Equity financing is a crucial method for businesses to raise capital by selling ownership stakes to investors. In exchange for cash, companies offer shares of their business, making the investors part-owners. This infusion of funds can be pivotal for various stages of a business's life, from a startup's initial needs to a mature company's expansion plans. This guide will delve into all facets of equity financing, providing a comprehensive overview for anyone looking to understand this fundamental aspect of business finance.

This article outlines the key aspects of equity financing to help businesses gain a clearer understanding of its mechanisms and implications. We specialize in company formation and do not provide financial advice. For financial matters, please consult a qualified legal or financial expert.

What is equity financing?

At its core, equity financing is the process of raising capital through the sale of shares. Companies, both private and public, utilize this method to secure funds for long-term projects and growth initiatives rather than short-term necessities like paying bills. Unlike debt financing, where money is borrowed and must be repaid with interest, equity financing does not create a repayment obligation. Instead, investors who purchase equity become shareholders and expect a return on their investment through profit sharing (dividends) or an increase in the company's value over time. Additionally, shareholders may obtain certain rights, such as voting power and influence in company decisions, depending on the class of shares held.

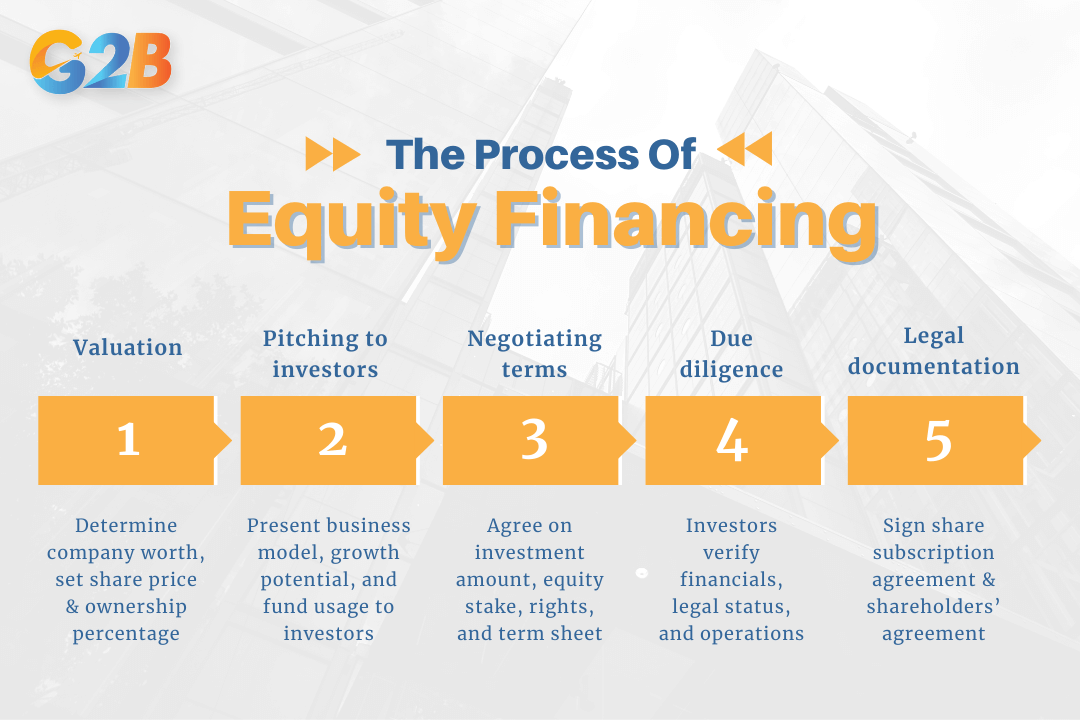

The process of equity financing

Securing equity financing is a multi-step process that requires careful planning and execution. The journey typically involves the following stages:

- Valuation: Before seeking investment, a company must determine its worth. This valuation will influence the price of the shares and the percentage of ownership offered to investors.

- Pitching to investors: Businesses create a compelling pitch to present to potential investors, outlining their business model, growth potential, and how the funds will be utilized.

- Negotiating terms: Once an investor expresses interest, a negotiation process begins. This involves agreeing on key terms such as the amount of investment, the equity stake, voting rights, and potential board seats. A crucial document in this stage is the "term sheet," which outlines the principal terms of the deal.

- Due diligence: Investors will conduct a thorough investigation of the company's financials, legal standing, and overall operations to verify the information presented.

- Legal documentation: The agreement is formalized through legally binding documents, most notably a Share Subscription Agreement and a Shareholders' Agreement. The former solidifies the investor's commitment to fund the company in exchange for shares, while the latter governs the relationship between the company and its shareholders.

The process of equity financing involves 5 stages

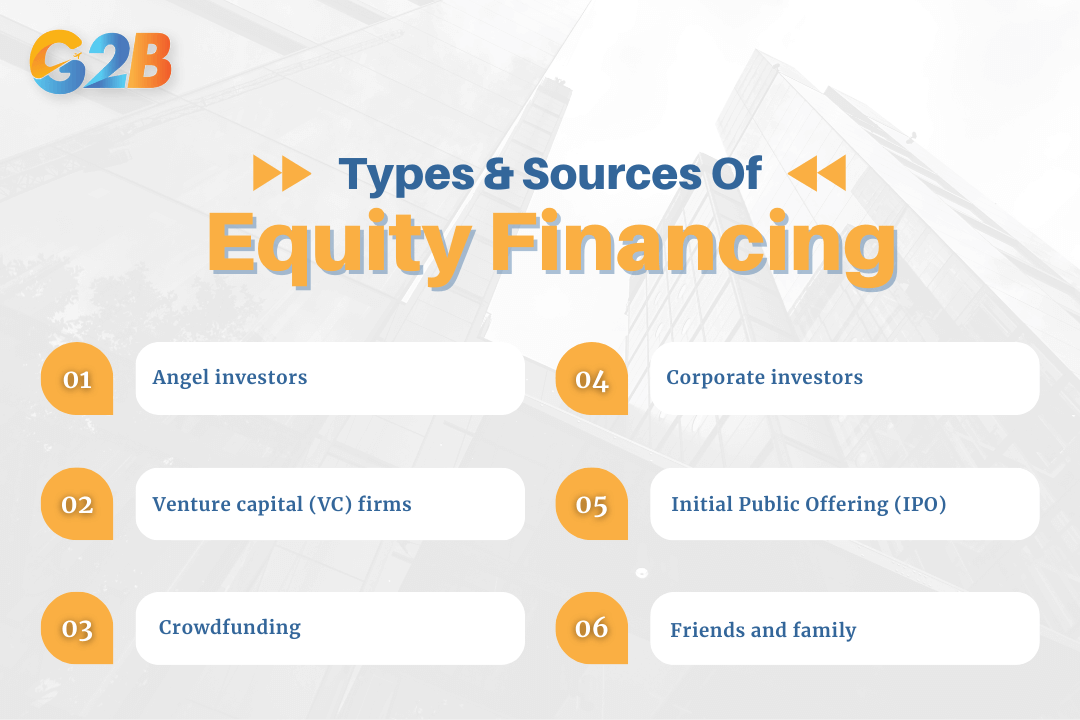

Types and sources of equity financing

Companies can tap into various sources for equity financing, depending on their stage of development and funding requirements. Key sources include:

- Angel investors: These are affluent individuals who provide capital to startups and early-stage businesses in exchange for an ownership stake. They often bring valuable industry expertise and mentorship to the table.

- Venture capital (VC) firms: These firms invest in young, high-growth potential companies using funds pooled from various sources. VCs typically invest larger amounts than angel investors and often take an active role in the company's management. Vietnam's VC market includes both domestic and foreign funds, with foreign VCs currently dominating investments, especially in technology, healthcare, and retail sectors. Corporate venture capital (CVC) is also increasingly significant among local conglomerates.

- Crowdfunding: This method involves raising smaller amounts of money from a large number of people, usually through online platforms. It allows the general public to invest in private companies. However, in Vietnam, crowdfunding remains limited due to undeveloped legal frameworks and market acceptance.

- Corporate investors: Established corporations may invest in smaller companies for strategic purposes, such as gaining access to new technologies or markets.

- Initial Public Offering (IPO): This is the process where a private company offers its shares to the public for the first time, allowing it to be traded on a stock exchange. An IPO can raise significant capital for expansion and development. Vietnam’s stock market has become a vital channel for capital raising, governed by strict regulatory oversight to ensure transparency and investor protection.

- Friends and family: For many startups, the initial round of funding comes from the personal networks of the founders.

There are 6 key sources of equity financing

Explore the differences between Angel investors and Venture capital

Funding rounds explained

Equity financing often occurs in distinct stages known as funding rounds, each corresponding to a different phase of the company's growth:

- Pre-seed and seed funding: These are the earliest stages, where the capital is used to develop a business idea, build a prototype, and conduct initial market research.

- Series A, B, and C Funding: As a company matures and demonstrates a track record of growth, it can seek subsequent rounds of funding. Series A is typically for optimizing a user base and product offering. Series B is for scaling the business, and Series C is for further expansion, often into new markets.

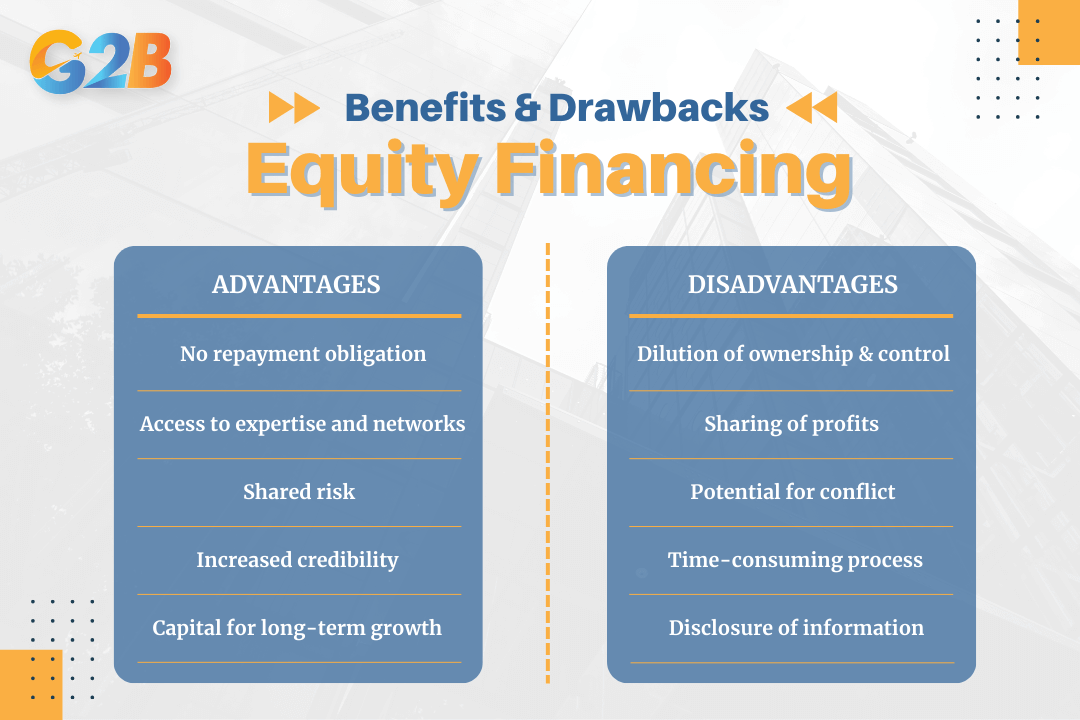

Advantages and disadvantages of equity financing

While equity financing offers significant benefits, it also comes with potential drawbacks that businesses must carefully consider.

Advantages:

- No repayment obligation: The most significant advantage is that the funds raised do not need to be repaid, which can be particularly beneficial for early-stage companies without a steady cash flow.

- Access to expertise and networks: Investors, especially angel investors and venture capitalists, often provide valuable guidance, mentorship, and access to their networks, which can be instrumental for a company's growth.

- Shared risk: By selling ownership stakes, the financial risk is shared with the investors.

- Increased credibility: Securing funding from reputable investors can enhance a company's credibility and attract further investment and customers.

- Capital for long-term growth: Equity financing provides the necessary capital for significant, long-term projects and expansion.

Disadvantages:

- Dilution of ownership and control: The primary drawback is that founders and existing shareholders have their ownership percentage reduced, which can lead to a loss of control over the company's decisions.

- Sharing of profits: Investors become entitled to a share of the company's future profits.

- Potential for conflict: Disagreements can arise between founders and investors regarding the company's direction and strategy.

- Time-consuming and complex process: The process of raising equity finance can be lengthy and demanding, requiring significant management time and resources.

- Disclosure of information: Companies are required to share sensitive business information with potential investors during the due diligence process.

Equity financing comes with significant benefits and potential drawbacks

Equity financing vs. Debt financing

The alternative to equity financing is debt financing, which involves borrowing money that must be repaid with interest. The key differences are:

| Feature | Equity financing | Debt financing |

|---|---|---|

| Repayment | No obligation to repay the principal amount. | Principal and interest must be repaid on a set schedule. |

| Ownership | Founders give up a portion of ownership and control. | Founders retain full ownership and control. |

| Risk | Investors share the risk with the business owners. | The business owner bears the full risk of repayment. |

| Investor relationship | Investors become long-term partners in the business. | The relationship with the lender typically ends once the loan is repaid. |

Explore more information about business funding options

Legal and regulatory aspects

Equity financing is subject to a complex legal and regulatory framework. Key legal considerations include:

- Securities laws: Companies must comply with securities laws and regulations, such as the Securities Act of 1933 and the Securities Exchange Act of 1934 in the United States, which govern the issuance and sale of securities.

In Vietnam, equity financing is governed by the Securities Law and regulations issued by the State Securities Commission (SSC), including recent updates on foreign ownership limits, private placements, and public offerings aimed at enhancing transparency and investor protection. - Shareholder agreements: These legally binding contracts outline the rights and obligations of shareholders and are crucial for governing the relationship between them and the company. In the Vietnamese context, shareholder agreements often override company charter bylaws to regulate investor rights and conflict resolution better.

- Intellectual property protection: Startups need to ensure their intellectual property is protected before engaging with potential investors. Vietnam’s Intellectual Property Law provides mechanisms to register and protect IP rights critical for investor confidence.

- Compliance and disclosure: Companies have ongoing obligations to provide investors with certain information and to comply with reporting requirements. Vietnamese companies must comply with strict reporting regimes, including recent obligations on beneficial ownership disclosure under the Amended Law on Enterprises 2025.

Equity financing is a powerful tool for businesses to access the capital needed for growth and innovation. By understanding its various forms, processes, and the inherent advantages and disadvantages, entrepreneurs can make informed decisions about whether this funding path is the right choice for their venture and foundational steps like register a company in Vietnam. Careful planning, thorough due diligence, and expert legal advice are essential for a successful equity financing journey.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom