Vietnamese law allows foreigners to serve as a company’s legal representative. However, complying with the applicable conditions, residency requirements, and statutory responsibilities is critical. A legal representative acts as the company’s official face in all legal and financial matters, with full authority to sign contracts and represent the enterprise before competent authorities and courts. This guide offers an overview of the relevant legal framework - from the Law on Enterprises to practical requirements such as Work permits and Temporary Residence Cards (TRCs) - to help you confidently appoint a foreign national to this key role.

Eligibility and conditions for a foreign legal representative

To appoint a foreigner as a legal representative, they must meet a specific set of criteria mandated by Vietnamese law. These conditions are designed to ensure that the individual is capable, present, and legally permitted to manage a business in the country.

Core legal requirements

The foundational eligibility criteria are straightforward. Any individual, regardless of nationality, appointed as a legal representative must satisfy the following conditions:

- Full civil act capacity: The individual must be at least 18 years old and possess full legal capacity to enter into transactions and be held responsible for their actions.

- No prohibitions: The person must not be subject to any legal prohibitions on managing an enterprise. This means they cannot be currently facing criminal prosecution, serving a prison sentence, or be banned from holding managerial positions by a court.

The crucial residency requirement

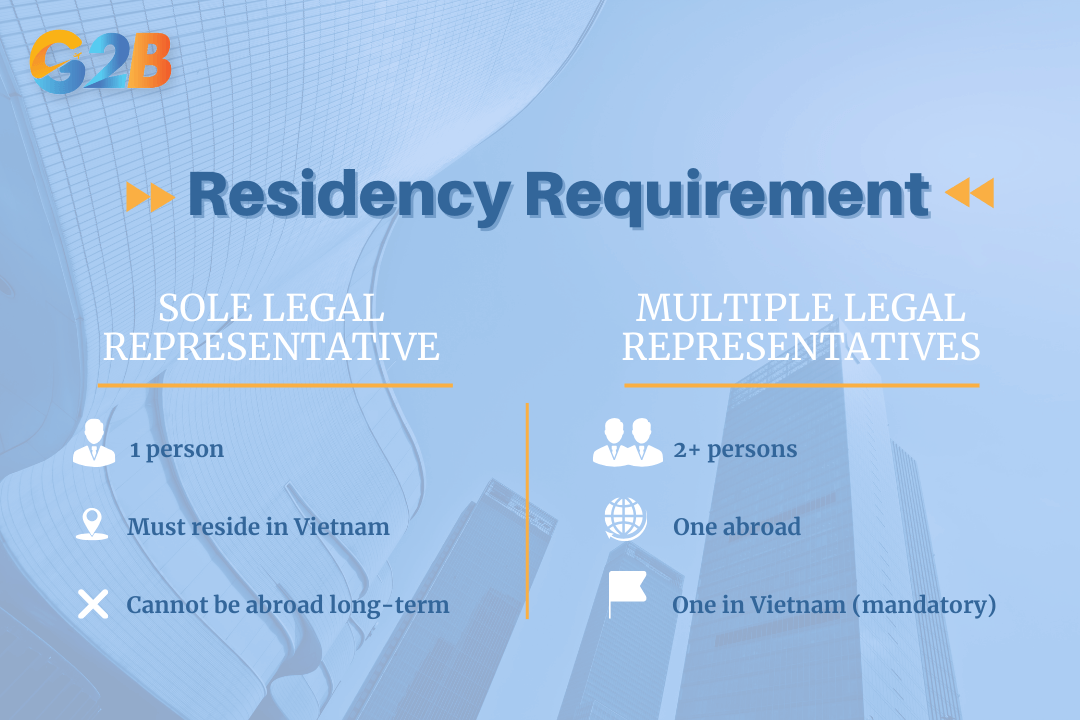

A non-negotiable rule under the Law on Enterprises is that a company must always have at least one legal representative residing in Vietnam.

- Sole representative: If the company has only one legal representative, that individual is required by the Law on Enterprises to reside in Vietnam. This ensures a point of contact is always available within the country for legal and administrative matters.

- Multiple representatives: Companies can appoint more than one legal representative, which is a common strategy for foreign-invested enterprises (FIEs). In this structure, one representative (often a foreign owner or director) can reside abroad, while another representative must be based in Vietnam to meet the residency requirement.

- Absence from Vietnam: If the sole legal representative leaves Vietnam, they are obligated to authorize, in writing, another person residing in the country to act on their behalf. The original representative remains legally responsible for the actions of the authorized person. Should they be absent for over 30 days without making such an authorization, the company must appoint a new legal representative.

Residency requirement between sole and multiple legal representatives

Necessary documentation and procedures

A foreign legal representative must possess the correct legal documentation to work and reside in Vietnam long-term.

- Work permit: In most cases, a foreigner holding the position of director or general director must obtain a work permit. The application process involves the employer demonstrating the need for a foreign expert and the candidate providing documents, such as proof of qualifications and a clean criminal record. There are some exceptions, for instance, for company owners who have contributed a significant amount of capital (e.g., VND 3 billion or more).

- Temporary Residence Card (TRC): A TRC is essentially a long-term visa that allows a foreigner to live in Vietnam for an extended period, typically one to five years. Foreigners with a valid work permit or those who are significant investors are generally eligible to apply for a TRC. This card simplifies entry and exit procedures and is crucial for satisfying the long-term residency requirement.

Powers, duties, and liabilities of the foreign legal representative

The role of the legal representative carries significant authority and equally substantial responsibilities. It is a position of trust that is central to the company's governance and legal standing.

Scope of authority

The legal representative is the primary individual empowered to act on the company's behalf. Their authority is broad and fundamental to daily operations. The representative has many powers, including signing binding contracts, opening and managing corporate bank accounts, representing the company in legal disputes or arbitration, and filing official documents with government bodies. The specific scope of these powers can be defined and, if necessary, limited within the company's charter.

Fiduciary duties

Under the Law on Enterprises, the legal representative has a fiduciary duty to act in the best interests of the company. This involves several key obligations:

- Honesty and diligence: They must perform their duties honestly, carefully, and to the best of their ability to protect the company's legitimate interests.

- Loyalty: The representative must be loyal to the interests of the enterprise and its owners, refraining from using corporate information, secrets, or business opportunities for personal gain.

- Disclosure: They are required to promptly and fully notify the company if they or a related person owns or has a controlling interest in another enterprise.

Personal and corporate liability

The authority vested in the legal representative is balanced by significant accountability. They are responsible for ensuring the company complies with all relevant Vietnamese laws and regulations. A failure to fulfill these duties can lead to serious consequences. A representative is personally responsible for any damages caused to the company resulting from a breach of their obligations. In cases of serious non-compliance, this can extend to administrative fines or even criminal liability.

A foreigner can absolutely serve as a legal representative in Vietnam, a role that is integral to the command and control of any business. The key is to ensure strict adherence to the legal prerequisites, particularly the conditions of legal capacity and the mandatory residency requirement for at least one representative. This role carries substantial power to direct the company's affairs but also imposes serious fiduciary duties and personal liability for compliance with Vietnamese law. Foreign investors should carefully select their legal representative and precisely define their authority in the company's charter.

Ready to start your journey in Vietnam? Contact G2B today for a consultation on how to establish a company in Vietnam and to follow annual compliance requirements during operations. Let us handle the bureaucracy so you can focus on your business.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom