The setup process and requirements for foreign investors in Vietnam have undergone significant streamlining following the implementation of the Law on Investment 2020 and the Law on Enterprises 2020. However, the intersection of local administrative procedures and international treaty compliance remains a complex landscape for many. Navigating the transition from a foreign entity to a locally compliant Vietnamese subsidiary requires precise execution of documentation and strict adherence to statutory timelines. This article will provide the definitive roadmap for establishing a legal commercial presence in Vietnam.

To ensure a seamless transition, many investors rely on a professional Vietnam Incorporation Service to navigate these complexities and ensure 100% compliance from day one.

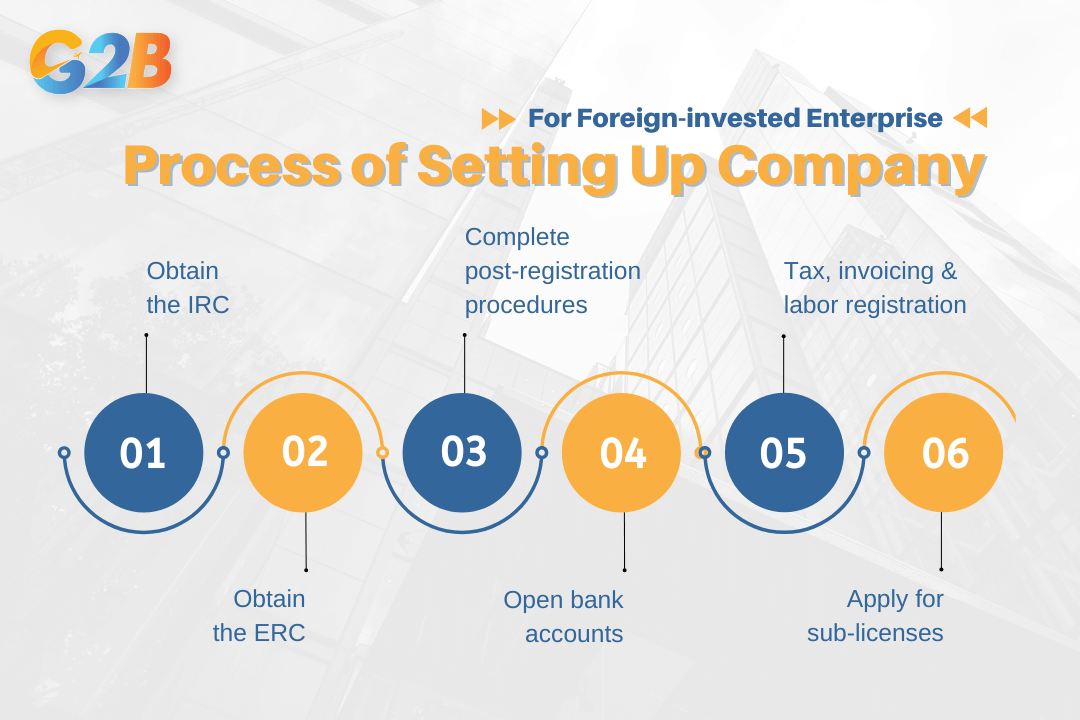

Step 1: Obtain the Investment Registration Certificate (IRC)

The Investment Registration Certificate (IRC) is the initial "birth certificate" of an investment project. It is mandatory only for projects subject to investment conditions (e.g., conditional business lines or projects exceeding VND 300 billion excluding Vietnamese investor capital).

- Why: To ensure the investment project aligns with Vietnam’s national development goals, environmental standards, and WTO Commitments. The IRC records the project’s objectives, scale, and capital contribution schedule.

- How: Investors submit an application file to the Department of planning and investment (DPI) or the Management Board of Industrial Zones. This includes a detailed Investment Project Proposal and proof of financial capacity.

- Timeline: The statutory timeframe is 15 working days from the receipt of a valid application, though complex projects involving "Conditional business lines" may require longer for inter-ministerial consultation.

Step 2: Obtain the Enterprise Registration Certificate (ERC)

Once the IRC is secured, the investor must apply for the Enterprise Registration Certificate (ERC), also known as the Business Registration Certificate.

- Why: The ERC officially recognizes the company as a legal entity in Vietnam. It assigns the 10-digit Tax Identification Number (TIN) which serves as the unique identifier for all tax and administrative purposes.

- How: The application is submitted online via the National Business Registration Portal or to the Business Registration Office (BRO) under the DPI. It includes the Company Charter and the list of founding shareholders or members.

- Timeline: This step is relatively fast, typically taking 3 to 5 working days.

Comparison: IRC vs. ERC

| Feature | Investment Registration Certificate (IRC) | Enterprise Registration Certificate (ERC) |

|---|---|---|

| Primary purpose | Authorizes the specific investment project and activities. | Establishes the legal entity/corporate personhood. |

| Issuing authority | DPI (Investment Section) or IZ Management Board. | DPI (Business registration office). |

| Statutory timeline | 15 Working days. | 3 - 5 Working days. |

| Key content | Project location, scale, and capital schedule. | Company name, address, and legal representative. |

Step 3: Complete post-registration procedures

Securing the ERC is not the end of the journey. Several administrative tasks are required before a company can legally commence operations.

- Corporate seal: While the Law on Enterprises 2020 allows companies to decide the form and number of seals, all companies must still possess a physical or digital seal to authorize official documents and contracts.

- Public announcement: The enterprise's information must be posted on the National business registration portal within 30 days of incorporation.

- Corporate e-ID registration (New for 2025): Under updated digitalization mandates, the Legal Representative must register the company’s electronic identity via the VNeID platform. This e-ID is essential for accessing the National Public Service Portal for future administrative filings and tax submissions.

Step 4: Open bank accounts (DICA vs. Transaction account)

Foreign investors are legally required to open at least two distinct types of bank accounts in Vietnam.

- Direct investment capital account (DICA): This is a specialized foreign currency or VND account used exclusively for injecting charter capital, receiving offshore loans, and remitting profits back to the home country. All capital flows must pass through the DICA to be recognized by the State Bank of Vietnam (SBV).

- Transaction account: This is the daily operational account used for paying salaries, settling local supplier invoices, and receiving domestic revenue.

Understanding the nuances of opening a bank account in Vietnam is vital for the legal repatriation of profits later.

Step 5: Tax, invoicing, and labor registration

Compliance within the first 30 days of ERC issuance is critical to avoid administrative penalties.

- License tax (Business license fee): Companies must pay an annual 2,000,000 VND registration fee based on their registered charter capital. This applies to most new SMEs.

- Electronic invoicing (E-invoices): Since 2022, paper invoices are obsolete. Companies must register with a licensed e-invoice provider and notify the General Department of Taxation.

- Labor & Social insurance: If the company hires local or foreign employees, it must register with the Social Insurance Agency and the local Labor Department.

- Initial tax declaration: Even if no revenue is generated yet, a "Nil" tax return must be filed for the first quarter. At this stage, appointing a qualified chief accountant in Vietnam is highly recommended to manage these initial tax filings and ensure long-term financial health

Compliance with the labor law in Vietnam and maintaining proper social insurance records are mandatory post-licensing steps

Step 6: Apply for sub-licenses (conditional businesses)

If your company operates in "Conditional" sectors - such as Logistics, Education, Retailing, or Tourism - the ERC is not enough.

- Why: These sectors affect national security, public health, or social order.

- How: You must apply for a Business license or an Operating permit from the relevant line ministry (e.g., MOIT for retail, Ministry of Education for schools).

- Timeline: This is often the most time-consuming phase, taking anywhere from 30 to 90 days.

Incorporating a FIE in Vietnam is a multi-stage legal process

Essential requirements for company setup in Vietnam

Before proceeding with company incorporation in Vietnam, foreign investors must understand the essential legal, regulatory, and practical requirements applicable to their investment. The following section outlines the key conditions to ensure a compliant and smooth company setup process.

Minimum capital requirements (Charter capital)

Unlike many jurisdictions, Vietnam does not have a general statutory minimum capital requirement for most business lines. However, the Department of Planning and Investment (DPI) will scrutinize the capital amount to ensure it is "reasonable" for the scale of the project.

- Service-based entities: Often $10,000 - $30,000 is accepted.

- Manufacturing: Capital must be sufficient to cover machinery, factory lease, and initial operating costs.

- Note: The charter capital must be fully contributed within 90 days of the ERC issuance date.

Business lines and conditional sectors

Vietnam utilizes a "negative list" approach. Foreign investors can invest in any sector not expressly prohibited by the Law on Investment.

- Prohibited sectors: Narcotics, firecrackers, human organs, and debt collection services.

- Conditional sectors: Require foreign investors to meet specific criteria regarding ownership percentages (e.g., a 49% or 51% cap in some logistics sectors) and local partnership requirements.

Legal representative requirements

Every company in Vietnam must have at least one Legal representative who resides in the country.

- If the company has only one Legal Rep, that person must reside in Vietnam.

- If the Legal Rep leaves the country for more than 30 days, they must authorize another person in writing to exercise their rights and obligations.

- Foreign Legal Representatives must obtain a Work permit and a Temporary residence card (TRC).

Physical registered office address

A virtual office is generally permitted for service-based businesses, but a physical address is mandatory.

- The address cannot be an apartment building or a residential flat (unless the building is zoned for commercial use).

- Investors must provide a signed lease agreement and, in some cases, the landlord’s ownership certificate (pink book).

Required documentation for foreign investors

All documents issued outside of Vietnam must be notarized, translated into Vietnamese, and consularly legalized by the Vietnamese Embassy or Consulate in the investor's home country.

Necessary documents for individual investors

- Notarized passport copy: Must be valid for at least 6 months.

- Bank balance certificate: A statement showing funds equal to or greater than the intended investment amount.

- Lease agreement: For the registered office in Vietnam.

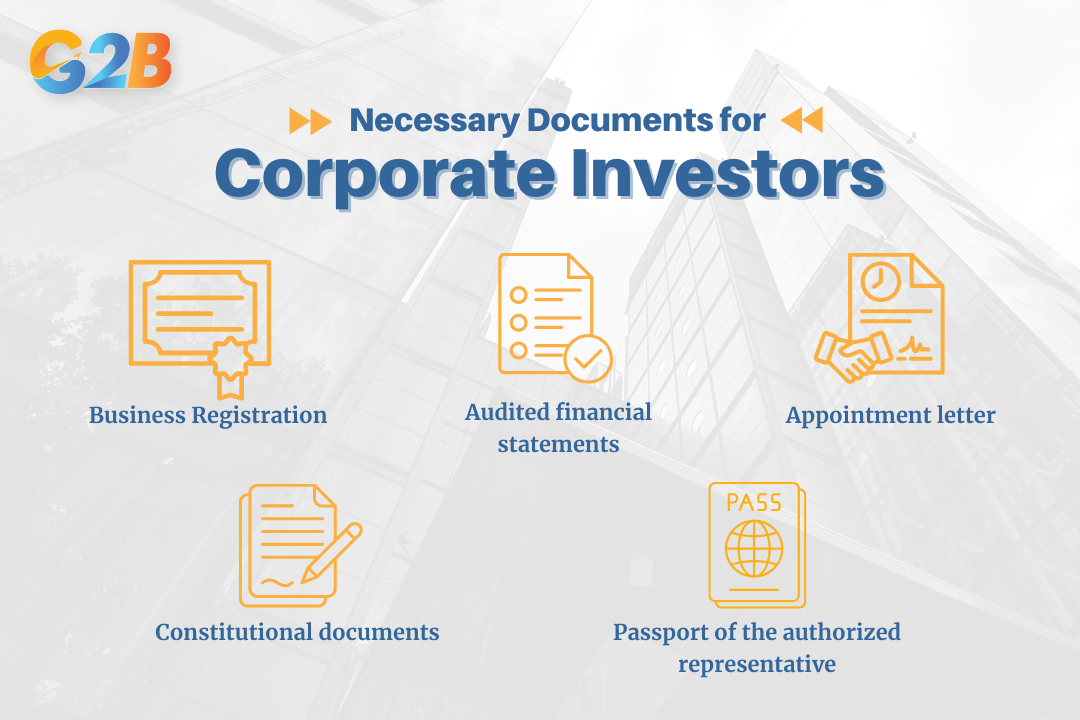

Necessary documents for corporate/institutional investors

- Certificate of incorporation/business registration: Proving the parent company is a legal entity.

- Audited financial statements: Usually for the last 2 years to prove financial capability.

- Constitutional documents: Articles of Association or Company Charter.

- Appointment letter: Designating the authorized representative of the parent company who will sign documents in Vietnam.

- Passport of the authorized representative: Notarized copy.

There are 5 necessary documents for corporate/institutional investors

Consular legalization and translation requirements

The "Chain of Authentication" is non-negotiable. Documents must follow this sequence:

- Notary public in the home country.

- Ministry of foreign affairs (or equivalent) in the home country.

- Vietnam embassy/consulate in the home country.

- Certified translation into Vietnamese by a licensed translation house in Vietnam.

Navigating the company setup process in Vietnam for foreign investors demands a meticulous approach to legal compliance and a deep understanding of local administrative nuances. While the government has significantly improved the "Ease of Doing Business" rankings by digitizing the ERC and IRC processes, the burden of proof regarding financial capability and sector-specific eligibility remains high. By aligning your market entry strategy with the Law on Investment 2020 and leveraging the mandatory digital updates like the Corporate e-ID, you position your enterprise for long-term stability.

Ready to start your journey? Contact G2B today for a tailored consultation on our Vietnam Incorporation Service and let us handle the paperwork while you focus on your business growth.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom