A global recession is a period of widespread economic decline that simultaneously affects multiple countries around the world. In an increasingly interconnected world, economic shocks in one region can rapidly spread across the globe, affecting businesses, consumers, and financial markets worldwide. Understanding the dynamics of a global recession is no longer just for economists; it's essential knowledge for strategic business planning and sound personal finance.

This article explains the key concepts of a global recession, helping businesses and investors gain a clearer understanding of it. We specialize in company formation but not in macroeconomic forecasting or crisis-management consulting. For technical guidance on recession analysis or economic modeling, please consult a qualified economist or financial expert.

What is a global recession?

A global recession is a extended period of significant economic decline affecting many countries at the same time. Unlike a national recession, which is often identified by two consecutive quarters of negative Gross Domestic Product (GDP) growth, there isn't one single, universally accepted definition for a global recession. However, major international bodies like the International Monetary Fund (IMF) and the World Bank provide authoritative frameworks for its identification.

The IMF and the World Bank define a global recession as a year in which the annual real world GDP per capita contracts. This downturn is confirmed by a broad decline in other key economic indicators such as industrial production, international trade, capital flows, oil consumption, and employment. A global recession typically involves a rise in unemployment and increased policy uncertainty. It's this synchronized, widespread nature that distinguishes a global event from a localized one. Economic shocks and recessions are transmitted globally through interconnected trade and international financial systems, causing synchronized contraction across multiple national economies. Therefore, a global recession isn't just about a few large economies struggling; it's a shared downturn where multiple national economies are contracting in unison.

Characteristics of a global recession

Identifying a global recession involves looking beyond a single data point to a collection of interconnected economic signals. These characteristics paint a picture of a broad and synchronized downturn.

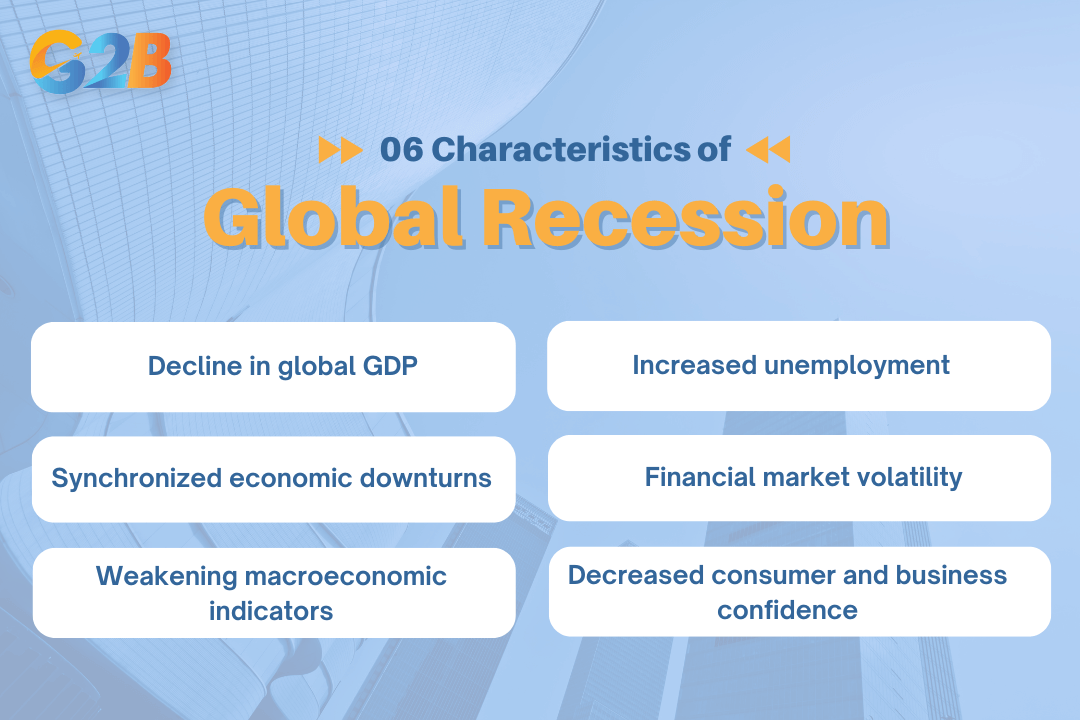

06 Characteristics of a global recession

Here are the key features that signify a global recession:

- Decline in global GDP: The most fundamental characteristic is a contraction in the world's real GDP per capita. This indicates that, on average, people around the globe are producing and earning less.

- Synchronized economic downturns: A global recession involves recessions occurring simultaneously across many interconnected national economies. This high degree of international synchronicity is a defining feature, especially in more recent recessions, reflecting stronger global trade and financial links.

- Weakening macroeconomic indicators: There is a broad-based weakening of multiple key indicators of global economic activity. This includes significant declines in industrial production, international trade volumes, cross-border capital flows, oil consumption, and employment rates. This often impacts an emerging market economy more severely due to capital flight.

- Increased unemployment: As businesses face reduced demand and cut costs, unemployment rates tend to rise across many countries. This rise in joblessness further dampens consumer spending, creating a negative feedback loop.

- Financial market volatility: Global recessions are often accompanied by significant turbulence in financial markets. This can manifest as sharp declines in stock markets, a "flight to safety" where investors move capital to less risky assets, and tightening credit conditions as lenders become more cautious.

- Decreased consumer and business confidence: Widespread economic uncertainty leads to a sharp drop in both consumer and business confidence. Consumers delay large purchases, and businesses postpone investments and hiring, further slowing business activities. Alongside confidence, policy uncertainty typically increases during global recessions, further dampening economic activity.

Impact of a global recession

A global recession creates a challenging environment that reverberates through every level of the economy, from large multinational corporations to individual households. The effects are interconnected, as weakness in one area often exacerbates problems in another.

03 Main impact of a global recession

Impact on businesses

Businesses face numerous challenges during a global recession, primarily driven by reduced demand and financial uncertainty. Key impacts include:

- Reduced consumer spending and lower profits: As households tighten their belts, businesses experience a significant drop in sales and revenue. This is especially true for cyclical industries like manufacturing and tourism.

- Disrupted supply chains and bloated inventories: A slowdown in global trade can disrupt supply chain management for businesses, while falling demand can lead to manufacturers facing bloated inventories, forcing them to cut production.

- Tighter access to credit: Financial institutions become more cautious, making it more difficult for businesses to secure loans and lines of credit. Interest rates may rise, and lending requirements often become stricter.

- Pressure to cut costs: To survive, companies are often forced to implement cost-cutting measures. These can include layoffs, reducing capital spending, and slashing budgets for marketing and research.

Impact on consumers

Individuals and households feel the impact of a global recession directly through their finances and job security. The primary effects are:

- Job insecurity and unemployment: Rising unemployment is a hallmark of recessions. Many people face job losses or wage stagnation, which directly impacts their ability to spend.

- Decreased wealth: Declines in the stock market and real estate values directly impact household wealth and retirement savings.

- Reduced purchasing power: Even for those who remain employed, high inflation can erode purchasing power, meaning their income buys less than before.

- Psychological impact: The financial strain and uncertainty of a recession can lead to significant stress and anxiety for individuals and families.

Impact on financial markets

Financial markets often act as a barometer for the health of the global economy and are highly sensitive during a recession. The typical impacts include:

- Stock market downturns: Recessions often coincide with bear markets, which are defined as market declines of 20% or more. Investor pessimism about future corporate earnings drives stock prices down.

- Flight to safety: In times of uncertainty, investors tend to sell riskier assets like stocks and move their capital into safer investments, such as government bonds.

- Credit crunch: The tightening of lending standards by banks and other financial institutions can lead to a "credit crunch," where it becomes harder for both businesses and consumers to borrow money. This further constricts economic activity.

Strategies to overcome the global recession

While a global recession presents significant hurdles, it does not have to be a period of paralysis. Proactive and strategic actions can help both businesses and individuals not only survive but also emerge stronger.

Strategies to overcome the global recession

For businesses

For business owners, a recession is a critical time to focus on resilience and efficiency. The following checklist can serve as a guide:

- Protect and manage cash flow: In a recession, cash is king. Businesses should focus on several key areas, such as effective cash flow management and revising their financial plan. This includes implementing rigorous budgeting, monitoring cash flow weekly, and managing accounts receivable and payable diligently.

- Cut costs strategically: Audit all expenses to eliminate waste, such as unused software subscriptions or inefficient processes. However, be cautious not to cut costs that are crucial for revenue generation, like marketing and customer retention.

- Seek alternative funding: Explore options like a business grant or government assistance programs designed to support distressed industries.

- Nurture your existing customer base: Acquiring new customers is more difficult during a downturn. Focus on providing exceptional service to your loyal customers to retain their business. Their loyalty can provide a stable revenue stream.

- Diversify revenue streams: Relying on a single product or market is risky. Explore opportunities to add complementary products or services to create multiple streams of income.

- Embrace innovation and adaptability: A recession can be an opportunity to pivot. Stay close to your customers to understand their changing needs and be willing to adjust your business model to meet them.

For individuals

For individuals, the focus should be on building a strong financial foundation to weather the economic storm. Key personal finance strategies include:

- Build a substantial emergency fund: Aim to save three to six months' worth of essential living expenses in an easily accessible account. This fund can cover unexpected job loss or other emergencies without forcing you into debt.

- Prioritize paying down high-interest debt: Focus on aggressively paying off high-interest debts, such as credit card balances. Reducing these obligations frees up cash flow and reduces financial risk.

- Review your budget and cut non-essential spending: Carefully track your income and expenses to identify areas where you can reduce discretionary spending. Prioritize needs over wants.

- Stay invested (if possible): While it can be tempting to sell investments during a market downturn, history shows that markets tend to recover. If your financial situation allows, continuing to invest through strategies like dollar-cost averaging can be beneficial long-term.

- Assess your career and skills: Use this time to evaluate your career path and consider upskilling or diversifying your expertise to enhance your employability. Exploring side hustles for additional income can also increase financial resilience.

Historical examples of global recessions

Understanding past global recessions provides valuable context, showing that while each event is unique, they are a recurring part of the global economic cycle. Over the past seven decades, the world economy has experienced four major global recessions prior to the COVID-19 pandemic: 1975, 1982, 1991, and 2009, characterized by synchronized declines in real per capita GDP (PPP-weighted) accompanied by downturns in key economic indicators.

- The 1975 Oil shock recession: This recession was primarily triggered by a global supply shock. In 1973, the Organization of Petroleum Exporting Countries (OPEC) imposed an oil embargo, causing oil prices to quadruple. This led to "stagflation" - a combination of stagnant economic growth and high inflation - in many developed countries.

- The 1982 Debt crisis: The 1982 recession was driven by a combination of factors. It followed a second major oil shock in 1979 and was exacerbated by tight monetary policies in advanced economies to combat inflation, which led to a debt crisis in many Latin American countries.

- The 1991 Post-cold war recession: This downturn resulted from a confluence of events, including the geopolitical uncertainty following the Gulf War and the collapse of the Soviet Union, a credit crunch in the United States, and issues within the European Monetary System.

- The 2009 Great recession: By far the deepest and most synchronized of the post-war recessions, this crisis was set off by the global financial crisis that originated in the U.S. subprime mortgage market. The collapse of major financial institutions led to a severe credit crunch and a plunge in world trade of over 15% between 2008 and 2009. Governments responded with massive stimulus packages, showcasing the power of aggressive fiscal policy to mitigate damage.

- The 2020 COVID-19 recession: The most recent global recession was triggered by economic shutdowns in response to the global pandemic. This event was unique in its speed and its origins in a public health crisis rather than a purely financial one, and it is recognized by the IMF as a global recession with an unprecedented rapid worldwide economic contraction.

A global recession is a complex and challenging phenomenon, characterized by a synchronized contraction of economies worldwide. Its impacts affect businesses, consumers, and financial markets, but downturns are cyclical. As companies plan for recovery and long-term growth, some consider new opportunities abroad, including the option to register a company in Vietnam to diversify operations.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom