Company registration timeline in Vietnam is often the first variable foreign investors need to calculate when planning their market entry. While Vietnam offers a dynamic economic landscape, its administrative procedures can appear labyrinthine to the uninitiated. A common pitfall for foreign businesses is relying solely on statutory deadlines - what the law says - without accounting for administrative realities - what actually happens in practice. This guide deconstructs the setup process using the Critical path method, distinguishing between official processing times and the realistic preparation required to get your business operational.

Step 1: Preparation and consular legalization

Status: Pre-licensing phase | Timeline: 2 to 4 weeks

The clock for your company registration timeline in Vietnam actually starts in your home country. Vietnam requires foreign documents (Articles of incorporation, bank statements, passport copies) to be apostilled (if from a Hague Convention country) or "Consular legalized" to be legally valid. This is often the most underestimated time sink. The process is strictly sequential:

- Notarization: Documents are notarized by a public notary in the investor's country.

- MOFA authentication: The Ministry of Foreign Affairs (or equivalent) in that country authenticates the notary’s signature.

- Vietnam embassy legalization: The Vietnamese diplomatic mission stamps the documents.

Consular legalization process required for foreign documents

Step 2: Securing office address & lease

Status: Pre-licensing phase | Timeline: 1 to 2 weeks

You cannot register a company in Vietnam without a physical address. You must submit a signed Memorandum of Understanding (MOU) or Lease Agreement and specific landlord documents to the licensing authority.

- Commercial offices: Usually straightforward. You need the landlord’s land use right certificate (LURC) and proof that they are licensed to lease commercial space.

- Virtual offices: Legal in Vietnam, but scrutinized. Ensure the provider can give you hard copies of ownership documents.

The bottleneck: Negotiating the lease terms. While signing takes minutes, finalizing the contract and obtaining the landlord's certified documents can take 5 to 10 days.

Step 3: Investment Registration Certificate (IRC)

Status: Licensing phase | Timeline: 15 to 30 working days

For foreign investors, this is the primary hurdle. The Investment registration certificate (IRC) validates your project. You will submit your dossier to the Department of planning and investment (DPI) or the Industrial zone management board (if you are located in an industrial park).

The statutory timeline

According to the Law on Investment 2020, the authority must issue the IRC within 15 days of receiving a valid dossier.

The practical reality

"Valid dossier" is the operative phrase. In practice, the DPI may issue a request for clarification regarding your financial capacity or the location of your project.

- Standard projects: Expect 20 to 25 working days.

- Projects requiring ministry consultation: If your business line is "conditional" (not fully open under WTO), the DPI must query ministries in Hanoi. This can extend the timeline to 45 working days or more.

Common delays: Explanation of financial capability (Source of Funds) is a frequent point of contention. The authorities may require proof of funds dating back 3 to 6 months.

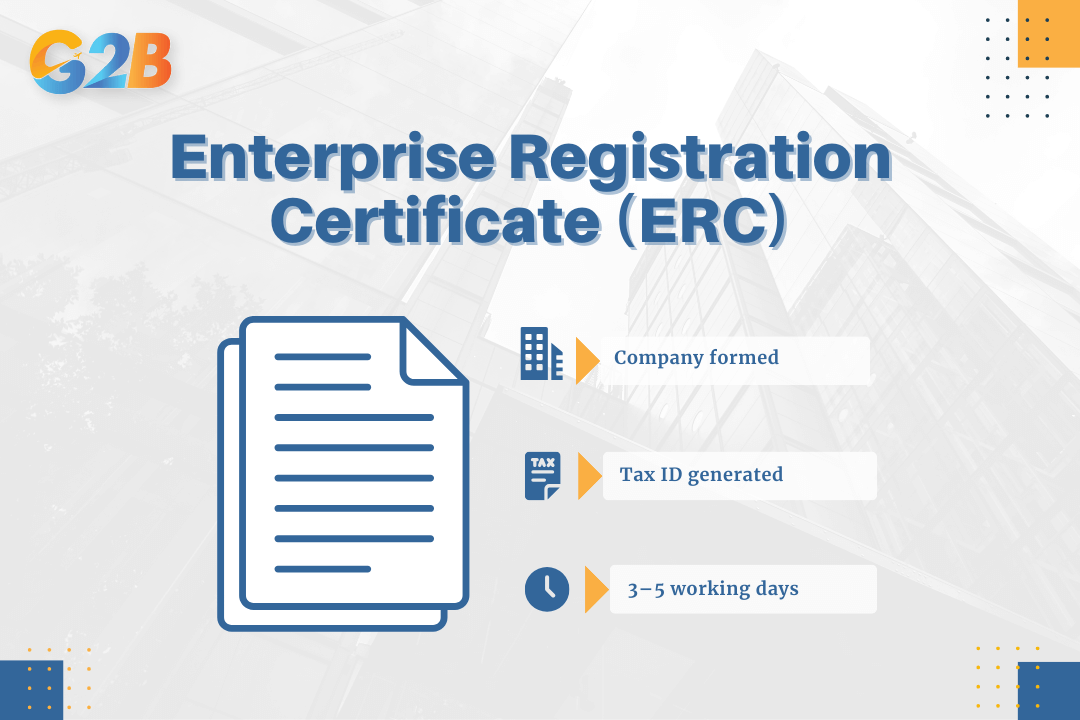

Step 4: Enterprise Registration Certificate (ERC)

Status: Incorporation phase | Timeline: 3 to 5 working days

Once the IRC is issued, you apply for the Enterprise Registration Certificate (ERC). This document legally births your company (Ex: LLC or JSC). It serves as your tax registration and official incorporation paper.

- Statutory deadline: 3 working days from the date of submission.

- Practical outcome: This step is generally efficient. Unless there are errors in the company Charter or the Legal Representative’s details, the ERC is almost always issued within the 3 to 5 day window.

- Tax ID generation: During this process, Vietnam’s National Business Registration System automatically generates your Tax Identification Number.

ERC incorporates the company and generates the Tax Identification Number

Step 5: Seal carving & public announcement

Status: Post-licensing | Timeline: 1 to 3 working days

Historically, the company seal was a sacred object in Vietnam. Today, regulations have relaxed, but the seal remains essential for signing contracts and banking.

- Seal creation: You can have a physical seal carved in 1 day.

- Digital signaling: You decide the form and content of the seal. While you no longer need police approval, you must notify the business registration authority to publish the seal sample on the National Portal for transparency.

- Public announcement: By law, you must publish your registration information on the National Business Registration Portal. This must be done within 30 days of receiving the ERC.

Step 6: Bank accounts & capital injection

Status: Financial setup | Timeline: 5 to 14 days (Account open) + 90 Days (Injection)

With the ERC and Seal in hand, you can approach a bank to open two types of accounts:

- Direct investment capital account (DICA): Used exclusively for incoming and outgoing capital transfers (foreign currency).

- Current account: Used for daily transactions (VND).

The KYC timeline

Due to global anti-money laundering (AML) standards, banks in Vietnam perform strict KYC (Know Your Customer) checks on foreign owners. This review can take 1 to 2 weeks.

The capital deadline

Crucial warning: You must inject at least 50% of your subscribed Charter Capital within 90 days from the issuance date of the ERC (remaining within 2 years). Failure to do so results in heavy fines.

Step 7: Tax registration & license fee

Status: Compliance setup | Timeline: Immediate post-licensing

Once the bank account is active, you must connect it to the tax authorities.

- Digital signature token (e-signature): Required for filing all taxes online. Obtained in 1 day.

- Business license fee (Monopoly tax): You must pay this fee (typically 2,000,000 to 3,000,000 VND) immediately.

- E-invoice registration: You must register to issue Electronic VAT Invoices. The tax authority typically approves this within 1 working day.

Step 8: Sub-licenses

Status: Operational authorization | Timeline: 1 to 4 months (sector dependent)

For many investors, the ERC is not the finish line. If you are in manufacturing, retail, F&B, or education, you need "Sub-Licenses" to legally operate.

- Retail trading license: Required for foreign-owned trading companies to sell to consumers. Timeline: 3 to 6 months.

- Food safety certificate: For F&B. Timeline: 20 to 30 days.

- Fire safety & environment: Essential for manufacturing. Timeline: 1 to 2 months.

Strategic note: You can rent an office and hire staff with just the ERC, but you cannot issue invoices for these specific services until the sub-license is granted.

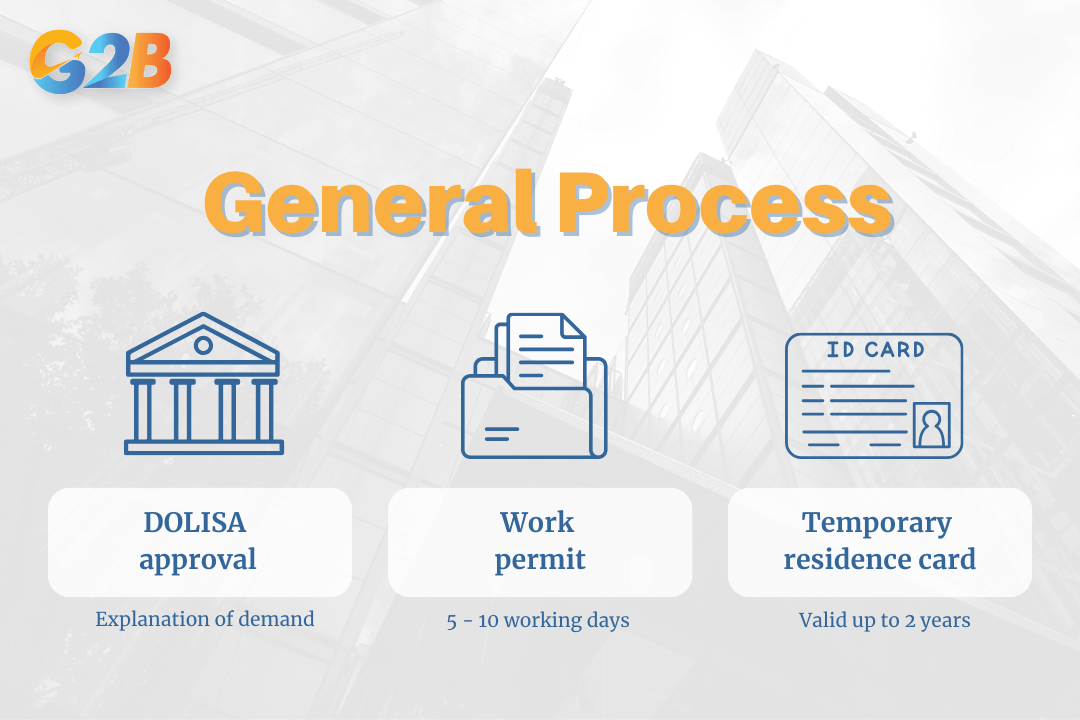

Step 9: Visa & Work permits

Status: Personnel | Timeline: 4 to 6 weeks

Finally, getting your foreign experts into the country legally:

- Explanation of demand: You must seek approval from the Department of Labor (DOLISA) to hire a foreigner. This request must be submitted 30 days before the expected start date.

- Work permit application: Once the demand is approved, you submit the Work Permit application. Review time: 5 to 10 working days.

- Temporary residence card (TRC): Once the Work Permit is issued, you can apply for a TRC (valid for 2 years), replacing the visa.

The process for foreign employees in WP & TRC

When you tally the statutory periods, the company registration timeline in Vietnam looks like a 20-day sprint. However, when you factor in consular legalization, lease negotiations, banking KYC, and potential Ministry consultations, a realistic "Time-to-market" for a foreign investor is typically 1.5 to 3 months.

A clear understanding of the company registration timeline in Vietnam helps investors and entrepreneurs plan their market entry more effectively, from initial dossier preparation to full operational readiness. While the process involves multiple stages and regulatory approvals, proper preparation and compliance with documentation requirements can significantly reduce delays.

Ready to start your journey in Vietnam? Contact G2B today for a consultation on how to establish company in Vietnam and follow annual compliance during operation. Let us handle the bureaucracy so you can focus on your business.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom