Vietnam's business landscape has become increasingly attractive to entrepreneurs seeking to establish their own ventures. The Sole Proprietorship structure, governed by the 2020 Law on Enterprises, represents one of the most accessible business forms for individuals looking to start their entrepreneurial journey. This comprehensive guide will walk you through everything you need to know about establishing and operating a Sole Proprietorship in Vietnam.

What is a Sole Proprietorship in Vietnam?

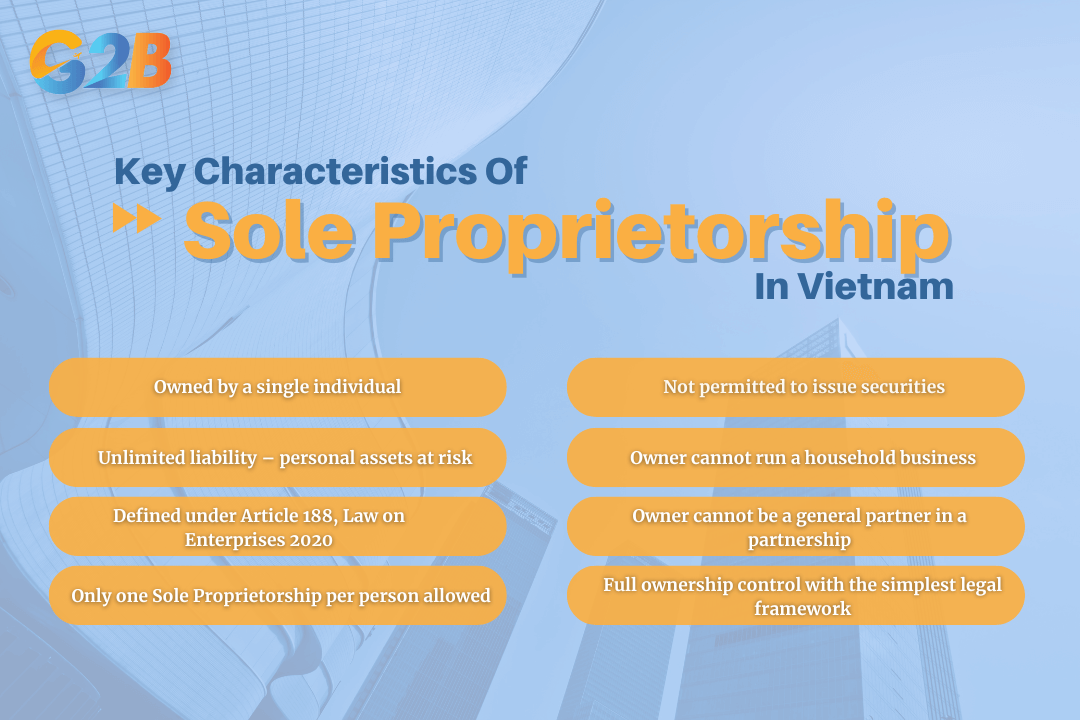

A Sole Proprietorship in Vietnam is a business owned by an individual who has unlimited liability for all obligations of the business using all their personal assets, as defined under Article 188 of the 2020 Law on Enterprises. This business structure is characterized by several key restrictions: It is not allowed to issue securities, each individual may establish only one Sole Proprietorship, and the owner cannot simultaneously own a household business or be a general partner in a partnership.

Sole Proprietorship provides complete ownership control while maintaining the simplest legal framework for business operations in Vietnam. However, foreigners are not permitted to establish a Sole Proprietorship in Vietnam due to current legal restrictions. Instead, they can choose other business structures such as a Limited Liability Company (LLC), Joint Stock Company, or Representative Office. Working with a trusted consulting firm for company formation in Vietnam helps ensure a smooth and compliant process, allowing business owners to focus on more important aspects of their operations.

A Sole Proprietorship is a business where one owner holds unlimited personal liability

Necessary information about Sole Proprietorship in Vietnam

Understanding the various aspects of Sole Proprietorship in Vietnam is crucial for successful business establishment and operation. The following sections cover the essential requirements, procedures, and considerations that every prospective business owner must understand before embarking on their entrepreneurial journey.

1. Conditions for establishing a Sole Proprietorship in Vietnam

Legal requirements for business owners:

- The owner must be at least 18 years old with full legal capacity

- Must have no criminal record or legal restrictions

- Cannot be a current state official or active military personnel

- Must not be prohibited from business activities by court order or administrative decision

Ownership limitations:

- Each individual is only permitted to own one Sole Proprietorship

- Cannot simultaneously operate a household business or participate as a general partner in a partnership

- Must comply with specific industry regulations if applicable to the chosen business sector

2. Business registration procedure

Required registration documents:

- Completed business registration application form (Form 02/DK-DNTN)

- Certified copy of the owner's ID card, citizen ID, or passport

- Business plan including name, headquarters address, business activities, registered capital, and projected number of employees

- Additional documents may be required for specific industries or locations

Submission and processing:

- Apply through the Business Registration Office under the Department of Planning and Investment

- Alternative submission to the district-level registration authority depending on location

- Online submission is available through the National Business Registration Portal

- Processing time: Approximately 3 working days for initial consideration and up to 6 working days to obtain the Certificate of Business Registration after complete application submission

3. Capital and assets

Capital requirements:

- Capital is self-declared by the owner with no minimum capital requirement

- May include cash, property, gold, or foreign currency converted to Vietnamese Dong (VND)

- Capital contribution must be documented and valued appropriately

- Foreign currency contributions must be converted at official exchange rates

Capital management:

- The owner may increase or decrease the capital during operations

- Any capital changes must be registered with the authorities within the prescribed timeframes

- Capital adjustments require updated business registration documents

- Changes may affect tax obligations and licensing requirements

4. Legal liability

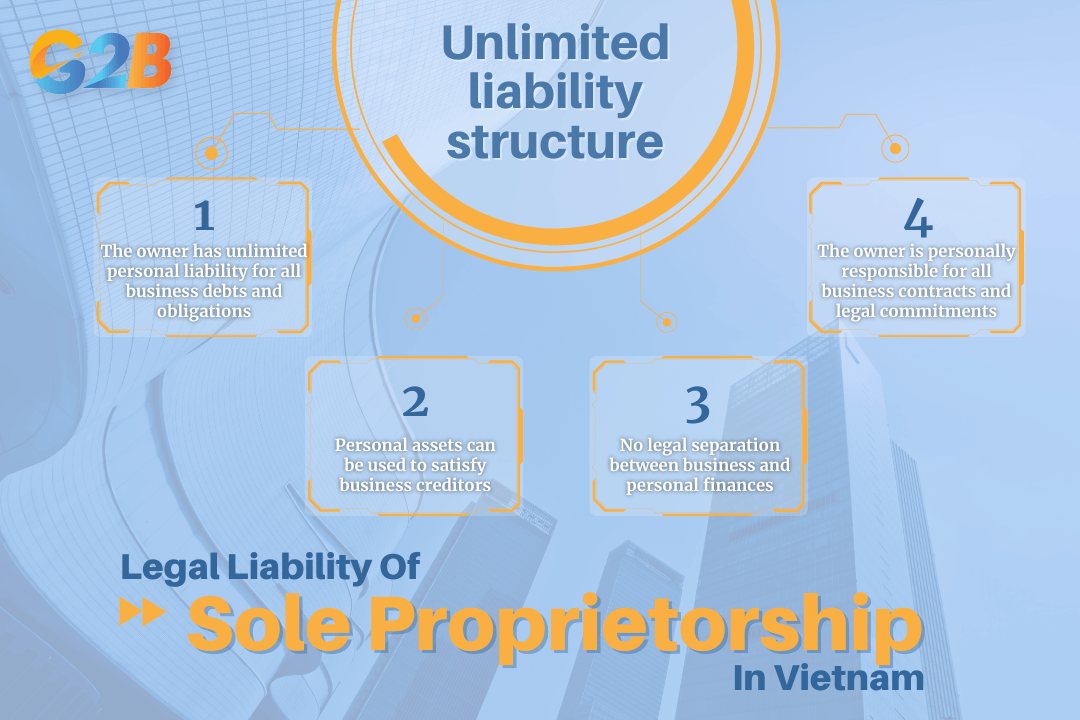

Unlimited liability structure:

- The owner has unlimited personal liability for all business debts and obligations

- Personal assets can be used to satisfy business creditors

- No legal separation between business and personal finances

- The owner is personally responsible for all business contracts and legal commitments

A Sole Proprietorship has an unlimited liability structure

Risk implications:

- High financial risk exposure for the business owner

- Personal property may be subject to business debt collection

- Insurance coverage is highly recommended to mitigate operational risks

- Careful financial management is essential to protect personal assets

5. Taxes and financial obligations

Required tax payments:

- Annual licensing fee based on registered capital (ranging from VND 2 million to 3 million per year, payable by January 31 annually)

- Business license tax (licensing fee) depends on annual revenue, not registered capital

- Personal income tax on business profits at progressive rates

- Value-added tax (VAT) if trading in goods or services subject to VAT

- Other applicable taxes depend on business activities and location

Financial reporting requirements:

- Must submit annual financial statements to tax authorities

- Monthly or quarterly tax filings, depending on business size and turnover

- Maintain proper accounting records by Vietnamese accounting standards

- Comply with invoicing and receipt requirements for all business transactions

6. Advantages

Operational benefits:

- Simple, fast, and low-cost establishment procedure

- Full control over business operations and decision-making by the owner

- All profits belong exclusively to the owner

- No internal conflicts since there is only one decision-maker

Administrative advantages:

- Minimal regulatory compliance compared to other business structures

- Taxed as personal income of the owner, not subject to corporate income tax

- Flexibility in business operations and strategic changes

- Easy dissolution process when needed

Sole Proprietorship provides operational benefits and administrative advantages

7. Limitations and risks

Financial constraints:

- Unlimited personal liability results in high financial risk exposure

- Cannot issue shares or raise capital from external investors

- Limited access to large-scale financing options

- Growth potential constrained by the owner's personal financial capacity

Operational limitations:

- Limited scalability and business expansion opportunities

- Difficulty attracting professional management or partners

- Single point of failure if the owner becomes unavailable

- May face challenges in securing large contracts or partnerships due to size limitations

Frequently asked questions about Sole Proprietorship in Vietnam for foreigners

This section answers frequently asked questions from foreigners about Sole Proprietorship in Vietnam. It also clarifies key legal points to ensure compliance with Vietnamese regulations and avoid potential violations.

Can foreigners establish a Sole Proprietorship in Vietnam?

- No, according to the Vietnamese Law on Enterprises, a Sole Proprietorship can only be established by a Vietnamese citizen who has full civil capacity and permanent residence in Vietnam.

- Foreigners are NOT allowed to directly establish a Sole Proprietorship under their own name in Vietnam.

If foreigners cannot establish a Sole Proprietorship, what other options do they have for doing business in Vietnam?

- Foreigners may establish other types of businesses, such as a limited liability company (LLC), a joint-stock company (JSC), or invest by contributing capital or purchasing shares in existing companies.

- Alternatively, they can open a representative office, branch, or invest through a Business Cooperation Contract (BCC).

Can foreigners be listed as the legal owner on a Sole Proprietorship business license?

- No. Only Vietnamese citizens can be legally listed as the owner of a Sole Proprietorship.

- Foreigners may collaborate with a Vietnamese citizen, but they cannot be the legal owner of the business license of a Sole Proprietorship.

Can a foreigner work as a manager or executive in a Sole Proprietorship in Vietnam?

- Yes, if they are hired by the business owner to work as a manager, director, or advisor.

- However, ownership and legal responsibility remain solely with the Vietnamese citizen who owns the business.

Do the capital and financial obligations of a Sole Proprietorship apply to foreigners?

- Capital, tax, and financial obligations are applicable only to the Vietnamese owner.

- Foreigners are not legally liable for the business unless there is a separate contract with the owner or they are involved through another legal entity.

Are there legal risks if a foreigner “uses” a Vietnamese citizen’s name to operate a Sole Proprietorship?

- Yes. “Name lending” is illegal and carries significant legal risks, such as disputes, loss of asset control, and no legal protection for the foreign party.

- If discovered, both the Vietnamese name-lender and the foreigner may be penalized under Vietnamese law.

Note: If you are a foreigner looking to do business in Vietnam, it is strongly recommended to choose a business structure that complies with Vietnamese law and to consult a legal expert to protect your rights and ensure full compliance.

Sole Proprietorship offers an accessible entry point to establish a business with minimal complexity and cost. The registration process is designed to be efficient and user-friendly, typically completed within a week of application submission. Before proceeding with registration, consider consulting with legal and tax professionals to ensure compliance with all requirements and to develop strategies for protecting your personal assets while maximizing your business potential in Vietnam's dynamic economy.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom