the most common questions industry professionals ask when considering formation or membership in a 501(c)(6) organization.

What is a 501(c)(6) organization?

A 501(c)(6) organization is a nonprofit entity that promotes the common business interests of its members rather than operating for individual profit. These organizations include business leagues, chambers of commerce, real estate boards, boards of trade, and professional associations like the NFL. The IRS specifically designates these entities as associations formed to advance collective industry goals. Unlike charitable organizations, 501(c)(6) groups focus on improving business conditions for entire industries or professions rather than serving the general public.

Can a 501(c)(6) lobby?

Yes, 501(c)(6) organizations can engage in unlimited lobbying activities. This represents one of their most significant advantages compared to other nonprofit structures. These organizations may advocate extensively for legislation and policies that benefit their industries without risking their tax-exempt status. This powerful advocacy capability allows trade associations and chambers of commerce to influence regulations, tax policies, and industry standards that affect their members' business interests.

Are 501(c)(6) dues tax-deductible?

Dues paid to 501(c)(6) organizations are generally deductible as ordinary business expenses - not as charitable contributions. This distinction carries important tax implications for members.

For businesses and professionals, this deductibility helps offset membership costs. However, organizations must provide clear documentation to members regarding:

- Which portion of dues qualifies for business expense deduction

- Any portions allocated to lobbying activities (which may have different tax treatment)

- Required substantiation for tax filing purposes

Who can join a 501(c)(6)?

Membership in a 501(c)(6) organization typically includes:

- Businesses operating within the relevant industry

- Professionals practicing in the specific field

- Companies sharing common business interests

- Individuals working in positions related to the industry

Most 501(c)(6) organizations establish specific membership criteria in their bylaws. These criteria must align with the organization's exempt purpose and promote industry-wide advancement rather than individual business interests.

A 501(c)(6) organization stands as an opportunity and growth for driven professionals eager to effect change within their industries. Its structure offers significant advantages, from fostering robust business leagues to providing a pivotal platform for advocacy and networking. By navigating the tax-exempt landscape judiciously, associations can amplify their influence while maintaining compliance and reducing tax burdens. Understanding these dynamics ensures not just survival but thriving success in the intricate world of business associations.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom