Capital structure defines how a company finances its operations and growth through a mix of debt, equity, and retained earnings. A well-structured balance not only ensures financial stability but also influences profitability, risk exposure, and long-term competitiveness. This article explores the definition, key components, strategic role, and practical approaches to optimizing capital structure for sustainable business success.

This article outlines the key aspects of capital structure to provide entrepreneurs with a clearer understanding. We specialize in company formation and do not provide legal or financial consulting services. For personalized guidance or compliance-related matters concerning capital structure, please seek advice from a qualified legal or financial professional.

What is capital structure?

The capital structure is the specific long-term mix of debt and equity a company uses to finance its assets and overall operations. This financial term essentially describes the source of funds used to operate the business. Every company, from a tech startup to a multinational corporation, must make strategic decisions about how to fund its activities, and these decisions form the foundation of its financial health and sustainability, affecting the company's cost of capital, financial risk, and control.

The two primary pillars of any capital structure are:

- Debt: This represents borrowed money that must be repaid over time, usually with interest. Common forms include financial instruments like bank loans and corporate bonds.

- Equity: This represents ownership in the company. It is capital raised from investors who, in return, receive a stake in the company's future profits and assets. This includes funds from issuing shares and retained earnings, which are profits reinvested back into the business rather than distributed to shareholders.

Understanding the 2 pillars of capital structure is the first step in a sound corporate finance strategy

Understanding capital structure is not only essential for managing finances effectively but also for laying the foundation of a successful business. For entrepreneurs looking to establish or expand their presence in dynamic markets, Vietnam offers a wealth of opportunities thanks to its growing economy, investor-friendly policies, and competitive business environment. Setting up a company in Vietnam can be the first step toward optimizing your capital structure while unlocking access to one of Asia’s most promising markets.

Key components of capital structure

A company’s capital structure is built from various financial instruments, each with unique characteristics. These can be broadly categorized into debt and equity instruments. Understanding these components is essential for analyzing a company's financial risk.

Debt instruments

Debt financing involves borrowing funds that a company is obligated to repay within a specified period, along with interest payments. However, some debt instruments may be revolving or without a fixed maturity date. A company can utilize several debt instruments, such as long-term bank loans, publicly issued corporate bonds, and short-term credit lines. While it introduces financial risk due to fixed repayment obligations, it also offers benefits like tax-deductible interest payments.

Popular types of debt instruments include:

- Bank loans: Direct borrowing from financial institutions, which can be short-term or long-term.

- Corporate bonds: Debt securities sold to investors on the open market. The company pays periodic interest (coupon payments) to bondholders and repays the principal amount at maturity.

- Short-term debt: Includes credit lines and commercial papers used to finance daily operations and working capital needs.

Equity instruments

Equity financing involves selling ownership stakes in the company to investors. Unlike debt, there is no repayment obligation, but it dilutes the ownership of existing shareholders. Various equity instruments are used to raise capital, such as common stock, preferred stock, and retained earnings.

Popular types of equity instruments include:

- Common shares (common stock): Represent a direct ownership stake in the company and typically come with voting rights, allowing shareholders to influence corporate decisions.

- Preferred shares (preferred stock): A hybrid security that combines features of both debt and equity. Holders usually receive fixed dividends before common shareholders but may have voting rights under certain conditions, such as when dividends are in arrears.

- Retained earnings: The portion of a company's profit that is held or "retained" for reinvestment in the business rather than being paid out as dividends to shareholders. It is an internal source of equity financing and not capital raised from external investors.

Key measurement indicators

To analyze and compare capital structures, specific financial ratios are used. These metrics provide a quick snapshot of a company's reliance on debt and help assess financial risk and cost of capital.

- Debt-to-equity ratio (D/E): This is a primary indicator that compares a company's total debt to its total shareholders' equity. A D/E ratio of 1.0 means the company is financed by an equal amount of debt and equity. A higher ratio indicates greater reliance on debt, or leverage.

- Debt-to-assets ratio: This ratio measures the proportion of a company's assets that are financed through debt. It is calculated by dividing total debt by total assets. For example, a ratio of 0.4 signifies that 40% of the company's assets are funded by debt.

Illustrative example of capital structure

To make the concept of capital structure more tangible, let's consider a simple numerical example: Imagine Company A has a total capital of VND 5 billion to fund its operations. This capital is composed of:

- Debt: VND 2 billion (raised through a long-term bank loan).

- Equity: VND 3 billion (raised from selling shares to investors).

To analyze Company A's capital structure, we first determine the proportion of each component:

- Percentage of debt: (VND 2 billion / VND 5 billion) * 100 = 40%

- Percentage of equity: (VND 3 billion / VND 5 billion) * 100 = 60%

Next, we can calculate the Debt-to-equity (D/E) ratio:

- Debt-to-equity ratio: VND 2 billion / VND 3 billion = 0.67

This means that for every VND 1 of equity, Company A has VND 0.67 of debt. This example clearly shows that Company A has a capital structure comprising 40% debt and 60% equity, with a D/E ratio of 0.67. This is a relatively conservative structure, suggesting a lower reliance on borrowed funds.

Comparing the advantages and disadvantages of debt and equity

Choosing between debt and equity financing is a fundamental strategic decision that involves a series of trade-offs. Each funding source carries its own set of benefits and drawbacks that can significantly impact a company's cost of capital, risk profile, and control.

| Feature | Debt financing | Equity financing |

|---|---|---|

| Cost | Generally lower cost. Interest payments are typically tax-deductible, creating a "tax shield." | Higher cost. Investors demand a higher return to compensate for greater risk, and dividends are not tax-deductible. |

| Risk | A high proportion of debt increases financial risk due to fixed interest payment obligations, which can lead to bankruptcy if the business underperforms. | Lower financial risk. There is no legal obligation to pay dividends, providing more flexibility during financial downturns. |

| Control | No dilution of ownership. Lenders do not gain voting rights or control over the company's strategic decisions. | Dilution of ownership. New shareholders gain an ownership stake and, typically, voting rights, which can reduce the control of existing owners. |

| Tax benefits | Interest payments on debt are tax-deductible, which lowers the company's taxable income and overall tax liability. | No direct tax benefits. Dividend payments to shareholders are made from after-tax profits. |

| Flexibility | Less flexible. Debt comes with contractual obligations (covenants) and fixed repayment schedules that must be met regardless of business performance. | More flexible. There are no mandatory payments, giving the company more room to reinvest earnings and manage cash flow. |

Role and importance of capital structure

The decision of how to structure capital is one of the most critical choices a company's management makes. It's not merely a financial exercise; it's a strategic decision that reverberates through every aspect of the business, from profitability to risk management. A well-managed capital structure is the backbone of a company's financial strategy. Here are the key roles and the importance of capital structure:

- Optimizing the cost of capital: A primary goal of capital structure management is to minimize the Weighted Average Cost of Capital (WACC). WACC is the average rate a company pays to finance its assets, blending the costs of both debt and equity. It is calculated based on the total capital employed by the company (both debt and equity). A lower WACC increases the present value of future cash flows, thereby enhancing the company's value.

- Maximizing enterprise value and shareholder wealth: The ultimate objective is to find the capital mix that maximizes the market value of the company. By lowering the WACC, a company can generate higher returns for its investors, leading to an increase in its stock price and overall enterprise value, which is reflected in market capitalization and credit ratings.

- Balancing risk and return: Capital structure decisions directly influence a company's risk profile. While debt can amplify returns on equity (a concept known as financial leverage), it also increases the risk of financial distress if the company cannot meet its interest payments. An optimal structure finds the right equilibrium between risk and return that aligns with the company's strategic goals and industry characteristics, ensuring leverage is used prudently to avoid excessive financial risk.

- Enhancing financial flexibility: A well-planned capital structure provides the flexibility to seize growth opportunities as they arise, whether it's funding a new project, acquiring another company, or navigating an economic downturn. It ensures the company can access capital when needed without being overly constrained by high debt loads.

- Signaling to the market: A company's financing choices send signals to investors and creditors. A stable and prudent capital structure can boost investor confidence, improve creditworthiness, and lower the cost of future borrowing.

There are 5 key roles of capital structure

Factors affecting capital structure

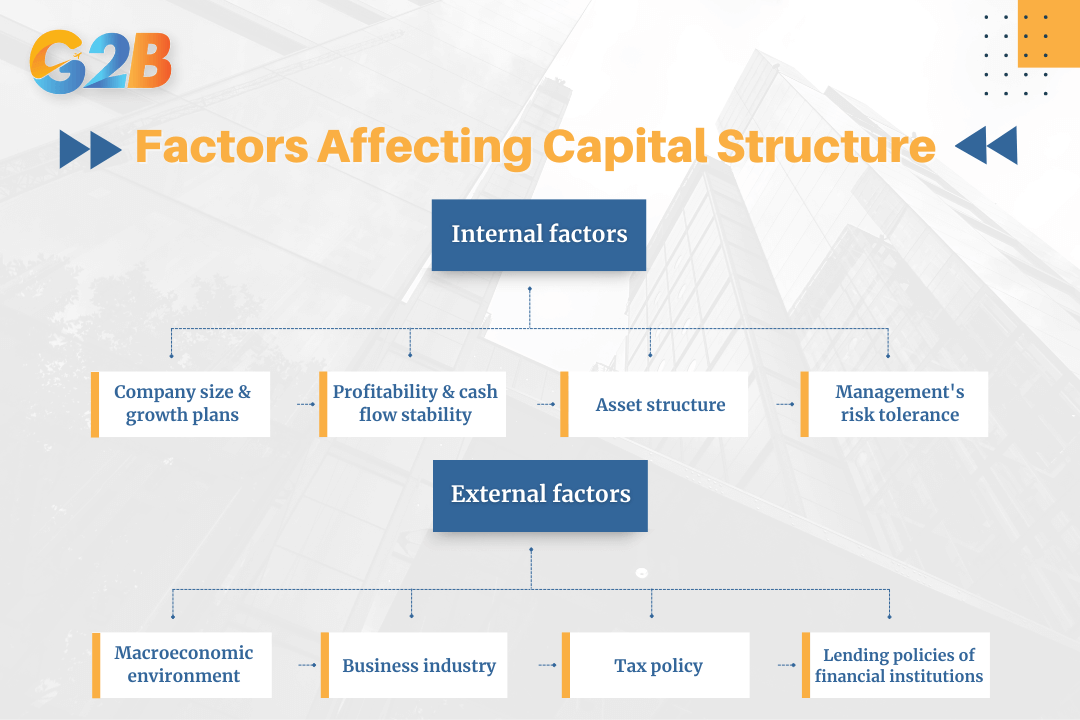

A company's capital structure is not decided in a vacuum. It is influenced by a dynamic interplay of internal and external factors that management must continuously evaluate.

- Internal factors

- Company size and growth plans: Larger, more established companies often have easier access to debt markets and can borrow at lower rates. Conversely, rapidly growing companies may rely more on equity to fund expansion without being burdened by debt repayments.

- Profitability and cash flow stability: Companies with high profitability and stable, predictable cash flows are better positioned to handle debt obligations. This stability reduces the risk of default, making them attractive to lenders.

- Asset structure: Firms with a high proportion of tangible assets, like real estate or machinery, can use these assets as collateral to secure cheaper debt financing. The type, quality, and proportion of collateralizable assets influence borrowing capacity and terms. Companies with mostly intangible assets, such as software firms, may find it harder to borrow.

- Management's risk tolerance: The leadership's attitude towards risk plays a significant role. A risk-averse management team may prefer a conservative structure with less debt, while a more aggressive team might use leverage to amplify returns.

- External factors

- Macroeconomic environment & market conditions: The state of the economy and capital markets is a crucial factor. During periods of low interest rates, debt financing becomes more attractive. In contrast, when stock markets are bullish, issuing equity can be a more effective way to raise capital.

- Business industry: Industry norms often dictate capital structure. For example, capital-intensive industries like utilities or telecommunications tend to have higher leverage ratios due to their stable revenue streams and large asset bases.

- Tax policy: Government tax policies have a direct impact. Since interest payments on debt are generally tax-deductible, a higher corporate tax rate makes debt financing more appealing because the value of the "tax shield" is greater.

- Lending policies of financial institutions: The willingness of banks and other creditors to lend money, and the terms they offer, including interest rates, covenants, and collateral requirements, can either facilitate or constrain a company's ability to use debt financing.

There are internal factors and external factors affecting capital structure

Capital structure is far more than just a mix of numbers on a balance sheet; it is the financial engine that drives a company's ability to operate, grow, and create value. The decision to use debt or equity involves a delicate balancing act between cost, risk, and control. From the foundational components of debt and equity instruments to the strategic goal of finding an optimal mix that minimizes the cost of capital, every aspect of capital structure management is critical to long-term success.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom