Appointing the right legal representative in Vietnam is one of the most critical decisions for any company's success and compliance. This individual serves as the official face and authorized signatory of the company, bridging the gap between the enterprise and Vietnam's legal system. For both foreign investors navigating the local market and domestic entrepreneurs scaling their operations, a thorough understanding of this role is fundamental to sound corporate governance and to avoiding significant legal pitfalls.

Who is the legal representative in Vietnam?

Under Vietnam's Law on Enterprises, the legal representative is an individual who acts on behalf of a company to exercise rights and fulfill obligations arising from the company's transactions. This person represents the enterprise in legal proceedings, such as arbitration or court cases, and before government authorities. Their signature legally binds the company to contracts and other official documents.

It is crucial to distinguish this role from that of a company owner, director, or shareholder. While a single individual can hold multiple positions, their legal functions are distinct:

- Owners/shareholders: Provide capital and make decisions on the company's strategic direction.

- Legal representative: Executes the day-to-day operations and ensures the company functions within the legal framework of Vietnam.

Every corporate legal entity in Vietnam is required to have at least one legal representative, whose details are recorded in the company charter and on the Enterprise Registration Certificate.

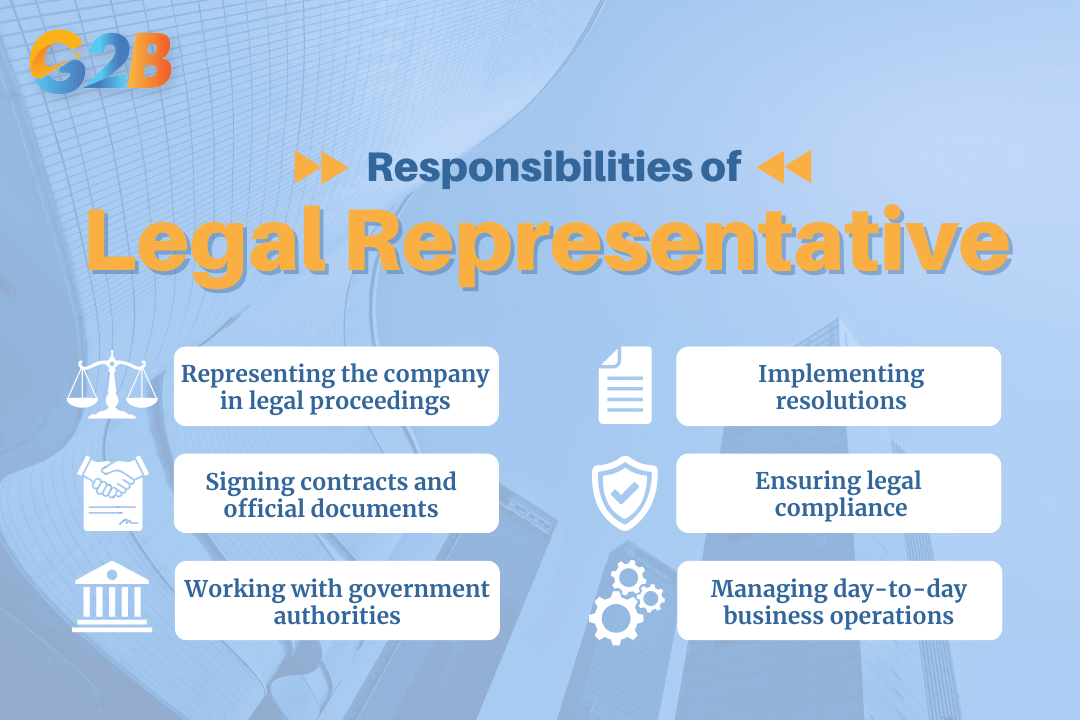

Key responsibilities and powers of a legal representative

The legal representative holds significant power, but this is balanced with substantial responsibilities. Their primary duties and authority include:

- Representing the company in legal proceedings: They act as the plaintiff, defendant, or person with relevant interests in any litigation or arbitration involving the company.

- Signing contracts and official documents: The legal representative has the authority to execute commercial contracts, labor agreements, and other transactions on behalf of the company, making their signature legally binding.

- Working with government authorities: This includes signing tax returns, applying for necessary business licenses, and handling all administrative procedures with bodies like the Department of Planning and Investment.

- Notifying changes in enterprise information: They must notify changes such as address, capital, or representative details to the registration authority within 10 days.

- Implementing resolutions: They are responsible for carrying out the decisions made by the Board of Members or Shareholders.

- Ensuring legal compliance: A core responsibility is to ensure that the company adheres to all Vietnamese laws and regulations, including tax and labor obligations.

- Managing day-to-day business operations: The legal representative often oversees the company's daily activities as authorized by the company charter.

These rights and obligations are designed to protect the interests of the company, its shareholders, and third parties.

Key responsibilities and powers of a legal representative

Eligibility and requirements to become a legal representative

To be appointed as a legal representative in Vietnam, an individual must meet several key eligibility criteria:

- Full civil act capacity: The individual must be at least 18 years old and have full legal capacity to act.

- No prohibitions: They must not be subject to any legal prohibitions on managing an enterprise. This includes individuals facing criminal prosecution, serving a prison sentence, or being banned from business practice by a court. Civil servants, public employees and commissioned officers in the armed forces are also generally prohibited. They must not be on the list of warnings or under special control by the business registration authority.

- Residency requirements: Vietnamese law mandates that a company must always have at least one legal representative residing in Vietnam. If a company has only one legal representative, that person must reside in Vietnam. Should they need to leave the country, they must authorize another person in writing to perform their duties in their absence, though they remain ultimately responsible. For a foreigner, this typically means having a valid residential address registered with the local authorities in Vietnam and often a Work Permit if working in Vietnam.

Number of legal representatives a company can have

The Law on Enterprises allows Limited Liability Companies (LLCs) and Joint Stock Companies (JSCs) to have one or more legal representatives. This flexibility allows businesses to choose a structure that best suits their operational needs. The number of representatives and their specific rights and obligations must be clearly defined in the company charter.

Here is a comparison of the two models:

| Model | Advantages | Disadvantages |

|---|---|---|

| Single legal representative | Clear authority: A single point of contact simplifies decision-making and external communication. Faster Decisions: Avoids delays that can arise from needing multiple signatures or approvals. | Key person risk: The company's operations can be halted if the representative is unavailable due to travel, illness, or other reasons. |

| Multiple legal representatives | Flexibility & continuity: Ensures business continuity, as another representative can step in if one is unavailable. Shared Workload & Checks and Balances: Allows for the division of responsibilities (e.g., one for finance, one for operations) and creates a system of internal controls. | Potential for disputes: Can lead to conflicting decisions or internal disputes if the scope of authority for each representative is not clearly defined in the company charter. Unclear Authority: If the charter is vague, it can create confusion for employees and external partners regarding who has the final say. |

For foreign-invested enterprises, a popular structure is to appoint two representatives: one in Vietnam to handle daily administrative and compliance tasks, and another abroad to maintain strategic control.

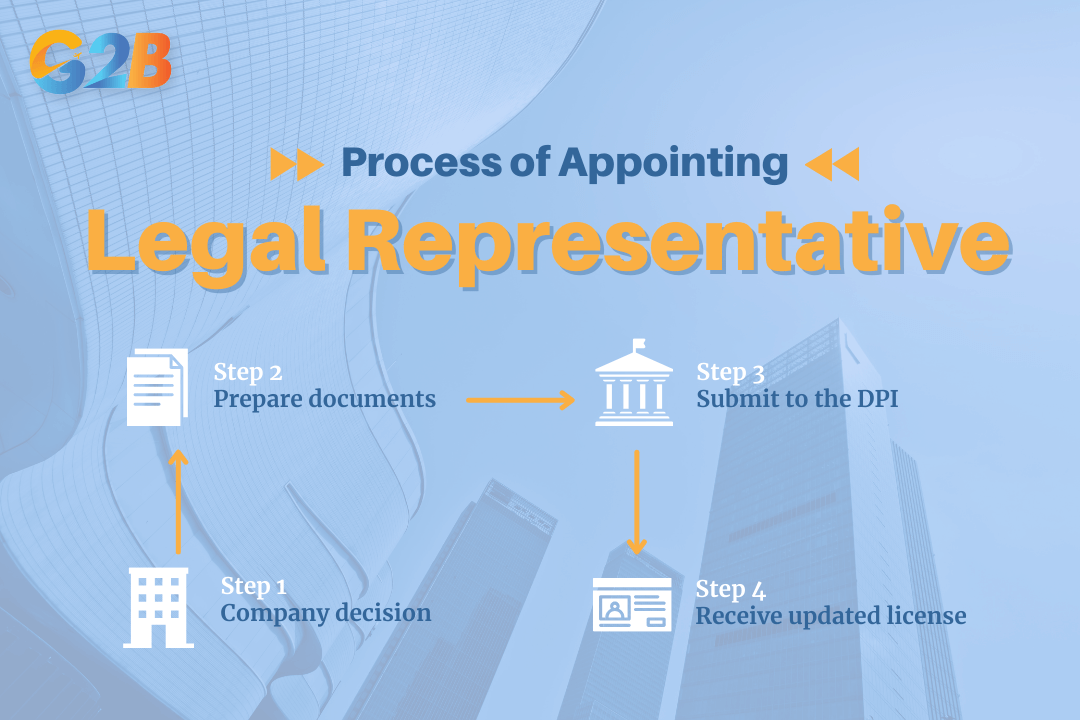

Process of appointing and changing a legal representative

The appointment and changing of a legal representative is a formal process that must be registered with the provincial Department of Planning and Investment (DPI) to be legally valid.

Here is a step-by-step guide:

- Step 1 - Company decision: The appropriate governing body of the company (e.g., the Members' Council for an LLC, the Board of Directors for a JSC) must pass a formal resolution to appoint or change the legal representative.

- Step 2 - Prepare documents: A complete dossier must be prepared, which typically includes:

- A formal notification of the change of the legal representative (using a standard form).

- The resolution or decision from the relevant company body.

- Minutes of the meeting where the decision was made.

- A copy of the new representative's personal identification, such as a passport or ID card (notarized or certified).

- Documents proving eligibility (e.g., ID/passport copy, residence confirmation if required).

- An authorization letter if the documents are submitted by a third party.

- Step 3 - Submit to the DPI: The complete application dossier must be submitted to the business registration office of the provincial DPI within 10 days of the decision.

- Step 4 - Receive updated license: Upon successful review of the application, the DPI will issue a new Enterprise Registration Certificate reflecting the change.

This process requires precision, and any errors can lead to delays that disrupt business operations.

Process of appointing and changing a legal representative

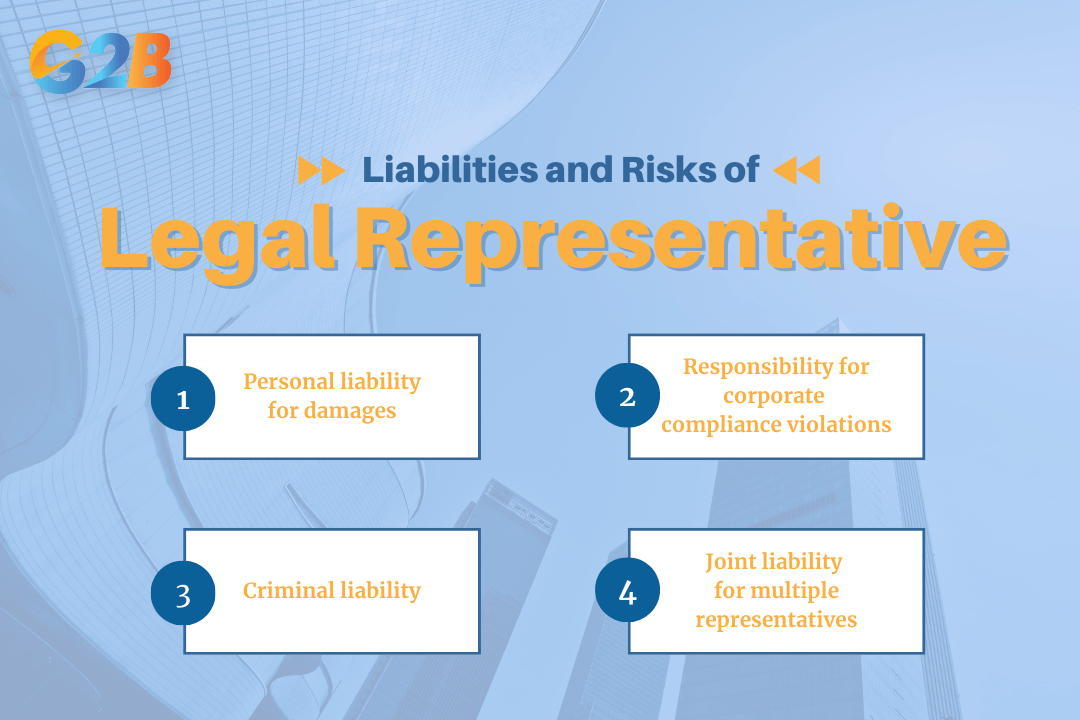

Liabilities and risks associated with the role

The position of a legal representative carries significant personal liability. They are required to act honestly, prudently, and in the best interests of the company. Failure to do so can lead to severe legal consequences.

- Personal liability for damages: The legal representative can be held personally responsible for any damages caused to the company if they violate their prescribed responsibilities or act beyond their authority. For instance, signing a contract that exceeds the scope of power defined in the company charter can result in personal liability for the unauthorized portion of the transaction.

- Responsibility for corporate compliance violations: If the company fails to comply with laws regarding taxes, labor, or environmental standards, the legal representative can be held accountable, potentially facing administrative penalties.

- Criminal liability: In severe cases, such as tax evasion, fraud, or gross negligence that leads to significant financial loss, the legal representative may face criminal prosecution. This is a critical risk, especially for individuals acting as "nominee" representatives.

- Joint liability for multiple representatives: If a company has multiple legal representatives and their duties are not clearly divided in the charter, they are jointly responsible for any damages caused to the enterprise.

These risks underscore the importance of appointing a trustworthy and qualified individual to the role.

Liabilities and risks associated with the role

Foreign vs. Vietnamese legal representative: What to choose?

Businesses, particularly foreign-invested ones, face a strategic choice between appointing a foreigner or a Vietnamese national as their legal representative. There is no legal restriction on nationality, but there are practical pros and cons to each option.

| FOREIGN REPRESENTATIVE | VIETNAMESE REPRESENTATIVE |

|---|---|

PROS | |

| Direct control: Allows the parent company or foreign owner to maintain direct strategic control over operations. | Local expertise: Possesses a deep understanding of local laws, regulations, and business culture, which is invaluable for navigating bureaucracy. |

| Understanding of HQ vision: Can ensure that the Vietnamese entity's operations are closely aligned with the global headquarters' vision and standards. | Language fluency: No language barriers when dealing with government authorities, employees, and local partners. |

| Trusted individual: Often a long-standing employee of the parent company, providing a high level of trust. | Easier authority dealings: Navigating administrative procedures with government agencies is often smoother and more efficient. |

CONS | |

| Language and cultural barriers: May struggle with the nuances of the local language and business etiquette, potentially leading to misunderstandings. | Requires oversight: The parent company may need to implement stronger oversight and reporting mechanisms to ensure alignment with its strategic goals. |

| Lack of local knowledge: May not be familiar with the intricacies of Vietnamese law and the local network, which can slow down processes. | Potential for misalignment: There is a risk that their operational style may not fully align with the parent company's corporate culture without proper guidance. |

| Residency and logistical issues: Must reside in Vietnam and obtain the necessary work permit or temporary residence card, which adds an administrative layer. | |

Practical tips for businesses

- Conduct thorough due diligence: Before appointing anyone as a legal representative, conduct a comprehensive background check to verify their qualifications, experience, and legal history. This is the first line of defense against future complications.

- Define authority clearly in the company charter: The company charter is the most important document for defining the scope of the representative's powers. Be explicit about the limits of their authority, especially concerning financial transactions and contract signing. This is crucial for mitigating personal liability risks and preventing internal disputes, particularly when there are multiple representatives.

- Establish strong internal controls: Do not rely solely on one individual. Implement a system of checks and balances, such as requiring board approval for contracts above a certain value or having dual-signature requirements for major financial transactions. This is a best practice for good corporate governance.

- Secure proper employment contracts: The rights, responsibilities, and liabilities of the legal representative should be clearly detailed in their employment contract, in addition to the company charter.

The legal representative is the lynchpin of a company's legal framework in Vietnam, vested with significant power and equally significant responsibility. A carefully considered appointment, a clearly defined scope of authority, and robust internal controls are essential for ensuring compliance, mitigating risk, and paving the way for sustainable business success. The choice of who fills this role has lasting implications for a company's operational efficiency and legal standing.

Ready to start your journey in Vietnam? Contact G2B today for a consultation on how to establish a company in Vietnam and to follow annual compliance requirements during operations. Let us handle the bureaucracy so you can focus on your business.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom