How to source industrial suppliers in Vietnam requires a strategic understanding of the country's distinct regional industrial clusters, labor economics, and free trade frameworks. As the "China+1" strategy accelerates, Vietnam has emerged as a primary alternative for manufacturing, driven by key industries such as textiles, electronics, and furniture. This article provides the technical data needed to verify Foreign Direct Investment (FDI) parks, navigate the EVFTA and CPTPP agreements, and audit factories in provinces like Binh Duong and Bac Ninh.

This article highlights the key considerations for sourcing industrial suppliers in Vietnam. We specialize in company formation in Vietnam and do not provide direct supplier negotiation services. For complex sourcing requirements, supplier audits, or contract negotiations, businesses should work with experienced sourcing consultants.

Why source from Vietnam?

The shift toward Vietnam is not merely a trend; it is a structural realignment of the global supply chain. The China+1 Strategy, accelerated by the US-China trade war and pandemic-induced disruptions, has positioned Vietnam as a critical manufacturing hub. Procurement directors must analyze the following economic vectors to justify market entry.

Competitive labor economics

Cost reduction remains the primary driver for relocation. Vietnam offers significantly lower manufacturing costs compared to its northern neighbor.

- Vietnam: The average manufacturing labor cost is approximately $3.00 USD/hour to $3.50 USD/hour (2025 data).

- China: The average manufacturing labor cost has risen to approximately $6.00-$6.50 USD/hour.

This disparity allows for a reduction in OpEx (Operational Expenditure) of nearly 50% on labour-intensive goods such as footwear, garments, and basic assembly.

The network of Free Trade Agreements (FTAs)

Vietnam has aggressively integrated into the global economy through high-standard trade pacts. Sourcing from Vietnam grants access to reduced or zero tariffs under the following agreements:

- EVFTA (EU-Vietnam free trade agreement): Eliminates 99% of customs duties between Vietnam and the European Union. This is critical for European buyers seeking duty-free import of machinery and textiles.

- CPTPP (Comprehensive and progressive agreement for trans-pacific partnership): Connects Vietnam with 10 other economies, including Canada, Australia, and Japan, facilitating preferential market access.

- UKVFTA (UK-Vietnam free trade agreement): Ensures continuity of trade benefits with the United Kingdom post-Brexit.

- RCEP (Regional comprehensive economic partnership): Harmonizes rules of origin among 15 Asia-Pacific nations, allowing materials sourced from China or South Korea to be processed in Vietnam and exported within the bloc with tariff preferences.

Macroeconomic stability

Vietnam maintains a stable political environment under a single-party system, which ensures consistent economic policy and Foreign Direct Investment (FDI) incentives. The GDP growth rate reached 8.02% in 2025 (GSO data), providing a predictable environment for long-term capital investment.

Where are the key industrial clusters in Vietnam?

Vietnam’s geography dictates its industrial specialization. The country is divided into three distinct economic zones, each with specific logistical advantages and industry focuses.

Regional comparison of industrial capability

| Region | Key provinces | Primary industries | Main logistics hub |

|---|---|---|---|

| Northern | Bac Ninh, Hai Phong, Hai Duong | Electronics, Heavy Industry, Automotive | Hai Phong Port, Noi Bai Airport |

| Southern | Binh Duong, Dong Nai, Ho Chi Minh City | Textiles, Furniture, Plastics, Footwear | Cat Lai Port, Cai Mep - Thi Vai |

| Central | Da Nang, Quang Nam, Quang Ngai | Food Processing, Light Manufacturing | Da Nang Port |

Northern Vietnam (electronics & heavy industry)

The North is the hub for high-tech manufacturing, heavily influenced by proximity to the Chinese border (simplifying component supply chains).

- Major entities: Tech giants like Samsung, Canon, and Foxconn have established massive assembly plants here.

- Key provinces:

- Bac Ninh: Known as the electronics capital of Vietnam.

- Hai Phong: A crucial port city facilitating heavy industrial logistics.

- Specific industrial parks:

- Deep C industrial complex (Hai Phong): Specializes in petrochemicals and heavy industry with direct port access.

- VSIP (Vietnam Singapore industrial park) Bac Ninh: A standard-bearer for integrated high-tech manufacturing facilities.

- Yen Phong industrial park: Houses major mobile phone component suppliers.

Southern Vietnam (textiles, furniture, & plastics)

The South is the traditional commercial engine of Vietnam, possessing the most mature supply chain for consumer goods.

- Major entities: This region hosts the headquarters of major contract manufacturers for brands like Nike, Adidas, and IKEA.

- Key provinces:

- Ho Chi Minh City: The financial and commercial control center.

- Binh Duong: The primary destination for wood processing and furniture manufacturing.

- Dong Nai: A hub for supporting industries and mechanical engineering.

- Specific industrial parks:

- Phuoc Dong industrial park (Tay Ninh): Massive capacity for textile and tire manufacturing.

- Hiep Phuoc industrial park: Located near HCMC with excellent port connectivity.

- Amata city (Dong Nai): A high-standard park favored by international multinational corporations (MNCs).

Central Vietnam (light industry & food processing)

The Central region serves as a cost-effective alternative to the potentially saturated North and South.

- Major entities: Focuses on seafood processing and light assembly.

- Key provinces: Da Nang and Quang Nam.

- Specific parks: Da Nang high-tech park offers specific incentives for IT and biotech firms.

How to find reliable suppliers in Vietnam?

Identifying a legitimate manufacturer requires a multi-channel approach to filter out trading companies masquerading as factories.

Three steps to find reliable suppliers in Vietnam

Step 1: Online directories & B2B platforms

While digital sourcing is convenient, it requires rigorous filtering.

- Alibaba Vietnam: Useful for initial lists, but highly populated by trading intermediaries. Filter for "Gold Supplier" and "Verified Manufacturer."

- VietnamExport: An official portal operated by the Ministry of Industry and Trade (MOIT), offering a database of verified exporters.

- Yellow Pages Vietnam: Good for finding local contract manufacturers who may not have a strong SEO presence.

- VCCI (Vietnam chamber of commerce and industry): The VCCI database provides lists of registered enterprises by sector.

Step 2: Attending trade shows

Physical verification at trade shows is the most effective way to gauge supplier capability.

- Vietnam expo: A general multi-industry exhibition held in Hanoi.

- VIMF (Vietnam industrial & manufacturing fair): Focuses on machinery, automation, and industrial supplies.

- MTA Vietnam: The premier event for precision engineering and machine tools.

- VTG (Vietnam textile & garment exhibition): Essential for apparel sourcing managers.

- VIFA EXPO: The leading fair for furniture and wood products in HCMC.

Step 3: Hiring sourcing agents vs. Direct sourcing

Direct sourcing can be hindered by the language barrier and cultural nuances in negotiation.

- Language barrier: While senior management often speaks English, factory floor managers and technical staff predominantly speak Vietnamese.

- Quality control (QC): Remote management of QC is risky.

Vetting and verifying Vietnamese suppliers

Due diligence is non-negotiable. Procurement managers must verify the legal and operational status of potential partners to avoid fraud and compliance risks.

Check the ERC (Enterprise Registration Certificate)

Every legal business in Vietnam possesses an Enterprise Registration Certificate (ERC).

- Business lines: Verify that the "Registered Business Lines" on the ERC match the product they are selling. If a company claims to manufacture furniture but is registered only for "Wholesale of household goods," they are a trading company, not a factory.

- Establishment date: Longer operational history generally correlates with financial stability.

Verify certifications

International compliance standards are the quickest way to filter high-quality manufacturers.

- ISO 9001: Validates the Quality Management System (QMS).

- SA8000: Certifies Social Accountability. This is crucial for Western brands to ensure no child labor or forced labor is used in the supply chain.

- WRAP (Worldwide responsible accredited production): Specifically for the apparel / textile industry to ensure ethical production.

Red flags to watch

- Email domain: Use of free domains (e.g., @gmail.com) rather than a corporate domain (@companyname.vn).

- Refusal of factory visit: If a supplier refuses a physical audit or tries to meet only in a coffee shop/showroom, they likely do not own the facility.

- No certificate of origin (C/O) capability: If a supplier cannot issue a C/O, you cannot claim tax reductions under EVFTA or CPTPP.

Understanding Vietnam's payment and contract terms

Vietnamese business culture values relationship-building, but contracts must be rigid and internationally compliant.

Incoterms 2020 and shipping

- FOB (Free On Board): The most common term. The supplier handles transport to the port (e.g., Cat Lai or Hai Phong) and export clearance. The buyer controls the freight from there.

- EXW (Ex works): Common for smaller orders or when the buyer uses a consolidation warehouse. The buyer is responsible for pick-up from the factory floor.

You can see the list of ports in Vietnam for more detailed information

Currency and banking

- Currency: By law, all transactions within Vietnam must be in Vietnam Dong (VND). However, export contracts are typically denominated in USD or EUR.

- Exchange Controls: Vietnam has strict foreign exchange controls. Ensure the supplier has a USD bank account authorized to receive international payments.

Standard payment terms

- Deposit: Typically 30% T/T (Telegraphic transfer) upon signing the Sales Contract / Proforma Invoice.

- Balance: 70% T/T upon the buyer receiving the scanned copy of the Bill of Lading (B/L).

- L/C (Letter of credit): For orders exceeding $50,000 USD, an Irrevocable L/C at sight is recommended to protect both parties.

Logistics and export documentation in Vietnam

Navigating the General Department of Vietnam Customs requires precise documentation to ensure smooth export clearance.

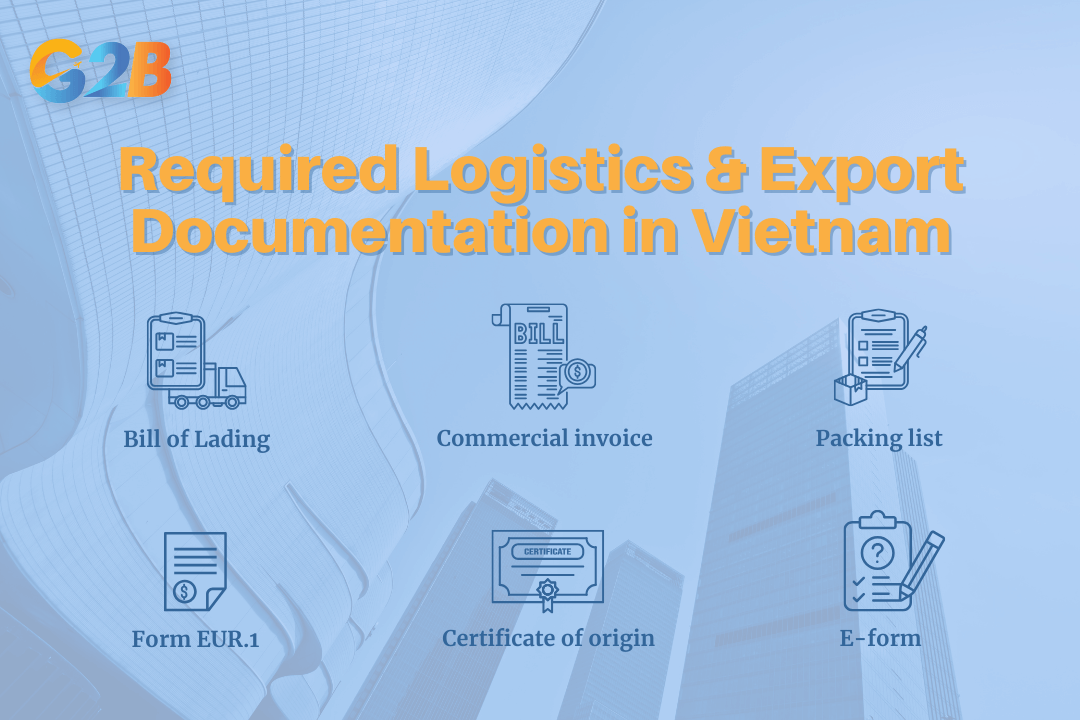

Required documents

Failure to present the correct documents will result in shipment delays and demurrage charges.

- Bill of Lading (B/L): The master transport document.

- Commercial invoice: Must clearly state the HS Code, unit price, and total value.

- Packing list: details net weight, gross weight, and cubic measurement (CBM).

- Certificate of origin (C/O):

- Form EUR.1: Required for trade with the EU under EVFTA.

- Form A: For Generalized System of Preferences (GSP).

- Form B: For non-preferential trade.

- Emphasize to the supplier that the C/O must be accurate to trigger tariff reductions.

- E-form HQ/2015/XK: The electronic customs declaration form.

Required logistics and export documentation in Vietnam

Key logistics hubs

- Cat Lai port (Ho Chi Minh City): The busiest container port in Vietnam. Note that congestion is common here; plan for buffer time.

- Hai Phong port (Northern Vietnam): The primary gateway for electronics and heavy industry exports from the North.

- Cai Mep - Thi Vai (Vung Tau): A deep-water port complex capable of accommodating mother vessels for direct shipments to the US and Europe, bypassing transshipment hubs like Singapore.

Frequently asked questions (FAQ)

Below are some frequently asked questions to help clarify common concerns when sourcing industrial suppliers in Vietnam.

Is Vietnam cheaper than China for manufacturing?

Yes, in terms of labor. Vietnam's labor costs are approximately 50% lower than China's. However, Vietnam's supply chain for raw materials (especially in electronics and specialized textiles) is less mature, often requiring the import of components from China, which can affect the total landed cost.

What are the main exports of Vietnam?

Vietnam's export economy is dominated by Telephones and mobile phones (led by Samsung), Textiles and Garments, Computers and Electronics, Footwear, and Wood/Furniture products.

Sourcing industrial suppliers in Vietnam offers a distinct competitive advantage through reduced labor costs, strategic trade agreements like EVFTA, and a stable political climate. However, success requires navigating a complex landscape of regional industrial clusters, verification protocols, and logistics compliance.

Investors and procurement managers must move beyond surface-level directories and engage in deep due diligence. Whether auditing a furniture factory in Binh Duong or an electronics assembly line in Bac Ninh, the presence of a trusted local partner is invaluable.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom