ERC in Vietnam is the foundational legal document that signifies the official birth of a corporate entity within the country’s dynamic economy. For foreign investors and entrepreneurs, understanding the nuances of the Enterprise Registration Certificate (ERC) is the critical first step toward establishing a compliant and operational business presence when setting up a company in Vietnam.

What is an ERC?

The Enterprise Registration Certificate (ERC) is a binding legal document issued by the Business Registration Office under the Department of Planning and Investment (DPI). It serves as official recognition by the State of Vietnam that a business entity has been legally established and is authorized to operate.

Think of the ERC as the "birth certificate" of your company. Without this document, a company has no legal personality, cannot open a corporate bank account, cannot issue VAT invoices, and cannot sign legally binding commercial contracts.

The ERC contains encoded information regarding the company, including the Enterprise Code, which doubles as the company’s Tax Code. This integration simplifies the administrative burden for investors, merging what used to be separate tax and business registrations into a unified identification number.

Distinguishing between ERC and IRC

For foreign investors, the most common source of confusion is the difference between the Enterprise Registration Certificate (ERC) and the Investment Registration Certificate (IRC). While domestic Vietnamese companies usually only require an ERC, foreign-led projects often require both.

- Investment Registration Certificate (IRC): This document approves the specific investment project. It outlines the project's scope, location, total investment capital, and objectives. Under the Law on Investment, foreign investors must generally obtain the IRC before establishing the enterprise. The IRC validates that the foreign capital entering Vietnam is for a legitimate, approved purpose.

- Enterprise Registration Certificate (ERC): This document establishes the legal entity (the company) that will execute the project. It is obtained after the IRC is issued.

Why this distinction matters: The timeline for market entry is heavily dependent on this two-step process. Investors must first secure the IRC (which can take 15–45 days depending on the complexity of the project) before they can apply for the ERC (which takes 3–7 days). However, there are strategic exceptions. For example, foreign investors entering via M&A (Mergers and Acquisitions) - purchasing shares in an existing Vietnamese company - may bypass the requirement for a new IRC, significantly speeding up the process.

Legal role and significance of the ERC

The ERC is not merely a piece of paper; it grants specific rights and imposes strict obligations on the business owner. Its legal significance covers several critical areas:

- Legal personality: Upon issuance of the ERC, the company gains the status of a juridical person. This allows the company to own assets, sue and be sued, and assume independent liability separate from its individual owners (in the case of Limited Liability Companies and Joint Stock Companies).

- Tax and customs identification: The Enterprise Code printed on the ERC is automatically synchronized with the General Department of Taxation. It functions as the company’s Tax Identification Number (TIN) and is used for all customs procedures when importing or exporting goods.

- Operational authorization: The ERC serves as proof to third parties - such as banks, landlords, and partners - that the company is valid. You cannot sign a valid office lease or hire employees under the company name without it.

- State management tool: The ERC allows the government to monitor the business community. It records vital data points, such as the Legal Representative, Headquarters Address, and Charter Capital, ensuring transparency and accountability.

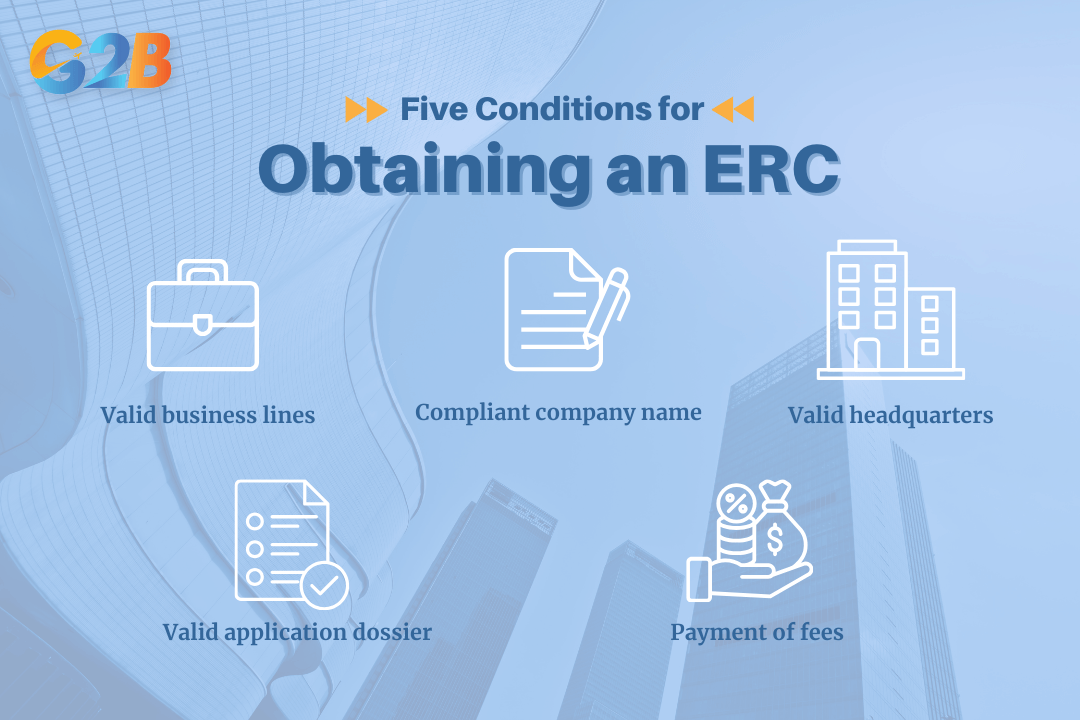

Conditions for obtaining an Enterprise Registration Certificate

To successfully obtain an ERC in Vietnam, investors must satisfy specific conditions laid out in the Law on Enterprises. These conditions ensure that the new entity aligns with national regulations and public order.

1. Valid business lines

The company must register industry codes (VSIC codes) that are not prohibited by Vietnamese law. For foreign investors, this is more scrutiny-heavy. You must ensure your chosen sectors, such as retail distribution, education, or IT services, are open to foreign investment under WTO Commitments or local laws.

2. Compliant company name

The proposed company name must not duplicate or cause confusion with the names of existing enterprises nationwide. The name must be composed of the Vietnamese alphabet, the letters F, J, Z, W, and numerals. It must include two elements: the type of enterprise and the proper name.

3. Valid headquarters

The registered head office must be a physical location within Vietnamese territory with a clear address. It must be legally owned or leased.

- Crucial restriction: You cannot use an apartment unit (designated for residential purposes) as a registered office. The location must be a commercial building or a landed property with relevant function.

4. Valid application dossier

The investor must submit a complete dossier comprising all required legal documents, such as the application form, company charter, and identification papers. The information in the dossier must be truthful and accurate.

5. Payment of fees

The investor must pay the full business registration fees and the fee for publishing the registration contents on the National Business Registration Portal.

Five conditions for obtaining an Enterprise Registration Certificate

Detailed ERC application process and procedures

Efficiency in obtaining the ERC depends heavily on preparation.

Step-by-step workflow

Step 1 - Preparation and drafting: This phase involves selecting the company type (LLC vs. JSC), defining the Charter Capital, checking the availability of the company name, and drafting the Company Charter. For foreign investors, this step also includes the consular legalization of overseas documents.

Step 2 - Account registration and online submission: Since the modernization of the DPI system, physical submissions are largely replaced by digital ones.

- The applicant must create a National Business Registration Account.

- The dossier is scanned and uploaded to the National Business Registration Portal (dangkykinhdoanh.gov.vn).

- The submission must be authenticated using a public digital signature or a business registration account.

Step 3 - Administrative review: The Business Registration Office will review the validity of the dossier.

- Timeline: The standard processing time is 03 working days from the date of receipt of a valid dossier.

- Outcome: If the dossier is valid, the DPI issues a "Notification on Granting Enterprise Registration Certificate." If invalid, they issue a "Notification on Amendment and Supplement," detailing exactly what needs to be fixed.

Step 4 - Submission of hard copies and result collection: Once the electronic dossier is approved, the investor submits the hard copy documents to the DPI to verify consistency with the digital upload. Upon verification, the original ERC is released.

Required documents for ERC application

The documentation required varies depending on the type of legal entity and the nature of the investors (Individual vs. Organization).

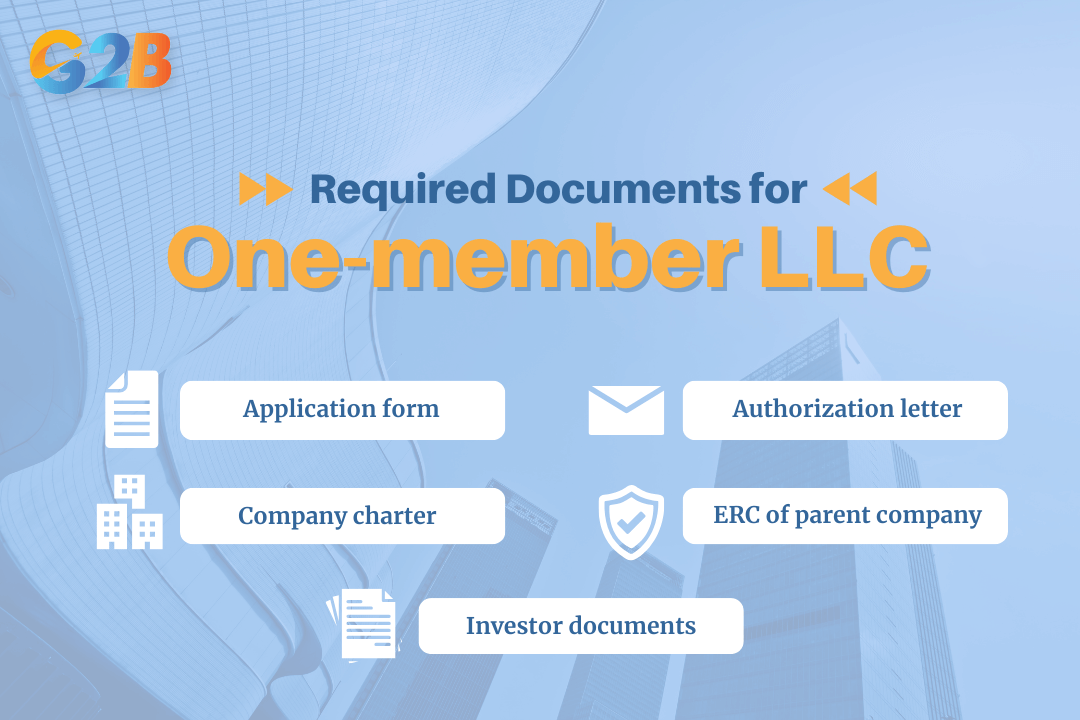

For a one-member Limited Liability Company (LLC)

- Application form: Request for enterprise registration (standard form).

- Company charter: The "constitution" of the company, signed by the owner or legal representative.

- Investor documents:

- If Individual: Valid copy of Passport or ID Card.

- If Organization: Valid copy of the Certificate of Incorporation (or equivalent), and the Passport of the authorized representative managing the capital in Vietnam.

- Authorization letter: If utilizing a service provider, a power of attorney is required.

- ERC of parent company: (For organizational investors) This must be consularized and translated into Vietnamese.

Required documents for a one-member Limited Liability Company

For a multi-member LLC or Joint Stock company (JSC)

In addition to the documents above, you must provide:

- List of members/shareholders: Detailing the capital contribution ratio, personal details, and signatures.

- Identification for all members: Passports or ID cards for every individual listed.

Note on foreign documents: All documents issued by foreign authorities (such as a foreign company's business license) must undergo Consular Legalization and be notarized and translated into Vietnamese to be legally valid for the ERC application.

Key information displayed on the ERC

The format of the ERC has evolved. Modern certificates are streamlined A4 yellow documents containing only the most essential public information.

What is visible on the ERC:

- Enterprise code: (Also the Tax Code).

- Company name: In Vietnamese, English, and Abbreviated forms.

- Head office address: Full specific address including ward, district, and province.

- Charter capital: The total capital registered.

- Legal representative: Full name, gender, date of birth, nationality, and ID/Passport number.

- Owner/members: (For LLCs).

What is NO LONGER visible (but stored digitally):

- Business lines: Previously, all business activities were printed on the back. Now, they are recorded in the national database but not printed on the certificate.

- Shareholders (for JSCs): Founding shareholders are recorded initially, but the ERC does not list them on the face of the document to facilitate easier share transfers later without constant re-printing of the license.

Mandatory post-licensing procedures (after obtaining ERC)

Receiving the ERC in Vietnam is a milestone, but it triggers a series of immediate compliance obligations. Failure to complete these can result in heavy administrative fines.

- Public announcement: The company must publish its registration contents on the National Business Registration Portal within 30 days of obtaining the ERC.

- Corporate seal (chop) creation: Since 2021, companies can decide on the design and quantity of their seals. You generally do not need to register the seal sample with the police, but you must manage it securely.

- Hanging the company signboard: A signboard displaying the company name, address, and tax code must be hung at the registered headquarters. Tax officers frequently inspect this; failure to display it can lead to the tax office locking your tax code.

- Digital signature (token) & e-invoices: Companies must purchase a digital signature token to submit tax declarations online. Furthermore, registration for electronic invoices (e-invoices) with the tax authority is mandatory.

- Bank account opening: Open a payment account (VND/USD) for daily operations. For foreign investors, opening a Direct Investment Capital Account (DICA) is crucial for receiving capital transfers from overseas.

- Payment of business license tax (BLT): The BLT must be paid annually. For new companies, the deadline is typically the last day of the month of license issuance.

Important notes and common mistakes

1. The 90-day capital contribution rule

Legally, investors have 90 days from the issuance date of the ERC to fully contribute the registered Charter Capital.

- The mistake: Investors often delay transfer or transfer to the wrong account type (current account instead of capital account).

- The consequence: Failure to contribute on time requires a capital reduction procedure. Failure to do so results in fines ranging from 10,000,000 to 20,000,000 VND and potential liability for debts.

2. Virtual office risks

While virtual offices are legal, using a "ghost" address where no one receives mail or meets tax officers is dangerous. If a tax officer visits and finds no activity, they will flag the company as "absent from the registered location," effectively freezing your operations.

3. Failure to update changes

Any change to the company’s status - such as changing the Legal representative, moving address, or increasing capital - must be reported to the DPI within 10 days. Late notifications attract cumulative fines.

Frequently asked questions (FAQ) about the ERC

Q1: How long is the ERC valid for? Generally, the ERC in Vietnam does not have an expiration date. It remains valid as long as the company operates and complies with tax and reporting obligations. However, if the project has an IRC, the project duration (usually 50 years) serves as a functional limit.

Q2: Can a foreigner be the Legal Representative on the ERC? Yes. A foreigner can be the Legal Representative. However, at least one Legal Representative must reside in Vietnam. If they leave Vietnam for more than 30 days, they must authorize another person to act on their behalf.

Q3: What happens if I lose my ERC? If the original ERC is lost, burnt, or destroyed, the company must file a request for re-issuance with the Business Registration Office and pay the requisite fee.

Q4: Can I add business lines after receiving the ERC? Yes. Companies can expand their scope of business by submitting a "Notification of Change" to the DPI. For foreign companies, adding certain conditional sectors may require updating the IRC first.

Obtaining an ERC in Vietnam is the definitive step in transforming your business vision into a legal reality. It grants you the legitimacy to hire, trade, and grow within one of Southeast Asia’s most exciting markets. However, the document represents more than just rights; it represents a commitment to compliance, transparency, and adherence to Vietnamese law. From the distinction between the IRC and ERC to the strict 90-day capital contribution deadline, the details matter. A minor oversight in the application dossier or a missed post-licensing step can lead to significant delays or financial penalties.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom