Economies of scale are the cost advantages businesses gain as their production output increases. It is the engine of modern business, creating a powerful link between production volume, cost efficiency, and market competitiveness. Understanding how to achieve these efficiencies is critical for any company aiming for profitability, competitive pricing, and sustainable long-term growth.

This article outlines the key aspects of economies of scale to help businesses gain a clearer understanding of their types and how they differ from other cost-related concepts. We specialize in company formation and do not provide financial advice. For financial matters, please consult a qualified expert.

Definition of economies of scale

At its core, the definition of economies of scale is simple: As a company grows and its production volume rises, the average cost to produce each individual unit falls. This is the result of spreading fixed costs over a larger output, as well as operational efficiencies gained from increased scale. Fixed costs are expenses that do not change with the level of production, such as rent for a factory, the cost of machinery, administrative salaries, and insurance.

Whether a factory produces 1,000 widgets or 100,000 widgets, the monthly rent remains the same. When production is low, each widget must bear a large portion of that rent. When production is high, that same rental cost is divided among many more widgets, making the cost per unit significantly smaller. This principle allows larger companies to lower their prices, increase their profit margins, or reinvest in further growth, creating a powerful competitive advantage.

Types of economies of scale

The cost advantages of scaling are not monolithic. They originate from different sources, which are broadly categorized as either internal or external. Understanding both types is crucial for developing a comprehensive global expansion strategy.

Internal economies of scale

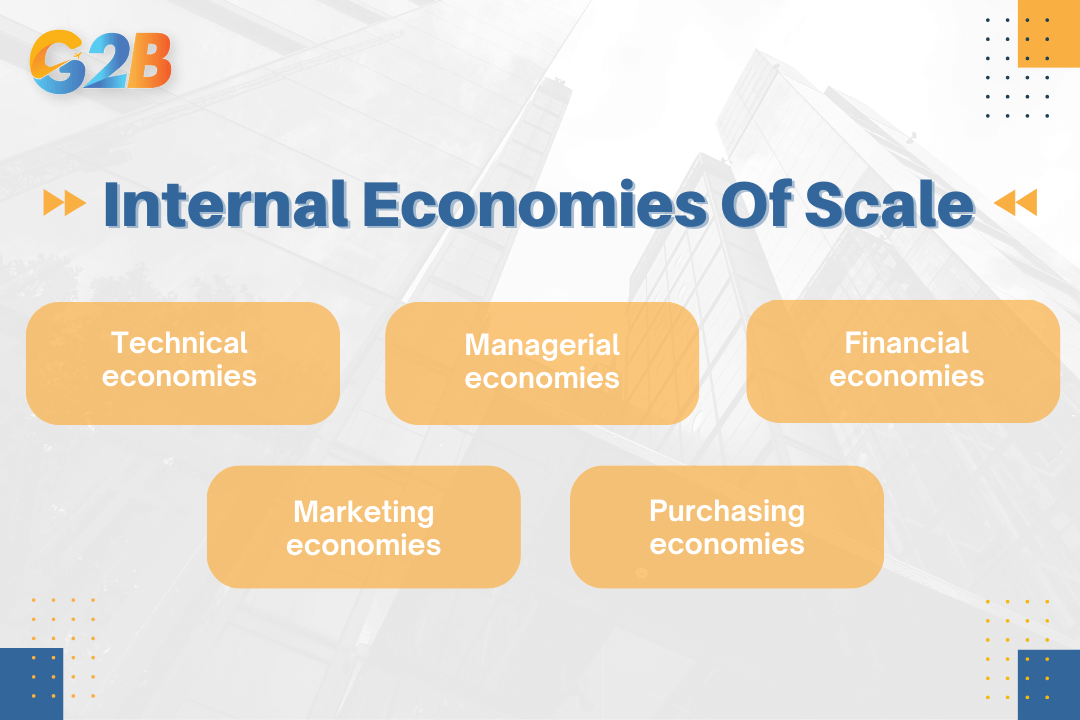

Internal economies are advantages generated by a company's own growth and strategic decisions; they are factors within the firm's direct control. Internal economies arise from several sources, such as technical efficiencies, managerial specialization, financial advantages, marketing scale, and purchasing power.

- Technical economies: These are gained by using more advanced and efficient technology at a larger scale. A large automotive plant can invest in multi-million-dollar robotics and assembly lines that a small workshop cannot afford, drastically reducing the labor time and cost per vehicle.

- Managerial economies: As a business grows, it can hire specialized managers for distinct functions like finance, operations, and marketing. This specialization leads to greater expertise and efficiency compared to a small business where one person might handle multiple roles.

- Financial economies: Larger, established companies are seen as less risky by banks and financial institutions. Consequently, they can secure loans and capital at lower interest rates than smaller businesses, reducing their cost of financing for expansion.

- Marketing economies: The cost of a national advertising campaign is the same whether a company has 100 retail outlets or 2,000. By spreading advertising and marketing expenses over a higher volume of sales, the marketing cost per unit sold decreases. Additionally, larger firms benefit from stronger brand recognition and more efficient distribution channels.

- Purchasing economies: This is one of the most common forms of scale advantage. Businesses buying raw materials in bulk can negotiate significant discounts from suppliers. A company ordering 1,000,000 computer chips will pay a much lower price per chip than a company ordering 1,000.

Internal economies are advantages generated by a company's own growth and strategic decisions

External economies of scale

External economies are cost advantages that a business enjoys due to factors outside its direct control, often related to its industry and geographic location. External economies benefit all firms in a region, including clusters of specialized suppliers, a skilled local labor pool, and shared infrastructure development. Government policies, industry associations, and public infrastructure investments also play key roles in generating external economies.

Diseconomies of scale: When growth hurts?

Growth is not without its perils. Beyond a certain point, the very act of getting bigger can introduce new inefficiencies, a phenomenon known as diseconomies of scale. This occurs when a company becomes so large that its average costs per unit begin to rise instead of fall.

This can result in several challenges, such as communication breakdowns across sprawling departments, increased coordination and overhead costs, complex bureaucracy that slows down decision-making, and a loss of managerial control and employee morale. A small, agile team can innovate quickly, but a massive corporation may struggle with internal politics and rigid procedures.

Diseconomies of scale arise not only from increased size but also from the growing complexity in managing and coordinating resources efficiently. Mitigating these risks requires investing in scalable systems, fostering a strong corporate culture, and leveraging local expertise in new markets to maintain operational agility. Diseconomies of scale represent a natural limit on growth, forcing firms to carefully balance between expansion and efficiency to avoid rising average costs.

How Vietnam enables economies of scale for foreign businesses

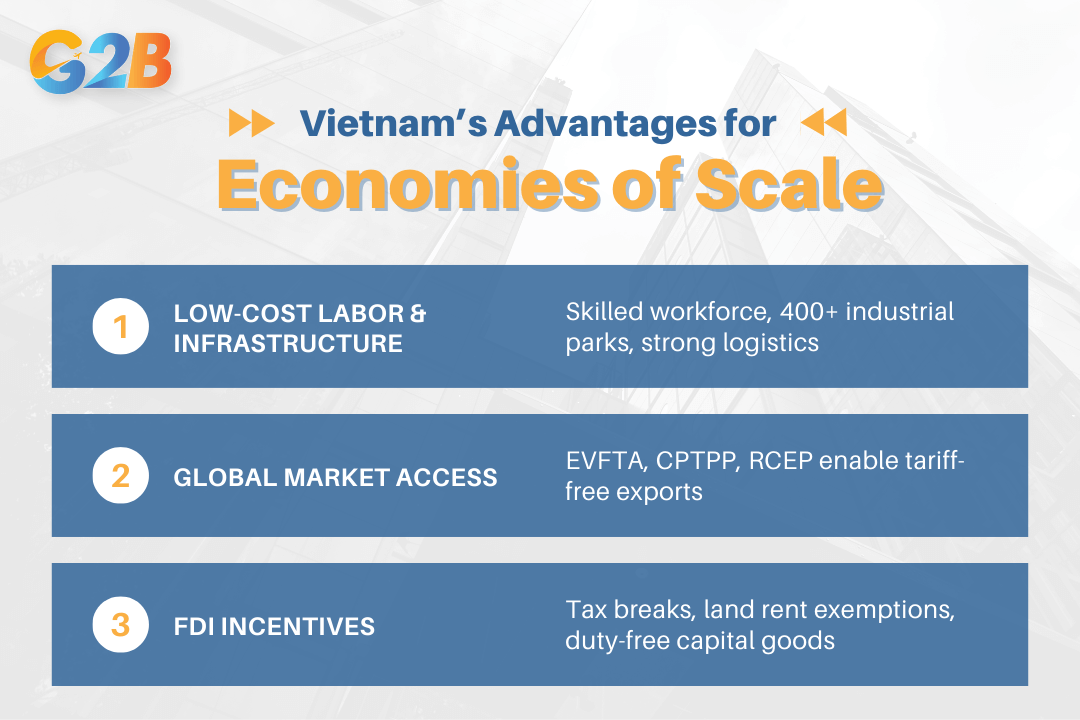

For businesses looking to scale internationally, Vietnam has emerged as a premier destination, offering a powerful combination of factors that directly enable cost efficiencies.

Competitive labor and industrial infrastructure

Vietnam provides a strong foundation for scalable manufacturing with its competitive labor costs, a young and increasingly skilled workforce, and robust infrastructure. The country is home to over 400 industrial parks with ready-built factories, reliable utilities, and streamlined logistics connections. In addition to industrial parks, ongoing improvements in transportation infrastructure and port facilities enhance supply chain efficiency, although some bottlenecks still remain. These parks are designed as ecosystems for production, allowing companies to set up quickly and benefit from established external economies of scale.

Access to global markets via trade agreements

Manufacturing in Vietnam provides a strategic gateway to the world's largest consumer markets. Vietnam's participation in major trade agreements, such as the EVFTA (EU-Vietnam Free Trade Agreement), CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership), and RCEP (Regional Comprehensive Economic Partnership), provides duty-free or reduced-tariff access to massive markets in Europe, the Americas, and Asia. This significantly reduces the cost of exporting finished goods, enhancing the price competitiveness of products made in Vietnam.

Government incentives for large-scale investors

The Vietnamese government actively encourages foreign direct investment (FDI) through a range of compelling incentives. In priority sectors like high-tech, renewable energy, and advanced manufacturing, the corporate income tax (CIT) rate can be as low as 10% for up to 15 years, which includes a period of full tax exemption followed by a 50% reduction. Furthermore, investors can benefit from exemptions on land rent and import duties for capital goods, directly lowering the fixed costs associated with setting up and running a large-scale operation.

How Vietnam enables economies of scale for foreign businesses

Explore the economies of growth of Vietnam

How to legally set up for scale in Vietnam

To operate legally and unlock these powerful benefits, foreign companies must complete a two-step registration process. The core requirement is obtaining the Investment Registration Certificate (IRC), which approves the investment project, followed by the Business Registration Certificate (ERC), which formally establishes the legal entity. This two-certificate system is the key to securing land use rights, qualifying for tax incentives, and building a fully compliant, scalable business.

Navigating the IRC and ERC process requires local expertise. Learn more about our foreign company setup services in Vietnam

Challenges entrepreneurs need to consider

While the rewards of scaling are significant, businesses must be aware of potential obstacles. Anticipating these challenges is the first step in overcoming them.

Management complexity

Rapid growth can strain a company's internal systems. Managing a larger, geographically dispersed team and a more complex production process requires robust financial, operational, and compliance frameworks. The solution is to invest in local compliance and operational support from the outset to ensure that your administrative backbone can handle the demands of growth without creating bureaucratic bottlenecks.

Geographic and regulatory barriers

Entering any new country involves navigating an unfamiliar regulatory landscape. While Vietnam allows 100% foreign ownership in most sectors, successfully navigating the IRC and ERC application process requires deep local knowledge. Without expert guidance, companies can face delays and compliance issues that stall their expansion plans.

Supply chain dependencies

Over-reliance on a single country or region for manufacturing creates supply chain vulnerabilities. A smart global expansion strategy involves diversification. Using Vietnam as a key manufacturing hub within a broader Southeast Asian footprint can mitigate risks and create a more resilient, cost-effective, and scalable supply chain for the long term.

Challenges entrepreneurs need to consider

FAQs about economies of scale

Q1: Can small businesses achieve economies of scale?

A: Yes, small businesses can achieve economies of scale through methods like outsourcing production to larger contract manufacturers, using third-party logistics (3PL) platforms to access shared warehousing and shipping networks, or joining industry purchasing cooperatives to buy raw materials in bulk, and utilizing supply chain clusters available in industrial zones.

Q2: Are economies of scale only for manufacturers?

A: No, service businesses also benefit. For example, a SaaS (Software-as-a-Service) company achieves economies of scale by spreading its initial software development costs over thousands of subscribers, while its per-user costs for cloud infrastructure and customer support decrease as it grows. Traditional service sectors like restaurant chains and hotels also benefit from economies of scale when expanding their operations.

Q3: What’s the difference between economies of scale and scope?

A: Economies of scale involve reducing the average cost by producing more of the same product. Economies of scope involve reducing the average cost by producing a variety of different but related products using the same resources, such as a single factory or distribution channel. They also help businesses diversify risk and optimize shared assets.

Economies of scale represent a fundamental law of business: growth, when managed correctly, creates powerful cost efficiencies. Successful scaling is not just about producing more; it is about building a strategic, compliant, and efficient foundation for growth. Executing flawlessly on the ground with an expert partner is what turns the powerful theory of economies of scale into a reality of sustainable profit.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom