The EVFTA is a comprehensive trade agreement between the European Union and the Socialist Republic of Vietnam that eliminates over 99% of customs duties and significantly reduces non-tariff barriers to trade. Beyond simple tax cuts, it is a legal framework that liberalizes investment environments, enforces stronger Intellectual Property (IP) protection, and ensures sustainable development. The agreement essentially grants EU companies "national treatment" in many sectors, allowing them to compete on equal footing with local Vietnamese enterprises while enjoying the high standards of legal protection mandated by Brussels.

This article provides an overview of the European Union - Vietnam Free Trade Agreement. We offer company formation and do not provide legal or government advisory services. For detailed trade, legal, or investment-related matters, please consult qualified professional advisors.

What is the EVFTA and how does it impact foreign investment in Vietnam?

To operate effectively in Vietnam, investors must understand the structural and timeline-based commitments of the agreement. It is not merely a static document but a progressive roadmap that unlocks new benefits every year.

What are the key timeline milestones for EVFTA implementation?

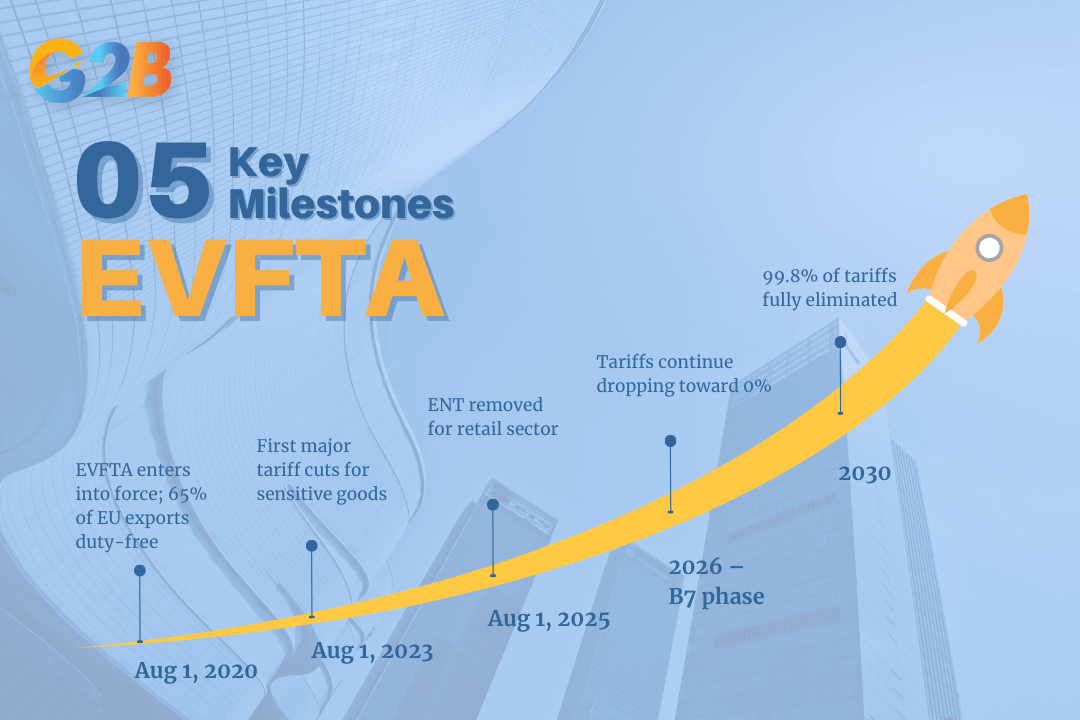

The EVFTA follows a rigid schedule for liberalization. Understanding where we stand in 2026 is vital for strategic planning:

- August 1, 2020: The agreement officially entered into force. 65% of EU exports to Vietnam became duty-free immediately.

- August 1, 2023 (year 3): Specific sensitive agricultural and industrial goods saw their first major tariff reductions.

- August 1, 2025 (year 5): A landmark milestone has occurred with the removal of the Economic Needs Test (ENT) for the retail sector, allowing EU retailers to expand outlets without discretionary approval.

- 2026 (current year): We are now in the "B7" phase. Tariffs on complex manufactured goods, certain automotive parts, and machinery continue to drop toward 0%.

- 2030 (year 10): The final phase where nearly 99.8% of all tariff lines will be fully eliminated.

The key timeline milestones for EVFTA implementation

How does EVFTA differ from WTO commitments?

While Vietnam’s accession to the World Trade Organization (WTO) in 2007 opened the door, the EVFTA tears down the walls. The most significant difference lies in the "Ratchet Mechanism". Under the EVFTA, Vietnam has committed to a "Ratchet Clause," which implies that if Vietnam unilaterally liberalizes a service sector or lowers a barrier for any other partner in the future, it cannot "backtrack" or re-impose restrictions on EU investors. Furthermore, the EVFTA opens service sectors that remained closed or highly restricted under the WTO, such as interdisciplinary R&D services, nursing services, and packaging services.

What is the relationship between EVFTA and EVIPA?

Investors often confuse the EVFTA with the EVIPA (EU - Vietnam Investment Protection Agreement). While negotiated together, they are legally distinct:

- EVFTA: Covers trade, tariffs, and market access. It is currently fully active.

- EVIPA: Focuses on investor protection and dispute resolution. It replaces the old bilateral investment treaties (BITs) between Vietnam and individual EU member states.

As of 2026, the EVIPA is in the final stages of ratification by individual EU parliaments. Once fully active, it will introduce the Investment Court System (ICS), a permanent tribunal to resolve disputes between foreign investors and the Vietnamese state, offering a higher degree of impartiality and transparency than traditional local courts.

How does EVFTA benefit company formation in Vietnam for EU investors?

The most immediate value of the EVFTA in 2026 is the ability to establish 100% foreign-owned enterprises (FOEs) in an expanded range of sectors that were previously restricted or required a local joint venture partner.

Which service sectors are now open to 100% foreign ownership?

The EVFTA has expanded the list of sectors where EU investors can own 100% of the equity. This allows for total operational control and profit repatriation without sharing decision-making power with a local entity. Key sectors now fully open include:

- Higher education services (CPC 923): EU entities can invest in universities and training institutions with significantly increased foreign ownership possibilities compared to previous caps, subject to Vietnam’s specific licensing conditions.

- Environmental services: Specifically covering refuse disposal services (CPC 9402) and sanitation services (CPC 9403), allowing EU green-tech firms to operate with full or majority ownership in many sub-sectors.

- Computer and related services (CPC 84): Including consultancy, software implementation, and data processing.

- Rental/leasing services: Machinery and equipment leasing without operators is now more broadly open to EU investors, facilitating heavy industry support services.

What are the "Economic Needs Test" (ENT) waivers for retailers?

For years, the Economic Needs Test (ENT) was the single biggest barrier for foreign retailers. Previously, if a foreign retailer wanted to open a second outlet in Vietnam, they had to undergo a rigorous test to prove that their new store would not negatively impact local wet markets or small businesses - a process that was often subjective and opaque.

As of August 2025, the ENT has been officially abolished for EU retailers. This means in 2026, an EU fashion brand, supermarket chain, or convenience store franchise can open its 2nd, 10th, or 50th store in Vietnam purely based on market strategy, without seeking permission from the local Department of Planning and Investment (DPI) for market impact.

How does the agreement protect Intellectual Property (IP)?

Company formation is risky without IP security. The EVFTA compels Vietnam to adopt international standards of enforcement.

- Geographical indications (GIs): 169 European GIs (such as Champagne, Feta cheese, and Scotch whisky) are automatically protected in Vietnam. This allows EU producers to petition authorities to seize counterfeit products misusing these names.

- Enforcement: Customs authorities are now empowered to seize suspected counterfeit goods at the border upon request by the rights holder, shifting the burden of proof closer to international norms.

What are the EVFTA commitments on work permits and movement of natural persons?

One of the most complex aspects of doing business in Vietnam is navigating the Department of Labor, Invalids and Social Affairs (DOLISA). The EVFTA provides specific exemptions that streamline this process for EU citizens.

Who qualifies as a "Business visitor" under EVFTA?

Under the agreement, a "Business visitor" is an EU national traveling to Vietnam for investment purposes (e.g., setting up a company or negotiating contracts) who does not sell services to the public or receive remuneration from a source within Vietnam.

Benefit: Business visitors are permitted to stay in Vietnam for up to 90 days within any 12-month period without requiring a work permit under Vietnam’s implementation of its entry and work permit exemption rules for EVFTA nationals. This is significantly more flexible than the standard tourist or e-visa options for conducting legitimate pre-investment activities.

Revisions under Decree 219/2025/ND-CP for intra-corporate transferees (ICT)

The Vietnamese government recently issued Decree 219/2025/ND-CP, codifying the EVFTA's commitments regarding Intra-Corporate Transferees (ICTs). This decree specifically addresses managers, executives, and specialists moving from an EU parent company to a Vietnamese subsidiary.

Key requirements for ICT status in 2026:

- Prior employment: The employee must have worked for the EU parent company for at least 12 months prior to the transfer.

- Role definition: They must hold a position strictly defined as a Manager, Executive, or Specialist.

The benefit: Qualified ICTs are exempt from obtaining a Work Permit. Instead, they undergo a simplified "Work Permit Exemption Certificate" process. Unlike standard work permits which are often capped at 2 years, the initial stay for EVFTA ICTs can be granted for up to 3 years, linked to their visa or temporary residence status under Vietnam’s implementation of EVFTA commitments.

How to apply for a work permit exemption

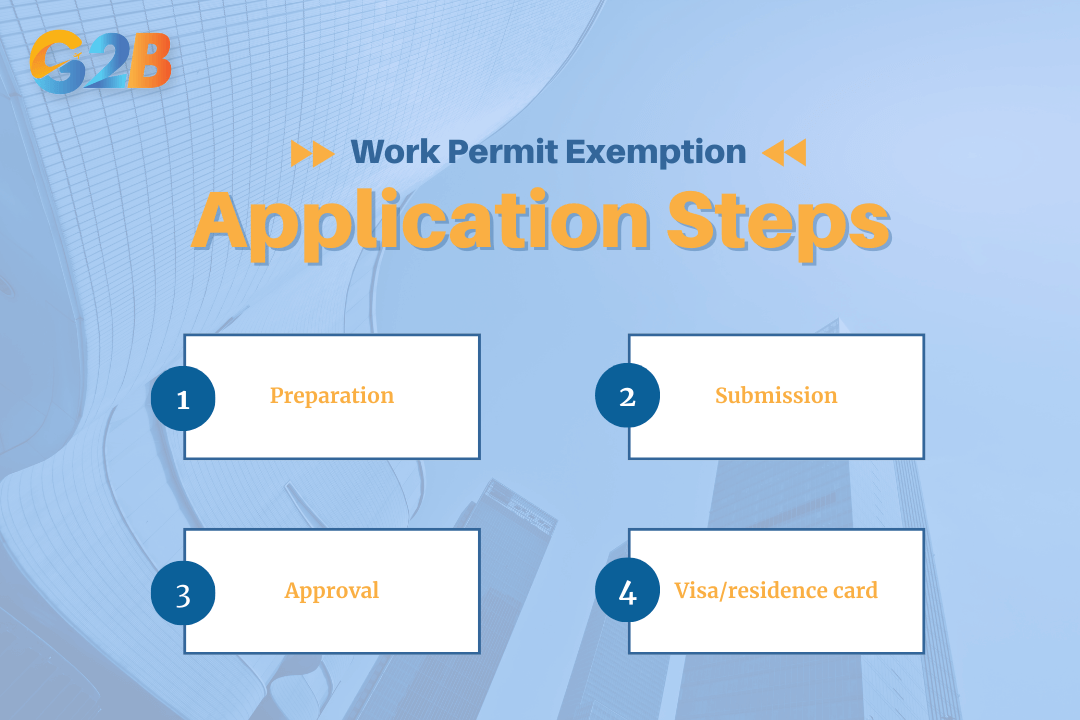

While "exemption" sounds automatic, it requires a formal administrative procedure with the local DOLISA or MOLISA.

- Preparation: Gather the Letter of Appointment, proof of 12-month prior employment in the EU, and the subsidiary’s Enterprise Registration Certificate (ERC).

- Submission: Submit the dossier to DOLISA at least 10 days before the employee starts work.

- Approval: Under the new Decree 219/2025/ND-CP guidelines, the authority must respond within 5 working days.

- Visa/residence card: Once the Exemption Certificate is issued, the employee can apply for a Temporary Residence Card (TRC) matching the duration of the exemption (up to 3 years).

Navigating labor laws can be complex. Let our experts handle your Work Permit and Temporary Residence Card with our Work Permit/TRC/Visa services in Vietnam.

Four steps to apply for a work permit exemption

What is the EVFTA tariff elimination roadmap for 2026?

For trading companies, the "meat" of the EVFTA is the tariff reduction schedule. In 2026, we have moved past the initial phase and are seeing deep cuts in high-value categories.

Which goods are eligible for 0% import tax in 2026?

By the start of 2026, a substantial majority of Vietnam’s tariff lines on EU goods have already been reduced to 0% or very low rates, in line with the roadmap towards 91.8% duty‑free lines by the end of 2026. Key categories that EU exporters can now ship to Vietnam duty-free (or at significantly reduced rates) include:

- Pharmaceuticals: Crucial for Vietnam’s aging population, a large share of EU drugs now enter at 0% or very low tariffs under the EVFTA schedule.

- Automotive parts: While fully assembled cars still have a longer roadmap, many engine components and safety systems have seen tariffs drop from 15-20% down to 0-5%.

- Machinery and appliances: Industrial equipment needed for Vietnam’s manufacturing sector enjoys near-zero tariffs to encourage technology transfer.

- Textile fabrics: High-quality EU fabrics enter duty-free, supporting Vietnam’s garment export industry.

EUR.1 certificate vs. REX system

To claim these lower tariffs, you cannot simply ship the goods; you must prove their "economic nationality" via Rules of Origin (ROO).

- EUR.1 certificate: The traditional movement certificate issued by customs authorities in the EU.

- REX system (registered exporter system): This is the future of trade compliance. The EVFTA allows and, on the EU side, effectively prioritizes that registered exporters self-certify the origin of goods on the invoice itself.

Important note for 2026: Vietnamese customs are increasingly scrutinizing "self-certification" documents. If your invoice declaration does not strictly follow the specific wording required by the EVFTA protocol, the preferential tariff will be rejected, and standard WTO rates will apply.

What are the rules of origin (ROO) requirements?

The EVFTA allows for "cumulation." This means materials originating in the other party (the EU or Vietnam), and in specific cases certain materials from Korea, may count towards the "originating status" of the final product. However, strictly speaking, products must generally undergo "sufficient working or processing" in the EU to qualify. Simple assembly or repackaging is never enough to qualify for EVFTA tax cuts.

Why choose a professional consultant for EVFTA compliance in Vietnam?

While the EVFTA is "free trade", it is not "deregulated trade." The administrative burden has shifted from paying taxes to proving compliance:

Risks of non-compliance

Vietnamese customs authorities conduct post-clearance audits up to 5 years after importation. If they discover that a Rules of Origin (ROO) declaration was incorrect, or that an HS code was manipulated to fit an EVFTA bracket:

- You will be forced to pay the full back-taxes (the difference between the EVFTA rate and standard rate).

- You will be subject to heavy administrative fines (often around 20% of the tax amount) plus interest.

- Your company may be "blacklisted" into the Red Channel for customs, meaning 100% physical inspection of all future shipments.

Challenges with the Investment Registration Certificate (IRC)

When setting up a company under EVFTA specific commitments (like the retail or education sectors mentioned above), the Investment Registration Certificate (IRC) should clearly reflect EVFTA-based market access rights, for example by citing EVFTA commitments or their implementing legislation as part of the legal basis.

Local licensing officers at the DPI may not always be up-to-date with the latest 2026 liberalizations. They might default to older, more restrictive WTO rules. A consultant acts as your advocate, utilizing specific legal citations (like the removal of the ENT) to force the correct application of the law, ensuring your business license accurately reflects your full rights under the treaty.

VSIC code matching

Vietnam uses the VSIC (Vietnam Standard Industrial Classification) system, which doesn't always align perfectly with the CPC codes used in the EVFTA. Mismatching these codes during company registration can leave you legally unable to perform the services you intended to offer.

Frequently asked questions (FAQ) about EVFTA

1. Does EVFTA apply to the UK after Brexit? No. The United Kingdom is no longer a member of the EU. Trade between Vietnam and the UK is governed by a separate agreement called the UKVFTA (United Kingdom - Vietnam Free Trade Agreement), which mirrors many EVFTA terms but is legally distinct. You cannot use a European EUR.1 certificate for UK goods.

2. How does EVFTA affect retail businesses in Vietnam? The impact is transformative. As of August 2025, the Economic Needs Test (ENT) was removed. This means EU retailers can now expand their chain of stores in Vietnam without undergoing the subjective "market impact" test that previously restricted foreign chains. This opens the door for massive retail expansion in 2026.

3. What documents are needed to claim EVFTA preferential tariffs? To claim the 0% or reduced tax rate, the importer must present either a valid EUR.1 Certificate of Origin issued by the competent authority in the export country, or an origin declaration made out by a Registered Exporter (REX) on the invoice or delivery note. The document must explicitly refer to the goods in question and follow the protocol text exactly.

The EVFTA in 2026 represents the "Gold Standard" for foreign investment in Vietnam. It has successfully lowered costs, removed the ENT barrier for retailers, and simplified labor mobility through Decree 219/2025/ND-CP. However, the benefits are not automatic - they are rewards for compliance. To unlock 100% ownership, tax exemptions, and streamlined visas, investors must navigate a complex web of CPC codes, Rules of Origin, and local administrative procedures.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom