In recent years, the State Bank of Vietnam (SBV) has tightened regulations regarding Know Your Customer (KYC) protocols and anti-money laundering (AML) compliance. Opening a bank account in Vietnam for foreigners is often a confusing administrative hurdle expats face when relocating to this vibrant Southeast Asian hub. Whether you are a digital nomad settling in Da Nang, a foreign investor establishing an entity in Ho Chi Minh City, or an English teacher starting a contract in Hanoi, navigating the Vietnamese banking system requires patience and specific legal knowledge. Beyond personal banking, if you are establishing a company in Vietnam, the financial requirements become even more stringent

Can foreigners open a bank account in Vietnam?

Yes, but the type of account foreigners qualify for depends entirely on their legal status within the country. To establish authority on this subject, let’s look at the specific definitions provided by the State Bank of Vietnam.

Understanding "resident" vs. "non-resident" status

Vietnam’s banking law classifies foreign customers into two distinct entities:

- Resident foreigners: These are individuals residing in Vietnam for a duration of 12 months or more. To prove this status, you generally need a Temporary Residence Card (TRC) or a long-term visa with a validity of at least one year.

- Privileges: Residents can open Payment Accounts (for daily transactions) and Term Deposit Accounts (Savings accounts with interest). Navigating the latest regulations on visa and employment permits is essential to secure your resident status and unlock full banking privileges

- Note: The term of any savings deposit cannot exceed the validity of your visa or TRC.

- Non-resident foreigners: These are individuals residing in Vietnam for less than 12 months. This category typically includes tourists, short-term business visitors, and those on e-visas (even if you renew them repeatedly).

- Limitations: Non-residents are strictly limited. You can generally only open a Payment Account in VND (Non-Resident Payment Account). You are legally prohibited from opening Term Deposit (Savings) accounts to earn interest.

The reality of tourist visas in 2026

In 2026, the reality is stark. While the law technically allows for non-resident payment accounts, most major banks (like Vietcombank or Techcombank) will refuse to open accounts for tourist visa holders. The compliance costs and paperwork required to monitor non-resident accounts often outweigh the benefits for the bank.

- If you are strictly on a tourist visa, your chances are slim at head offices. However, some smaller branches of local banks (such as TPBank or ACB) or digital-forward banks might make exceptions if you can prove a legitimate reason for being in Vietnam, but do not rely on this as a primary banking strategy.

Requirements to open a bank account in Vietnam

To ensure a smooth experience, you must treat your bank visit like a formal business meeting. Missing a single document can result in being turned away.

Checklist for opening a personal bank account:

- Valid passport: Your passport must be valid for at least 6 months beyond the date of application. The bank will scan the bio-page and your entry stamp.

- Valid visa or temporary residence card (TRC): This is the single most critical document. It dictates your "Resident" status.

- Note: If you are in the process of applying for a TRC, the receipt of the application is usually not accepted; you need the physical card or the visa stamp in your passport.

- Proof of address: Simply showing your lease is often not enough. Banks require a Confirmation of Temporary Residence (Phieu Khai Bao Tam Tru).

- How to get it: Your landlord must register you with the local ward police (Cong An Phuong). Once registered, the police issue a stamped paper or the landlord can print the confirmation from the online immigration portal.

- Alternative: A notarized rental contract (valid for 6+ months) is accepted by some banks, but the police confirmation is the gold standard.

- Proof of employment (for salary accounts): If you want to receive a salary or open a credit card, you must provide:

- A valid Work Permit (or Work Permit Exemption certificate).

- A signed Labor Contract.

- If you are a business owner, your Enterprise Registration Certificate (ERC) serves as your proof of income source.

- Minimum deposit: You will need a small amount of cash to activate the account. This ranges from 50,000 VND ($2) to 3,000,000 VND ($120), depending on the bank and account tier.

Types of bank accounts available for foreigners

Understanding the architecture of Vietnamese banking products will save you from costly conversion fees and withdrawal issues.

There are 3 types of bank accounts available for foreigners

1. Payment accounts (current accounts)

This is the standard checking account used for daily life - paying for Grab, shopping at WinMart, or paying rent.

- VND account: The essential account. You can deposit cash (VND), receive transfers, and use a debit card (Napas or Visa/Mastercard) at ATMs.

- Foreign currency account (USD/EUR): Many expats open a USD account thinking they can use it as a multi-currency wallet. Be careful.

- The Trap: You can receive USD from abroad into this account. However, you cannot withdraw USD cash from an ATM. To access the money, you generally must convert it to VND at the bank's exchange rate.

- Exception: You can only withdraw foreign currency in cash if you can prove you are traveling abroad (e.g., showing a flight ticket and visa for a foreign country) or for specific permitted purposes.

2. Direct investment capital account (DICA)

If you are a foreign investor setting up a company in Vietnam, you cannot use a personal account to inject capital. You must open a DICA. This account is legally designated to receive the charter capital transfer from your overseas bank account. Using a personal account for this purpose will cause significant legal issues during future audits or when you try to repatriate profits.

For investors, our Vietnam Incorporation Service includes full support in opening the correct DICA and transaction accounts to ensure seamless capital injection.

3. Savings/term deposit accounts

If you hold "Resident" status (TRC/1-year visa), you can open high-interest savings accounts. Vietnam often offers attractive interest rates compared to Western banks (ranging from 4% to 7% depending on market conditions).

- Crucial rule: The maturity date of the savings term must be prior to the expiry date of your Visa or TRC.

- Example: If your TRC expires on December 31, 2026, you cannot open a 12-month term deposit in February 2026. You would be limited to a 6-month or 9-month term.

Best banks in Vietnam for foreigners

The "best" bank depends on your priorities: English customer service, low fees, or digital app quality.

International banks

Best for: Reliability, Global Transfers, and English Support.

- HSBC Vietnam & Standard Chartered: These are the gold standards for compliance. If you already bank with them in your home country, "Expat Banking" services may allow you to set up an account before you even arrive (though this is rare).

- Pros: Impeccable English support, safe, easy international transfers.

- Cons: Strict requirements, higher monthly fees, fewer ATMs/branches, and often poor mobile app experiences compared to local rivals.

- Shinhan Bank (South Korea) / UOB (Singapore): These Asian powerhouses have aggressively expanded in Vietnam.

- Verdict: Shinhan Bank is currently a top favorite among expats. They offer excellent customer service, English-fluent staff, and lower fees than Western banks.

Local Vietnamese banks

Best for: Digital Experience, Low Fees, and Accessibility.

- Vietcombank (VCB): The largest state-owned bank. Having a VCB account is like having a "universal key" - it works with every payment gateway and e-wallet (Momo, ZaloPay).

- Pros: Accepted everywhere.

- Cons: Branches are perpetually crowded. Service can be bureaucratic.

- Techcombank: A favorite for digital nomads. Their app is robust, and they were pioneers in offering "Zero Fee" transfers for domestic transactions.

- Pros: Great app, English interface, free transfers.

- TPBank (Tien Phong Bank): Known for their "LiveBank" kiosks - automated booths where you can deposit cash or issue debit cards 24/7 without meeting a teller.

- Timo (Digital Bank): Timo is not a bank itself but a digital banking platform powered by BVBank. It is arguably the most foreigner-friendly interface available.

- Pros: 100% English app, easy sign-up (at the Timo Hangout), fee-free withdrawals at any ATM in the Napas network.

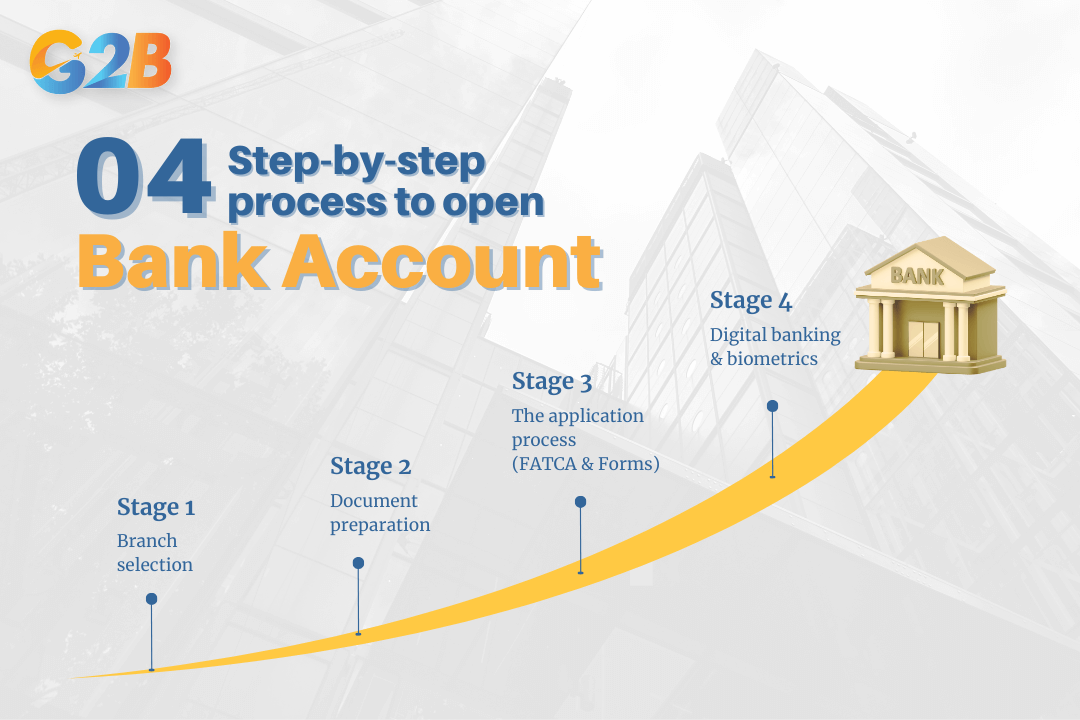

Step-by-step process to open your account

While locals can use e-KYC, foreigners are almost always required to visit a branch for passport verification.

Foreigners need to go through 4 steps to open bank accounts

Step 1: Branch selection

Strategy matters. Do not walk into a small provincial branch where staff may never have seen a foreign passport.

- Hanoi: Visit branches in Tay Ho (West Lake) or Hoan Kiem districts.

- Ho Chi Minh City: Visit branches in Thao Dien (District 2) or District 1. Staff in these areas are accustomed to expat names, TRCs, and English communication.

Step 2: Document preparation

Gather your "Checklist" documents (Passport, Visa/TRC, Work Permit, Residence Confirmation). Bring original copies. The bank will make photocopies and stamp them on-site.

Step 3: The application process (FATCA & Forms)

You will fill out an Application for Opening a Payment Account.

- For US Citizens: You must complete FATCA (Foreign Account Tax Compliance Act) forms. This authorizes the bank to report your account details to the IRS. Failure to disclose US citizenship can lead to account freezing.

- Signatures: Vietnam is strict about signatures. You must sign exactly as you did on your passport. If your signature varies, they will make you re-sign until it matches perfectly.

Step 4: Digital banking & biometrics

Once the account is open, download the banking app immediately while at the branch. Ask the staff to help you activate "Smart OTP."

- Crucial update: As of July 2026, the State Bank of Vietnam requires biometric authentication (facial recognition) for any transfer exceeding 10,000,000 VND (approx. $400) or total daily transfers over 20,000,000 VND.

- Action: You must register your biometric data (face scan) via the banking app using your NFC-enabled smartphone and chip-embedded residence card/passport, or do it at the counter. Without this, high-value transfers will be blocked.

Important regulations about transfers & repatriation

This section addresses the most complex aspect of banking in Vietnam: Moving money in and out.

Receiving money (inbound)

Receiving money is simple. You will need to provide your sender with:

- Account name (Must match passport exactly).

- Account number.

- SWIFT / BIC Code of the Vietnamese bank.

- Bank Branch Name (sometimes required). Most inbound transfers clear within 1-3 business days.

Sending money out of Vietnam (outbound)

Vietnam has strict Foreign exchange control laws. You cannot simply log into your app and wire $50,000 to the US or Europe.

To send money abroad, you must visit the branch and prove the Source of Funds.

- For employees: You must present your Labor Contract, Pay Slips, and proof that Personal Income Tax (PIT) has been paid. You can only repatriate the amount equal to your net salary. Ensuring full compliance with the labor law in Vietnam and social insurance obligations is vital for a smooth tax finalization process

- For investors: You need audited financial statements and proof of tax fulfillment. Collaborating with a professional chief accountant in Vietnam is the best way to ensure your financial records are audit-ready for profit repatriation

- For asset liquidation: If you sell an apartment, you need the notarized sales contract and tax payment receipts.

Domestic transfers (Napas 24/7)

For transferring money within Vietnam, the system is world-class.

- Napas 24/7: This system allows real-time transfers between different banks. You can transfer money using the recipient's Card number (on the ATM card) or Account number. It works instantly, even on weekends and holidays.

How to close a bank account in Vietnam

When your journey in Vietnam ends, do not simply board the plane and leave the account dormant. Monthly maintenance fees will accrue, and debt could complicate future entry into Vietnam.

The closure process

- Visit the branch: Go to the same bank (ideally the same branch) where you opened the account.

- Withdraw balance: You can withdraw the remaining cash or transfer it to a friend.

- Repatriation (The legal exit): If you have significant savings to bring home, this is the time to present your Tax finalization documents. The bank will allow you to convert your VND balance to USD/EUR and wire it to your overseas account as a "one-time repatriation of assets."

- Sign closure form: Ensure you receive a confirmation that the account is closed.

Frequently asked questions

1. Can I open a bank account in Vietnam online from abroad? No. Vietnamese law requires foreigners to be physically present in the country for the initial KYC (Know Your Customer) verification. You cannot open an account before you land.

2. Is my money safe in Vietnamese banks? Yes. The banking sector is heavily regulated by the State Bank of Vietnam. Additionally, deposits are insured by the Deposit Insurance of Vietnam (DIV), although the insurance cap is relatively low compared to Western standards. For large sums, stick to "Big 4" state banks (Vietcombank, BIDV, Agribank, VietinBank) or international banks for maximum peace of mind.

3. Why was my application rejected? The most common reasons are:

- Holding a visa with less than 6 months' validity.

- Lack of a "Police Confirmation of Residence" (using just a lease).

- Inconsistent signatures on forms vs. passport.

4. Can I use my Vietnamese debit card internationally? If you are issued a Visa or Mastercard debit card, yes. However, you will incur foreign transaction fees (usually 3-4%). If you have a domestic Napas card, it only works at ATMs and POS terminals within Vietnam.

Need help navigating Vietnam's business landscape? Opening a bank account is just step one. From choosing the right legal entity to obtaining your Investment Registration Certificate (IRC), G2B provides end-to-end support for your success. Whether you are setting up a company, need assistance with Investment Registration Certificates (IRC), or require professional taxation & accounting services, G2B is your trusted partner. We bridge the gap between global investors and local regulations. Contact G2B today to simplify your journey in Vietnam!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom