Types of companies in Vietnam vary significantly in terms of liability, capital structure, and operational complexity, requiring investors to navigate the legal framework of the Enterprise Law 2020 with precision. Choosing the correct corporate structure is the foundational step for any business entity, whether you are a foreign investor seeking market entry, a tech startup planning for future capital fundraising, or a local entrepreneur establishing a family business. The decision dictates your tax obligations, management hierarchy, and the extent of your personal financial risk. Let’s explore the 11 distinct types of companies recognized under Vietnamese law in this article.

1. Single-member limited liability company (LLC)

The Single-Member Limited Liability Company (LLC) is the most common entity structure for foreign investors and local entrepreneurs who desire complete control over their business operations. As defined by the Enterprise Law, this entity is owned by a single organization or individual.

The defining characteristic of this structure is the separation between the owner and the entity. The owner is liable for the company’s debts and other property obligations only to the extent of the charter capital stated in the company's charter. This structure provides a crucial safety net for the investor's personal assets.

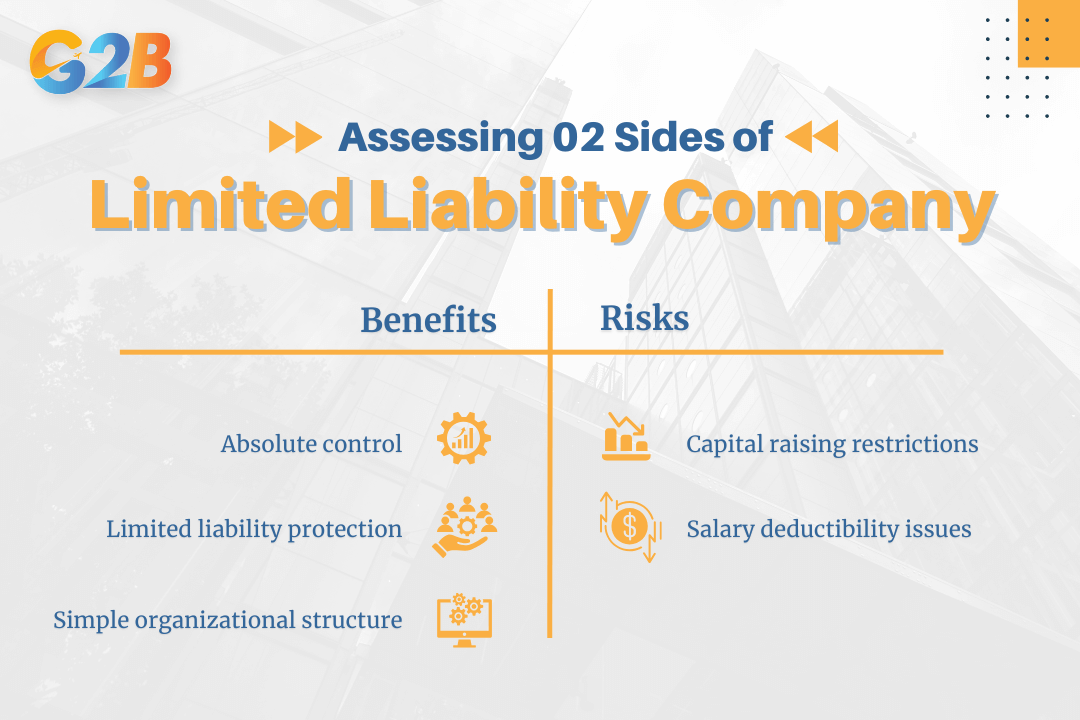

Advantages of a single-member LLC

- Absolute control: The owner holds full decision-making power regarding the company's organizational structure, business strategy, and profit allocation. There is no need to convene a Members' Council or seek consensus from partners, streamlining the administrative process.

- Limited liability protection: The owner's financial risk is strictly limited to the amount of capital they have contributed. Personal assets, such as real estate, private savings, and vehicles, remain protected from creditors in the event of bankruptcy.

- Simple organizational structure: The management hierarchy is flexible. The owner can appoint a Legal Representative or serve in that capacity themselves, reducing the complexity of corporate governance compared to a Joint Stock Company.

Disadvantages of a single-member LLC

- Capital raising restrictions: A Single-member LLC cannot issue shares to the public. If the company requires significant capital expansion, the owner must either increase their own capital contribution or convert the entity into a Multi-Member LLC or a Joint Stock Company to admit new investors.

- Salary deductibility issues: Under current Vietnamese tax regulations, the salary paid to the owner (if they are an individual) is generally not considered a deductible expense for Corporate Income Tax (CIT) purposes, potentially increasing the tax burden.

The LLC is the most common entity structure for foreign investors

Before deciding, you might want to compare the LLC vs Sole Proprietorship to see which one offers better asset protection for your specific case.

2. Multi-member limited liability company (LLC)

A Multi-member Limited Liability Company is an enterprise comprised of at least two members but no more than 50. The members can be organizations or individuals. This structure is ideal for small to medium-sized enterprises (SMEs) where a few trusted partners wish to pool resources while maintaining a closed ownership circle. In this model, the Members' Council is the highest decision-making body, comprising all capital-contributing members. The voting power and profit distribution are directly proportional to the capital contribution ratio of each member.

Advantages of a multi-member LLC

- Shared financial burden: By pooling capital from multiple sources, the business can launch with stronger financial health. The risk is distributed among members, rather than falling on a single individual.

- Diverse management expertise: The company benefits from the combined skills, networks, and management experience of multiple members, which enhances decision-making quality.

- Limited liability: Similar to the Single-Member LLC, all members are liable only up to the value of their capital contribution.

- Restricted share transfer: Members typically have the right of first refusal on capital transfers. However, transfers to non-members are allowed if existing members do not exercise their preemptive rights or fail to meet the required approval ratio (per Article 52, Enterprise Law 2020). This prevents hostile takeovers and ensures that outsiders cannot enter the company without the consent of existing members.

Disadvantages of a multi-member LLC

- Management friction: Decision-making can become slow or contentious if members disagree on strategic direction. The Enterprise Law requires specific voting thresholds for passing resolutions, which can lead to deadlocks.

- Membership cap: The law strictly limits the entity to 50 members. If the company grows and requires a broader investor base, it must undergo a complex conversion process into a Joint Stock Company.

- No public shares: Like the Single-member LLC, this entity cannot issue shares to the public or list on the stock exchange.

3. Joint stock company (JSC)

The Joint Stock Company (JSC) is the only legal entity in Vietnam capable of issuing shares and listing on the stock market. It requires at least three shareholders, with no maximum limit. Shareholders can be individuals or organizations, known as founding shareholders during the initial setup. The JSC is the preferred vehicle for large-scale projects, high-growth startups intending to IPO, and businesses requiring substantial capital mobilization. It involves a distinct separation between ownership (shareholders) and management (Board of Directors).

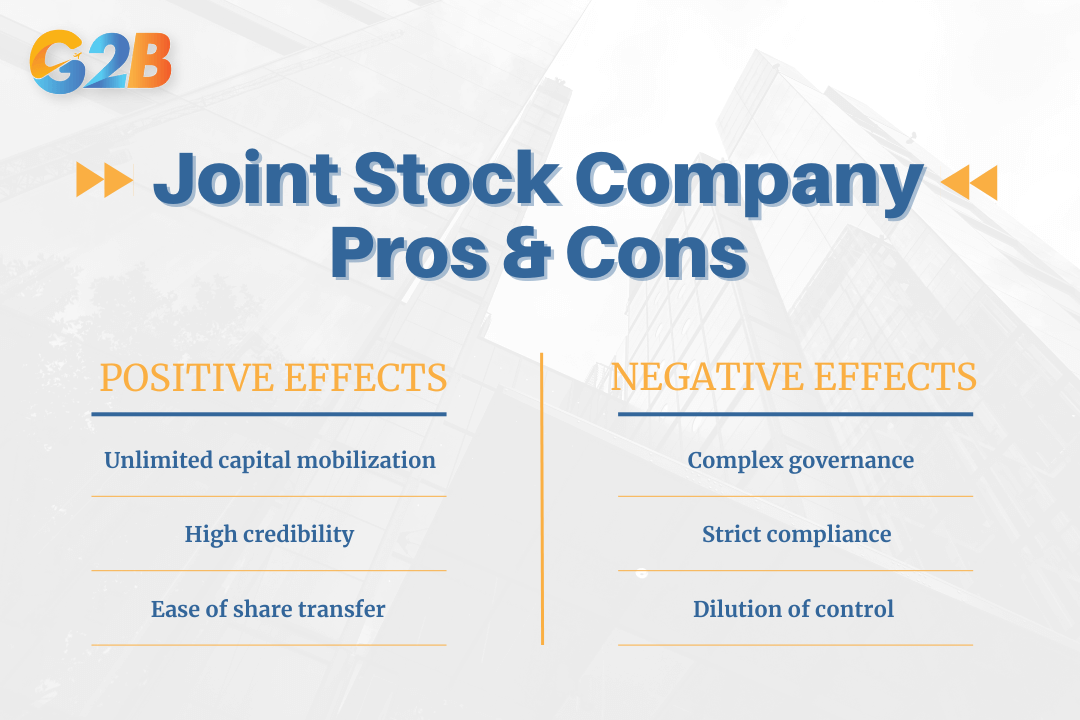

Advantages of JSC

- Unlimited capital mobilization: The JSC can raise capital flexibly by issuing various classes of shares (ordinary shares, dividend preference shares) and equity financing. This is the only structure allowed to list on the Ho Chi Minh City Stock Exchange (HOSE) or the Hanoi Stock Exchange (HNX).

- High credibility: Due to stricter reporting and governance requirements, JSCs often enjoy higher credibility with banks, partners, and the Department of Planning and Investment (DPI).

- Ease of share transfer: Unlike LLCs, shareholders in a JSC can freely transfer their shares to others (except that founding shareholders are restricted from transferring more than 50% of their ordinary shares within the first 3 years after establishment, per Article 119.3, Enterprise Law 2020), providing high liquidity for investors.

Disadvantages of JSC

- Complex governance: The JSC must maintain a rigorous structure, including a General Meeting of Shareholders, a Board of Directors, a Supervisory Board, and a Director/General Director. This results in higher administrative costs.

- Strict compliance: JSCs face stringent financial reporting and disclosure requirements to ensure transparency for shareholders, particularly if they are public companies.

- Dilution of control: As new shares are issued to raise capital, the original founders' ownership percentage and voting power decrease, potentially leading to a loss of control.

The JSC requires a minimum of three shareholders with no maximum limit

4. Partnership company

A Partnership Company is a legal entity requiring at least two general partners (must be individuals) who are the co-owners of the company, and may optionally include limited partners (capital contributing members). The company may also have limited partners. This structure relies heavily on the personal reputation and professional qualifications of the general partners. It is commonly used for professional service firms such as law firms, auditing firms, and medical practices.

Advantages of partnership

- Professional trust: Because general partners have unlimited liability, this structure signals a high level of commitment and personal responsibility to clients, enhancing professional prestige.

- Operational independence: General partners manage the company directly and have decision-making rights proportional to their capital contribution (per Article 180, Enterprise Law 2020), fostering a collaborative environment.

- Ease of management: The structure is less bureaucratic than a JSC, with fewer reporting formalities.

Disadvantages of partnership

- Unlimited liability (high risk): General partners are liable for the company's debts with their entire personal property. This is the most significant risk factor.

- Limited partners: Limited partners contribute capital and are only liable up to their contribution, but they have no voice in the management of the company.

- Restricted capital raising: Partnerships cannot issue shares, limiting their ability to scale rapidly compared to JSCs.

5. Private enterprise (sole proprietorship)

A Private Enterprise is a business owned by a single individual who is liable for all activities of the enterprise with their entire personal assets. It is not considered a legal entity (juridical person) under Vietnamese law because it lacks separation between the owner's assets and the business's assets.

Advantages of private enterprise

- Total autonomy: The owner has absolute authority over all business activities.

- Minimal compliance: This structure has the simplest registration and operational procedures, resulting in low administrative overhead.

- Tax simplicity: The enterprise is not subject to separate corporate tax in the same way; income is often treated as personal income for the owner.

Disadvantages of private enterprise

- Unlimited liability: The owner faces total financial exposure. If the business fails, creditors can seize the owner's home, savings, and other personal assets.

- No legal personality: The enterprise cannot be a plaintiff or defendant in court in its own name; the individual owner must take on this role.

- Capital constraints: A private enterprise cannot issue any form of securities. An individual can only establish one private enterprise.

6. State-owned enterprise (SOE)

A State-owned enterprise (SOE) is an enterprise where the State holds 100% of the charter capital (per Law on Management and Use of State Capital 2014). Enterprises where the state holds >50% charter capital or voting shares are classified as "state-invested enterprises" rather than pure SOEs. These entities play a pivotal role in strategic sectors of the national economy, such as energy, telecommunications, and national defense. Private investors, including foreigners, cannot establish SOEs.

Advantages of SOE

- Government backing: SOEs receive priority access to land, capital, and government projects. They benefit from state support mechanisms.

- Stability: Due to their strategic importance, SOEs are less likely to face bankruptcy compared to private firms.

- Brand authority: Being state-linked often provides immediate trust in the domestic market.

Disadvantages of SOE

- Bureaucracy: Operations are often slow due to rigid administrative procedures and multi-layered approval processes.

- Inefficiency: Lack of competition and guaranteed state support can sometimes lead to lower operational efficiency compared to the private sector.

7. Social enterprise

A Social Enterprise is registered under the Enterprise Law (usually as an LLC or JSC) but operates with the primary objective of solving social or environmental issues. There is no mandatory legal requirement to reinvest 51% of profits (per Circular 05/2022/TT-MPI), enterprises self-certify their social objectives in the charter and demonstrate community impact.

Advantages of social enterprise

- Funding opportunities: These entities can receive aid and sponsorship from foreign non-governmental organizations (NGOs), domestic sponsors, and government grants that are unavailable to purely commercial firms.

- Reputation: The social mission creates strong brand loyalty and public goodwill.

- Tax incentives: Certain activities may qualify for Corporate Income Tax exemptions or reductions.

Disadvantages of social enterprise

- Profit constraints: Unlike the 51% myth, there is no mandatory profit reinvestment ratio, but the social focus may limit aggressive profit maximization, making it less attractive to traditional investors.

- Monitoring: They must maintain transparency regarding their social impact and financial flows to maintain their status.

8. Foreign-invested enterprise (FIE)

A Foreign Invested Enterprise (FIE) is any company type (usually LLC or JSC) established by foreign investors. Foreign investors require an Investment Registration Certificate (IRC) only for investment projects; pure business registration requires only the Enterprise Registration Certificate (ERC) (per amended Law on Investment 2020).

Investors often weigh the pros and cons of setting up an offshore company vs onshore company (FIE) based on their international tax planning and operational needs

Advantages of FIE

- Market access: Allows full operational capability within Vietnam to trade, manufacture, and provide services.

- Control: Foreign investors can own up to 100% of the capital in most sectors (subject to WTO commitments and local laws).

- Asset protection: Operates under Vietnamese law with full legal protections for intellectual property and assets.

Disadvantages of FIE

- Complex setup: The registration process is longer and more rigorous than for local companies, requiring proof of financial capacity and a physical location.

- Conditional sectors: Certain industries (e.g., logistics, tourism) restrict foreign ownership percentages or require sub-licenses.

9. Representative office (RO)

A Representative Office is a dependent unit of a foreign parent company. It is strictly forbidden to conduct direct profit-generating activities. Its sole purpose is to function as a liaison office. While an RO is limited, it is often the first step before a full company establishment in Vietnam.

Advantages of RO

- Low cost: No capital contribution is required to establish an RO. Operational costs are limited to office rental and staff salaries.

- Market research: Ideal for companies wanting to investigate the Vietnamese market, build relationships, and oversee contract implementation without full investment.

- Simpler compliance: No CIT or VAT on revenue (since there is no revenue), but must file business license tax and personal income tax for staff.

Disadvantages of RO

- No commercial activity: An RO cannot sign contracts, issue invoices, or receive revenue in Vietnam.

- Limited scope: Operations are strictly limited to market research and promotion. Any deviation can lead to heavy fines and revocation of the license.

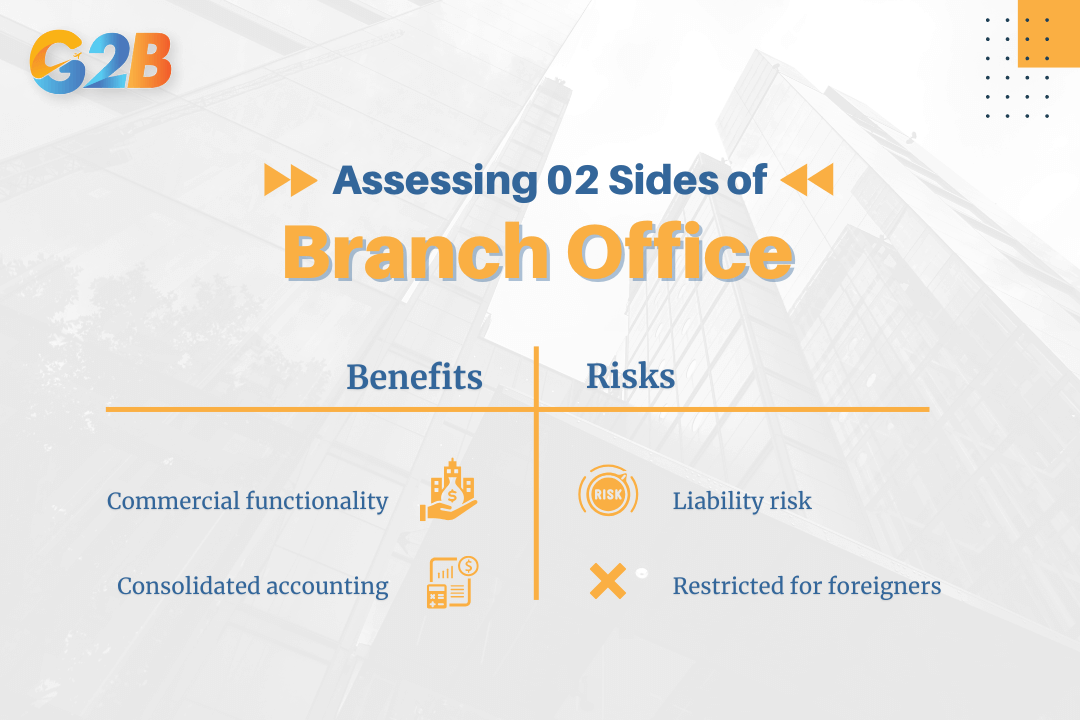

10. Branch office

A Branch Office is a dependent unit of an enterprise (local or foreign) that has the right to conduct business activities in Vietnam. Unlike an RO, a Branch can generate revenue.

Advantages of a branch office

- Commercial functionality: Can sign contracts and conduct business activities fully, similar to the parent company.

- Consolidated accounting: For local companies, branch financials can often be consolidated with the parent company, simplifying tax strategies.

Disadvantages of a branch office

- Liability risk: The parent company bears full liability for the debts and obligations of the branch.

- Restricted for foreigners: Vietnam restricts the establishment of branches by foreign companies to very specific sectors (primarily banking, law, and insurance). Most foreign investors must form an FIE instead.

A branch office is a dependent unit of an enterprise having the right to conduct business activities in Vietnam

11. Business household

A Business household is a simple business model owned by an individual or a group of family members. It is suitable for small-scale operations like shops, restaurants, or small service providers.

Advantages of a business household

- Simplicity: Registration is handled at the commune People's Committee level (not district or provincial DPI). Accounting standards are minimal.

- Tax regime: Taxes are often calculated based on a presumptive flat rate rather than detailed profit/loss accounting.

Disadvantages of a business household

- Employee limit: Strictly limited to 10 employees.

- Liability: The owner has unlimited liability for debts.

- Expansion limits: Cannot open branches or representative offices.

Comparison table: Which entity suits you?

| Feature | Single-Member LLC | Multi-Member LLC | Joint Stock Company (JSC) | Representative Office (RO) |

|---|---|---|---|---|

| Ownership | 1 Owner | 2 - 50 Members | Min 3 Shareholders | Parent Company |

| Liability | Limited to Capital | Limited to Capital | Limited to Capital | Parent Company Liable |

| Capital | No min (generally) | No min (generally) | No min (generally) | None Required |

| Management | Simple, the Owner decides | Members' Council | Board of Directors (Complex) | Chief of RO |

| Stock Listing | No | No | Yes | No |

| Profit Activity | Yes | Yes | Yes | No |

| Taxation | CIT, VAT | CIT, VAT | CIT, VAT | PIT for staff only |

| Best For | SMEs, Solo Investors | SMEs, Partners | Large Corps, IPO seekers | Market Research |

What type of company is right for you in Vietnam?

Selecting the correct entity is not a "one-size-fits-all" process. It requires a strategic assessment of your business goals, capital resources, and risk tolerance.

1. For small and medium enterprises (SMEs)

The Limited Liability Company (LLC) is the undisputed champion for SMEs.

- If you are a solo foreign investor, the Single-Member LLC offers total control with the safety of limited liability.

- If you are entering the market with a local partner, the Multi-member LLC provides a robust framework for shared governance without the heavy regulatory burden of a JSC.

2. For startups seeking venture capital

If your roadmap includes raising millions of dollars from Venture Capitalists (VCs) or an eventual IPO, you must incorporate as a Joint Stock Company (JSC). VCs require the ability to purchase shares (equity) and often demand a seat on the Board of Directors. An LLC structure is often too rigid for complex investment rounds involving Employee Stock Ownership Plans (ESOPs) and multiple classes of shares.

3. For market explorers

If you are uncertain about the long-term viability of the Vietnamese market and simply want to establish a presence to meet potential clients, a Representative Office is the most cost-effective entry point. It avoids the complexities of capital injection and tax auditing. However, remember that you cannot issue invoices.

4. For professional service providers

Lawyers, architects, and auditors often choose the Partnership model. While the unlimited liability is a risk, the structure signals the highest level of trust and personal integrity to potential clients.

5. For large corporations

Large Multinational Corporations (MNCs) entering Vietnam for manufacturing or large-scale retail typically establish a Single-Member LLC (as a subsidiary of their global HQ) to maintain control, or a JSC if they plan to leverage the local stock market for funding. Navigating the legal landscape of Vietnam requires more than just filling out forms. It demands a partner who understands the nuance of the law and the reality of business operations.

Whether you need to register a Joint Stock Company, set up a flexible LLC, or obtain the necessary Investment Registration Certificate (IRC) for your Foreign Invested Enterprise, G2B is your trusted partner. Contact G2B today for consultation on setting up a company in Vietnam and secure your foothold in Vietnam’s dynamic economy. Beyond registration, G2B also assists with post-incorporation tasks such as opening a bank account in Vietnam and navigating local labor laws

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom