When funding a startup, two of the most common sources of early-stage capital are Angel Investors and Venture Capitalists (VCs). While both play crucial roles in supporting new businesses, their investment approaches, expectations, and involvement can differ significantly. Choosing the right type of investor can impact everything from how much control you retain to how fast your company grows. This article will break down the key distinctions between them and help you determine which option aligns best with your startup’s goals.

This article is intended for general informational purposes to help startup founders and business owners better understand key concepts related to startup funding. G2B is a specialist in company formation and does not provide licensed financial or investment advisory services. Therefore, this information should not be taken as professional financial guidance. For personalized advice, please consult with a qualified financial advisor or investment professional.

Introduction to startup funding

Securing the right type of funding is pivotal for the growth and success of startups. Understanding the various funding sources available and aligning them with business needs can significantly alter a startup's trajectory.

Overview of funding sources

Startups can tap into a diverse array of funding options, each possessing unique characteristics and implications for the business. Key funding sources include:

- Angel investors: These are affluent individuals who provide capital for startups, often at the nascence of the business. They contribute personal funds in exchange for equity or convertible debt, frequently offering mentorship as a form of additional support.

- Venture capital firms: Operating as professional investment entities, these firms aggregate capital from multiple investors to fund startups with high growth potential. Investments are generally larger than those from angel investors and are accompanied by strategic guidance.

- Accelerators and incubators: These programs provide capital, mentorship, office space, and operational resources in exchange for equity stakes. They are designed to accelerate startups' growth and refine their business models over a fixed, short-term period.

- Crowdfunding: Platforms like Kickstarter and Indiegogo enable startups to raise small amounts of money from a large number of people, providing early market validation and community engagement.

- Corporate investors: Large corporations often invest in startups to drive innovation within their domains or to gain competitive advantages. This type of funding is usually strategic and may involve technology sharing or other synergies.

Importance of choosing the right investor

The right investor brings not only capital but also expertise, credibility, and industry networks. Here’s why the choice of investor holds significant weight:

- Alignment with objectives: It's essential for startups to choose investors whose goals and visions align with their own. Misalignment can lead to conflicts and derail a startup's strategy.

- Level of involvement: Different investors have varying levels of involvement in business operations. While some may prefer a hands-off approach, others might want to be actively involved in decision-making processes. Startups should be clear on the level of authority they are comfortable ceding.

- Long-term consequences: The type of investor and the terms agreed upon can have profound impacts on ownership structure, governance, and exit strategies. It's crucial to consider long-term implications such as equity dilution and board control.

After choosing the right investor, if you're still unsure about how to set up a company in the US, it’s a smart move to seek professional guidance. G2B offers expert support with Delaware incorporation service to help you navigate the process with confidence and a successful setup.

Terminology and definitions

Navigating startup funding requires familiarity with specific industry terms. Here are some critical definitions to comprehend:

- Equity financing: In this model, investors receive partial ownership of the company in exchange for their investment. This often results in equity dilution for existing owners but aligns investor interests with business growth.

- Convertible debt: This form of investment starts as a loan, with the provision that it can be converted to equity at a later date, typically during future funding rounds. It is often used to bridge the gap between funding stages.

- Seed funding: The initial capital invested to support the formation and incubation of the business, often used for early product development and market research.

- Series A, B, C Funding: Sequential rounds of investment that occur at various stages of a startup's lifecycle, with each subsequent round aimed at scaling operations, expanding market reach, or achieving profitability.

- Exit strategy: A plan to realize financial returns on investment, commonly through IPOs (Initial Public Offerings), acquisitions, or mergers.

Who are angel investors?

Angel investors play a critical role in the startup ecosystem. As high-net-worth individuals, these investors offer more than financial support; they bring invaluable experience and insight that can be pivotal for early-stage startups.

Characteristics and motivations

At the core, an angel investor is typically a high-net-worth individual who invests personal funds into startups, usually during the early stages. Unlike venture capitalists who manage pooled funds, angel investors use their personal wealth, allowing them greater flexibility in their investment strategies. These investors often have a background in entrepreneurship or corporate leadership, providing them with the insight necessary to assess potential startup success.

Motivations for angel investing can vary. While financial return is a consideration, many angel investors are driven by the satisfaction of helping fledgling companies grow. They enjoy being part of the entrepreneurial journey and often have a vested interest in seeing innovative ideas come to life. Additionally, angel investors may be keen on diversifying their portfolios or seeking the tax benefits associated with startup investment.

Investment criteria and process

The processes and criteria that angel investors use to select startups are distinct and personalized. Typically, their investment decisions are based on:

- Personal interests and expertise: Many angel investors focus on industries they are passionate about or have extensive knowledge in, enabling them to provide more than just capital.

- Founder’s vision and team quality: Angels often look for a strong, coherent vision and a capable, committed team. The founder's passion, resilience, and ability to execute the business plan are paramount.

- Market opportunity: A substantial and growing market is attractive to angel investors, as it indicates potential scalability and profitability.

The investment process with an angel investor is generally less bureaucratic than with a venture capital firm. It often begins with an informal meeting or pitch, followed by due diligence, where the investor reviews the startup's market potential, business model, and financial projections. If the due diligence is satisfactory, terms are negotiated, culminating in the investment agreement.

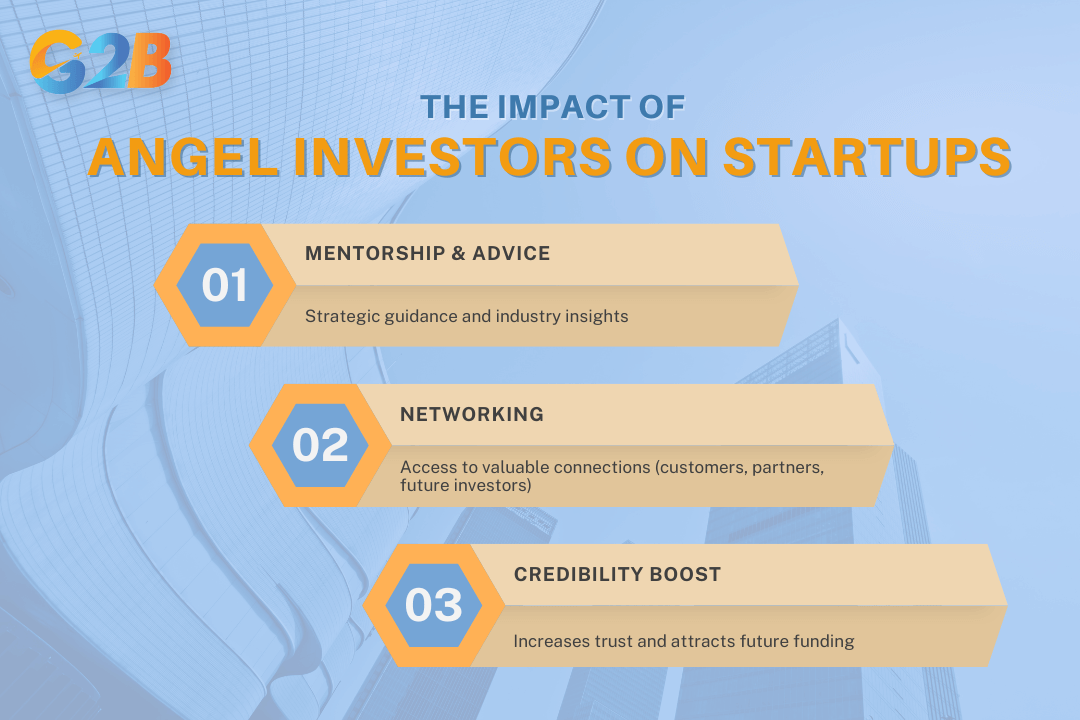

Impact on startups

Angel investors have a profound impact on startups, far exceeding their financial contribution. Their involvement typically includes:

- Mentorship and advisory: One of the most significant benefits is the mentorship that angel investors offer. With their experience, they provide strategic guidance, help navigate early business challenges, and lend invaluable industry insights.

- Networking opportunities: Angel investors often open doors to their extensive networks, facilitating introductions to potential customers, partners, or even subsequent investors.

- Increased credibility: Securing an investment from a reputable angel can enhance a startup’s credibility, making it easier to attract additional investment in the future.

Angel investors have a profound impact on startups

Who are venture capitalists?

Venture capitalists (VCs) are institutional investors or individuals who provide capital to startups and early-stage companies with high growth potential. Unlike angel investors, venture capitalists typically manage pooled funds from multiple investors and focus on larger-scale investments with an expectation of significant returns.

Structure and operation of VC firms

Venture capital firms are structured organizations that raise capital from limited partners, such as institutional investors, high-net-worth individuals, endowments, and pension funds. These firms then deploy the pooled capital to invest in promising startups, typically in exchange for equity. The lifecycle of a VC firm often includes several funding rounds, known as investment stages, with each round aiming to raise more capital and target larger, more mature companies.

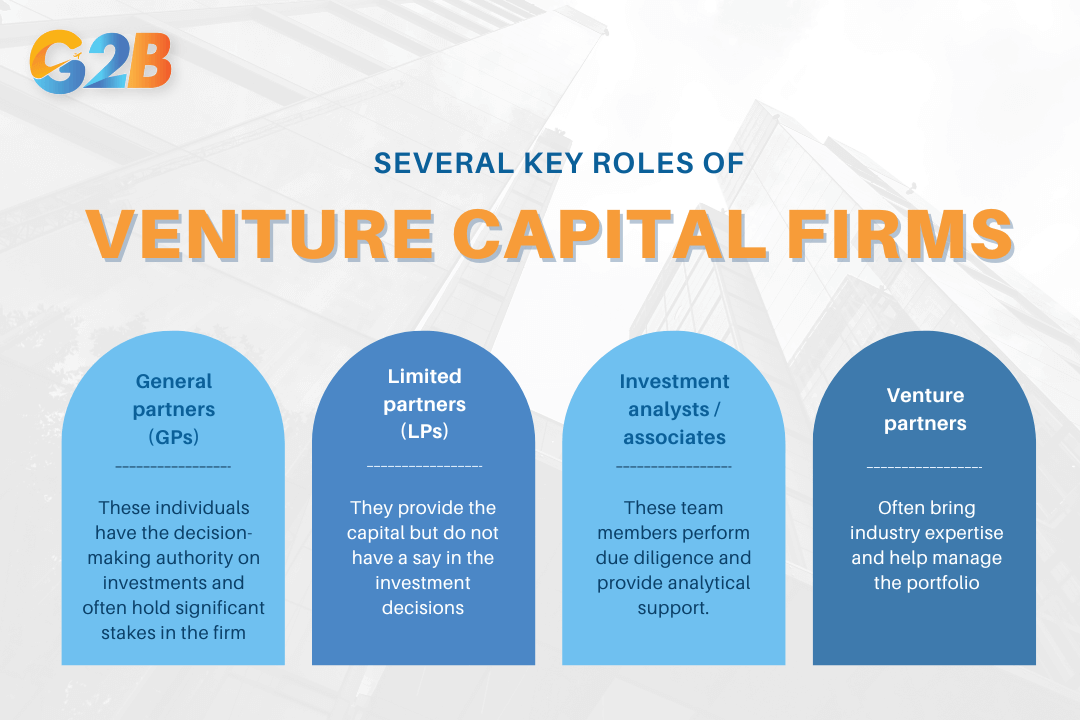

VC firms are usually comprised of several key roles:

- General partners (GPs): These individuals have the decision-making authority on investments and often hold significant stakes in the firm.

- Limited partners (LPs): They provide the capital but do not have a say in the investment decisions.

- Investment analysts/associates: These team members perform due diligence and provide analytical support.

- Venture partners: Often bring industry expertise and help manage the portfolio.

VC firms are comprised of several key roles

Investment stages and focus

Venture capitalists typically invest across multiple stages of a company's growth, including:

- Seed stage: Initial capital to develop a business idea into a viable product or service.

- Series A: Helps to optimize the product, scale the user base, and establish a business model.

- Series B and beyond: Focuses on expanding market reach and enhancing business operations.

VC investment strategies prioritize industries with high-growth potential, such as technology, healthcare, and green energy. The primary goal is to identify companies that can provide a substantial return on investment (ROI) and potentially lead to an initial public offering (IPO) or acquisition.

Factors influencing venture capital decisions

Venture capitalists evaluate several critical factors before committing to an investment. Key considerations include:

- Market potential: A large and expanding market size increases the potential for a high ROI.

- Team competency: A skilled and experienced founding team often determines the startup's success.

- Unique value proposition: Companies with innovative products or services that address unmet needs are highly attractive.

- Scalability: Businesses with a scalable business model have a higher likelihood of substantial growth and profitability.

- Risk assessment: VCs weigh the potential risks against the expected returns, including competitive threats, regulatory challenges, and technological feasibility.

Venture capitalists play an instrumental role in the startup ecosystem by providing vital funding and strategic support for high-growth companies. They operate through structured firms with rigorous investment processes aimed at identifying and nurturing promising ventures. Unlike angel investors, VCs manage larger funds, invest in later stages, and focus on scalability and significant financial returns. Each investment decision is influenced by market, team, and product characteristics, reflecting a calculated approach to venture funding.

Comparing investment stages

Angel investors and venture capitalists (VCs) typically engage at different stages of a startup's lifecycle, each providing unique value and resources.

Seed stage funding

The seed stage is often the first formal round of funding. Here, startups aim to develop their product, conduct market research, and build a prototype. Angel investors are the primary players in this phase, given their propensity to invest in earlier, high-risk opportunities. During this stage, angel investors often provide valuable mentorship and advice, leveraging their experience to guide startups through initial hurdles. By contrast, venture capital firms generally avoid the seed stage due to the inherent risks and the relatively small deal sizes. While some seed funds exist within VC firms, they are exceptions rather than the norm. Thus, startups seeking early financing often rely on angel investors to kickstart their operations.

Growth stage funding

In the growth stage, startups have typically achieved product-market fit and are focused on scaling operations, acquiring more customers, and entering new markets. This phase demands significant capital, making it a prime opportunity for venture capitalists, who prefer investing in companies with proven potential. Venture capital firms often provide large funding rounds - ranging from millions to hundreds of millions - crucial for rapid expansion. Along with capital, VCs bring strategic guidance to help refine business models and improve operational efficiency. Their networks also open doors to key industry players, partnerships, and new customer bases.

While angel investors may remain involved during this stage, their role usually diminishes. Compared to the vast resources and expertise VCs provide, the smaller contributions from angels have less impact at this point. That said, some angels choose to continue investing to maintain their equity and support the startup's journey. Their early-stage insight and loyalty can still offer value, but the spotlight largely shifts to VCs as the company moves toward becoming a market leader.

Maturity and exit strategies

As startups reach maturity, the focus shifts to optimizing operations and preparing for potential exits. An exit can occur through an acquisition, buyout, or initial public offering (IPO). Venture capitalists are heavily involved in shaping these exit strategies, as they seek significant returns on their investments. They often possess the expertise and connections necessary to navigate complex exit negotiations and processes.

For VCs, an IPO represents a lucrative opportunity, offering a return that can exceed many times their original investment. They prepare startups by helping them comply with regulatory requirements, refine their financial strategies, and enhance their public market narratives. Angel investors, typically less involved in the exit stage, benefit passively from the process. Their return is realized upon the execution of an exit strategy. While some angels may participate in exit negotiations, their influence is limited compared to the structured and comprehensive approach that VCs bring.

Comparing funding amounts and ownership

Angel investors and venture capitalists offer distinct paths, and the differences can significantly affect the trajectory and control of the startup.

Typical investment sizes

Angel investors typically provide early-stage funding, with investment amounts ranging from $25,000 to $100,000 per investor, although in some cases, angel groups may pool resources to provide up to $1 million. In contrast, venture capital firms usually deal with much larger sums, often starting from $1 million and extending into the tens of millions for later-stage investment rounds. This disparity stems from the different focuses of each investor type: angels often invest personal funds in early-stage ventures, while VCs manage pooled capital seeking significant return on investment in scalable companies.

| Investor type | Typical investment size |

|---|---|

| Angel investors | $25,000 - $100,000+ |

| Venture capital firms | $1 million - $10 million+ |

Equity dilution and control

The amount of equity surrendered in exchange for funding - known as dilution - is a key consideration for founders. Angel investments generally result in lower equity dilution, as the typical funding amounts are smaller, and angels often do not seek substantial control over company operations. This dynamic can be beneficial for founders who wish to maintain more significant control and flexibility in decision-making processes.

Conversely, venture capitalists often require more substantial equity stakes - and consequently, significant influence over company operations - as a condition of their larger financial investment. This can be seen through the appointment of board seats and involvement in key business decisions. It’s not uncommon for venture capital firms to secure 20-30% equity in a fundraising round, which could affect the founder’s ability to steer their company independently.

Long-term impact on startup ownership

The long-term implications of choosing between angel investors and venture capital revolve around control, growth potential, and exit strategies. Angels offer a more personal touch, often with mentorship benefits, but typically expect slower growth and returns aligned with early-stage business development. Venture capital, with its larger investment sums, positions startups for rapid scaling and aggressive entry into markets, aligning with exit strategies like acquisitions or Initial Public Offerings (IPOs). However, the pressure to deliver high returns can sometimes lead to strategic decisions favoring short-term gains over the founder's vision.

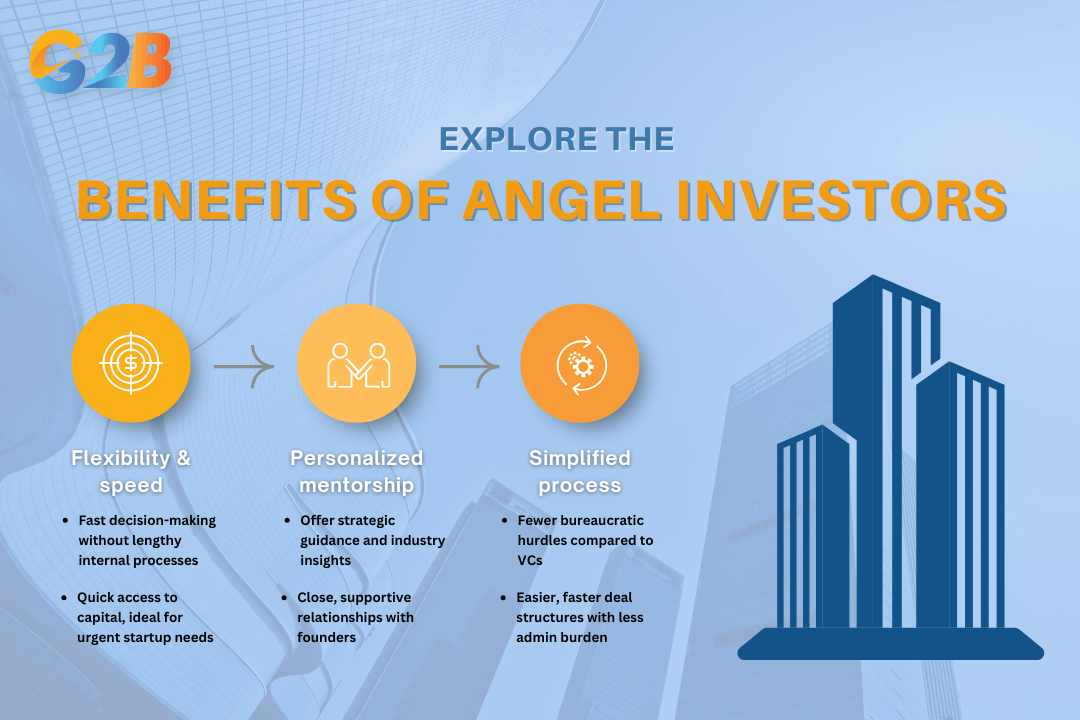

Benefits of angel investors

Understanding the benefits of choosing angel investors over other funding sources is crucial for early-stage startups seeking financial backing. Here are the central advantages of involving angel investors.

There are 3 central advantages of involving angel investors

Flexibility and speed

One of the most valued aspects of angel investors is their ability to act quickly and flexibly. Unlike venture capital firms, which often have extensive internal processes and committees to consult, angel investors typically operate independently. This autonomy allows them to make swift decisions based on their insights and instincts. For a startup on the brink of an important launch or pivot, this rapid response can be vital. Angel investors often eliminate the need for protracted due diligence periods that characterize larger funding bodies, allowing startups to secure capital much quicker.

Personalized attention and mentorship

Angel investors are not just financiers but often become important mentors for a startup. Given their typically extensive experience and interest in specific industries, angel investors can provide invaluable insights and guidance. For entrepreneurs, especially those new to their industries, this mentorship can prove essential. Angel investors can offer seasoned advice on business strategy, operations, and navigating the complexities of scaling. The close relationships that develop between angel investors and startup founders often provide a personalized level of support that is harder to achieve in institutional settings.

Less bureaucratic processes

In contrast to venture capital firms, the simplicity of angel investment deals is often a breath of fresh air for startup founders. Traditionally, venture capital firms possess a formalized structure, requiring board meetings, legal vettings, and multiple approval layers before decisions are finalized. Angel investors, operating individually or in small groups, bypass many of these layers. This streamlined approach not only accelerates the investment process but also reduces the administrative load on startups, allowing them to focus primarily on product development and market strategies rather than getting bogged down with lengthy compliance requirements.

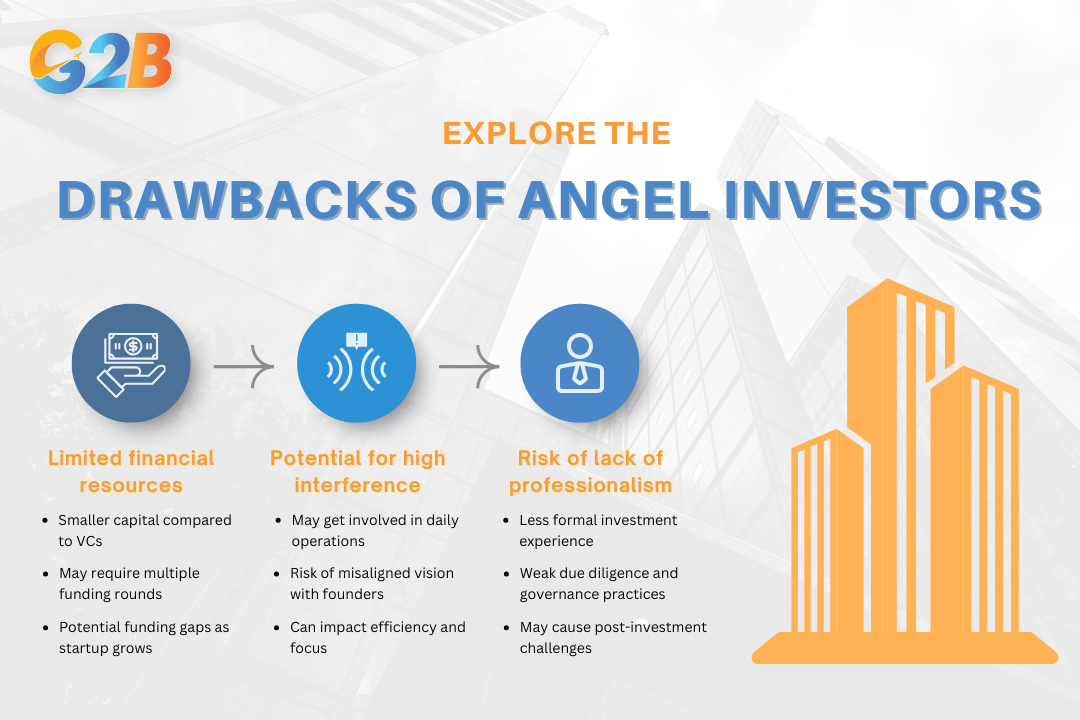

Drawbacks of angel investors

While angel investors’ involvement can bring numerous benefits, there are also significant drawbacks to consider when engaging with angel investors.

There are 3 drawbacks to consider when engaging with angel investors

Limited financial resources

One of the primary drawbacks of angel investors is their limited financial resources compared to venture capital firms. While angel investors are typically high-net-worth individuals, their capacity to provide capital is significantly smaller. Startups with high capital needs might find the fragmented funding approach of angel investors challenging. This limitation necessitates the consideration of supplementary funding rounds or transitioning to venture capital funding as the business grows. For entrepreneurs, this requires planning for potential funding gaps and strategically managing investor relations to maintain a cohesive ownership structure.

Potential for high interference

Angel investors’ engagement often comes with a high degree of personal involvement in the startup. While angel investors provide valuable mentorship and guidance, this hands-on approach can lead to potential interference in operational or strategic decisions. Unlike institutional investors such as venture capital firms, who adhere to structured advisory roles, angel investors might exert influence beyond their expertise.

This interference can manifest in several ways:

- Operational decisions: Angel investors might have strong opinions on day-to-day operations, impacting efficiency and focus.

- Strategic direction: Divergence in vision between entrepreneurs and investors can lead to conflicts, as seen in scenarios where angel investors push for premature scaling or diversification.

Risk of a lack of professionalism

The varying backgrounds and experiences of angel investors contribute to another potential drawback - the risk of encountering a lack of professionalism. Unlike venture capital firms, which are typically comprised of seasoned corporate finance professionals and adhere to industry standards, angel investors might lack formal investment training or comprehensive industry knowledge.

Several risks stem from this:

- Due diligence: Angel investors might conduct less rigorous due diligence, increasing the likelihood of misalignments in expectations or unforeseen challenges post-investment.

- Governance: A lack of understanding of corporate governance can lead to inefficient decision-making processes, affecting the overall governance framework of the startup.

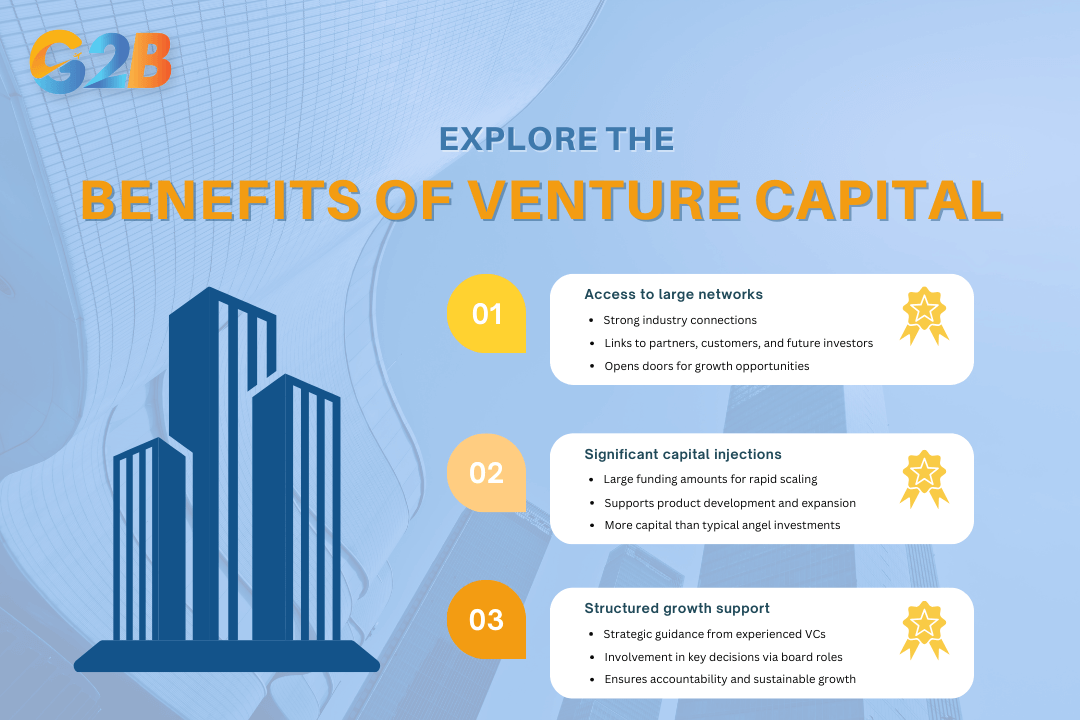

Benefits of venture capital

Unlike individual angel investors who often have constraints in terms of network and capital, venture capital firms provide robust advantages, which can significantly influence a startup's trajectory.

Venture capital firms provide robust advantages

Access to large networks

One of the primary benefits of venture capital is access to extensive networks. VC firms are deeply embedded within the entrepreneurial ecosystem, connecting startup founders with a plethora of industry contacts, potential customers, and strategic partners. This network access is invaluable, as it can open doors to new business opportunities and provide critical insights from seasoned business leaders. Additionally, these connections can facilitate partnerships that may be pivotal in securing subsequent rounds of funding or in accelerating market entry efforts.

Significant capital injections

Venture capital firms are known for their ability to offer significant capital injections, which is often a deciding factor for startups seeking to scale operations swiftly. According to the data from market reports, venture capital funding in the U.S. reached approximately $300 billion in 2022 alone. The availability of large financial resources allows startups to implement ambitious growth strategies, expand their market presence, and invest in product development or research. The capital provided is typically much larger compared to the amounts offered by angel investors, enabling startups to compete more effectively in highly competitive industries.

Structured growth and scaling support

Startups benefit immensely from the structured growth and scaling support that venture capitalists offer. VCs often bring expertise in scaling businesses, providing strategic guidance on operational efficiencies, sales strategies, and market expansion. This support is structured through board participation, where VCs contribute to key decision-making processes, ensuring the startup is on a growth trajectory that is sustainable and aligned with market opportunities. Moreover, the oversight provided by venture capitalists ensures startups remain accountable and focused on achieving predefined milestones, which is critical for long-term success.

Want to establish a company in the UK? Let G2B help you navigate the administrative steps with confidence!

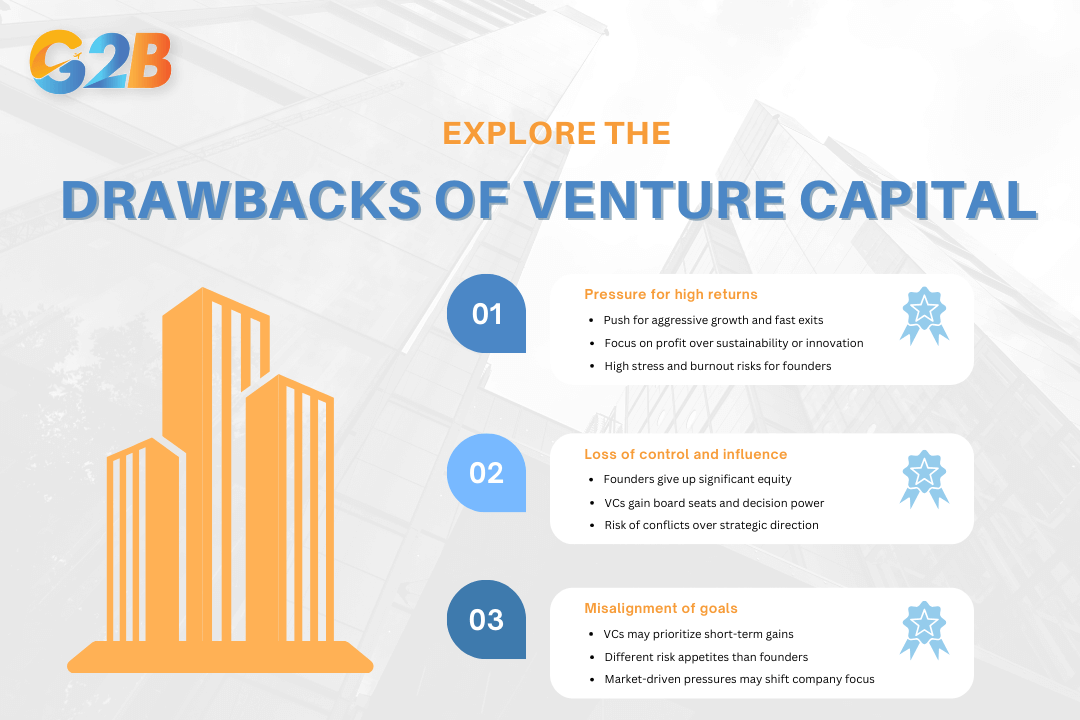

Drawbacks of venture capital

Venture capital (VC) offers startups significant financial resources and strategic guidance, but it is not without drawbacks. Here's an in-depth look at the main disadvantages of venture capital.

There are 3 main disadvantages of venture capital

Pressure for high returns

When startups take on venture capital, one of the most significant drawbacks they face is the pressure for high returns. Venture capital firms are driven by the need to deliver substantial returns to their limited partners, typically expecting a tenfold return on investment within a relatively short timeframe. Because of this, startups often face:

- Intense growth targets: VC firms push startups towards aggressive growth strategies, sometimes at the expense of sustainable business practices or company culture.

- Profit maximization focus: The relentless pursuit of profitability can overshadow innovation and product development, potentially stifling creativity.

- Stress and burnout: The high-pressure environment can lead to stress for the founders and the team, causing burnout and potentially affecting long-term success.

Loss of control and influence

Another significant drawback of accepting venture capital is the loss of control and influence over the company. As VC firms invest capital, they receive substantial equity in exchange. This equity comes with decision-making power, which can lead to:

- Dilution of founder control: As founders cede equity, they may also sacrifice control over business decisions, shifting power dynamics within the company.

- Board seats for VCs: Venture capital typically involves VCs securing board seats, allowing them to influence strategic decisions and guide the company’s direction based on their interests.

- Potential for conflict: The VC’s objectives may clash with the founder’s vision for the company, possibly leading to disagreements and misalignment on strategic priorities.

Potential misalignment of goals

For many startups, the objectives of venture capitalists may not always align with the company's original mission or the founders’ personal aspirations. This misalignment can manifest in several ways:

- Short-term focus: Many VCs have a shorter investment horizon, focusing on quick exits through acquisitions or public offerings. This short-term perspective may not align with a founder’s long-term vision for the company.

- Risk appetite variances: VCs often have a higher tolerance for risk, pushing companies towards bolder, riskier actions that might not align with the original, more cautious approach of the founders.

- Market-driven decisions: The need to appease VC interests can force startups to prioritize market-driven decisions over product-centric strategies, leading to potential deviations from core company values or products.

These drawbacks underscore the complexity of venture capital as a funding strategy. While it brings substantial resources, expertise, and networks, it also requires startups to navigate the demands and expectations of powerful stakeholders. Entrepreneurs must weigh these considerations carefully, balancing the need for significant capital injection with the desire to maintain control, influence, and alignment with their original vision.

Understanding these dynamics is crucial for startups aiming to secure the right investment at the right time. Balancing the needs and expectations of both angel investors and venture capital can guide entrepreneurs toward sustainable growth and success, transforming promising startups into thriving enterprises.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom