Open representative office in Vietnam is widely recognized as the smartest market-entry vehicle for international investors eyeing Southeast Asia. It serves as a low-risk bridge, allowing you to cultivate local relationships and analyze market trends without the administrative burden of a full-fledged enterprise. Let’s break down the costs, timeline, and legal steps to secure your license without delay.

What is a representative office (RO) in Vietnam?

Under the framework of Vietnam Commercial Law, a Representative Office (RO) is legally defined as a "dependent unit" of the parent entity. Think of it not as a separate company, but as the extended arm of your foreign headquarters reaching into the Vietnamese market. Unlike establishing a Limited Liability Company (LLC), setting up an RO does not require "Charter Capital" or complex shareholder structures. It grants you a legitimate legal status to operate physically in Vietnam - renting office space, hiring staff, and obtaining visas - but with a clear boundary: it acts as a cost center, not a profit center.

Role and functions of an RO in Vietnam

The primary function of a Representative Office is to serve as a liaison office. Under current Vietnamese regulations, the scope of operations for an RO is strictly defined and monitored by the Department of Industry and Trade (DOIT). The lawful activities of an RO include:

- Market research: Conducting surveys, analyzing consumer behavior, and identifying business opportunities.

- Liaison activities: Acting as a bridge between the parent company and potential Vietnamese partners or clients.

- Promotion: Promoting the brand, products, or services of the parent company (without direct sales).

- Supervision: Monitoring the implementation of contracts signed between the parent company and Vietnamese partners.

An RO is strictly prohibited from generating revenue in Vietnam. It cannot issue invoices, sign commercial contracts (except for its own operational needs like office lease or utilities), or receive direct payment from clients. Violating this rule can lead to severe penalties and revocation of the operation license. DOIT conducts periodic inspections to enforce this.

Why set up a representative office in Vietnam?

Foreign investors typically choose to open a representative office in Vietnam due to the balance of low risk and high strategic value.

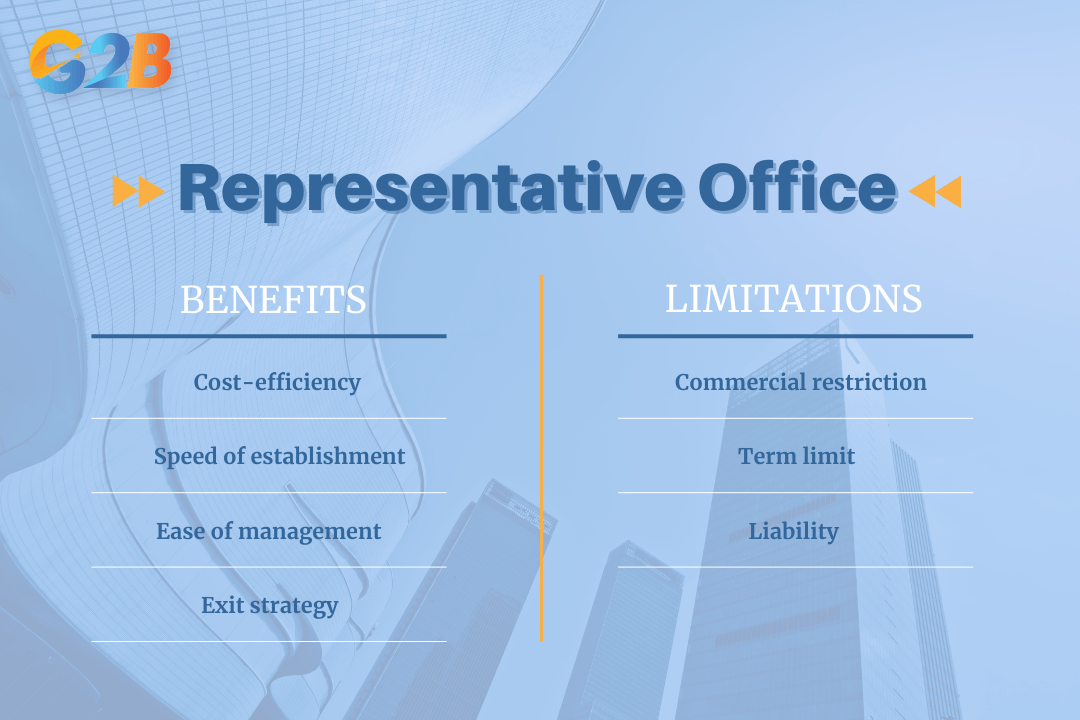

Benefits

- Cost-efficiency: There is no requirement for "Charter Capital" (registered investment capital) to establish an RO. The initial setup costs are significantly lower than forming an LLC.

- Speed of establishment: The licensing process is generally faster than that of a foreign-owned enterprise (FDI company).

- Ease of management: Compliance requirements regarding accounting and tax are less burdensome compared to a fully operational company.

- Exit strategy: If the market research yields negative results, closing a representative office (dissolution) is a simpler and faster process than liquidating a company.

Limitations

- Commercial restriction: As mentioned, you cannot trade, invoice, or profit.

- Term limit: The license is granted for five years (though it is renewable).

- Liability: The parent company bears full liability for the activities and debts of the Representative Office.

Benefits and limitations of a representative office in Vietnam

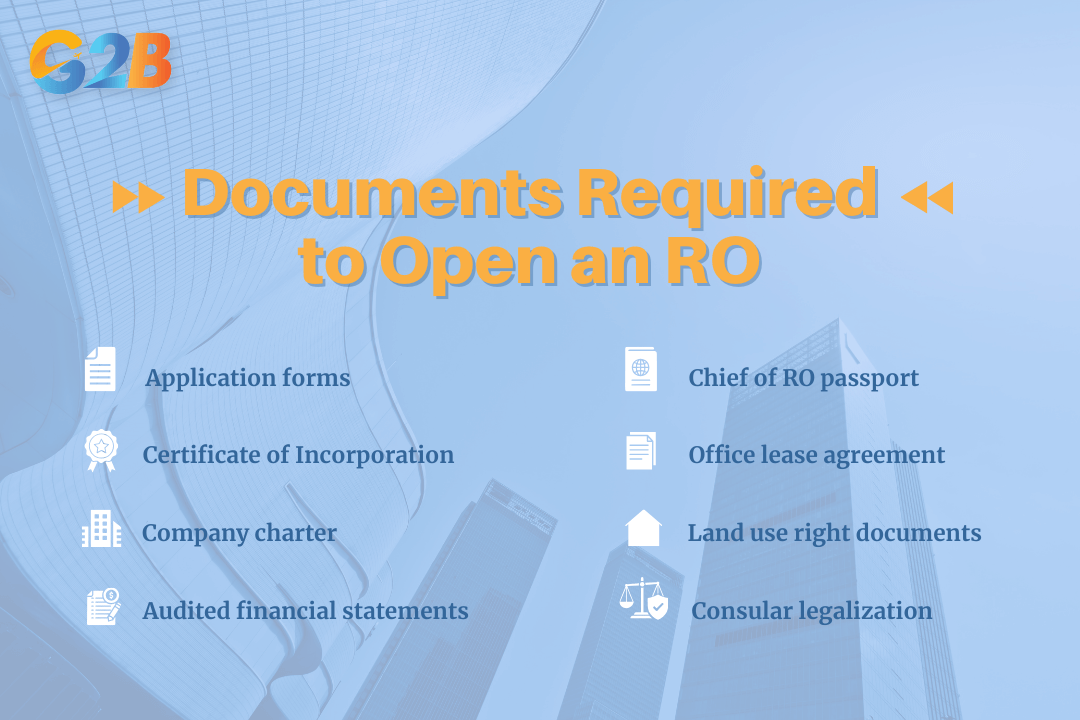

Checklist of required documents for RO registration

The success of your application largely depends on the precision of your dossier. Vietnamese authorities are meticulous; a single discrepancy between the application form and the supporting documents can result in rejection or delays.

To open representative office in Vietnam, you must prepare the following dossier:

- Application form (Form MD-3): The standard application form issued by the Ministry of Industry and Trade, signed by the legal representative of the parent company.

- Notification of establishment of RO (Form I-6): Issued by the parent company.

- Legalized documents (The most critical step):

- Certificate of incorporation (COI): or Business Registration Certificate of the parent company.

- Company charter/articles of association: Defining the scope of the parent company.

- Audited financial statements: You must provide the audited financial report of the most recent fiscal year to prove the parent company is solvent and has been operating for at least one year.

- Note regarding consular legalization: These documents must be notarized in the home country, certified by the Ministry of Foreign Affairs of that country, and finally legalized by the Vietnamese Embassy/Consulate in that country.

- Personnel documents:

- Passport of the chief of representative office: A notarized copy. If the Chief is already in Vietnam, a valid visa or Temporary Residence Card is required.

- Letter of appointment: A formal document from the parent company appointing the Chief of the RO, detailing their salary and tenure. This must be consular legalized if issued abroad, plus CV and qualifications if Chief is foreigner.

- Location documents:

- Office lease agreement: A signed Memorandum of Understanding (MOU) or official lease contract.

- Landlord’s legal documents: Notarized copies of the landlord's Certificate of Land Use Rights (Red Book) and their business registration (if a corporate landlord) to prove they are authorized to lease the space for commercial use.

Key documents required to open a representative office in Vietnam

How to open a representative office in Vietnam

Step 1: Preparation & legalization of documents

Before submitting anything to the Vietnamese authorities, the documents from the parent company must undergo Consular legalization.

- Process: The documents are notarized locally -> Certified by the State/Foreign Office of the home country -> Authenticated by the Vietnam Embassy.

- Translation: Once legalized, these documents must be translated into Vietnamese and notarized by a judicial notary public in Vietnam.

Step 2: Submission of application to DOIT

Once the dossier is complete, it is submitted to the licensing authority.

- Authority entity: In most cases, this is the Department of Industry and Trade (DOIT) of the province or city where the RO will be located (e.g., DOIT Ho Chi Minh City or DOIT Hanoi).

- Industrial parks: If the office is located inside an Industrial Park or Export Processing Zone, the dossier is submitted to the Management Board of that zone.

- Submission method: Depending on the specific province, this can be done via the online public service portal or direct physical submission.

Step 3: Application review & clarification

This is the phase where expertise matters most. The DOIT will review the validity of the documents.

- If the dossier is incomplete or requires clarification (e.g., the business scope of the parent company is vague), the DOIT will issue a Request for Amendment.

- You must respond and amend the dossier within a specific timeframe. Failure to address these queries precisely often leads to application rejection.

Step 4: Issuance of RO license

- Statutory timeline: According to the Commercial Law, the license should be issued within 30 working days of receiving a valid dossier.

- Practical timeline: In reality, due to administrative workload and dossier reviews, the process typically takes 15 to 20 working days from the date of submission.

- Upon approval, the DOIT issues the Representative Office Registration Certificate.

Step 5: Post-licensing procedures

Receiving the license is not the finish line. To be fully operational, the RO must complete the following compliant steps:

- Seal carving: Obtain the official circular company stamp (Seal) from an authorized agency and publish the seal sample on the National Business Registration Portal.

- Tax code registration (MST): Even though the RO does not pay Corporate Income Tax, it must register for a Tax Identification Number (MST) with the local Tax Department to declare Personal Income Tax for employees.

- Bank account opening: Open a specialized payment account in Vietnamese Dong (VND) or foreign currency at a commercial bank in Vietnam. This account is used solely for funding office operations (salary, rent, utilities) using funds transferred from the parent company.

- Activity announcement: In some cases, you must publish an announcement of the RO establishment in a permitted newspaper (printed or electronic).

Tax & reporting obligations for Representative Offices

One of the most attractive features of an RO is its tax neutrality regarding corporate profits, but strict compliance is required for other areas.

Personal income tax (PIT)

The Representative Office acts as the tax agent for its employees.

- Obligation: The RO must withhold, declare, and pay Personal Income Tax (PIT) on behalf of the Chief of RO and all employees (local and foreign).

- Rates: PIT is progressive for residents (up to 35%) and a flat rate (20%) for non-residents.

Annual reports

The RO must submit an Annual operation report (Form BC-1) to the Department of Industry and Trade.

- Deadline: Before January 30th of the following year.

- Content: The report details the HR situation, activities conducted during the year, and confirmation that no profit-generating activities took place.

Social insurance

For Vietnamese staff, the RO is mandatory to register and pay Social Insurance (BHXH), Health Insurance, and Unemployment Insurance.

Note regarding Corporate Income Tax (CIT): The RO does not declare or pay CIT. However, if the tax authorities discover the RO has been conducting hidden commercial activities (shadow operations), they may impose a deemed tax on the deemed revenue.

Hiring staff & the chief of Representative Office regulations

The Chief of representative office is the legal face of the RO in Vietnam.

- Nationality: The Chief can be a Vietnamese national or a foreigner.

- Residency: If the Chief is a foreigner, they must obtain a Work Permit (or Work Permit Exemption) and a Temporary Residence Card (TRC). The Chief must be present in Vietnam. If they leave Vietnam for more than 30 consecutive days, they must authorize another person to act on their behalf.

- Conflict of interest: The Chief of the RO cannot concurrently hold the position of the Legal Representative of a subsidiary of the same parent company in Vietnam. This rule is strictly enforced to prevent conflict of interest between the non-commercial RO and the commercial subsidiary.

Recruiting staff: The RO has the right to recruit Vietnamese and foreign employees. The number of foreign employees must be justified and explained to the Department of Labor, Invalids and Social Affairs (DOLISA) via a demand report.

Estimated costs to setup an RO in Vietnam

The cost structure for opening an RO is transparent but variable based on document readiness.

- State fees: The official government fee for issuing the RO license is nominal (typically around 3,000,000 VND or approx. $120 USD, subject to change).

- Translation & notarization: Costs vary based on the volume of documents (Certificates, Charters, Financial Statements).

- Consular legalization: Fees paid to the Ministry of Foreign Affairs in your home country and the Vietnamese Embassy.

FAQs about opening a representative office in Vietnam

1. Can a Representative Office sign sales contracts? No. An RO is strictly prohibited from entering into commercial contracts. It can only sign contracts related to its own operations, such as office leasing, employment contracts, and purchasing office supplies.

2. How long is the RO license valid? The Representative Office Registration Certificate is valid for five (05) years but not exceeding the remaining term of the parent company's business license (if applicable). It can be renewed multiple times.

3. Can I convert an RO into a Limited Liability Company (LLC)? No, there is no direct legal procedure to "convert" an RO into an LLC. You must dissolve the Representative Office and separately incorporate a new Limited Liability Company. However, assets and staff can be transferred via new agreements.

4. Is a virtual office address allowed for an RO? This is a nuanced area. While the law requires a physical location, many virtual office providers offer a physical room for inspections. However, the DOIT frequently inspects ROs. If the authorities visit and find no actual operations or personnel present, the license may be revoked.

5. Does the parent company need to be profitable? Vietnam law does not explicitly require profitability, but you must provide Audited Financial Statements to prove the parent company exists and is solvent. If the parent company is too young (less than 1 year), it cannot open an RO.

Deciding to open a representative office in Vietnam is a prudent move for international companies seeking to understand the local market dynamics before making a full-scale entry. While the process involves strict administrative procedures - from consular legalization to tax code registration - the long-term benefits of having a lawful presence in Vietnam are undeniable.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom