Economic growth is more than just a statistic for foreign entrepreneurs, it is a gateway to one of Asia's most dynamic markets. While global economic uncertainty looms, Vietnam continues to surge ahead with impressive resilience. This guide reveals how to legally enter this fast-growing market and transform economic data into real business opportunities. Let's explore how entrepreneurs can position businesses to thrive in Vietnam's expanding marketplace.

Vietnam's economic growth: Why global entrepreneurs are moving here in 2024

Vietnam's economic growth story stands out in today's global landscape. While many economies struggle with inflation and slowing demand, Vietnam continues to deliver impressive results. The country's strategic location in Southeast Asia, stable political environment, young and dynamic workforce, competitive operating costs, and commitment to international trade agreements have created a perfect storm for sustained expansion.

For foreign entrepreneurs from Singapore, South Korea, Japan, the U.S., Taiwan, China, and India, Vietnam represents more than just another emerging market, it's a launchpad for regional expansion with tangible advantages. Understanding this economic growth isn't merely academic; it directly impacts your business decisions, market entry strategy, and potential return on investment.

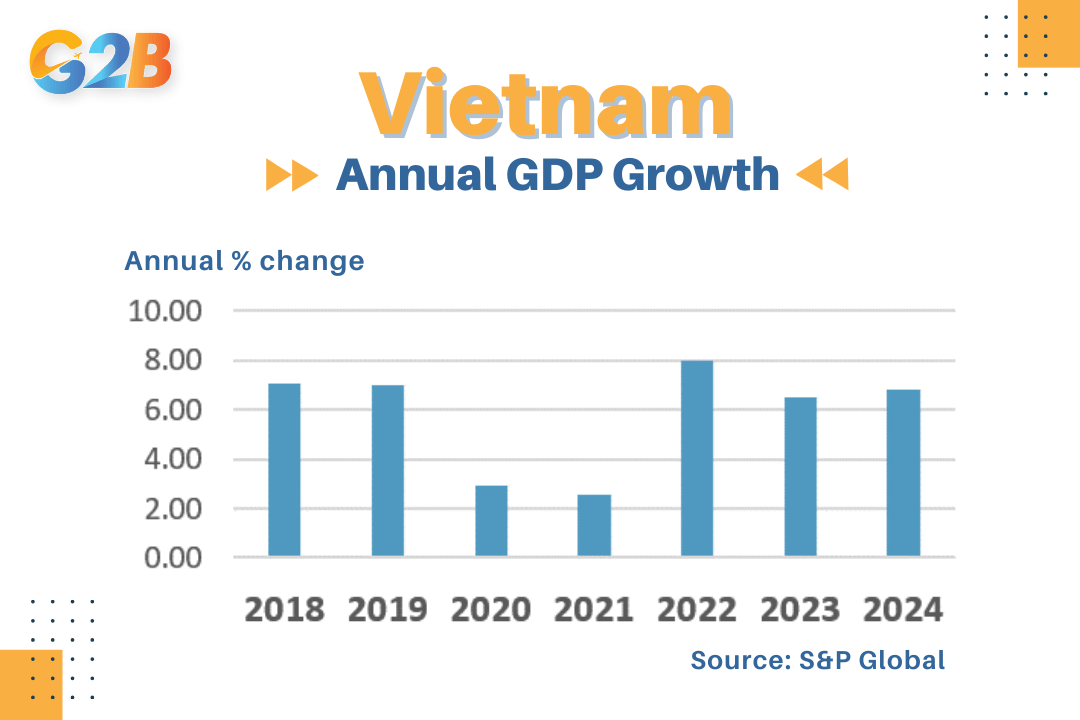

Understanding Vietnam's economic growth (2020 - 2024)

Vietnam's economic growth has defied global headwinds with remarkable consistency. According to the General Statistics Office (GSO), Vietnam achieved 8.02% GDP growth in 2022, followed by 5.05% in 2023 despite global economic challenges. The Ministry of Planning and Investment (MPI) projects growth to accelerate to 5.5 - 6% in 2024 as manufacturing and export sectors rebound.

Vietnam’s annual GDP growth from 2018 to 2024

What drives this impressive economic growth? Four key factors stand out:

- Export manufacturing powerhouse: Vietnam has become the world's factory for electronics, textiles, and furniture, with exports reaching $371 billion in 2023 (up 6.3% from 2022).

- Record foreign direct investment (FDI): Despite global FDI declines, Vietnam attracted $26.5 billion in registered FDI in 2023, with actual disbursement reaching $22.7 billion, the highest in five years.

- Digital transformation: Vietnam's digital economy grew to $29 billion in 2023 (11.4% of GDP), with e-commerce projected to reach $39 billion by 2025.

- Demographic advantage: With 70% of the population under 35 and increasing educational attainment, Vietnam offers a tech-savvy workforce that's both young and skilled.

To understand Vietnam's position relative to regional competitors, consider this comparative data:

| Country | 2023 GDP growth | FDI inflows (2023) | Ease of doing business (World Bank) |

|---|---|---|---|

| Vietnam | 5.05% | $26.5B | Not ranked (but improving) |

| Thailand | 3.1% | $7.2B | 21st (2020) |

| Indonesia | 5.05% | $43.5B | 73rd |

| India | 6.3% | $62.5B | 63rd |

| Malaysia | 3.5% | $14.8B | 12th |

While India leads in total FDI, Vietnam offers faster setup, lower costs, and strategic access to global supply chains. The UNCTAD World Investment Report 2023 confirms Vietnam as Southeast Asia's second-largest FDI destination after Singapore, with manufacturing and high-tech sectors attracting the most investment. This economic growth is the result of deliberate policy choices, strategic trade agreements, and a business-friendly regulatory environment that actively welcomes foreign investment.

Sectors riding Vietnam's growth wave & opportunities for foreigners

- Manufacturing & export: Vietnam has become a global manufacturing hub, particularly for electronics (22% of exports), textiles (12%), and furniture (6%). The sector benefits from competitive labor costs (40-50% lower than China), trade agreements with 60+ countries, and established supply chains. Foreign investors can leverage Vietnam's position in global value chains to serve both domestic and international markets.

- Technology & SaaS: Vietnam's tech sector grew 12.5% in 2023, with software development exports reaching $1.5 billion. The country produces 50,000 ICT graduates annually, creating a talent pool for software development, AI, and fintech. Singaporean and American startups particularly benefit from Vietnam's cost advantages while maintaining quality standards.

- E-commerce & logistics: With e-commerce growing at 20% annually, supporting infrastructure is booming. Last-mile delivery networks, cross-border platforms, and fulfilment centers represent significant opportunities. The logistics sector is projected to reach around $70 billion by 2025, driven by rising consumer demand and manufacturing expansion.

- Renewable energy: Vietnam leads Southeast Asia in solar and wind adoption, with renewable capacity growing from 1% to 12% of total power in just three years. Government incentives for green manufacturing and energy projects create openings for foreign expertise in solar panel production, wind farm development, and energy storage solutions.

- Education & training: As Vietnam's economy modernizes, demand for upskilling surges. EdTech platforms, vocational training centers, and corporate training services are in high demand, particularly those focusing on digital skills, language training, and technical certifications.

- Healthcare & wellness: Vietnam's healthcare market is growing at 15% annually, driven by rising incomes and an ageing population. Medical devices, telehealth platforms, and wellness services represent significant opportunities, especially as the government pushes to modernize healthcare infrastructure.

- Good news: Most of these sectors allow 100% foreign-owned LLCs under the Law on Investment (2020). The government actively encourages foreign participation in these high-growth areas, removing previous ownership restrictions that existed in many sectors.

Sectors ride Vietnam's growth wave

How to enter Vietnam's growing market

Vietnam’s rapidly expanding economy and strategic position in Southeast Asia make it an attractive destination for foreign investors seeking new opportunities. Understanding the process to enter this dynamic market is essential for businesses aiming to establish a strong and sustainable presence in Vietnam.

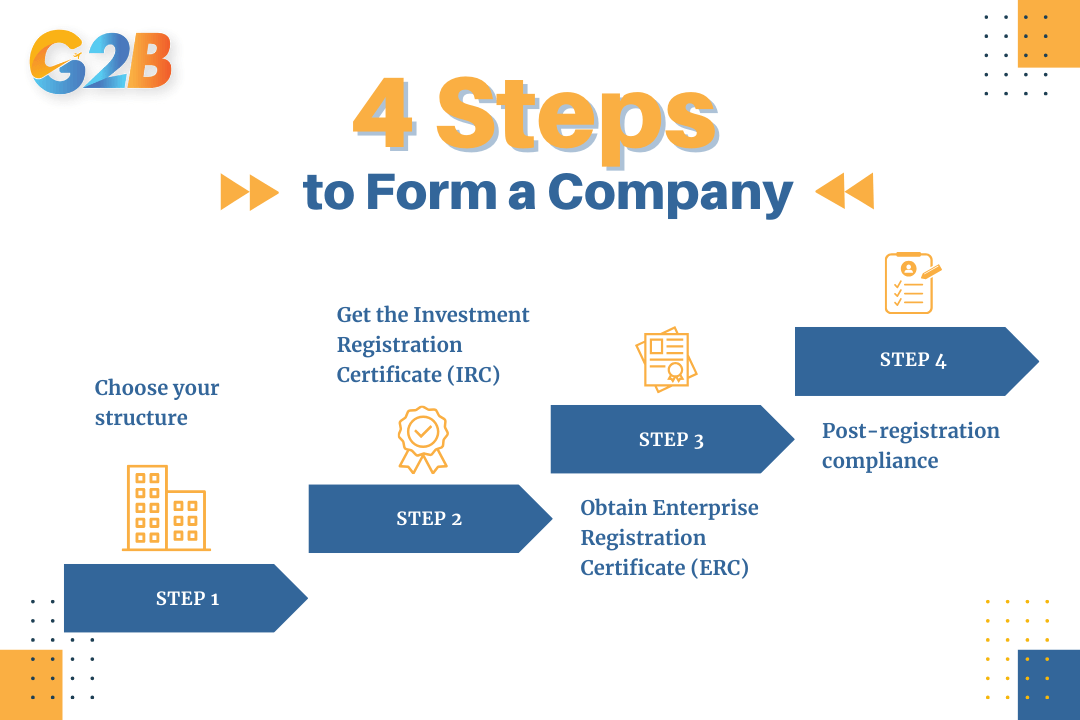

There are 4 steps to enter Vietnam's growing market

Step 1: Choose your structure

Your business structure determines your operational flexibility, tax obligations, and legal protection:

- 100% foreign-owned LLC - Best for revenue-generating businesses (most common choice)

- Branch office - Extension of parent company (limited operational scope)

- Representative office - Market research only (cannot generate revenue)

- Joint venture - Required in restricted sectors (e.g., telecom, real estate)

For most foreign entrepreneurs, the 100% foreign-owned LLC offers the optimal balance of control, flexibility, and compliance. This structure functions as Vietnam’s equivalent of a legal entity with full operational independence similar to a domestic corporation, and allows full profit repatriation.

Step 2: Get the Investment Registration Certificate (IRC)

The IRC is your gateway to operating legally in Vietnam. Issued by the Department of Planning and Investment (DPI), this document:

- Confirms your foreign investor status

- Verifies business scope compliance

- Approves your charter capital plan

The application requires:

- Passport copies of shareholders and the legal representative

- Business plan with specific industry codes

- Proof of address and financial capacity

A critical pain point that halts many market entries is an application rejection by the Department of Planning and Investment (DPI). This often happens due to vague business descriptions; for instance, the DPI requires precise, approved industry codes like "software development" and will reject general terms such as "tech services." Our expert service for incorporation in Vietnam ensures your application is compliant from day one, preventing these costly delays.

Step 3: Obtain Enterprise Registration Certificate (ERC)

With your IRC secured, apply for the ERC, your company's legal identity in Vietnam. The ERC includes:

- Company name

- Registered address

- Legal representative details

- Approved business lines

- Charter capital amount

This process typically takes 3-5 business days. Your company becomes legally recognized upon ERC issuance, appearing in Vietnam's National Business Registry.

Step 4: Post-registration compliance

Complete these within 30 days of ERC issuance:

- Company seal registration (required for all official documents)

- Tax code activation (automatic with ERC but requires verification)

- Corporate bank account opening (requires ERC, IRC, passport, and seal)

- Public announcement on National Business Registration Portal

- Work permits and visas for foreign staff

FAQs: Economic growth & market entry in Vietnam

Q: Is Vietnam's economic growth sustainable?

A: Yes, driven by manufacturing exports, FDI, and a young, tech-savvy workforce.

Q: Can foreigners start a company in Vietnam to benefit from this growth?

A: Yes, foreigners can fully own a Vietnam company via 100% foreign LLC in most sectors.

Q: How long does it take to set up a company in Vietnam as a foreigner?

A: Around 15 business days with complete documents and professional assistance.

Q: Are there tax incentives for businesses in high-growth sectors?

A: Yes, corporate income tax incentives range from 10% to 15%, applicable for periods between 9 and 15 years, depending on the project’s sector, location, and scale.

Q: Can I repatriate profits from Vietnam?

A: Yes, profit repatriation is allowed after tax compliance and audit.

If you are interested in how this compares to establishing a company in Singapore, let’s figure it out in our step-by-step guide on incorporating in Singapore

Ready to capitalize on Vietnam's economic growth?

Vietnam's economic growth isn't just happening, it's accelerating. With GDP expanding at 5%+ annually, FDI pouring in, and digital transformation reshaping traditional industries, the window for strategic market entry has never been wider.

Vietnam's economic growth is built on solid foundations: Strategic location, stable governance, demographic advantages, and proactive economic policies. For foreign entrepreneurs from Singapore, South Korea, Japan, the U.S., Taiwan, China, and India, Vietnam offers a strategic springboard for regional expansion with tangible advantages over neighbouring markets.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom