Mergers and acquisitions drive growth and redefine industries. They promise market entry and are critical in navigating competitive threats. Entrepreneurs and C-suite executives weigh the benefits and risks of these transformative deals. Understanding legal frameworks, due diligence, and cost implications is essential. M&A reshapes company structures, guiding businesses toward strategic goals. Let's dive deeper to master the intricacies of these opportunities.

This article provides general information to help business owners understand the basics of mergers and acquisitions (M&A). We specialize in company formation and do not provide M&A advisory services. For personalized guidance, please consult a qualified legal or financial advisor.

What are mergers and acquisitions (M&A)?

Mergers and acquisitions (M&A) refer to the processes by which companies consolidate through various types of transactions, resulting in the combination or transfer of ownership of businesses or their assets.

Definitions and differences between Merger & Acquisition

- Merger: This is a business transaction in which two companies, usually of similar size, agree mutually to combine and form a new, single legal entity. Both companies dissolve their previous identities and often issue new shares under a new or one of the existing company’s names. Mergers are typically friendly and consensual, aiming to increase market share, achieve economies of scale, or enhance competitive positioning.

- Acquisition: This occurs when one company (often larger) purchases another company’s shares or assets, thereby gaining control. The acquired company may cease to exist as an independent entity or become a subsidiary. Acquisitions can be friendly, with agreement from the target company, or hostile, where the target resists the takeover. Acquisitions usually involve one company absorbing another, either through stock sales (buying the entire business entity, including assets and liabilities) or asset sales (buying specific assets).

Key differences: Merger vs. acquisition

| Characteristic | Merger | Acquisition |

|---|---|---|

| Entity formation | Creates an entirely new legal entity | No new entity is formed |

| Original companies | Both original companies ceased to exist | The acquiring company continues to exist |

| Power dynamic | Generally occurs between similar-sized companies | Often involves a larger company buying a smaller one |

| Management structure | A new management team is typically formed | Acquiring a company's management usually remains in control |

| Branding | A new brand identity is often created | The acquired company's brand may be maintained or phased out |

| Regulatory requirements | Requires extensive documentation for the new entity | Focuses on ownership transfer documentation |

| Shareholder impact | Shareholders from both companies receive shares in the new entity | Target company shareholders receive payment for their shares |

In practice, many transactions labelled as "mergers" actually function as acquisitions, with one company effectively taking control. The terminology sometimes reflects strategic positioning rather than the true legal structure of the transaction.

Need a free consultation with Delaware incorporation service? Let G2B help you navigate the process with confidence!

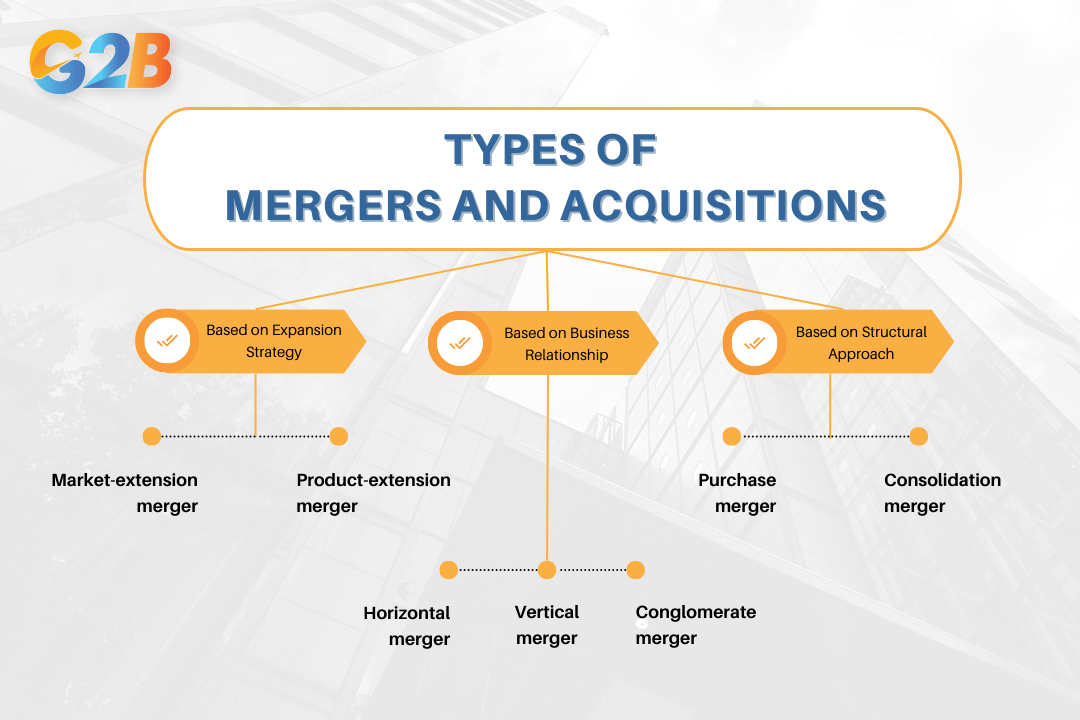

Types of mergers and acquisitions

Mergers and acquisitions (M&A) transactions fall into several distinct categories, each with unique strategic implications for businesses of all sizes. Understanding these variations helps entrepreneurs make informed decisions.

Horizontal, vertical, and conglomerate mergers

Horizontal mergers combine companies operating in the same industry at the same level of the supply chain. These transactions directly eliminate competition while consolidating market share. For SMEs and startups, horizontal mergers provide immediate scale advantages and expanded customer reach. Facebook's acquisition of Instagram exemplifies this strategy, where two competing social media platforms joined forces, allowing the acquirer to neutralize a rising competitor while expanding their service offerings.

Vertical mergers unite companies at different stages of the same supply chain. This structure creates operational efficiencies by bringing previously separate production stages under one roof. IKEA's acquisition of forestland demonstrates vertical integration, giving the furniture retailer direct control over raw material sourcing. For smaller businesses, vertical mergers reduce dependency on suppliers or distributors, potentially lowering costs and improving margins.

Conglomerate mergers bring together completely unrelated businesses, primarily for diversification purposes. When Amazon acquired Whole Foods, the e-commerce giant expanded into brick-and-mortar grocery retail - a distinctly different business model. For SMEs, conglomerate mergers spread risk across multiple sectors, creating stability during industry-specific downturns and opening new revenue channels.

Market-extension and product-extension mergers

Market-extension mergers combine companies selling similar products in different geographic markets. This strategy accelerates geographic expansion without the slower organic growth process. When T-Mobile acquired MetroPCS, they instantly gained access to new regional markets and customer segments. For entrepreneurs seeking rapid expansion, market-extension mergers provide immediate entry into territories where establishing a presence might otherwise take years.

Product-extension mergers unite companies offering complementary products or services. This approach helps businesses broaden their offerings while maintaining focus within related fields. PepsiCo's acquisition of Pizza Hut exemplifies this strategy, expanding from beverages into complementary food products. Small businesses benefit from these mergers through cross-selling opportunities, enhanced customer loyalty, and more complete solutions for their target markets.

| Extension type | Primary goal | Key benefit for SMEs |

|---|---|---|

| Market | Geographic expansion | Rapid access to new territories |

| Product | Portfolio diversification | Enhanced customer value proposition |

Purchase vs. consolidation mergers

Purchase mergers occur when one company directly acquires another, with the buyer maintaining its identity while the target typically dissolves or becomes a subsidiary. Tesla's acquisition of Twitter represents this approach - the acquirer remained intact while gaining control of the target's operations and assets. This structure gives entrepreneurs a straightforward path to absorb competitors or complementary businesses.

Consolidation mergers create entirely new entities from previously separate companies. GlaxoSmithKline emerged as a new organization when Glaxo Wellcome merged with SmithKline Beecham, dissolving both original entities. For startups seeking to combine strengths with partners, consolidations offer a fresh start approach, allowing teams to build a unified culture and brand without either party appearing subordinate.

- Purchase benefits:

- Simpler integration process

- Maintains brand continuity

- Clear leadership structure

- Consolidation benefits:

- Equal partnership perception

- Fresh market positioning opportunity

- Combined strengths under new identity

Mergers and acquisitions (M&A) transactions fall into several distinct categories

Who's involved in M&A? Key roles and stakeholders

Mergers and acquisitions involve multiple parties working together to complete complex transactions. For entrepreneurs and business leaders, understanding these key players proves essential for navigating the M&A landscape effectively.

Acquirer, target, and advisors

The acquirer (buyer) drives the strategic vision behind mergers and acquisitions transactions. This party identifies growth opportunities, conducts preliminary valuations, and initiates contact with potential targets. Acquirers typically seek strategic advantages such as market expansion, product diversification, or elimination of competition. Their leadership team must clearly articulate the business rationale and secure appropriate funding before proceeding.

The target (seller) represents the company being purchased or merged. Their motivations vary significantly - from founders seeking profitable exits to struggling companies needing financial stability. Target companies must prepare comprehensive documentation, maintain operational stability during negotiations, and collaborate on due diligence requests. The management team often balances conflicting priorities: Maximizing sale value while ensuring post-transaction success.

Advisors play critical, specialized roles throughout the M&A process:

- Investment bankers: Value businesses, identify potential matches, structure deals

- Corporate attorneys: Draft purchase agreements, ensure regulatory compliance

- Accountants/financial advisors: Conduct financial audits, identify tax implications

- Integration consultants: Plan operational transitions between organizations

Regulatory and compliance authorities

Regulatory bodies serve as gatekeepers in the M&A process, particularly for transactions reaching certain size thresholds or involving sensitive industries. Their primary function involves protecting market competition, preventing monopolistic practices, and ensuring consumer protection. Common regulatory authorities include:

- Federal Trade Commission (FTC)

- Department of Justice (DOJ) Antitrust Division

- Securities and Exchange Commission (SEC)

- Industry-specific regulators (banking, healthcare, telecommunications)

- International regulatory bodies for cross-border transactions

The regulatory review process follows these general steps:

- Pre-filing consultations with relevant authorities

- Formal submission of required documentation

- Waiting period during the government review

- Possible requests for additional information

- Final determination (approval, conditional approval, or denial)

SMEs and startups should note that regulatory scrutiny increases with transaction size and market concentration. While smaller deals may receive expedited review or exemptions from certain filing requirements, cross-border transactions typically face multiple regulatory hurdles regardless of size. Experienced legal counsel becomes essential for navigating these complex approval processes, as regulatory delays can significantly impact deal timelines and integration planning.

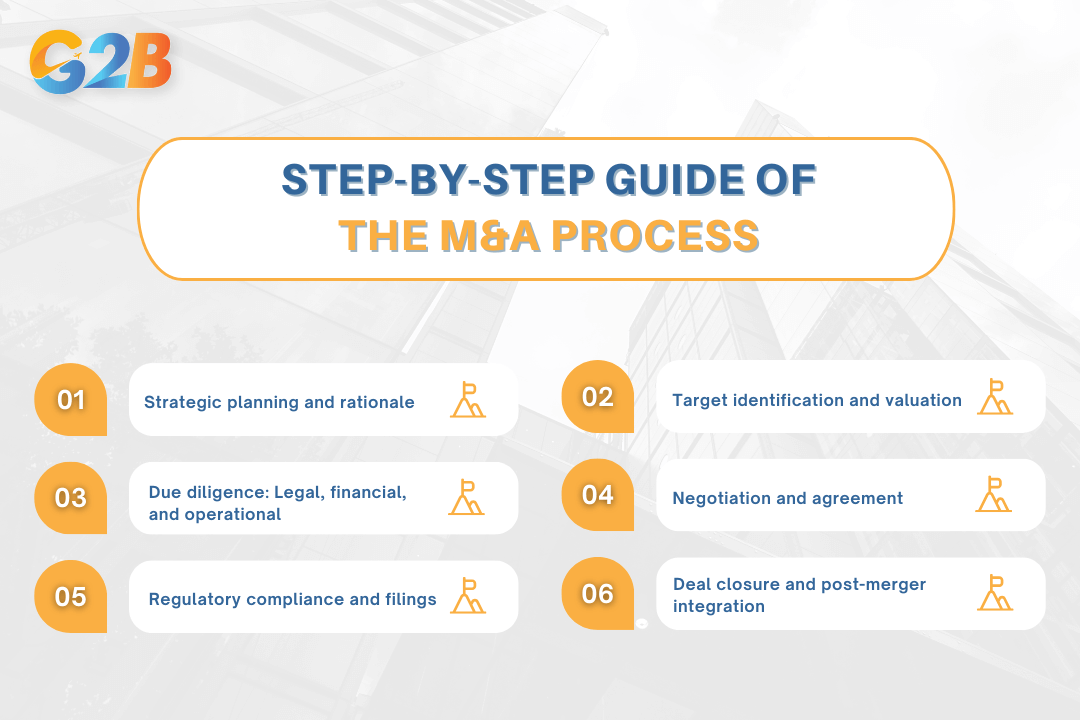

The M&A process: Step-by-step guide

Mergers and acquisitions follow a structured process that requires meticulous planning and execution. The following steps provide entrepreneurs and executives with actionable guidance to navigate complex M&A transactions efficiently.

Strategic planning and rationale

Effective M&A begins with defining clear objectives that align with broader business goals. Companies must determine whether they seek growth into new markets, diversification of product lines, or a strategic exit. This initial phase requires executives to assess the strategic fit of potential transactions with their long-term vision.

Business leaders should create a detailed strategic document outlining specific and measurable goals for the transaction. This document serves as the foundation for the entire process, guiding decision-making and helping maintain focus when complications arise. Securing alignment among key stakeholders - including board members, investors, and executive leadership - minimizes friction during later stages and ensures unified direction.

Target identification and valuation

Establishing clear selection criteria forms the backbone of target identification. These criteria should include financial thresholds, market positioning, geographic presence, and cultural compatibility. Companies then generate a comprehensive list of potential targets that meet these parameters. The valuation process requires rigorous financial analysis, including revenue trends, profit margins, cash flow patterns, and growth projections. Businesses should employ multiple valuation methods such as:

- Discounted cash flow analysis

- Comparable company analysis

- Precedent transaction analysis

- Asset-based valuation

Due diligence: Legal, financial, and operational

| Due diligence area | Key elements to review |

|---|---|

| Legal | Corporate records, material contracts, litigation history, and intellectual property |

| Financial | Financial statements, tax returns, debt obligations, and working capital |

| Operational | Business processes, IT systems, supply chain, organizational structure |

| HR | Employment agreements, compensation structures, benefits plans, and culture |

| Regulatory | Permits, licenses, compliance history, pending regulatory changes |

Negotiation and agreement

Negotiation extends beyond purchase price to encompass deal structure, payment terms, escrow requirements, and post-closing adjustments. Typical negotiation points include:

- Purchase price and payment structure (cash, stock, or combination)

- Representations and warranties regarding business condition

- Indemnification provisions and liability caps

- Non-compete agreements and transition services

- Employment contracts for key personnel

Legal counsel plays a vital role in drafting acquisition agreements that protect their client's interests while addressing concerns uncovered during due diligence. The Letter of Intent (LOI) serves as an important preliminary document outlining key terms before parties proceed to definitive agreements.

Regulatory compliance and filings

Regulatory requirements vary based on transaction size, industry, and geography. M&A transactions typically require filings with:

- Antitrust authorities for competition review

- Securities regulators for public company transactions

- Industry-specific regulators (banking, healthcare, telecommunications)

- Tax authorities for restructuring approval

Cross-border transactions introduce additional complexity, requiring analysis of foreign investment restrictions and obtaining approvals from multiple jurisdictions. Failure to secure necessary regulatory clearances can delay or derail transactions entirely, making thorough compliance planning essential.

Deal closure and post-merger integration

Closing day involves executing final transaction documents, transferring funds, and legally completing the combination. This culmination of the transaction process requires coordinating multiple parties, including banks, registrars, and government agencies. Post-merger integration represents the most challenging yet critical phase for realizing transaction value. Successful integration requires:

- Establishing a dedicated integration management office

- Creating detailed integration plans with clear timelines

- Addressing cultural differences proactively

- Communicating consistently with employees and customers

- Tracking synergy realization against initial projections

Companies that prioritize integration planning before closing achieve faster synergy realization and minimize business disruption. The integration process typically spans 12-24 months, with early planning focused on day-one critical activities and longer-term structural alignment.

06 steps provide entrepreneurs with actionable guidance to navigate the M&A

How M&A affects company formation and structure

Mergers and acquisitions fundamentally reshape corporate structures, often requiring significant changes to legal entities, governance frameworks, and operational systems. These structural changes demand careful planning and execution to ensure legal continuity.

Forming a new company via merger

The merger of two or more businesses typically necessitates the creation of an entirely new legal entity. This process begins with drafting comprehensive articles of incorporation that define the merged company's structure, governance, and purpose. These documents must then be filed with the relevant state or federal authorities to establish the new corporation's legal existence. Following registration, the merging entities must systematically transfer all assets, liabilities, contracts, and intellectual property to the newly formed company:

- Formal asset transfer agreements

- Bill of sale documentation

- Assignment of contracts and licenses

- IP transfer agreements

- Real estate deed transfers

The new entity must also obtain essential operational credentials, including:

- Federal Employer Identification Number (EIN)

- State tax registration certificates

- Business licenses and permits

- Professional and industry-specific certifications

- Banking relationships and accounts

Acquisition: Absorption or subsidiary?

When one company acquires another, executives must decide whether to fully absorb the target or maintain it as a subsidiary. This decision carries significant implications for corporate structure, management, and compliance. Full absorption dissolves the acquired company's separate legal identity, integrating all operations, assets, and personnel into the acquiring company's structure.

This approach streamlines governance and reduces administrative overhead but requires complex asset transfers and may disrupt established business processes. The acquiring company assumes direct responsibility for all liabilities and contractual obligations of the target. Maintaining the target as a subsidiary preserves its distinct legal identity while transferring ownership control. This structure offers several advantages:

| Subsidiary benefits | Operational implications |

|---|---|

| Brand continuity | Separate financial reporting |

| Liability isolation | Distinct governance structure |

| Operational autonomy | Multiple tax entities |

| Simplified integration | Decentralized management |

| Easier divestiture | Regulatory compliance complexity |

Operational and legal changes Post-M&A

The completion of an M&A transaction triggers numerous operational and legal updates to reflect the new corporate structure. Companies must systematically revise ownership records, including shareholder registries, stock certificates, and corporate minute books. Existing contracts require careful review and potential amendment through:

- Assignment and novation agreements

- Change of control notifications

- Consent requests from contractual counterparties

- Updated terms reflecting the new corporate identity

Comprehensive stakeholder communication becomes essential to maintain relationships and ensure compliance:

- Employee notifications about changes in employment terms

- Customer communications regarding service continuity

- Vendor notices about payment processes and procurement changes

- Regulatory filings with government agencies

- Press releases and public announcements

Ongoing regulatory compliance demands attention to industry-specific requirements, securities laws, and corporate governance standards. The restructured entity must establish updated operational processes, reporting frameworks, and compliance protocols to align with its new configuration while maintaining legal and regulatory adherence.

Finding a trustworthy US incorporation service? Let G2B simplify the process - Book your free consultation now!

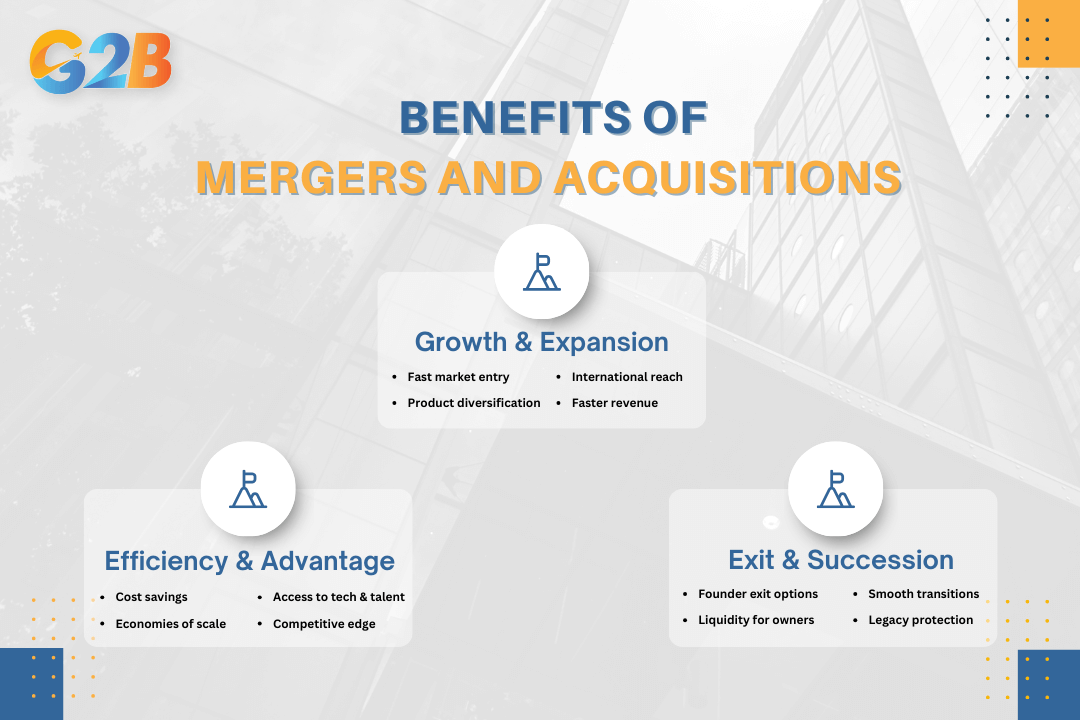

Benefits and strategic importance of M&A

Mergers and acquisitions (M&A) serve as powerful strategic tools for businesses seeking growth, competitive advantage, and exit opportunities. For entrepreneurs and SMEs, M&A transactions create pathways to optimize operations.

Growth, expansion, and diversification

M&A transactions provide businesses with immediate market expansion capabilities without building a presence from scratch. When a regional retailer acquires a competitor in an adjacent territory, they instantly gain established locations, customer relationships, and local market knowledge. This approach eliminates years of site selection, staff recruitment, and brand building that organic growth would require.

Companies leverage acquisitions to diversify product portfolios without substantial R&D investments. For example, a software company specializing in accounting solutions might acquire a complementary CRM developer, immediately expanding their offering without developing new technology internally. This strategy creates immediate cross-selling opportunities to existing customers while attracting new client segments through a more comprehensive solution suite.

International expansion becomes significantly more accessible through M&A. Rather than navigating unfamiliar regulatory environments and building brand recognition abroad, businesses can acquire established local companies with existing compliance frameworks, customer relationships, and market understanding. This approach reduces market entry risks while accelerating revenue generation in new territories.

- Key growth benefits:

- Immediate access to established customer bases

- Rapid geographic expansion capabilities

- Instant product line diversification

- Accelerated revenue scaling

- Reduced time-to-market for new offerings

Competitive advantage and cost efficiencies

M&A transactions create powerful operational synergies by eliminating redundancies across combined organizations. When two manufacturing companies merge, they can consolidate production facilities, streamline administrative functions, and reduce overhead expenses that previously existed in parallel. These efficiencies typically generate 10-15% cost savings across combined operations.

The enhanced scale achieved through mergers significantly improves negotiating leverage with suppliers. A doubled order volume often translates to preferential pricing, extended payment terms, and priority fulfilment - advantages that directly improve profit margins. This purchasing power creates competitive advantages that smaller competitors cannot match.

Strategic acquisitions provide access to proprietary technologies, talent pools, and intellectual property that may be otherwise unobtainable. When a larger corporation acquires an innovative startup, they gain both the technological capabilities and the specialized talent that developed them. This approach accelerates innovation cycles while protecting market position against disruptive competitors.

Operational efficiencies include:

- Elimination of duplicate administrative functions

- Consolidated facilities and equipment

- Unified technology platforms and systems

- Streamlined supply chains

- Optimized marketing and distribution networks

Succession planning and exit strategies

M&A transactions offer business owners structured exit paths that maintain company legacy while providing financial liquidity. When founders approach retirement without family successors, strategic acquisitions by complementary businesses ensure operational continuity while releasing equity value accumulated over decades of building the enterprise.

These transactions create flexible transition arrangements that benefit all stakeholders. Acquisition structures often include earnout provisions, consulting agreements, or board positions that allow founders to gradually reduce involvement while sharing expertise. This approach facilitates knowledge transfer while providing the selling owner with an ongoing connection to their life's work.

For investors and shareholders, M&A events create liquidity opportunities without the complexity and expense of public offerings. Private equity-backed acquisitions provide immediate liquidity while often allowing management teams to retain operational control through rollover equity arrangements. This structure aligns incentives while providing immediate financial returns for early investors and founders.

| Exit strategy type | Key benefits | Common application |

|---|---|---|

| Strategic acquisition | Premium valuations, operational synergies | Industry consolidation, technology acquisition |

| Management buyout | Maintains culture, rewards key employees | Family businesses, founder transitions |

| Private equity transaction | Immediate liquidity, growth resources | Scale-ready businesses needing capital |

| Merger of equals | Shared control, complementary strengths | Similar-sized companies seeking scale |

M&A transactions create many key growth benefits

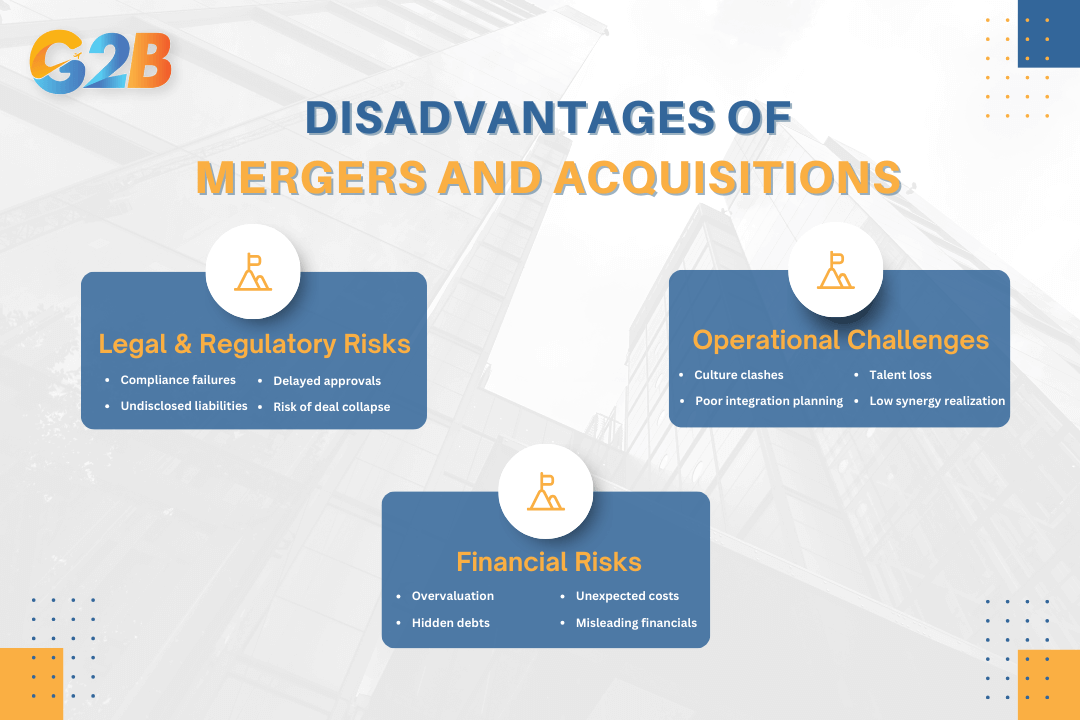

Risks, disadvantages, and common pitfalls

Mergers and acquisitions carry significant risks that can derail even the most promising transactions. While M&A offers strategic advantages, understanding the potential pitfalls helps business leaders navigate these complex processes with realistic expectations.

Legal and regulatory risks

Regulatory compliance remains one of the most treacherous aspects of M&A transactions. Failure to conduct thorough due diligence can void deals entirely or trigger substantial financial penalties. Many transactions collapse when buyers discover undisclosed liabilities, compliance violations, or pending litigation too late in the process.

Organizations must secure all necessary regulatory approvals before proceeding with integration. Anti-trust concerns, industry-specific compliance requirements, and cross-border regulations often extend pre-close periods beyond expected timeframes. For SMEs pursuing mergers and acquisitions, engaging specialized legal counsel familiar with industry-specific regulations provides essential protection against these compliance pitfalls.

Cultural and operational integration challenges

Post-merger integration represents the phase where most M&A deals struggle or fail. Cultural fault lines between organizations frequently manifest in conflicting decision-making styles, leadership approaches, and fundamental operational philosophies. Studies consistently show that 70-90% of mergers and acquisitions fail to achieve their expected value, with cultural incompatibility cited as the primary cause.

Early planning and transparent communication prove essential for successful integration. Smart acquirers begin mapping cultural differences during due diligence, not after closing. Disparate cultures inevitably create workforce fragmentation when leaders fail to articulate a compelling shared vision. The most successful integrations involve:

- Dedicated integration teams with clear authority

- Cultural assessment and alignment strategies

- Regular stakeholder communication

- Prioritized retention of key talent

- Phased integration of processes and systems

Financial risks: Overvaluation and hidden liabilities

Overpaying for acquisition targets represents a common and costly mistake in mergers and acquisitions. Acquirers frequently overestimate synergies, underestimate integration costs, or succumb to deal fever - pursuing transactions regardless of price or strategic fit. Hidden liabilities pose equally dangerous financial risks:

- Outstanding tax obligations

- Underfunded pension liabilities

- Pending litigation or regulatory penalties

- Deferred maintenance or capital expenditure requirements

- Operational inefficiencies masked by creative accounting

Robust financial due diligence and conservative valuation approaches help organizations avoid these costly surprises. Acquiring companies should engage third-party experts to conduct thorough financial assessments, including stress-testing financial projections against various market conditions.

Common misconceptions and mistakes

Several persistent myths mislead business leaders about the merger and acquisition process. Contrary to common assumptions, not all M&As result in the formation of new companies - many operate as asset acquisitions or subsidiary arrangements with different legal implications. The process typically requires significantly more time and resources than initially anticipated.

Small and mid-sized businesses frequently make these critical errors:

- Insufficient integration planning timeframes

- Assuming existing systems can absorb acquisition targets without significant investment

- Delaying difficult strategic and personnel decisions

- Failing to retain key talent through the transition period

- Underestimating the importance of cultural integration

While larger corporations dominate M&A headlines, these transactions represent valuable strategic tools for businesses of all sizes when approached with proper preparation and realistic expectations.

Understanding the potential risks helps business leaders navigate the complex processes

Frequently asked questions (FAQ) about M&A and company formation

Mergers and acquisitions (M&A) processes involve complex legal, structural, and operational considerations that raise numerous questions. The following answers address the most common questions about M&A transactions.

What is the difference between a merger and an acquisition?

A merger creates an entirely new company by combining two or more existing businesses, while an acquisition occurs when one company purchases and absorbs another. The distinction carries significant legal and operational implications.

In a merger, two companies of comparable size and influence unite to form a new legal entity. Both original companies dissolve their previous corporate identities, combining assets and liabilities under the newly established organization. The process typically involves issuing new shares, registering a new corporate entity with regulatory authorities, and establishing unified management structures representing both original companies.

Acquisitions, by contrast, maintain the legal identity of the acquiring company. The buyer purchases controlling interest (at least 51%) in the target company, which may continue operating as a subsidiary or be fully integrated into the acquirer's operations. Unlike mergers, acquisitions don't necessarily require forming new legal entities, though they often involve substantial reorganization of the acquired business.

How does M&A affect company formation and structure?

M&A transactions fundamentally reshape corporate structures, with different implications depending on the transaction type. These structural changes affect everything from legal registrations to operational hierarchies. Mergers typically require forming a new legal entity, dissolving both original companies, and transferring all assets, liabilities, intellectual property, and contracts to the newly created organization. This process involves:

- Filing new incorporation documents

- Obtaining new tax identification numbers

- Reapplying for business licenses and permits

- Issuing new stock certificates to shareholders

- Creating unified governance structures

- Consolidating banking relationships

Acquisitions maintain the legal identity of the acquiring company while potentially transforming the acquired business. The target company may:

- Continue as a subsidiary with its own legal identity

- Be fully absorbed into the parent company

- Maintain separate operations but change ownership

- Adapt its governance structure to align with the parent company

Both transaction types necessitate updating corporate registrations, amending contracts, and notifying stakeholders of structural changes.

What are the legal steps in an M&A deal?

The M&A process involves several critical legal steps to ensure proper compliance and risk management throughout the transaction. Initial legal preparations include:

- Signing confidentiality agreements

- Drafting letters of intent (LOIs)

- Structuring preliminary deal terms

- Conducting thorough due diligence

The due diligence phase involves reviewing:

- Corporate formation documents

- Contracts and agreements

- Intellectual property registrations

- Litigation history and potential liabilities

- Regulatory compliance status

- Employment arrangements

Final transaction execution requires:

- Negotiating definitive agreements

- Obtaining board and shareholder approvals

- Securing regulatory clearances (antitrust, securities)

- Filing ownership transfer documents

- Conducting closing proceedings

- Registering the transaction with the appropriate authorities

Post-closing legal steps include transferring assets, updating registrations, amending licenses, and integrating governance structures according to the agreed terms.

What are the main risks and benefits of M&A?

M&A transactions offer significant strategic advantages while presenting substantial challenges that business leaders must carefully evaluate.

Key benefits include:

- Accelerated growth and market expansion

- Access to new technologies and intellectual property

- Enhanced competitive positioning

- Cost reductions through economies of scale

- Expanded customer base and market reach

- Diversification of product offerings

- Improved operational efficiencies

- Strategic exit options for founders

- Tax advantages (in certain structures)

- Talent acquisition and capability enhancement

Primary risks involve:

- Cultural integration challenges

- Hidden liabilities discovered post-transaction

- Regulatory and compliance hurdles

- Customer and employee retention issues

- Overvaluation of the target company

- Integration costs exceeding projections

- Management disagreements

- Disruption to existing business operations

- Failure to achieve expected synergies

- Legal complications in ownership transfer

Successful M&A requires balancing these potential benefits against the inherent risks through careful planning and execution.

Can SMEs and startups use M&A, or is it just for large corporations?

M&A presents viable strategic options for companies of all sizes, not just large corporations. Small and medium-sized enterprises (SMEs) and startups increasingly utilize these transactions to achieve strategic objectives.

For startups and SMEs, M&A offers several advantages:

- Accelerated scaling beyond organic growth limitations

- Access to complementary technologies without development costs

- Entry into new markets without building presence from scratch

- Acquisition of established customer relationships

- Solution to succession planning challenges

- Consolidation within fragmented industry segments

- Competitive defense against larger market players

- Strategic alternatives when funding options are limited

SMEs can structure M&A transactions appropriately for their size through:

- Asset purchases rather than stock acquisitions

- Seller financing arrangements

- Earnout structures that link payment to performance

- Phased integration approaches

- Strategic partnerships preceding full integration

- Targeted acquisitions of specific capabilities

The accessibility of M&A for smaller companies has increased as advisory services have developed specialized offerings for the SME market segment, making professional guidance more affordable and appropriate for smaller-scale transactions.

Mergers and acquisitions stand as powerful catalysts for transformation, uniting diverse strengths for unparalleled growth. They hold the promise of seamless market entry, or strategic exits, reshaping landscapes with each calculated move. Amidst intricate legal requirements and dynamic company structures, M&A offers the tapestry for visionary leaders to weave new narratives.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom